Crypto World

ECB Flags Stablecoins as a Growing Risk to Bank Lending

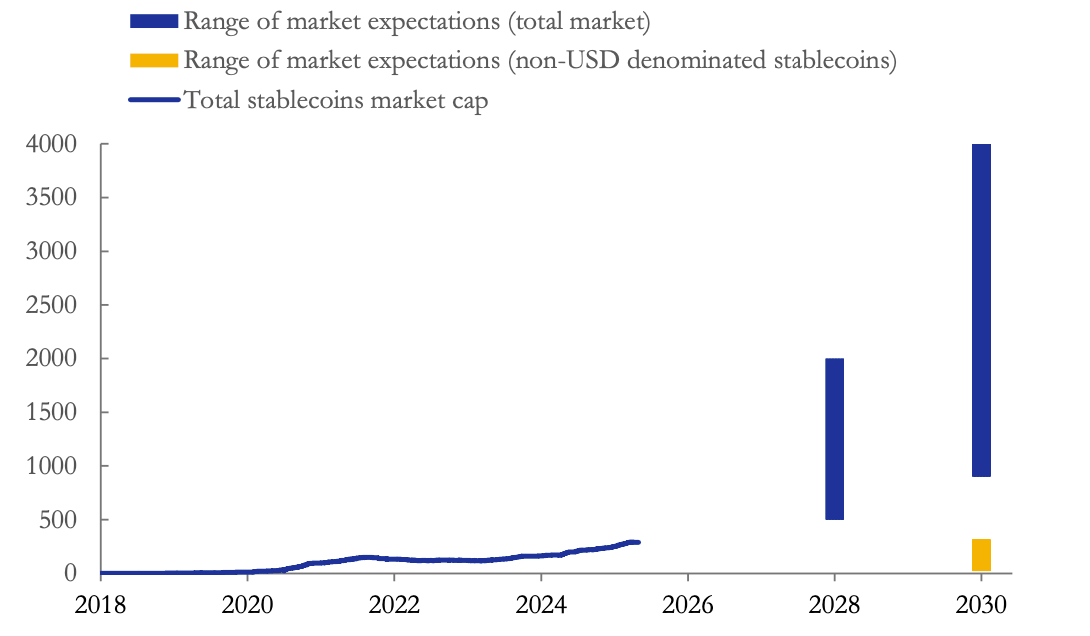

The European Central Bank said rising stablecoin use can pull money out of bank deposits and weaken the way monetary policy flows through to lending, according to a new ECB working paper published Tuesday.

Growing adoption of stablecoins, which are digital assets often pegged to currencies such as the US dollar or euro, is expected to draw funds away from traditional bank deposits, the ECB said in its latest working paper series, “Stablecoins and Monetary Policy Transmission,” released Tuesday.

“Our analysis shows that rising interest in stablecoins is linked to a measurable decline in retail bank deposits and a reduction in lending to firms,” the report said, noting that stablecoins can reduce the amount of credit banks provide to the real economy.

The ECB noted that the effects are nonlinear and vary depending on the scale of stablecoin adoption, their design features, and how they are regulated.

The report is part of the ECB’s ongoing efforts to monitor stablecoins, whose market capitalization has more than doubled over the past three years to $312 billion and is projected to reach $2 trillion by 2028.

Stablecoin impact: Banks, monetary policy and why currency matters

In assessing the impact of growing stablecoin adoption on banks, the ECB highlighted a deposit-substitution effect, where households and firms move funds from retail bank deposits to digital assets.

“Banks rely heavily on deposits as a stable and low-cost source of funding to support lending to households and businesses,” the study said.

“When deposits decline, banks may be forced to rely more on wholesale or market-based funding, which is typically more expensive and less stable,” it added.

The report also finds that stablecoins can change how policy interest rates affect bank funding costs and lending, with impacts varying by adoption scale, design and regulation.

“We find that stablecoin adoption interferes with multiple monetary policy transmission channels, potentially weakening the predictability of policy actions,” the ECB said.

Related: ECB targets 2027 digital euro pilot as provider selection begins in Q1 2026

The central bank warned that foreign-currency stablecoins could further weaken the connection between domestic monetary policy and bank lending, with risks amplified when the market is dominated by non-euro-denominated tokens.

The study reiterated that US dollar-backed stablecoins make up the vast majority of the stablecoin market. Data from CoinGecko shows these dollar-pegged tokens are valued at $301 billion, representing 97% of total stablecoin market capitalization at publishing time.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

