Crypto World

Visa and Stripe’s Bridge Expand Global Stablecoin Card Program

Global payment giant Visa is expanding its stablecoin card partnership with Stripe-owned Bridge, expanding the rollout of stablecoin-linked Visa cards worldwide and testing onchain settlement.

Visa and Bridge are expanding their joint card program to 18 countries, with plans to reach more than 100 across Europe, Asia-Pacific, Africa and the Middle East by the end of the year, according to a Tuesday announcement.

The expansion follows the program’s initial launch in April 2025, which first supported markets in Latin America, including Argentina, Colombia, Ecuador, Mexico, Peru and Chile.

In addition to the expansion, the companies are testing stablecoin settlement through Visa’s pilot program, enabling issuers and acquirers to settle transactions using stablecoins rather than fiat.

The move highlights the ongoing stablecoin race in the payments industry, with Mastercard recently enabling stablecoin card spending in the US via the self-custodial crypto wallet MetaMask.

Onchain support enabled through Bridge’s partnership with Lead Bank

When the card program launched in 2025, transactions were processed by Bridge, deducting funds from the customer’s stablecoin balance and converting them into fiat, allowing merchants to receive payment in local currency like any other card transaction.

Under the new collaboration, enabled by independent commercial bank Lead Bank, settlement is now set to occur directly in stablecoins.

“Now, through Bridge’s partnership with Lead Bank, these card transactions can be settled onchain with Visa,” the announcement noted.

“Visa is committed to meeting businesses where they operate, and increasingly, that’s onchain,” Visa’s head of crypto, Cuy Sheffield said. “Expanding our work with Bridge gives us one more way to bring the speed, transparency and programmability of stablecoins directly into the settlement process,” he added.

Related: Stripe considers acquiring some or all of PayPal: Report

Additionally, Visa is evaluating potential support for Bridge-issued assets, or stablecoins created and managed using Bridge’s infrastructure platform. Unlike major stablecoins such as Tether’s USDt (USDT) or Circle’s USDC (USDC), Bridge-issued stablecoins are created programmatically by businesses rather than a third-party issuer.

“This expansion of our work with Visa will enable businesses launching their own custom stablecoins to use them seamlessly within their card programs,” Bridge co-founder and CEO Zach Abrams said.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

Visa & Stripe’s Bridge Plan Expands Stablecoin Cards to 100+ Countries

Visa is expanding its stablecoin-linked card program with Bridge, broadening its geographic reach and pushing toward onchain settlement. The latest move lifts the program from its initial Latin American rollout to 18 countries, with a plan to surpass 100 countries across Europe, Asia-Pacific, Africa and the Middle East by year-end. The expansion builds on the program’s April 2025 debut in markets including Argentina, Colombia, Ecuador, Mexico, Peru and Chile, and comes as the two companies test settlement directly in stablecoins through a pilot tied to Visa’s rails and Bridge’s banking partner. The broader industry context features heightened activity around stablecoins in payments, with rival initiatives in the space highlighting a competitive push toward real-time, programmable settlement.

Key takeaways

- Visa and Bridge are extending the stablecoin-linked card program to 18 countries, with a target of more than 100 countries by year-end across Europe, Asia-Pacific, Africa and the Middle East.

- The program’s initial launch in 2025 covered Latin American markets, including Argentina, Colombia, Ecuador, Mexico, Peru and Chile.

- Settlement is moving toward onchain processing, enabled by Bridge’s collaboration with Lead Bank, allowing transactions to be settled in stablecoins instead of fiat.

- Visa is evaluating potential support for Bridge-issued assets, which are created programmatically by businesses rather than by a traditional issuer.

- The move comes amid broader payments-industry activity around stablecoins, including Mastercard’s recent stablecoin card enablement with MetaMask in the United States.

Tickers mentioned: $USDT, $USDC

Market context: The expansion aligns with a wider shift toward crypto-enabled payments and onchain settlement rails, as major incumbents test how tokens can streamline merchant settlements and reduce counterparty risk in everyday purchases.

Market context: Linked to broader USDt and USDC usage in payments, the push also sits against a backdrop of regulatory scrutiny and ongoing experimentation with tokenized settlement in traditional rails.

Why it matters

The enhanced collaboration between Visa and Bridge underscores a strategic bet on programmable, onchain settlement as a means to speed up merchant settlements and improve transparency for card programs built on stablecoins. By enabling issuers and acquirers to settle transactions directly in stablecoins, the network could reduce latency and friction inherent in fiat conversions, especially for cross-border transactions or cross-currency purchases. The approach also signals an appetite to expand the set of tools available to fintechs and brands that want to issue their own digital dollars or stable assets tailored to their customer base, without relying solely on a third-party issuer.

Bridge’s participation remains central to the evolution of these rails. The program leverages Bridge’s infrastructure to enable onchain settlement, with Lead Bank providing the regulatory and banking framework necessary to move transactions from card networks into the onchain ecosystem. In practice, this arrangement allows card issuers to settle in stablecoins rather than converting transactions to local fiat post-authorization, aligning settlement timelines with blockchain realities and potentially improving settlement finality for merchants and consumers alike.

From a competitive standpoint, the Visa-Bridge expansion sits alongside a broader trend in the payments space: the growing willingness of major processors to experiment with crypto rails. Mastercard, for example, has recently enabled stablecoin card spending in the US through a partnership with the MetaMask wallet, illustrating how traditional payment networks are responding to consumer interest in crypto-backed payments and the desire for real-time settlement capabilities. The juxtaposition of these efforts signals a broader industry push toward integrating crypto-native settlement with fiat-backed consumer spending, while navigating the regulatory and risk considerations that come with such a transition.

Visa’s crypto leadership has been clear about meeting businesses where they operate. Cuy Sheffield, Visa’s head of crypto, has framed the expansion as part of a broader strategy to bring the speed, transparency and programmability of stablecoins into the settlement process. The company is exploring how Bridge-issued assets—stablecoins that are created programmatically by businesses on Bridge’s platform—could be supported more broadly within Visa’s network, a path that could unlock new programmable currency options for merchants and brands that want to control settlement terms or tokenized reward structures. Unlike the most widely used stablecoins issued by independent entities, Bridge-issued assets are designed to be created and managed via Bridge’s infrastructure, a model that could appeal to fintechs seeking bespoke token strategies.

Bridge has positioned the expansion as a step toward more seamless, on-chain settlement for digital-asset-enabled card programs. The practical effect is a potential reduction in the time and complexity involved in moving value from a customer’s stablecoin balance to a merchant’s local currency—an outcome that could matter for shoppers who want near-instant payments and for issuers seeking tighter control over settlement economics. The program’s onchain settlement is described as a natural extension of Bridge’s rail, with Lead Bank acting as the bridge between traditional banking and the onchain settlement layer. In a mid-February update, Bridge noted that it had received conditional approval from a regulator to become a national trust bank, a milestone that underscores the regulatory dimensions of this kind of expansion and the careful navigation required to scale such rails.

As part of the broader, ongoing stablecoin race in payments, Visa’s initiative adds to a landscape where banks and fintechs are willing to experiment with programmable money at the point of sale. The expansion’s strategic rationale rests on creating more options for merchants to accept stablecoins without abandoning familiar payment interfaces, and for consumers to transact with tokens that can be settled efficiently. By aligning with Bridge’s architecture and Lead Bank’s regulatory framework, Visa is building a more integrated model where stablecoins do not live only in wallets or exchanges but become a practical settlement instrument for everyday card purchases.

The announcement also highlights a broader industry trend: the move toward enhanced interoperability between card rails and blockchain settlement. If the onchain settlement pilot proves scalable, issuers may gain more flexibility in structuring rewards, fees and settlement terms around stablecoins, potentially broadening the appeal of crypto-enabled cards to a wider audience of merchants and cardholders. While regulatory considerations remain a constant backdrop, the practical demonstrations of speed and transparency in settlement have kept this initiative in the spotlight as a potential blueprint for future integrations across the payments ecosystem.

What to watch next

- Timeline and results of the onchain settlement pilot with Lead Bank and Bridge; potential adjustments to settlement cadence and liquidity requirements.

- Progress toward the goal of reaching 100+ countries by year-end, and which markets will be prioritized in the near term.

- Details on Visa’s potential support for Bridge-issued assets and any regulatory approvals that shape that path.

- Regulatory developments regarding Bridge’s national trust bank status and how they affect cross-border card programs.

Sources & verification

- Visa and Bridge expansion to over 100 countries: official Visa investor relations announcement.

- Original Latin American rollout: Visa and Bridge collaboration announcement outlining the April 2025 launch.

- Onchain settlement pilot and Bridge-Lead Bank collaboration: Visa press materials and Bridge announcements, including regulatory status updates.

- Industry context: Mastercard’s stablecoin card spending in the US via MetaMask—contextual reference in related coverage.

Key figures and next steps

Market reaction and key details

Why it matters

The Visa-Bridge collaboration represents a deliberate push to embed stablecoins deeper into everyday payments while testing the viability of onchain settlement for consumer card programs. If the pilot demonstrates efficiency gains and regulatory viability, issuers and merchants could gain access to more flexible settlement terms and new token-based monetization options. For users, the prospect of faster settlement and more predictable funds availability could enhance the appeal of stablecoins as a practical payments tool, particularly for cross-border purchases and commerce that spans multiple currencies.

Beyond Visa, the broader payments ecosystem is watching how these rails will coexist with existing fiat-based settlement, risk controls, and compliance regimes. The tension between innovation and regulation remains a key driver, but the ongoing experiments with stablecoins at the point of sale reflect a maturing phase in crypto-enabled payments where real-world usage and governance concerns are increasingly aligned. As more institutions participate, the competence and reliability of onchain settlement in consumer contexts will be tested under a variety of market conditions, from everyday retail transactions to cross-border remittances.

What to watch next

- End-of-year milestones for country expansion and the potential scaling of onchain settlement.

- Regulatory updates on Bridge’s national trust bank status and related compliance requirements.

- Adoption metrics from merchants and issuers participating in the program, including any changes in settlement times and cost structures.

Crypto World

Bitcoin leverage jumps as open interest spikes near $70k

Bitcoin perpetual open interest posts its largest daily rise since 2025 as BTC stalls below $70k.

Summary

- Perpetual open interest records its biggest daily percentage increase since July 2025 as BTC tests $69.4k resistance.

- Leverage expands sharply into a failed breakout attempt, leaving speculative longs vulnerable to liquidations if price moves away from the $69k–$70k zone.

- BTC trades just under $70k with elevated open interest and hotter funding, signaling higher short-term volatility risk for derivatives markets.studio.

Bitcoin’s (BTC) derivatives market has shifted into a more fragile configuration after a sudden surge in perpetual futures open interest coincided with a stalled breakout attempt just below the psychologically important $70k level. On-chain analytics firm glassnode reported that perpetual open interest saw its largest daily percentage jump since July 2025 as BTC pushed to $69.4k, only for the move to fade without a clean break of resistance. The pattern suggests speculators rushed to add leverage in anticipation of a breakout that did not materialize, leaving a substantial cluster of long positions now exposed to any downside or extended consolidation.

The mechanics are straightforward: when open interest spikes faster than spot prices, it usually signals an influx of leveraged capital rather than organic spot demand. In this case, the new positioning came right as BTC approached the $69.4k–$70k band that several technical analysts identified as a key decision area for the market. If price fails to extend higher, even a modest pullback can push stretched longs toward margin limits, forcing them to reduce risk or face liquidations. The result is a market where short-term moves can become exaggerated as derivatives flows feedback into spot, especially on high-volume venues tracked by platforms such as Coinbase.phemex+4

Leverage and market structure

Several recent analyses have highlighted $69.4k–$70k as a pivotal zone where BTC (BTC) either breaks higher into a new leg up or resolves into a deeper correction. With perpetual open interest now elevated, futures traders are effectively amplifying whichever direction comes next, increasing the probability of a sharp squeeze rather than a calm drift. A clean move above $70k would likely force shorts to cover into strength, while a breakdown below nearby supports in the high-$60k area could trigger a cascade of long liquidations.

The episode underscores how much short-term BTC price action is still dictated by derivatives rather than spot flows, even as regulated products and frameworks like MiCA slowly reshape parts of the market. For traders, the signal is blunt: high leverage near major resistance rarely stays comfortable for long. Watching open interest, funding, and liquidation data in real time—alongside spot metrics from exchanges like Coinbase and aggregated price feeds for BTC—remains essential for managing risk in an environment where a crowded bet on a $70k breakout can quickly turn into a scramble for the exits.

Crypto World

Mining Companies Move Deeper into AI, HPC as MARA may Sell Bitcoin

In a Monday SEC filing, the US Bitcoin miner said it would consider selling some of the coins on its balance sheet, depending on market conditions.

US-based cryptocurrency miner MARA Holdings made waves after a regulatory filing signaled that the company could change its HODL strategy.

In a Monday filing with the US Securities and Exchange Commission (SEC), MARA said it was open to selling some of its Bitcoin (BTC) holdings “from time to time” depending on market conditions and its investment priorities. According to the miner, it changed its strategy to allow for BTC sales in 2026, while Bitcoin sales generated from mining at the company have been permitted since 2025.

MARA’s strategy shift comes as many crypto mining companies are pivoting some of their infrastructure into artificial intelligence (AI) and high-performance computing (HPC) amid increasing BTC difficulty and associated costs. On Monday, Riot reported a net loss of $663 million for 2025 in part due to the value of its Bitcoin holdings, while Core Scientific said its Q4 2025 revenue was down 16% from the year-earlier period.

