Money

Should we be concerned about surge in mortgages running into retirement?

It is not often the Financial Conduct Authority comes up with a snappy soundbite.

However, responding to the growth in mortgages with terms running beyond pension age, earlier this year the regulator said such lending was moving “from a niche to norm”.

I think this admirably sums things up. But should we be concerned?

Using the Freedom of Information Act, I asked the Bank of England to give me information about new mortgages (for both first-time buyers and remortgages) whose term ran past the state pension age. In the fourth quarter (Q4) of 2021, just under one in three (31%) of mortgages ran past pension age.

Regulators and those interested in pensions policy need to take a close look at what is going on in the mortgage market

By Q4 2022, the proportion had risen to 38%, and at the end of last year it was 42% — certainly no longer a “niche”.

Some of this is clearly first-time buyers doing their best to get started with a mortgage and willing to take on a super-long term to do so.

Out of just over 91,000 new mortgages taken out in Q4 2021 and which ran past pension age, just over a third were for people in their thirties or younger. But a surprising proportion went to older borrowers, with more than a quarter going to those aged 50-plus.

Surface view

At first sight, we might be fairly relaxed about the rise of the long mortgage.

If it enables a young person to move from private renting into homeownership, it may look very attractive. And, as their career progresses, there is the potential to shorten the mortgage term.

If the mortgage runs up to retirement, those mortgage-free later-life working years to top up the pension may never happen

Likewise, we may be relatively unconcerned about people in their sixties taking out a mortgage that runs a few years past pension age.

Mortgage lenders will have a good sense of the income in retirement of this group. This may be enough to be confident the debt can be safely serviced to the end of the term.

We may also hope that some of this very long-term lending is a temporary reaction to higher interest rates and that the need for super-long mortgages will diminish as rates fall.

Deeper look

However, I still think we should be concerned.

First, many millions of people are heading towards retirement with inadequate pension savings. Often, state and private pensions combined may be inadequate for much more than a modest retirement, and certainly will not service a mortgage debt as well.

One particular concern would be if people were to reach pension age with a modest defined contribution pension pot and an outstanding mortgage balance; they might use one to pay off the other, leaving them with a very low income in retirement.

We may hope that some of this very long-term lending is a temporary reaction to higher interest rates

Even if mortgages run only to pension age, this is a change from a historical pattern where many people had cleared their mortgage a decade before retirement and could use the remaining years in work to boost their pension.

If the mortgage runs up to retirement, those mortgage-free later-life working years to top up the pension may never happen.

And all of this assumes that individuals are working all the way up to pension age. In reality, millions of UK adults in their fifties and early sixties are now out of paid work because of long-term sickness.

Those who have taken on a mortgage with a term that runs into retirement, but whose stream of earnings dries up a decade earlier, could find themselves in serious difficulty.

Wiping out progress

We do not yet know if falling interest rates will lead to a significant drop in the number of new mortgages running into retirement, but it is hard not to envisage this being a significant factor for years.

At first sight, we might be fairly relaxed about the rise of the long mortgage

Regulators and those interested in pensions policy need to take a close look at what is going on in the mortgage market.

They must make sure the progress that has been made in getting 10 million more people saving into a workplace pension is not wiped out by changes in borrowing and lending patterns.

Steve Webb is a partner at pension consultants LCP and was pensions minister 2010–15

This article featured in the November 2024 edition of Money Marketing.

If you would like to subscribe to the monthly magazine, please click here.

Money

Over a quarter of a million households on benefits have payments STOPPED – how to avoid it happening to you

OVER a quarter of a million households have had their benefit payments stopped after failing to act on a key deadline.

New government figures show 318,834 (up from 284,660 reported in August) benefits claimants have lost out by not moving to Universal Credit within an important three-month window.

Two million people on legacy benefits are gradually moving to Universal Credit under a process known as managed migration.

Universal Credit was set up to replace legacy benefits and kicked off in November 2022 after a successful pilot in July 2019.

As part of the process, eligible households on legacy benefits, including tax credits, are sent “migration notices” in the post which tell them how to make the move to Universal Credit as it’s not automatic.

Households must apply for Universal Credit within three months of receiving their managed migration letter.

Failing to do this can result in benefits being stopped.

Between July 2022 and September 30, 2024, the Department for Work and Pensions (DWP) sent almost 1.4 million migration notices.

However, according to the DWP’s latest figures, 318,834 individuals lost their benefits after failing to act on migration notices received between July 2022 and June 2024.

Some 883,944 individuals have since made successful claims for Universal Credit, and another 166,594 are still in the process of transitioning.