AAVE plunges 10%, leading index lower

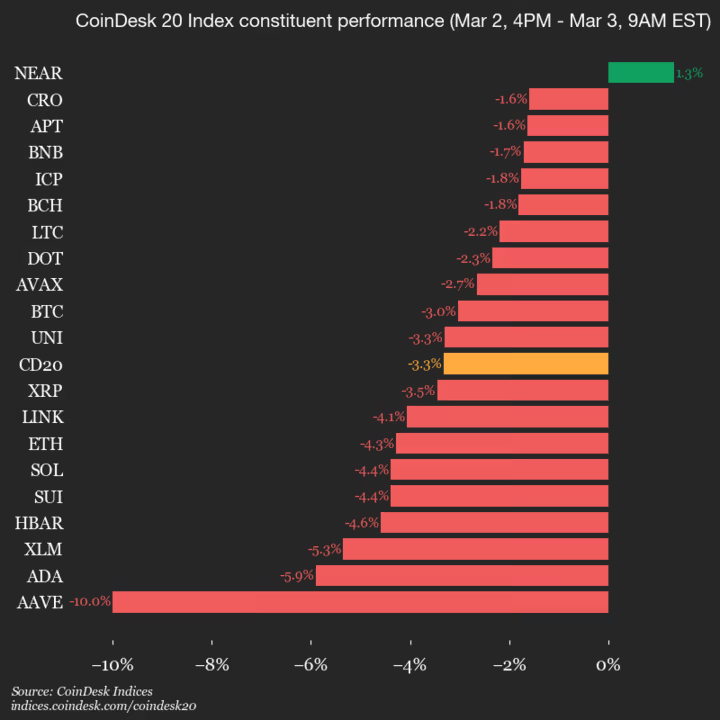

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1924.9, down 3.3% (-66.23) since 4 p.m. ET on Monday.

One of the 20 assets are trading higher.

Leaders: NEAR (+1.3%) and CRO (-1.6%).

Laggards: AAVE (-10.0%) and ADA (-5.9%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Justin Sun’s TRON stock is dying

Justin Sun, the creator and face of TRON, went public with a company called TRON Inc. last year. Since then, its price has tumbled from a high of $12.80 to a recent close of $1.36 — a fall of nearly 90% in eight months.

But what exactly does TRON Inc. do and why is it fairing so poorly?

A toy company with a TRON treasury

TRON Inc. “specialize[s] in creating imaginative, high-quality toys and products that celebrate the world’s most beloved characters.”

These beloved characters include The Smurfs, Zoonicorns, and ICEE. However, TRON doesn’t control the intellectual property for these brands; instead it produces related merchandise, including, but not limited to, plushies, backpacks, and dinnerware.

Read more: ‘Biggest NFT trading platform on TRON,’ AINFT, has $6 in volume

For some reason, it also purchased the rights to the film The Kid, starring Ethan Hawke, Chris Pratt, and Vincent D’Onofrio (RottenTomatoes: 43%, IMDb: 5.9/10).

Importantly, however, that’s not everything. There’s also TRX.

The company calls the TRX token “an attractive digital asset which can create long-term value for… shareholders.”

It claims, “Our TRX token strategy generally involves from time to time… (i) issuing debt or equity securities or engaging in other capital raising transactions with the objective of using the proceeds to purchase TRK tokens, and (ii) acquiring TRX tokens with our liquid assets that exceed working capital requirements.”

What TRON Inc. is engaging in is akin to the Strategy Bitcoin Treasury concept, but with fewer guardrails, a very small product line outside of the TRX token treasury, and a just as significant dependence on unrealized gains.

A family company failing miserably

While TRON Inc. is now basically a penny stock, barely sitting above the $1/share price, Sun has built up a strange board of directors.

This board includes his father Weike Sun, who’s being paid in private investment in public equity (PIPE) offerings and warrants, and a 27-year-old blockchain investor and Chinese national named Zi Yang, who also works for Tronscan (the barely functional explorer that’s supposed to allow TRX users to view wallet addresses and transactions on the blockchain).

The executive leadership and board of directors have collectively been able to accumulate millions of shares of TRON Inc. through these PIPE offerings and warrants (Weike Sun isn’t listed as an insider).

Left to right: TRON Inc. CEO Douglas McKinnon, TRON founder Justin Sun, and Sun’s father Weike Sun on July 24, 2025.

No real path to profitability

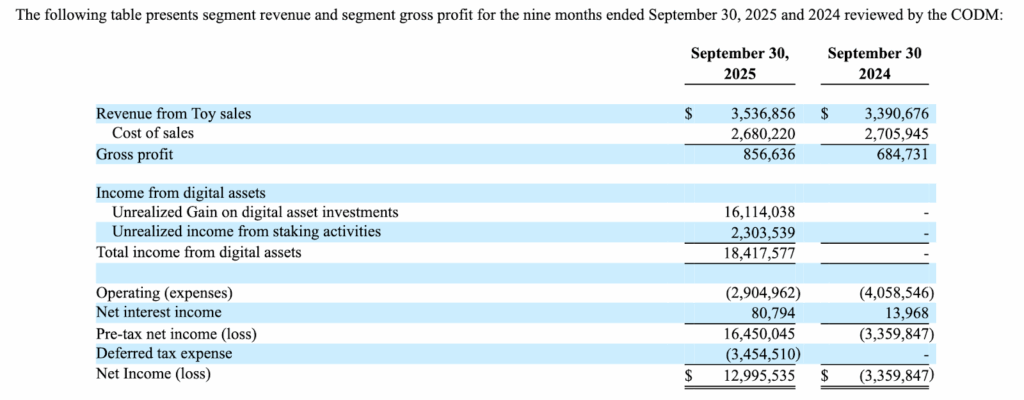

Outside issuing debt to fund more TRX purchases, TRON Inc.’s 10-Q from September points to a company that’s completely unprofitable, with no path toward a way of making money.

