Business

Governor Gavin Newsom warns proposed wealth tax damages California economy

‘The Big Money Show’ panel reacts to billionaires fleeing California as Gov. Gavin Newsom’s proposed wealth tax sparks backlash and red state migration.

California Gov. Gavin Newsom acknowledged that the state’s proposed wealth tax is “bad economics.”

Newsom said he feels vindicated in opposing the proposed wealth tax after reports showed some of California’s wealthiest residents moving money and businesses out of the state, warning the measure would damage the economy and drive away investment.

“This is my fear,” Newsom said in a POLITICO interview on Monday. “It’s just what I warned against. It’s happening.”

“The evidence is in. The impacts are very real — not just substantive economic impacts in terms of the revenue, but start-ups, the indirect impacts of … people questioning long-term commitments, medium-term commitments,” he continued. “That’s not what we need right now, at a time of so much uncertainty. Quite the contrary.”

While the initiative has not yet qualified for the November 2026 ballot, the proposed measure — backed by the Service Employees International Union–United Healthcare Workers West — would impose a one-time 5% tax on the net worth of California residents with assets exceeding $1 billion. The tax would be due in 2027, and taxpayers could spread payments over five years, with interest, according to the Legislative Analyst’s Office.

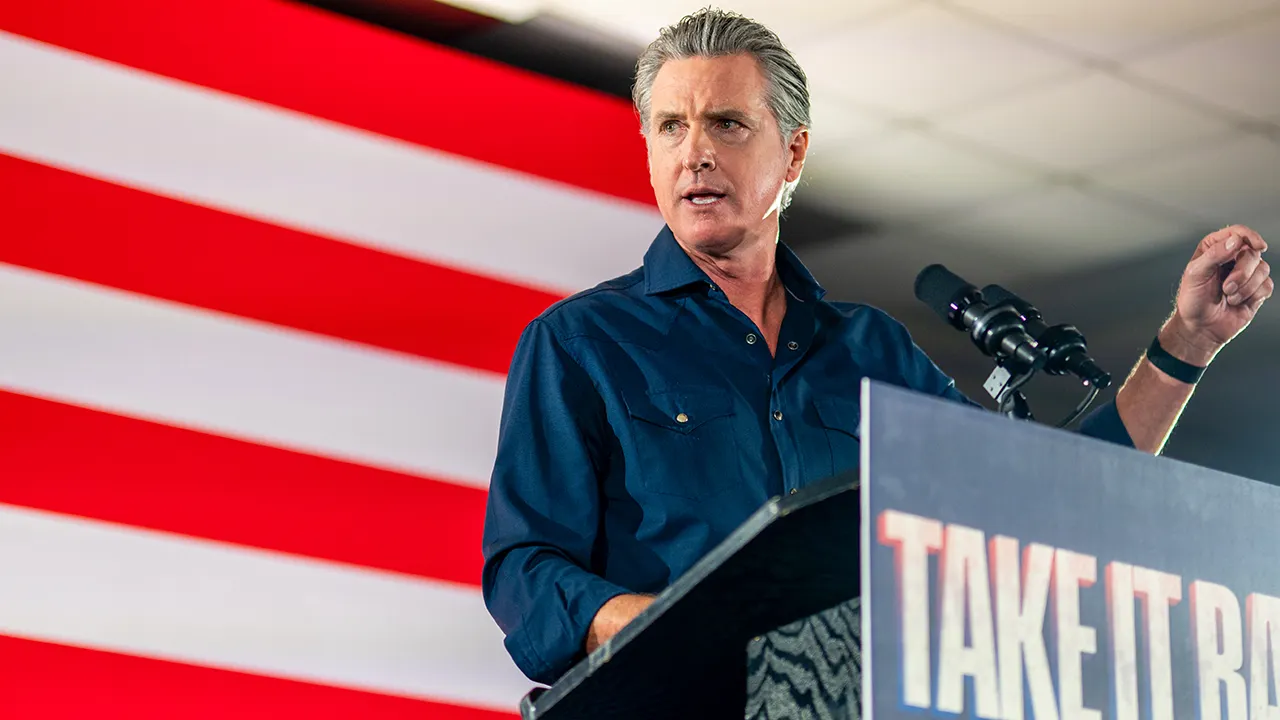

California Gov. Gavin Newsom speaks during a rally on November 8, 2025, in Houston, Texas. (Getty Images)

If approved by voters, the measure would apply to anyone who was a California resident on Jan. 1, 2026. Because of that provision, several prominent business figures and billionaires have reportedly relocated or restructured holdings outside the state.

That includes Google co-founder Larry Page. Public filings reviewed by Fox News Digital from the California Secretary of State’s Office show that several business entities linked to Page were relocated out of the state in December. He also reportedly purchased two Miami properties valued at about $73.4 million.

Oracle chairman Larry Ellison sold his San Francisco mansion for about $45 million, while The New York Times reported that Google co-founder Sergey Brin and venture capitalist Peter Thiel have shifted some business operations out of California.

California Congressman Darrell Issa discusses reports that as many as 20 billionaires could leave the state amid concerns over a proposed new wealth tax which critics say is driving high-net-worth taxpayers out of California on ‘The Evening Edit.’

Though Newsom has publicly supported a progressive tax structure, he said the billionaire tax “makes no sense,” adding that, “It’s really damaging to the state.”

“I have a very specific agenda that I’m trying to follow, and then also [be] very pragmatic about what I don’t know — that is, all the things that come your way that are not on the agenda,” he told POLITICO. “This is not how I wanted to spend my last year.”

“The good news is the overwhelming opposition to this by others,” Newsom said. “I think it will be defeated, because I think people understand what it does versus what it promotes to do.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

‘Fox News @ Night’ panelists discuss calls for investigation into alleged fraud in California and the consequences of the state’s proposed billionaire tax.

Newsom’s office did not immediately respond to Fox News Digital’s request for comment.

A spokesperson for Newsom previously told The Wall Street Journal that the governor opposes “state-level wealth taxes” because they drive away affluent residents. At the New York Times DealBook Summit in December 2025, Newsom criticized wealth-tax proposals and emphasized California’s competitive environment, saying states “can’t isolate [themselves] from the 49 others” regarding tax policy.