Money

Another big bank brings back £175 free cash offer just in time for Christmas – and £50 interest-free overdraft

A MAJOR bank has announced it’s offering free cash for switching accounts just in time to give your balance a boost for Christmas.

It’s also giving account holders a £50 interest-free overdraft buffer to ease burden at what can be an expensive time.

Nationwide Building Society has launched a new offer of £175 to switch to its FlexDirect, FlexPlus or FlexAccount current accounts.

In order to get the free money, you must switch through the Current Account Switch Service (CASS).

Banks often offer incentives like free cash to attract new customers.

Until recently several bank switch bonuses were up for grabs, but were pulled in the past few weeks.

But that could be set to change as Nationwide is the second bank to bring one back.

Rachel Springall, a finance expert at Moneyfacts Compare, said: “The £175 free-cash perk is a joint-market leading sum with First Direct, so it will be interesting to see if any other providers launch a switching incentive to compete for business in the weeks ahead.

“The FlexDirect (account) will pay up to £5 per month in cashback, but this is not diluted by any account management fee, which is a plus.”

The lender is also set to launch a £50 interest-free overdraft buffer in November, with the exact date to be confirmed closer to the time.

The buffer will apply to overdrafts on the lender’s three main current accounts, which are the FlexPlus, FlexDirect and the FlexAccount.

It’s worth noting that the FlexPlus account does charge a monthly fee in return for benefits such as insurance and breakdown cover.

Springall says Nationwide’s £50 interest-free buffer could also be useful to some people as the Christmas shopping season draws nearer.

She says: “This safety net can make a difference for those who might overspend by a small amount.”

Springall suggested that, in general, current account holders should weigh up the benefits they use as well as the charges for using their account “to see if it’s working hard enough”.

The FlexDirect account gives the holder 5% credit interest on balances up to £1,500 for the first 12 months.

This account also offers an interest-free overdraft for the first 12 months.

Those who open a new FlexDirect account will still get the 5% credit interest rate, and will also receive 1% cashback for the first 12 months on debit card purchases, capped at £5 per month.

For new FlexDirect account openings, the previous interest-free overdraft offer will be withdrawn.

But if you are an existing customer who is benefiting from an interest-free overdraft offer then don’t worry, this will continue until the end of their 12-month period.

We’ve asked Nationwide if there’s a minimum amount you need to pay in to the accounts to qualify for the bonus and will update when we hear back.

While the £175 might look enticing, it is important to consider all aspects of a bank account when planning to change.

So for starters, it is important to look at what fees and charges are associated with an account.

There is no account fee on the FlexDirect or FlexAccount current accounts.

The FlexPlus account fee is currently £13, it will increase to £18 per month from December.

You should consider account opening fees, transaction fees, monthly maintenance fees, any overdraft changes and fees if you plan on spending abroad.

Account management, in terms of your preference for online or in a branch, and eligibility criteria, such as a good credit score, should also be looked at.

Finally incentives and mobile banking are two more important considerations when choosing whether to change accounts.

How to switch bank accounts?

Switching bank accounts in the UK, in the vast majority of cases, can be done using the CASS to move your money and close your old account.

The first step to setting up a new account is done by contacting your chosen bank or building society to open an account.

This can be done by applying online, in branch, by phone, or via the lender’s app.

Step two involves your chosen lender checking your eligibility for an account, and to switch using the CASS.

Following this, you need to select the date you want your old account to close and your new account to open.

You will be required to provide information about yourself and your finances, and present a form of photo ID.

The bank will check your credit report to verify your identity and assess the risk of lending money to you.

Lastly, it is just a case of counting down the days until the switch is complete, with the minimum being seven working days.

What other banks are offering bonus switches?

Right now, options are quite limited with only one other major lender offering incentives to switch.

But don’t fret, lenders often introduce these incentives from time to time, so simply stay on the lookout if you have a particular bank or building society you want to switch to.

FirstDirect are currently offering £175 to customers who choose to make the switch.

To be eligible for the bonus you cannot have had any account with First Direct in the past, and you can’t have opened a current account with HSBC since January 2018.

If this is you, then all you need to do is open the account in app, and switch in an account from a different bank including two direct debits or standing orders within 45 days.

You will also need to pay in £1,000 and make five or more debit card payments within 45 days.

The £175 is paid by the 20th of the following month after you meet the switch bonus criteria.

What is an overdraft and how does it work?

The ins and outs of an overdraft are simple enough to understand, for starters there are two types.

These are arranged and unarranged. An arranged overdraft is a pre-arranged limit that you agree with your bank, while an unarranged overdraft occurs when you go overdrawn without an arranged overdraft.

You will usually be charged interest for using an overdraft, but some providers offer an interest-free amount. This is common with student accounts.

If you manage an arranged overdraft well it is unlikely to have any impact on your credit score.

But, if you do not pay it off regularly, have payments declined, or use the unarranged overdraft, it is likely to have a negative impact.

You should also know that if you do not pay your overdraft off in time, your bank may turn your account over to a collection agency.

Money

Map reveals nine best places to live where salaries are higher than living costs and you can save £1,000 a month

SAVING money for a rainy day or big purchase is no easy feat at the best of times, let alone when you’re battling against soaring bills with stagnant wages.

By the time food and household costs are met, many of us have barely anything left at the end of the month to save

However, if you can bring your earnings up and the cost of living down, you will start to increase your disposable income which can be used for savings.

It sounds easier said than done, but the cash you earn each month, as well as living costs are heavily influenced by where in the UK you live.

It means that if you choose your location wisely you can start to increase the gap between wages and costs for the better – giving you more free cash to put into savings.

There are nine locations in the UK where the amount you’re paid is on average at least £1,000 more than living costs – see map above – according to research from property site Compare My Move.

The location with the highest gap between the cost of living and earnings is York.

The cost of both buying or renting a flat in the historic city is low compared to other parts of the UK, and you can get on to the property ladder for around £198,093, found Compare My Move.

At the same time, the cost of living comes in at £1,415 while average earnings after tax are £2,846, leaving £1,431 of disposable income each month.

Even if the cost of living is relatively high, you can still save if salaries are higher.

For example, in second place is Cambridge where the average salary is a bumper £3,143 while the cost of living is £1,829 meaning there is still £1,314 leftover.

And in third spot is Reading with the highest employability rate of any city or town in the UK with 86.1% of its residents in employment, according to Compare My Move.

In the South East, means buying a flat is more expensive than other locations at a typical £227,525. However, the average salary is competitive at £2,909 after tax, while the cost of living is £1,714 meaning that disposable income is still high at £1,195.

Wigan, Derby, Bolton and Glasgow are among other spots where there is a sizeable difference between earnings and costs – and some of the most underrated spots in the UK for young adults, according to Compare My Move.

Of course, your earnings in any location will depend on other factors such as the job you do and the company you work for.

However, you can use job sites to see advertised salaries in your field across different locations and compare with your current earnings.

Costs will also depend on exactly where you choose to live but you can use a property site to look up rent or house prices in different locations to try to gauge how to create a bigger disposable income in your budget.

SAVING £1,000 A MONTH

If saving to buy a home is an important achievement for you, living in one of the locations on the list could help.

Putting away £1,000 a month after a year would give you £12,000. And after three years you could have £36,000 – enough for a 10% deposit on £360,000 property.

If you are going to start saving, it’s also important to keep your cash in a spot where it will earn the highest interest.

It’s also important to be able to access at least a month or two’s worth of income in an easy access account for emergency situations – such as a job loss.

You can currently earn as much as 5.2% in an easy access account with Ulster Bank if you have at least £5,000 in savings – you will earn 2.25% if you have less than that.

Or for smaller sums from £1 you can get a rate of 4.84% with app-based provider Chip.

On a lump sum of £12,000 you’d earn £580.80 worth of interest after a year at a rate of 4.84%.

Opting for as high rate of interest as possible helps you to achieve your savings goals faster. It also stops inflation eroding the value of your nest egg.

If you want to save regularly, you can rates of up to 7% with first direct. You will need to hold a current account with the bank but can then put away up to £300 a month over a year at the top rate.

How you can find the best savings rates

If you are trying to find the best savings rate there are websites you can use that can show you the best rates available.

Doing some research on websites such as MoneyFacts and price comparison sites including Compare the Market and Go Compare will quickly show you what’s out there.

These websites let you tailor your searches to an account type that suits you.

There are three types of savings accounts fixed, easy access, and regular saver.

A fixed-rate savings account offers some of the highest interest rates but comes at the cost of being unable to withdraw your cash within the agreed term.

This means that your money is locked in, so even if interest rates increase you are unable to move your money and switch to a better account.

Some providers give the option to withdraw but it comes with a hefty fee.

An easy-access account does what it says on the tin and usually allow unlimited cash withdrawals.

These accounts do tend to come with lower returns but are a good option if you want the freedom to move your money without being charged a penalty fee.

Lastly is a regular saver account, these accounts generate decent returns but only on the basis that you pay a set amount in each month.

Money

I won £166K People’s Postcode Lottery win but husband won’t get a penny… he has his begging letter written

A GREAT gran who won £166,666 says her husband will have to write a “begging letter” if he wants to see a single penny of it.

Gill English landed the cash on People’s Postcode Lottery in Rugby, Warwickshire – and is now planning a slap-up carvery dinner for her big family.

The retired carer also said she is prepared to buy her hubby a new pair of shoes – but only once shes sees his “begging letter”.

Gill said: “Oh my God! Flippin’ heck! I’ll take the family to a carvery. I also said I’d buy Kev a new pair of shoes.

“He’ll have the begging letter written!”

Retired chauffeur Kev laughed: “I’ve already written the begging letter.”

The couple are both recovering from cancer.

Kev had melanoma and Gill is still receiving treatment after having part of her right lung removed.

But Gill said they are more interested in helping family – including her three sons, eight grandchildren and nine great grandchildren – than treating themselves.

She said: “I love buying presents and love doing things for people. It’s lovely when you feel you have done something for somebody.

“I love giving. I get great joy out of it. If you’ve got money, you’ve got it. If you haven’t, you haven’t.

“I’m not money motivated, but I am now! This is so lovely. Thank you.”

Gill also revealed she hadn’t told her hubby that she played Postcode Lottery until she got the call to say she’d won.

She said: “Kev didn’t know I even played; I don’t tell him everything. I hadn’t told anyone except my youngest son.

“I’ll never get any sleep now just working it all out.”

Kev said: “It wasn’t a secret, she just never told me.”

How to enter the People’s Postcode Lottery

- The Postcode Lottery is a subscription-based lottery in which players sign up with their postcode.

- Your postcode is your ticket number – 40p a day ensures entry into all drawers, or £12 a month.

- Once subscribed, they are automatically entered into every draw.

- Prizes are announced every day of the month.

- If your postcode gets luck, every player in your postcode wins.

- 33 per cent of the ticket price will go to charity that is re-funnelled back into the community.

Money

Exact animal to spot on sought after King Charles III 50p coin worth up to £41

IF you pay close attention to your change, you might spot an animal on your King Charles III 50p that could make it worth more than £40.

Coins with a distinctive design could be worth a small fortune because very few make it into circulation.

For this reason, they are very attractive to collectors who are sometimes willing to pay large sums in exchange for one.

One of the most current sought-after coins is the King Charles III Atlantic Salmon 50p, which first entered circulation on November 2023.

The coin was one of eight new special varieties released by the Royal Mint, reflecting the King’s passion for conservation and the natural world.

Despite an estimated 500,000 Salmon 50ps entering circulation in, collectors have been finding them hard to come by, according to ChangeChecker.

The coin is marked with an engraving of salmon fish jumping out of Atlantic ocean water.

It has become much harder to find in change, and prices on online marketplaces such as eBay and Amazon have continued to rise.

Copes Coins previously told The Sun that Atlantic Salmon 50p could become “one of the rarest coins to enter circulation in the last 15 years”.

You can make money from these rare coins by selling them at auction, either online or in person, or through a dealer.

The Sun found that one of these coins recently sold on eBay for £41 on September 22 with 13 bids.

Another sold for £25 on September 20 with 18 bids.

On September 11, one of these coins sold for £28 with nine bids.

The price of a coin varies based on things like demand at the time and how common it is.

It’s important to remember that you aren’t guaranteed to fetch huge amounts if you do choose to sell your change.

Sometimes you’ll get better individual prices if another enthusiast needs your coin to complete their collection.

Anyone can list a coin on eBay and charge whatever amount they wish, but it’s only ever worth what someone is willing to pay.

By checking the recently sold items you will get a more accurate indication of what people are willing to pay for a specific coin.

What are the most rare and valuable coins?

How to sell a rare coin

If, after checking, you realise you’ve come across a rare coin, there’s a number of ways you can sell it.

You can sell it on eBay, through Facebook, or in an auction.

But be wary of the risks.

For example, there are a number of scams targeting sellers on Facebook.

Crooks will say they’re planning to buy the item and ask for money upfront for a courier they’ll be sending around.

But it’s all a ruse to get you to send free cash to them – and they never have any intention of picking your item up.

It’s always best to meet in person when buying or selling on Facebook Marketplace.

Ensure it’s a public meeting spot that’s in a well-lit area.

Avoid payment links and log in directly through the payment method’s website.

Most sellers prefer to deal with cash directly when meeting to ensure it’s legitimate.

The safest way to sell a rare coin is more than likely at auction.

You can organise this with The Royal Mint’s Collectors Service. It has a team of experts who can help you authenticate and value your coin.

You can get in touch via email and a member of the valuation team will get back to you.

You will be charged for the service, though – the cost varies depending on the size of your collection.

Meanwhile, you can sell rare coins on eBay.

But take into account that if you manage to sell your item then eBay will charge you 10% of the money you made – this includes postage and packaging.

The design of the coin, its condition and whether or not the coin is in circulation also affects how much it could be worth.

You can easily figure out how rare a coin is, by checking its mintage figures.

This relates to how many coins were produced by The Royal Mint.

If a coin has a low mintage, it means there are fewer of them in circulation and is therefore rarer and it could potentially be worth more than its face value.

But remember a coin is only ever worth what someone is willing to pay at the time.

Either way, you’ll want to keep an eye out for some in particular which can sell for big numbers.

A rare Blue Peter Olympic 50p has been flogged on eBay for £205 in the past.

The coin shows an athlete doing the high jump and was drawn by nine-year-old Florence Jackson after winning a competition on the kid’s TV show.

Plus, one seller managed to pocket a whopping £63,000 flogging his Battle of Hasting’s 50p too.

So-called ‘error coins’ tend to be worth a lot too, because there’s rarely more than a few thousand of them in circulation.

One 50p that was mistakenly struck twice sold for as much as £510 on eBay because it was rare.

It’s not only 50ps either – a rare error 10p coin sold for over 1,000 times more than its face value on eBay in the past.

Likewise, there are several rare £2 coins in circulation which could be worth just under £50.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

Money

Child benefit not paid due to TSB Bank issues leaving hundreds of parents fuming over missing cash

HUNDREDS of parents are fuming after a technical error at TSB Bank has left them unable to access their child benefit payment and other cash.

Upset mums and dads took to social media this morning to raise their concerns, with one sharing how she is now unable to give her son cash for a school trip.

Another said she had a lot of bills due out of her account this morning and has now been left with “mega anxiety” over the issue.

While a third said: “You have ruined my entire holiday. I will take this up when I return. This is absolutely unacceptable.”

A fourth added: “Not been paid, my son’s birthday is tomorrow and my bills are due this is a nightmare bank.”

The high street lender, which has over five million customers in the UK, apologised to customers and said it was working to “fix the issue”.

Around 307 customers logged complaints on Downdetector with 70% of those complaints relating to issues about transferring funds.

TSB spokesperson told The Sun: “We’re aware of an issue with some BACS payments not yet showing on customers’ accounts.

“We are working on fixing this and will provide an update as soon as possible.”

It comes as parents are dealing with extra costs as their children return to school following the summer break.

Child Benefit is usually paid every four weeks on either a Monday or Tuesday by HMRC.

The benefit is worth £25.60 a week for your eldest child, and then £16.95 a week for any subsequent children.

For a family with two children who qualify, this adds up to £2,212.60 a year. For just one child, you get £1,331.20 a year.

HMRC has told claimants on X, formally known as Twitter, that if they have not yet received their monthly payment to contact their bank first.

They added: “We are aware of this and understand this relates to issues certain banking providers are experiencing.”

Back in June, customers faced a similar issue when the tax office flagged an issue with the system that sends the cash directly to bank accounts.

It is important to note that this issue is related to TSB and not HMRC, so any issues relating to a delayed payment should go to the bank.

However, it is not just parents and guardians impacted by the issue with hundreds of other customers also not seeing cash land in their accounts.

How to claim Child Benefit

Child benefit is worth up to £1,331 a year for your first or only child and up to £881 a year for additional children.

This works out at £102.40 every four weeks or £25.60 a week for your first child and £67.80 every 4 weeks or £16.95 a week for their siblings.

There is no limit on the number of children that can be claimed for.

Applying is straightforward and can be done in minutes at gov.uk or through the HMRC app.

Parents with a newborn baby should make a claim online as soon as possible and could then receive their first payment in as little as three days.

You can also backdate claims for up to three months.

Parents can make a claim and then choose to opt out of receiving Child Benefit payments can still receive National Insurance credits if one parent is not working.

National Insurance credits build up your entitlement to the state pension.

Over a million of its customers use online banking with the service becoming increasingly popular as high street banks cut down on the number of physical branches they operate.

TSB is set to close 36 banks over the coming months, leading to the loss of hundreds of jobs.

The first of the 36 sites closed on September 3, when branches in Bedworth, Banff and Stornoway shut their doors for good.

The closures will continue through to May next year.

Can I claim compensation for an outage?

As this is an issue with TSB and not HMRC you must log an issue with the bank.

Banks aren’t obliged to pay compensation to customers if there’s been an outage or if they’ve experienced technical issues.

But you might be entitled to some money back depending on how much the disruption affected you.

You’ll have to present evidence of how the outage negatively impacted you, including any extra costs incurred through late payment fees for instance.

You should make a note of when you were unable to access the services and the names of the people you spoke to at the bank that suffered the outage.

You can find more details about how to complain to TSB on its website.

If your bank doesn’t resolve your complaint, you can take your case to the Financial Ombudsman Service.

It is an independent body which will resolve any issues based on what it thinks is “fair and reasonable” depending on the circumstances of the case.

The service can resolve your issue over the phone, by email or post depending on what best suits you.

In the case of an IT system outage at a bank, the FOS says any compensation you may receive will be dependent on your circumstances and whether you lost any money as a result.

If it finds the bank was at fault, you may see any fees, charges or fines reimbursed.

How to check if your bank is down

THERE are a few different ways to find out if your bank is experiencing an outage.

Senior consumer reporter Olivia Marshall explains how you can check.

If you’re trying to send money to someone, or you just want to check if you have enough cash for a coffee, finding your online banking is down can be a real pain.

Most banks have a dedicated news page on their website to show service problems, including internet banking, mobile apps, ATMs, debit cards and credit cards.

You can also check on any future work they have planned and what it might mean for you.

Plus, you can check websites such as Down Detector, which will tell you whether other people are experiencing problems with a particular company online.

Money

‘We need to try this!’ cry Cadbury fans after launch of new ‘special edition’ bar – but you’d be lucky to get one

SHOPPERS have noticed a brand new flavour of special edition Cadbury’s chocolate – but you’ll be lucky to get your hands on a bar.

The new Tiramisu-flavoured bar is part of the brand’s white chocolate range, Dream.

It was relaunched in 2020 and has seen several exciting editions including Oreo and raspberry.

News of the brand new Tiramisu flavour was shared on the New Foods UK Facebook group – where it received 840 reactions and 110 shares.

Meanwhile, 600 commenters shared their thoughts on the new chocolate.

One said: “Oh my I need this.”

Another said: “I need that.”

A third wrote: “Imagine this as my easter egg!!!”

However, others shared the disappointing update that the bar had already sold out on the specialist Bombon website, where it was originally spotted.

One said: “Just to let you know the bar was £6 plus delivery of £3.50 and it has sold out now that site.”

Another moaned that special edition bars are often hard to find in supermarkets, saying: “It’s pretty funny there’s lots of pictures of these chocolate bars and you go to shops to try and find then but you never can”.

The bar, which is £5.99 for 150g, is currently out of stock on the website.

The new launch comes after Cadbury announced an exciting new opportunity for chocoholics – to be appointed a professional chocolate taster.

However, the brand has not been without controversy in recent weeks, as it was revealed that the beloved Brunch snack bar was getting smaller – but remaining the same price.

It also announced it was axing its Christmas treats Festive Friends, with shoppers claiming “Christmas is ruined”.

However, chocolate-lovers can still get excited about a number of other new chocolatey treats hitting supermarket shelves.

Aldi released a dupe of Cadbury Pots of Joy, while Nestle launched a new flavour of Quality Street Matchmakers – which supposedly tastes. like Nutella.

Money

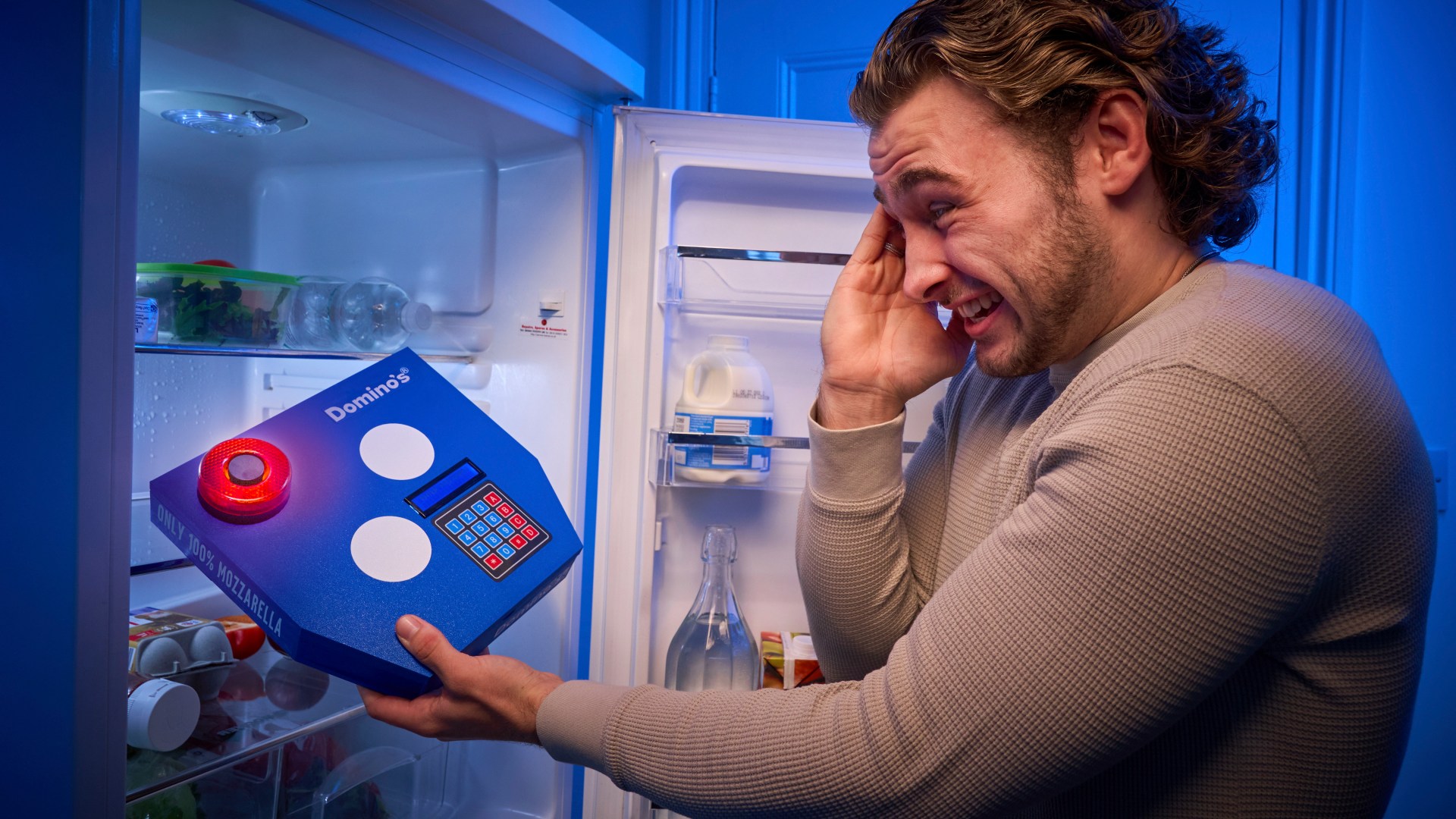

Domino’s are giving out lockable boxes to students – so they can hide their takeaways from hungry housemates

DOMINO’S has created a lockable box to keep leftover pizza safe, as university students head off for fresher’s week.

The pizza chain is giving away the limited-edition safes, which fit perfectly in a fridge and keep pizza secure, away from prying eyes and hungry mouths.

The boxes are available to students or anyone else at risk of fridge thefts through their website.

Melanie Howe from Domino’s said: “There’s nothing worse than thinking you’ve got some tasty leftovers ready for the next day – only to be left fuming when someone has pinched them.

“For most people students, that’s an all-too-common reality.

“To make sure you don’t become a victim to the same misfortune, we wanted to create the Slice Security safe which fits in fridges and keeps precious leftover pizza safe from greedy housemates.”

It comes as research of 400 of university students who’ve lived in student accommodation in last 10 years found 65% have had food stolen during their time at uni.

Milk (45 %) and bread (33%) are the most swiped items, followed by leftover pizza (18%).

And in a bid to stop their goods being stolen, 60% have written their name on items.

It also emerged 46% have caught others in the act of stealing their grub.

While 52% said food theft is one of the biggest causes of arguments as student.

The research also found living with friends (39%) and having your own space (35%) are the best things about living in student accommodation.

While living in messy conditions (48%), having loud roommates (43%), and having food stolen (36%) are the biggest worries.

Those polled also had their say on their favourite takeaway in the research carried out through OnePoll – and pizza (46%) came top.

Motivations for ordering a food delivery include great taste (45%), not having to wash up (40%), and having leftovers for the following day (30%).

How to save money on your takeaway

TAKEAWAYS taste great but they can hit you hard on your wallet. Here are some tips on how to save on your delivery:

Cashback websites– TopCashback and Quidco will pay you to order your takeaway through them. They’re paid by retailers for every click that comes to their website from the cashback site, which eventually trickles down to you. So you’ll get cashback on orders placed through them.

Discount codes – Check sites like VoucherCodes for any discount codes you can use to get money off your order.

Buy it from the shops – Okay, it might not taste exactly the same but you’ll save the most money by picking up your favourite dish from your local supermarket.

Student discounts – If you’re in full-time education or a member of the National Students Union then you may be able to get a discount of up to 15 per cent off the bill. It’s always worth asking before you place your order.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

-

Womens Workouts1 day ago

Womens Workouts1 day ago3 Day Full Body Women’s Dumbbell Only Workout

-

News6 days ago

News6 days agoYou’re a Hypocrite, And So Am I

-

Sport5 days ago

Sport5 days agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Technology7 days ago

Technology7 days agoWould-be reality TV contestants ‘not looking real’

-

News3 days ago

News3 days agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment6 days ago

Science & Environment6 days ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment6 days ago

Science & Environment6 days agoHow to unsnarl a tangle of threads, according to physics

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Science & Environment6 days ago

Science & Environment6 days agoLiquid crystals could improve quantum communication devices

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

Science & Environment6 days ago

Science & Environment6 days agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment6 days ago

Science & Environment6 days agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment6 days ago

Science & Environment6 days agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment6 days ago

Science & Environment6 days agoHow to wrap your mind around the real multiverse

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

Science & Environment6 days ago

Science & Environment6 days agoWhy this is a golden age for life to thrive across the universe

-

Health & fitness7 days ago

Health & fitness7 days agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment6 days ago

Science & Environment6 days agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment6 days ago

Science & Environment6 days agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment7 days ago

Science & Environment7 days agoNerve fibres in the brain could generate quantum entanglement

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoCardano founder to meet Argentina president Javier Milei

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoSEC asks court for four months to produce documents for Coinbase

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoBlockdaemon mulls 2026 IPO: Report

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

Science & Environment2 days ago

Science & Environment2 days agoMeet the world's first female male model | 7.30

-

News5 days ago

News5 days agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Sport5 days ago

Sport5 days agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Science & Environment6 days ago

Science & Environment6 days agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology5 days ago

Technology5 days agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

Science & Environment6 days ago

Science & Environment6 days agoQuantum forces used to automatically assemble tiny device

-

News5 days ago

News5 days agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Science & Environment7 days ago

Science & Environment7 days agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment6 days ago

Science & Environment6 days agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment6 days ago

Science & Environment6 days agoPhysicists are grappling with their own reproducibility crisis

-

Science & Environment1 week ago

Science & Environment1 week agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Science & Environment6 days ago

Science & Environment6 days agoNuclear fusion experiment overcomes two key operating hurdles

-

CryptoCurrency5 days ago

CryptoCurrency5 days ago2 auditors miss $27M Penpie flaw, Pythia’s ‘claim rewards’ bug: Crypto-Sec

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoJourneys: Robby Yung on Animoca’s Web3 investments, TON and the Mocaverse

-

CryptoCurrency5 days ago

CryptoCurrency5 days ago$12.1M fraud suspect with ‘new face’ arrested, crypto scam boiler rooms busted: Asia Express

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoVitalik tells Ethereum L2s ‘Stage 1 or GTFO’ — Who makes the cut?

-

CryptoCurrency5 days ago

CryptoCurrency5 days ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Womens Workouts4 days ago

Womens Workouts4 days agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts4 days ago

Womens Workouts4 days agoEverything a Beginner Needs to Know About Squatting

-

News5 days ago

News5 days agoChurch same-sex split affecting bishop appointments

-

Politics5 days ago

Politics5 days agoLabour MP urges UK government to nationalise Grangemouth refinery

-

Science & Environment6 days ago

Science & Environment6 days agoHow one theory ties together everything we know about the universe

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoHelp! My parents are addicted to Pi Network crypto tapper

-

Science & Environment6 days ago

Science & Environment6 days agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

Science & Environment6 days ago

Science & Environment6 days agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

CryptoCurrency5 days ago

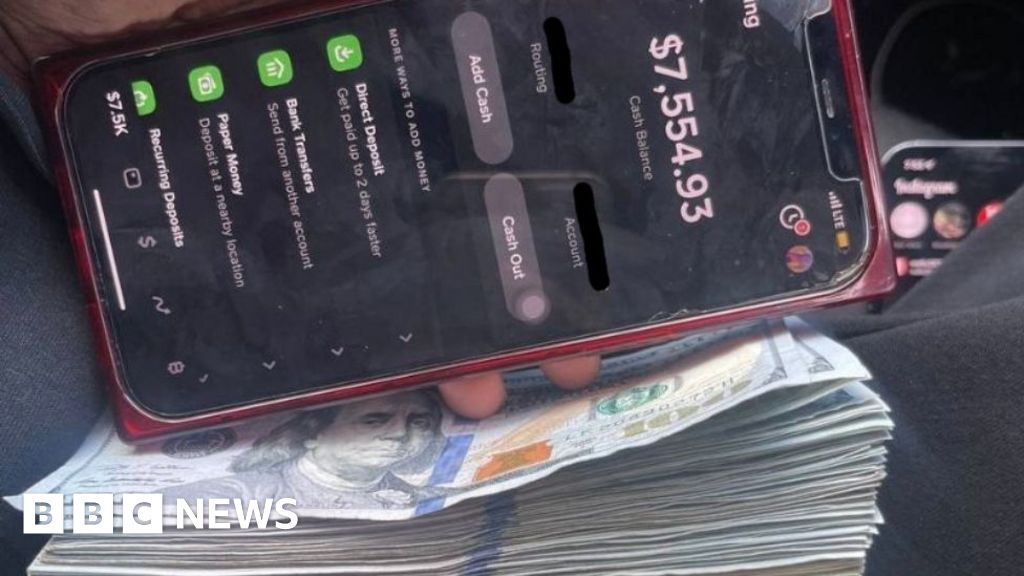

CryptoCurrency5 days agoSEC sues ‘fake’ crypto exchanges in first action on pig butchering scams

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoCertiK Ventures discloses $45M investment plan to boost Web3

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoVonMises bought 60 CryptoPunks in a month before the price spiked: NFT Collector

-

CryptoCurrency5 days ago

CryptoCurrency5 days ago‘Silly’ to shade Ethereum, the ‘Microsoft of blockchains’ — Bitwise exec

-

Business5 days ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Business5 days ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

News5 days ago

News5 days agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

News4 days ago

News4 days agoBangladesh Holds the World Accountable to Secure Climate Justice

-

News2 days ago

News2 days agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Politics1 week ago

Politics1 week agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Technology5 days ago

Technology5 days agoFivetran targets data security by adding Hybrid Deployment

-

Money6 days ago

Money6 days agoWhat estate agents get up to in your home – and how they’re being caught

-

Science & Environment6 days ago

Science & Environment6 days agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Fashion Models5 days ago

Fashion Models5 days agoMixte

-

Science & Environment6 days ago

Science & Environment6 days agoHow Peter Higgs revealed the forces that hold the universe together

-

News6 days ago

News6 days ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

News6 days ago

News6 days agoRoad rage suspects in custody after gunshots, drivers ramming vehicles near Boise

-

Health & fitness7 days ago

Health & fitness7 days agoThe maps that could hold the secret to curing cancer

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoCrypto scammers orchestrate massive hack on X but barely made $8K

-

Science & Environment5 days ago

Science & Environment5 days agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment5 days ago

Science & Environment5 days agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoElon Musk is worth 100K followers: Yat Siu, X Hall of Flame

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoBitcoin price hits $62.6K as Fed 'crisis' move sparks US stocks warning

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoCZ and Binance face new lawsuit, RFK Jr suspends campaign, and more: Hodler’s Digest Aug. 18 – 24

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoBeat crypto airdrop bots, Illuvium’s new features coming, PGA Tour Rise: Web3 Gamer

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoTelegram bot Banana Gun’s users drained of over $1.9M

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoEthereum falls to new 42-month low vs. Bitcoin — Bottom or more pain ahead?

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoETH falls 6% amid Trump assassination attempt, looming rate cuts, ‘FUD’ wave

-

Politics5 days ago

The Guardian view on 10 Downing Street: Labour risks losing the plot | Editorial

-

Politics5 days ago

Politics5 days agoI’m in control, says Keir Starmer after Sue Gray pay leaks

-

Politics5 days ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

Business5 days ago

UK hospitals with potentially dangerous concrete to be redeveloped

-

Business5 days ago

Axel Springer top team close to making eight times their money in KKR deal

-

News5 days ago

News5 days ago“Beast Games” contestants sue MrBeast’s production company over “chronic mistreatment”

-

News5 days ago

News5 days agoSean “Diddy” Combs denied bail again in federal sex trafficking case

-

CryptoCurrency5 days ago

CryptoCurrency5 days agoBitcoin options markets reduce risk hedges — Are new range highs in sight?

-

Money5 days ago

Money5 days agoBritain’s ultra-wealthy exit ahead of proposed non-dom tax changes

-

Womens Workouts4 days ago

Womens Workouts4 days agoHow Heat Affects Your Body During Exercise

-

Womens Workouts4 days ago

Womens Workouts4 days agoKeep Your Goals on Track This Season

-

Womens Workouts4 days ago

Womens Workouts4 days agoWhich Squat Load Position is Right For You?

-

News3 days ago

News3 days agoWhy Is Everyone Excited About These Smart Insoles?

-

Womens Workouts1 day ago

Womens Workouts1 day ago3 Day Full Body Toning Workout for Women

-

News5 days ago

News5 days agoPolice chief says Daniel Greenwood 'used rank to pursue junior officer'

-

Science & Environment6 days ago

Science & Environment6 days agoElon Musk’s SpaceX contracted to destroy retired space station

-

Politics1 week ago

Starmer ally Hollie Ridley appointed as Labour general secretary | Labour

-

Technology1 week ago

Technology1 week ago‘The dark web in your pocket’

-

Business1 week ago

Business1 week agoGuardian in talks to sell world’s oldest Sunday paper

You must be logged in to post a comment Login