Entertainment

Kanye West Brings Out North West at Mexico Concert to Perform Her New Song

Kanye West‘s fully embracing the mentor role for his daughter North West‘s rap career … bringing her out at his Mexico show to perform her new song.

The music legend performed in Mexico City Friday night — his first show in the country in nearly 20 years — and, North joined him onstage to play “Piercing On My Hand” … a song which references the dermal implants she got in her right hand a few months ago.

North West teases her new song “Piercing On My Hand” live pic.twitter.com/SxvjNwlQoU

— Complex Music (@ComplexMusic) January 31, 2026

@ComplexMusic

Check out the clip … like father, like daughter when it comes to the outfit — thick sunglasses and an all-black ‘fit which looks a lot like a mini version of something Ye would wear.

Ye takes a background role during the clip … bouncing onstage while his daughter draws eyes and raps about her blue hair and her alleged bad girl lifestyle.

North showed off her new look — with the hair and black grills — earlier this month on social media … captioning the clip by saying she shared the pic with all the haters that were “mad over a finger piercing.”

While North took center stage Friday, it’s her father who has been grabbing headlines recently … apologizing for his slew of antisemitic comments over the last few years — claiming his mania was caused by a car accident 20 years ago.

He told fans the accident “does not excuse what I did though. I am not a Nazi or an antisemite. I love Jewish people” before telling members of the Black community, “I am sorry to have let you down. I love us.”

Kanye’s clearly throwing himself fully into his career and fatherhood after his apology … so we can probably expect to see North at more shows in the future.

Entertainment

Netflix’s Hard-R, Hardcore Sci-Fi Thriller Goes Full On Mad Max

By Robert Scucci

| Published

Given the Mad Max franchise’s influence on the pop culture landscape since it kicked off in 1979, it’s easy to call any post-apocalyptic road thriller set in the Australian Outback a cheap imitation. The way I’ve made peace with that kind of assessment is by appreciating the fact that Mad Max created its own distinct genre, where there’s plenty of room for filmmakers to work out similar concepts while still offering their own take. 2014’s The Rover, written and directed by David Michôd, is a shining example of using the punishing Australian desert as a backdrop to tell his story about a society well into its ongoing collapse.

With Guy Pearce leading the charge with support from Robert Pattinson, The Rover is a violent journey across barren landscapes inhabited by people who’ve been forgotten by the rest of the world. It’s a lawless land, but there are still clear power structures at play. Watching those structures slowly fall apart makes for a satisfying watch because society collapsed recently enough for people to remember the before times, but not so recently that they aren’t aware of where things are heading.

A Rampage For A Stolen Car

Before The Rover’s conflict is properly established, we’re introduced to Archie (David Field), Caleb (Tawanda Manyimo), and Henry (Scoot McNairy). They’re fleeing a robbery, and with them is Rey (Robert Pattinson), Henry’s younger brother. Having been injured during the robbery, Rey is kicked out of the vehicle and left for dead. During the scuffle, their car crashes, prompting them to steal a new getaway vehicle.

Unfortunately for the gang, they stole a car belonging to a nomadic loner named Eric (Guy Pearce). Having lived through society’s initial collapse roughly 10 years earlier, which resulted in the loss of his family and his farm, Eric doesn’t take too kindly to the thieves and immediately sets out to hunt them down, obstacles be damned. Stumbling upon a gravely injured Rey, who he knows was at the very least indirectly responsible for his car getting stolen, Eric brings him to a doctor to nurse him back to health before grilling him on his brother’s whereabouts.

Along the way, Eric has violent encounters with a gun-dealing dwarf operating out of an opium den, traveling circus members, and what’s left of the Australian Army, who still try to exert power over the country’s citizens despite lacking the firepower they once had. Rey, dragged along and not fully himself due to his injuries, proves to be more burden than leverage, complicating matters for Eric, who just wants to retrieve his car and get back to being a miserable drunk wandering through the wasteland.

A Madmaxian Action Flick That Stands On Its Own

While the obvious Mad Max setup can be found in The Rover, it never once feels like a carbon copy of the franchise that inspired it. We’ve got the Australian desert, car chases, and showdowns packed with firepower, but given how wide-reaching the lore is in Mad Max, there’s plenty of room for films like The Rover to occupy similar thematic territory while traveling a completely different road. Using that template as a jumping-off point, The Rover tells a more personal story about loss and revenge that would work just as well in any other setting.

Michôd has gone on record about the similarities, stating, “You put cars in the desert in Australia and people are going to think of Mad Max, and with all due respect to that film, I think The Rover is going to be way more chillingly authentic and menacing.” He’s not wrong in that assessment because there are no nitro trucks and masked marauders here. There’s no sprawling folklore that feels almost biblical. Instead, we get a raw glimpse of humanity barely hanging on by a thread, and we witness the continued collapse of society while it’s still actively happening.

