Entertainment

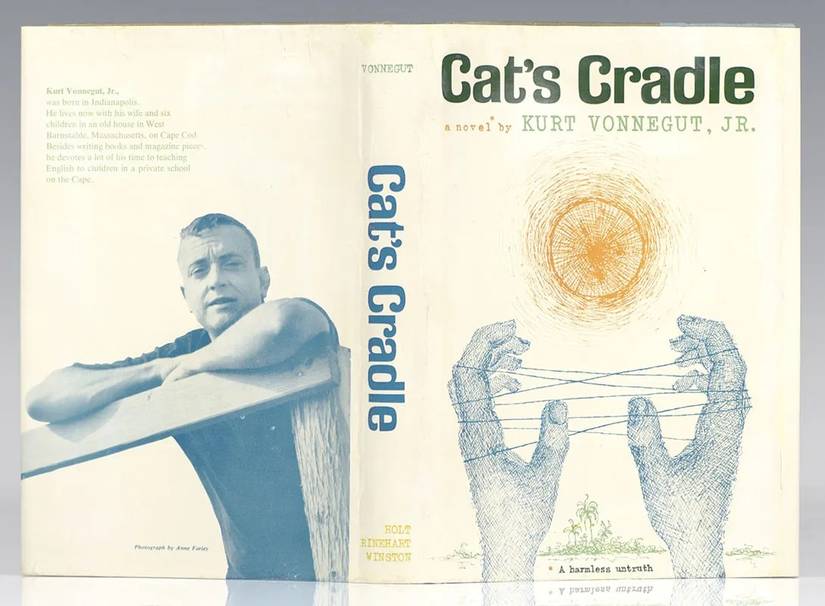

Hollywood Needs to Adapt This 63-Year-Old Sci-Fi Classic Novel After Leonardo Dicaprio Failed To

Kurt Vonnegut is one of the most beloved authors of the 20th century, and for good reason. It’s no wonder that his works have been sought after for adaptation, including Butch Cassidy and the Sundance Kid and The Sting. Emphasize “sought after” because not many of his novels or short stories have actually made it to the big screen. Vonnegut’s stories are often sarcastic, time-hopping, told from the first person, and uniquely bleak… but also hilarious. His specifically strange brand of sci-fi, comedy, and satire has long been a tough cookie to crumble over onto film, like Cat’s Cradle.

As one of the flagship novels in his bibliography, unabashedly represents all of these attributes in ways that make it one of the most “Vonnegut” novels there is. It’s an odd choice on Hollywood’s part to adapt, not only in a business sense, but because it also feels like one of the remaining novels left that is still unable to be adapted for the screen.

‘Cat’s Cradle’ Might Be Kurt Vonnegut’s Best Book

Cat’s Cradle is a 1963 postmodern satire, written by the late great Kurt Vonnegut. The film follows Felix Hoenikker and a group of scientists as they navigate life after the invention of ice-nine, a substance that could freeze the entire planet. The novel is bleakly comical, absurd, and hits some of its commentaries pretty hard on the nose, but it also has its moments of subtlety. That’s just how Vonnegut operates, though. He knows that he gets in his audience’s face with social and political commentary, but any time it’s on the nose, it’s to get a laugh. Cat’s Cradle is one of those Vonnegut books, though. It’s like the even more well-known Slaughterhouse-Five in that it has actual statements that it’s trying to make. Kurt Vonnegut is a funny guy, but when he wants to make an actual point about something, he does so like a gut punch. There’s a reason that he’s largely considered one of the greatest authors of his time. It’s because he can do it all!

There’s a good argument to be made that Cat’s Cradle is Vonnegut’s best book. It’s a sprawling epic that manages to fit a ridiculous amount of subplots, ideas, and themes into one pretty tight story. When there’s this much going on, it’d probably be preferred if the book was able to breathe a bit more (it’s only a little over 300 pages) and let these ideas expand upon themselves more naturally. There’s a case to be made that this is where a format like a TV show could benefit the source material.

That being said, that’s kind of its charm. Heavy subjects are brought up and briefly touched upon, usually with some degree of humor, then we move on to the next thing. It makes for a bit of a disorienting experience with how quickly we move from scene to scene, but that also adds to the framing device that the story is being told in flashback. It really does feel like you’re reading a memory.

What Is Kurt Vonnegut’s ‘Cat’s Cradle’ About?

Given Cat’s Cradle’s odd narrative structure, its tendency to jump from plot point to plot point, and oddball, Vonnegut-ian sense of humor, it’s not ideal to say that the book is unadaptable… but it just might need to stay on the page. It’s not the book’s high-concept ideas that would be tough for audiences to swallow, but it’s the way that the author delivers them. Cat’s Cradle is fun because of how little time we spend on the detrimental choices made and events leading toward the post-apocalyptic setting that our narrator is in. If a movie or TV show tried to recreate that, there would probably be too much filler added, and the story’s breakneck pace would ultimately become diluted.