Ayla Ozmen, director of policy and campaigns at Z2K, said: “We’re concerned to see that more people have had vital benefit payments stopped as part of the government’s plan to move people on to Universal Credit.

“The government now looks to have moved all disabled people on to Universal Credit by March 2026, and we are worried that more people may miss the deadline and have their benefits stopped, with potentially disastrous results.

“The government needs to ensure that appropriate safeguards are put in place to stop disabled people being left with nothing to live on.”

Experts have previously warned that managed migration poses a risk to vulnerable people who face losing money.

Top bosses at charities, including Mind, The Trussell Trust, Turn2Us and the Money and Mental Health Policy Institute, said in 2022 that around 700,000 with mental health problems, learning disabilities, and dementia could struggle to engage with the process.

More than 20 organisations have called on the government to halt managed migration to fix flaws in the system that could cause those at risk to fall through.

Which benefits are stopping?

UNIVERSAL Credit is replacing six benefits under the old welfare system, commonly called legacy benefits. They are:

- Working tax credit

- Child tax credit

- Income-based jobseeker’s allowance

- Income support

- income-related employment and support allowance

- Housing benefit

If you’re on any of these benefits now, you can choose to move over – but you might not be better off.

You should consider carefully what moving over means for your money, as you can’t move back once you’re on Universal Credit.

Using an online benefits calculator, which is free and easy to use from charities such as Turn2Us and EntitledTo, can help you compare.

You may be moved to Universal Credit if your circumstances change, such as moving home, changing your working hours, or having a baby.

But eventually everyone will be moved over to Universal Credit under the managed migration process.

MANAGED MIGRATION PROGRESS

In January, the government announced the number of migration notices it plans to send out in the coming financial year.

Before this date, the focus was sending migration notices to households claiming tax credits only.

However, 110,000 income support claimants and a further 120,000 claiming tax credits with housing benefit started receiving their letters in April.

Over 100,000 housing benefit-only claimants were contacted in June.

More than 90,000 people claiming employment and support allowance (ESA) along with child tax credits started being asked to switch in July.

Meanwhile, 20,000 claimants on jobseekers allowance (JSA) were contacted in September.

The Sun previously reported that, in August, those claiming tax credits who are over state pension age will be asked to apply for either Universal Credit or pension credit.

It was initially planned that those claiming income-related ESA alone would not be moved until 2028.

However, the DWP brought forward plans to move these households to Universal Credit by the end of 2025.

Since September 2024, 800,000 households have begun receiving letters explaining how to move from ESA to Universal Credit.

HELP CLAIMING UNIVERSAL CREDIT

As well as benefit calculators, anyone moving from tax credits to Universal Credit can find help in a number of ways.

You can visit your local Jobcentre by searching at find-your-nearest-jobcentre.dwp.gov.uk/.

There’s also a free service called Help to Claim from Citizen’s Advice:

- England: 0800 144 8 444

- Scotland: 0800 023 2581

- Wales: 08000 241 220

You can also get help online from advisers at citizensadvice.org.uk/about-us/contact-us/contact-us/help-to-claim/.

Will I be better off on Universal Credit?

ANALYSIS by James Flanders, The Sun’s Chief Consumer Reporter:

Around 1.4million people on legacy benefits will be better off after switching to Universal Credit, according to the government.

A further 300,000 would see no change in payments, while around 900,000 would be worse off under Universal Credit.

Of these, around 600,000 can get top-up payments (transitional protection) if they move under the managed migration process, so they don’t lose out on cash immediately.

The majority of those – around 400,000 – are claiming employment support allowance (ESA).

Around 100,000 are on tax credits, while fewer than 50,000 each on other legacy benefits are expected to be affected.

Those who move voluntarily and are worse off won’t get these top-up payments and could lose cash.

Those who miss the managed migration deadline and later make a claim may not get transitional protection.

The clock starts ticking on the three-month countdown from the date of the first letter, and reminders are sent via post and text message.

There is a one-month grace period after this, during which any claim to Universal Credit is backdated, and transitional protection can still be awarded.

Examples of those who may be entitled to less on Universal Credit include:

- Households getting ESA and the severe disability premium and enhanced disability premium

- Households with the lower disabled child addition on legacy benefits

- Self-employed households who are subject to the Minimum Income Floor after the 12-month grace period has ended

- In-work households that worked a specific number of hours (e.g. lone parent working 16 hours claiming working tax credits

- Households receiving tax credits with savings of more than £6,000 (and up to £16,000)

Either way, if these households don’t switch in the future, they risk missing out on any future benefit increase and seeing payments frozen.