As of this writing, The Rover is streaming on Netflix.

Entertainment

Ari Fletcher Sparks Reactions After Debuting “Demario” Tattoo

Ari Fletcher and Moneybagg Yo have been unbothered and in love. From luxury car gifts to RIAA plaques, the couple hasn’t missed a moment to celebrate each other loudly and proudly on social media. And while they continue to flex their unbreakable bond, the internet has still found its way into the mix.

RELATED: Hol’ Up! Ari Fletcher Appears To Call Moneybagg Yo Her “Husband” In Romantic Clip From Their Valentine’s Day Dinner (WATCH)

Ari Pens A Sweet Message To Her Mannnnn Moneybagg Yo

On Monday, Feb. 23, Ari took to Instagram with a heartfelt message for her man, Moneybagg Yo. On her Story, she shared a photo of her hand showing off a tattoo of his legal first name, “Demario,” while a massive diamond sparkled on her ring finger.

With ‘My Truth’ by India Arie playing in the background, she wrote, “You show me LOVE, real love. Unconditional forever love. I’ll always follow your lead because you are a true leader and I know greatness comes with wherever you decide to go. I would choose life with you over and over again in any life.”

Moneybagg later reportedly responded via his Instagram Story, writing, “Foreva Us my Zawja 🤞🏾 #TheUnbreakables”

Social Media Reacts

Ari’s sweet message to Moneybagg Yo sparked mixed reactions in The Shade Room’s comments. While some fans thought the tattoo and tribute were cute, others brought up past drama in their relationship. Specifically, a few critics mentioned recent rumors linking Ari to Lil Baby, while others suggested the latest gestures were related to her ex, G Herbo, and his engagement to Taina Williams. However, Ari’s supporters quickly defended her, saying they love the bond she shares with Moneybagg and believe the couple is genuinely happy.

Instagram user @straightouttachat wrote, “She love that man down, baby! ❤️❤️”

Instagram user @deestackss added, “The D being a heart is soooo cute”

While Instagram user @pay.r0ll wrote, “I love them but I know somebody bout to have something negative to say about this too”

Instagram user @ell. plaga wrote, “After Jayda exposed her for f**** Baby now she loves him again😂😂😂”

Instagram user @m.armanij added. “Idk sista i love you but since taina got engaged sis you been showing bag off more than usual 👀😭”

While Instagram user @addictedtoleelee wrote, “Peep that big ass ring too thangyaaaa 👏🏾 👏🏾 “

Instagram user @mickipeezie wrote, “Lots of haters in the comments, to be young, rich and in love is 🔥 😍

Instagram user @azraa2.0 wrote. “I can’t wait to be this in love wrote 😍 🔥l

While Instagram user @its.dreanaaa wrote, “but why do we have to put people’s names on our bodies like they own us?? like there are so many other ways to show love”

Love And Going RIAA Gold

A few months ago, rapper Moneybagg Yo celebrated a major milestone after earning 25 new gold. Reflecting on the achievement, he wrote:

“So All My Support, Die Hards and Certified We Got #25 Mo Trophies In Today. We Like 75 Plaques In! This History Coming From Where I Came From! Now Watch How We Shake Sht Up With This New Work. #ForevaHoldYourPeace Album Soon!”

While the Memphis rapper was in a celebratory mood, Ari made sure to show love and support for her partner. Among the plaques was also the couple’s record, ‘Brain Dead,’ which earned a gold RIAA certification. The 2020 record, featured on ‘Code Red,’ the joint project with Blac Youngsta, captures the emotional ups and downs of a relationship and even includes a voicemail from Ari. Celebrating the plaque, Ari wrote: “Not I got my first plaque @moneybaggyo. I’m so proud of you and all of your success. Not just witnessing it but being apart of it.”

RELATED: Cupid’s Move! Ari Fletcher Flexes Lavish Valentine’s Day Gift From Moneybagg Yo & The TL Is In Their Feelings (PHOTOS)

What Do You Think Roomies?

Entertainment

Hilary Duff Reacts After ‘Lizzie McGuire’ Dad Robert Carradine Dies

Hilary Duff gave her fans chills when she debuted her comeback earlier this year. Now, just days into releasing her first album in a decade, the pop star is grieving the loss of a dear person from her childhood. On Monday (Feb. 23), she shared two throwback photos and a caption honoring Robert Carradine. Fans of Disney in the 2000s will remember him as her TV dad on the hit show, ‘Lizzie McGuire.’ Carradine’s family confirmed on Monday that he died at age 71.

RELATED: Go Rae, Go Rae! Fans Sound Off After Video Shows Raven-Symoné Dancing In Tribute To Brandy (WATCH)

What Happened To Robert Carradine?

