Entertainment

Claressa Shields & Papoose React To Megan Thee Stallion’s Lyrics

Claressa Shields has the internet living for her reaction to Megan Thee Stallion’s spicy lyrics about her and Papoose. Meg’s bars hit so hard about the couple that fans are saying she snapped — and of course, Claressa is agreeing too!

RELATED: Love Day Lit! Papoose Goes All Out For Claressa Shields With MAJOR Oceanfront Surprise On Valentine’s Day (VIDEO)

Claressa Shields & Papoose Can’t Stop Vibin’ To Megan Thee Stallion’s Fiery Bars

Social media is already speculating that Megan Thee Stallion might pop out at Claressa Shields’ next fight. The hype started after the Hot Girl dropped her new track, ‘B.B.B.,’ with Juvenile. If you haven’t tapped in yet, crank your speakers up — fans have listened, and they’re calling it a bop! Claressa and Papoose peeped the song too, and one line they’re living for is when Meg raps, “Just like Claressa, he love this Papoosey, Get In that flow state, he don’t wanna lose me.” Both Claressa and Pap chimed in after hearing the shoutout. Pap said he was feeling it and called the song a 10/10. Claressa, on the other hand, popped off, repeating the lyrics and tagging Meg to let her know she snapped! As for Juvenile, he didn’t have any doubt that the couple wouldn’t love the lyrics. The rapper slid right into The Shade Room comment section, writing, “🔥🔥🔥🔥🔥🔥🔥🔥 i knew it.”

The Internet Is Here For Claressa & Pap’s Reaction To Meg’s Shoutout

After TSR posted the clip of Claressa and Papoose reacting to Megan Thee Stallion’s bars, social media went absolutely wild! Fans in the comment section said they think Claressa is about to make the ‘B.B.B.’ Remix her anthem, while others said they knew she would be hype over the shoutout.

Instagram user @toot_reacts wrote, “She so dope!!! Keep going champ!! 😍😍😍😍😍”

Instagram user @naomiflairsalon_ wrote, “Meg did eat with that line 😂”

Then Instagram user @beechmovee wrote, “Love them downnn.. I love a Picses in Love too 😍😂 cause we really love showing off our man and catering 🥺😍”

While Instagram user @only1melaninmel wrote, “Clareesa has really grown on me! I love how no matter how much negativity comes her way, she keeps on keeping on! 💯”

Another Instagram user @keraazhene wrote, “She snaaaaappped frfr❤️❤️❤️”

Instagram user @_millionairemoni wrote, “😂😂😂😂she knew exactly who to mention, Clarissa gon promote this like she wrote it.”

While another Instagram user @imrozburton wrote, “I knew she was gone behave like this once she heard that line 😂😂”

Finally, Instagram user @_cocostylezz wrote, “Ts ate so bad 😂😂😂😂😂🔥 i feel like Claressa needed this W 😂😂😂😂”

Claressa Shields Proudly Celebrates Her & Papoose’s “Invincible Love”

By now, folks online know Claressa Shields doesn’t play when it comes to Papoose. After her fight against Franchón Crews-Dezurn, she flexed her love for her man on Instagram, sharing multiple photos of her Pap from different occasions. In her caption, Shields called their relationship “invincible black love” and expressed her gratitude that they get to love each other out loud.

“Every time I step into that ring, I carry your love with me

You calm my nerves, pray over me, and remind me who I am Daily! Winning is sweet… but sharing it with you is everything

This joy feels different. This love feels powerful

That invincible black love — and I’m so grateful we get to live it out loud.

Thank you for being a man, making my life easier & protecting me. Your support doesn’t do unnoticed Papi. Love you

”

RELATED: Claressa Shields Brags About Living Her And Papoose’s “Invincible Black Love” Out Loud (PHOTOS)

What Do You Think Roomies?

Entertainment

“Lizzie McGuire” actor Robert Carradine's cause and manner of death confirmed

:max_bytes(150000):strip_icc():format(jpeg)/Robert-Carradine-022726-554efe3fd7624a71a0f7b220ca88c678.jpg)

The “Revenge of the Nerds” star died on Monday at 73.