Its merchandising business, when coupled with operating expenses and the cost of sales, is a net loser for the company, and without the unrealized gains from TRX tokens and the unrealized gains from staking TRX tokens, it bled over $5 million last year.

Read more: CHART: Strategy and TRON Inc. down bad compared to bitcoin this year

How TRON Inc. is able to profit from the unrealized gains of its crypto treasury is unclear. However, what’s more understandable is that it’s essentially become a vehicle for Justin Sun to purchase hundreds of millions of TRX tokens to prop up the price of his personal cryptocurrency.

Since Sun rang the opening bell on Nasdaq, TRON Inc. is down ~90%, but TRX is down only 9%, in stark contrast to bitcoin which is down more than 43% over the same period.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Visa and Stripe’s Bridge Expand Global Stablecoin Card Program

Global payment giant Visa is expanding its stablecoin card partnership with Stripe-owned Bridge, expanding the rollout of stablecoin-linked Visa cards worldwide and testing onchain settlement.

Visa and Bridge are expanding their joint card program to 18 countries, with plans to reach more than 100 across Europe, Asia-Pacific, Africa and the Middle East by the end of the year, according to a Tuesday announcement.

The expansion follows the program’s initial launch in April 2025, which first supported markets in Latin America, including Argentina, Colombia, Ecuador, Mexico, Peru and Chile.

In addition to the expansion, the companies are testing stablecoin settlement through Visa’s pilot program, enabling issuers and acquirers to settle transactions using stablecoins rather than fiat.

The move highlights the ongoing stablecoin race in the payments industry, with Mastercard recently enabling stablecoin card spending in the US via the self-custodial crypto wallet MetaMask.

Onchain support enabled through Bridge’s partnership with Lead Bank

When the card program launched in 2025, transactions were processed by Bridge, deducting funds from the customer’s stablecoin balance and converting them into fiat, allowing merchants to receive payment in local currency like any other card transaction.

Under the new collaboration, enabled by independent commercial bank Lead Bank, settlement is now set to occur directly in stablecoins.

“Now, through Bridge’s partnership with Lead Bank, these card transactions can be settled onchain with Visa,” the announcement noted.

“Visa is committed to meeting businesses where they operate, and increasingly, that’s onchain,” Visa’s head of crypto, Cuy Sheffield said. “Expanding our work with Bridge gives us one more way to bring the speed, transparency and programmability of stablecoins directly into the settlement process,” he added.

Related: Stripe considers acquiring some or all of PayPal: Report

Additionally, Visa is evaluating potential support for Bridge-issued assets, or stablecoins created and managed using Bridge’s infrastructure platform. Unlike major stablecoins such as Tether’s USDt (USDT) or Circle’s USDC (USDC), Bridge-issued stablecoins are created programmatically by businesses rather than a third-party issuer.

“This expansion of our work with Visa will enable businesses launching their own custom stablecoins to use them seamlessly within their card programs,” Bridge co-founder and CEO Zach Abrams said.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

Ripple (XRP) News Today: March 3rd

Ripple continues to draw attention due to important developments concerning its entire ecosystem.

The company’s native token, XRP, has posted a minor recovery over the past week, but some indicators suggest a renewed downfall could be knocking on the door.

Ripple & Hidden Road

The firm made the headlines in April last year when it announced it would purchase the brokerage platform Hidden Road for a whopping $1.25 billion. The official conclusion of the deal occurred in October 2025.

Some industry participants described the acquisition as a “game changer” because it gives Ripple direct control over a prime brokerage that processes over $3 trillion in volume every year. This makes it much easier for banks, hedge funds, and other large players to use XRP in settlements, thereby increasing its institutional adoption.

A recent DTCC notice revealed that Hidden Road has officially gone live on the National Securities Clearing Corporation (NSCC) on March 2nd. The X account BankXRP shared the news, arguing:

“Ripple Prime’s role in bridging TradFi and DeFi will likely move post-trade volume to the XRPL.”

David Schwartz – one of the original architects of the XRP Ledger and CTO Emeritus at Ripple – also touched upon the matter, saying that the development “seems important.”

RLUSD’s Progress

Ripple’s stablecoin, dubbed RLUSD, officially saw the light of day in late 2024 and has been gradually advancing ever since. The product, pegged 1:1 to the US dollar, received backing from numerous exchanges and renowned banking institutions, such as the oldest American bank, BNY Mellon.

RLUSD’s market cap now nears $1.6 billion, with X user SMQKE recently noting that the stablecoin has grown “much faster” than Circle’s USDC in its first year.

Several hours ago, another 69 million tokens were minted at the RLUSD Treasury, with Vet emphasizing that this is the largest single mint to date.