In a Tuesday statement, Robert Carradine’s family said he lived with bipolar disorder for two decades. His brother, Keith Carradine, told Deadline that Carradine died by suicide. The actor was the youngest of his prolific Hollywood family. His biggest hit was the 1984 comedy ‘Revenge of the Nerds,’ but many millennials remember him for his role as Lizzie McGuire’s dad on Disney Channel.

“We want people to know it, and there is no shame in it,” Keith Carradine told Deadline. “It is an illness that got the best of him, and I want to celebrate him for his struggle with it, and celebrate his beautiful soul. He was profoundly gifted, and we will miss him every day.”

EDITOR’S NOTE — This story includes discussion of suicide. If you or someone you know needs help, the national suicide and crisis lifeline in the U.S. is available by calling or texting 988.

Known for both his film and television work, Robert Carradine worked steadily in the industry for over 40 years, starting in the ’70s. Despite his work with top-tier directors, he never gained the worldwide recognition of his more famous brothers Keith Carradine and the late David Carradine.

Hilary Duff Shares Touching Message About ‘Lizzie McGuire’ Dad

As mentioned, in the 2000s, Robert Carradine picked up a new generation of fans with the character, Sam McGuire. He played a corny but extremely loving dad to Lizzie, played by Hilary Duff, and a younger son. His character was married to Jo McGuire, played by Hallie Todd. On Monday, Hilary opened about how Robert Carradine and Hallie made her feel protected growing up on set. Her Instagram post included two photos with Robert, a solo shot and another of the McGuire family.

“This one hurts. It’s really hard to face this reality about an old friend. There was so much warmth in the McGuire family and I always felt so cared for by my on-screen parents. I’ll be forever grateful for that. I’m deeply sad to learn Bobby was suffering. My heart aches for him , his family, and everyone who loved him. 💔”

Robert Carradine’s Real-Life Daughter Shares Memories

Robert’s survivors include his three children, actor Ever Carradine, Marika Reed Carradine and Ian Alexander Carradine. On Monday, Ever confirmed her dad’s death in a lengthy Instagram caption about his love as a single parent. She was born in 1974 to Robert and Susan Synder.

“Whenever anyone asks me how I turned out so normal, I always tell them it’s because of my dad. I knew my dad loved me, I knew it deep in my bones, and I always knew he had my back,” Ever Carradine wrote on Instagram. “I think it’s partly because we basically grew up together. Twenty years age difference really isn’t that much, and while I never ever thought of him as a sibling, I did always think of him as my partner. We were in it together.”

In 1990, Robert Carradine married Edith Mani, whom he had his middle and youngest child with. After more than 25 years of marriage, they divorced following a 2015 car crash in Colorado. In her divorce documents, she claimed he admitted to her and their two kids that he “deliberately drove into the truck” to kill them both, per TMZ. She alleged he had been depressed after his brother, David, died by hanging in 2009. At the time, she had requested possession of his 17 guns out of fear he might hurt himself. They settled and finalized their split in 2018, per The Blast. He reportedly was allowed to keep his gun collection amid other possessions.

RELATED: Oop! Reginae Carter Recalls Losing Disney Opportunity Over Mack Maine’s Lyrics In “Every Girl” (VIDEO)

AP Film Writer Lindsay Bahr contributed to this report via AP Newsroom.

What Do You Think Roomies?

Entertainment

Lisa Rinna Finally Addresses Sexuality Rumors About Her Husband

Lisa Rinna is finally addressing one of the longest-running rumors surrounding her marriage, and she’s making her stance crystal clear. In her new book, “You Better Believe I’m Gonna Talk About It,” the former “Real Housewives of Beverly Hills” star opens up about speculation surrounding her husband Harry Hamlin’s sexuality, something she says has followed him for decades. Rinna not only defends her husband but also reflects on how Hollywood, reality TV, and his early career choices contributed to the chatter. Her comments come amid renewed headlines about the couple and Lisa Rinna’s personal life, including a recent incident that reportedly left her concerned for her own well-being.

Article continues below advertisement

Lisa Rinna Directly Addresses Rumors About Harry Hamlin

Lisa Rinna didn’t mince words when discussing speculation about her husband of nearly three decades. In her book, she makes it clear she wants to put the rumors to rest once and for all. “Let’s just clear this up one last time, once and for all: Harry’s heterosexual,” the Bravo alum wrote. “He is not a gay man in any way, shape or form, not that there’s anything wrong with that,” she continued.

Rinna explained that she didn’t even become aware of the rumors until she joined “The Real Housewives of Beverly Hills” in 2014, suggesting the speculation intensified once her personal life became part of reality television storylines. “I just figured b-tches will say anything to get my hackles up, so it never concerned me,” she added. “My reaction was always more, ‘why you mad, boo?’”