The novel’s sense of humor also wouldn’t likely translate well onto the screen. Not that the book is offensive or “couldn’t be made today” because of jokes that just didn’t age well. It’s just, you know, a Kurt Vonnegut novel! He makes light of things that are touchy subjects, like discussing what North American civilians were doing the day the atomic bomb was dropped on Hiroshima. This is done so in a way that comments on how unaware people can be of what their government is up to. (Either that or how they willingly turn a blind eye.) Other times, Vonnegut jokes around the parameters of philosophy and religion.

This is mostly explored through a fictional religion, Bokononism, a pretty hilarious concept that is practiced through extremely odd practices. For instance, boku-maru is an act of worship in Bokononism when two people press the exposed soles of their feet together for a long period of time. I don’t really know how you would get audiences on board with watching an adaptation of a novel that works so well because of how fast-paced it is, or how singular the author’s sense of humor is. This all just works best on the page.

Leonardo DiCaprio and Noah Hawley Want To Adapt ‘Cat’s Cradle’

There have been multiple attempts to bring Cat’s Cradle to both the big and small screens. Elements of the novel were adapted for the 1972 TV movie Between Time and Timbuktu, a project that pulled from several different Kurt Vonnegut stories. Leonardo DiCaprio‘s production company attempted to adapt the book into a movie back in 2005, but the film never moved past the writing stages. Most recently, co-creator of the FX series Fargo, Noah Hawley, attempted to adapt Cat’s Cradle as a limited series. Like DiCaprio’s attempt before him, Hawley’s series remains unmade.

It’s tough to choose which project would do the novel justice best, but it’s safe to assume that a film would probably encapsulate the book’s spirit best. Vonnegut’s book is only 300-ish pages, so there’s likely not a lot that would need to be trimmed down to properly bring the story to life. The movie would require a truly gifted editor to try to make the movie properly flow, but at least its fast pace would be true to Vonnegut’s work. As stated before, a TV show would just stretch the story out too much, and it wouldn’t feel like Cat’s Cradle anymore.

Sure, it’d carry over characters like Jonah the narrator and Felix Hoenikker, on-screen practices of Bokononism, and some pretty interesting ice-nine visuals, but the bloat of a TV show would suck all the fun out of it. Cat’s Cradle is the perfect novel for those looking to get Vonnegut’s trademark sense of humor and philosophy in rapid fire. There’s no need to drag it out in 10 episodes over 10 hours. That being said, if someone did make this movie, please make it Yorgos Lanthimos!

Cat’s Cradle just might be Kurt Vonnegut’s best book, but that doesn’t mean it should also be adapted for film. Some novels can survive the process of being brought off the page and adapted to the screen, while others are successful narratives because of the medium in which they reside. We do need more adaptations of Kurt Vonnegut’s books (Deadeye Dick and Galápagos, please), but let’s also be real about which ones will work the best. It’s an easy answer, but a book that might be more feasible to adapt would be his most widely known work, Slaughterhouse-Five.

It’s a similarly fast, heavy-handed, hilarious read, with an even more unconventional narrative structure, but it’s also a more cinematic book. Yeah, there was already a movie made in 1972, but let’s give that one another go, and if it’s successful, we can talk about making other Vonnegut movies. In the meantime, how about we leave Cat’s Cradle on the bookshelf? Is that too much to ask?

Entertainment

Jon Gosselin’s Ex-Girlfriend and Martha Stewart’s Make-Up Artist Join ‘RHONY’

Jon Gosselin & Martha Stewart

Crazy Ties To New ‘RHONY’ Cast!!!

Published

Hailey Glassman — best known as Jon Gosselin‘s ex-girlfriend — and celebrity makeup artist Daisy Toye, a longtime glam pro for Martha Stewart, have joined the cast of “The Real Housewives of New York City” for season 16.

Hailey, who’s a public relations pro, shot to fame in 2009 when she dated Jon in the immediate aftermath of his explosive split from Kate Gosselin. The two were together for several months with their whirlwind romance playing out in the tabloids before they ultimately called it quits by the end of 2009.

Daisy, meanwhile, brings serious polish to the franchise. She’s spent years working high-profile shoots, red carpets and media appearances. Daisy’s connection to New York City’s elite social and beauty circles makes her a natural fit for the franchise’s next era.

Waiting for your permission to load the Instagram Media.

As for season 16, returning cast members include Erin Lichy, Sai De Silva, and Jessel Taank, and newbie Erika Hammond, a celebrity fitness trainer. Former “RHONY” star Carole Radziwill is also returning to the series for the first time in eight years.

