In spring this year, Elliott Management, the $70bn US hedge fund known for circling distressed assets, alighted on a new target: Britain’s largest water company.

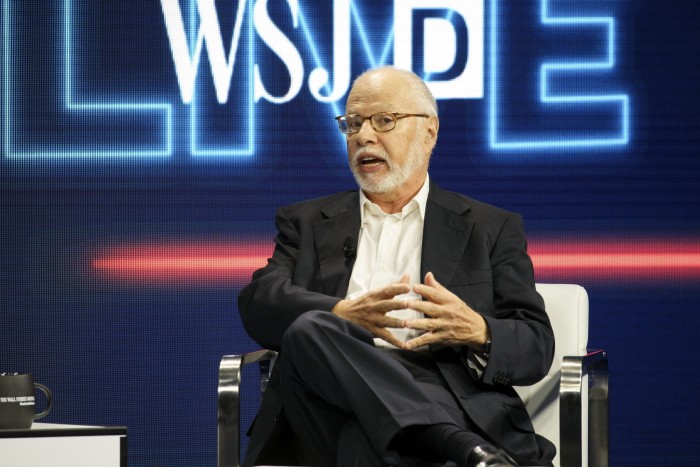

After scooping up hundreds of millions of pounds of Thames Water’s debt from panicked asset managers willing to sell at a discount, Paul Singer’s Elliott is now one of several hedge funds engaged in a tussle over the future of the troubled utility.

Elliott, which earned notoriety for seizing a Argentine naval ship during a 15-year skirmish with the Latin American nation over its defaulted debt, is in the vanguard of a group of Thames Water’s top-ranking bondholders that has agreed to provide a loan of as much as £3bn to the cash-strapped utility, which has warned that without urgent intervention it could run out of money around Christmas.

The emergency loan will not come cheap. On top of a near 10 per cent annual interest rate, the lenders will also pocket substantial fees and stand to gain a further windfall if Thames Water repays the loan ahead of its 2.5-year maturity.

While Thames Water has already signed a so-called lock-up agreement with these bondholders and is trying to gain approval for the deal from the rest of its lenders, a rival group of investors holding the utility’s lower-ranking debt has made a competing offer to provide their own £3bn loan at a lower 8 per cent interest rate and with fewer strings attached.

The two sets of bondholders include large asset managers such as BlackRock — which is in both groups through investments in separately managed funds — but the competing offers have also pitched a number of specialist distressed debt investors against one another. Elliott is joined by fellow US hedge funds Silver Point Capital and GoldenTree Asset Management in the so-called class A bonds and the likes of London-based credit fund Polus Capital Management hold the class B debt.

The fact that the utility, which provides water and sewerage services to 16mn customers in and around London, is now host to a fight between some of the US and Europe’s biggest debt specialists underscores its fall from grace in debt markets.

Thames Water’s near £19bn of debt was once viewed as among the safest investments in the sterling corporate bond market, due to the regulated regional monopoly’s predictable revenue stream. But now credit rating agencies have downgraded the utility to the lowest reaches of junk.

While both proposed loans have been pitched as short-term solutions to keep Thames Water afloat while it tries to raise at least another £3bn in fresh equity from new investors, some campaigners fear it could saddle the company with even more expensive debt to the detriment of its customers.

Feargal Sharkey, the former rock musician who now campaigns for cleaner water in Britain and is fiercely critical of industry regulator Ofwat, said that “customers would pay for this as more of their bills get eaten by savage lenders”.

“Ofwat seems content to allow Thames Water’s debilitated corpse to implode under even yet more debt,” he said, “while the vulture capitalists and banks look on, licking their lips, eager for a quick buck.”

A spokesperson for the class A bondholders said that about 70 per cent of their group is “long-term, real money investors in UK infrastructure”, that their loan offer “is open to all creditors” and that they want to “give Thames the best opportunity to attract the new equity it needs and allow for a full recapitalisation and successful turnaround”.

A spokesperson for the class B bondholders said that their financing offer was “drastically cheaper, more flexible and more substantial than the expensive loan proposed by the class A [group]”.

Ofwat said: “’We have been pushing Thames Water to make significant improvements in its operational performance and financial resilience for some time.”

“The company has made a request for a substantial increase in expenditure as part of the current price review process. We are reviewing that request and the supporting information provided, and will announce our final decisions in December.”

People close to the class A bondholders argue that their overall deal will lessen the company’s immediate debt repayment burden, due to a maturity extension that Thames Water would simultaneously gain from lenders, while freeing up hundreds of millions of pounds of cash currently trapped in reserve accounts.

The interest on the new debt would be funded from the proceeds of the loan itself rather than customer bills, those people also claimed.

But it is also true that there is the potential for instant profits to the funds that participate: traders have already started quoting conditional prices on the new debt showing that they will buy and sell it well above face value.

The class B bondholders, meanwhile, have said that Thames Water has not given a fair hearing to their offer, which they estimate could save the utility hundreds of millions of pounds.

“They said ‘it’s all too little too late’,” one bondholder said.

Credit funds such as Sculptor Capital Management and Marathon Asset Management are among the funds that have provided commitments to fund the class B group’s loan, according to people familiar with the matter.

Sculptor declined to comment. Marathon did not respond to a request seeking comment.

Zimmer Partners — a US investment firm that specialises in utilities and infrastructure — is one of the biggest funders of the rival loan offer, the people added. The New York-based firm has experience in providing rescue financing to troubled utilities, having provided $675mn of equity to bankrupt Californian electricity company PG&E in 2020.

PG&E’s bankruptcy also prompted a tussle between hedge funds that saw Elliott and Zimmer sit in opposing camps, with the former firm unsuccessfully pursuing legal action against the company for allegedly snubbing Elliott from participating in a $2bn equity raise.

Elliott and Zimmer also declined to comment.

While there are heavyweight firms on both sides, the class B bondholders are relative minnows in Thames Water’s debt stack, accounting for £1.4bn of its borrowing versus £16bn of class A debt. The class A bondholders would be paid ahead of any class B if the utility were to become insolvent, while the new loan would rank ahead of both classes of existing debt.

Even though the class B bondholders are offering cheaper terms, their proposed loan would still need approval from class A bondholders. This could prove a sticking point.

The class B group said on Thursday that it was calling on “all of the company’s other creditors to support this committed financing [ . . .] rather than needlessly paying lenders interest on expensive debt with money that could be spent investing in the water and wastewater supplies of London and the Thames Valley”.

If either loan goes through, it will allow Thames Water to keep running while Ofwat agrees a five-year regulatory settlement over customer bills, which is expected to be announced in December or early January.

It will also give the utility breathing room to potentially challenge the regulator with the Competition and Markets Authority if the settlement disappoints. The company has asked for a 53 per cent increase in bills by 2030.

“If they raise £3bn debt, this should get you to the other side of any CMA referral, so the can may be well and truly kicked down the road,” said Dominic Nash, an analyst at Barclays.

The equity process is being run separately by Rothschild with final bids due early in the new year. Potential bidders including Castle Water, which already handles Thames Water’s business customers, and US private equity firm KKR are carrying out due diligence on the deal, according to two people familiar with the situation.

Some have argued that an onerous new loan or a messy dispute between bondholders could make Thames Water less appealing to potential investors, however.

“If that exploitative deal is agreed we will definitely consider walking away,” said one potential equity investor.

The bondholders declined to comment. Thames Water did not respond to a request seeking comment.

But while the two groups of bondholders are at odds over which loan deal goes through, they are unified in their determination to avoid the renationalisation of Thames Water under the government’s special administration regime.

With any new funding from the government ranking ahead of their debt in that process, special administration would have the potential for inflicting large losses even on hedge funds that scooped up Thames Water’s debt for pennies on the pound.

You must be logged in to post a comment Login