Article continues below advertisement

Lisa Rinna Says Reality TV Culture Played A Role

According to Lisa Rinna, speculation about spouses was common during her time on the Bravo series. She claimed that “every husband’s sexuality was questioned at some point on that show.”

“When you’re a good-looking man in Hollywood with a good sense of style, that adds up to ‘is he gay?’” Rinna questioned.

Article continues below advertisement

Harry Hamlin’s Career Choice Sparked Early Speculation

Lisa Rinna also pointed to a specific moment in Hamlin’s career that she believes fueled rumors for decades: his role in the 1982 film “Making Love.” In the Arthur Hiller-directed movie, Hamlin portrayed Bart McGuire, an openly gay man involved in a relationship with a married heterosexual character, a storyline considered groundbreaking at the time.

“Mainstream films about gay men are still rare today, but back then it was unheard of,” Rinna wrote. “He does what rings true to him. It was something that he felt was absolutely necessary to do. Harry made a brave decision, and it bit him in the a-s.”

Article continues below advertisement

She claimed the decision had long-term professional consequences, alleging Hamlin was “blacklisted for several years afterward,” and noting it took him decades before landing a major studio film again with 2023’s “80 for Brady.” “To this day, Harry says he would do ‘Making Love’ all over again because it was so impactful,” Rina wrote. “Harry changed so many people’s lives, and that’s why he wouldn’t have it any other way.”

Article continues below advertisement

Marriage Built On Trust And Longevity

Despite years of rumors, Lisa Rinna says their relationship has remained strong and largely unaffected by outside speculation. The couple married in 1997 and later welcomed daughters Delilah Belle and Amelia Gray.

Hamlin was previously married to Laura Johnson and Nicollette Sheridan before meeting Rinna. She emphasized the trust they share, explaining she doesn’t worry about infidelity. “I would be shocked if I ever found out he was having an affair,” Rinna said.

The actress has also spoken openly about their intimacy, previously revealing that while their sex life has evolved over time, it remains fulfilling.

Recent Headlines Surround Lisa Rinna’s Personal Life

According to reports, a source claimed Rinna’s co-star Colton Underwood noticed she appeared unusually intoxicated during the event. The source alleged Underwood became concerned because he knew she typically doesn’t drink heavily, and he reportedly alerted her team. Rinna was then removed from the party shortly afterward, though details surrounding the situation remain unclear.

“You Better Believe I’m Gonna Talk About It” is out now wherever books are sold.

Entertainment

Kendall Jenner Poses for Sizzling Hot Vogue France Photoshoot

Kendall Jenner

Haute & Bothered for Vogue France!!!

Published

Kendall Jenner’s booked, busy, and still finding time to break the internet … and if you thought her shoots couldn’t get any hotter, Vogue France says Hold My Croissant!

The supermodel snagged the cover and a full spread to match — and let’s just say the looks are working overtime … ’cause we’re talking seriously risqué snaps that put those supermodel stats to very good use.

Waiting for your permission to load the Instagram Media.

You’ve gotta see these pics — the stylist clearly clocked in early and left late, dressing Kendall in a lineup of daring cut-out numbers, some so microscopic they showed off plenty of underboob.

Cropped fits, unbuttoned shirts, smoldering poses … Kendall was absolutely giving supermodel supremacy and reminding everyone why she’s in a league of her own.

One thing about Kendall — she knows how to werk!

Entertainment

Social Says Shaded Chrisean Rock, Karlissa Weighs In

Karlissa Saffold Harvey weighs in as folks think Blueface shaded Chrisean Rock, while speaking on how he and Nevaeh Akira plan to have a “great, healthy pregnancy.”

RELATED: In Bliss! Nevaeh Akira Shares A Few Messages After She & Blueface Reveal They’re Expecting A Baby

Blueface Speaks On How He & Nevaeh Akira Plan To Have A “Great, Healthy Pregnancy”

On the evening of Monday, February 23, Instagram user @livebitez shared footage from what appears to be a recent livestream of Blueface’s. Furthermore, during the session, Blue explained that he’s “focused on one thing.”

“That’s a great, healthy pregnancy, a great, healthy baby,” he said. “My pregnant baby momma, she will not be in the club. She will not be partying, drinking, or smoking — or doing any of that stuff. For nine months. That’s the main goal.”

To note, Nevaeh Akira appeared to be by his side and in agreement with his sentiments.

Peep the clip below.

Karlissa Saffold Harvey Weighs In As Folks Think He Shaded Chrisean Rock

Social media users reacted to Blueface’s words in @livebitez’s comment section. Some appeared to think he was throwing shade at Chrisean Rock, with whom he shares his third child, Chrisean Jr.

