Business

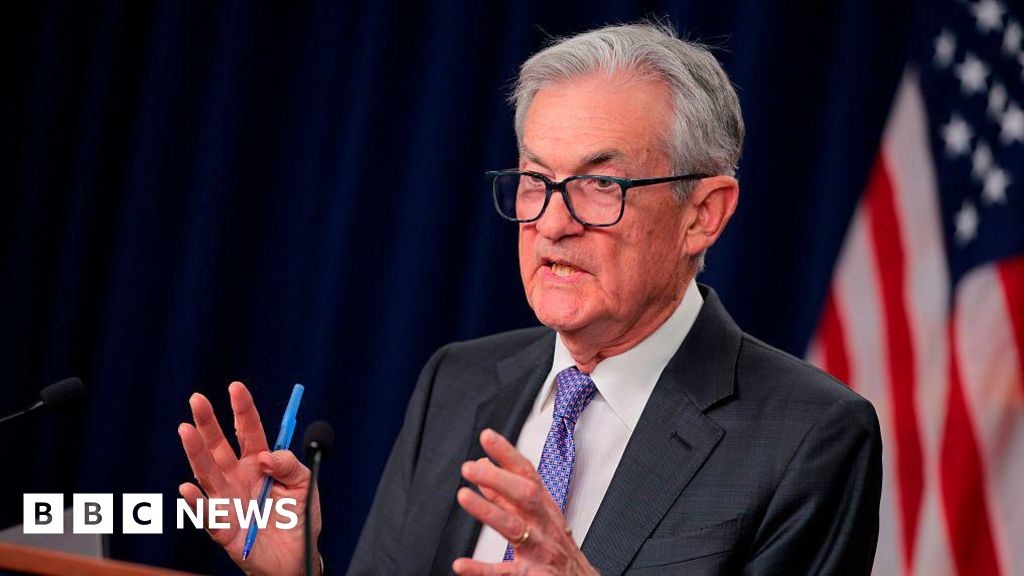

US Fed Chair Jerome Powell under criminal investigation

Federal prosecutors have opened a criminal investigation into Federal Reserve Chairman Jerome Powell, he said on Sunday.

In a video announcing the probe, Powell said the US justice department served the agency with subpoenas and threatened a criminal indictment over testimony he gave to a Senate committee about renovations to Federal Reserve buildings.

He called the probe “unprecedented” and said he believed it was opened due to him drawing Donald Trump’s ire over refusing to lower interest rates despite repeated public pressure from the president.

The Fed chair is the latest to come at odds with Trump and then face criminal investigation by the US justice department.

The justice department and the White House have not yet commented on the matter.

“This is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions, or whether instead monetary policy will be directed by political pressure or intimidation,” Powell said.

“I have deep respect for the rule of law and for accountability in our democracy. No one, certainly not the chair of the Federal Reserve is above the law, but this unprecedented action should be seen in the broader context of the administration’s threats and ongoing pressure,” he went on to say.

Trump said in an interview with NBC News on Sunday that he did not have any knowledge of the Justice Department’s investigation into the Fed.

“I don’t know anything about it, but he’s certainly not very good at the Fed, and he’s not very good at building buildings,” he said of Powell.

The probe, which prosecutors have not confirmed, would signal a fresh escalation in Trump’s ongoing dispute with Powell, who the president nominated for the role as Fed chair in 2017.

Trump has repeatedly threatened to remove Powell, who he has criticised for not cutting interest rates as quickly as the president would have liked. In the second half of 2025, the Fed cut interest rates three times.

The president has consistently blamed his predecessor, Joe Biden, and interest rates for inflation and costs in the US.

Critics have raised concerns that Trump’s pressure to oust the Fed chair would muddy the institution’s authority to set interest rates independently from presidents.

North Carolina Senator Thom Tillis, a Republican who is a member of the Senate Banking Committee, said he would oppose the nomination of Powell’s replacement by Trump, and any other Fed Board nominee, “until this legal matter is fully resolved”.

“If there were any remaining doubt whether advisers within the Trump Administration are actively pushing to end the independence of the Federal Reserve, there should now be none,” Tillis said in a statement.

“It is now the independence and credibility of the Department of Justice that are in question,” the senator said.

Senator Elizabeth Warren, a Democrat, said she believed Trump’s plan was to push Powell off the Fed board for good and “install another sock puppet to complete his corrupt takeover of America’s central bank”.

“This committee and the Senate should not move forward with any Trump nominee for the Fed, including Fed Chair,” she said.

Powell’s investigation will be overseen by the US Attorney’s Office for the District of Columbia, according to the New York Times, which first reported the probe.

Trump previously took aim at Lisa Cook, a governor at the US central bank, whom he tried to fire over alleged mortgage fraud.

The case was blocked by a US federal court and will be heard by the Supreme Court later this month.

Criminal charges brought by Trump’s justice department against political adversaries like New York Attorney General Letitia James, who brought a civil fraud case against Trump in 2024, and ex-Federal Bureau of Investigation boss James Comey were also dismissed by a court.

Comey was accused of making false statements and obstructing justice. He was fired by Trump during his first term after leading a probe into Russian interference in the 2016 US presidential election, an election Trump won over Hillary Clinton. resulted in Biden’s election.

Both Comey and James have maintained their innocence and said the prosecutions were politically charged.