Money

Mortimer Street Capital completes £27.5m commercial refinance facility

MSC was instructed to structure a facility and explore options in the market that included commercial properties, residential assets, land and development sites totalling 11 securities.

The post Mortimer Street Capital completes £27.5m commercial refinance facility appeared first on Property Week.

Money

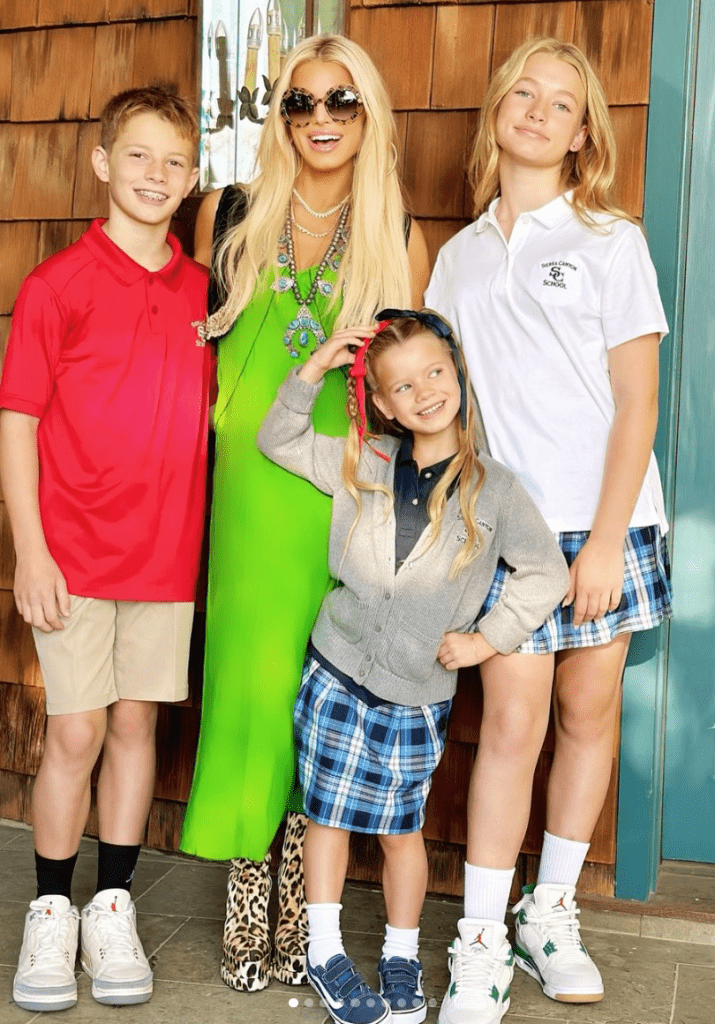

Jessica Simpson’s $22M Mortgage Moves Amid Split Rumors

Mortgage Mayhem: Jessica Simpson and Eric Johnson’s $22M Loans Amid Money Troubles and Rumored Split

Jessica Simpson and her husband, former NFL star Eric Johnson, have taken out over $22 million in loans on their opulent Hidden Hills mansion, raising questions about the couple’s finances and sparking rumors of a potential split after a decade of marriage. Despite the whispers of financial struggles and relationship troubles, the two have not publicly confirmed any separation or filed for divorce.

jessicasimpson – Instagram

Property records reveal a complex series of financial maneuvers on the home, which Simpson purchased in 2013 from Ozzy and Sharon Osbourne for $11.5 million under her “Dixie Trail Trust.” Initially, in 2015, Simpson and Johnson took out a $7.3 million mortgage on the property with JPMorgan Chase, followed by an $8 million loan in 2017. Additional loans with other lenders — $3.65 million with Platinum Loan Servicing Inc. and $3.04 million with the Bank of Southern California — brought the total loan amount to over $22 million. Although they have continued to meet these loan obligations, the sheer scale of the debt has fueled speculation about the couple’s financial standing.

An Oasis of Luxury in Hidden Hills

Simpson and Johnson’s estate in the celebrity-favored, gated community of Hidden Hills is a stunning example of luxury California real estate. This 13,274-square-foot home, nestled on 2.25 acres of land, boasts an impressive eight bedrooms and 13 bathrooms. Blending Cape Cod-inspired design with contemporary elegance, the home is secluded at the end of a cul-de-sac, offering both privacy and sweeping views of the city and nearby mountains.

The house is built for both entertaining and family life, featuring a grand spiral staircase that makes a memorable first impression. A large family room is warmed by a reclaimed brick fireplace and framed by oversized sliding barn doors, giving the space a rustic, yet refined look. Floor-to-ceiling windows flood the space with natural light, creating a sense of openness and connection to the outdoors.

jessicasimpson – Instagram

The kitchen is truly a chef’s dream, with high-end Wolf appliances, a spacious center island, a walk-in pantry, and a charming breakfast nook where Simpson has shared glimpses of cozy family mornings with her children, Maxwell, Ace, and Birdie. The master suite is a luxurious retreat within the home, complete with a fireplace, a wood-paneled walk-in closet, and an adjacent office for quiet moments or remote work. Outdoor spaces add to the estate’s allure, with expansive lawns, a spa, a shallow pool, and numerous seating areas designed for lounging, socializing, and relaxation. A separate guesthouse provides additional living space, suitable for an office or gym, and a four-car garage adds a practical touch.

Financial Struggles and the Fight to Save Her Brand

Simpson’s financial challenges have become public knowledge over the years, with the singer and entrepreneur candidly discussing her journey to reclaim control of the Jessica Simpson Collection, the billion-dollar brand she co-founded with her mother, Tina, in 2005. The business grew rapidly, becoming a household name and a major force in fashion retail. However, in 2015, Sequential Brands Group acquired a controlling stake in the business, leaving Simpson with a 37.5% ownership share.

In 2021, when Sequential Brands filed for bankruptcy, Simpson was forced to make a difficult decision. Determined to regain full control of her company, she and her mother placed a $65 million bid, a move funded by a mix of loans and family contributions. “I drained everything to buy it back,” Simpson revealed in an interview, explaining the extent of her financial commitment to the business. Her decision meant taking on significant personal financial risk, even to the point of not having a working credit card at one point. “I went to Taco Bell the other day and my card got denied,” she admitted on The Real, highlighting her willingness to prioritize her brand’s future over her own financial comfort.

For Simpson, the choice to regain control of her brand was deeply personal. “With money, there’s just so much fear attached to it,” she said, acknowledging the anxiety that can come with financial instability. Despite these struggles, Simpson has remained resolute, regularly showcasing pieces from her collection on social media and discussing her plans to expand the brand further.

jessicasimpson – Instagram

Rumors of a Rocky Marriage and Separate Lives

Alongside these financial hurdles, Jessica and Eric’s relationship has faced scrutiny, with rumors circulating that the couple may be living separate lives. The two celebrated their 10-year wedding anniversary this year, but Simpson’s failure to acknowledge the milestone on social media fueled speculation about the state of their marriage. Observers noted that she has been spotted without her wedding ring in recent months, and Eric has been noticeably absent from her social media posts. Even during recent family gatherings, such as Easter, the couple appeared together with their children but did not pose side-by-side.

Jessica’s recent post from her Nashville music room, where she announced new music, further hinted at personal challenges. She wrote, “This comeback is personal, it’s an apology to myself for putting up with everything I did not deserve,” a statement that many fans interpreted as a veiled reference to her marriage. Her return to music seems to be both a professional and personal endeavor, a chance for Simpson to reconnect with her passions and redefine herself after years of business and family commitments.

Looking to the Future with Resilience and Renewal

Though Jessica and Eric put their Hidden Hills mansion on the market for $22 million in September 2023, they later removed the listing in August 2024. This move leaves questions about their future — will they remain in Los Angeles, or could they be considering a more permanent move to Nashville, where Simpson has been spending more time and working on new music?

Despite the rumors and financial strains, Simpson’s determination remains clear. She’s shown a fierce commitment to her brand, her family, and her own personal growth. Reflecting on her drive and resilience, she once shared, “I’ll put it all out there if it’s me that’s driving the show, because I believe in myself… And I know that nothing will stop me, and if you try to stop me, I’ll try harder.”

jessicasimpson – Instagram

Her journey has been anything but conventional, marked by financial gambles, a high-profile marriage, and a struggle to maintain her footing in a demanding industry. Simpson’s story is one of both public and private battles, of a woman unafraid to push her limits in pursuit of a vision that’s entirely her own. As she embarks on her latest “personal comeback,” fans and critics alike are watching closely, anticipating what the next chapter holds for the multi-talented star.

Money

AJ Bell reduces charges on multi-asset income range

AJ Bell has reduced ongoing charges across its multi-asset income range, including flagship funds.

The charges for the VT AJ Bell Income Fund and VT AJ Bell Income & Growth Fund have been reduced by 15 basis points.

The reduction from 0.65% to 0.50% came into effect on 1 November.

AJ Bell said its multi-asset income range has delivered strong performance with a five-year total return of 22.51% and 27.58% respectively.

The funds, which were launched in 2019, will now offer a smoothed income profile, with 11 equal monthly income payments and a final balance distribution in month 12.

The wealth manager said the multi-asset income range, alongside its Managed Portfolio Service (MPS), Growth and Responsible investing funds, has formed an important part of its investments business.

The investments business has grown to assets under management of £6.8 bn as of 30 September 2024, up 45% in the year and with inflows of £1.5 bn.

AJ Bell said today’s announcement further evidences its commitment to delivering exceptional value for customers and follows charge reductions on its Investcentre adviser platform earlier this year, with fees cut to between 0.2% and 0.075% and capped on accounts over £2m.

Ryan Hughes, AJ Bell Investments managing director, said: “After another strong year for our investments business, we are very happy to announce a reduction in charges for our range of income funds. We remain committed to passing on economies of scale to our customers as we continue to grow, ensuring we are delivering excellent value investment solutions alongside strong investment returns.

“At the same time, the move to a ‘smoothed income’ approach helps customers using our income funds manage their investment income. As more investors look to rely on investment income in retirement, this approach will make life easier, with a consistent, reliable income enabling better budgeting and cashflow planning.”

Money

What the new ‘pension megafunds’ plan by Rachel Reeves means for YOUR retirement

THE government is set to announce huge plans to create “pension megafunds” in a bid to boost both savers’ retirement pots and investment in the UK.

Chancellor Rachel Reeves will outline the plans to move around £800billion of pension savings into larger so-called “megafunds” in her first annual “Mansion House” speech this evening.

Local government pension schemes, which manage around £400billion of that cash, will be forced to split into eight megafunds.

Eventually, the plan is to then group all other defined contribution (DC) schemes – what most workers save into – into a number of other big funds.

DC schemes are where you and your employer both put money into a scheme and the cash is invested to grow your pot over time.

The plan is to set a minimum amount these funds can have in them – currently touted as somewhere between £25billion and £50billion.

The government is also consulting on allowing fund managers – who manage where all this cash is invested – to move savers from schemes which are under-performing into schemes that will deliver them better value.

The megafund set-up is similar to the pension systems in other countries like Australia and Canada, where pension cash is pooled into huge so-called “superfunds” and invested on behalf of larger groups of savers.

Ms Reeves said the reforms are the biggest change to the pensions market “in decades” that will “boost people’s savings in retirement” and “drive economic growth”.

The government added: “Consolidating the assets into a handful of megafunds run by professional fund managers will allow them to invest more in assets like infrastructure, supporting economic growth and local investment.”

What do the changes mean for your money?

Currently, most workers in the UK are automatically enrolled into their workplace pension scheme.

These are usually DC schemes. The other type of pensions in the UK are “defined benefit” schemes, where workers receive a guaranteed income in retirement based on their years of service.

But “megafunds” will pool a number of workplace pension schemes together to create giant pots of money to invest.

The aim is that by having much larger amounts to invest, the cash returns on those investments will be far higher than having lots of smaller pots.

For example, if you returned 5% on £1,000 in a year, you would earn £50, but if you returned 5% on £100,000 over a year, you would earn £5,000, and so on.

This should mean savers should end up with much larger pots of money by the time they retire.

Having more cash also means investment managers can take more risk with their investments with the aim of achieving higher returns.

Looking at the bigger picture, the government is hoping that these larger pension funds can be used to invest in infrastructure projects, which will ultimately benefit everyone.

Currently, most DC pensions in the UK are too small to invest in any meaningful capacity in infrastructure projects, such as roads, railways or building developments.

But government analysis has found pension funds worth between £25billion and £50billion can achieve much greater “productive investment levels”.

For example, it found Canada’s pension schemes invest around four times more in infrastructure than the UK currently does, while Australia’s pension schemes invest around three times more.

By combining UK schemes, the government estimates it could unlock a whopping £80billion to invest in the country’s infrastructure.

Jon Greer, head of retirement policy at wealth manager Quilter, said that by pooling resources into larger funds, savers will access “high-yield investments that smaller schemes often miss”.

“Drawing inspiration from successful models in Australia and Canada, this approach has the potential to deliver stable returns while supporting meaningful long-term projects,” he added.

However, some pensions industry experts have expressed concern that the government’s main focus is on investing in the UK rather than achieving returns for savers.

Tom Selby, director of public policy at AJ Bell, warned: “Conflating a government goal of driving investment in the UK and people’s retirement outcomes brings a danger because the risks are all taken with members’ money.

“If it goes well, everyone can celebrate – but it’s clearly possible that it will go the other way, so there needs to be some caution in this push to use other people’s money to drive economic growth.”

How do pensions make money?

DEFINED contribution pension cash is pooled together to make money for savers.

Schemes are managed by investment firms, such as Hargreaves Lansdown or Fidelity, and fund managers at those firms decide where to invest savers’ cash to earn as much money as possible.

Over a long period, these returns from investments gradually increase the size of the pot – and as the pot size increases, the amount it can return also increases, as the return is calculated on a larger amount of money.

This is known as “compound interest”.

We have previously revealed how over 40 years, you could save a total of £109,671, while only paying in £40,000 of your own money because of compound interest.

The larger the amount of money is that’s invested, the higher the returns can be in cash-terms for savers.

CryptoCurrency

3 Ultra-Safe Dividend Stocks That Have Been Paying Dividends for More Than 100 Years

The past doesn’t predict the future. But if a company has been paying dividends for a long time, that can give investors confidence in its ability to continue doing so. It demonstrates that the company can weather a lot of adversity and innovate and launch new products to meet changing demand. Those are key characteristics investors will want to see when considering long-term investments.

Three stocks that have not only been around for a century but have also been paying dividends for that long are Coca-Cola (NYSE: KO), Eli Lilly (NYSE: LLY), and Abbott Laboratories (NYSE: ABT). Here’s why these can be some of the safest stocks you can add to your portfolio today.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Coca-Cola has an iconic brand that’s known all around the world. It’s a top Warren Buffett holding, and a big reason for that is its strong brand power. Its products are found in millions of households, across hundreds of countries. While the company is known for its Coke products, it has evolved over the years and now has more than 200 brands, branching out beyond just soft drinks and into coffee, tea, and water.

The company has created no-sugar products to meet changing customer demand, and it has also expanded via acquisitions. Coca-Cola may not be the growth machine it once was, but it’s still a reliable business to invest in. It has generated $10.4 billion in profit over the past four quarters on sales of $46.4 billion, for a profit margin of 22%.

Coca-Cola has paid a dividend going back to 1893. Today, it’s part of an exclusive club of Dividend Kings, which have increased their dividend payments for more than 50 straight years. Its dividend yields 3%, and if your priority is to generate a safe and recurring dividend, Coca-Cola may be an ideal stock to put into your portfolio right now.

Eli Lilly is a hot growth stock to buy, as investors are bullish on its prospects in the weight loss market. The company has an incredibly promising product in tirzepatide, which regulators have approved for diabetes treatment (Mounjaro) and weight loss (Zepbound). At its peak, tirzepatide may be the best-selling drug ever, with some analysts projecting that its annual revenue will eventually top more than $50 billion.

To put into perspective just how massive that is, consider that Eli Lilly generated $34 billion in sales last year — from all of its products. With so much excitement surrounding Eli Lilly’s potential, it’s little wonder that the healthcare stock has risen by more than 200% in just the past three years.

-

Science & Environment2 months ago

Science & Environment2 months agoHow to unsnarl a tangle of threads, according to physics

-

Technology2 months ago

Technology2 months agoWould-be reality TV contestants ‘not looking real’

-

Technology2 months ago

Technology2 months agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment2 months ago

Science & Environment2 months agoHyperelastic gel is one of the stretchiest materials known to science

-

Science & Environment2 months ago

Science & Environment2 months agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment2 months ago

Science & Environment2 months ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment2 months ago

Science & Environment2 months agoPhysicists have worked out how to melt any material

-

MMA1 month ago

MMA1 month ago‘Dirt decision’: Conor McGregor, pros react to Jose Aldo’s razor-thin loss at UFC 307

-

News1 month ago

News1 month ago‘Blacks for Trump’ and Pennsylvania progressives play for undecided voters

-

News1 month ago

News1 month agoWoman who died of cancer ‘was misdiagnosed on phone call with GP’

-

Money1 month ago

Money1 month agoWetherspoons issues update on closures – see the full list of five still at risk and 26 gone for good

-

Sport1 month ago

Sport1 month agoAaron Ramsdale: Southampton goalkeeper left Arsenal for more game time

-

Football1 month ago

Football1 month agoRangers & Celtic ready for first SWPL derby showdown

-

Sport1 month ago

Sport1 month ago2024 ICC Women’s T20 World Cup: Pakistan beat Sri Lanka

-

Science & Environment2 months ago

Science & Environment2 months agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Business1 month ago

how UniCredit built its Commerzbank stake

-

Science & Environment2 months ago

Science & Environment2 months agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment2 months ago

Science & Environment2 months agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment2 months ago

Science & Environment2 months agoLiquid crystals could improve quantum communication devices

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum forces used to automatically assemble tiny device

-

Science & Environment2 months ago

Science & Environment2 months agoLaser helps turn an electron into a coil of mass and charge

-

Technology2 months ago

Technology2 months agoUkraine is using AI to manage the removal of Russian landmines

-

Business1 month ago

Top shale boss says US ‘unusually vulnerable’ to Middle East oil shock

-

Technology1 month ago

Technology1 month agoSamsung Passkeys will work with Samsung’s smart home devices

-

MMA1 month ago

MMA1 month agoPereira vs. Rountree prediction: Champ chases legend status

-

News1 month ago

News1 month agoNavigating the News Void: Opportunities for Revitalization

-

Science & Environment2 months ago

Science & Environment2 months agoQuantum ‘supersolid’ matter stirred using magnets

-

Technology2 months ago

Technology2 months agoRussia is building ground-based kamikaze robots out of old hoverboards

-

Science & Environment2 months ago

Science & Environment2 months agoWhy this is a golden age for life to thrive across the universe

-

News1 month ago

News1 month agoMassive blasts in Beirut after renewed Israeli air strikes

-

Technology1 month ago

Technology1 month agoGmail gets redesigned summary cards with more data & features

-

News1 month ago

News1 month agoCornell is about to deport a student over Palestine activism

-

Technology1 month ago

Technology1 month agoSingleStore’s BryteFlow acquisition targets data integration

-

Technology2 months ago

Technology2 months agoMicrophone made of atom-thick graphene could be used in smartphones

-

Sport1 month ago

Sport1 month agoBoxing: World champion Nick Ball set for Liverpool homecoming against Ronny Rios

-

Sport1 month ago

Sport1 month agoShanghai Masters: Jannik Sinner and Carlos Alcaraz win openers

-

Entertainment1 month ago

Entertainment1 month agoBruce Springsteen endorses Harris, calls Trump “most dangerous candidate for president in my lifetime”

-

Money1 month ago

Money1 month agoTiny clue on edge of £1 coin that makes it worth 2500 times its face value – do you have one lurking in your change?

-

Technology1 month ago

Technology1 month agoEpic Games CEO Tim Sweeney renews blast at ‘gatekeeper’ platform owners

-

Business1 month ago

Business1 month agoWater companies ‘failing to address customers’ concerns’

-

MMA1 month ago

MMA1 month agoPennington vs. Peña pick: Can ex-champ recapture title?

-

Technology2 months ago

Technology2 months agoMeta has a major opportunity to win the AI hardware race

-

Science & Environment2 months ago

Science & Environment2 months agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

MMA1 month ago

MMA1 month agoDana White’s Contender Series 74 recap, analysis, winner grades

-

MMA1 month ago

MMA1 month agoKayla Harrison gets involved in nasty war of words with Julianna Pena and Ketlen Vieira

-

Sport1 month ago

Sport1 month agoAmerica’s Cup: Great Britain qualify for first time since 1964

-

Technology1 month ago

Technology1 month agoMicrosoft just dropped Drasi, and it could change how we handle big data

-

Technology1 month ago

Technology1 month agoLG C4 OLED smart TVs hit record-low prices ahead of Prime Day

-

Sport1 month ago

Sport1 month agoWXV1: Canada 21-8 Ireland – Hosts make it two wins from two

-

Science & Environment2 months ago

Science & Environment2 months agoNuclear fusion experiment overcomes two key operating hurdles

-

News2 months ago

News2 months ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

Technology2 months ago

Technology2 months agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

News1 month ago

News1 month agoHarry vs Sun publisher: ‘Two obdurate but well-resourced armies’

-

MMA1 month ago

MMA1 month ago‘Uncrowned queen’ Kayla Harrison tastes blood, wants UFC title run

-

Travel1 month ago

World of Hyatt welcomes iconic lifestyle brand in latest partnership

-

Business1 month ago

It feels nothing like ‘fine dining’, but Copenhagen’s Kadeau is a true gift

-

Football1 month ago

Football1 month ago'Rangers outclassed and outplayed as Hearts stop rot'

-

Sport1 month ago

Sport1 month agoNew Zealand v England in WXV: Black Ferns not ‘invincible’ before game

-

Science & Environment2 months ago

Science & Environment2 months agoNerve fibres in the brain could generate quantum entanglement

-

Technology2 months ago

Technology2 months agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Sport1 month ago

Sport1 month agoURC: Munster 23-0 Ospreys – hosts enjoy second win of season

-

News2 months ago

News2 months agoRwanda restricts funeral sizes following outbreak

-

Technology1 month ago

Technology1 month agoCheck, Remote, and Gusto discuss the future of work at Disrupt 2024

-

TV1 month ago

TV1 month agoসারাদেশে দিনব্যাপী বৃষ্টির পূর্বাভাস; সমুদ্রবন্দরে ৩ নম্বর সংকেত | Weather Today | Jamuna TV

-

Business1 month ago

Italy seeks to raise more windfall taxes from companies

-

Business1 month ago

The search for Japan’s ‘lost’ art

-

Sport1 month ago

Sport1 month agoPremiership Women’s Rugby: Exeter Chiefs boss unhappy with WXV clash

-

Politics1 month ago

‘The night of the living dead’: denial-fuelled Tory conference ends without direction | Conservative conference

-

Technology1 month ago

Technology1 month agoNintendo’s latest hardware is not the Switch 2

-

Science & Environment2 months ago

Science & Environment2 months agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

MMA1 month ago

MMA1 month agoStephen Thompson expects Joaquin Buckley to wrestle him at UFC 307

-

Business1 month ago

Business1 month agoWhen to tip and when not to tip

-

News1 month ago

News1 month agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

MMA1 month ago

MMA1 month agoHow to watch Salt Lake City title fights, lineup, odds, more

-

Sport1 month ago

Sport1 month agoHow India became a Test cricket powerhouse

-

Sport1 month ago

Sport1 month agoSnooker star Shaun Murphy now hits out at Kyren Wilson after war of words with Mark Allen

-

Sport1 month ago

Sport1 month agoFans say ‘Moyes is joking, right?’ after his bizarre interview about under-fire Man Utd manager Erik ten Hag goes viral

-

News1 month ago

News1 month agoCrisis in Congo and Capsizing Boats Mediterranean

-

Money1 month ago

Money1 month agoThe four errors that can stop you getting £300 winter fuel payment as 880,000 miss out – how to avoid them

-

TV1 month ago

TV1 month agoTV Patrol Express September 26, 2024

-

Science & Environment2 months ago

Science & Environment2 months agoA slight curve helps rocks make the biggest splash

-

News2 months ago

News2 months ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment2 months ago

Science & Environment2 months agoHow to wrap your mind around the real multiverse

-

News1 month ago

News1 month agoUK forces involved in response to Iran attacks on Israel

-

Football1 month ago

Football1 month agoFifa to investigate alleged rule breaches by Israel Football Association

-

Football1 month ago

Football1 month agoWhy does Prince William support Aston Villa?

-

News1 month ago

News1 month ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

Technology1 month ago

Technology1 month agoSamsung Galaxy Tab S10 won’t get monthly security updates

-

Technology1 month ago

Technology1 month agoMusk faces SEC questions over X takeover

-

Sport1 month ago

Sport1 month agoChina Open: Carlos Alcaraz recovers to beat Jannik Sinner in dramatic final

-

Sport1 month ago

Sport1 month agoBukayo Saka left looking ‘so helpless’ in bizarre moment Conor McGregor tries UFC moves on Arsenal star

-

Sport1 month ago

Sport1 month agoPhil Jones: ‘I had to strip everything back – now management is my focus’

-

Sport4 weeks ago

Sport4 weeks agoSunderland boss Regis Le Bris provides Jordan Henderson transfer update 13 years after £20m departure to Liverpool

-

TV1 month ago

TV1 month agoএই ডিভাইস দিয়ে দেখা যায় পৃথিবীর সব টিভি চ্যানেল! | Smart Tv Box | Independent TV

-

Business1 month ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Technology1 month ago

Technology1 month agoJ.B. Hunt and UP.Labs launch venture lab to build logistics startups

-

Money1 month ago

Money1 month agoDWP reveals exact date that cold weather payments will start this winter – can you get free cash for your energy bills?

-

Sport1 month ago

Sport1 month agoSturm Graz: How Austrians ended Red Bull’s title dominance

-

Money1 month ago

Money1 month agoFive benefits changes the Government could make next month in its Autumn Budget – from PIP to fraud crackdown

-

MMA1 month ago

MMA1 month ago‘I was fighting on automatic pilot’ at UFC 306

You must be logged in to post a comment Login