Instagram user @shaniseeeeeeee wrote, “He can’t shade someone who he condoned…”

While Instagram user @mama_of_superheroes added, “He so bitter that Chrisean finally snapped out of it and got some sense now lol”

Instagram user @bigh_75 wrote, “You so in love with Chrisean that you can’t keep her name out your mouth 👄 lol 😂”

While Instagram user @everybodycallsmeb added, “He’s trying to get a response from Chrisean ….”

Instagram user @scorpio_arrangements3010 wrote, “You sat there and watched Chrisean do it…”

While Instagram user @kr1styl3 added, “He in love with Chrisean. He wants her attention so bad. Every few days he does something so damn spiteful”

Instagram user @honeyboochile1 wrote, “He was shading chrisean bc he also shaded chrisean and jayden when he said this is gonna be his baddest babymama.Im happy he think that of lil king!!!Is crazy he gotta tear them down just to build her up”

While Instagram user @pinknlovelyisstill_fat_ugly added, “That’s not shade when it’s the truth”

Instagram user @supermom.to.5 wrote, “don’t nothing good come to nobody that speaks bad on this girl that’s all ima say.”

While Instagram user @aisha_freckles added, “Doesn’t sound like he’s shading Rock, in order to have a healthy pregnancy and baby the woman shouldn’t be doing things to put herself at risk.”

Instagram user @lynetteh64 wrote, “The truth can never be a diss tho! 🥴🤷🏽♀️”

Furthermore, Karlissa Saffold Harvey weighed in, writing:

“Johnathan is suffering from not being able to see his son and the different things that have been reported to him daily is overwhelming. Y’all literally send us videos talking about seizures and some more stuff. He was in denial and now he knows nothing and doesn’t have a relationship with the baby. He’s probably the only father who would allow her to leave the baby and not even look for her. These same people who talking all this s**t didn’t even know her and promoted for her to drink and smoke while pregnant because y’all did. I blame her fans and keep him in prayer. 🙏🏾”

More On Blueface & Nevaeh Akira’s Pregnancy

As The Shade Room previously reported, Blueface and Nevaeh Akira announced their pregnancy during a livestream on Sunday, February 22. Subsequently, that same evening, Karlissa Saffold Harvey reacted by taking to social media to write, “Kids are a blessing if he happy I’m happy [heart hands emoji] congratulations to them both and may God bless the baby.”

On Monday, February 24, Nevaeh Akira took to her social media to express her excitement for her and Blue’s upcoming chapter. As The Shade Room previously reported, Akira wrote about being “overly in love” with Blue and expressed her excitement about her son having a sibling.

In addition to his unborn baby with Akira and son with Chrisean Rock, Blue also shares two children with Jaidyn Alexis. On Monday evening, she broke her silence and addressed how she feels about his new addition.

RELATED: Jaidyn Alexis Breaks Silence & Reacts To Blueface & Nevaeh Akira’s Pregnancy Announcement (WATCH)

What Do You Think Roomies?

Entertainment

Maia Mitchell Weighs In on Joining Cast of Hannah Dodd’s Bridgerton

Maia Mitchell has already worked with Hannah Dodd so what are the chances she could join her hit Netflix series Bridgerton?

“Oh my God, why not? I’ll ask Hannah. I’ll text her now,” Mitchell exclusively told Us Weekly while promoting season 2 of Hulu’s The Artful Dodger. “I don’t think my contract would allow me to work with Netflix right now on a show but maybe after we get done with The Artful Dodger.”

Mitchell noted that she currently has her “hands full” playing Lady Belle. She didn’t rule it out though considering the amount of seasons still yet to air.

Based on Julia Quinn’s book series, each season of Bridgerton focuses on a different member of the titular family as they attempt to find love in 19th-century London. The Netflix show is expected to have eight seasons based on the eight novels written by Quinn about each Bridgerton sibling.

Dodd, for her part, plays Francesca and is expected to lead either season 5 or 6. Mitchell, meanwhile, just returned to Hulu after a lengthy hiatus between seasons.

“It was a long painstaking wait to hear [about a season 2], so we are very happy to be back,” Mitchell noted to Us. “In terms of jumping back into character, the break was good. It’s always nerve-wracking going back. But it’s so easy with our sets and in our costumes, you just really do melt right into the world. But the break was good because I would have needed that circuit break to find a different tone in her, to do some different prep. Especially with the dialect coaches, I was vocally dropping her a little lower and there was a slightly different physicality. Hopefully we get a season 3, and hopefully the break isn’t as long.”

Mitchell was thrilled at the chance to film a project in her native Australia.

“At the end of 2021, I had written a list of things I was manifesting. It was a job that was shot in Australia, a period drama and it was a woman who was playing a feminist and claiming her power. That is literally The Artful Dodger for me. So it is a dream job,” she gushed. “And to be able to work at home is fantastic. It’s less of a flight to visit family and our crew is so amazing. I’ve now shot a couple projects in Australia in the last few years, since I’ve moved home — and also overseas — and I can say for sure that it’s the best and most elevated work that I’ve been able to do.”

She concluded: “It’s because of the crew and everyone behind the camera and the cast. We have such immense talent here and I’m so excited that the world is becoming privy to it because we’ve known it. We’ve always made such fantastic shows but they have this Aussie tone with a gritty drama. Now we’re expanding that and we’ve got these massive period dramas with crazy budgets. It’s really fun to be a part of that kind of new moment in Aussie film and TV. So I couldn’t be more stoked and I would just work in Australia with Aussie crew for the rest of my career if I could. It’s the best.”

Looking ahead, Mitchell expressed hope she would get to return to film more.

“There’s a lot [more story] to tell,” Mitchell shared. “It’s such a massive show with so many characters and so many plots happening all at once.”

The actress noted that there is “a lot of opportunity” for “way more character development” in the future, adding, “With Belle and Jack, it is seeing what domestic life could look like. I don’t know how they pull that off. I don’t see them ever being settled but seeing what that looks like and seeing them actualize their relationship.”

Bridgerton returns with the second part of season 4 on Thursday, February 26. The Artful Dodger is currently streaming on Hulu.

Entertainment

Jennifer Garner Stuns in Brown Leather, Talks Ben Affleck in New Interview

Jennifer Garner

Flaunts in Brown Leather!!!

Published

Jennifer Garner is flaunting her assets in a new magazine spread for Flaunt … while also getting real about her relationship with her ex-husband, Ben Affleck.

The actress looks absolutely stunning in her brown leather Givenchy dress during a recent photoshoot and interview with a Flaunt reporter, whose cover story about the star was published Monday.

For the shoot, Jennifer wore several other outfits, including Saint Laurent by Anthony Vaccarello — a gray pantsuit and a large brown leather jacket over a white knotted shirt with brown pants.

In the interview, Jennifer talked generally about her long relationship that eventually went sour with Ben — something she doesn’t normally do. The two got married in 2005, but later divorced in 2018.

Now, Jen says she wants to help women who have gone through similar experiences, telling the Flaunt reporter … “Time has passed, and other women are going through really hard seasons in their lives, and I think it’s helpful to know that time will go on and you will get to the other side.”

The actress also says she was “in the middle of something for a really long time, and it didn’t make sense,” but “there was no way to talk about it, and it’s certainly not my place to talk about him or his experience or anything he’s gone through, or my children or their experience.” Ben and Jen share three kids — Violet, 20, Finn, 17, and Samuel, 12.

Jen went on to say she feels “lighter and happier and more myself [than I have] in a really long time, and I think that’s important to know because I really felt like, ‘Oh my gosh, has this family shake up — has it changed me forever?’”

She notes, “When you’re many years into something, you think, ‘I don’t know how it’s gonna pass.’”

Entertainment

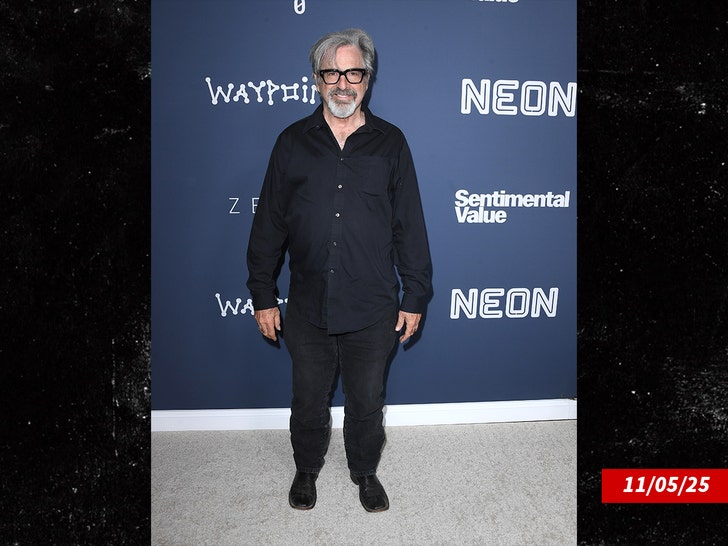

Robert Carradine Went MIA From Final Film Project, Director Says

Robert Carradine

Actor Was MIA on Current Film, Director Says

Published

The death of Robert Carradine has shocked Hollywood … but TMZ has learned there was a troubling sign on his final film project, according to one of his most recent colleagues.

Connie Lamothe, director of “The Driver” — AKA “Driving into Darkness” — tells TMZ … she’s shocked and devastated about “Bobby’s” death … but she knew there was something wrong when he went MIA from her film prior to the table read this week.

Everything was finally back on track and moving along well after the project got derailed by the pandemic … but then in January, Connie tells us David went radio silent. Producers had no idea where he was or what was going on. They were worried … but a friend who is also in the cast knew of his struggles with mental health. So, they decided to give him some space … and hoped he would return.

As we reported … the “Revenge of the Nerds” and “Lizzie McGuire” icon took his own life after a nearly two-decade-long battle with bipolar disorder.

Robert had been super excited for the project — a crime drama in which he was playing a mob boss, a leading role — Connie says, noting the actor wanted to show he could do more than comedy and westerns.

Recalling their time together during pre-production, Connie says David was delightful and always cheerful when they spoke — including when she joked with him about cutting his hair and shaving off his beard for the role.

Robert was 71.

RIP

If you or someone you know is struggling or in crisis, help is available. Call or text 988 or chat 988lifeline.org.

Entertainment

8 Best Romantic Fantasy Movies Released Since ‘The Princess Bride’

When The Princess Bride was released in 1987, it quietly rewrote the rules of romantic fantasy. It proved that a love story could be sweeping without being saccharine, ironic without being cynical, and adventurous without losing emotional sincerity. Since then, filmmakers have chased that same 1980s alchemy—the delicate balance of magic, humor, danger, and devotion. And luckily, some have found it.

Many would argue that the best romantic fantasy films released in its wake understand one crucial thing: spectacle alone is not enough. Whether told through animated kingdoms, time-traveling meet-cutes, or sky-bound ships, these stories endure because they treat love as transformative. They remind us that romance, at its best, feels both impossible and inevitable (like destiny, but still chosen). And in a genre built on magic, that sincerity is the most powerful spell of all.

8

‘Tangled’ (2010)

After a magical flower grants her healing powers, baby Princess Rapunzel is stolen from the palace by the vain and manipulative Mother Gothel (Donna Murphy), who locks her away in a hidden tower for 18 years. Now, on the brink of adulthood, Rapunzel (Mandy Moore) finally seizes her chance at freedom when charming thief, Flynn Rider (Zachery Levi), stumbles into her tower, and promises to escort her to see the floating lanterns she’s long dreamed of.

Tangled feels like a direct descendant of The Princess Bride in the best way: it gives us swashbuckling adventure, razor-sharp banter, and a romance that builds through shared danger. The lantern sequence alone solidifies itself in the Disney hall of fame as it’s not only visually stunning, but emotionally significant as it showcases a true moment of vulnerability. Throughout the film, Flynn’s bravado softens, Rapunzel finds her courage, and the fairy-tale becomes deeply human. It’s a classic romance polished with modern wit, and a true underrated addition to Disney’s animated collection.

7

‘Edward Scissorhands’ (1990)

In a pastel suburban town, an unfinished artificial man named Edward (Johnny Depp) is discovered living alone in a gothic mansion. Taken in by a well-meaning family, Edward struggles to adapt to suburban life, all the while forming a tender connection with their daughter, Kim (Winona Ryder). Unfortunately for him, his scissor-bladed hands and gentle strangeness quickly make him both a fascination and target to others.

Tim Burton’s melancholic masterpiece transforms a simple love story into something hauntingly tragic. Like in The Princess Bride, Edward and Kim’s romance is defined by distance—physical, emotional, and societal. It’s a story about loving someone you can never quite hold. However, where many fantasy romances promise happily-ever-afters, Edward Scissorhands lingers in the longing. Its bittersweet devotion, quiet sacrifice, and gothic atmosphere give it the emotional weight of a modern myth made legendary in the 90s.

6

‘Howl’s Moving Castle’ (2004)

When Sophie (Chieko Baishô), a shy young woman working in her family’s hat shop, is cursed by a jealous witch and transformed into an elderly woman, she has no means to tell anyone of her plight. So, seeking a way to break the spell, she finds refuge in the magical, ever-shifting castle of the mysterious wizard Howl (Takuya Kimura). But as war looms and curses intertwine, Sophie and Howl slowly unravel each other’s defenses.

From the brilliant minds at Studio Ghibli and famed director Hayao Miyazaki, this romance is whimsical, strange, and yet still profoundly tender. Sophie learns confidence in a body she doesn’t recognize, while Howl learns bravery in a world he’s been avoiding. Together, their love unfolds through quiet acts of protection rather than grand speeches. In many ways, the magic externalizes their insecurities, making their emotional growth feel even more profound. Howl’s Moving Castle is fantasy at its most poetic.

5

‘Big Fish’ (2003)

As Edward Bloom (Albert Finney) nears the end of his life, his estranged son Will (Billy Crudup) attempts to separate fact from fiction in the fantastical stories his father has told for years—those being tales of witches, giants, mermaids, and impossible adventures. Threaded through every outlandish anecdote, however, is Edward’s unwavering devotion to his wife, Sandra (Jessica Lange), whom he claims to have loved from the very first moment he saw her.

While Big Fish operates as a father-son drama, its most enduring thread is romantic devotion. Edward’s love story unfolds like folklore—exaggerated, stylized, larger than life—yet grounded in something deeply sincere. Whether every detail happened exactly as told almost becomes irrelevant. What matters is that Edward’s love for Sandra feels mythic in its consistency. For many, this movie highlights how romance isn’t just about how love begins, but how it is remembered and retold. And in that sense, it’s one of the grandest love stories of all.

4

‘Enchanted’ (2007)

When animated fairy tale princess Giselle (Amy Adams) is banished by an evil queen into live-action modern-day New York City, she finds herself navigating a world without talking animals or instant happily-ever-afters. Taken in by pragmatic divorce lawyer Robert (Patrick Dempsey) after an accidental stumble, Giselle’s unwavering optimism begins to disrupt his carefully ordered life—especially when people (and creatures) from her world begin to creep in.

There’s no doubt that Enchanted thrives on its playful collision between sincerity and skepticism. Giselle’s belief in true love initially seems naive, but the film gradually proves that romance can survive even outside storybook rules. The love that develops between Giselle and Robert surely isn’t instant magic—instead, it’s built through partnership and growth. By lovingly poking fun at classic tropes while still embracing them, the film becomes both parody and love letter to the genre.

3

‘Shrek 2’ (2004)

After returning from their honeymoon, Shrek (Mike Myers) and Fiona (Cameron Diaz) are invited to return to the Kingdom of Far Far Away to meet her royal parents. The only problem: they don’t know that she’s married to an ogre, nor that she’s fully become one. Throw in a scheming Fairy Godmother (Jennifer Saunders), a swoon-worthy (and deeply smarmy) Prince Charming (Rupert Everett), and one unforgettable potion mishap, and you have a sequel that goes bigger in every possible way.

Underneath the meme-worthy one-liners and iconic needle drops lies a romance that feels shockingly grounded. Indeed, Shrek 2 dares to ask whether love should be reshaped to meet the world’s expectations—or whether the world should adjust instead. Fiona choosing Shrek again and again, even when offered conventionally “perfect” versions and alternatives, makes their relationship one of the most affirming in animated history. There’s no doubt that it’s truly one of the best movies (and sequels) to ever be made.

2

‘About Time’ (2013)

When Tim Lake (Domhnall Gleeson) learns from his father that the men in his family have the ability to travel through time, he decides to use his newfound ability to improve his life—starting with finding love. Lucky for him, after a series of awkward first encounters, Tim finally meets Mary (Rachel McAdams), and their relationship unfolds with a mixture of do-overs, missteps, and small triumphs.

Directed by Richard Curtis, About Time transforms a high-concept premise into something incredibly intimate. In this world, time travel isn’t about spectacle, but about presence. Tim slowly realizes that perfection isn’t the goal—appreciation is, leaving the fantasy element to reinforce the film’s central truth: love lives in the ordinary days, messy conversations, and feeling moments you can’t rewind forever. It truly is romance in the most grounded way possible.

1

‘Stardust’ (2007)

In the quiet village of Wall, Tristan Thorn (Charlie Cox) promises the woman he adores that he will retrieve a fallen star for her birthday. Needing to cross into a magical realm, Tristan soon discovers that the star is not a stone at all, but a woman named Yvaine (Claire Danes). But as dangerous forces close in, a reluctant partnership develops, alongside an unexpected love story.

Based on the famed Neil Gaiman novel, Stardust easily earns the crown in this list as it most faithfully channels the spirit of the grand, unabashed romantic fantasy. Between sword fights, sky pirates, wicked witches, and declarations that make your heart lurch—it never undercuts its own sincerity. Tristan begins the film by chasing the fantasy of love and ends it by choosing real partnership, while Yvaine proves she’s not a mere prize to be won, but a force in her own right. It’s funny, bold, and deliciously ridiculous in the best way. For any Gen Z, this is our Princess Bride.

Stardust

- Release Date

-

August 10, 2007

- Runtime

-

127 minutes

- Director

-

Matthew Vaughn

- Writers

-

Jane Goldman, Matthew Vaughn, Neil Gaiman

Next: 10 Fantasy Movie Flips That Are Actually Misunderstood Masterpieces

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports1 day ago

Sports1 day agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Business7 days ago

Business7 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment6 days ago

Entertainment6 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Politics1 day ago

Politics1 day agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech6 days ago

Tech6 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World12 hours ago

Crypto World12 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business6 days ago

Business6 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat1 day ago

NewsBeat1 day ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Tech1 hour ago

Tech1 hour agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting