CryptoCurrency

Stablecoin Payment Gateway in 2026: Faster Settlement, Lower Costs

Slow settlement is one of those problems businesses tolerate for years, until it starts quietly choking growth. Payments may look “successful” at checkout. Still, the real story begins after that, when funds take days to become available, payouts get delayed, reconciliation turns into a manual grind, and cross-border collections feel unpredictable.

In 2026, this is no longer a minor operational issue. It is a cashflow problem, a margin problem, and a scalability problem. That is exactly why stablecoins are moving beyond trading and becoming a serious settlement rail for modern businesses. In this guide, you will learn how a stablecoin payment gateway works, why it fixes settlement delays at the infrastructure level, and what features matter if you want a system that is secure, scalable, and ready for real-world payment operations.

Why Slow Settlement Is Breaking Modern Payment Operations

Slow settlement is no longer a backend inconvenience. It is a measurable business bottleneck. Traditional payment rails can take 1 to 5 business days to settle funds because they rely on intermediaries, batch processing, and banking cut-off times. Stripe also highlights that stablecoins can offer faster settlement compared to traditional payment systems. Stablecoin rails solve this by enabling settlement in minutes or seconds on-chain, with 24/7 availability that does not pause for weekends or holidays. This is why more businesses are exploring a production-ready, stablecoin payment gateway to improve cash flow predictability and reduce operational friction.

Adoption is not small anymore. Did you know? “In 2025, stablecoin transaction volume hit a record $33 trillion, led by USDC.” In parallel, the stablecoin market had reached a total circulation of nearly $300 billion by late 2025, driven primarily by USDT and USDC. This shift is also being validated by major payment networks. Visa has piloted settlement using USDC to support faster settlement and extended settlement hours. That signals stablecoin settlement is moving closer to mainstream payment infrastructure. For businesses building a full stablecoin payment platform, the advantage is clear: faster settlement, better treasury control, and cleaner reconciliation. A robust build ties together confirmation, treasury routing, and reporting into a scalable, stablecoin payment system.

What is a Stablecoin Payment Gateway?

A stablecoin payment gateway is a payment infrastructure that helps businesses accept stablecoin payments like USDT and USDC, verify transactions on-chain, and settle funds faster with automated routing and reporting. It connects your checkout or invoice flow to blockchain-based payment confirmation, so transactions can be tracked and completed without manual follow-ups.

It also supports merchant-ready features like payment links, webhooks, and settlement dashboards, making stablecoin payments easier to operate at scale. In simple terms, it works like a modern checkout system, backed by blockchain confirmation and stablecoin settlement rails.

Who Needs a Stablecoin Payment Gateway in 2026?

In 2026, stablecoin payments are becoming a practical settlement strategy for businesses that want faster cash flow, smoother cross-border collections, and more control over payouts. A production-ready stablecoin payment gateway helps teams move from delayed settlement cycles to real-time payment confirmation and faster fund availability.

1) Merchants and global eCommerce businesses

If you sell internationally, you often deal with:

- High payment processing fees

- Card declines and failed transactions

- Delayed settlement cycles

- Chargeback exposure

Stablecoins help you accept value globally and settle faster, without waiting on traditional banking timelines. For merchants, this works best when integrated through a unified stablecoin payment platform that supports checkout, confirmation, and settlement reporting in one flow.

2) Fintech Products Building modern Payment Flows

If you are building:

- Neobanking applications

- Remittance and cross-border payment products

- Payout systems for vendors or users

- Embedded finance experiences

Stablecoin settlement can reduce delays and improve cost efficiency, especially when moving funds across regions. With the right stablecoin payment platform development, fintech teams can automate settlement routing, payouts, and transaction monitoring without rebuilding the stack repeatedly.

3) Marketplaces & Platforms Handling Multi-Party Payouts

If your platform pays multiple participants like creators, vendors, or partners, you need:

- Split payments

- Automated payout logic

- Transparent reconciliation and reporting

Stablecoins make settlement programmable, traceable, and scalable across large transaction volumes. A well-designed Stablecoin payment system also makes it easier to manage payouts, track balances, and maintain clean financial records.

4) Web3-Native Products

If your users already hold stablecoins inside wallets, exchanges, or dApps, you can unlock new payment flows like:

- Subscription payments

- Merchant checkout

- Instant payouts

- On-chain billing

That is where a payment gateway becomes revenue infrastructure, not just a payment option.

How a Stablecoin Payment Gateway Works?

Here’s the practical flow:

Step 1: Customer chooses a stablecoin payment

They select USDT or USDC at checkout or via an invoice link.

Step 2: Gateway generates a payment request

A unique wallet address or payment intent is created with the exact amount and an expiration window.

Step 3: Customer sends the payment

The customer pays from a wallet, exchange account, or custodial app.

Step 4: On-chain confirmation

The system verifies payment status using blockchain events and confirmation logic.

Step 5: Settlement and routing

Funds settle to the merchant wallet, treasury wallet, or payout module based on configured rules.

Step 6: Post-payment automation

Webhooks trigger order confirmation, service activation, or delivery workflows.

This is where a stablecoin payment system becomes more than a payment button. It becomes settlement automation.

Explore a stablecoin settlement upgrade for your business.

Core Features Your Stablecoin Payment Gateway Must Include in 2026

If you are pitching or building this for serious buyers, generic features will not convert. Your ICP wants outcomes like faster settlement, lower ops overhead, better treasury control, and compliance readiness. That means the feature set must look enterprise-grade, even if you launch an MVP first. A well-designed stablecoin payment gateway is not just a payment option. It is a complete transaction and settlement layer built for scale.

1) Merchant Readiness & Checkout Conversion

This is what merchants, platforms, and product teams care about first. If checkout is not smooth, adoption fails.

- API-first checkout integration with a hosted checkout option

- Payment links and invoice payments for B2B collections

- Auto payment confirmation with clear success and failure states

- Multi-merchant and multi-store onboarding with role controls

- Refund workflows with approval-based controls

- Webhooks for real-time order confirmation and service activation

- Merchant dashboard with transaction status, settlement view, and reconciliation exports.

2) Settlement Speed & Treasury Control

Businesses need predictable settlement timelines, clear treasury visibility, and full control over how funds move across wallets, chains, and payout routes.

- Multi-chain settlement support based on target corridors

- Stablecoin support for USDT and USDC, with optional custom stablecoin rails

- Confirmation logic using chain finality thresholds and safety buffers

- Automated settlement routing rules (merchant wallet, treasury wallet, payout wallet)

- Hot wallet and cold wallet treasury strategy for secure operations

- Gas fee estimation, batching, and retry logic to reduce failed settlements

- Payout orchestration for merchants, vendors, creators, and partners

3) Platform-Grade Security & Operational Governance

Enterprises and fintechs will not move money through a system that lacks governance. Security is not optional in 2026.

- Role-based access control with granular permissions

- Key management options, including MPC or HSM integrations

- Transaction monitoring with alerts for unusual flows

- Rate limiting and abuse prevention for APIs and checkout endpoints

- Audit logs for admin actions, wallet actions, and settlement events

- Approval workflows for high-value transfers and treasury moves

4) Compliance, Risk Scoring, & Finance Reporting

This layer separates enterprise-grade infrastructure from basic crypto tooling.

- KYB and KYC modules aligned to jurisdiction and use case

- AML transaction screening integrations for risk reduction

- Sanctions screening and configurable policy rules, if required

- Wallet risk scoring to flag suspicious addresses and patterns

- Finance-ready reporting exports for reconciliation and audit trails

- Dispute and exception handling workflows for ops teams

This is what makes a full stablecoin payment platform credible for merchants, fintechs, and enterprise payment teams. It becomes a scalable payment product with settlement control, not just a wallet address generator.

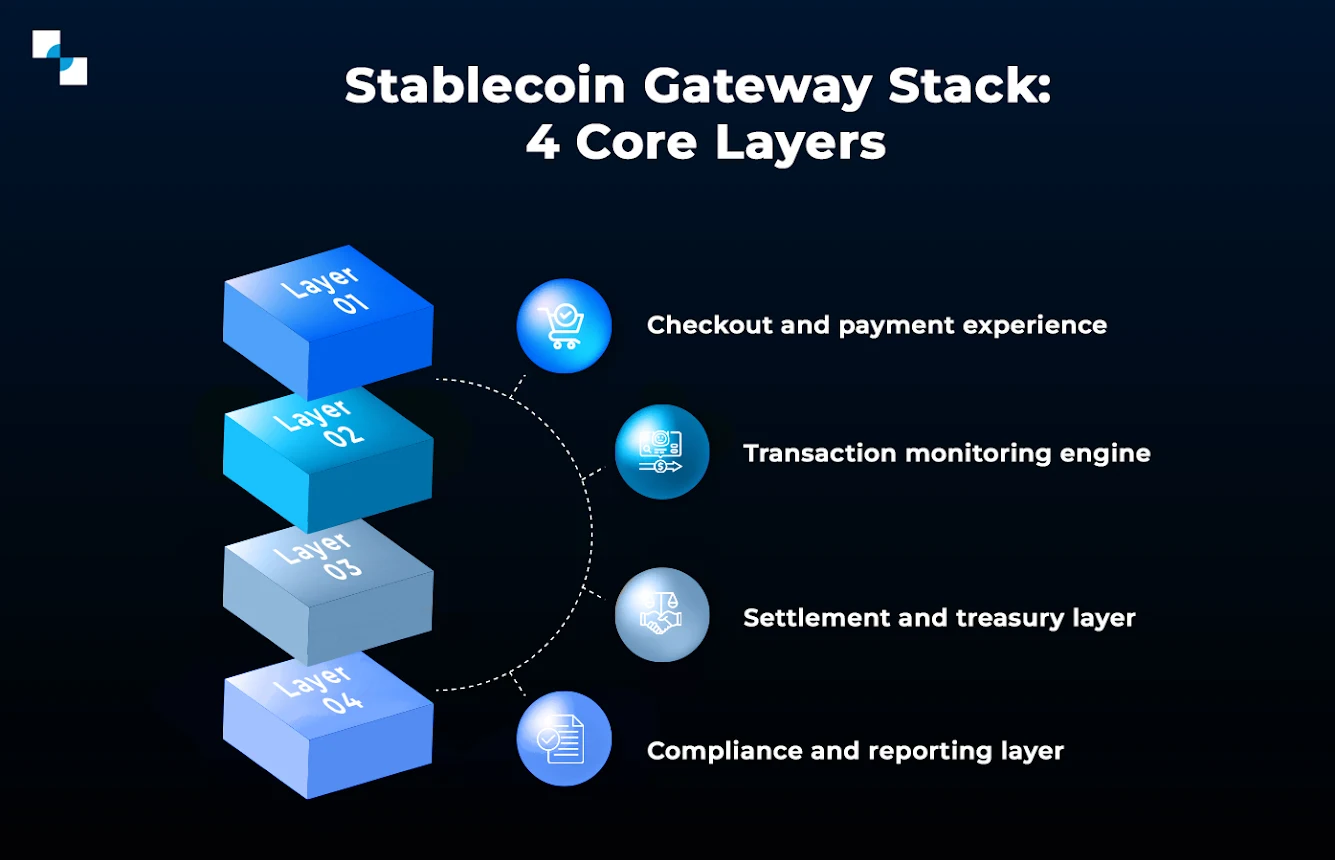

Architecture: What You Are Really Building

Most decision-makers want a clear picture of what sits behind a stablecoin gateway. The easiest way to explain it is in layers. Each layer has a specific job, and together they deliver fast payments, reliable confirmation, and clean settlement. When built correctly, this becomes a scalable, stablecoin payment gateway that works across merchants, regions, and high-volume transaction flows.

Layer 1: Checkout and payment experience

This layer handles how customers pay and how merchants collect payments.

- Hosted checkout and SDK

- QR payments

- Invoice generator

- Payment intent creation

Layer 2: Transaction monitoring engine

This layer confirms payments by tracking blockchain events and updating payment status in real time. It ensures merchants can automatically trigger order confirmation once funds are received, without manual checks. In production, this layer becomes the foundation of a reliable, stablecoin payment platform that supports automation and scale.

- Blockchain listeners and indexing

- Confirmation logic

- Payment status resolver

- Webhook dispatcher

Layer 3: Settlement and treasury layer

This layer manages where funds go after confirmation. It controls settlement routing, treasury visibility, and payout execution based on business rules. For enterprises and platforms, this is where payment operations become a product, not just a feature. It is also a key part of scalable stablecoin payment platform development for multi-chain settlement and payout workflows.

- Wallet management

- Liquidity routing

- Payout orchestration

- Multi-chain treasury dashboard

Layer 4: Compliance and reporting layer

This layer adds governance and audit readiness. It helps teams monitor transactions, manage risk, and generate reporting that finance teams can reconcile easily. Without this layer, scaling becomes difficult. With it, your gateway behaves like a structured stablecoin payment system that supports real-world operations.

- AML and monitoring integrations

- Risk engine

- Logs and reconciliation exports

- Admin controls

Want to launch a stablecoin payment gateway in 2026?

Use cases that Show Real ROI

This section proves where stablecoin rails create measurable business value, not just technical upgrades.

- Use case 1: Global SaaS subscriptions.

Accept USDC for recurring billing, settle faster, and reduce card failures in international markets using a stablecoin.

- Use case 2: Cross-border payouts for vendors and partners.

Send payouts in stablecoins within minutes instead of waiting on international transfers through a scalable stablecoin payment gateway.

- Use case 3: Digital products and high-risk categories.

Reduce chargeback exposure, improve payment finality, and stabilize cash flow with a reliable payment system.

- Use case 4: Marketplace split payments.

Route settlement across multiple recipients automatically with transparent tracking.

How to Choose the Right Chain for Stablecoin Payments

Choosing the right blockchain is not about hype. It is about matching settlement speed, fees, liquidity, and wallet adoption to your payment model.

| Chain | Main Benefit | Best For |

|---|---|---|

| Ethereum | Highest security + liquidity | Enterprise settlement, large payments |

| Tron | Lowest fees, huge USDT usage | High-volume USDT payments |

| Solana | Fast finality, low cost | Real-time merchant payments |

| Polygon | Low fees + EVM compatibility | Scalable checkout integrations |

| Arbitrum | Low fees with the Ethereum ecosystem | EVM payments at scale |

| Optimism | Efficient, low-cost settlement | Consumer payment apps |

| Base | Low fees, fast-growing adoption | New payment products on EVM |

| BNB Chain | Fast + low fees | Mass-market transfers |

| Avalanche | Fast finality + EVM support | Cross-border settlement apps |

| Stellar | Payment-focused design | Remittances, simple transfers |

| XRPL | Fast, low-cost transfers | Institutional-style settlement |

| Algorand | Fast finality, low fees | High-speed payment rails |

That is why most businesses go multi-chain, so they can reduce operational risk, improve reach, and keep settlement reliable across regions with a scalable, stablecoin payment platform.

Conclusion

In 2026, the biggest payment advantage is not checkout speed. It is the settlement speed. If funds are still taking days to arrive, cash flow planning becomes harder, payouts slow down, and reconciliation stays manual. That is not scalable. A stablecoin payment gateway fixes this at the infrastructure level by enabling faster settlement, automated confirmations, and programmable routing across wallets and payout flows. For teams ready to modernize their payment stack, the smartest move is to build with a partner that understands compliance, security, and production-grade deployment.

Antier helps businesses launch stablecoin payment infrastructure with the right architecture, controls, and integration readiness. Talk to Antier’s experts today and get a complete gateway roadmap for your product.

Frequently Asked Questions

01. What is slow settlement and why is it a problem for businesses?

Slow settlement refers to the delay in funds becoming available after a payment is made, which can take 1 to 5 business days due to traditional payment systems. This creates cash flow issues, operational bottlenecks, and hinders business growth.

02. How do stablecoins improve payment settlement times?

Stablecoins enable on-chain settlement in minutes or seconds, offering 24/7 availability without interruptions, which significantly reduces the delays associated with traditional payment systems.

03. What are the benefits of using a stablecoin payment gateway for businesses?

A stablecoin payment gateway provides faster settlement, better treasury control, and cleaner reconciliation, making it a scalable solution for modern payment operations.