The ETFs

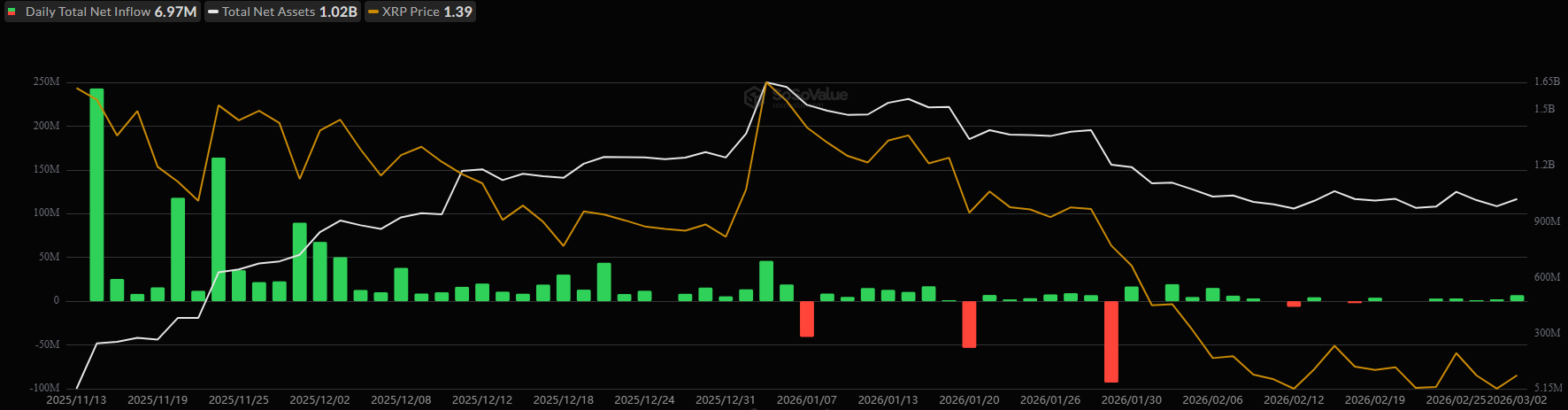

In November last year, Canary Capital became the first company to launch a spot XRP ETF in the US, which has 100% exposure to the token. The renowned names that followed suit shortly after include Bitwise, Franklin Templeton, 21Shares, and Grayscale.

Initially, the investment vehicles were a major success, with millions of dollars pouring in during the first weeks, generating a cumulative net inflow of roughly $1.25 billion to date. Lately, though, that momentum has noticeably faded.

XRP Price Outlook

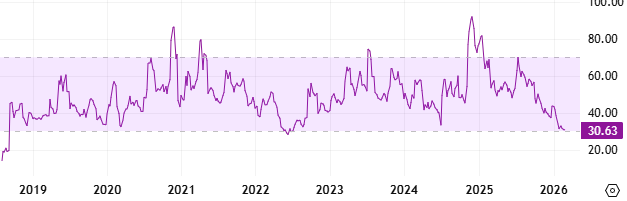

As of this writing, Ripple’s native cryptocurrency trades around $1.35, representing a minor 1.5% increase on a weekly scale. However, the market’s overall bearish condition, as well as certain indicators, hint that a new pullback could be on the way.

For example, almost 500 million XRP (worth around $650 million) have been transferred to Binance following the escalating military conflict between the USA and Iran. This is considered a bearish factor as it may suggest that investors are preparing to cash out.

On the other hand, XRP’s Relative Strength Index (RSI) has fallen to 30 on a weekly scale. The development indicates that the asset is oversold and could be due for a short-term resurgence. The metric runs from 0 to 100, where anything above 70 is seen as bearish territory.

The post Ripple (XRP) News Today: March 3rd appeared first on CryptoPotato.

Crypto World

Ethereum’s First Sell Signal Faces $2.8 Billion Demand Zone

Ethereum has recently seen a struggle in its price recovery, primarily due to growing uncertainty in the market. After multiple failed attempts to rally, Ethereum’s price is currently facing pressure from both selling activity and a crucial demand zone.

While the demand zone, hovering around $1,880, has provided support, it is also preventing any immediate price reversal.

