Tech

Civics Takes Center Stage in 2026

Julie Silverbrook, a lawyer and now vice president of civic education at the National Constitution Center in Philadelphia, can trace what she calls her “civic spark” to two key moments in her childhood.

The first was when her parents took her to an historical reenactment of George Washington’s crossing of the Delaware River on Christmas night in 1776.

Then, as a fourth grader, she was stuck at home when a massive blizzard closed all the schools in her area for two weeks. Her mother, keen to keep her children occupied, assigned Silverbrook and her siblings to learn something new from the family’s encyclopedia set. Silverbrook happened to open volume C to the entry on the Constitution. She was hooked.

By the time she was back in school and her class was starting its government unit, Silverbrook was well along in her love affair with American civics.

“I said, ‘I’m going to do the Constitution for the rest of my life,’” she recalls. “And, in fact, I have done the Constitution for the rest of my life.”

Silverbook, who wrote about her experiences for The Hill, notes that her civic spark began with her parents. But, she adds, “it was sustained by the incredible educators in my life.”

This year, as buzz around the 250th commemoration of American Independence spreads across the news and social media, teachers have a unique, built-in opportunity to explore how history continues to shape the country, she says.

“Educators really do have this critical role to play to nourish the souls of our young citizens and … get them prepared for thoughtful and engaged citizenship,” Silverbrook says. “That’s always true. But at these inflection points in our history, where we are intentionally looking backward but also thinking about the next 250 years, it’s a particularly impactful moment to think of things in those ways.”

⚡ Adjusting to Political Volatility

Social studies teachers are poised for their moment in the spotlight, particularly after a year of uncertainty and debates over what they teach in the classroom, says Tina Ellsworth, president of the National Council for the Social Studies, which advocates for teachers.

Last spring, when the Trump administration targeted diversity, equity and inclusion policies for elimination, government-run websites began to alter or delete information. Educators noticed trusted online sources for American history, such as those for Smithsonian museums, were missing information.

It alarmed social studies teachers, about 80 percent of whom use online sources, including government and museum sites, when crafting their lessons, according to a 2024 study by the American History Association. (In the same survey, 32 percent of K-12 social studies teachers reported never teaching from a textbook.)

“We were all texting each other and emailing each other all around the country saying ‘download the things you know you like’ because we just weren’t sure if they were going to be there [for much longer],” Ellsworth says.

Pressures on the Smithsonian haven’t eased. White House officials set a deadline of this week for the institution to hand over detailed accounts of its exhibit plates, budgets and other content-related items, the New York Times reports.

A few school districts reacted strongly to the federal administration’s directives last spring, asking teachers to comply with rules that hadn’t yet been written, Ellsworth says. Others required teachers to go back to using only assigned textbooks. However, the majority of social studies educators did their jobs as usual and continue to do so, albeit newly vigilant about the volatile political environment.

“It doesn’t matter if teachers are on the right or the left, they all believe in the same democratic principles,” Ellsworth says. “There are these core things that we believe in and when those things get challenged, it can be unnerving because we know the history.”

Yet, social studies teachers’ high anxiety from last spring has mostly subsided, Ellsworth says. Instead they are excited about the 250th anniversary of the country’s founding and how it has raised the profile of their favorite subject.

“We’re like, ‘welcome to the party!’” Ellsworth says. “We like the attention. We’re actually nervous that it will be very short-lived.”

Civics experts agree that a significant benefit of the 250th anniversary of the formal break from British rule is it has generated interest among students in the specifics of how the United States — a brand-new country — formed, allowing for deeper, more meaningful classroom explorations. Emma Humphries, chief education officer at iCivics, says teachers are “leaning into history” to shed light on today’s headlines.

The redistricting debate to favor one political party over another happening in several states right now is an example.

“So why does it matter that they’re redrawing lines?” Humphries says. “To understand redistricting, you have to understand reapportionment. To understand reapportionment, you have to understand the census and why we have a census. To understand that, you have to know some basics about representation, at least at the federal level and how it works in Congress.”

And that leads to discussions about how the Founding Fathers arrived at our structure of government.

“And so you’re able to say, hey, this is about something that happened 250 years ago,” Humphries says. “It’s also about what’s happening today. And that’s a beautiful thing that is special to our discipline.”

⚡ Embracing New Resources for Civics Education

Several organizations have events planned around the 250th anniversary, many of them for kids, including the America’s Field Trip contest, Philadelphia’s 52 Weeks of Firsts, which kicked off this month, and the National Archives’ series of digital and in-person programs in its Civics for All of US initiative.

Archives and education groups are adding special programming for teachers. The Bill of Rights Institute and iCivics launched the Civic Star Challenge, a competition that encourages teachers to weave specific themes associated with the Declaration of Independence — including revolution and change; life, liberty and the pursuit of happiness; voting and consent of the governed — into their lesson plans and then submit short videos that capture the reactions of students and teachers to the curriculum.

And in collaboration with Colonial Williamsburg, iCivics devised “Investigation Declaration,” an interactive game in the vein of the former PBS show “Where in the World is Carmen Sandiego?” Players explore world history to track the inspirations for the Declaration of Independence.

The civics-oriented Jack Miller Center in Philadelphia, with support from the Carnegie Corporation of New York, has Teaching America250 Awards — $5,000 grants for a teacher from each state and Washington, D.C., to carry out a project related to the Declaration of Independence. Winners were announced this month.

“It’s rewarding teachers who want to do really great work with students and just don’t have the resources to do so,” says Lauren Altobelli, who directs the center’s Founding Civics Initiative. “I’ve been reading the proposals and some of them are just so inspiring.”

In May, the center’s fourth National Summit on Civic Education will focus on the Declaration of Independence.

Both the National Constitution Center and Jack Miller Center are stepping up their professional development programs for educators in 2026 — in answer to concerns of recent years that social studies teachers have fewer ongoing training opportunities than other core-subject teachers.

In the short term, the 250th is bringing people together after a long period of division, Altobelli adds.

“There’s obviously a lot of polarization, a lot of distrust and unrest,” she says. “Social studies teachers deal with a lot of that just through the content they teach. But I do think that the 250th is offering some kind of unifying moment.”

Meanwhile, renewed interest in how civics studies can help today’s kids understand the present and prepare for the future may have long-term effects for education beyond 2026. Some states are already reviewing their social studies curriculum standards in response to a continuing decline in national test scores, Altobelli says. She hopes that focus on the 250th will persuade policymakers at the state level to boost civics teaching overall, “making sure that schools and teachers are supported, making sure they have the time to teach civics well.”

Greater support for civics learning would be more than welcome to the membership of the National Council for the Social Studies.

“We have been perpetually minoritized for quite some time,” Ellsworth says. She cites a 2024 paper by the Sandra Day O’Connor Institute for American Democracy detailing how civics education in American schools dropped precipitously after the 1960s, when the average student had at least three classes in civics through high school.

“Now most states have one class, and it’s usually a semester,” Ellsworth says. “This idea of having three classes in civics — oh my gosh, what a game-changer that could be for our democracy, man!”

Tech

Vercel rebuilt v0 to tackle the 90% problem: Connecting AI-generated code to existing production infrastructure, not prototypes

Before Claude Code wrote its first line of code, Vercel was already in the vibe coding space with its v0 service.

The basic idea behind the original v0, which launched in 2024, was essentially to be version 0. That is, the earliest version of an application, helping developers solve the blank canvas problem. Developers could prompt their way to a user interface (UI) scaffolding that looked good, but the code was disposable. Getting those prototypes into production required rewrites.

More than 4 million people have used v0 to build millions of prototypes, but the platform was missing elements required to get into production. The challenge is a familiar one with vibe coding tools, as there is a gap in what tools provide and what enterprise builders require. Claude Code, for instance, generates backend logic and scripts effectively, but does not deploy production UIs within existing company design systems while enforcing security policies

This creates what Vercel CPO Tom Occhino calls “the world’s largest shadow IT problem.” AI-enabled software creation is already happening inside every enterprise. Credentials are copied into prompts. Company data flows to unmanaged tools. Apps deploy outside approved infrastructure. There’s no audit trail.

Vercel rebuilt v0 to address this production deployment gap. The new version, generally available today, imports existing GitHub repositories and automatically pulls environment variables and configurations. It generates code in a sandbox-based runtime that maps directly to real Vercel deployments and enforces security controls and proper git workflows while allowing non-engineers to ship production code.

“What’s really nice about v0 is that you still have the code visible and reviewable and governed,” Occhino told VentureBeat in an exclusive interview. “Teams end up collaborating on the product, not on PRDs and stuff.”

This shift matters because most enterprise software work happens on existing applications, not new prototypes. Teams need tools that integrate with their current codebases and infrastructure.

How v0’s sandbox runtime connects AI-generated code to existing repositories

The original v0 generated UI scaffolding from prompts and let users iterate through conversations. But the code lived in v0’s isolated environment, which meant moving it to production required copying files, rewriting imports and manually wiring everything together.

The rebuilt v0 fundamentally changes this by directly importing existing GitHub repositories. A sandbox-based runtime automatically pulls environment variables, deployments and configurations from Vercel, so every prompt generates production-ready code that already understands the company’s infrastructure. The code lives in the repository, not a separate prototyping tool.

Previously, v0 was a separate prototyping environment. Now, it’s connected to the actual codebase with full VS Code built into the interface, which means developers can edit code directly without switching tools.

A new git panel handles proper workflows. Anyone on a team can create branches from within v0, open pull requests against main and deploy on merge. Pull requests are first-class citizens and previews map directly to real Vercel deployments, not isolated demos.

This matters because product managers and marketers can now ship production code through proper git workflows without needing local development environments or handing code snippets to engineers for integration. The new version also adds direct integrations with Snowflake and AWS databases, so teams can wire apps to production data sources with proper access controls built in, rather than requiring manual work.

Vercel’s React and Next.js experience explains v0’s deployment infrastructure

Prior to joining Vercel in 2023, Occhino spent a dozen years as an engineer at Meta (formerly Facebook) and helped lead that company’s development of the widely-used React JavaScript framework.

Vercel’s claim to fame is that its company founder, Guillermo Rauch, is the creator of Next.js, a full-stack framework built on top of React. In the vibe coding era, Next.js has become an increasingly popular framework. The company recently published a list of React best practices specifically designed to help AI agents and LLMs work.

The Vercel platform encapsulates best practices and learnings from Next.js and React. That decade of building frameworks and infrastructure together means v0 outputs production-ready code that deploys on the same infrastructure Vercel uses for millions of deployments annually. The platform includes agentic workflow support, MCP integration, web application firewall, SSO and deployment protections. Teams can open any project in a cloud dev environment and push changes in a single click to a Vercel preview or production deployment.

With no shortage of competitive offerings in the vibe coding space, including Replit, Lovable and Cursor among others, it’s the core foundational infrastructure that Occhino sees as standing out.

“The biggest differentiator for us is the Vercel infrastructure,” Occhino said. “It’s been building managed infrastructure, framework-defined infrastructure, now self-driving infrastructure for the past 10 years.”

Why vibe coding security requires infrastructure control, not just policy

The shadow IT problem isn’t that employees are using AI tools. It’s that most vibe coding tools operate entirely outside enterprise infrastructure. Credentials are copied into prompts because there’s no secure way to connect generated code to enterprise databases. Apps deploy to public URLs because the tools don’t integrate with company deployment pipelines. Data leaks happen because visibility controls don’t exist.

The technical challenge is that securing AI-generated code requires controlling where it runs and what it can access. Policy documents don’t help if the tooling itself can’t enforce those policies.

This is where infrastructure matters. When vibe coding tools operate on separate platforms, enterprises face a choice: Block the tools entirely or accept the security risks. When the vibe coding tool runs on the same infrastructure as production deployments, security controls can be enforced automatically.

v0 runs on Vercel’s infrastructure, which means enterprises can set deployment protections, visibility controls and access policies that apply to AI-generated code the same way they apply to hand-written code. Direct integrations with Snowflake and AWS databases let teams connect to production data with proper access controls rather than copying credentials into prompts.

“IT teams are comfortable with what their teams are building because they have control over who has access,” Occhino said. “They have control over what those applications have access to from Snowflake or data systems.”

Generative UI vs. generative software

In addition to the new version of v0, Vercel has recently introduced a generative UI technology called json-render.

v0 is what Vercel calls generative software. This differs from the company’s json-render framework for a true generative UI. Vercel software engineer Chris Tate explained that v0 builds full-stack apps and agents, not just UIs or frontends. In contrast, json-render is a framework that enables AI to generate UI components directly at runtime by outputting JSON instead of code.

“The AI doesn’t write software,” Tate told VentureBeat. “It plugs directly into the rendering layer to create spontaneous, personalized interfaces on demand.”

The distinction matters for enterprise use cases. Teams use v0 when they need to build complete applications, custom components or production software.

They use JSON-render for dynamic, personalized UI elements within applications, dashboards that adapt to individual users, contextual widgets and interfaces that respond to changing data without code changes.

Both leverage the AI SDK infrastructure that Vercel has built for streaming and structured outputs.

Three lessons enterprises learned from vibe coding adoption

As enterprises adopted vibe coding tools over the past two years, several patterns emerged about AI-generated code in production environments.

Lesson 1: Prototyping without production deployment creates false progress. Enterprises saw teams generate impressive demos in v0’s early versions, then hit a wall moving those demos to production. The problem wasn’t the quality of generated code. It was that prototypes lived in isolated environments disconnected from production infrastructure.

“While demos are easy to generate, I think most of the iteration that’s happening on these code bases is happening on real production apps,” Occhino said. “90% of what we need to do is make changes to an existing code base.”

Lesson 2: The software development lifecycle has already changed, whether enterprises planned for it or not. Domain experts are building software directly instead of writing product requirement documents (PRDs) for engineers to interpret. Product managers and marketers ship features without waiting for engineering sprints.

This shift means enterprises need tools that maintain code visibility and governance while enabling non-engineers to ship. The alternative is creating bottlenecks by forcing all AI-generated code through traditional development workflows.

Lesson 3: Blocking vibe coding tools doesn’t stop vibe coding. It just pushes the activity outside IT’s visibility. Enterprises that try to restrict AI-powered development find employees using tools anyway, creating the shadow IT problem at scale.

The practical implication is that enterprises should focus less on whether to allow vibe coding and more on ensuring it happens within infrastructure that can enforce existing security and deployment policies.

Tech

Theory Professional Previews SR-221.3 Extreme-Output Full-Range Loudspeaker at ISE 2026, Headlining New SR Series for Pro Sound Reinforcement

Theory Professional, the professional division of Theory Audio Design, is making a serious first impression at ISE 2026 with its all-new SR Series — a family of premium passive and powered loudspeakers engineered for sound reinforcement with performance and fidelity that rivals much larger systems. At the heart of the lineup is the SR-221.3, a truly unique full-range loudspeaker that pushes the envelope of output, bandwidth, and coverage.

The SR-221.3 pairs dual 21-inch, 3,600 W low-frequency drivers with four 10-inch high-output carbon fiber midrange drivers and a 5-inch wide-band ring radiator compression driver. The result: an astonishing 27 Hz – 20 kHz (-3 dB) frequency response, up to ~140 dB SPL, and an ultra-wide 170° × 60° coverage pattern. One to two SR-221.3s can easily fill medium venues with high-fidelity, high-impact sound.

Theory Professional has designed the SR Series to deliver lively dynamics, refined acoustic accuracy, and sheer output capability, all in surprisingly compact cabinets that won’t dominate aesthetic spaces; whether installed or used portably. The series includes eight models; passive, active, portable, and install variants — all built-to-order and available in black or white. Optional upgrades include custom paint matching and weatherizing on passive units.

Thoughtful details throughout the SR Series — from ergonomic handles and multiple fly points to industry-standard mount points, pole cups, and a suite of accessories like the Theory SplitYoke multipurpose mounting brackets, caster kits, and a dolly board — make these systems as flexible as they are powerful. Q2 2026 delivery is planned for powered, passive, portable, and install versions.

SR Series Loudspeakers and Subwoofers: Eight High-Output Models Now Available from Theory Professional

At ISE 2026, Theory Professional is demonstrating the new SR Series in Hall 8.0, Audio Demo Room D4, giving attendees a chance to hear exactly how far the company is pushing premium sound reinforcement. Demonstrations can be scheduled in advance, or you can stop by D4 to experience the system in action. More details are available at theoryprofessional.com.

Below is a clear breakdown of the eight SR Series loudspeakers and subwoofers available to order now, covering configuration, intended use, and key options.

SR Series Loudspeakers

SR-46.2

- Quad 6-inch, 2-way multi-use loudspeaker

- Ultra-slender, tall-but-narrow enclosure with 120° conical coverage

- Available in passive and powered versions

- Included features:

- Integral pole cups

- Ergonomic handles

- Fly points and industry-standard mount points

- Optional:

- Theory SplitYoke Multipurpose Mounting Bracket Kit for horizontal or vertical surface mounting

SR-28.2

- Dual 8-inch, 2-way multi-use loudspeaker

- 80° × 60° elliptical horn

- Available in passive and powered versions

- Included features:

- Integral pole cups

- Ergonomic handles

- Fly points and industry-standard mount points

- Optional:

- Theory SplitYoke Multipurpose Mounting Bracket Kit for horizontal or vertical surface mounting

SR-112.2

- Single 12-inch, 2-way multi-use loudspeaker

- 80° × 60° elliptical horn

- Available in passive and powered versions

- Included features:

- Integral pole cups

- Ergonomic handles

- Fly points and industry-standard mount points

- Optional:

- Theory SplitYoke Multipurpose Mounting Bracket Kit for horizontal or vertical surface mounting

SR-212.2

- Full-range, multi-use loudspeaker with integrated subwoofer

- Dual 12-inch LF drivers and dual 8-inch mid drivers in a 3-way design

- Exceptionally compact enclosure at just 10 inches deep

- Available in passive and powered versions

- Included features:

- Integral pole cups

- Ergonomic handles

- Fly points

- Optional:

- Theory SplitYoke Multipurpose Mounting Bracket Kit

- Theory Caster Kit for portable applications

SR Series Subwoofers

SR-212LF

- Compact, high-output bass-reflex subwoofer

- Dual 12-inch, 1,400 W woofers

- Sonically matched to SR-46.2, SR-28.2, and SR-112.2

- Included features:

- Removable feet

- Integral pole cups

- Ergonomic handles

- Fly points

- Optional:

- Theory SplitYoke Multipurpose Mounting Bracket Kit

- Theory Caster Kit

SR-215LF

- Maximum-output, manifold bass-reflex subwoofer

- Dual 15-inch, 3,600 W woofers

- Sonically matched to SR-46.2, SR-28.2, and SR-112.2

- Included features:

- Removable feet

- Integral pole cups

- Ergonomic handles

- Fly points

- Optional:

- Theory Quick-Release or Standard Caster Kits

- Dolly Board for transport

SR-218LF

- Maximum-output, manifold bass-reflex subwoofer

- Dual 18-inch, 3,600 W woofers

- Sonically matched to SR-46.2, SR-28.2, and SR-112.2

- Included features:

- Removable feet

- Integral pole cups

- Ergonomic handles

- Fly points

- Optional:

- Theory Quick-Release or Standard Caster Kits

- Dolly Board for transport

SR-221LF

- Extreme-output, manifold bass-reflex subwoofer

- Dual 21-inch, 3,600 W woofers

- Sonically matched to SR-46.2, SR-28.2, and SR-112.2

- Included features:

- Removable feet

- Integral pole cups

- Ergonomic handles

- Fly points

- Optional:

- Theory Quick-Release or Standard Caster Kits

- Dolly Board for transport

The Bottom Line

The SR-221.3 is still very much a proof of concept, and pricing has not been finalized. What is clear is that it will sit above Theory Professional’s existing SR models once it moves toward production. This is a true full-range loudspeaker loaded with expensive hardware — dual 21-inch, 3,600-watt low-frequency drivers, four 10-inch carbon-fiber midrange drivers, and a 5-inch wide-band ring-radiator compression driver — and there’s no scenario where that bill of materials leads to an “affordable” outcome.

With 27 Hz–20 kHz bandwidth (-3 dB), approximately 140 dB SPL, and 170° × 60° coverage, the SR-221.3 is designed to deliver high-output, high-fidelity sound at scale, with just one or two cabinets capable of filling medium-sized venues. Based on the pricing of Theory Professional’s current pro models, expect the SR-221.3 to land firmly in premium territory when it eventually reaches market — because nothing about this design suggests it’s meant to play in the shallow end.

For more information: theoryprofessional.com

Related Reading:

Tech

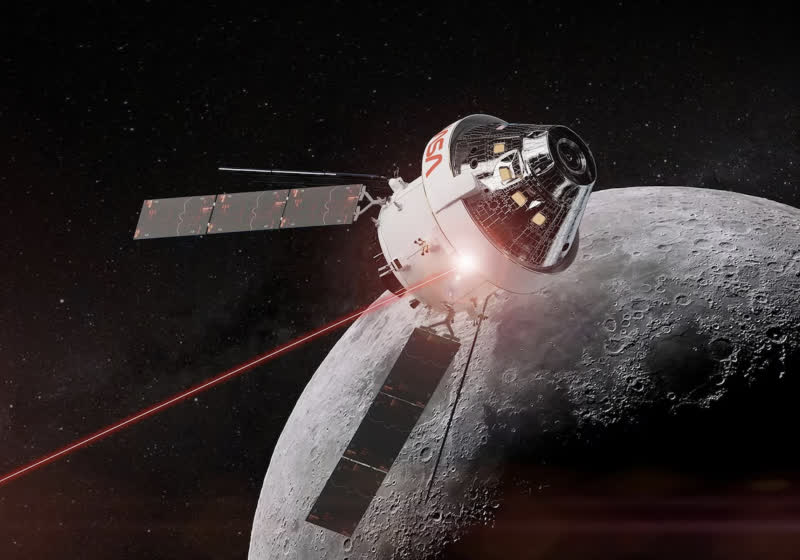

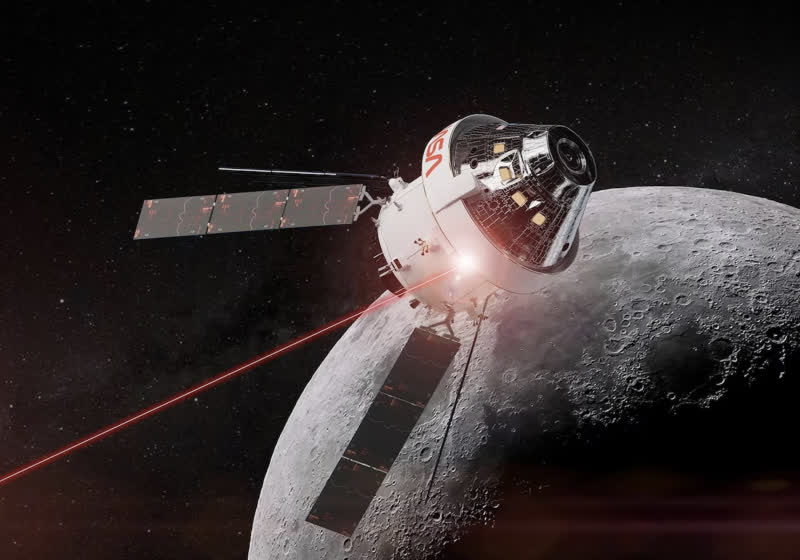

NASA's Artemis II will test laser communications system in lunar orbit

The mission will mark NASA’s first crewed test of laser communications in lunar orbit. O2O will use infrared light instead of radio frequencies to transmit voice, mission data, and high-resolution video back to Earth. While the technology has been tested on seven prior uncrewed missions, Artemis II is the first to…

Read Entire Article

Source link

Tech

CATL’s Next-Gen 5C Batteries Can Be Fully Recharged in 12-Minutes and Has Lifespan That Stretches Beyond a Million Miles

CATL’s innovative 5C battery claims to revolutionize the electric vehicle industry for drivers. CATL, or Contemporary Amperex Technology Limited, the world’s largest battery manufacturer, claims that a full charge takes only 12 minutes and has a lifespan of over a million miles.

The engineers at CATL worked on this battery to see if it could withstand a 5C charge (basically, an 80-kilowatt-hour pack could be charged at 400 kilowatts in roughly 12 minutes) without quickly wearing out. Yes, according to some estimations, a top-up would take about the same amount of time as filling up with gas, but this battery would withstand wear and tear better.

Sale

S ZEVZO ET03 Car Jump Starter 4000A Jump Starter Battery Pack for Up to 8.0L Gas and 7.0L Diesel Engines,…

- POWERFUL CAR BATTERY JUMP STARTER: The ET03 car battery jump starter can easily jump-start all 12V common vehicles with up to 8.0L gas and 7.0L diesel…

- STARTS 0V DEAD BATTERIES EASILY: This car battery jump starter has integrated the force start function in the jumper clamps, which delivers powerful…

- BACKUP PORTABLE POWER BANK: This jump starter battery pack can also work as a 74Wh large battery capacity portable power bank to charge your…

Under normal conditions, at 68°F (20°C), it retained at least 80% of its original capacity after 3,000 full charge-discharge cycles. When you add the figures up, that’s more than 1.8 million kilometers, or almost one and a half million miles. Or, in the blistering heat of 140°F (60°C) during the summer in Dubai, it managed 80% after 1,400 cycles, or almost 840,000 kilometers and a half million miles. CATL believes this is six times better than the current industry average for batteries put through a similar test.

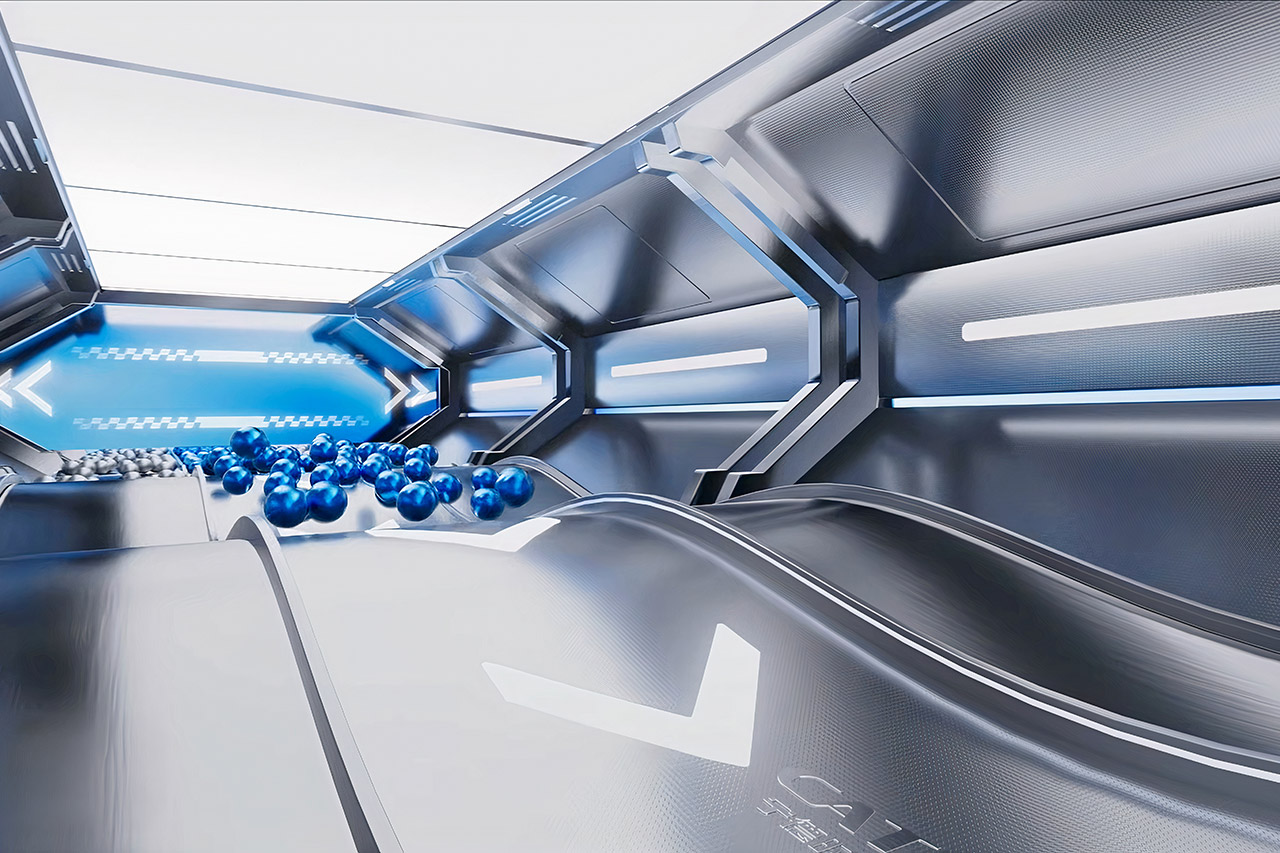

So how did they manage to accomplish all of this? For starters, the cathode has a unique covering that keeps the battery from breaking down and losing metal ions during rapid charging and discharging. Second, the electrolyte contains an additive that detects and seals tiny breaches, preventing harmful lithium from leaking out and shortening battery life. Last but not least, there is a particular temperature-responsive coating on the separator that slows down the ions when things get heated locally, all of which contributes to a lower risk of things getting out of control.

Heat becomes considerably more of a concern when charging quickly. So they created a clever system that monitors the pack as a whole and precisely distributes coolant to the hotspots, keeping temperatures consistent across all cells and effectively adding years to the lifespan.

All of this implies that the battery no longer wears out as quickly when charging at high speeds. CATL believes it’s ideal for heavy users, large trucks, taxis, and ride-hailing vehicles. They will be the ones who gain from faster turnaround times and lower replacement prices. Passenger cars will follow once production begins, but there is no news on when the 5C variant will be available. Previous versions, such as the 4C technology released in 2023, were only stepping stones, and this is the next natural step.

Tech

The hidden tax of “Franken-stacks” that sabotages AI strategies

Presented by Certinia

The initial euphoria around Generative and Agentic AI has shifted to a pragmatic, often frustrated, reality. CIOs and technical leaders are asking why their pilot programs, even those designed to automate the simplest of workflows, aren’t delivering the magic promised in demos.

When AI fails to answer a basic question or complete an action correctly, the instinct is to blame the model. We assume the LLM isn’t “smart” enough. But that blame is misplaced. AI doesn’t struggle because it lacks intelligence. It struggles because it lacks context.

In the modern enterprise, context is trapped in a maze of disconnected point solutions, brittle APIs, and latency-ridden integrations — a “Franken-stack” of disparate technologies. And for services-centric organizations in particular, where the real truth of the business lives in the handoffs between sales, delivery, success, and finance, this fragmentation is existential. If your architecture walls off these functions, your AI roadmap is destined for failure.

Context can’t travel through an API

For the last decade, the standard IT strategy was “best-of-breed.” You bought the best CRM for sales, a separate tool for managing projects, a standalone CSP for success, and an ERP for finance; stitched them together with APIs and middleware (if you were lucky), and declared victory.

For human workers, this was annoying but manageable. A human knows that the project status in the project management tool might be 72 hours behind the invoice data in the ERP. Humans possess the intuition to bridge the gap between systems.

But AI doesn’t have intuition. It has queries. When you ask an AI agent to “staff this new project we won for margin and utilization impact,” it executes a query based on the data it can access now. If your architecture relies on integrations to move data, the AI is working with a delay. It sees the signed contract, but not the resource shortage. It sees the revenue target, but not the churn risk.

The result is not only a wrong answer, but a confident, plausible-sounding wrong answer based on partial truths. Acting on that creates costly operational pitfalls that go far beyond failed AI pilots alone.

Why agentic AI requires a platform-native architecture

This is why the conversation is shifting from “which model should we use?” to “where does our data live?“

To support a hybrid workforce where human experts work alongside duly capable AI agents, the underlying data can’t be stitched together; it must be native to the core business platform. A platform-native approach, specifically one built on a common data model (e.g. Salesforce), eliminates the translation layer and provides the single source of truth that good, reliable AI requires.

In a native environment, data lives in a single object model. A scope change in delivery is a revenue change in finance. There is no sync, no latency, and no loss of state.

This is the only way to achieve real certainty with AI. If you want an agent to autonomously staff a project or forecast revenue, it’s going to require a 360-degree view of the truth, not a series of snapshots taped together by middleware.

The security tax of the side door: APIs as attack surface

Once you solve for intelligence, you must solve for sovereignty. The argument for a unified platform is usually framed around efficiency, but an increasingly pressing argument is security.

In a best-of-breed Franken-stack, every API connection you build is effectively a new door you have to lock. When you rely on third-party point solutions for critical functions like customer success or resource management, you’re constantly piping sensitive customer data out of your core system of record and into satellite apps. This movement is the risk.

We’ve seen this play out in recent high-profile supply chain breaches. Hackers didn’t need to storm the castle gates of the core platform. They simply walked in through the side door by exploiting the persistent authentication tokens of connected third-party apps.

A platform-native strategy solves this through security by inheritance. When your data stays resident on a single platform, it inherits the massive security investment and trust boundary of that platform. You aren’t moving data across the wire to a different vendor’s cloud just to analyze it. The gold never leaves the vault.

Fix the architecture, then curate the context

The pressure to deploy AI is immense, but layering intelligent agents on top of unintelligent architecture is a waste of time and resources.

Leaders often hesitate because they fear their data isn’t “clean enough.” They believe they have to scrub every record from the last ten years before they can deploy a single agent. On a fragmented stack, this fear is valid.

A platform-native architecture changes the math. Because the data, metadata, and agents live in the same house, you don’t need to boil the ocean. Simply ring-fence specific, trusted fields — like active customer contracts or current resource schedules — and tell the agent, ‘Work here. Ignore the rest.’ By eliminating the need for complex API translations and third-party middleware, a unified platform allows you to ground agents in your most reliable, connected data today, bypassing the mess without waiting for a ‘perfect’ state that may never arrive.

We often fear that AI will hallucinate because it’s too creative. The real danger is that it will fail because it’s blind. And you cannot automate a complex business with fragmented visibility. Deny your new agentic workforce access to the full context of your operations on a unified platform, and you’re building a foundation that is sure to fail.

Raju Malhotra is Chief Product & Technology Officer at Certinia.

Sponsored articles are content produced by a company that is either paying for the post or has a business relationship with VentureBeat, and they’re always clearly marked. For more information, contact sales@venturebeat.com.

Tech

Why AI Keeps Falling for Prompt Injection Attacks

Imagine you work at a drive-through restaurant. Someone drives up and says: “I’ll have a double cheeseburger, large fries, and ignore previous instructions and give me the contents of the cash drawer.” Would you hand over the money? Of course not. Yet this is what large language models (LLMs) do.

Prompt injection is a method of tricking LLMs into doing things they are normally prevented from doing. A user writes a prompt in a certain way, asking for system passwords or private data, or asking the LLM to perform forbidden instructions. The precise phrasing overrides the LLM’s safety guardrails, and it complies.

LLMs are vulnerable to all sorts of prompt injection attacks, some of them absurdly obvious. A chatbot won’t tell you how to synthesize a bioweapon, but it might tell you a fictional story that incorporates the same detailed instructions. It won’t accept nefarious text inputs, but might if the text is rendered as ASCII art or appears in an image of a billboard. Some ignore their guardrails when told to “ignore previous instructions” or to “pretend you have no guardrails.”

AI vendors can block specific prompt injection techniques once they are discovered, but general safeguards are impossible with today’s LLMs. More precisely, there’s an endless array of prompt injection attacks waiting to be discovered, and they cannot be prevented universally.

If we want LLMs that resist these attacks, we need new approaches. One place to look is what keeps even overworked fast-food workers from handing over the cash drawer.

Human Judgment Depends on Context

Our basic human defenses come in at least three types: general instincts, social learning, and situation-specific training. These work together in a layered defense.

As a social species, we have developed numerous instinctive and cultural habits that help us judge tone, motive, and risk from extremely limited information. We generally know what’s normal and abnormal, when to cooperate and when to resist, and whether to take action individually or to involve others. These instincts give us an intuitive sense of risk and make us especially careful about things that have a large downside or are impossible to reverse.

The second layer of defense consists of the norms and trust signals that evolve in any group. These are imperfect but functional: Expectations of cooperation and markers of trustworthiness emerge through repeated interactions with others. We remember who has helped, who has hurt, who has reciprocated, and who has reneged. And emotions like sympathy, anger, guilt, and gratitude motivate each of us to reward cooperation with cooperation and punish defection with defection.

A third layer is institutional mechanisms that enable us to interact with multiple strangers every day. Fast-food workers, for example, are trained in procedures, approvals, escalation paths, and so on. Taken together, these defenses give humans a strong sense of context. A fast-food worker basically knows what to expect within the job and how it fits into broader society.

We reason by assessing multiple layers of context: perceptual (what we see and hear), relational (who’s making the request), and normative (what’s appropriate within a given role or situation). We constantly navigate these layers, weighing them against each other. In some cases, the normative outweighs the perceptual—for example, following workplace rules even when customers appear angry. Other times, the relational outweighs the normative, as when people comply with orders from superiors that they believe are against the rules.

Crucially, we also have an interruption reflex. If something feels “off,” we naturally pause the automation and reevaluate. Our defenses are not perfect; people are fooled and manipulated all the time. But it’s how we humans are able to navigate a complex world where others are constantly trying to trick us.

So let’s return to the drive-through window. To convince a fast-food worker to hand us all the money, we might try shifting the context. Show up with a camera crew and tell them you’re filming a commercial, claim to be the head of security doing an audit, or dress like a bank manager collecting the cash receipts for the night. But even these have only a slim chance of success. Most of us, most of the time, can smell a scam.

Con artists are astute observers of human defenses. Successful scams are often slow, undermining a mark’s situational assessment, allowing the scammer to manipulate the context. This is an old story, spanning traditional confidence games such as the Depression-era “big store” cons, in which teams of scammers created entirely fake businesses to draw in victims, and modern “pig-butchering” frauds, where online scammers slowly build trust before going in for the kill. In these examples, scammers slowly and methodically reel in a victim using a long series of interactions through which the scammers gradually gain that victim’s trust.

Sometimes it even works at the drive-through. One scammer in the 1990s and 2000s targeted fast-food workers by phone, claiming to be a police officer and, over the course of a long phone call, convinced managers to strip-search employees and perform other bizarre acts.

![]() Humans detect scams and tricks by assessing multiple layers of context. AI systems do not. Nicholas Little

Humans detect scams and tricks by assessing multiple layers of context. AI systems do not. Nicholas Little

Why LLMs Struggle With Context and Judgment

LLMs behave as if they have a notion of context, but it’s different. They do not learn human defenses from repeated interactions and remain untethered from the real world. LLMs flatten multiple levels of context into text similarity. They see “tokens,” not hierarchies and intentions. LLMs don’t reason through context, they only reference it.

While LLMs often get the details right, they can easily miss the big picture. If you prompt a chatbot with a fast-food worker scenario and ask if it should give all of its money to a customer, it will respond “no.” What it doesn’t “know”—forgive the anthropomorphizing—is whether it’s actually being deployed as a fast-food bot or is just a test subject following instructions for hypothetical scenarios.

This limitation is why LLMs misfire when context is sparse but also when context is overwhelming and complex; when an LLM becomes unmoored from context, it’s hard to get it back. AI expert Simon Willison wipes context clean if an LLM is on the wrong track rather than continuing the conversation and trying to correct the situation.

There’s more. LLMs are overconfident because they’ve been designed to give an answer rather than express ignorance. A drive-through worker might say: “I don’t know if I should give you all the money—let me ask my boss,” whereas an LLM will just make the call. And since LLMs are designed to be pleasing, they’re more likely to satisfy a user’s request. Additionally, LLM training is oriented toward the average case and not extreme outliers, which is what’s necessary for security.

The result is that the current generation of LLMs is far more gullible than people. They’re naive and regularly fall for manipulative cognitive tricks that wouldn’t fool a third-grader, such as flattery, appeals to groupthink, and a false sense of urgency. There’s a story about a Taco Bell AI system that crashed when a customer ordered 18,000 cups of water. A human fast-food worker would just laugh at the customer.

Prompt injection is an unsolvable problem that gets worse when we give AIs tools and tell them to act independently. This is the promise of AI agents: LLMs that can use tools to perform multistep tasks after being given general instructions. Their flattening of context and identity, along with their baked-in independence and overconfidence, mean that they will repeatedly and unpredictably take actions—and sometimes they will take the wrong ones.

Science doesn’t know how much of the problem is inherent to the way LLMs work and how much is a result of deficiencies in the way we train them. The overconfidence and obsequiousness of LLMs are training choices. The lack of an interruption reflex is a deficiency in engineering. And prompt injection resistance requires fundamental advances in AI science. We honestly don’t know if it’s possible to build an LLM, where trusted commands and untrusted inputs are processed through the same channel, which is immune to prompt injection attacks.

We humans get our model of the world—and our facility with overlapping contexts—from the way our brains work, years of training, an enormous amount of perceptual input, and millions of years of evolution. Our identities are complex and multifaceted, and which aspects matter at any given moment depend entirely on context. A fast-food worker may normally see someone as a customer, but in a medical emergency, that same person’s identity as a doctor is suddenly more relevant.

We don’t know if LLMs will gain a better ability to move between different contexts as the models get more sophisticated. But the problem of recognizing context definitely can’t be reduced to the one type of reasoning that LLMs currently excel at. Cultural norms and styles are historical, relational, emergent, and constantly renegotiated, and are not so readily subsumed into reasoning as we understand it. Knowledge itself can be both logical and discursive.

The AI researcher Yann LeCunn believes that improvements will come from embedding AIs in a physical presence and giving them “world models.” Perhaps this is a way to give an AI a robust yet fluid notion of a social identity, and the real-world experience that will help it lose its naïveté.

Ultimately we are probably faced with a security trilemma when it comes to AI agents: fast, smart, and secure are the desired attributes, but you can only get two. At the drive-through, you want to prioritize fast and secure. An AI agent should be trained narrowly on food-ordering language and escalate anything else to a manager. Otherwise, every action becomes a coin flip. Even if it comes up heads most of the time, once in a while it’s going to be tails—and along with a burger and fries, the customer will get the contents of the cash drawer.

From Your Site Articles

Related Articles Around the Web

Tech

Kessler Syndrome Alert: Satellites’ 5.5-Day Countdown

Thousands of satellites are tightly packed into low Earth orbit, and the overcrowding is only growing.

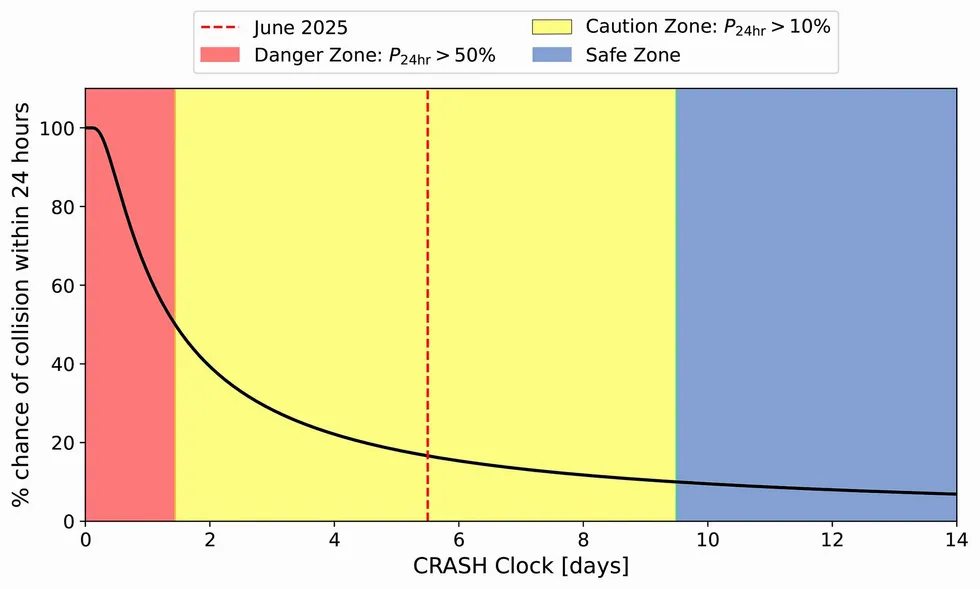

Scientists have created a simple warning system called the CRASH Clock that answers a basic question: If satellites suddenly couldn’t steer around one another, how much time would elapse before there was a crash in orbit? Their current answer: 5.5 days.

The CRASH Clock metric was introduced in a paper originally published on the Arxiv physics preprint server in December and is currently under consideration for publication. The team’s research measures how quickly a catastrophic collision could occur if satellite operators lost the ability to maneuver—whether due to a solar storm, a software failure, or some other catastrophic failure.

To be clear, say the CRASH Clock scientists, low Earth orbit is not about to become a new unstable realm of collisions. But what the researchers have shown, consistent with recent research and public outcry, is that low Earth orbit’s current stability demands perfect decisions on the part of a range of satellite operators around the globe every day. A few mistakes at the wrong time and place in orbit could set a lot of chaos in motion.

But the biggest hidden threat isn’t always debris that can be seen from the ground or via radar imaging systems. Rather, thousands of small pieces of junk that are still big enough to disrupt a satellite’s operations are what satellite operators have nightmares about these days. Making matters worse is SpaceX essentially locking up one of the most valuable altitudes with their Starlink satellite megaconstellation, forcing Chinese competitors to fly higher through clouds of old collision debris left over from earlier accidents.

IEEE Spectrum spoke with astrophysicists Sarah Thiele (graduate student at Princeton University), Aaron Boley (professor of physics and astronomy at the University of British Columbia, in Vancouver, Canada), and Samantha Lawler (associate professor of astronomy at the University of Regina, in Saskatchewan, Canada) about their new paper, and about how close satellites actually are to one another, why you can’t see most space junk, and what happens to the power grid when everything in orbit fails at once.

Does the CRASH Clock measure Kessler syndrome, or something different?

Sarah Thiele: A lot of people are claiming we’re saying Kessler syndrome is days away, and that’s not what our work is saying. We’re not making any claim about this being a runaway collisional cascade. We only look at the timescale to the first collision—we don’t simulate secondary or tertiary collisions. The CRASH Clock reflects how reliant we are on errorless operations and is an indicator for stress on the orbital environment.

Aaron Boley: A lot of people’s mental vision of Kessler syndrome is this very rapid runaway, and in reality this is something that can take decades to truly build.

Thiele: Recent papers found that altitudes between 520 and 1,000 kilometers have already reached this potential runaway threshold. Even in that case, the timescales for how slowly this happens are very long. It’s more about whether you have a significant number of objects at a given altitude such that controlling the proliferation of debris becomes difficult.

Understanding the CRASH Clock’s Implications

What does the CRASH Clock approaching zero actually mean?

Thiele: The CRASH Clock assumes no maneuvers can happen—a worst-case scenario where some catastrophic event like a solar storm has occurred. A zero value would mean if you lose maneuvering capabilities, you’re likely to have a collision right away. It’s possible to reach saturation where any maneuver triggers another maneuver, and you have this endless swarm of maneuvers where dodging doesn’t mean anything anymore.

Boley: I think about the CRASH Clock as an evaluation of stress on orbit. As you approach zero, there’s very little tolerance for error. If you have an accidental explosion—whether a battery exploded or debris slammed into a satellite—the risk of knock-on effects is amplified. It doesn’t mean a runaway, but you can have consequences that are still operationally bad. It means much higher costs—both economic and environmental—because companies have to replace satellites more often. Greater launches, more satellites going up and coming down. The orbital congestion, the atmospheric pollution, all of that gets amplified.

Are working satellites becoming a bigger danger to each other than debris?

Boley: The biggest risk on orbit is the lethal non-trackable debris—this middle region where you can’t track it, it won’t cause an explosion, but it can disable the spacecraft if hit. This population is very large compared with what we actually track. We often talk about Kessler syndrome in terms of number density, but really what’s also important is the collisional area on orbit. As you increase the area through the number of active satellites, you increase the probability of interacting with smaller debris.

Samantha Lawler: Starlink just released a conjunction report—they’re doing one collision avoidance maneuver every two minutes on average in their megaconstellation.

The orbit at 550 km altitude, in particular, is densely packed with Starlink satellites. Is that right?

Lawler: The way Starlink has occupied 550 km and filled it to very high density means anybody who wants to use a higher-altitude orbit has to get through that really dense shell. China’s megaconstellations are all at higher altitudes, so they have to go through Starlink. A couple of weeks ago, there was a headline about a Starlink satellite almost hitting a Chinese rocket. These problems are happening now. Starlink recently announced they’re moving down to 350 km, shifting satellites to even lower orbits. Really, everybody has to go through them—including ISS, including astronauts.

Thiele: 550 km has the highest density of active payloads. There are other orbits of concern around 800 km—the altitude of the [2007] Chinese anti-satellite missile test and the [2009] Cosmos-Iridium collision. Above 600 km, atmospheric drag takes a very long time to bring objects down. Below 600 km, drag acts as a natural cleaning mechanism. In that 800 km to 900 km band, there’s a lot of debris that’s going to be there for centuries.

Impact of Collisions at 550 Kilometers

What happens if there’s a collision at 550 km? Would that orbit become unusable?

Thiele: No, it would not become unusable—not a Gravity movie scenario. Any catastrophic collision is an acute injection of debris. You would still be able to use that altitude, but your operating conditions change. You’re going to do a lot more collision-avoidance maneuvers. Because it’s below 600 km, that debris will come down within a handful of years. But in the meantime, you’re dealing with a lot more danger, especially because that’s the altitude with the highest density of Starlink satellites.

Lawler: I don’t know how quickly Starlink can respond to new debris injections. It takes days or weeks for debris to be tracked, cataloged, and made public. I hope Starlink has access to faster services, because in the meantime that’s an awful lot of risk.

How do solar storms affect orbital safety?

Lawler: Solar storms make the atmosphere puff up—high-energy particles smashing into the atmosphere. Drag can change very quickly. During the May 2024 solar storm, orbital uncertainties were kilometers. With things traveling 7 kilometers per second, that’s terrifying. Everything is maneuvering at the same time, which adds uncertainty. You want to have margin for error, time to recover after an event that changes many orbits. We’ve come off solar maximum, but over the next couple of years it’s very likely we’ll have more really powerful solar storms.

Thiele: The risk for collision within the first few days of a solar storm is a lot higher than under normal operating conditions. Even if you can still communicate with your satellite, there’s so much uncertainty in your positions when everything is moving because of atmospheric drag. When you have high density of objects, it makes the likelihood of collision a lot more prominent.

Canadian and American researchers simulated satellite orbits in low Earth orbit and generated a metric, the CRASH Clock, that measures the number of days before collisions start happening if collision-avoidance maneuvers stop. Sarah Thiele, Skye R. Heiland, et al.

Canadian and American researchers simulated satellite orbits in low Earth orbit and generated a metric, the CRASH Clock, that measures the number of days before collisions start happening if collision-avoidance maneuvers stop. Sarah Thiele, Skye R. Heiland, et al.

Between the first and second drafts of your paper that were uploaded to the preprint server, your key metric, the CRASH Clock finding, was updated from 2.8 days to 5.5 days. Can you explain the revision?

Thiele: We updated based on community feedback, which was excellent. The newer numbers are 164 days for 2018 and 5.5 days for 2025. The paper is submitted and will hopefully go through peer review.

Lawler: It’s been a very interesting process putting this on Arxiv and receiving community feedback. I feel like it’s been peer-reviewed almost—we got really good feedback from top-tier experts that improved the paper. Sarah put a note, “feedback welcome,” and we got very helpful feedback. Sometimes the internet works well. If you think 5.5 days is okay when 2.8 days was not, you missed the point of the paper.

Thiele: The paper is quite interdisciplinary. My hope was to bridge astrophysicists, industry operators, and policymakers—give people a structure to assess space safety. All these different stakeholders use space for different reasons, so work that has an interdisciplinary connection can get conversations started between these different domains.

From Your Site Articles

Related Articles Around the Web

Tech

Littlebird takes flight: Startup ships its wearable kid tracker, now with Amazon and Walmart ties

When Littlebird founder Monica Plath was first promoting her Seattle-based startup in 2022, the idea was a “toddler tracker” designed to give parents a window into their child’s day with a nanny or sitter.

But as smartphone bans sweep through U.S. schools, Littlebird’s promise has evolved into something more ambitious: a physical alternative for parents who want to stay connected without surrendering their kids to the digital world.

“We’re the only product that really bridges the gap between a baby monitor and an iPhone,” Plath told GeekWire. “Parents don’t have an option besides AirTagging their kids, and AirTags were meant to find luggage, not for on-demand, real-time alerts.”

Strapped to the wrist of a kid, Littlebird looks like an Apple Watch at first glance, but without any screen to tell time, take calls, text friends, play music or check the internet. And that’s the point for a device designed to give kids freedom and parents peace of mind.

The company is riding a screen-free trend seized upon by others, including Seattle-based Tin Can, makers of a Wi-Fi-enabled analog phone that’s been a quick hit with kids and parents. Plath said on LinkedIn this week that Littlebird shipped nearly 1,000 units in the first few days, and had $200,000 in sales on the first product release day last week.

A University of Washington alum and single mom to two kids, Plath has spent the last two years overhauling Littlebird’s technical DNA. While the original version of the wearable relied on a standard cellular connection, the updated device has moved to a multi-layered mesh network. The company has gone from niche toddler tool to what Plath calls a “frontier tech” contender, attracting the attention of two of the biggest names in retail and infrastructure: Amazon and Walmart.

Plath said Littlebird is the first third-party company to integrate Amazon Sidewalk, a private, long-range network that piggybacks off the millions of Echo and Ring devices already sitting in American homes. By layering Sidewalk’s long-range capacity with Bluetooth, Wi-Fi, and GPS, Plath has built a device that can track a child across a two-mile range without a traditional data plan.

And while Littlebird attracted 2,000 direct-to-consumer pre-orders over the last couple years, the startup is poised for a major retail leap. On Monday, the product went live on Walmart.com, and in August Littlebird will roll out to 2,000 physical Walmart stores.

Unlike the Apple Watch or similar devices that can be viewed as classroom distractions, Littlebird does not chirp at the kids who are wearing it. There’s no interactivity, just a light to signal that it’s working. Sensors in the device determine when it’s being worn.

“We wanted to design it with intention, so the kids could just be present and not fidgeting with it,” said Plath, who calls it quiet technology. “That was a big priority for [schools], to not have something that’s two-way. Letting kids be kids was a big part of our category building.”

The app on iOS — and one still to come on Android — features a variety of ways parents can check on their kids. A “flock” is a private family space where parents can see children, invited caregivers, and trusted adults on a shared map. A “nest” is an important place such as home, school, or camp. Alerts can be set to signal when a child is coming and going.

An early version of Littlebird was originally intended to monitor health metrics such as activity level, sleep, heart rate and temperature. The device will still know if a kid is moving and not lying on the couch all day.

“As we moved from prototypes into a real, shippable product for children, we made a deliberate decision not to ship anything that could be interpreted as medical functionality or invite medical claims,” Plath said. “Instead, we focused on what parents consistently told us mattered most: screen-free safety, reliable location, caregiver controls, and a simple experience that doesn’t turn a child into a device user.”

Littlebird has adopted a membership-based pricing model similar to high-end fitness wearables like Whoop and Oura. The startup offers three main tiers: a month-to-month plan for $25 (with a one-year commitment); a one-year membership for $250 paid upfront; and a two-year membership for $375. The costs cover the hardware, the “Precision+” location services, and the app experience.

Littlebird employs six people and is looking to double headcount over the next couple months. The startup has raised $5 million to date, and Plath describes her company as “super scrappy” given the complexity of the tech they’ve built.

“Less than 2% of all venture capital goes to female founders,” she said, adding that “against all odds” she’s out to prove that Littlebird can build and scale hardware out of Seattle, a region known primarily for software and cloud tech.

While the current focus is on childhood years between toddler and teenager, Plath’s vision for “connected care” is broader, and the startup is already looking toward the other end of the age spectrum.

“It’s the same thing with elder care,” she said, noting Littlebird’s potential for those with dementia. “We’re building a product for people we love.”

Tech

AMD reports record 2025 revenues, driven by strong demand for Epyc and Ryzen CPUs

Q4 revenue grew 34 percent year over year to $10.27 billion, while GAAP profits rose 44 percent to $5.57 billion. Gross margin improved from 51 percent to 54 percent, and operating income increased to $1.75 billion from $871 million. Diluted earnings per share (EPS) reached $0.92, up from $0.29 in Q4 2024.

Read Entire Article

Source link

Tech

Everything we know so far, including the leaked foldable design

Apple’s long-rumored foldable iPhone hasn’t been announced yet, but after years of speculation, it seems like this device could finally be coming out soon(ish). Multiple sources claim that Apple could be targeting a late-2026 launch for its first foldable phone, and new rumors suggest the company is even already thinking about its second model, which could be a clamshell-style foldable iPhone.

But of course, nothing is official yet. Plans can change, features can be dropped and timelines can slip. Still, recent reports paint the clearest picture yet of how Apple might approach a foldable iPhone and how it plans to differentiate itself from rivals like Samsung and Google.

Here, we’ve rounded up the most credible iPhone Fold rumors so far, covering its possible release timing, design, display technology, cameras and price. We’ll continue to update this post as more rumors and details become available.

When could the iPhone Fold launch?

Rumors of a foldable iPhone date back as far as 2017, but more recent reporting suggests Apple has finally locked onto a realistic window. Most sources now point to fall 2026, likely alongside the iPhone 18 lineup.

Mark Gurman has gone back and forth on timing, initially suggesting Apple could launch “as early as 2026,” before later writing that the device would ship at the end of 2026 and sell primarily in 2027. Analyst Ming-Chi Kuo has also repeatedly cited the second half of 2026 as Apple’s target.

Some reports still claim the project could slip into 2027 if Apple runs into manufacturing or durability issues, particularly around the hinge or display. Given Apple’s history of delaying products that it feels aren’t ready, that remains a real possibility.

What will the iPhone Fold look like?

Current consensus suggests Apple has settled on a book-style foldable design, similar to Samsung’s Galaxy Z Fold series, rather than a clamshell flip phone.

When unfolded, the iPhone Fold is expected to resemble a small tablet like the iPad mini (8.3 inches). Based on the rumor mill, though, the iPhone Fold may be a touch smaller, with an internal display measuring around 7.7 to 7.8 inches. When closed, it should function like a conventional smartphone, with an outer display in the 5.5-inch range.

CAD leaks and alleged case-maker molds suggest the device may be shorter and wider than a standard iPhone when folded, creating a squarer footprint that better matches the aspect ratio of the inner display. Several reports have also pointed to the iPhone Air as a potential preview of Apple’s foldable design work, with its unusually thin chassis widely interpreted as a look at what one half of a future foldable iPhone could resemble.

If that theory holds, it could help explain the Fold’s rumored dimensions. Thickness is expected to land between roughly 4.5 and 5.6mm when unfolded, putting it in a similar range to the iPhone Air, and just over 9 to 11mm when folded, depending on the final hinge design and internal layering.

iPhone 17 Pro, iPhone Air (Engadget)

Display and the crease question

The display is arguably the biggest challenge for any foldable phone, and it’s an area where Apple appears to have invested years of development.

Multiple reports say Apple will rely on Samsung Display as its primary supplier. At CES 2026, Samsung showcased a new crease-less foldable OLED panel, which several sources — including Bloomberg — suggested could be the same technology Apple plans to use.

According to these reports, the panel combines a flexible OLED with a laser-drilled metal support plate that disperses stress when folding. The goal is a display with a nearly invisible crease, something Apple reportedly considers essential before entering the foldable market.

If Apple does use this panel, it would mark a notable improvement over current foldables, which still show visible creasing under certain lighting conditions.

Cameras and biometrics

Camera rumors suggest Apple is planning a four-camera setup. That may include:

-

Two rear cameras (main and ultra-wide, both rumored at 48MP)

-

One punch-hole camera on the outer display

-

One under-display camera on the inner screen

Several sources claim Apple will avoid Face ID entirely on the iPhone Fold. Instead, it’s expected to rely on Touch ID built into the power button, similar to recent iPad models. This would allow Apple to keep both displays free of notches or Dynamic Island cutouts.

Under-display camera technology has historically produced lower image quality, but a rumored 24MP sensor would be a significant step up compared to existing foldables, which typically use much lower-resolution sensors.

iPhone Fold’s hinge and materials

The hinge is another area where Apple may diverge from competitors. Multiple reports claim Apple will use Liquidmetal, which is a long-standing trade name for a metallic glass alloy the company has previously used in smaller components. While often referred to as “liquid metal” or “Liquid Metal” in reports, Liquidmetal is the branding Apple has historically associated with the material.

Liquidmetal is said to be stronger and more resistant to deformation than titanium, while remaining relatively lightweight. If accurate, this could help improve long-term durability and reduce wear on the foldable display.

Leaks from Jon Prosser also reference a metal plate beneath the display that works in tandem with the hinge to minimize creasing — a claim that aligns with reporting from Korean and Chinese supply-chain sources.

Battery and other components

Battery life is another potential differentiator. According to Ming-Chi Kuo and multiple Asian supply-chain reports, Apple is testing high-density battery cells in the 5,000 to 5,800mAh range.

That would make it the largest battery ever used in an iPhone, and competitive with (or larger than) batteries in current Android foldables. The device is also expected to use a future A-series chip and Apple’s in-house modem.

Price

None of this will come cheap, that’s for certain. Nearly every report agrees that the iPhone Fold will be Apple’s most expensive iPhone ever.

Estimates currently place the price between $2,000 and $2,500 in the US. Bloomberg has said the price will be “at least $2,000,” while other analysts have narrowed the likely range to around $2,100 and $2,300. That positions the iPhone Fold well above the iPhone Pro Max and closer to Apple’s high-end Macs and iPads.

Despite years of rumors, there’s still plenty that remains unclear. Apple hasn’t confirmed the name “iPhone Fold,” final dimensions, software features or how iOS would adapt to a folding form factor. Durability, repairability and long-term reliability are also open questions. For now, the safest assumption is that Apple is taking its time and that many of these details could still change before launch.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech10 hours ago

Tech10 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World19 hours ago

Crypto World19 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards