Money

Chaos for Brits as Rachel Reeves’s Budget hike on employers’ costs is set ‘to shut even more dental practices’

MORE Brits are facing pulling their own teeth out — as the hike on employers’ costs is set to prove a pain for dentists.

Chancellor Rachel Reeves is already facing fury over her £25billion Budget raid on firms by hiking National Insurance Contributions and lowering the threshold at which they kick in.

But for dentists the rise is said to be an “existential threat to services”.

The industry is already in crisis — with 13 million Brits unable to get an appointment — while 97 per cent of new patients trying to access NHS dental care in the last year were unsuccessful.

But the average surgery is now facing an extra £30,000 in costs.

The British Dental Association warned that NHS providers cannot access an employment allowance set up to soften the blow for small businesses.

It said hundreds are already running at a loss and the extra burden “will push more of them closer to the brink with no choice other than to move away from NHS services”.

The dental group said it will lead to price hikes for patients — and raise wait times for those in need.

A spokesman for the organisation said yesterday: “We already are seeing people ripping out their own teeth or being tricked by scammers because they’re desperate.

“This is going to get much worse these extra costs are the nail in the coffin for many dental providers.”

In a letter sent to Ms Reeves it argues Labour has gone back on its promise of rebuilding dentistry by “recycling existing budgets” and failing to “reflect the soaring expenses colleagues now face”.

UK’s £45m for Snow White

DISNEY’S woke new version of Snow White received £45million in British taxpayers’ cash, documents reveal.

The live-action reimagining, due out in March, has cost Disney £217.7million in production already, company filings show.

It was made at Pinewood Studios, near Iver, Bucks, directly employing 419 people over the last two years.

Disney benefited from generous government tax credits that allowed it to recover a quarter of the amount it spent, provided the UK accounts for at least 10 per cent of the production’s total costs.

The tax boost comes as Disney is due to announce on Thursday it made £17billion in revenues in the last three months.

Film studios argue that tax credits make the UK a more attractive destination for investment and Labour has committed to maintaining them.

Disney said that in the last five years it had invested £3.5billion into the UK, directly supporting 32,000 jobs on a variety of film and streaming projects.

The firm’s new version of Snow White has already been engulfed in racism, sexism and political rows — including stars Rachel Zegler and Gal Gadot at loggerheads on social media over their opposing views on the Israel-Hamas war.

Zegler also infuriated fans by calling the original 1937 animated movie “creepy” and referring to Prince Charming as a “stalker”.

Crypto’s Trumped FTSE100

DONALD Trump’s victory in the US Presidential election has sent the cryptocurrency market’s value surging above the total of London’s FTSE 100.

Bitcoin surged above $84,000 for the first time yesterday, pushing the total value of all cryptocurrencies to $2.77trillion in anticipation of a more crypto-friendly environment in Washington.

That is higher than the combined value of London’s top 100 listed companies at £2.09trillion ($2.69trillion).

Mr Trump accepted millions of dollars of crypto donations during his campaign trail and in September he and his children started their own crypto business called World Liberty Financial.

Bitcoin is still unregulated in the UK, meaning investors are highly vulnerable to losses. Two years ago investors lost more than $2trillion when Bitcoin’s value lost 70 per cent in six months.

Two-tier pay rises

PAY awards for public sector workers are set to overtake the private sector’s for the first time in four years, according to the Chartered Institute of Personnel and Development.

Public wage rises are tipped to climb from 2.5 per cent to 5 per cent in the next three months, while private awards are expected to be 3 per cent.

It follows warnings that private companies will have to limit pay rises for staff due to extra employment costs.

Direct jobs axe

DIRECT LINE has revealed plans to axe around 550 jobs as its new boss grapples with a turnaround of the insurer.

The firm wants to save £50million in costs by 2025 and the cuts are equivalent to more than 5 per cent of its 9,000 workforce.

It comes as the firm said it lost 71,000 motor insurance customers in the last three months.

CEO Adam Winslow said: “We are in the early stages of a significant turnaround and our third-quarter trading is not yet fully reflective of the actions we have taken.”

Bank’s buyback

NATWEST has taken another step towards privatisation after buying back £1billion of stocks from the Government.