Ethereum Selling Is Necessary

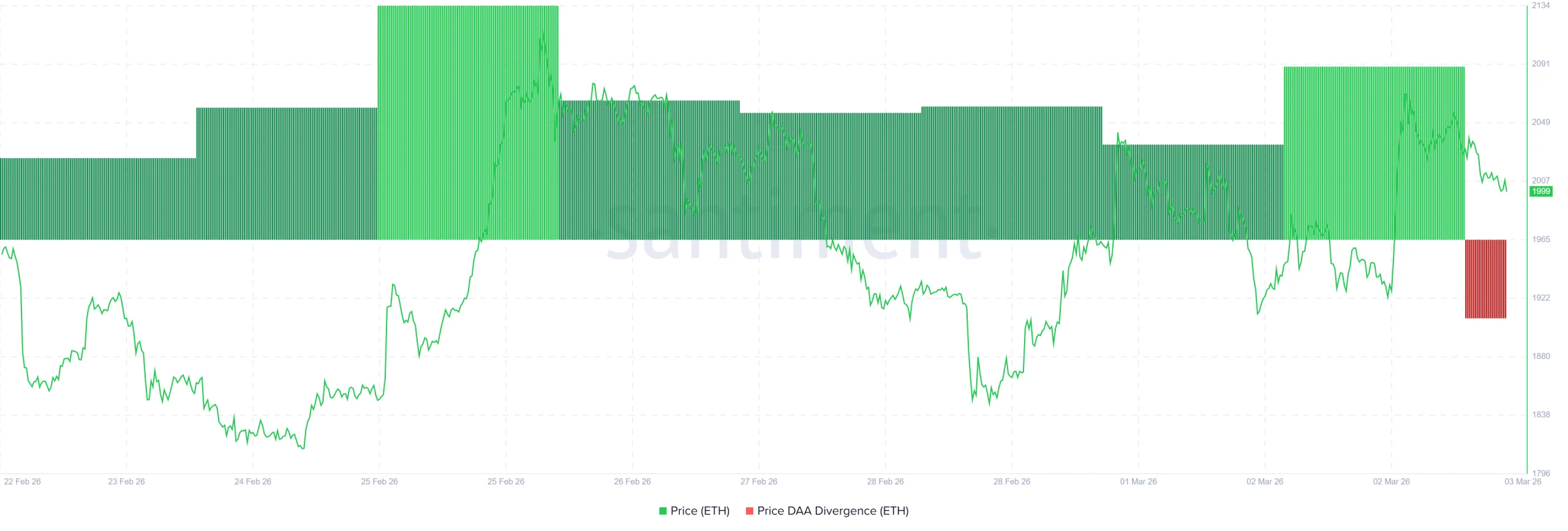

For the first time in over two months, Ethereum is flashing a key sell signal as its Price DAA Divergence metric shows a concerning trend. The metric compares daily active addresses (DAA) against Ethereum’s price, providing insights into investor sentiment.

As DAA begins to fall alongside Ethereum’s price, it signals that the network is experiencing a decrease in activity, suggesting rising selling pressure. This trend is reflected in the appearance of a red bar, which indicates mounting bearish sentiment.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The drop in DAA suggests that fewer users are engaging with the network, which typically leads to a weakening market structure. When both DAA and price decline together, it’s often a sign that Ethereum’s bullish momentum has stalled, and a price dip could be imminent.

Interestingly, while the rising selling pressure around Ethereum might appear negative at first glance, it could be the catalyst for a much-needed price reversal. Ethereum’s MVRV (Market Value to Realized Value) pricing bands are signaling that ETH is nearing a pivotal moment. MVRV below 0.8 has historically indicated that the altcoin is undervalued, suggesting that ETH is due for a rebound.

With Ethereum trading below the Extreme Lows for approximately 5% of trading days, the MVRV signal is often a precursor to a price reversal. However, Ethereum needs more than just market signals—it requires investor confidence to push through. The current selling pressure may be limiting this momentum, but the situation remains fluid. If investors hold onto their positions rather than sell, ETH could soon see a price rebound.

Investors Are Blocking ETH Recovery

The most significant support level Ethereum currently faces is the $1,880 demand zone, formed by ETH holders who have accumulated 1.406 million ETH worth over $2.81 billion. This price range has been a critical level, with price dips to this area being met with a strong bounce back. Ethereum’s price has consistently been supported at this level, demonstrating that investors are reluctant to sell below it.

If Ethereum’s price does fall to this demand zone again, it is likely to be met with buying pressure. This would prevent further downside movement. However, should selling activity intensify and Ethereum slip below $1,880, this would trigger a sharper decline.

Such a drop would likely trigger the reversal Ethereum needs, but it would also leave the cryptocurrency vulnerable to even lower levels. The balance at this demand zone is crucial in determining Ethereum’s immediate future.

ETH Price Has Some Resistance Ahead

Ethereum is currently trading at $1,998, facing resistance along a downtrend line. This bearish momentum could suppress Ethereum’s price in the short term, making it difficult to initiate a rally. As a result, the price is likely to remain subdued, limiting the possibility of an immediate recovery.

With the ongoing bearish factors, there is a chance that Ethereum could drop toward the $1,902 support. A break below this level could see the price falling further, potentially reaching the $1,816 mark or lower. Such a move would be necessary to trigger the reversal that Ethereum needs to regain its upward momentum.

Alternatively, if investor sentiment improves and macroeconomic conditions turn favorable, Ethereum could push past the current downtrend line. A move above this resistance would bring Ethereum closer to the $2,165 mark. This would invalidate the current bearish outlook and open the door for potential price rallies.

Crypto World

Ondo Finance’s tokenized stock on Binance win Abu Dhabi regulatory approval

Binance’s renewed push into tokenized stocks gained regulatory backing Tuesday as the Abu Dhabi Global Market (ADGM) approved trading of Ondo Finance’s tokenized equities on the exchange’s regulated platform.

The Financial Services Regulatory Authority of ADGM cleared Ondo Global Markets’ tokenized stocks and ETFs to trade on Binance’s FSRA-regulated Multilateral Trading Facility, according to a press release shared with CoinDesk. The listing includes tokenized versions of Amazon, Alphabet, Apple, Circle, Meta, Microsoft, Nvidia, Tesla and the Invesco QQQ ETF. The products are available for non-U.S. users.

This is the first time the ADGM approved tokenized securities trading under the its regulatory framework, allowing UAE-based financial institutions, intermediaries, and counterparties deal in token versions of equities, Ondo said.

“Through offering Ondo tokenized stocks for trading on Binance, we are expanding access to hundreds of millions of investors,” Ian de Bode, president of Ondo Finance, said in a statement.

The approval gives Binance a regulated venue to trade tokenized equities, nearly five years after it shut down a similar service following scrutiny from U.K. and German regulators. The move comes after Binance listed Ondo’s tokenized equities on its Alpha platform, dedicated to riskier, early-stage projects.

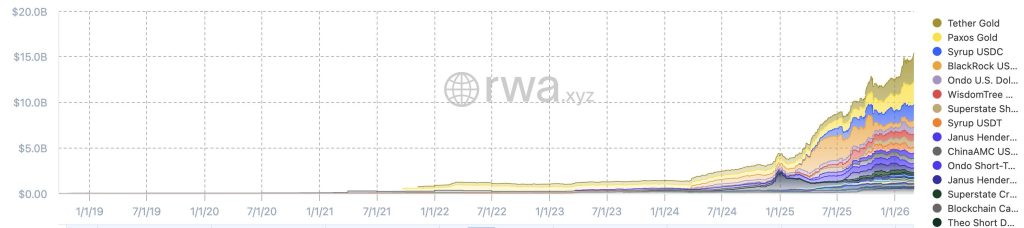

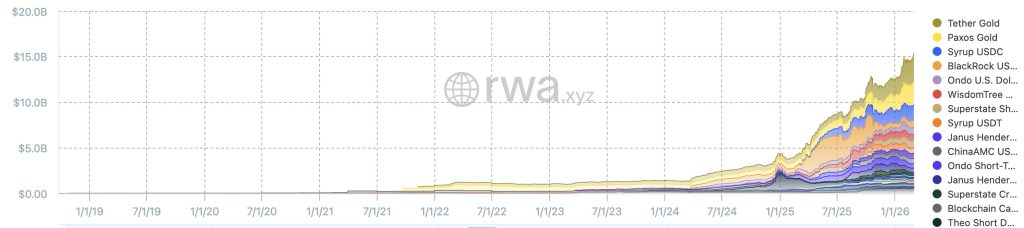

Tokenized stocks have drawn interest from crypto exchanges such as Kraken, brokerages like Robinhood and traditional market operators like Nasdaq and the New York Stock Exchange. The market’s total value has surpassed $1 billion, RWA.xyz data shows.

Supporters argue that putting equities on blockchain rails can widen investor access and allow the assets to move across trading and lending platforms more easily, linking stock markets with decentralized finance.

Ondo structures its products as equity-linked notes tied to the underlying shares. The firm says it has processed more than $11 billion in cumulative trading volume with over $600 million in total value locked since launching its offering less than six months ago.

Last year, Ondo secured approval for its base securities prospectus in the European Union, allowing public distribution across the European Union.

Crypto World

Best Buy (BBY) Stock Jumps 12% After Quarterly Earnings Exceed Projections

Key Takeaways

- Best Buy (BBY) exceeded Q4 adjusted EPS projections at $2.61 compared to analyst expectations of $2.47, driving shares up approximately 12% during premarket hours.

- Quarterly revenue totaled $13.81 billion, representing a 1% year-over-year decline and falling short of the $13.87 billion consensus estimate.

- Comparable store sales decreased 0.8%, contrasting with analyst predictions of a 0.1% increase.

- Annual guidance disappointed: EPS range of $6.30–$6.60 versus analyst expectations of $6.66, with comparable sales projected between -1% and +1% against estimates of +1.63%.

- The electronics retailer increased its quarterly dividend payout by one cent to $0.96 per share, delivering the strongest yield within the Consumer Discretionary Select Sector SPDR ETF.

Best Buy (BBY) unveiled its fiscal fourth-quarter financial performance on Tuesday, delivering earnings that exceeded Wall Street predictions — though top-line results and forward guidance disappointed investors.

Shares surged as much as 11.8% during premarket hours following the earnings release, bouncing back from an 11-month trough reached just one trading session earlier.

BBY concluded Monday’s session with a 0.6% decline to $61.59, marking the end of a challenging four-month period that witnessed a nearly 25% depreciation. Entering Tuesday’s announcement, market sentiment was already subdued.

Adjusted profit per share reached $2.61, improving from $2.58 in the year-ago period and comfortably surpassing analyst projections of $2.46–$2.47. This positive surprise provided the catalyst shares needed.

Top-line results for the quarter concluding January 31 totaled $13.81 billion, reflecting a 1% year-over-year contraction and marginally trailing the consensus projection of $13.87 billion.

Comparable store sales contracted 0.8%, falling short of predictions calling for a 0.1% expansion. While disappointing, this decline remains manageable within the current retail environment.

Chief Executive Corie Barry emphasized that overall market positioning remained stable throughout the holiday quarter, notwithstanding softer consumer appetite across the electronics retail sector.

Cost of goods sold totaled $10.93 billion, down from $11.03 billion in the prior-year period — indicating effective cost management strategies.

Barry additionally highlighted that comparable sales for the complete fiscal year returned to positive territory for the first time in three years, and that Best Buy’s advertising division delivered solid performance.

Annual Projections Fall Short of Expectations

The retailer projected full-year revenue between $41.2 billion and $42.1 billion, trailing the consensus estimate of $42.2 billion. Comparable sales are anticipated to range from negative 1% to positive 1%, underperforming the analyst projection of 1.4% growth.

Adjusted EPS guidance spanning $6.30–$6.60 similarly disappointed relative to the $6.63–$6.66 consensus band.

CFRA Research analyst Ana Garcia characterized the quarter as evidence of “operational resilience,” while acknowledging “mounting headwinds” approaching fiscal 2027.