Entertainment

Elisabeth Hasselbeck's friend gave her real 'armor of God' for protection amid return to “The View”

:max_bytes(150000):strip_icc():format(jpeg)/The-View-Joy-Behar-Elisabeth-Hasselbeck-022826-4fb19baf7c044d88ae6ae17f68608a36.jpg)

The “Survivor” alum’s arsenal of defenses from the Hot Topics table includes a “helmet of salvation,” “breastplate of righteousness,” “belt of truth,” and more!

Entertainment

“Drag Race ”star Athena Dion wanted to 'fall on the sword' for granddaughter in emotionally devastating lip-sync

:max_bytes(150000):strip_icc():format(jpeg)/RuPauls-Drag-Race-022626-1-1449c22a169c4aff96261e57af409437.jpg)

Athena tells EW why she wants Bianca Del Rio to “throw me down in the bedroom and call me Sally,” and reacts to daughter Plane Jane shading the season 18 cast.

Entertainment

Shia LaBeouf Arrested Again in New Orleans Following Mardi Gras Incident

Shia LaBeouf has once again been arrested in New Orleans in connection with an alleged Mardi Gras-related incident.

The Associated Press reported on Saturday, February 28, that LaBeouf, 39, was arrested earlier in the day on suspicion of misdemeanor simple battery. This charge is related to his previous arrest on two counts of battery for allegedly striking an unidentified victim multiple times while being escorted out of a New Orleans restaurant on February 17.

The incident allegedly occurred at the Royal Street Inn & R Bar, near New Orleans’ French Quarter, where LaBeouf allegedly had a confrontation with multiple people during Mardi Gras festivities.

His attorney, Sarah Chervinsky, told the Associated Press that LaBeouf voluntarily turned himself in at the Orleans Parish jail after learning that a new arrest warrant was issued on Friday, February 27.

“No regular person would be required to post over $100,000 in bonds, and be jailed two separate times for one misdemeanor incident,” Chervinsky told the outlet. “Just as he does not deserve preferential treatment, Mr. LaBeouf also does not deserve to be treated more harshly by the police and courts just because he is a public figure.”

Us Weekly has reached out to representatives for LaBeouf and the New Orleans Police Department for comment.

Following his arrest on February 17, LaBeouf appeared in court that same day and now has a pretrial hearing set for Thursday, March 19. He was advised by the judge to return to drug and alcohol rehabilitation during his initial court appearance. (LaBeouf has yet to enter a plea for any of the three pending charges.)

The Indiana Jones and the Kingdom of the Crystal Skull actor — who has had multiple run-ins with the law over the years — initially responded to his arrest by tweeting “free me” hours after the alleged Mardi Gras altercation.

He has since sat down for an interview with Channel 5 with Andrew Callaghan, which was released Saturday, where he responded to his arrest by saying it’s “not nice to hurt people ever.”

“It’s f***ing lame,” he insisted. “People got hurt, I got to deal with that. I’mma deal with that in full. I’ll eat it all. It’s on me. I f***ed up.”

Shia LaBeouf at the Cannes Film Festival in May 2025. Getty Images/Sameer AL-DOUMY / AFP

LaBeouf said he’d relocated from Los Angeles to New Orleans because he’d “failed [in his] marriage” to Mia Goth but admitted he’d “hit a roadblock” with this latest setback. (Goth, 32, and LaBeouf were together on an off from 2012 to 2025.)

“I was drunk, and then I felt infringed upon, like, in terms of my proximity,” the former Even Stevens star explained. “I wasn’t in my right mind, so it’s on me. … It was probably just my fault, for, somewhere. I don’t know how, but I’m going to figure it out.”

He then dismissed the idea of going to rehab, saying, “My behavior? Bulls***. I gotta deal with it. Does that mean I got to go to rehab again? I’m just not into it, bro. I don’t think my answers are there, I don’t. If I genuinely did, I’d go. I don’t think I have a drinking problem. I think I have a different problem, and I’m going to address it.”

As for why the Mardi Gras incident occurred, LaBeouf suggested that he has “a small man complex” which is “something that has to do with anger and ego more so than my drinking.”