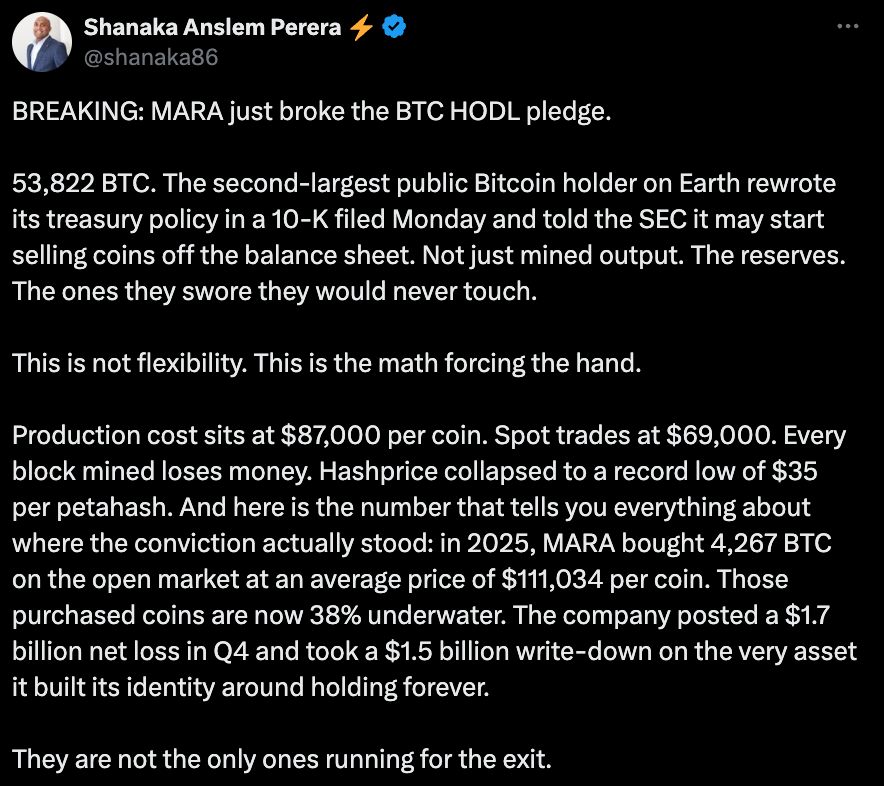

“This is not flexibility,” said analyst Shanaka Anslem Perera in a Tuesday X post on MARA’s SEC filing. “This is the math forcing the hand. Production cost sits at $87,000 per coin. Spot trades at $69,000. Every block mined loses money. Hashprice collapsed to a record low of $35 per petahash.”

He added:

“The entities that mine Bitcoin no longer want to hold it. The entity that holds the most Bitcoin [Michael Saylor’s Strategy] has never mined a single satoshi. Production and accumulation have fully decoupled for the first time in this asset’s sixteen-year history.”

MARA announced last month that it had acquired a 64% stake in computing infrastructure operator Exaion, in a move to strengthen its position through HPC and AI. Similarly, digital infrastructure company Terawulf reported last week that it expects additional growth in 2026 fueled by AI and HPC contracts.

Related: Will Bitcoin crash if oil prices hit $100 per barrel?

At the time of publication, BTC was trading hands for $67,717, off by more than 13% in the past 30 days. MARA reported holding 53,822 BTC as of Dec. 31, then worth about $4.7 billion. At current price levels, that equates to $3.64 billion.

How the US-Iran conflict is affecting Bitcoin

The military actions taken by the United States and Israel against Iran during the weekend spurred concerns over oil supplies and inflation. The price of Bitcoin failed to stay over $70,000 on Tuesday while even assets like gold experienced some volatility amid concerns of a drawn-out conflict.

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

Crypto World

Why the endowment is swapping bitcoin for ethereum ETFs

Harvard University endowment’s decision to trim its bitcoin holdings while adding exposure to ether (ETH) has raised a familiar question: Is the endowment making a bet on Ethereum over Bitcoin, or simply adjusting risk?

The answer may be less dramatic than it appears and potentially bullish for the sector.

Michael Markov, co-founder and chairman of Markov Processes International, who studies university endowments, said crypto is likely the most volatile part of Harvard’s public markets portfolio. In the fourth quarter of 2025, price swings in both bitcoin and ether surged, with both assets losing around 25% of their value.

These sharp price swings have, at least in part, led Harvard to rebalance its portfolio, even if it did not change its long-term view of bitcoin. When an asset becomes more volatile and riskier than intended in a portfolio, cutting back restores balance.

“When volatility rises sharply, the risk contribution of that sleeve can expand disproportionately relative to its capital weight,” Markov said. In that setting, he added, trimming exposure can happen “without implying a strategic shift.”

Simply put, Harvard, which bought BlackRock’s bitcoin ETFs last year, likely didn’t lose its conviction in bitcoin; rather, it moved to rebalance its risk appetite.

In fact, it’s not just a crypto-specific move. Rebalancing capital out of assets that have done well and into underperforming sectors is something most Wall Street portfolio managers do to keep returns fixed. The idea is to rebalance the portfolio ahead of a market rotation, moving outperforming assets into underperforming ones to capture an eventual shift in sentiment.

For example, given sky-high valuations of traditional equities, some of these endowments, which tend to focus on long-term return, have begun looking into other alternative investment ideas, including digital assets-related ETFs. Harvard first bought bitcoin in the third quarter of 2025, allocating roughly 20% of its reported U.S.-listed public equity holdings into the crypto asset. The idea is not to overhaul portfolios but to add measured exposure that could lift returns in years when crypto or underperforming assets perform well, and traditional equities start to lose their higher valuations.

Another possibility is liquidity.

Harvard has increased its allocation to private equity in recent years, Markov noted, pushing more capital into long-term, illiquid investments. At the same time, billions of dollars in unfunded commitments remain on the books. That creates pressure on the smaller slice of the portfolio that can be sold quickly.

“That means the liquid sleeve is relatively small compared to the capital call obligations,” he said. When that happens, and investors such as Harvard need to fund capital investment requests from private equity, they tend to sell more liquid, publicly traded assets to fulfill those commitments.

“Selling some public ETFs – including crypto ETFs – is mechanically the easiest way to manage that pressure,” according to Markov.

Crypto demand

Despite the need to rebalance out of volatile assets or to fund other capital commitments, Harvard didn’t exit crypto.

Instead, it added almost 3.9 million shares of BlackRock’s ether ETF, currently valued at $56.6 million.

Samir Kerbage, chief investment officer at Hashdex, sees that move as part of a broader institutional shift into digital assets and beyond just investing in bitcoin.

“Harvard’s purchase of Ethereum ETFs is a clear sign of institutional demand for crypto assets beyond bitcoin,” Kerbage said. He pointed to the GENIUS Act — passed into law in July — making it easier for large allocators to navigate the crypto landscape.

As rules around stablecoins and tokenized securities take further shape, investment committees of large institutions may feel more comfortable backing networks that support those applications.

Ethereum sits at the center of much of that activity. Over the past few years, it has become the main network for stablecoins, tokenized funds and other onchain financial applications used by asset managers and fintech firms. Unlike bitcoin, it offers institution-level staking, allowing holders to lock up tokens to help secure the network and earn yield. That feature can make ether look less like a pure directional bet and more like exposure to the underlying infrastructure powering digital financial services.

Kerbage also expects institutions that move beyond bitcoin to favor diversified products, but slowly. While some allocators may consider assets such as ether, XRP or solana (SOL) on their own, he said many will likely choose index-style vehicles instead.

“This ongoing trend is not because it’s the fashionable choice, but because the alternatives are genuinely hard,” Kerbage said, citing questions such as which tokens to hold, how much to allocate and when to rebalance. “These aren’t crypto-specific problems.”

However, for a giant fund like Harvard signaling a desire to expand further into digital assets, even slowly, is likely positive for crypto, as even a few years ago, this was unthinkable.

Taken together, Harvard’s bitcoin trim and ether buy may reflect two things: managing short-term risk and cash needs, while slowly expanding beyond bitcoin as U.S. crypto rules become clearer. Ultimately, it’s likely a broader sign of further institutional confidence in digital assets.

Crypto World

Bitcoin slides 3% as assets rout; Gold smashes to $5K on oil fears

Bitcoin (CRYPTO: BTC) pulled back from its recent tilt toward the $70,000 threshold as geopolitical tensions in the Middle East intensified concerns about oil supply and global inflation. The closure of the Strait of Hormuz sparked a broad risk-off mood, with equities slipping and safe-haven assets showing mixed performance. By midday, BTC hovered near the $66,000 area after retreating from its earlier highs, underscoring how macro headlines continue to drive crypto liquidity and price action. A data point from TradingView highlighted a roughly 3.2% intraday decline, reinforcing traders’ focus on momentum and key technical levels in a volatile environment.

Key takeaways

- Bitcoin (CRYPTO: BTC) failed to sustain a move toward $70,000 as energy-market tensions resurfaced following Hormuz-related disruptions.

- Major equity indices were weaker at the open, with the S&P 500 and Nasdaq each down around 2%, and gold also retreating as risk appetite deteriorated.

- BTC price action remained range-bound and failed to break through critical trend lines, a dynamic traders described as evidence of persistent bearish pressure.

- Analysts linked the session to a broader risk-off cycle driven by oil supply concerns and potential inflationary stress, affecting both crypto and traditional markets.

- While some voices cautioned that BTC could see a rotation opportunity if macro conditions stabilize, the near-term path remained uncertain.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. BTC dropped about 3.2% on the day, returning to the $66,000 region as volatility in oil and cross-asset liquidity weighed on prices.

Market context: The move sits within a broader risk-off backdrop where energy-market shocks, inflation concerns, and geopolitical headlines shape appetite for both traditional assets and digital currencies. The episode underscored how crypto trading remains tethered to macro risk sentiment and liquidity dynamics that can shift quickly in response to geopolitical developments and energy data.

Why it matters

The day’s price action sheds light on Bitcoin’s evolving role in diversified portfolios during periods of geopolitical stress. As oil markets react to potential supply disruptions, the resulting spillovers to equities and currencies can compress risk-on assets, including digital currencies. The observed dynamics imply that BTC is not immune to macro shocks and that its appeal as an inflation hedge or portfolio diversifier may be contingent on broader liquidity conditions and investor risk tolerance.

For market participants, the session highlighted the importance of risk controls and scenario planning. While some analysts had suggested a rotation from gold into BTC as a store of value during periods of stress, the evidence from this single session indicates a more nuanced relationship. The price resilience of BTC in some shorter timeframes contrasts with the larger-timeframe momentum that favored bears, suggesting a wait-and-watch period for a clearer directional signal.

Looking ahead, the interplay between oil-market volatility, inflation expectations, and crypto liquidity will likely calibrate how traders approach BTC in the near term. If macro headwinds ease and risk assets stabilize, BTC could retest upside levels; if not, a continuation of range-bound trading or further downside pressure remains plausible. Investors should monitor whether BTC can reclaim key levels or remain anchored in a consolidative range while macro headlines evolve.

What to watch next

- Oil-price trajectories and official updates on energy supply risks, particularly around chokepoints like Hormuz, over the next several sessions.

- BTC price levels: watch for a decisive move above $70,000 or a clear break below $66,000 to signal a new short- or medium-term direction.

- General risk sentiment: observe moves in the S&P 500 and Nasdaq for continued correlation or decoupling from crypto markets.

- Geopolitical developments: any escalation or de-escalation could rapidly reframe liquidity and volatility in crypto markets.

Sources & verification

Market reaction and key details

Bitcoin (CRYPTO: BTC) traded in a narrow corridor as macro headlines continued to drive prices. The market faced a risk-off tilt after the Strait of Hormuz closed, amplifying concerns about oil-supply interruptions and potential inflationary pressures. In this environment, equities pulled back and safe-haven assets vacillated, with gold not providing the shelter some had anticipated. Data from TradingView captured BTC’s movement, showing a roughly 3.2% decline on the day and a retreat toward the $66,000 mark. The price action followed a broader pattern of cross-asset sensitivity to geopolitical risk and energy-market signals.

“The market is beginning to price-in a longer war,” The Kobeissi Letter wrote on X, reflecting a shift in risk perception as geopolitical tensions persisted.

From a technical standpoint, traders highlighted that BTC once again failed to flip key trend lines that would signal renewed bullish conviction. Keith Alan, cofounder of Material Indicators, observed that “So far $BTC bulls have failed to muster any momentum,” underscoring the lack of a clear breakout above resistance levels. A weekly chart review suggested a memory-like pattern of consolidation spanning 2021 through late 2024, with recent rallies not carrying the DNA of a sustained bull recovery.

“After losing the 2021 Top and the 21-Day SMA again, I’m having flashbacks to March – Nov 2024 when we endured 8 months of consolidation in this range. Nothing about Monday’s rally has the DNA of a bull recovery.”

Despite the bearish tone, some participants sought opportunities in the near term. A widely cited observation from traders noted that, relative to other assets, Bitcoin appeared to hold up better than some precious metals during the crisis, a theme that prompted discussions of potential capital rotation. Yet the prevailing consensus emphasized that volatility remained elevated and that BTC’s intermediate-term direction would hinge on how the oil-market dynamics and inflation outlook evolved in the days ahead.

“Not doing the worst since the escalation in the middle east. Actually outperforming stocks & precious metals for a change,” commented Daan Crypto Trades, highlighting the nuanced performance within a broad risk-off phase.

As the session progressed, gold came under pressure as macro concerns persisted. Nik Bhatia, founder of The Bitcoin Layer, described gold as “absolutely smashed,” while noting it had posted year-to-date gains of around 16%. This juxtaposition—gold weakening even as Bitcoin remains in a tight range—helped illustrate the complexity of risk markets during this period. Some observers, including Michaël van de Poppe, suggested that a rotation of capital from gold to BTC could be underway, a narrative that would require more data to confirm but remains a subject of debate among market watchers.

What’s next in the oil-BTC dynamic

The current episode underscores how energy-market shocks can feed into crypto liquidity, especially when inflation expectations are in flux. As traders reassess macro scenarios, BTC could either test higher resistance levels if risk appetite returns or continue trading within a defined range until new catalysts emerge. The next steps will hinge on how quickly energy markets stabilize, how central banks respond to any escalation in oil prices, and whether risk-on assets regain footing in a global environment of heightened uncertainty.

Crypto World

NEAR Protocol (NEAR) Soars by Double Digits: Breakout Confirmed or Bull Trap?

The cryptocurrency market has rebounded over the past 24 hours, with Bitcoin (BTC), Ethereum (ETH), and many other leading digital assets posting slight increases.

For its part, NEAR Protocol (NEAR) outperformed every competitor in the top 100 club, registering an impressive 12% pump.

What Fueled the Rally and What’s Next?

NEAR has been at the forefront of gains lately, with its valuation rising to a monthly peak of around $1.45 just several hours ago. Currently, it trades at around $1.35 (per CoinGecko’s data), representing a roughly 40% jump on a weekly scale. Its market capitalization has surpassed $1.7 billion, making it the 44th-largest cryptocurrency and flipping popular altcoins like Bittensor (TAO), Pi Network (PI), and others.

The main catalyst for the rally seems to be the latest technical upgrade announced by NEAR Protocol’s team. The project’s official X account revealed that Confidential Intents is live, a feature that lets users make private DeFi transactions without exposing sensitive details.

“DeFi users, developers, and institutions now unlock a wide range of privacy-first use cases without forgoing discretion,” the disclosure reads.

X user Emperor Osmo argued that NEAR is “fundamentally undervalued,” adding that Intents are generating widespread adoption.

“Meanwhile, they continue to increase the rate of adoption under which AI enables privacy-first trading (Iron Claw). Agentic payments are scaling, and Near is positioned to capture a lot of that flow,” they stated.

Michael van de Poppe also spoke highly of NEAR, describing it as “simply the best AI protocol in the ecosystem.” He wondered why investors wouldn’t want to add it to their portfolios, adding that from a technical standpoint, “it’s the best representation of the current status of altcoins.”

Altcoin Sherpa believes NEAR “is insanely strong,” while Sjuul | AltCryptoGems thinks the asset is trying to print “a cup and handle” formation on its price chart. This pattern consists of a rounded bottom (cup) and a small pullback on the right side (handle), and together they usually signal a bullish setup.

Not so Quick

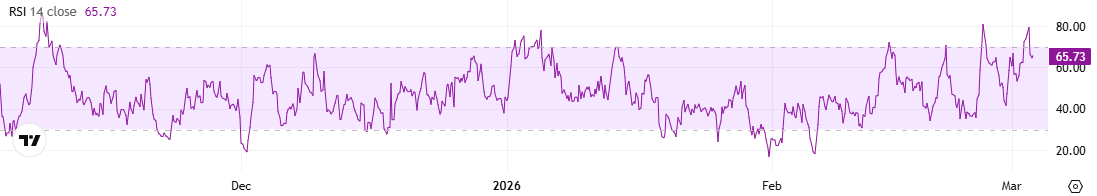

Despite the evident resurgence, NEAR remains far below its all-time high of around $20 witnessed at the start of 2022. Meanwhile, certain technical indicators suggest a correction could be on the way.

The asset’s Relative Strength Index (RSI), which measures the speed and magnitude of recent price changes, has briefly climbed past 70. This means that NEAR has entered overbought territory and could be on the verge of a move south. Conversely, ratios below 30 are considered buying opportunities.

The post NEAR Protocol (NEAR) Soars by Double Digits: Breakout Confirmed or Bull Trap? appeared first on CryptoPotato.

Crypto World

Iranian Exchange Outflows Jump 700% as USDT Sanctions Alert Intensifies

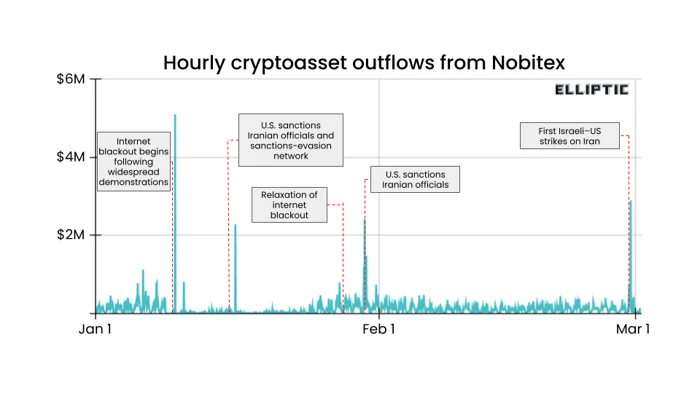

Iranian crypto exchange outflows spiked 700% to nearly $3 million immediately following coordinated US and Israeli military strikes, according to a blog post by blockchain analytics firm Elliptic.

The surge was detected on Iran’s largest exchange, Nobitex, suggesting a rapid flight to safety as users rushed to move assets off-platform and into overseas exchanges, in capital flight maneuvers that could be bypassing traditional banking systems.

This behavior signals acute distress in the local market, with capital potentially bypassing the domestic banking system entirely.

With the Iranian regime’s internet restrictions collapsing trading volumes by 80%, the value leaving exchanges indicates Iranian crypto speculation is over for now.

- Nobitex outflows surged 700% immediately after military strikes began.

- USDT trading pairs were suspended by central bank order, freezing liquidity.

- On-chain data shows 5.9% of volume is now linked to illicit or sanctioned activity.

Iranian Exchange Outflow Deep Dive: 700% Spike Defies Volume Collapse

Data from Elliptic reveals that net outflows on Nobitex, the country’s largest exchange, jumped 700% in the 48 hours following the strikes.

This massive exit occurred despite a wider collapse in market activity. Transaction volumes across Iranian platforms fell by roughly 80% between Feb. 27 and March 1 due to severe internet restrictions.

Bitcoin rebounded after the Iran strike shock, erasing losses quickly on global markets, but local Iranian traders did not wait for price discovery. They moved immediately to secure assets.

TRM Labs attributes the volume drop to “mechanical access limitations” rather than a collapse of market infrastructure. However, the simultaneous spike in withdrawals suggests that those who could access the network prioritized capital extraction over trading.

If these outflows sustain at current levels, domestic exchanges face a liquidity crisis. Users are effectively draining the order books, moving capital flow from centralized venues to decentralized wallets that are harder for local authorities to seize and harder for global regulators to track.

Discover: The best pre-launch crypto sales

USDT Sanctions Risk and Illicit Volume Signal: Is Tether the Next Target?

The primary bridge for this capital flight is Tether (USDT). Recognizing this, Iran’s central bank directed major platforms, including Nobitex and Wallex, to temporarily suspend trading of the USDT/toman pair. This move effectively severed the main link between the domestic fiat currency and the global crypto economy.

Given its deep liquidity and dollar peg, USDT is the preferred vehicle for sanctions evasion and illicit flows

This concentration of risk draws a target on Iran’s crypto infrastructure. Global regulators, particularly OFAC, are increasingly sophisticated at mapping on-chain relationships between exchanges and sanctioned entities. The suspension of USDT pairs suggests Tehran is aware of the vulnerability.

If sanctions enforcement tightens on Tether rails, Iranian exchanges could be cut off from global liquidity pools entirely. This would force flows into less transparent, peer-to-peer shadow banking networks, complicating compliance for every major exchange worldwide.

Macro Implication: Failure of Control vs. Risk of Isolation

The situation presents a binary outcome for the region’s crypto market. If tensions escalate, the oil price impact from the Iran war could further devalue the rial, driving a second, more desperate wave of capital flight into crypto assets. This would likely trigger aggressive secondary sanctions from the U.S. targeting any protocol or platform facilitating these flows.

On the other hand, if internet restrictions ease and the central bank restores USDT pairings, the market may return to the “risk containment mode” observed by TRM Labs.

However, the 700% outflow spike has already signaled that confidence in domestic platforms is fragile.

The implications for global traders are clear: liquidity in the region is becoming increasingly toxic, and compliance firewalls need to be higher than ever.

Discover: The best meme coins in crypto

The post Iranian Exchange Outflows Jump 700% as USDT Sanctions Alert Intensifies appeared first on Cryptonews.

Crypto World

CFTC chief Selig to clear path for U.S. perpetual futures in coming weeks

WASHINGTON, D.C. — Crypto perpetual futures have largely developed offshore because of the U.S. reluctance to pursue industry regulations, said U.S. Commodity Futures Trading Commission Chairman Mike Selig, and his agency will soon provide guidance on how that business should be handled.

Such derivatives contracts, which don’t expire and are often associated with leverage, have been an area of high interest to the industry. U.S. exchange Kraken, for instance, recently announced a move into perpetual futures for tokenized stocks for non-U.S. users.

Selig’s agency is “working towards getting professional futures, true professional futures here in the U.S. within the next month or so,” he said at a Milken Institute event in Washington on Tuesday. “We expect to announce that very soon.”

“The prior administration drove a lot of these firms and the liquidity offshore,” he noted.

That was a theme of his remarks and those from his U.S. Securities and Exchange Commission counterpart, Chairman Paul Atkins. As they’ve often done lately to underline their shared mission on digital assets, which they call Project Crypto, the two appeared together on stage and highlighted their unified approach.

One of the things the two are pursuing are “innovation exceptions” to allow for crypto experimentation without fear of regulatory crackdown. Selig said they’ll also soon define how decentralized finance (DeFi) developers are approached after years of prosecution and regulatory uncertainty.

Selig, who can act on his own because he’s currently the only member on the CFTC’s five-member commission, also said prediction markets — an overlapping cousin of the crypto sector — will get “guidance in the very near future” from the regulator. “We’re going to be setting very clear standards.” And he said the agency is also working on a more fulsome rulemaking process to soon give that position more permanent footing than guidance, which is procedurally easy to eliminate and rewrite.

Oversight of the events-contracts firms, including such leaders as Polymarket and Kalshi, is under dispute, with state gambling regulators pressing their own authorities over the firm’s sports contracts. Selig stepped forward to combat that in courts, arguing the CFTC’s position as a lead regulator of such firms’ activities.

“They can exist in parallel,” he said Tuesday of the two regulatory regimes.

Atkins, though, delved into one of the drawbacks of the regulators’ current work: legal standing. Despite Atkins’ earlier confidence that the SEC can forge ahead without new laws directing its crypto work, he said on Tuesday, “We really do need statutory certainty.”

“We need the sense of Congress,” he said.

A U.S. Supreme Court decision two years ago removed a significant degree of authority that federal regulators enjoyed in court disputes over their actions, so agencies going it alone on policy guidance doesn’t carry the weight it once did. Agencies such as the SEC and CFTC can more easily be challenged, and their positions also easily reversed by future officials arriving at the commissions.

The U.S. Senate is still working on the Digital Asset Market Clarity Act that’s meant to establish a regulatory system for the U.S crypto markets. That legislative effort remains jammed up in negotiations involving the industry, bankers, lawmakers from both parties and the White House. Its chances for passage in 2026 grow more difficult with each day, as midterm elections approach and available Senate floor time dwindles.

Read More: The chief of the SEC is headlining an event sponsored by a crypto firm at war with it

Crypto World

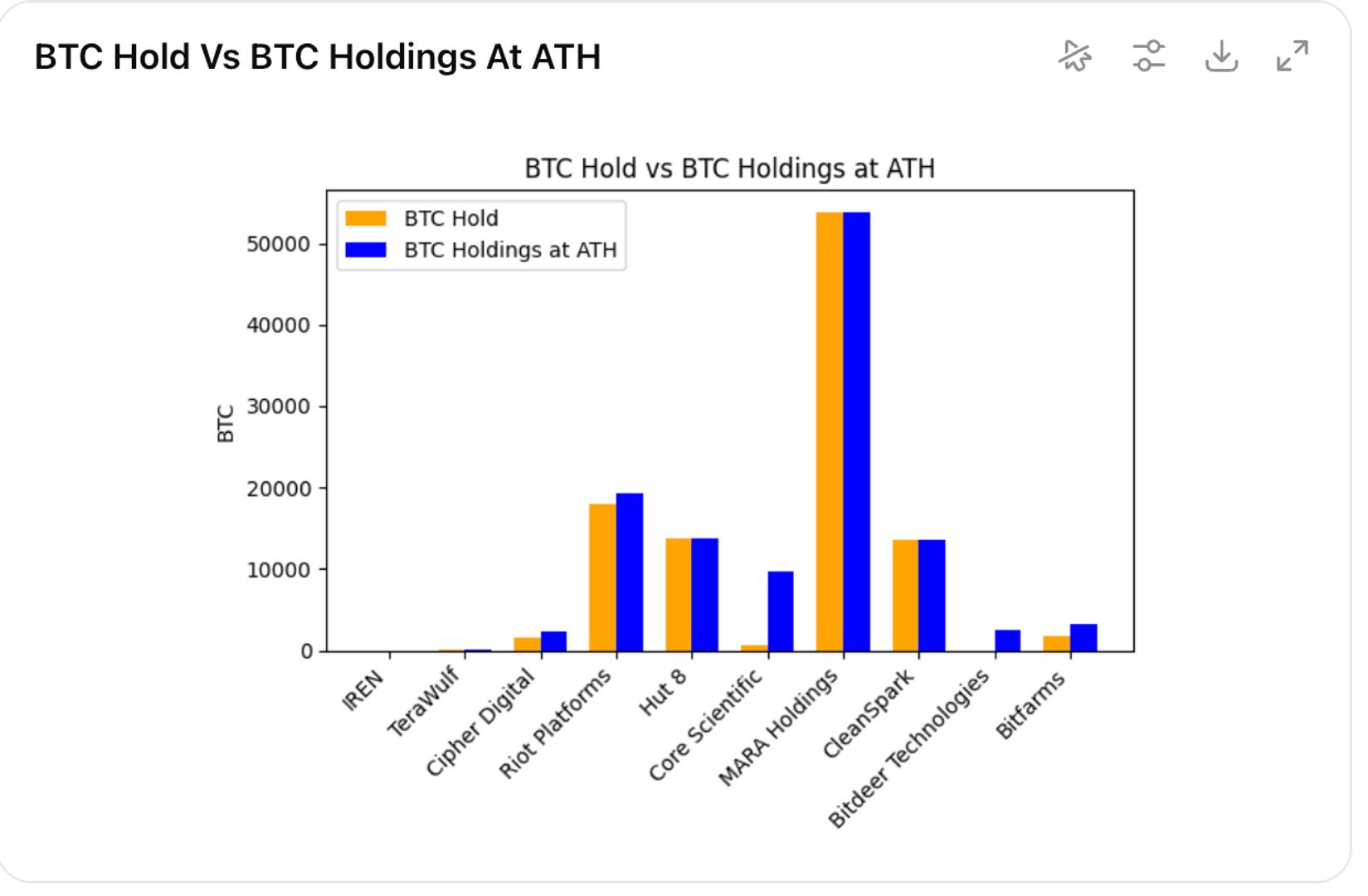

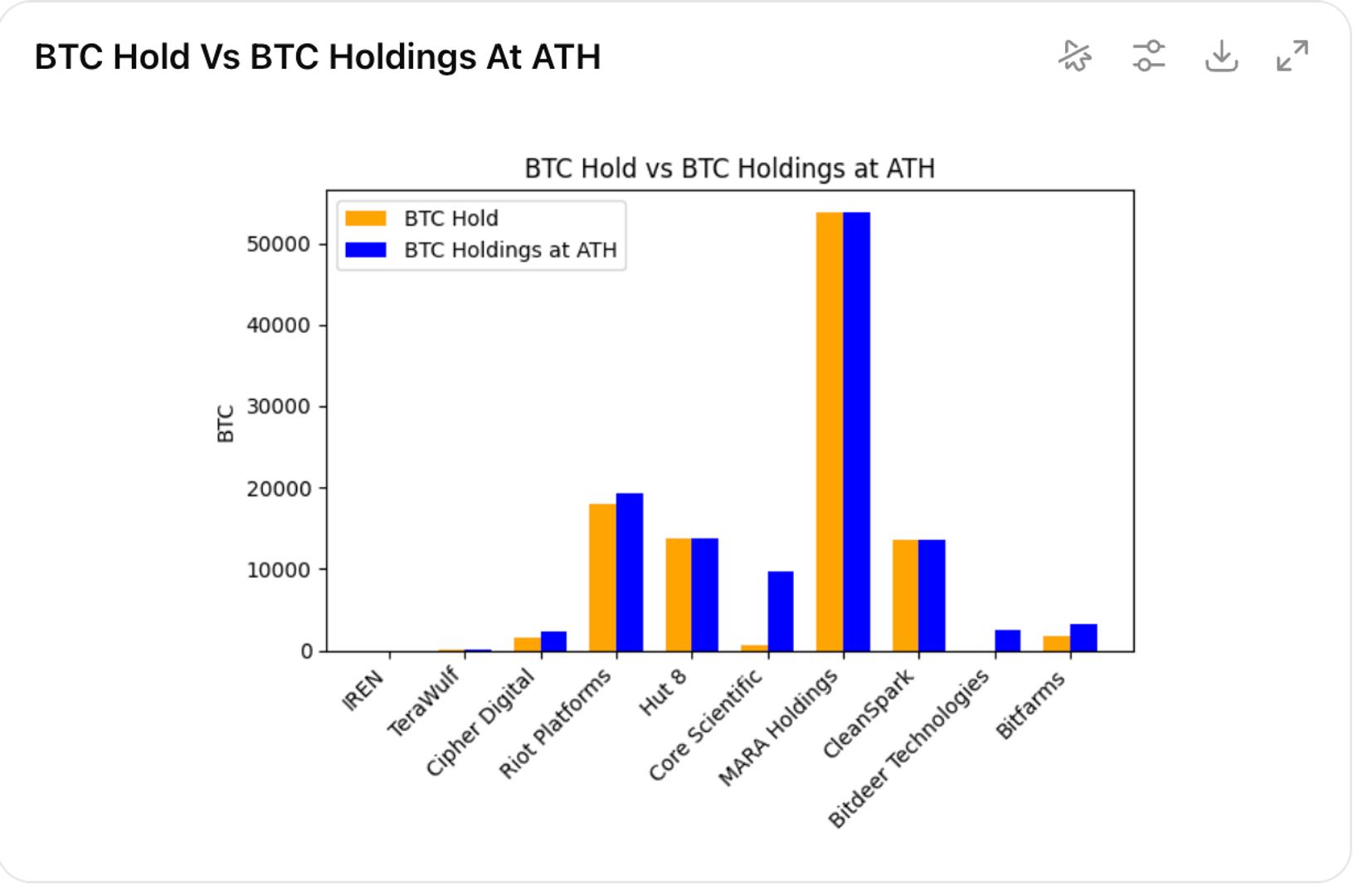

Over 15,000 BTC sold and more coming as public miners pivot to AI

Bitcoin miners are increasingly moving away from holding bitcoin on their balance sheets by selling more BTC to fund new identities as players in artificial intelligence (AI) infrastructure.

What started as holding onto bitcoin at all costs, or HODLing, is becoming a thing of the past for most publicly listed miners as they move into the capital-intensive but more attractive business of AI infrastructure. With tougher competition, higher energy costs and compressed prices, the profit margin for mining bitcoin, which during the 2021 bull run reached as high as 90%, has vanished, leaving miners who relied solely on that business struggling. Given that miners already have data centers ready to host AI computing machines, most have shifted their business away from bitcoin to become “AI infrastructure” companies.

This momentum is gaining more traction as prices sit roughly at $66,000, down nearly 50% from October’s all-time high. Many of the top 10 public miners are selling or openly discussing sales to fund these AI expansions.

Here are some miners that are either moving away from the bitcoin business by selling more BTC or have completely shifted into AI:

IREN (IREN) has never taken an ideological stance on holding bitcoin, focusing instead on infrastructure scale and operational execution as it leans into high-performance computing. The company currently holds 0 BTC, underscoring its lack of a treasury-driven strategy.

TeraWulf (WULF) has maintained a pragmatic posture, avoiding a hardline treasury approach while preserving balance sheet flexibility for AI aligned growth. It holds 15 BTC, in line with its historical peak, reflecting minimal emphasis on accumulation.

Cipher Digital (CIFR), formerly Cipher Mining, has made its repositioning explicit, calling 2025 a transformative year as it pivots toward HPC infrastructure. The company divested its 49% stake in three mining joint ventures for roughly $40 million in stock. Cipher now holds 1,500 BTC, down from an all-time high of 2,284 BTC, highlighting a gradual reduction alongside its structural shift.

Riot Platforms (RIOT) has treated bitcoin as a funding tool rather than a passive reserve, selling all monthly production and liquidating balance sheet holdings, including nearly 1,100 BTC to finance the Rockdale acquisition. Riot sold $200 million worth of bitcoin in the final two months of 2025. It currently holds 18,005 BTC versus peak holdings of 19,368 coins.

Hut 8 (HUT) said bitcoin is no longer a long-term strategic focus in its fourth-quarter earnings call, with exposure set to decline over time in favour of its equity stake in American Bitcoin (ABTC), which holds 6,039 BTC. Hut 8’s own balance stands at 13,696 BTC, unchanged from its peak.

Core Scientific (CORZ) sold $175 million of bitcoin as its AI pivot accelerated. After holding 2,537 BTC at year’s end 2025, its balance has dropped to around 630 BTC, well below its 9,618 BTC high watermark.

MARA Holdings (MARA) has softened its strict HODL identity, selling newly mined bitcoin and signaling it may buy or sell opportunistically, with about 28% of holdings loaned or pledged. It still holds 53,822 BTC, matching its all-time high, despite the more flexible policy.

CleanSpark (CLSK) treats its more than 13,000 BTC as productive capital, monetizing output, layering covered calls, and exploring bitcoin-backed credit lines as non-dilutive financing. Its current 13,513 BTC balance is in line with its historical peak.

Bitdeer Technologies (BTDR) reduced holdings to zero to fund AI data center expansion. That marks a massive drop from its prior peak of 2,470 BTC.

Bitfarms (BITF) has been blunt about its repositioning, with CEO Ben Gagnon stating, “We are no longer a Bitcoin company.” The miner now holds 1,827 BTC, down from a peak of 3,301 BTC, as it doubles down on AI infrastructure.

Crypto World

U.S. Court Dismisses Years-Long Scam Token Lawsuit Against Uniswap Labs

A federal court in the United States has dismissed a class action lawsuit accusing Uniswap Labs of facilitating the trading of scam tokens on its decentralized protocol. The court dismissed the plaintiffs’ claims with prejudice after four years of trial.

According to a filing with the U.S. Court for the Southern District of New York, Judge Katherine Polk Failla dismissed the case for several reasons, including the plaintiffs’ failure to allege the defendants’ knowledge of the fraud. Among other reasons, the judge also ruled that the plaintiffs failed to allege that Uniswap Labs and its founder, Hayden Adams, aided, abetted, and substantially assisted the fraud.

Uniswap Wins Scam Token Class Suit

While filing the initial complaint and the first amended complaint (FAC) in April and September 2022, respectively, the plaintiffs alleged 14 claims against Uniswap, Adams, and other defendants. The complainants argued that the defendants were liable for scam tokens issued and traded on Uniswap.

The argument stemmed from the fact that the identities of the scam token issuers were unknown. They claimed that Uniswap served as a marketplace for the tokens in exchange for transaction fees. The plaintiffs also insisted that the defendants had, in effect, sold the tokens as unregistered broker-dealers by drafting smart contracts that enabled ownership of the protocol’s native asset, UNI.

By August 2023, the court dismissed the FAC for failure to state a claim under federal securities laws. Judge Failla insisted that the accusers’ attempts to hold defendants liable for the losses from the scams were unconvincing. Although the complainants appealed the dismissal, the Second Circuit court affirmed the judge’s decision in part in February 2025. The appeal resulted in the plaintiffs again being allowed to amend their complaint.

No Plausible Claims

In the second amended complaint (SAC) filed in May 2025, the accusers focused on state-law violations. By this time, the judge had dismissed all defendants except Uniswap and Adams. By July, the defendants had filed a motion to dismiss under the Federal Rules of Civil Procedure.

In dismissing the SAC, Judge Failla insisted that the plaintiffs still failed to allege plausible claims against Uniswap, despite three attempts.

“Even if Plaintiffs had adequately alleged Defendants’ actual knowledge, their claim would still fail because they have not alleged that Defendants provided substantial assistance to the issuers’ fraud,” the judge stated.

Meanwhile, Adams commented on the dismissal, calling it a “good, sensible outcome.”

The post U.S. Court Dismisses Years-Long Scam Token Lawsuit Against Uniswap Labs appeared first on CryptoPotato.

-

Politics5 days ago

Politics5 days agoITV enters Gaza with IDF amid ongoing genocide

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Iris Top

-

Politics9 hours ago

Politics9 hours agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Tech3 days ago

Tech3 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Business7 days ago

Business7 days agoTrue Citrus debuts functional drink mix collection

-

NewsBeat6 days ago

NewsBeat6 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Sports4 days ago

The Vikings Need a Duck

-

NewsBeat3 days ago

NewsBeat3 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Tech7 days ago

Tech7 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat6 days ago

NewsBeat6 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat2 days ago

NewsBeat2 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat3 days ago

NewsBeat3 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat7 days ago

NewsBeat7 days agoPolice latest as search for missing woman enters day nine

-

Entertainment1 day ago

Entertainment1 day agoBaby Gear Guide: Strollers, Car Seats

-

Business6 days ago

Business6 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business5 days ago

Business5 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech4 days ago

Tech4 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics3 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

Crypto World7 days ago

Crypto World7 days agoEntering new markets without increasing payment costs