Evercore ISI’s Greg Melich adopted a more balanced perspective, noting the guidance “signals modest growth with overall demand normalization — which was better than feared.”

Wedbush’s Matthew McCartney had indicated prior to the release that diminished expectations were already reflected in valuations, with limited catalysts visible to reignite investor enthusiasm. The earnings surprise provided markets with a positive data point.

Dividend Payout Receives Incremental Increase

Best Buy elevated its quarterly dividend distribution by one cent to $0.96 per share. Using Monday’s closing price as a reference, this translates to an annualized yield of 6.23%.

This represents the most attractive dividend yield among all constituents of the Consumer Discretionary Select Sector SPDR ETF — and exceeds five times the implied yield on the S&P 500 of 1.16%.

Management referenced a “mixed macro environment” as a contributing factor to its conservative annual outlook, with consumers facing pressure from tariff-driven cost escalations and an unpredictable employment landscape.

BBY has declined 29% over the trailing 12 months through Monday, while the S&P 500 advanced 17.6% during the identical timeframe.

Adjusted Q4 EPS of $2.61 exceeded projections of $2.46, whereas full-year EPS guidance spanning $6.30–$6.60 trailed the $6.63 consensus estimate.

Crypto World

AI-Driven Deflation Could Push Bitcoin To $11 Million By 2036, Strive Says

Technological deflation driven by artificial intelligence could help push Bitcoin above $10 million within a decade by pressuring central banks to keep expanding the money supply, according to a report from Strive strategist Joe Burnett.

Burnett, Strive’s vice president of Bitcoin strategy, said in a report published Monday that faster productivity gains from AI will push down prices across goods and services, squeezing margins and prompting policymakers to respond with sustained monetary expansion. His “base case” calls for Bitcoin (BTC) to reach $11 million in the first quarter of 2036, he wrote.

”My base case for Q1 2036 is $11 million per Bitcoin.”

The forecast rests on a set of aggressive assumptions, including that Bitcoin would grow to about 12% of the value of global financial assets and that global wealth would compound at 7% annually through 2036. With Bitcoin currently accounting for about 0.2% of all financial assets, this would involve an over 176-fold increase in Bitcoin’s market capitalization during the next decade to hit $230 trillion.

The forecast would imply that Bitcoin becomes the dominant global reserve asset along with structurally loose monetary policy over the next decade, Nic Puckrin, co-founder and lead market analyst of educational platform Coin Bureau, told Cointelegraph.

”The forecast implies Bitcoin would become around 10 times as large as the current US M2 money supply, nearly four times as large as the US equity market today, and nearly double current global GDP.”

The prediction would also imply a compound annual growth rate (CAGR) of around 53% per annum, which is not unprecedented considering Bitcoin’s average 60% CAGR between 2015 and 2024, but a slowdown may be expected due to its larger market capitalization, added Puckrin.

AI deflation engine to lead to structural monetary expansion

Burnett’s thesis centers on what he described as an “AI deflation engine,” arguing that AI-driven automation and cost reductions could create persistent deflationary pressure.

In a debt-based fiat system, sustained deflation can strain credit markets because wages and asset prices may fall while debt obligations remain fixed in nominal terms, he wrote, potentially pushing central banks and fiscal authorities to add liquidity to avoid a deflationary spiral.

Related: Bitcoin manipulation claims face pushback as ETFs snap 5-week outflow run: Finance Redefined

”Under a debt-based fiat framework, persistent deflation destabilizes credit markets because wages and asset prices decline while mortgages, corporate loans, and sovereign debt remain fixed in nominal terms,” Burnett said.

”As AI drives real-economy deflation, central banks and fiscal authorities expand liquidity to prevent a deflationary spiral.”

Burnett said this will lead to a persistent increase in money relative to the supply of scarce assets.

Related: Solo Bitcoin miner bags over $200K block reward using rented hashrate

Emergence of digital credit set to bolster Bitcoin demand

The report also points to what Burnett calls the emergence of “digital credit” models promoted by companies including Strategy, the largest corporate Bitcoin holder.

Digital credit provides US dollar income to investors through publicly traded securities backed by large Bitcoin balance sheets issued by treasury firms as a means to raise capital to acquire more Bitcoin.

Burnett foresees digital credit products creating a ”reflexive loop” between global yield demand and Bitcoin accumulation, marking the ”early stage of a credit system built on verifiably scarce money.”

Still, the $11 million forecast stands well above most bullish scenarios that use shorter time horizons. For instance, ARK Invest predicted a 2030 Bitcoin price target of $1.5 million in the company’s bull case and a $300,000 price target in the bear case, Cointelegraph reported in November 2025.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation — Santiment founder

Crypto World

Ethereum Price Prediction: Whales Drive 7th Red Month While RWA Sector Hits $15B Record

Ethereum is on the verge of something it has never experienced before: a seventh consecutive red month and that is fueling bearish price prediction.

For an asset of this size and history, that kind of streak carries psychological weight.

It is not just about price drifting lower, it is about confidence slowly eroding as each monthly close reinforces the downtrend.

Large holders have played a major role in shaping that pressure. Wallets holding between 100K and 1M ETH have been steadily reducing exposure, using relief rallies to distribute rather than accumulate.

That persistent supply has kept upside attempts muted and sentiment fragile. When whales derisk, the rest of the market tends to tread carefully.

Yet beneath the surface, a very different story is unfolding.

While ETH struggles on the chart, Ethereum’s Real World Asset sector has surged past $15 billion in total value locked. Tokenized Treasuries, gold products like PAXG and XAUT, and institutional vehicles such as BlackRock’s BUIDL fund are expanding rapidly on-chain.

That divergence is what makes this moment so tense. Price action suggests exhaustion and potential capitulation, but network adoption is accelerating.

Ethereum Price Prediction: Can ETH Price Catch Up?

Technically, Ethereum is compressing around the $2,150 zone, which now acts as a decisive structural level. A confirmed weekly break below it would validate a larger bearish formation and expose the $1,320 region as a downside target.

However, repeated defenses of this support leave room for a reversal scenario. If buyers reclaim $2,400 and push through $2,500, the bearish setup weakens significantly and opens the door for a squeeze higher.

Discover: The best new crypto in the world

The post Ethereum Price Prediction: Whales Drive 7th Red Month While RWA Sector Hits $15B Record appeared first on Cryptonews.

Crypto World

U.S. judge dismisses Uniswap scam token class action with prejudice

A federal judge has dismissed a proposed class action lawsuit against Uniswap Labs, CEO Hayden Adams and several venture capital backers, ruling they cannot be held liable for alleged “rug pull” tokens traded on the decentralized exchange’s protocol.

In a ruling issued Monday by the U.S. District Court for the Southern District of New York, Judge Katherine Polk Failla threw out the remaining state law claims in Risley v. Universal Navigation Inc., the Brooklyn-based firm that operates Uniswap. after previously dismissing the plaintiffs’ federal securities claims. The decision effectively ends the case at the district court level.

The ruling is one of the first to specifically address whether developers and investors behind a decentralized protocol can be held liable under existing securities and state laws for tokens created and traded by third parties.

“Due to the Protocol’s decentralized nature, the identities of the Scam Token issuers are basically unknown and unknowable, leaving Plaintiffs with an identifiable injury but no identifiable defendant,” Failla wrote.

“Undaunted, they now sue the Uniswap Defendants and the VC Defendants, hoping that this Court might overlook the fact that the current state of cryptocurrency regulation leaves them without recourse, at least as to the specific claims alleged in this suit,” she added.

Irina Heaver, a UAE-based crypto lawyer, told CoinDesk “the dismissal signals that courts are beginning to engage more seriously with the realities of decentralization.”

By recognizing that a permissionless protocol governed by autonomous smart contracts is not the same as a centralized intermediary exercising control, the court drew an important distinction for DeFi, she explained.

“When code executes automatically and there is no discretionary control, liability cannot simply be reassigned to developers because bad actors misuse the infrastructure,” Heaver said. “The real question now is how this reasoning carries into criminal cases such as Tornado Cash. If decentralization is acknowledged as a structural reality, prosecutors will need to prove intent and control, not merely authorship of code.”

Brian Nistler, Uniswap’s head of policy, celebrated the ruling on X, calling it “another precedent-setting ruling for DeFi.” He highlighted what he described as his “favorite quote” from the case: “It defies logic that a drafter of a smart contract, a computer code, could be held liable … for a third party user’s misuse of the platform.”

The plaintiffs, a group of investors , claimed they lost an undisclosed amount of money after purchasing dozens of tokens on the Uniswap Protocol that they later described as scams. Because the token issuers were unidentified, the investors instead sued Uniswap Labs, the Uniswap Foundation, Adams and venture firms Paradigm, Andreessen Horowitz and Union Square Ventures.

Failla rejected the argument that the defendants could be held responsible simply for providing the infrastructure on which the tokens were issued and traded.

“Plaintiffs’ theories of liability are still predicated on Defendants having ‘facilitated’ the scam trades by providing a marketplace and facilities for bringing together buyers and sellers of Tokens,’” Failla wrote, concluding that the claims failed as a matter of law.

In an earlier dismissal of the federal claims, Failla said it “defies logic” to hold the drafter of a smart contract liable for a third party’s misuse of the platform — language that has been widely cited by decentralized finance advocates.

-

Politics5 days ago

Politics5 days agoITV enters Gaza with IDF amid ongoing genocide

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Iris Top

-

Tech2 days ago

Tech2 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Politics6 hours ago

Politics6 hours agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business7 days ago

Business7 days agoTrue Citrus debuts functional drink mix collection

-

NewsBeat6 days ago

NewsBeat6 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Sports3 days ago

The Vikings Need a Duck

-

NewsBeat3 days ago

NewsBeat3 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Tech7 days ago

Tech7 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat6 days ago

NewsBeat6 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat2 days ago

NewsBeat2 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat3 days ago

NewsBeat3 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat7 days ago

NewsBeat7 days agoPolice latest as search for missing woman enters day nine

-

Entertainment1 day ago

Entertainment1 day agoBaby Gear Guide: Strollers, Car Seats

-

Business5 days ago

Business5 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business5 days ago

Business5 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech4 days ago

Tech4 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics3 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

Crypto World7 days ago

Crypto World7 days agoEntering new markets without increasing payment costs