“What kind of things set off that anger? I mean, boy, I haven’t experienced that for a while, but I’ll be honest with you, big gay people are scary to me,” he told Channel 5 News. “When I’m standing by myself and three gay dudes are next to me, touching my leg, I get scared. I’m sorry if that’s homophobic, then I’m that. It just happened one time, [and] that’s why I got arrested.”

LaBeouf ultimately admitted that he was “wrong for touching anyone ever.”

“That’s the end of my statement on this whole s***,” he insisted.

If you or someone you know is struggling with substance abuse, contact the Substance Abuse and Mental Health Services Administration (SAMHSA) National Helpline at 1-800-662-HELP (4357).

Entertainment

Woman Allegedly Stabs Boyfriend Over Phone

Whew! Things reportedly went left in a Texas relationship — and it all allegedly started over a phone. Authorities in Texas say Terriana Johnson is now facing serious charges after an argument with her boyfriend escalated inside their Waco home. What police claim happened next has social media talking, and it’s definitely not your average lovers’ quarrel.

RELATED: Miami Juveniles Reportedly Face Adult Charges In Connection To Alleged Rape Of 12-Year-Old Girl

Texas Woman Booked After Heated Argument

According to jail records reviewed by Law & Crime, Terriana Johnson has been charged with aggravated assault and was booked into the McLennan County Jail on Thursday. The incident reportedly took place on Wednesday at a residence on the 1900 block of South 5th Street in Waco, where Johnson and her boyfriend of about one year were living.

Police say the boyfriend was in the shower when Johnson allegedly walked in yelling at him. After he got out, he reportedly saw her coming out of the kitchen, holding three knives. Authorities claim she approached him and said, “I’m going to cut you if you don’t give me your f— phone.”

Argument Escalates, Knives Allegedly Pulled

Furthermore, according to the arrest affidavit, the boyfriend grabbed bed sheets in an attempt to shield himself, but Johnson allegedly cut him on the arm. He then ran to a neighbor’s home for help, and officers were called to the scene. When police arrived, Johnson reportedly claimed her boyfriend had taken her phone and pushed her to the ground — though officers noted she had no visible injuries.

Suspect Denies Knowledge, Posts Bond

The boyfriend later told officers that Johnson stabbed him, and police say they observed a cut on his left arm. When asked about the injury, Johnson allegedly said she did not know what happened. She also reportedly told officers she had scissors in her hand during the altercation “to cut the sheets.” Johnson was arrested and later released on a $10,000 bond, according to jail records.

RELATED: Prayers Up! Uber Eats Driver Fatally Struck By His Own Van During Chicago Carjacking (VIDEO)

What Do You Think Roomies?

Entertainment

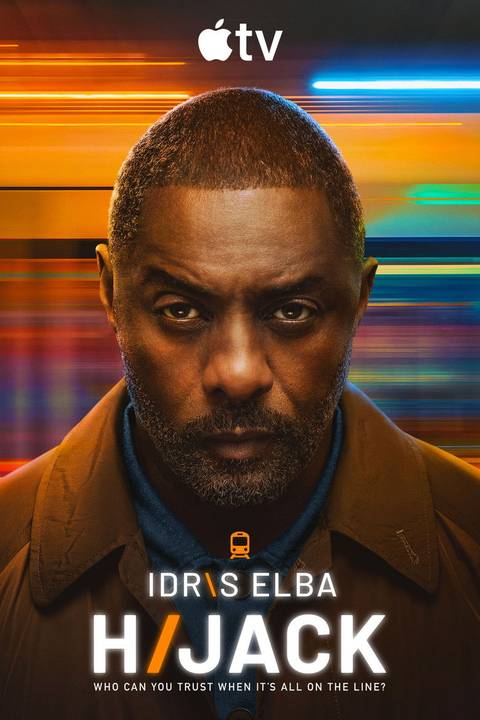

Idris Elba’s Intense Apple TV Thriller Didn’t Need a Season 2

Sometimes the old phrase, “if it ain’t broke, don’t fix it,” isn’t right for every situation. After the success of Hijack’s first season on Apple TV, the streamer naturally tried to replicate that same white-knuckle, high-stakes adventure for a Season 2. Unfortunately, Hjack sacrifices dramatic storytelling for action.