Filming gets underway this week.

Entertainment

Carole Radziwill returns to divisive “RHONY” reboot nearly a decade after dramatic exit

:max_bytes(150000):strip_icc():format(jpeg)/carole-Radziwill-030226-2f366f954a49444db23990bd71832a37.jpg)

Radziwill originally left the reality series in 2018 amid twin feuds with castmate Bethenny Frankel and Bravo boss Andy Cohen.

Entertainment

BAFTAs host Alan Cumming calls it a 's‑‑‑show' after N-word debacle: 'We were all let down'

:max_bytes(150000):strip_icc():format(jpeg)/Alan-Cumming-bafta-030226-55247b7ba24d4cc4bd17c4a9375d095c.jpg)

Cumming originally apologized for attendee John Davidson, who has Tourette’s, shouting the slur toward Michael B. Jordan and Delroy Lindo during the ceremony.

Entertainment

Josh Duhamel shares how Fergie has 'different views of the world' than him

:max_bytes(150000):strip_icc():format(jpeg)/Fergie-Josh-Duhamel-Tom-Ford-Womenswear-Collection-Presentation-030226-6bcbc700153b4449a009aeabfe1d1b22.jpg)

Duhamel and Fergie divorced in 2019 after eight years of marriage.

Entertainment

General Hospital 2-Week Spoilers March 2-13: Sonny Reveals Devastating Truth & Kristina Unleashes Her Fury!

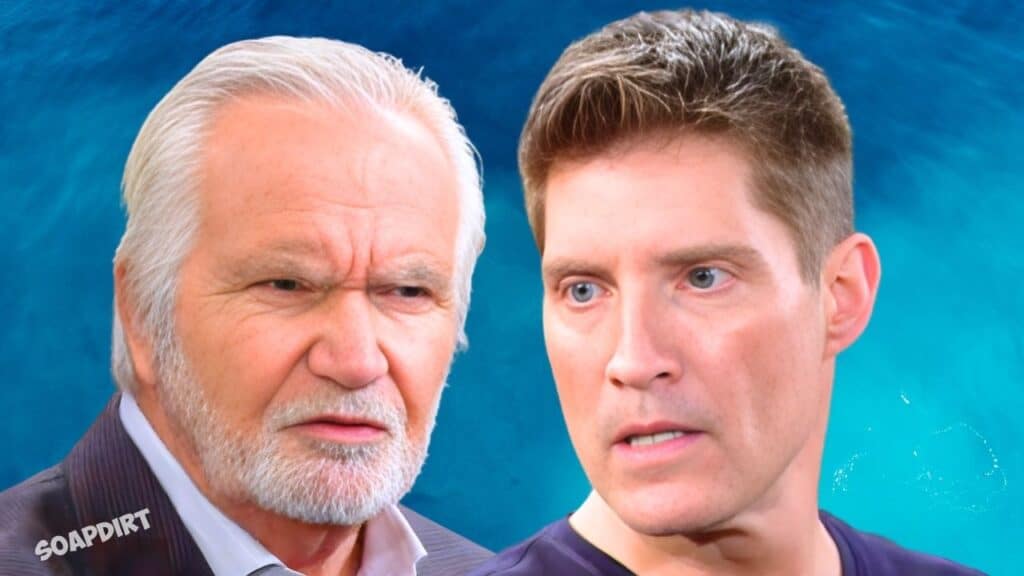

General Hospital 2-week spoilers for March 02 – 13, 2026 expect Sonny Corinthos (Maurice Benard) make a major confession and Kristina Corinthos-Davis (Kate Mansi) absolutely rage.

General Hospital Spoilers: Monday, March 2nd: Chase Faces Consequences and Kristina Questions Fairness

On Monday, March 2nd, Brook Lynn Quartermaine (Amanda Setton) and Harrison Chase (Josh Swickard) find out something really upsetting. This could be about his future at the PCPD or possibly about their adoption plans. Nathan West (Ryan Paevey) talks to Brook Lynn and Chase up at General Hospital, and those two look very worried.

This may be about the PCPD situation. Ned Quartermaine (Wally Kurth) updates Chase on his heart condition, and he’s glad Ned is making his health a priority. Then he asks Chase about his priorities, and Ned thinks Chase’s loyalties lie with Willow Tait (Katelyn MacMullen) instead of his wife Brook Lynn. Chase is shocked and tells Ned he deeply regrets what he’s done and is going to fix it.

Will Brook Lynn Doubt Chase?

Tracy Quartermaine (Jane Elliot) talks to Brook Lynn, maybe about the Chase and Michael key incident, and asks if she knows for sure or just wants to believe it. Will Tracy have Brook Lynn doubting Chase’s innocence in planting it? Also, Kai Taylor (Jens Austin Astrup) gets an offer. Willow may want him to work for her like he did for Drew Cain Quartermaine (Cameron Mathison).

Also, District Attorney Justine Turner (Nazneen Contractor) tells Dante Falconeri (Dominic Zamprogna) and Nathan the last lead was a bust. The key incident makes it nearly impossible for them to keep looking into Michael Corinthos (Rory Gibson) as a suspect, and Chase made the PCPD look bad.

Michael opens up to Jacinda Bracken (Paige Herschell), likely about the Drew key incident and Chase’s involvement. Michael tells someone Dante wants to see him. Kristina asks Sonny, “How is that fair?” Has she heard about Willow getting Drew’s seat instead of her mom? Kristina was excited about Alexis Davis (Nancy Lee Grahn) getting the job, and now she’s been passed over for Willow.

General Hospital: Laura Looks at Ezra

Laura Spencer (Genie Francis) sees a different side of Ezra Boyle (Daniel Cosgrove). Look for recast Patrick Lewis to take on the role of Ezra short term. He and Laura have another chat, and she may see Ezra’s just as trapped and under Jenz Sidwell’s (Carlo Rota) thumb as she is. The usual actor was stuck in an ice storm and couldn’t get to LA to film, so they needed a fill-in.

Laura asks Willow if she plans to use her position to settle her own scores. I’m sure she tells Laura no, but come on, of course Willow’s planning on that. Curtis Ashford (Donnell Turner) makes a choice, maybe about finalizing divorce from Portia Robinson (Brook Kerr). Trina Robinson’s (Tabyana Ali) parents come together to see her and they look tense. Curtis and Portia might be breaking the news to Trina that their marriage is one hundred percent over.

Tuesday, March 3rd: Sonny’s Confession and Carly Hits Paydirt

On Tuesday, March 3rd, Sonny makes a confession. Maybe to Justine, or maybe to someone like Ric Lansing (Rick Hearst) about her. Carly Corinthos Spencer (Laura Wright) hits paydirt. She’s at Wyndemere looking alarmed this week.

Marco Rios (Adrian Anchondo) is trying to get a dose of Britt Westbourne‘s (Kelly Thiebaud) meds as Lucas Jones (Van Hansis) demands but faces a problem. Is he seen by Pascal? Marco heads up to General Hospital this week to see Lucas and they look really stressed.

Tracy and Alexis get an update from Jason Morgan (Steve Burton). Is it about Michael or Anna Devane (Finola Hughes)? Portia feels moved. Is she wowed that Dr. Isaiah Gannon (Sawandi Wilson) stepped in and helped her reconcile with Trina?

Wednesday, March 4th: Britt’s Vulnerability and Lulu’s Private Moment

On Wednesday, March 4th, Britt’s vulnerable and Elizabeth Webber (Rebecca Herbst) sees. Britt might be really shaken. She may get an update from Lucas that they couldn’t get her meds. Britt’s under so much stress, she may crack wide open.

Lulu Spencer (Alexa Havins Bruening) and Nathan’s private moment is witnessed. Does someone see them kissing? Ava Jerome (Maura West) assumes the wrong thing, maybe about Sidwell or Lucas. Josslyn Jacks (Eden McCoy) grows suspicious. Of Carly? Josslyn may see her at Wyndemere.

Thursday, March 5th: Jason Supports Britt and Carly Gets Shocked

On Thursday, March 5th, Lulu makes a realization. She might realize she and Nathan were spotted. Jason is there for Britt. She’s got new hope with Lucas helping, but Jason’s going to dip out in a few weeks and won’t be around. But it’s not by choice. Reportedly someone takes him.

Jack Brennan’s (Chris McKenna) frustrations grow, maybe about Ross Cullum (Andrew Hawkes), Sidwell, or not finding Valentin Cassadine (James Patrick Stuart). Carly’s shocked. Is this at Wyndemere? It may concern her scheme with Valentin. Brook Lynn and Chase come up with a plan. This might be about their adoption dream.

GH Spoilers: Friday, March 6th: Brennan Demands a Favor and Maxie Makes Her Feelings Known

On Friday, March 6th, Josslyn needs to see Jason. This may be about Cullum, but could be about Carly. Brennan demands a favor. I bet from Nina Reeves (Cynthia Watros). He may want payback for deleting Willow footage. Maxie Jones (Kirsten Storms) makes her feelings known. Is this about Nathan and Lulu?

or about the Deception ladies cutting a deal with Sidwell while she was comatose that’s bad for the company? Nathan’s completely honest with Liesl Obrecht (Kathleen Gati). I’m sure about the Maxie issue, but maybe about Lulu feels too. Trina gets a new opportunity that she embraces. Is this something to do with her parents?

General Hospital Week Two: March 9th-13th Spoilers – Willow Loving her New Power

During the second week, Willow revels in her new power. She hates being under Sidwell’s thumb, but Willow has no choice, so she’ll make the most of what he gave her. Michael’s going to be stunned and worried what this development could mean for him and the kids.

Lulu worries about Maxie’s reaction to her and Nathan. Will one of them tell Maxie like they planned, or does someone beat them to the punch and blab? Obrecht pushes back on Nathan. Liesl’s very stubborn and wants the Nathan and Maxie reunion.

Britt’s desperate to find her meds. She’s losing hope and will be devastated and scared when Jason vanishes. Marco is conflicted. He wants to help Lucas but is afraid of his father, Cullum, and Pascal. Lucas is in danger. Sidwell and Pascal are already prepared to kill Lucas. One of them might strike soon, especially if they think he’s manipulating Marco to turn on them.

Jason Leaving GH soon

It’s almost time for Jason to disappear. He’ll be back this summer—should be onscreen in July—and our leaker said he’s kidnapped by someone other than Sidwell or Cullum. Drew’s in deep despair. Between Willow and Sidwell, he’s completely trapped. But if Kai’s around working for Willow, he might help Drew.

Sonny wants to get closer to Justine. She’s fighting her feelings hard, but if Sonny kisses her again, she might not slap him. Trina and Portia rebuild their relationship. Trina’s getting excited about the baby.

That’s your General Hospital two-week spoiler outlook for March 2nd through the 13th. Thanks for watching Soap Dirt, and don’t forget to subscribe for more daily spoilers and news!

Entertainment

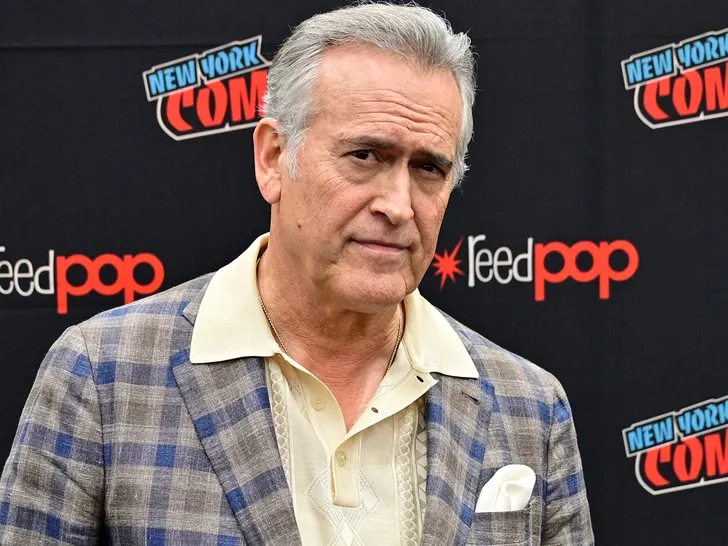

‘Evil Dead’ Star Bruce Campbell Reveals He Has Cancer

Bruce Campbell

I’m Battling Cancer

Published

Bruce Campbell has revealed he has cancer, but says it’s a type that’s treatable, though not curable.

“The Evil Dead” actor shared the news Monday in a message to fans, writing, “Hi folks, these days, when someone is having a health issue, it’s referred to as an ‘opportunity,’ so let’s go with that — I’m having one of those.” He continued, “It’s also called a type of cancer that’s ‘treatable’ not ‘curable.’ I apologize if that’s a shock — it was to me too.”

Campbell said he wouldn’t go into further detail about his diagnosis, but explained his work schedule will be changing. “Appearances and cons and work in general need to take back seat to treatment,” he wrote, adding he plans to focus on getting “as well as I possibly can over the summer.”

As a result, Campbell says he has to cancel several convention appearances this summer, noting, “Treatment needs and professional obligations don’t always go hand-in-hand.”

He says his plan is to tour this fall in support of his new film, “Ernie & Emma,” which he stars in and directs.

Ending on a determined note, Campbell told fans, “I am a tough old son-of-a-bitch … and I expect to be around a while.”

Entertainment

Bold and the Beautiful 2-Week Spoilers March 2-13: Deacon Heats Things Up & Eric Drops Major Bombshell!

The Bold and the Beautiful 2-week spoilers for March 02 – 13, 2026 bring a wild ride as some major shocks hit the Forrester mansion and Deacon Sharpe (Sean Kanan) finds himself in a very steamy situation.

The Bold and the Beautiful Spoilers: Week 1 Drama and Unlikely Encounters

The week kicks off on Monday, March 2nd, with Steffy Forrester (Jacqueline MacInnes Wood) seeking guidance from Finn (Tanner Novlan). She is still reeling from everything happening with her family, and Finn is her rock, but how much can he take?

Also, Hope Logan (Annika Noelle) and Deke Sharpe (Harrison Cone) are encouraging Deacon to follow his heart. They want him to take a stand, but we know Deacon is often caught between a rock and a hard place.

And keep an eye out for Taylor Hayes (Rebecca Budig), because she has a very uncomfortable encounter with Sheila Carter (Kimberlin Brown). These two under the same roof is always a recipe for disaster.

B&B Spoilers: Deacon Sharpe’s Daydreams and the Steffy Forrester vs. Hope Logan Rivalry

On Tuesday, March 3rd, the rivalry between Steffy and Hope heats up again as they clash over their parents’. It seems some things never change. Meanwhile, Deacon is with Sheila, but his mind is elsewhere. He is daydreaming about Taylor, and that is definitely going to lead to some sizzle—and some trouble.

By Wednesday, March 4th, Will Spencer (Crew Morrow) is officially back on the market, and he’s already catching Dylan’s (Sydney Bullock) eye. Is a new romance brewing in the younger set? At the same time, Taylor and Deacon are both fighting their growing attraction. They are trying to keep their distance, but the pull is getting stronger.

Bold and the Beautiful Spoilers: Sheila Carter’s Scheme and Will Spencer’s Massive Bombshell

On Thursday, March 5th, Sheila expresses her gratitude to Taylor for everything she’s done recently. Is this a genuine olive branch or another one of Sheila’s schemes?

Plus, Hope is urging her dad, Deacon, to prioritize his own happiness for once. And Dylan finally comes clean to Will about everything she’s been hiding.

Friday, March 6th, ends the week with RJ Forrester (Brayan Nicoletti) thinking back on that kiss with Electra Forrester (Laneya Grace). He can’t get it out of his head. And Will drops a massive bombshell on Steffy that is going to leave her absolutely stunned.

Week 2 Spoilers: Eric Forrester Shocks the Family and Power Dynamics Shift

As we head into the second week, the drama only intensifies. The headline here is that Eric Forrester (John McCook) is going to do something that shocks everyone.

We’ve seen him struggling with his health and his place at Forrester Creations lately, and whatever he does this week is going to shift the power dynamics significantly. Whether it’s a medical recovery or a business move against Ridge Forrester (Thorsten Kaye), Eric is not going quietly.

Deacon Sharpe and Taylor Hayes’ Sizzling Romance Reaches a Boiling Point

Meanwhile, that “Deacon sizzle” we’ve been teasing reaches a boiling point. His daydreams about Taylor might just become a reality, which would put him in direct conflict with both Ridge and the ever-dangerous Sheila. In other news for the second week, look for the situation with Dylan and Will to reach a turning point as the truth about Dylan’s past continues to emerge.

And Steffy will be dealing with the fallout of the news Will gave her on Friday, leading to a major confrontation at the Forrester estate. That’s what’s coming up on The Bold and the Beautiful for the next two weeks. It looks like the Forresters, Logans, and Spencers are in for some major shifts.

Entertainment

Perfect Comedy On Netflix Laughs In Death’s Face

By Chris Snellgrove

| Published

The Addams Family has never been too afraid of death, possibly because they know just how impermanent it really is. After all, this is a franchise that refused to die: after the ‘60s show was canceled after only two seasons, the show lived on through cartoons and TV specials before properly coming back to life with two successful blockbuster movies that defined an entire generation. Now, Wednesday has relaunched the brand yet again, and the success of that show has ensured that an Addams Family cinematic universe is right around the corner.

However, shortly before Wednesday made everyone embrace their inner goth, we got an entirely different franchise production: The Addams Family (2019), a slick, CGI cartoon that lovingly embraced the aesthetics of the original Addams Family comic strips. It’s a movie that honors the franchise in a surprisingly robust way while providing something fun for the entire family to enjoy. If you’re ready for something creepy, spooky, and altogether ooky, it’s time to stream The Addams Family on Netflix!

The Original Goth TV Family Is Back

The premise of The Addams Family is that the titular clan of weirdos has established a new home for themselves in New Jersey, essentially isolating themselves from the outside world. That isolation is brought to a forcible end when a crazy reality TV show host makes it her personal mission in life to destroy the Addams’ mansion and drive the family away, all in the name of creating a perfectly planned community. The film is ultimately a story about fitting in versus standing out, with the Addamses impressing upon their children the need to never let anyone change who they really are.

As with many animated blockbuster movies, The Addams Family has a cast full of big names, starting with Oscar Isaac (best known for Ex Machina) as Gomez Addams. His loving wife, Morticia, is played by Charlize Theron (best known for Mad Max: Fury Road), while Wednesday is played by Chloë Grace Moretz (best known for Kick-Ass). Rounding out the immediate family is Puggsley, played by Stranger Things icon Finn Wolfhard.

Big Names Made This Movie An Explosive Hit

Believe it or not, this is just scratching the surface of big names in this film. The Addams Family also features voice work by Nick Kroll and deceased comedy legends Bette Midler and Catherine O’Hara. Even Snoop Dogg makes a crowd-pleasing cameo that firmly establishes how well the two directors (Greg Tiernan and Conrad Vernon) understood the assignment.

After The Addams Family hit theaters, its success was anything but ‘altogether ooky.” Against a budget of $24 million, it earned $204.4 million. This was enough success (you could fill Gomez’s vault with all that money!) to earn a sequel, and The Addams Family 2 came out in 2021. More broadly speaking, the success of this first film signified that The Addams Family was still a viable brand, and development on the highly successful Wednesday television show started the same year this earlier movie hit theaters.

The Critics Were Shocked (And Not In A Good Way)

When The Addams Family came out, it quickly revealed a major divide between critics and audiences. On Rotten Tomatoes, the film has a 46 percent rating, with critics complaining that this was too sacharine of a story for the most macabre family in American history. But the movie has a 70 percent audience rating and earned itself a follow-up film, both of which prove how popular this quirky cartoon was for general moviegoers and not snobby critics.

If you’re a diehard fan of the franchise like I am, you’ll likely enjoy The Addams Family for hewing so close to the original source material. The character design faithfully recreates Charles Addams’ original art, and the film does an excellent job of channeling these characters’ familiar dark humor. It’s still family-friendly enough to watch with your kids, but the onscreen hijinks of this glum, sometimes gruesome family are perfect for any parents sick of watching cartoons as shiny as they are mindless.

Additionally, the star-studded cast does an excellent job of bringing The Addams Family to life. Nobody phones in their performances here, and longtime fans will be excited by how Oscar Isaac channels the manic charm of John Astin’s original performance as Gomez. Meanwhile, Chloë Grace Moretz channels the dry wit of Christina Ricci’s Wednesday from the ‘90s, effectively paving the way for Jenna Ortega’s sinfully sardonic performance as the titular star of the Wednesday TV show.

The Family That Streams Together Screams Together

Even if you’re not a huge fan of the franchise, though, it’s easy to love The Addams Family for what it is: a well-produced tale of outsiders discovering that what makes them weird is also what makes them strong. It’s a universal message that will resonate particularly well for anyone who has learned the value of found family or, for that matter, anyone who felt like an unwanted outcast when they were growing up. That makes this the ideal movie for former weirdos to share with their children, effectively breaking the outcast cycle in a way that helps you bond with your children.

Will you agree that The Addams Family is a perfectly creepy, family-friendly comedy, or will you want to shut this thing off and just go watch Jenna Ortega dance instead? The only way to find out is to stream this slice of gothic grandeur for yourself on Netflix. Afterward, you can always stream the sequel on the same streamer, just in case you end up loving this film as much as Puggsley loves bombs!

Entertainment

Canceled Star Wars Actress’s Western Is A Brutal, Unrated Post-War Thriller

By Jennifer Asencio

| Published

The recent release of a trailer for The Mandalorian and Grogu continues the story of the warrior hero and his young charge as they navigate, fight, and Force their way around the Star Wars galaxy. Cara Dune, played by Gina Carano, was an important character in this universe who was written off when the actress made some social media comments that Disney didn’t like. For comparing cancel culture to the Holocaust, Carano found herself canceled and fired from the original Mandalorian series.

She was scooped up by Daily Wire, the conservative news station, which was in the process of developing its entertainment division with fictional adult entertainment such as the movie Run Hide Fight. Carano’s project with the company was the western Terror on the Prairie.

Searching For Identity After The War

The movie takes place after the Civil War, starring Carano as Hattie McAllister, who has relocated with her husband Jeb (Donald Cerrone), pre-teen son Will (Rhys Jackson Becker), and infant daughter Bess to build a remote farm in Montana. Hattie’s wealthy family originates from St. Louis, and the devoted couple disagrees over whether they should persevere in their isolated independence or return to the city and kin. Jeb fought in the war but left the Confederacy for the Union.

Captain Miller (Nick Searcy) is also a veteran of the Confederacy and is now leader of an outlaw gang. When he and his gang stop at the McAllister homestead while Jeb is away, Hattie does what she can to keep the peace until it becomes clear the men have no intention of leaving. What results is a stand-off between Hattie and Cap and his gang as they siege her house to draw her and the children out. But what do they want with her, and will Jeb return in time to save his family?

