Entertainment

Kandi Burruss and Todd Tucker Reunite One Day After Announcing Split

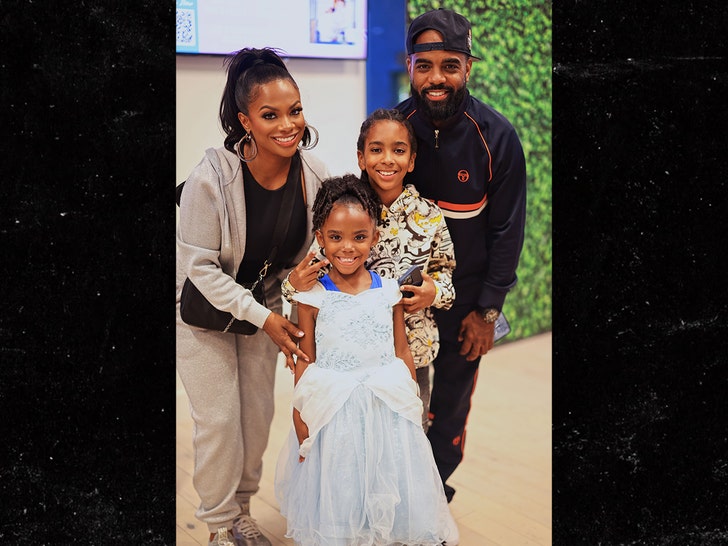

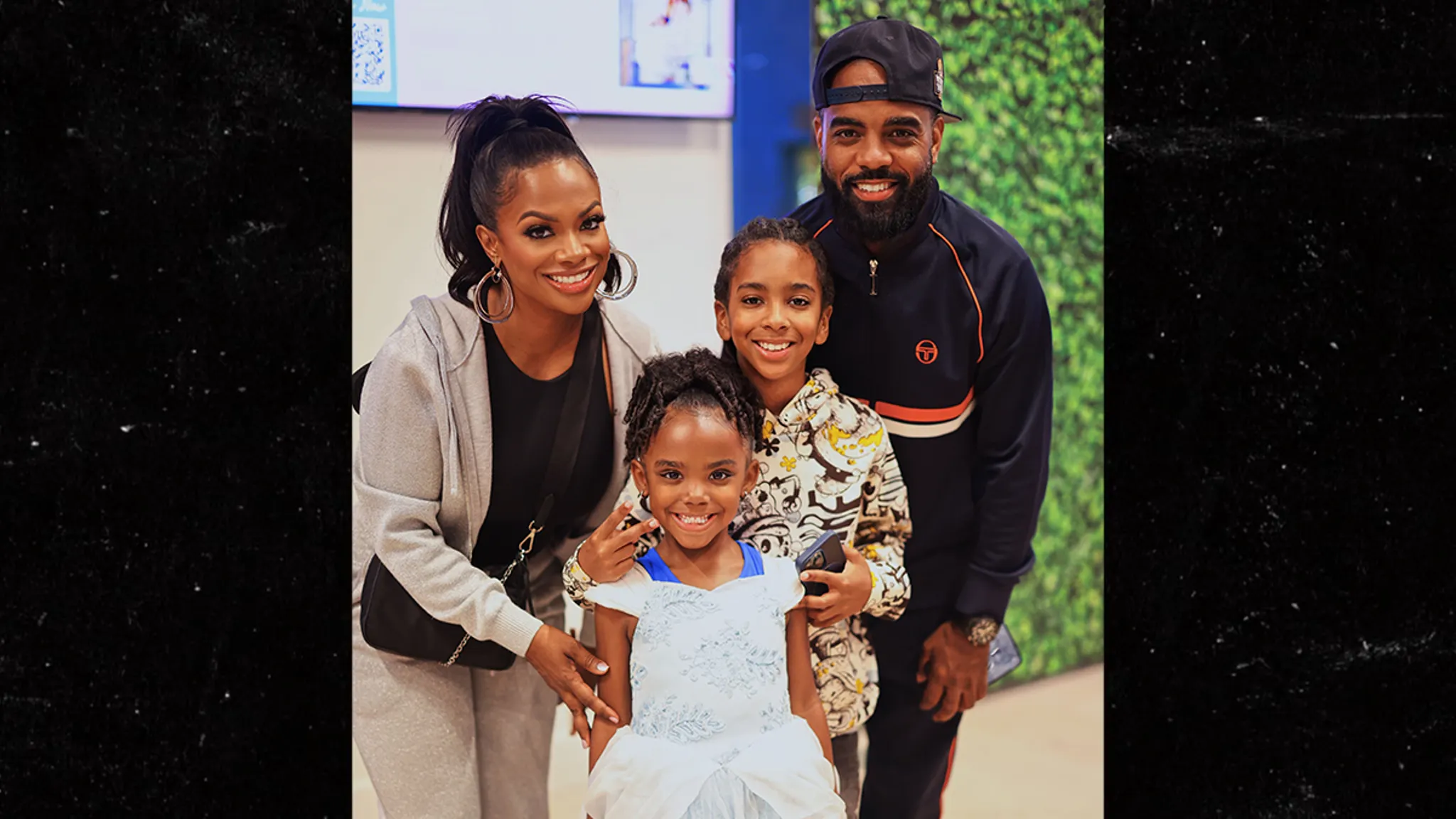

Kandi Burruss & Todd Tucker

United Front At Daughter’s Birthday Amid Split

Published

|

Updated

Kandi Burruss and Todd Tucker aren’t letting their breakup get in the way of family time.

Just one day after confirming their split, “The Real Housewives of Atlanta” star and her estranged husband reunited in Atlanta to celebrate their daughter Blaze‘s 6th birthday.

The former couple threw a Snow White themed party at Ready, Set FUN! and in photos we obtained the pair is smiling alongside Blaze, who looked like a real-life princess in her gown. Despite the emotional week, both parents appeared united for their little girl’s big day.

Waiting for your permission to load the Instagram Media.

Burruss and Tucker each shared separate Instagram tributes. “Happy birthday to my little twin @blazetucker!!!” Kandi wrote. “So strong, smart, talented, creative, big personality, & a winner! My beautiful little princess.” Todd added, “Happy Birthday to my Baby Blaze! She warms my heart every time I see her … Daddy loves you with all his heart!”

Waiting for your permission to load the Instagram Media.

The celebration came just 24 hours after Burruss confirmed to TMZ that she’s separated from Todd after 11 years of marriage. “After deep thought and a lot of prayer, I’ve made the decision to move forward with a divorce,” she said. “My focus remains on protecting my peace and co-parenting with love and respect.”

As we reported … sources told us the couple’s been separated for a few months and the split is amicable, with “legitimately no drama.” Kandi’s been spending time in New York City for work while Todd’s stayed in Atlanta with the kids.

The pair first met on “RHOA” in 2011, got engaged three years later, and tied the knot in 2014.