It bought 263million shares at 380.8p each — cutting the taxpayer’s stake from 14.8 per cent to around 11.4 per cent.

It is a legacy of the 84 per cent stake in the bank, then known as Royal Bank of Scotland, after a bailout in the 2008 financial crisis.

Former Chancellor Jeremy Hunt had considered a discounted share sale to ordinary Brits to offload the shares but Labour ruled that out.

HEATHROW is on track for a record year, as Europe’s busiest airport had more than 7.2million passengers travelling last month.

The airport now expects to handle a record 83.8 million in 2024, more than its 80.9 million pre-pandemic record in 2019.

Money

What the new ‘pension megafunds’ plan by Rachel Reeves means for YOUR retirement

THE government is set to announce huge plans to create “pension megafunds” in a bid to boost both savers’ retirement pots and investment in the UK.

Chancellor Rachel Reeves will outline the plans to move around £800billion of pension savings into larger so-called “megafunds” in her first annual “Mansion House” speech this evening.

Local government pension schemes, which manage around £400billion of that cash, will be forced to split into eight megafunds.

Eventually, the plan is to then group all other defined contribution (DC) schemes – what most workers save into – into a number of other big funds.

DC schemes are where you and your employer both put money into a scheme and the cash is invested to grow your pot over time.

The plan is to set a minimum amount these funds can have in them – currently touted as somewhere between £25billion and £50billion.

The government is also consulting on allowing fund managers – who manage where all this cash is invested – to move savers from schemes which are under-performing into schemes that will deliver them better value.

The megafund set-up is similar to the pension systems in other countries like Australia and Canada, where pension cash is pooled into huge so-called “superfunds” and invested on behalf of larger groups of savers.

Ms Reeves said the reforms are the biggest change to the pensions market “in decades” that will “boost people’s savings in retirement” and “drive economic growth”.

The government added: “Consolidating the assets into a handful of megafunds run by professional fund managers will allow them to invest more in assets like infrastructure, supporting economic growth and local investment.”

What do the changes mean for your money?

Currently, most workers in the UK are automatically enrolled into their workplace pension scheme.

These are usually DC schemes. The other type of pensions in the UK are “defined benefit” schemes, where workers receive a guaranteed income in retirement based on their years of service.

But “megafunds” will pool a number of workplace pension schemes together to create giant pots of money to invest.

The aim is that by having much larger amounts to invest, the cash returns on those investments will be far higher than having lots of smaller pots.

For example, if you returned 5% on £1,000 in a year, you would earn £50, but if you returned 5% on £100,000 over a year, you would earn £5,000, and so on.

This should mean savers should end up with much larger pots of money by the time they retire.

Having more cash also means investment managers can take more risk with their investments with the aim of achieving higher returns.

Looking at the bigger picture, the government is hoping that these larger pension funds can be used to invest in infrastructure projects, which will ultimately benefit everyone.

Currently, most DC pensions in the UK are too small to invest in any meaningful capacity in infrastructure projects, such as roads, railways or building developments.

But government analysis has found pension funds worth between £25billion and £50billion can achieve much greater “productive investment levels”.

For example, it found Canada’s pension schemes invest around four times more in infrastructure than the UK currently does, while Australia’s pension schemes invest around three times more.

By combining UK schemes, the government estimates it could unlock a whopping £80billion to invest in the country’s infrastructure.

Jon Greer, head of retirement policy at wealth manager Quilter, said that by pooling resources into larger funds, savers will access “high-yield investments that smaller schemes often miss”.

“Drawing inspiration from successful models in Australia and Canada, this approach has the potential to deliver stable returns while supporting meaningful long-term projects,” he added.

However, some pensions industry experts have expressed concern that the government’s main focus is on investing in the UK rather than achieving returns for savers.

Tom Selby, director of public policy at AJ Bell, warned: “Conflating a government goal of driving investment in the UK and people’s retirement outcomes brings a danger because the risks are all taken with members’ money.

“If it goes well, everyone can celebrate – but it’s clearly possible that it will go the other way, so there needs to be some caution in this push to use other people’s money to drive economic growth.”

How do pensions make money?

DEFINED contribution pension cash is pooled together to make money for savers.

Schemes are managed by investment firms, such as Hargreaves Lansdown or Fidelity, and fund managers at those firms decide where to invest savers’ cash to earn as much money as possible.

Over a long period, these returns from investments gradually increase the size of the pot – and as the pot size increases, the amount it can return also increases, as the return is calculated on a larger amount of money.

This is known as “compound interest”.

We have previously revealed how over 40 years, you could save a total of £109,671, while only paying in £40,000 of your own money because of compound interest.

The larger the amount of money is that’s invested, the higher the returns can be in cash-terms for savers.

CryptoCurrency

3 Ultra-Safe Dividend Stocks That Have Been Paying Dividends for More Than 100 Years

The past doesn’t predict the future. But if a company has been paying dividends for a long time, that can give investors confidence in its ability to continue doing so. It demonstrates that the company can weather a lot of adversity and innovate and launch new products to meet changing demand. Those are key characteristics investors will want to see when considering long-term investments.

Three stocks that have not only been around for a century but have also been paying dividends for that long are Coca-Cola (NYSE: KO), Eli Lilly (NYSE: LLY), and Abbott Laboratories (NYSE: ABT). Here’s why these can be some of the safest stocks you can add to your portfolio today.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Coca-Cola has an iconic brand that’s known all around the world. It’s a top Warren Buffett holding, and a big reason for that is its strong brand power. Its products are found in millions of households, across hundreds of countries. While the company is known for its Coke products, it has evolved over the years and now has more than 200 brands, branching out beyond just soft drinks and into coffee, tea, and water.

The company has created no-sugar products to meet changing customer demand, and it has also expanded via acquisitions. Coca-Cola may not be the growth machine it once was, but it’s still a reliable business to invest in. It has generated $10.4 billion in profit over the past four quarters on sales of $46.4 billion, for a profit margin of 22%.

Coca-Cola has paid a dividend going back to 1893. Today, it’s part of an exclusive club of Dividend Kings, which have increased their dividend payments for more than 50 straight years. Its dividend yields 3%, and if your priority is to generate a safe and recurring dividend, Coca-Cola may be an ideal stock to put into your portfolio right now.

Eli Lilly is a hot growth stock to buy, as investors are bullish on its prospects in the weight loss market. The company has an incredibly promising product in tirzepatide, which regulators have approved for diabetes treatment (Mounjaro) and weight loss (Zepbound). At its peak, tirzepatide may be the best-selling drug ever, with some analysts projecting that its annual revenue will eventually top more than $50 billion.

To put into perspective just how massive that is, consider that Eli Lilly generated $34 billion in sales last year — from all of its products. With so much excitement surrounding Eli Lilly’s potential, it’s little wonder that the healthcare stock has risen by more than 200% in just the past three years.

CryptoCurrency

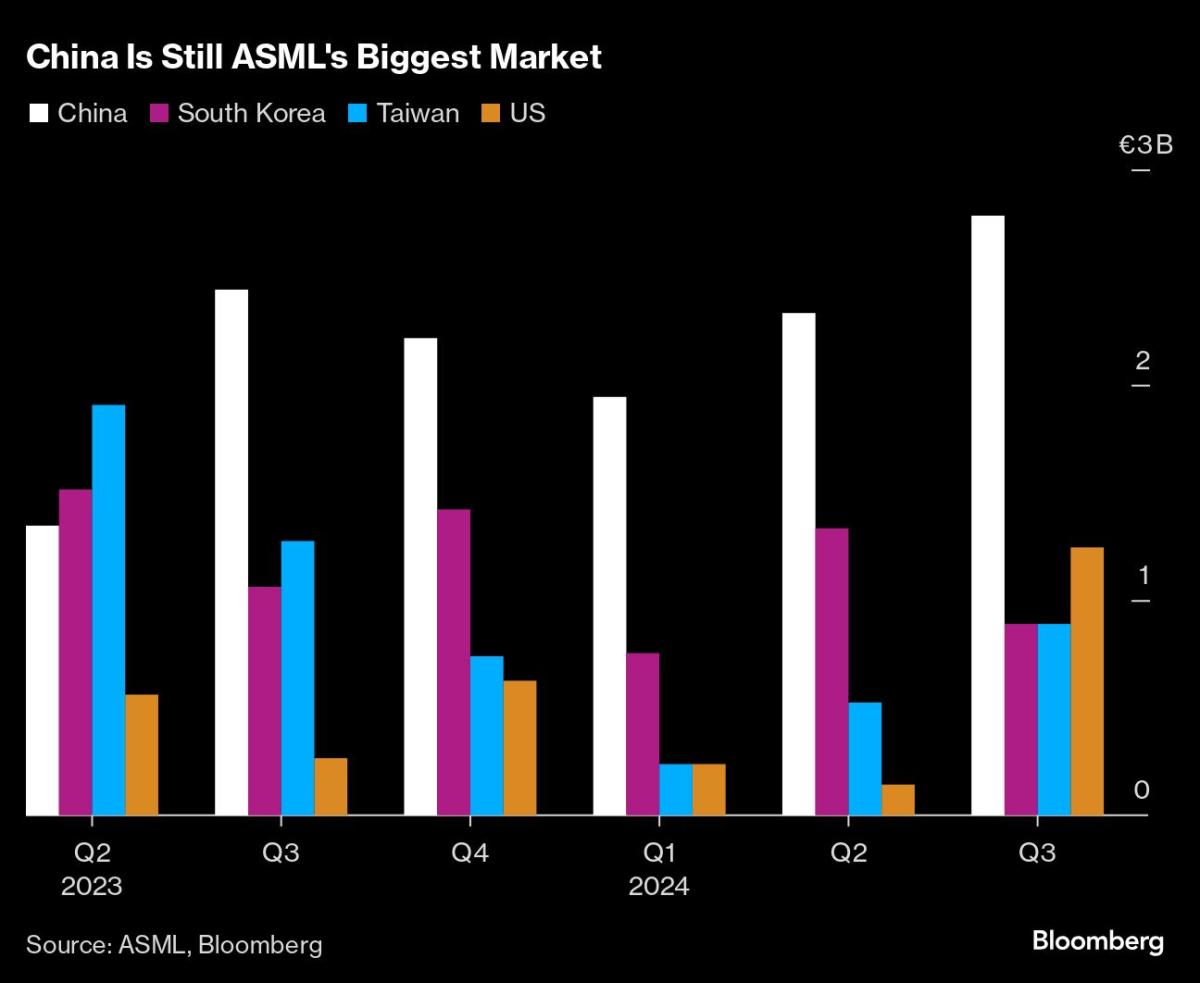

ASML maintains bullish 2030 outlook on AI-driven demand

(Bloomberg) — ASML Holding NV (ASML), the Dutch maker of advanced chip-making machines that are critical to global supply chains, reaffirmed its long-term revenue outlook as it bets on an artificial intelligence-driven boom in semiconductor demand.

Most Read from Bloomberg

The Dutch firm projected that sales in 2030 will range from €44 billion ($46 billion) to €60 billion, in line with its previous forecast, according to a statement issued as part of the company’s investor day on Thursday.

The outlook is meant to reassure investors after the company’s order intake significantly missed analysts’ estimates in the third quarter, sparking a selloff in its shares and those of other chip-related businesses. Chipmakers such as Nvidia Corp. have enjoyed a boom in demand for their AI chips. But sales to other key buyers, including automakers and mobile phone and PC manufacturers, have remained mired in a prolonged slump.

“A few weeks ago, we had a bit of a conservative view for 2025,” Chief Executive Officer Christophe Fouquet said at the investor day. “In many ways, this is related to the change of the market. But when it comes to 2030, we are still very, very bullish.”

ASML expects growing AI demand will help boost global chip sales to over $1 trillion by 2030, which it said represents an annual growth rate in the semiconductor market of about 9%.

ASML is the only company in the world that makes the kind of lithography machines that help semiconductor companies in turn produce the advanced chips powering everything from Apple Inc.’s smartphones to Nvidia’s AI accelerators. As such, it is often viewed as a bellwether for the broader industry and an early indicator of global semiconductor demand.

Manufacturing more cutting-edge AI chips will mean more of ASML’s advanced extreme ultraviolet lithography machines will be needed by semiconductor makers. The company foresees double-digit growth in EUV spending annually through 2030 for both advanced logic and DRAM.

The company forecast a gross margin of between approximately 56% and 60% in 2030.

ASML shares rose as much as 5.9% in Amsterdam on Thursday, the biggest intraday gain since July 31. They were up 5% to €659.10 at 1:18 p.m.

While ASML in October cut its sales outlook for next year, it said on Thursday it will maintain its spending priorities. ASML currently has an ongoing €12 billion buyback through 2025 of which only 14% has been repurchased.

CryptoCurrency

Bitcoin miner outflows surge as price hits new highs

Data from CryptoQuant showed that 25,367 BTC flowed out of miner wallets as Bitcoin approached $90,000 on Nov. 12.

CryptoCurrency

Disney earnings beat as streaming profit tops estimates

Disney (DIS) on Thursday reported fiscal fourth quarter earnings per share and revenue that topped Wall Street estimates as its direct-to-consumer business built on recent momentum and swung to a profit.

The company reported Q4 adjusted earnings of $1.14 per share, above the $1.10 analysts polled by Bloomberg had expected and higher than the $0.82 Disney reported in the prior-year period.

Revenue came in at $22.57 billion, exceeding consensus expectations for $22.47 billion and higher than the $21.24 billion reported in the year-ago period.

The stock rose over 5% in premarket trading immediately following the results.

Disney’s direct-to-consumer (DTC) streaming business, which includes Disney+, Hulu, and ESPN+, posted operating income of $321 million for the three months ending Sept. 28, compared to a loss of $387 million in the prior-year period.

Analysts polled by Bloomberg had expected DTC operating income to come in around $203 million after the company reached its first quarter of streaming profitability in its Q3 results.

Achieving consistent profits in streaming is critical for Disney and other media giants as more consumers shift to DTC services over traditional pay-TV packages.

In mid-October, the company hiked the price of its various subscription plans, highlighting a trend that has gained traction over the past year as media companies attempt to boost margins on direct-to-consumer (DTC) offerings in the face of greater linear television declines.

Disney said Thursday that it expects DTC operating income of approximately $875 million in fiscal 2025.

The entertainment giant’s results come as it searches for a successor to current CEO Bob Iger to help it navigate a changing industry. A recent report from the Wall Street Journal said the pool of candidates is expanding as the executive is set to leave Disney for a second time by the end of 2026.

Last month, Disney said it plans to announce its next CEO in early 2026, with current Disney board member and former Morgan Stanley (MS) CEO James Gorman leading the charge. He will serve as the company’s new chairman of the board, effective Jan. 2, 2025.

Among the investor concerns Iger’s successor will inherit is a potential slowdown in Disney’s theme parks business.

Revenue for the parks division came in slightly ahead of estimates, rising 1% year over year to reach $8.24 billion.

Operating income, however, fell short of expectations of $2.31 billion to hit $1.66 billion in the quarter, a 6% drop compared to the prior year.

This was primarily driven by weak results overseas with international operating income plummeting 32% year over year. The company cited a decline in attendance and a decrease in guest spending amid the Paris Olympics and a typhoon in Shanghai.

CryptoCurrency

Crypto community hopeful about new Senate leader John Thune

Not endorsed by Donald Trump, Senator John Thune defeated the Elon Musk-supported Senator Rick Scott to become the new Senate majority leader.

-

Science & Environment2 months ago

Science & Environment2 months agoHow to unsnarl a tangle of threads, according to physics

-

Technology2 months ago

Technology2 months agoWould-be reality TV contestants ‘not looking real’

-

Technology2 months ago

Technology2 months agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment2 months ago

Science & Environment2 months agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment2 months ago

Science & Environment2 months agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment2 months ago

Science & Environment2 months ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment2 months ago

Science & Environment2 months agoPhysicists have worked out how to melt any material

-

MMA1 month ago

MMA1 month ago‘Dirt decision’: Conor McGregor, pros react to Jose Aldo’s razor-thin loss at UFC 307

-

News1 month ago

News1 month ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

News1 month ago

News1 month agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Money1 month ago

Money1 month agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Sport1 month ago

Sport1 month agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Football1 month ago

Football1 month agoRangers & Celtic ready for first SWPL derby showdown

-

Sport1 month ago

Sport1 month ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Business1 month ago

how UniCredit built its Commerzbank stake

-

Science & Environment2 months ago

Science & Environment2 months agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment2 months ago

Science & Environment2 months agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment2 months ago

Science & Environment2 months agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment2 months ago

Science & Environment2 months agoLiquid crystals could improve quantum communication devices

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum forces used to automatically assemble tiny device

-

Science & Environment2 months ago

Science & Environment2 months agoLaser helps turn an electron into a coil of mass and charge

-

Technology2 months ago

Technology2 months agoUkraine is using AI to manage the removal of Russian landmines

-

Business1 month ago

Top shale boss says US ‘unusually vulnerable’ to Middle East oil shock

-

Technology1 month ago

Technology1 month agoSamsung Passkeys will work with Samsung’s smart home devices

-

MMA1 month ago

MMA1 month agoPereira vs. Rountree prediction: Champ chases legend status

-

News1 month ago

News1 month agoNavigating the News Void: Opportunities for Revitalization

-

Technology2 months ago

Technology2 months agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Science & Environment2 months ago

Science & Environment2 months agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum ‘supersolid’ matter stirred using magnets

-

News1 month ago

News1 month agoMassive blasts in Beirut after renewed Israeli air strikes

-

Technology1 month ago

Technology1 month agoGmail gets redesigned summary cards with more data & features

-

News1 month ago

News1 month agoCornell is about to deport a student over Palestine activism

-

Technology1 month ago

Technology1 month agoSingleStore’s BryteFlow acquisition targets data integration

-

Technology2 months ago

Technology2 months agoMicrophone made of atom-thick graphene could be used in smartphones

-

Sport1 month ago

Sport1 month agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Entertainment1 month ago

Entertainment1 month agoBruce Springsteen endorses Harris, calls Trump “most dangerous candidate for president in my lifetime”

-

Money1 month ago

Money1 month agoTiny clue on edge of £1 coin that makes it worth 2500 times its face value – do you have one lurking in your change?

-

Technology1 month ago

Technology1 month agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Business1 month ago

Business1 month agoWater companies ‘failing to address customers’ concerns’

-

Sport1 month ago

Sport1 month agoShanghai Masters: Jannik Sinner and Carlos Alcaraz win openers

-

Technology2 months ago

Technology2 months agoMeta has a major opportunity to win the AI hardware race

-

MMA1 month ago

MMA1 month agoPennington vs. Peña pick: Can ex-champ recapture title?

-

MMA1 month ago

MMA1 month agoDana White’s Contender Series 74 recap, analysis, winner grades

-

Science & Environment2 months ago

Science & Environment2 months agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

MMA1 month ago

MMA1 month agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

Sport1 month ago

Sport1 month agoAmerica’s Cup: Great Britain qualify for first time since 1964

-

Technology1 month ago

Technology1 month agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

Technology1 month ago

Technology1 month agoLG C4 OLED smart TVs hit record-low prices ahead of Prime Day

-

Sport1 month ago

Sport1 month agoWXV1: Canada 21-8 Ireland – Hosts make it two wins from two

-

Science & Environment2 months ago

Science & Environment2 months agoNuclear fusion experiment overcomes two key operating hurdles

-

News2 months ago

News2 months ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

News1 month ago

News1 month agoHarry vs Sun publisher: ‘Two obdurate but well-resourced armies’

-

MMA1 month ago

MMA1 month ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Travel1 month ago

World of Hyatt welcomes iconic lifestyle brand in latest partnership

-

Football1 month ago

Football1 month ago'Rangers outclassed and outplayed as Hearts stop rot'

-

Sport1 month ago

Sport1 month agoNew Zealand v England in WXV: Black Ferns not ‘invincible’ before game

-

Science & Environment2 months ago

Science & Environment2 months agoNerve fibres in the brain could generate quantum entanglement

-

Technology2 months ago

Technology2 months agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Technology2 months ago

Technology2 months agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Business1 month ago

It feels nothing like ‘fine dining’, but Copenhagen’s Kadeau is a true gift

-

News1 month ago

News1 month agoRwanda restricts funeral sizes following outbreak

-

Technology1 month ago

Technology1 month agoCheck, Remote, and Gusto discuss the future of work at Disrupt 2024

-

Sport1 month ago

Sport1 month agoURC: Munster 23-0 Ospreys – hosts enjoy second win of season

-

TV1 month ago

TV1 month agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Business1 month ago

Italy seeks to raise more windfall taxes from companies

-

Business1 month ago

The search for Japan’s ‘lost’ art

-

Sport1 month ago

Sport1 month agoPremiership Women’s Rugby: Exeter Chiefs boss unhappy with WXV clash

-

MMA1 month ago

MMA1 month agoStephen Thompson expects Joaquin Buckley to wrestle him at UFC 307

-

Business1 month ago

Business1 month agoWhen to tip and when not to tip

-

News1 month ago

News1 month agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Politics1 month ago

‘The night of the living dead’: denial-fuelled Tory conference ends without direction | Conservative conference

-

Science & Environment2 months ago

Science & Environment2 months agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Technology1 month ago

Technology1 month agoNintendo’s latest hardware is not the Switch 2

-

News1 month ago

News1 month agoCrisis in Congo and Capsizing Boats Mediterranean

-

MMA1 month ago

MMA1 month agoHow to watch Salt Lake City title fights, lineup, odds, more

-

Sport1 month ago

Sport1 month agoHow India became a Test cricket powerhouse

-

Sport1 month ago

Sport1 month agoSnooker star Shaun Murphy now hits out at Kyren Wilson after war of words with Mark Allen

-

Money1 month ago

Money1 month agoThe four errors that can stop you getting £300 winter fuel payment as 880,000 miss out – how to avoid them

-

TV1 month ago

TV1 month agoTV Patrol Express September 26, 2024

-

Sport1 month ago

Sport1 month agoFans say ‘Moyes is joking, right?’ after his bizarre interview about under-fire Man Utd manager Erik ten Hag goes viral

-

Science & Environment2 months ago

Science & Environment2 months agoA slight curve helps rocks make the biggest splash

-

News2 months ago

News2 months ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment2 months ago

Science & Environment2 months agoHow to wrap your mind around the real multiverse

-

Football1 month ago

Football1 month agoFifa to investigate alleged rule breaches by Israel Football Association

-

News1 month ago

News1 month agoUK forces involved in response to Iran attacks on Israel

-

Football1 month ago

Football1 month agoWhy does Prince William support Aston Villa?

-

News1 month ago

News1 month ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Technology1 month ago

Technology1 month agoSamsung Galaxy Tab S10 won’t get monthly security updates

-

Technology1 month ago

Technology1 month agoMusk faces SEC questions over X takeover

-

Sport1 month ago

Sport1 month agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

Sport1 month ago

Sport1 month agoBukayo Saka left looking ‘so helpless’ in bizarre moment Conor McGregor tries UFC moves on Arsenal star

-

Sport1 month ago

Sport1 month agoPhil Jones: ‘I had to strip everything back – now management is my focus’

-

Sport4 weeks ago

Sport4 weeks agoSunderland boss Regis Le Bris provides Jordan Henderson transfer update 13 years after £20m departure to Liverpool

-

Business1 month ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Technology1 month ago

Technology1 month agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

Money1 month ago

Money1 month agoDWP reveals exact date that cold weather payments will start this winter – can you get free cash for your energy bills?

-

Sport1 month ago

Sport1 month agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

Money1 month ago

Money1 month agoFive benefits changes the Government could make next month in its Autumn Budget – from PIP to fraud crackdown

-

MMA1 month ago

MMA1 month ago‘I was fighting on automatic pilot’ at UFC 306

-

Sport1 month ago

Sport1 month agoCoco Gauff stages superb comeback to reach China Open final

You must be logged in to post a comment Login