The Idris Elba-led drama had a unique Season 1, depicting a hijacking high in the sky, essentially giving an hour-by-hour adrenaline rush as help from the ground and Sam Nelson in the sky try to save the lives of everyone on board and in London. It worked as a novel idea at first, but then transporting the action below ground on a vehicle that has the ability to stop and start, and using Sam as part of the plot, simply didn’t work. Hijack simply didn’t need a Season 2.

Apple TV’s Thriller ‘Hijack’ Relied Too Much on Its Title for Season 2

The anticipation of a follow-up season was understandable, as the question of how one man could find himself in yet another hijacking was intriguing. Then, the big twist came at the top of the season, revealing that Sam Nelson was hijacking the U-Bahn train in Germany. As Season 2 trudged along, it became clear that it was much more complicated than that. It was just a facade. The reason? It was part of an act of revenge.

Because the premise of Hijack is about a hijacking, rather than making the series a brilliant one-off, Hijack returned with the hopes that a second hijacking experience would be equally gripping. With this plot for Season 2, the series didn’t need to come back. If it was desperate to bring Elba back, the series could have explored the same aftermath of revenge on John Bailey-Brown (Ian Burfield) for the death of his son, sans hijacking. Hijack was a bit too beholden to its title.

The intriguing element of Season 2 is watching a man on a mission of revenge. In a sense, it mirrors the hijackers’ actions in Season 1, who sought to fulfill their retribution. The difference is in perspective. Sam is seen as a hero, while the Season 1 hijackers were painted as villains, despite similar objectives. Had Hijack removed the underground hijacking, allowing Sam to embark on his journey like an action hero, we would understand it as still part of the Hijack universe. The show should be about Sam, not literal hijacking.

Idris Elba’s Apple TV Thriller ‘Hijack’ Worked in the Sky, but Not Underground

Lest we forget, Hijack offers action through scenes featuring those aiding Sam in stopping the events. Both seasons integrated multiple off-site scenes, from control rooms to homes, but the subplots this season, including Marsha Smith-Nelson’s (Christine Adams) woods ordeal, messed with the pacing as well. Plus, the German allies working on tracking the U-Bahn lack the heroism we saw from the likes of Alice Sinclair (Eve Myles), the humble air traffic controller. The energy and stakes are sadly not at the peak of Season 1.

The first season was extremely gripping because not only was the hijacking in the sky, but it was a literal non-stop adventure released almost in real time. Yes, Season 2 is a multi-hour expedition, but with the underground train able to stop and start. With many individuals able to affect its movement, the action no longer feels as high-stakes as it once did. There are bombs attached to carriages and some shady individuals who are on board to cause a stir, but it’s not nearly as captivating as a flying vehicle with a bevy of hijackers on board.

Even though the plane in Season 1 was massive, it was much more contained than the multi-carriage U-Bahn, where movement from train car to train car isn’t as unifying for passengers. The slower pace of Season 2 made the action dwindle, and by the end, it becomes crystal clear that Idris Elba’s thrilling Apple TV series should’ve stayed in the air.

- Release Date

-

2023 – 2024

- Network

-

Apple TV

- Directors

-

Mo Ali, Jim Field Smith

- Writers

-

Adam Gyngell, Catherine Moulton, Fred Fernandez Armesto, Anna-Maria Ssemuyaba, George Kay, Kam Odedra

Entertainment

Ashley Tisdale Snags Mommy Role Amid ‘Toxic Mom Group’ Drama

The Disney alum is reportedly hopping on a project from CBS Studios as an executive producer, marking a new vibe from her “toxic mom group” drama.

Ashley Tisdale’s “toxic mom group” story, which debuted on “The Cut” onthe first day of the year, has also captured the attention of a few prominent studios across Hollywood, which are looking to adapt her experience for the screen.

Article continues below advertisement

Inside Ashley Tisdale’s Upcoming Project

The comedy flick titled “You’re Only Young Twice” will be a multi-camera project, written by Tommy Johnagin, and will tell a story of Tisdale’s character, Emily and Alex, who got pregnant and subsequently married in high school.

Years later, the couple is now 35 and has sent their kid to college, which also means they can get divorced and pursue the lives they want while they are still young.

The movie follows Emily and Alex through different phases, including dating, co-parenting, and a second chance to make things work between them.

Article continues below advertisement

As noted by Deadline, the media personality and Johnagin will work alongside Mandy Summers to bring the movie to life. Tisdale has had several movie projects up her sleeve, including the 2020 sitcom “Carol’s Second Act,” “Hellcats,” “Merry Happy Whatever,” and a voice-over gig on “Phineas and Ferb.”

Article continues below advertisement

Hollywood Directors And Producers Are Reportedly Keying Into The Disney Alum’s Story

The controversy that broke out over her thought-provoking piece on “The Cut” seemingly sowed the seeds for a broader creative perspective among producers and directors in the industry.

As noted by The Blast, the insider explained that some major production companies are keen to leverage Tisdale’s expertise in acting and producing to express interest in collaborating with her to adapt the story into a movie.

In her story, Tisdale revealed that she had joined a mom group after welcoming her babies, hoping to find a community of like-minded women, including her celebrity friends such as Meghan Trainor, Hilary Duff, and Mandy Moore.

Unfortunately, she began to be intentionally excluded from social gatherings, prompting her to send a final message to the group to end the drama.

Article continues below advertisement

Ashley Tisdale On The Advantage Of Living Life Offline

The actress typically dealt with the unhealthy dynamics on social media by constantly clocking out. According to her, while she loves social media in ways that can be inspiring, funny, and keep her connected, she also understands that she is not meant to live her entire life online.

The Blast reported that the actress noted that taking time off the internet often feels like a reminder to live in the moment instead of living on the edge, looking for what to post and how to stay on trend.

Article continues below advertisement

Tisdale added that being online constantly put her in an unhealthy state of alertness, rather than allowing her to experience moments naturally. She recalled the first time she took time off social media, stressing that it helped give her the gift of perspective, where she could still care and stay informed, but on her own terms.

“You can open your phone without thinking and suddenly be absorbing outrage and fear, usually without looking for it,” the actress stated about how overwhelming a constant stream of information can be.

Hilary Duff Blamed Social Media For Escalating The ‘Toxic Mom Group’ Story

One of the celebrities identified in the article reacted to the claims, noting that while she is not a stranger to online controversies, social media fans made the situation worse with half-baked stories, lies, and clickbait.

Duff addressed an allegation about how none of the moms at school like her, nor do the teachers, clarifying that she loves all the women at school. Although Duff tried to defend herself against fans’ speculation, her estranged sister, Haylie, was on Tisdale’s support team and even liked her article on “The Cut.”

Haylie went ahead and shared a picture of her daughter and Tisdale’s kid on a playdate, which earned a repost from the “High School Musical” star.

Article continues below advertisement

Ashley Tisdale Was Dragged By Hilary Duff’s Husband

The 40-year-old did not receive uniform support from Duff’s camp, as her husband, Matthew Koma, took to social media to tag the actress self-obsessed and tone-deaf.

Another insider noted that the movie star herself is an insufferable person, and the split between her and her group of friends has been a long time coming. Tisdale’s conduct brought back memories of her alleged reaction to victims of a car crash she was involved in back in Los Angeles in 2022.

The legal dispute was between her and a woman named Liza Gonzalez, in which the lawyer representing her claimed she was extremely rude during her interaction with the plaintiff and avoided accountability.

During the time of the collision, Gonzalez revealed that she sustained injuries to her shoulders, neck, back, and left wrist, which she informed a dismissive Tisdale at the time. The attorney added that Tisdale’s husband also became involved in the case and went so far as to release the plaintiff’s private information online.

Entertainment

Shia LaBeouf’s Inner Circle Slams Claims He Caused Split With Mia Goth

Shia LaBeouf is reportedly not to blame for his split with Mia Goth. The pair separated last year after an on-and-off relationship spanning 13 years.

Now, those within the actor’s circle have claimed that he did his best to save his relationship with Goth, contrary to claims from those close to his estranged wife that he was at fault.

The reports come after Shia LaBeouf was involved in an altercation at the Mardi Gras celebrations in New Orleans.

Article continues below advertisement

Shia LaBeouf And Mia Goth’s Marriage ‘Just Didn’t Work Out,’ A Source Reveals

Shia LaBeouf’s relationship with Mia Goth has continued to make headlines following a recent report that they went their separate ways quietly last year.

While initial claims pointed to LaBeouf being at fault for the split, his close circle has now refuted the allegations, per TMZ.

According to a source, the relationship between the duo “just didn’t work out,” adding that LaBeouf wasn’t to blame.

Even with the relationship being over, LaBeouf is said to be committed to raising their daughter, Isabel, whom they welcomed in 2022.

Sources also say LaBeouf has stayed actively involved in their child’s life, even while living in New Orleans, and was reportedly fully present and hands-on while Goth was busy with work commitments.

Article continues below advertisement

The Actor Reportedly Tried His Best To Salvage Their Relationship

A close source of LaBeouf also claimed that not only was he not at fault for the end of the relationship, but he also did everything he could to save it.

The source said LaBeouf even tried various approaches, including taking vacations and even exploring religion, in the hope that Goth would be persuaded to stay.

However, every step forward felt like “ten steps back” during those attempts, as while Goth cared for LaBeouf, she ultimately didn’t want to be married to him.

One other insider close to Goth then insisted that LaBeouf was the problem, citing his drinking issues as a key factor in his relationship breaking up.

They also claimed that Goth didn’t believe the actor was ready or able to address his personal challenges and grow as a person.

Article continues below advertisement

Mia Goth Is Hopeful That Shia LaBeouf Will Seek Rehabilitation

Despite everything that has happened between LaBeouf and Goth, she is reportedly still hopeful that he will seek rehab following his recent arrest during the Mardi Gras celebrations in New Orleans.

The actor was arrested after he was involved in an altercation outside of a local bar.

Footage obtained by TMZ showed that the incident was serious enough to warrant paramedics, who arrived in the aftermath of the brawl and spent some time treating LaBeouf.

The actor was then taken away by ambulance and was later charged with two counts of simple battery, which is generally classified as a misdemeanor.

The incident caused LaBeouf to be criticized by netizens, with many calling on him to take accountability and stop drinking.

Article continues below advertisement

The Actor Was Recently Seen Getting Handsy With A Mystery Woman

Although sources claim LaBeouf still has love for his estranged wife, Goth, the actor seems to also be moving on romantically, as he was getting very cozy with a woman at a bar shortly after his Mardi Gras arrest.

According to a video obtained by TMZ, LaBeouf appeared to be in a happy mood as he flirted while standing hand in hand with the woman on a balcony overlooking the bar.

The woman at some point placed her hand on the actor’s chest while smiling up at him. He then leaned down to whisper to her before kissing her on the lip.

LaBeouf and the mystery lady were said to have locked lips several times and were locked in an embrace all through the night.

Article continues below advertisement

Another Arrest Warrant Was Obtained In Shia LaBeouf’s Case

After his arrest, LaBeouf was released on his own recognizance. However, at his initial court hearing, Judge Simone Levine set a $100,000 bond after being unimpressed by his drug and alcohol test results.

The judge also ordered LaBeouf to enter rehab, submit to frequent impairment testing, and stay away from the individuals he assaulted, as well as the locations of the incidents.

He is expected to return to court on March 19, though he could be required to appear sooner, as a new arrest warrant has been issued for him.

This is in connection with a third victim allegedly assaulted by the actor at the same Mardi Gras incident.

Entertainment

Dennis Quaid's ex-costar blasts his 'crazy' Trump support after Air Force One trip: 'At least I got to slap him'

:max_bytes(150000):strip_icc():format(jpeg)/Dennis-Quaid-and-Donald-Trump-0228260-4-7d81b2a81cfe472a8a4a6854a7c4b9a5.jpg)

Lauren Holly slammed her “Any Given Sunday” castmate after he appeared at a public event with the president on Friday.

Entertainment

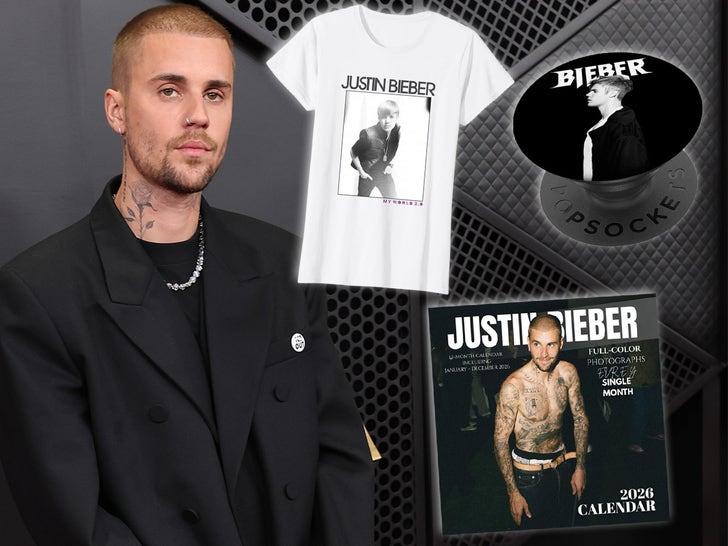

Treat Yourself with These Fan Items

Belieber 4Ever!

Get That Yummy-Yummy Drip 🎁

On JB’s Bday

Published

TMZ may collect a share of sales or other compensation from links on this page.

Justin Bieber is turning 32 and while you both may be grown now, somewhere deep inside is that tween who sang “One Less Lonely Girl” at the top of their lungs in their room after school.

In honor of the Bieb’s birthday, channel your inner OG Belieber by picking up some must-have fan-inspired products … from throwback tees to swoon-worthy posters and a calendar straight out of 2011.

After all, you don’t have to borrow your parent’s credit card anymore … so consider this your official excuse to lean into your inner fangirl.

Girl, you got that yummy, yummy … and you can have this Justin Bieber Changes T-Shirt too. If you’re reminiscing on the days of Justin’s “Changes” era, you’ll love this black and white tee.

With a moody snapshot and a graphic that features a nod to his fifth album, this tee is a must-have for true Beliebers.

Justin Bieber Throwback T-Shirt

If you’ve been around since the beginning, you’ll remember this Justin Bieber Throwback T-Shirt from back in the day.

Featuring an image where he’s still looking like a baby, baby, oh! this tee will bring you right back to the days when your room was plastered with JB posters and you were blasting “My World” loud enough for the whole neighborhood to hear.

Justin Bieber My World 2.0 T-Shirt

Who could forget Justin’s iconic debut album? This Justin Bieber My World 2.0 T-Shirt features the teen superstar that we all fell in love with over 15 years ago.

Pay tribute to where it all began with this throwback tee that’ll have you humming “U Smile” all day long.

You know that blank space on your living room wall? It’s the perfect place for this Justin Bieber Poster, obviously. And who could resist the Biebs in his blond era?

You can consider this the upgraded version of JB posters you ripped out of the pages of your favorite teen magazine and taped to your ceiling in 2011.

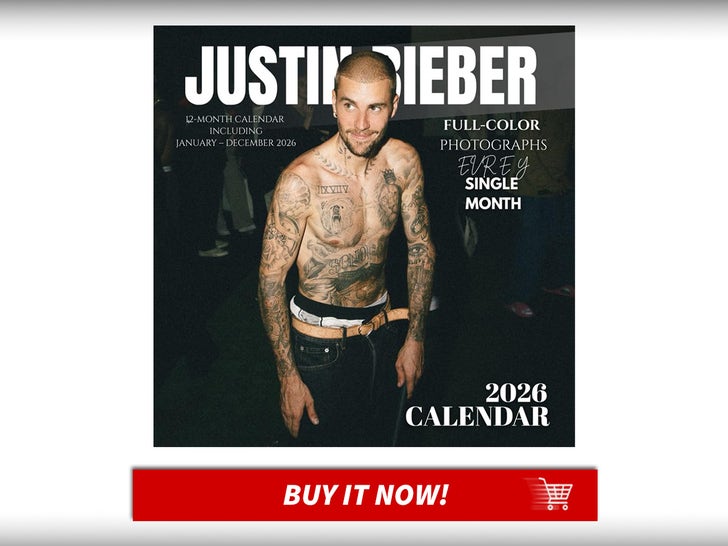

It’s not too late to upgrade your calendar for the year! This Justin Bieber 2026 Calendar is the only way you should be keeping track of your upcoming commitments, from work meetings to summer vacays and even friends’ birthdays.

While you’re at it … you can add JB’s birthday on March 1st.

Justin Bieber Pop Socket

Just when you thought you owned every piece of JB inspired tchotchke possible … this Justin Bieber Pop Socket shows up on Amazon.

This phone accessory is the perfect combination of function and fandom, providing you a new way to showcase your love for the Biebs.

Justin Bieber Love Yourself T-shirt

JB’s here to remind you to love yourself … and so is this Justin Bieber Love Yourself T-Shirt.

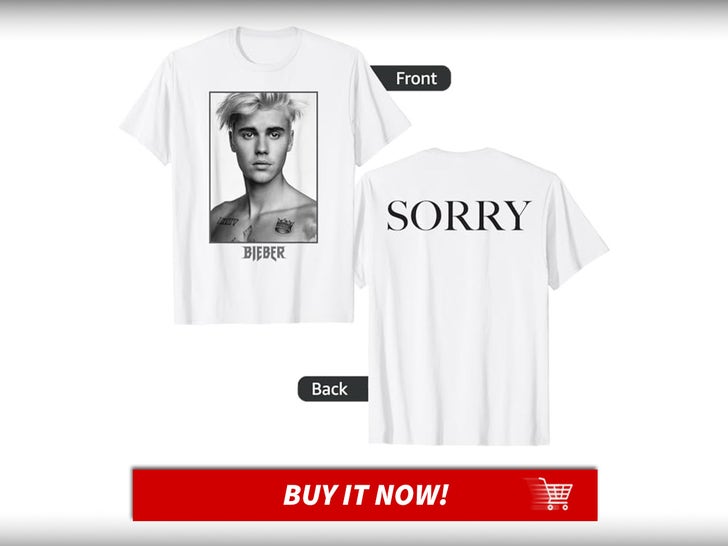

Featuring a black and white pic from his “Purpose” era, this tee is simple but makes a statement. You’re definitely going to like the way you look.

Don’t apologize for being a Belieber … Just pick up this Justin Bieber Sorry T-Shirt. Featuring a shirtless Biebs in a black and white snapshot, this tee will let everyone know exactly who you stan. It may not be the most subtle tribute to JB, but who really needs to be nonchalant about their love for Justin?

Sign up for Amazon Prime to get the best deals!

Products are not official merchandise and are not affiliated with or endorsed by the celebrity unless explicitly stated.

-

Sports6 days ago

Sports6 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Iris Top

-

Politics6 days ago

Politics6 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business5 days ago

Business5 days agoTrue Citrus debuts functional drink mix collection

-

Politics2 days ago

Politics2 days agoITV enters Gaza with IDF amid ongoing genocide

-

Sports1 day ago

The Vikings Need a Duck

-

Crypto World5 days ago

Crypto World5 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Tech7 hours ago

Tech7 hours agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Business7 days ago

Business7 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Tech5 days ago

Tech5 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat17 hours ago

NewsBeat17 hours agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Business7 days ago

Business7 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat3 days ago

NewsBeat3 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat3 days ago

NewsBeat3 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat22 hours ago

NewsBeat22 hours agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat6 days ago

NewsBeat6 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech7 days ago

Tech7 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat14 hours ago

NewsBeat14 hours agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat7 days ago

NewsBeat7 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics7 days ago

Politics7 days agoMaine has a long track record of electing moderates. Enter Graham Platner.