Gina Carano’s Potential Doesn’t Match The Role

For Cara Dune fans, I’ll rip the Band-Aid off quickly and admit that Gina Carano disappoints. It’s not that she was not very good in this role as much as the role was not very good for her. Hattie is a wealthy city belle who loves her husband enough to have relocated to this desolate territory and a mother determined to protect her children. Carano does what she can with this, but too much about her general demeanor betrays that the actress is not some pampered princess, which tricked me for much of the movie into thinking that Hattie had fought in the war beside, or rather than, her husband.

Daily Wire originally signed Carano to star in an adaptation of “White Knuckle,” which is about an undercover FBI agent on the trail of a trucker serial killer, but wound up making this film instead, so if it feels like she was hired to do a different job, it’s because she was.

Nick Searcy as Cap was a magnificent blend of reasonable and depraved, convincing and conniving. He would have made a perfect foil to a heroine allowed to use more of Carano’s strengths, but against Hattie McAllister, he is overpowering in his sinister combination of religious conviction and murderous rage. The late Heath Freeman, who died before the movie was released, was tragically conflicted as Gold Teeth, one of Cap’s followers, who is so manipulated by the former soldier that he’s afraid to disobey.

Stellar Production Undermined By Pacing

Production-wise, a major strength of the film is in shots and sound effects that punctuate the farm’s isolation. The distant mountains and vacant fields around the McAllister homestead dominate the visual landscape for much of the film. No musical soundtrack plays through any of the movie until the moment before the credits roll, indicating a conscious choice of using only the wind whispering over the prairie and Bess’s crying as background music. This combination drives home that the terror in question isn’t just on the prairie but is the prairie and the distance it puts between Hattie and help.

This would have been effective had the script had pacing to match, but it was so uneven that when I paused to go refill my drink, I was stunned to discover that I still had almost an hour left to go. There is even a scene that is a perfect allegory for the plot’s movement: a chase on foot across a swiftly moving river through whose current the participants must slog. In exactly this manner, the movie gets in its own way by having interesting characters and motivations that are held back by taking too long to have them do anything and dragging it out when they finally do. Even the conclusion was drawn out for too long and in too many phases to be considered anything like a climactic event.

A Western With An Identity Crisis

Terror on the Prairie was trying to be a lot of things, but it wasn’t. Since it was an early entry in the Daily Wire catalogue, director Michael Polish was given the leeway to make an art film, but writer Josiah Nelson’s sophomore script should not have been that film. There are too many dissonant parts that never quite find their fit because the movie is never sure whether it’s a drama, suspense, action, elevated horror, or a Western piece, and tries to be all at once.

Nelson went on to co-write Episode 5 of The Pendragon Cycle, whose script, I previously wrote, was its greatest strength. I can now see how that episode made use of the better elements of character development in Terror on the Prairie; Nelson has great characters and shines when he gives them something to do, but he didn’t succeed with his ponderous Western.

Gina Carano’s next move is a return to the fighting ring against Ronda Rousey for a Netflix event in May. Carano made a beautiful frontier belle, but she is too good a fighter to pretend to be an amateur. It’s a pity the other project didn’t work out, because that would have been really good. Meanwhile, since Lucasfilm has recently changed leadership, will Star Wars fans get a revival of Cara Dune?

Terror on the Prairie is streaming on Daily Wire+.

Entertainment

“American Idol”'s final 30 revealed after teen contestants face off in surprise battle and force 'tough decisions'

:max_bytes(150000):strip_icc():format(jpeg)/American-Idol-Lionel-Richie-Carrie-Underwood-Luke-Bryan-2-020226-ed8d0421d024487eaf3d7dc65a3aab76.jpg)

Judges Luke Bryan, Lionel Richie, and Carrie Underwood put two young contestants on the spot Monday.

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Iris Top

-

Politics4 days ago

Politics4 days agoITV enters Gaza with IDF amid ongoing genocide

-

Tech2 days ago

Tech2 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Business6 days ago

Business6 days agoTrue Citrus debuts functional drink mix collection

-

Sports3 days ago

The Vikings Need a Duck

-

Crypto World7 days ago

Crypto World7 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

NewsBeat5 days ago

NewsBeat5 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat3 days ago

NewsBeat3 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Tech7 days ago

Tech7 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat5 days ago

NewsBeat5 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat2 days ago

NewsBeat2 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat2 days ago

NewsBeat2 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoPolice latest as search for missing woman enters day nine

-

Entertainment22 hours ago

Entertainment22 hours agoBaby Gear Guide: Strollers, Car Seats

-

Business5 days ago

Business5 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business4 days ago

Business4 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech4 days ago

Tech4 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Crypto World6 days ago

Crypto World6 days agoEntering new markets without increasing payment costs

-

Politics2 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers