CryptoCurrency

Crypto Traders Quietly Pull Back From Polymarket Bets

Crypto traders are still active on prediction markets, but fewer are willing to take risk. New on-chain analysis from BeInCrypto shows that high-conviction crypto trading on Polymarket has cooled steadily since early January, after peaking twice in late December and the first week of the new year.

The data does not track casual users or passive viewers. Instead, it focuses on wallets that actively placed orders and provided liquidity on crypto-related markets, offering a clearer signal of trader sentiment.

Sponsored

Sponsored

High-Conviction Crypto Activity Peaked, Then Faded

BeInCrypto analysts observed daily maker activity on Polymarket over the past 30 days, filtering only crypto-tagged markets such as Bitcoin and Ethereum price outcomes, meme coins, NFTs, and airdrops.

Because the dataset counts makers only, it captures wallets actively risking capital, not traders simply filling existing orders. The results show two clear engagement waves.

The first occurred in late December, when daily active crypto makers climbed into the high-30,000 range. The second, and stronger, wave came in early January, with activity peaking around 40,000–45,000 wallets.

However, after January 9, the trend reversed. Daily crypto maker activity declined consistently through mid-January, falling back toward the low-20,000 range before dropping sharply at the end of the window.

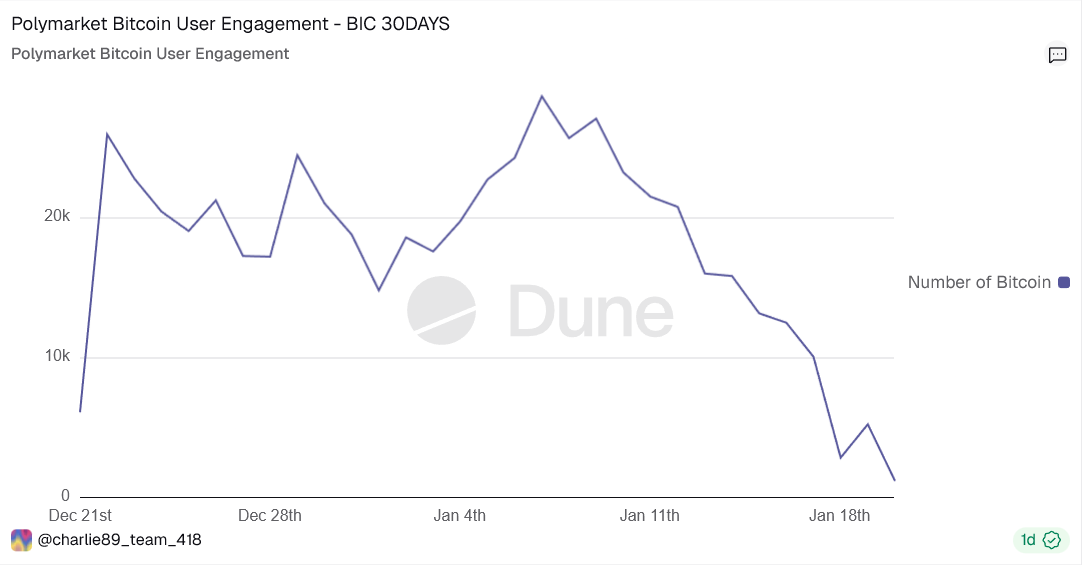

Bitcoin Engagement Confirms the Broader Cooldown

Bitcoin-focused markets followed the same pattern.

Sponsored

Sponsored

A separate Dune chart tracking Bitcoin-only maker wallets shows strong engagement in late December and early January, followed by a persistent decline.

By January 18, the number of active Bitcoin makers fell to 2,875 wallets, down sharply from the five-figure levels seen earlier in the period.

This confirms the slowdown was not limited to niche crypto bets or altcoin narratives. The pullback extended to Bitcoin, the platform’s most liquid and consistently traded crypto category.

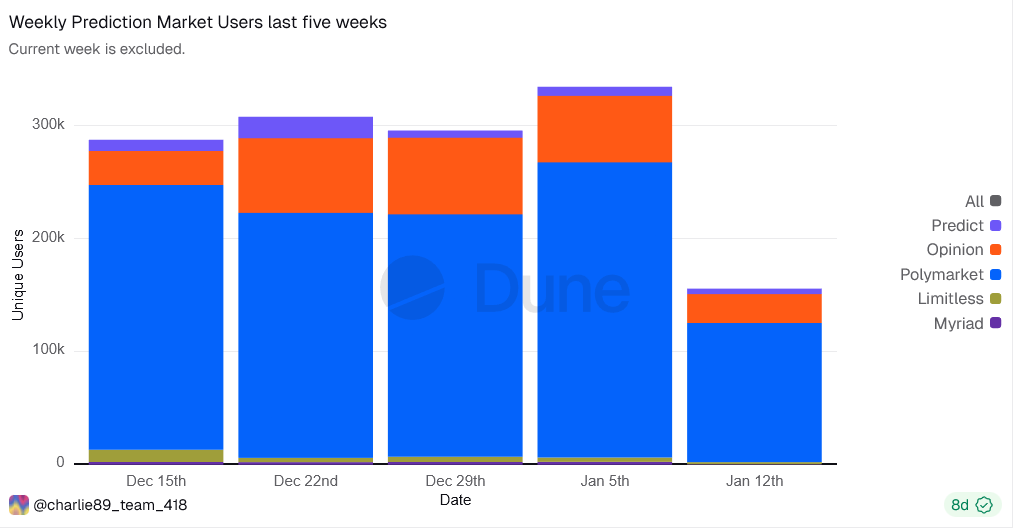

Weekly Data Shows Polymarket Dominance, but Shifting Behavior

Weekly data across prediction market platforms adds context. Polymarket continues to account for the majority of weekly prediction market users, dwarfing smaller competitors in absolute terms.

Sponsored

Sponsored

During peak weeks in late December and early January, total weekly users across platforms reached the high-200,000s to low-300,000s.

Yet while total users remained elevated, the composition of activity changed. Maker participation in crypto markets declined even as overall platform engagement stayed relatively high.

This divergence suggests traders did not leave prediction markets altogether. Instead, they became more selective about when and how much capital they were willing to commit.

Sponsored

Sponsored

Liquidity Providers Step Back Before Users Disappear

The maker-only filter is critical to understanding the signal.

Liquidity providers tend to pull back before broader user numbers fall. When volatility drops or narratives lose momentum, traders often stop posting new orders while still monitoring markets or trading opportunistically.

That pattern appears clearly in the data. Crypto maker activity declined steadily after early January, suggesting a cooling of conviction rather than a sudden collapse in interest.

This behavior mirrors dynamics seen in DeFi and derivatives markets, where funding rates, open interest, and liquidity depth often weaken before spot volumes follow.

Taken together, the data point to a clear conclusion.

Crypto traders have not abandoned prediction markets. However, fewer are willing to provide liquidity and take directional risk compared to early January.

In plain terms, prediction markets are signaling a risk-off shift in crypto sentiment, visible first among high-conviction traders.