Crypto World

Federal Judge Tosses Terror Financing Case Against Binance and CZ Following Court Victory

TLDR

- Manhattan federal court threw out terrorism financing claims filed by 535 victims against Binance, CZ, and Binance.US

- Judge ruled plaintiffs didn’t establish direct connection between exchange operations and individual terror attacks

- Court found Binance likely had “general awareness” of illicit financing activity on its platform

- Plaintiffs given 60-day window to submit revised complaint with stronger evidence

- Binance labeled the decision “a complete vindication,” though two separate lawsuits continue

A Manhattan-based federal judge threw out all allegations in a significant Anti-Terrorism Act case against Binance this past Friday. The legal action involved 535 individuals who were either victims or family members of those affected by 64 separate terrorist incidents.

The defendants in the case included Binance, its co-founder Changpeng “CZ” Zhao, and BAM Trading Services, which operates Binance.US. Those filing suit claimed the cryptocurrency platform enabled terrorist organizations to transfer money using digital assets.

The terrorist incidents cited occurred from 2016 through 2024. Organizations mentioned in the legal filing included Hamas, Hezbollah, ISIS, al-Qaeda, and Palestinian Islamic Jihad.

Judge Jeannette A. Vargas from the US District Court for the Southern District of New York delivered the decision. Her written judgment spanned 62 pages.

The ruling acknowledged that Binance appeared “generally aware” that its platform facilitated terrorist financing. Evidence included Binance’s track record of anti-money laundering compliance failures, its provision of services to Iranian users under sanctions, and internal company messages demonstrating executives understood terrorists were using the platform.

Yet general awareness proved insufficient. The court determined that those bringing the lawsuit needed to demonstrate “knowing and substantial assistance” with clear connections to the particular attacks that resulted in their harm. The complaint fell short of this requirement.

What the Court Found on Hamas and Iran Transactions

The legal documents outlined approximately $56 million in transfers associated with Hamas and $59 million connected to Palestinian Islamic Jihad flowing through Binance. The court characterized this segment of the lawsuit as “a closer call.”

Binance had also acknowledged internally that it was aware of Hamas conducting transactions on its platform since at least 2019. Nonetheless, the court determined the plaintiffs’ argument depended excessively on fungibility — the concept that because Binance enabled widespread illicit transactions, some money must have reached those responsible for the attacks.

The judgment referenced a 2025 Second Circuit ruling in Ashley v. Deutsche Bank. That decision elevated legal standards for terrorism financing lawsuits against financial entities.

Judge Vargas observed that another case, Raanan v. Binance, had withstood dismissal motions in February 2025 despite similar accusations. However, that proceeding concluded before the Ashley decision, which she indicated now demands a different legal outcome.

Binance’s Response and Ongoing Scrutiny

Binance General Counsel Eleanor Hughes characterized the dismissal as “a complete vindication.” CZ shared on X that centralized cryptocurrency platforms have “zero motive” to enable terrorists, arguing such individuals produce minimal trading fees.

Zhao entered a guilty plea to federal charges involving anti-money laundering violations and sanctions breaches in November 2023 and subsequently received a presidential pardon from President Trump.

The judge authorized plaintiffs to submit a revised complaint within 60 days. She indicated shortcomings might be addressed through more precise information regarding wallet ownership, transaction dates, and connections between account users and the attacks.

Two related legal proceedings remain ongoing: the Raanan case brought by October 7 survivors, and another lawsuit filed in North Dakota during November 2025.

Additionally, Binance continues to contest accusations from 11 US senators alleging the exchange handled more than $1 billion in transactions connected to Iranian entities.

Remember: Preserve all tokens like [[EMBED_0]], [[IMG_0]], [[LINK_START_0]], [[LINK_END_0]], [[SCRIPT_0]], [[FIGURE_0]] etc. exactly as they appear. These are placeholders for embeds, images, and links that must not be changed.

Crypto World

US Court Dismisses All Claims Against Binance in Anti-Terrorism Case

Editor’s note: A US federal court’s dismissal of all Anti-Terrorism Act claims against Binance marks a definitive legal vindication for the company. In a 62-page decision, the court found no evidence that Binance aided terrorists, participated in, or conspired with terrorist organizations, despite claims by 535 plaintiffs alleging material support related to 64 terrorist attacks. The ruling reinforces Binance’s stated commitment to compliance, governance, and constructive engagement with regulators worldwide, and signals that the company will vigorously defend its reputation and operations.

Key points

- The court dismissed all Anti-Terrorism Act claims against Binance in the case, across every allegation.

- The court found no evidence Binance aided terrorists, linked itself to attacks, or conspired with terrorist organizations.

- The ruling addresses claims by 535 plaintiffs alleging material support related to 64 terrorist attacks.

- While plaintiffs may seek to amend, Binance emphasizes it will defend its position and will continue to engage with regulators.

This dismissal is a complete vindication of all false allegations.

Why this matters

The ruling delivers a decisive legal victory and underlines Binance’s ongoing investment in compliance infrastructure, regulatory engagement, and robust governance. It reinforces that Binance’s operations do not support terrorism in any form and provides a clear clarification to the market about the company’s posture and risk controls.

What to watch next

- Whether plaintiffs file an amended complaint within the 60-day window.

- Binance’s ongoing regulatory engagement worldwide and governance actions.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

US Federal Court Dismisses All Claims Against Binance in Anti – Terrorism Lawsuit

Court rejects allegations that Binance assisted, participated in, or conspired with terrorists. This represents a decisive legal dismissal of all claims

Binance, the world’s largest cryptocurrency exchange by registered users, announced today that a U.S. federal court in the Southern District of New York has dismissed all claims brought against the company under the Anti-Terrorism Act (ATA). The lawsuit involved 535 plaintiffs who alleged that Binance provided material support related to 64 terrorist attacks.

In a 62-page decision, the Court found that plaintiffs failed to establish any of their central allegations: that Binance assisted terrorists, that Binance associated itself with terrorist attacks, that Binance participated in or sought to advance those attacks, or that Binance engaged in any conspiracy with terrorist organizations.

“This dismissal is a complete vindication of all false allegations,” said Eleanor Hughes, Binance’s General Counsel. “The court has unambiguously rejected the false and damaging narrative that Binance assisted terrorists. We have always maintained that these claims were without merit, and today’s ruling confirms that. We will continue to defend ourselves aggressively against any litigation or reporting that misrepresents who we are and how we operate.”

A Full and Complete Legal Victory

The Court’s decision to dismiss all claims, across every allegation, represents a decisive legal victory.

While the Court has allowed plaintiffs 60 days to file an amended complaint in light of a recent appellate decision, Binance is confident that no amended pleading will be able to cure the fundamental deficiencies the Court identified. The underlying claims have been thoroughly examined and rejected.

Commitment to Compliance and Legal Integrity

Binance has consistently invested in industry-leading compliance infrastructure, regulatory engagement, and legal governance. Today’s ruling affirms that Binance’s operations do not support, facilitate, or enable terrorism in any form.

The company will continue to engage constructively with regulators worldwide, operate within established legal frameworks, and pursue vigorous legal action where necessary to correct false and misleading narratives about its business.

About Binance

Binance is a leading global blockchain ecosystem behind the world’s largest cryptocurrency exchange by trading volume and registered users. Binance is trusted by more than 310 million people in 100+ countries for its industry-leading security, transparency, and unmatched portfolio of digital asset products. For more information, visit: https://www.binance.com

Crypto World

Nasdaq Partners with Boerse Stuttgart’s Seturion for tokenized Settlement

Nasdaq said it is working with Boerse Stuttgart Group’s tokenized settlement platform Seturion to connect its European trading venues to infrastructure designed to settle tokenized securities using distributed ledger technology.

According to Monday’s announcement, the collaboration will initially focus on structured products and aims to support faster settlement of tokenized assets across European capital markets.

Seturion supports multiple asset classes across public and private distributed ledger networks and allows transactions to be settled using either central bank money or on-chain cash. Boerse Stuttgart said the platform is intended to be open to a broader network of financial institutions across Europe.

Under the partnership, Nasdaq will link its European trading venues to Seturion so that tokenized securities traded on those markets can be settled through the platform. The companies said they plan to expand participation to additional issuers, brokers and financial institutions over time.

The partnership aims to address fragmentation in Europe’s post-trade infrastructure, where securities settlement is handled by multiple national systems with differing rules and processes. By using distributed ledger technology, the companies say a shared platform could help reduce settlement times and operational complexity across European markets.

The European Central Bank in April said there was “an urgent need to integrate Europe’s fragmented capital markets, not only in the area of post-trade but also in supervision and other areas.”

The system is designed to operate within existing European regulatory frameworks, including MiFID II and the DLT Pilot Regime, which allow financial institutions to test distributed ledger technology in trading and settlement of tokenized securities.

In February, Boerse Stuttgart Group said it would merge its cryptocurrency business with Frankfurt-based digital asset trading company Tradias as part of a strategy to expand its presence in institutional crypto markets.

Related: Kraken wins Kansas City Fed approval for limited master account access

Traditional exchanges push deeper into tokenized securities

Exchange operators are increasingly exploring tokenized versions of traditional securities as part of efforts to modernize capital market infrastructure.

Nasdaq said today that it was partnering with Kraken, a US-headquartered crypto exchange, and tokenization infrastructure provider Backed to develop a gateway aimed at supporting tokenized equities while preserving issuer control.

In September, Depository Trust & Clearing Corporation said it plans to bring a subset of US Treasury securities onto the Canton Network, with the long-term goal of expanding tokenization to a broader range of assets eligible for custody at its subsidiary, the Depository Trust Company. The market infrastructure operator processed around $3.7 quadrillion in 2024.

In January, the New York Stock Exchange and its parent company Intercontinental Exchange said they were developing a platform for trading tokenized stocks and exchange-traded funds that would support 24/7 trading and blockchain-based settlement.

Last week, Intercontinental Exchange announced it had taken a board seat in OKX after investing in the crypto exchange and plans to offer NYSE-listed tokenized stocks and derivatives to OKX users starting in 2026.

Tokenized public equities have grown to about $1.01 billion in total onchain value, according to data from RWA.xyz.

Magazine: What’s a ‘Network State’ and are there real-life examples? Big Question

Crypto World

Top Five Crypto Projects to Watch in 2026

The crypto industry is entering a cycle of adjustment that has shifted from speculative behavior to structural fundamentals due, in part, to the passage of major legislation such as the GENIUS Act in the United States and MiCA in the EU. This shift places greater weight on how individual networks generate revenue, manage supply, and attract sustained user activity.

As a result, investors are increasingly examining protocol upgrades, token mechanics, and real usage metrics when assessing long-term price potential rather than relying on short-term narratives. In practical terms, that means looking at projects with real traction – so here are five that could break out in 2026 based on trading ranges, on-chain usage, and adoption trends.

HYPE and the $100 Scenario

Hyperliquid recently announced the HIP-3 upgrade, which adds gold and silver to the list of assets it covers. These changes helped the price of its native HYPE token rise to about $33. Some market watchers are suggesting it can eventually fly past its current all-time high of just under $60 and hit as much as $100 in 2026.

Looking at HYPE’s technical picture above reinforces this constructive fundamental view. For example, the 50-day exponential moving average is trending higher and could soon cross above the 200-day EMA. That would form a “golden cross,” a pattern many analysts view as a bullish buy signal.

Furthermore, the MACD has extended above its signal line on the daily chart, meaning there is increasing bullish momentum. The RSI is also around 60, which suggests strong buying pressure but still leaves room for more upside before the asset starts to look overbought.

But reaching $100 would require more than just price expansion. It would mean that volume growth, buybacks, and burns would continue, and there would be deeper liquidity across tokenized assets on Hyperliquid.

If the platform maintains its lead in on-chain derivatives and successfully integrates more institutional-grade margin tools, the token could consolidate its value. And based on its current volume profile, facilitating $2.6 trillion worth of trades in 2025, and market penetration, a move toward $100 before year-end is within the boundaries of fundamental growth – assuming the ecosystem continues to attract high-liquidity markets.

BNB’s $2,000 Target

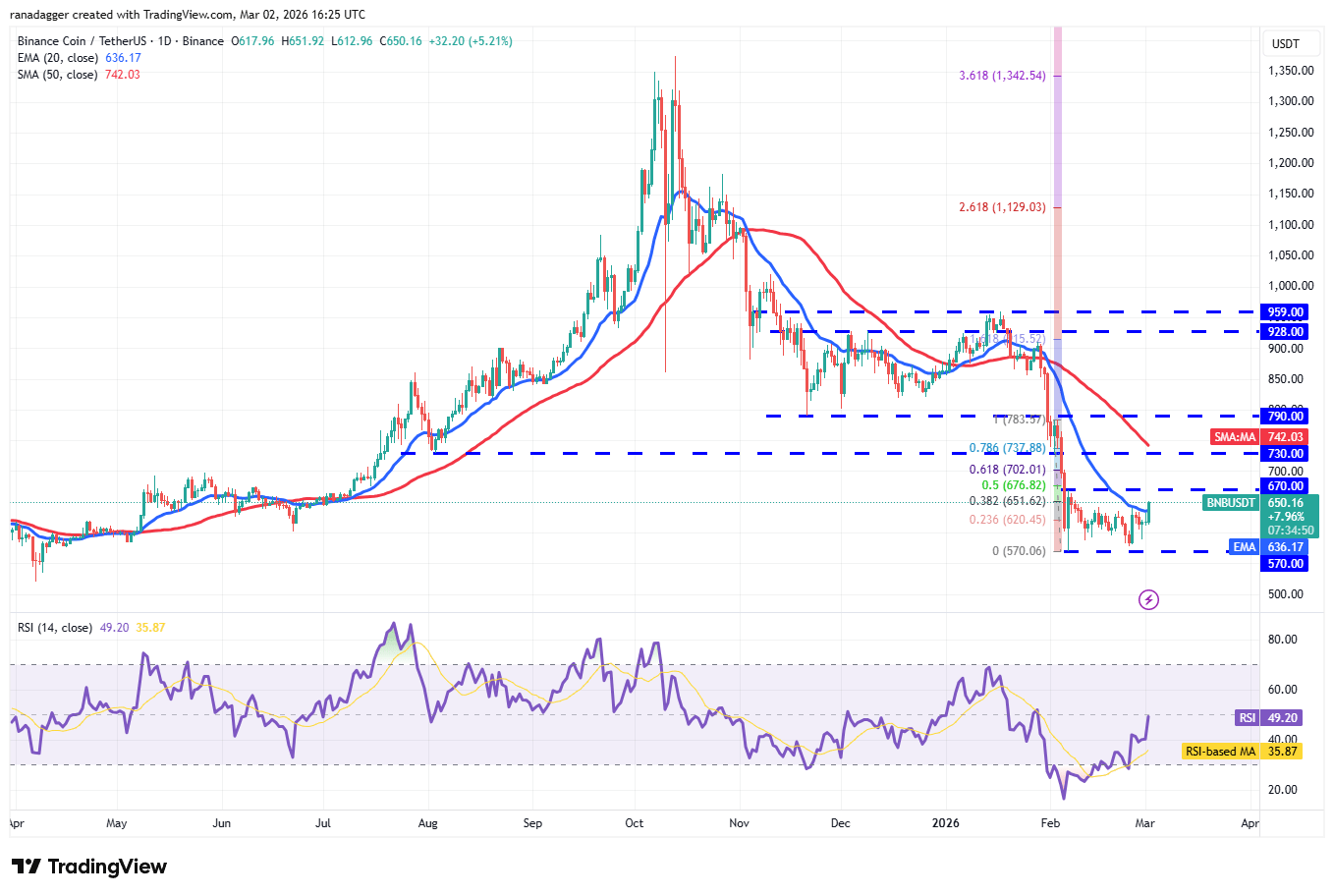

Ranked as the fourth-largest cryptocurrency by market cap, BNB was trading near $640 as of this writing, nearly 54% off its peak. However, from a technical standpoint, the asset is showing early signs of stabilization after a downtrend that began toward the end of January.

The 10- and 20-day exponential moving averages were of special interest, with TradingView data showing them flattening out while the RSI climbed higher for the first time in several weeks. That implies the selling pressure may be reducing, with the reversal leading some supporters to suggest that the next bull run will push BNB to $2,000.

Price forecast estimates indicate that BNB is expected to increase gradually over time, with a near-term price target of $610 and an expected average price of $640–$820 at approximately the mid-point of the forecast horizon.

Analyst Duo Nine supports this scenario and anticipates the first price target for BNB will be just below $700. If that level is reclaimed, the market watchers believe $900 will be the threshold.

However, reaching $2,000 in 2026 would require that the BNB Chain register more activity on-chain, and there would also need to be more clarity about how regulators treat tokens linked to exchanges.

Solana to $300

A strong run at the tail end of last year gave traders hope that 2026 could be the year Solana (SOL) finally hits the $300 milestone.

The coin’s narrative revolves around withstanding change in the market and keeping a loyal developer base focused on high-throughput applications. According to recent data, the network has the second-largest market share in DeFi and has at times had more 24-hour DEX trading volume than Ethereum.

Over the past week, SOL has gained more than 9%, outpacing the broader market. According to chartist Ali Martinez, the coin is currently range-bound, with support at $76 and resistance around the $90 level. A move above $90 would signal a potential shift toward upside continuation, with analyst Crypto Patel suggesting last month that once SOL outgrows its corrective phase, it could go past $300, even hitting $500 or $1000.

But to reach these elevated price points, there needs to be continued development, a stable network with solid performance, and wider Layer 1 infrastructure usage, driven by the clarity of the regulatory environment in key markets.

However, it must also be noted that Ethereum and other fast chains remain highly competitive, and outages, as seen in the past, could also impact SOL’s risk profile, making it more difficult to pass the record-breaking price milestone.

Uniswap’s $20 Projection

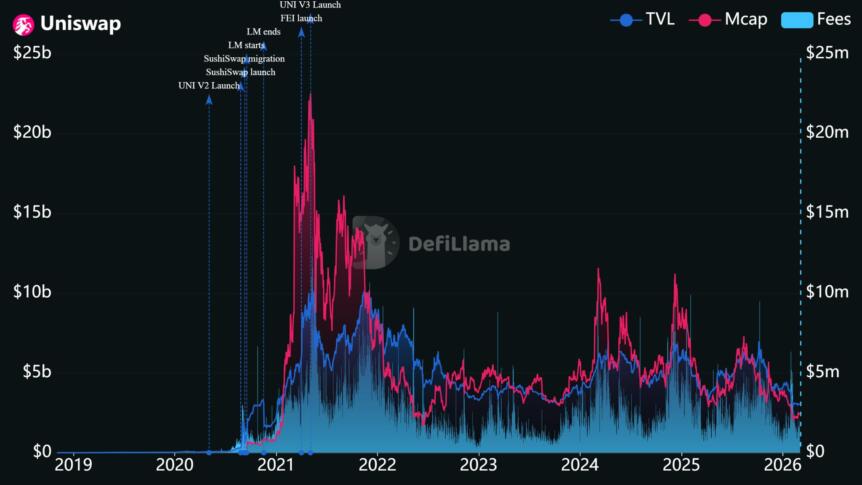

The case for Uniswap (UNI) climbing to $20 was strengthened on December 25, 2025, when tokenholders voted to flip the protocol’s fee switch, allowing a portion of its revenue to be used for a buy-and-burn program.

The move means that some of Uniswap’s profits are now being used to raise the value of UNI, and the results have been clear: the token has gone up more than 17% in the last week, bringing it to just under $4.00, according to CoinGecko.

Another indicator to consider is Uniswap’s market cap to TVL ratio. UNI currently holds the 37th spot in terms of market cap, with a value of around $2.5 billion. Meanwhile, DefiLlama puts the platform’s TVL at $3.12 billion, giving a ratio of 0.81 and indicating that UNI is quite undervalued.

With the token’s worth now tied to measurable revenue and supply reduction, and given that fundamentals have not been priced in, there is some upside potential that could push UNI to $20. This is more so, given that Uniswap recently won full dismissal of a scam token class action lawsuit, with the judge ruling the platform cannot be held liable for the misconduct of third-party token issuers.

WFI to Reach $100?

WFI is the native token of the WeFi ecosystem, which is building core infrastructure for a fully on-chain financial system and decentralized on-chain banks (deobanks). Crowned as the digital bank of the year for 2025 by Finance Feeds, WeFi has pushed WFI’s strong performance in the market.

The initiative offers its users the opportunity to manage their own crypto assets and use numerous services related to conventional banking, such as payment processing, fund transfers across borders, and savings account options.

According to data from CoinGecko, WFI has had an eventful 12 months, gaining well over 400% in the timeframe, which pushed it to a new all-time high of $3.00 in January 2026.

That yearly rise stands in sharp contrast to Bitcoin, Ethereum, and Ripple’s XRP, which are all heavily in the red for the same period.

If WeFi keeps growing its user base, and corporate stablecoin settlements expand as management anticipates, WFI’s demand profile could change materially, taking it from $3 to $20, $50, and potentially $100 in 2026.

Crypto World

Zcash Dev Team’s New Company Raises $25M in Seed Round

Zcash Open Development Lab, which Zcash devs formed after leaving Electric Coin Capital, raised funds from prominent crypto VCs.

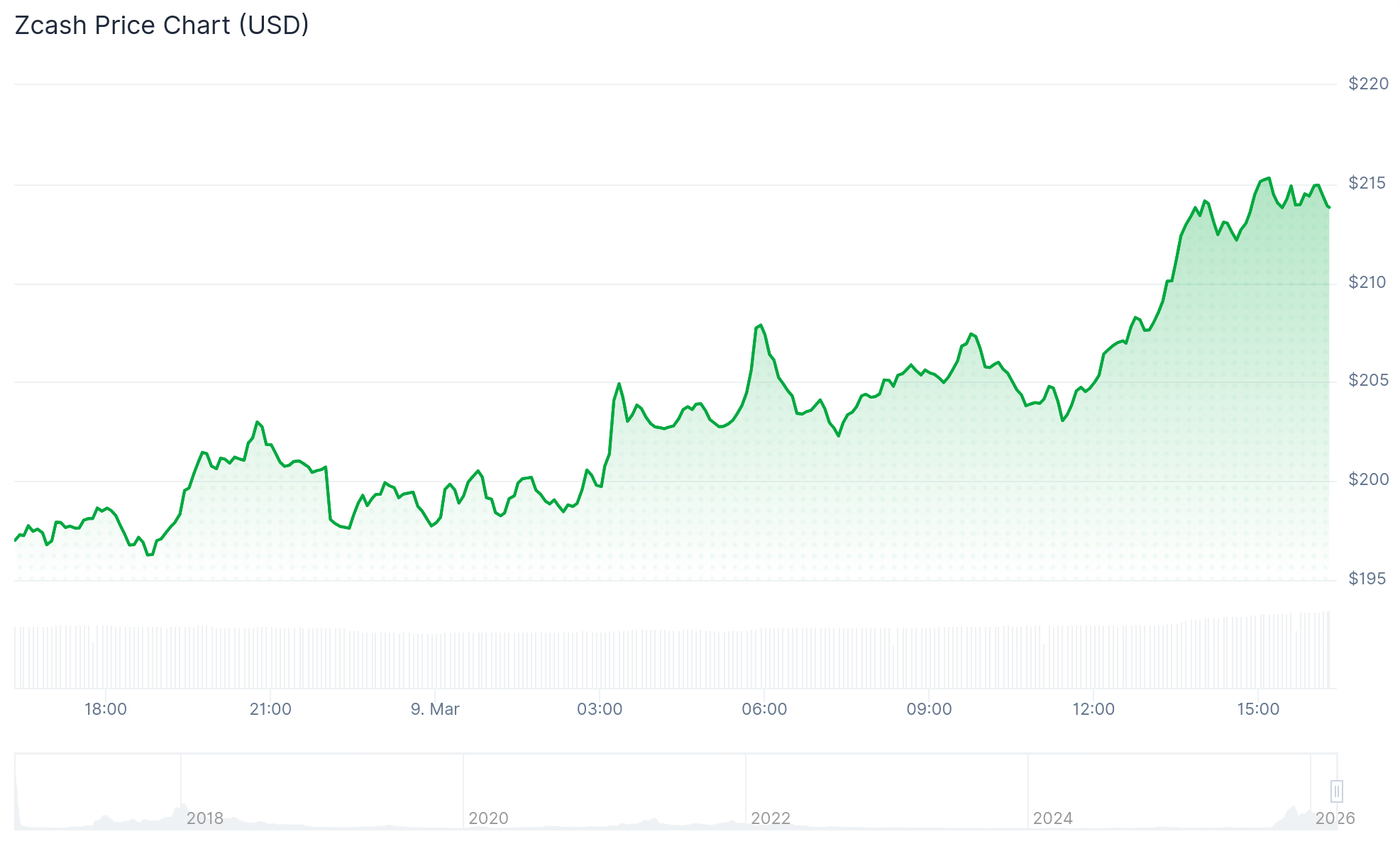

The recently founded firm Zcash Open Development Lab (ZODL) — formed by the core developers of Zcash (ZEC) after they recently exited Electric Coin Capital — announced today, March 9, that it has secured over $25 million in seed funding to support the privacy-focused ecosystem.

A number of prominent venture capital firms and investors participated in the seed round, including Paradigm, a16z crypto, Winklevoss Capital, Coinbase Ventures, Cypherpunk Technologies, Maelstrom, Chapter One, Balaji Srinivasan, Haseeb Qureshi, and Mert.

In a separate X post today, the founder of ZODL and former CEO of ECC, Josh Swihart, explained the move, the recent organization shifts, and the org’s goals post-funding:

“ Ultimately, we intend to deliver a private, decentralized financial system as an alternative to legacy institutions. This funding allows us to bring these ambitions to life, without relying on Zcash dev fund grants to get there.”

The price of ZEC rallied nearly 10% to over $215 on the news, making it the second-best performer among the top-100 crypto assets today.

ECC to ZODL

The fundraising round marks a major milestone for the new firm, which formed after a governance dispute in January that resulted in the entire core development and leadership team at ECC leaving.

ECC’s wallet app, Zalshi — now rebranded to Zodl — was a key focus of the dispute, as ECC and the nonprofit board overseeing it, Bootstrap, disagreed about the app’s development strategy.

Under Swihart’s leadership, the former ECC team swiftly moved to form a new entity and wallet, which are effectively rebrands of ECC and Zalshi, respectively. Swihart also clarified at the time that the team had no intentions of leaving the Zcash ecosystem or its core development.

This article was generated with the assistance of AI workflows.

Crypto World

White House Cyber Strategy Puts Crypto Under Federal Umbrella

The Trump administration’s cybersecurity framework names cryptocurrency and blockchain as technologies requiring federal protection, a first for a U.S. presidential strategy document.

The White House recently published President Trump’s Cyber Strategy for America, which states that the administration will pursue “supporting the security of cryptocurrencies and blockchain technologies” as part of a broader effort to “build secure technologies and supply chains that protect user privacy from design to deployment.”

This marks the first time a U.S. presidential cybersecurity document has explicitly named blockchain as a protected technology class, placing it alongside post-quantum cryptography and AI in the administration’s national security priorities.

The document also contains language with potential enforcement implications for crypto, calling on the government to “uproot criminal infrastructure and deny financial exit and safe haven,” framing cybercrime and intellectual property theft as “some of the greatest threats to global economies.” The administration also signed a companion executive order on the same day targeting cybercrime and fraud, which is expected to shape how agencies enforce the policy.

On the regulatory side, it commits the administration to streamlining compliance burdens across the board, pledging to “streamline cyber regulations to reduce compliance burdens, address liability, and better align regulators and industry globally” so that “the private sector has the agility necessary to keep pace with rapidly evolving threats.”

For crypto, the bottom line is a dual message: recognition as critical infrastructure worthy of federal protection, paired with a signal that the administration will pursue the illicit finance channels that the industry has long struggled to police.

Crypto World

Pudgy Penguins Launches ‘Pudgy World’ Browser Game

The PENGU token is up 7% in the past 24 hours.

Pudgy Penguins has officially launched Pudgy World, a free-to-play browser-based game.

Set across a fictional frozen landscape called The Berg, the game features 12 unique towns for players to explore. The central storyline tasks players with helping the character Pengu track down a missing friend named Polly, with mini-games woven throughout. The multiplayer setup means players can explore The Berg together in real time.

The launch marks a significant milestone for one of crypto’s most successful crossover brands. Pudgy Penguins was purchased by current CEO Luca Netz in 2022 and has since evolved from a forgotten relic of 2021’s NFT summer into one of the top collections in the NFT space.

What has set Pudgy Penguins apart from its peers is an aggressive push into mainstream consumer products. The brand’s IP coverage expanded steadily under Netz, with physical toys featured in Walmart and Amazon, a children’s book deal with Random House, and a mobile game called Pudgy Party, which became the top-ranked mobile racing game in Apple’s App Store within three days of its release.

The ecosystem’s PENGU token is up 7% in the past 24 hours, trading at a $440 million market capitalization.

Pudgy World is designed to bring the brand’s broad audience, spanning physical retail, social media, mobile gaming, and crypto, into a single, shared interactive space.

Crypto World

Crypto futures platforms compared: BTCC, Binance, and Bybit

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Traders compare crypto futures platforms as derivatives activity grows across major exchanges.

Summary

- Futures platforms BTCC, Binance, and Bybit differ in leverage, fees, and margin systems as derivatives trading grows.

- BTCC offers up to 500x leverage, compared with Bybit’s 200x and Binance’s 125x on major perpetual futures pairs.

- Binance, Bybit, and BTCC all provide USDT perpetual futures, but only Binance and Bybit offer coin-margined contracts.

Growing institutional and retail participation in cryptocurrency derivatives markets has prompted traders to examine the technical specifications of futures trading platforms more closely. Comparisons between BTCC, Binance, and Bybit reveal differences in leverage availability, trading costs, margin systems, and platform features.

Leverage and fees

Higher leverage allows traders to control larger positions with smaller margin deposits, but also increases the risk of liquidation when prices move against a position.

Bybit offers up to 200x, and Binance caps leverage at 125x on major perpetual futures pairs. BTCC offers the highest maximum leverage of the three platforms, at up to 500x on select perpetual futures contracts.

On maker fees — charged when a trader places a limit order that adds liquidity to the order book — Binance and Bybit both charge 0.02%, while BTCC charges 0.025%. On taker fees — charged when a trader executes a market order — Bybit charges the highest rate at 0.055%, followed by BTCC at 0.045% and Binance at 0.04%. All three platforms offer tiered fee structures in which higher trading volumes or account balances qualify users for reduced rates.

Contract types and margin modes

All three exchanges offer USDT-margined perpetual futures contracts, which settle in Tether (USDT). Binance and Bybit additionally offer coin-margined contracts, which allow traders to use cryptocurrencies such as Bitcoin or Ether as collateral. BTCC focuses on USDT perpetual contracts.

Cross-margin and isolated margin modes are available across all three platforms. Binance and Bybit also offer portfolio margin, which allows traders to offset positions and reduce capital requirements. BTCC does not list portfolio margin as a feature.

All three platforms maintain insurance funds intended to cover losses that exceed a trader’s margin balance during liquidation events. Each exchange also employs an auto-deleveraging mechanism, which reduces the positions of profitable traders when insurance funds cannot fully absorb a liquidation shortfall. Margin calls are issued across all three platforms when a trader’s equity falls below maintenance thresholds.

Demo and simulated trading

BTCC offers a demo trading environment that operates within the main platform interface using virtual funds. Binance and Bybit provide simulated trading through separate testnet environments. Testnets are distinct from demo environments, as they run on separate blockchain infrastructure rather than replicating live platform conditions.

BTCC was founded in 2011, making it the oldest of the three exchanges. Binance launched in 2017 and grew to become one of the largest cryptocurrency exchanges by trading volume. Bybit was founded in 2018 with a focus on derivatives trading.

The three platforms offer comparable core functionality in several areas, including USDT perpetuals, cross and isolated margin modes, insurance funds, and tiered fee structures, while differing on leverage ceilings, taker fee rates, contract variety, and the scope of available margin tools.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Bitcoin macro snapback after oil retreat lifts crypto

Bitcoin whipsawed between $65k and $69k as oil spiked then retreated, underscoring that macro energy shocks still script BTC’s role as a global risk barometer.

Summary

- Bitcoin rebounded from $65k toward $69k after oil slid from near $120 on strategic-reserve headlines, tying BTC’s bounce directly to easing energy shock fears.

- Traders framed BTC as a high-beta gauge of global risk appetite, watching the $67k area as a key line in the sand for whether the rally sticks.

- Spot data show BTC hovering near $68.6k with over $50.7b in volume as Ethereum and Solana lag or outperform on the risk curve rotation.

Bitcoin (BTC) reminded markets on Monday that macro still writes the script. After sliding to roughly $65,000 earlier in the session, the benchmark cryptocurrency snapped back toward $69,000 as crude oil retreated sharply from near $120 per barrel on headlines that strategic reserves could be tapped. CoinMarketCap summed it up bluntly: “Bitcoin recovered to around $69,000 after falling to $65,000, rebounding as oil pulled back sharply from near $120 per barrel following reports that strategic reserves may be tapped.”

That sequence – energy shock fears, then relief, then a crypto bid – was not lost on traders watching the tape. One macro‑focused account responded that “when energy shock fears fade, crypto catches a bid almost immediately,” framing BTC as a high‑beta expression of global risk appetite rather than an isolated digital asset. Another observer at Zeconomy wrote: “From 65K to 69K on an oil pullback is a good reminder that BTC still trades like a global risk barometer,” underlining how quickly flows rotate once pressure eases in commodities.

At the same time, positioning around key levels remains central to how this move is being read. Aequalis Lab argued that “if it holds 67k, next week could get spicy,” pointing to the mid‑$60K band as a line in the sand for trend traders. Short‑term sentiment, at least among vocal bulls, has already flipped back toward accumulation: one trader insisted that “$69K proves the dip was just a blip, accumulation continues,” while another suggested that future “nostalgia about buying BTC at current levels” will dominate once prices move to “levels that seem somewhat unbelievable to most of the market.”

For now, spot data show Bitcoin trading near $68,600, up about 2.5% over the last 24 hours, with 24‑hour turnover above $50.7 billion and a market capitalization north of $1.35 trillion. Ethereum changes hands around $2,011, down roughly 3.7% on the day with a market cap of about $260.2 billion, while Solana trades near $83.76, up roughly 2.7% over the same period as liquidity rotates down the risk curve.

Crypto World

ETFs and Corporate Treasuries Pull Millions of BTC Away From Exchanges

Analysts say Bitcoin increasingly sits inside ETFs and corporate treasuries.

Bitcoin reserves held on centralized exchanges have fallen back to levels last seen in 2019. Data shared by crypto market analyst Dark Fost shows that exchange reserves have been steadily declining since 2022.

This trend has accelerated following the collapse of the FTX exchange.

Bitcoin Supply Migration

In November 2022 alone, more than 325,000 BTC were withdrawn from exchange reserves as investors moved their assets off centralized platforms. As a result of this continued outflow, total BTC reserves on exchanges accessible to retail investors have now dropped to roughly 2.7 million BTC.

Among these platforms, Binance alone accounts for approximately 20% of the remaining reserves. When platforms primarily used by professional investors are included in the analysis, Coinbase Advanced ranks first, holding close to 800,000 BTC. However, this figure is still about 200,000 BTC lower than the level recorded in July 2025.

Dark Fost stated that while the FTX collapse played a major role in encouraging investors to hold assets in private wallets, two additional developments have also contributed to the reduction in exchange balances. The first is the launch of spot Bitcoin exchange-traded funds in January 2024. At the time of their introduction, exchange reserves were still above 3.2 million BTC. Since then, ETFs have accumulated around 1.3 million BTC, which represents roughly 6.7% of Bitcoin’s total supply and effectively removes that amount from exchange liquidity.

The second factor is the growth of digital asset treasury companies (DATs) that hold Bitcoin as a reserve asset. Collectively, these firms now control about 1.1 million BTC, or nearly 5% of the total supply. Both ETF holdings and corporate treasuries represent a growing share of Bitcoin supply held in structured financial vehicles.

“Over the long term, this transformation could play an important role in market liquidity and price formation, even if these structural effects always take time to fully materialize.”

Geopolitical Tensions Halt Breakout

Against this backdrop of changing supply patterns, Bitcoin entered the second week of March under pressure as markets remained focused on escalating tensions in the Middle East. The cryptocurrency recently failed a breakout attempt above $70,000 as the ongoing US-Iran conflict contributed to broader market uncertainty. Despite the pullback, crypto trader and analyst Michaël van de Poppe said BTC’s current price action does not represent a worst-case scenario.

You may also like:

In his latest post on X, the trader noted that Bitcoin continues to trade within a range but described the performance as relatively strong given the current market conditions. According to him, oil prices surged about 15% on Monday to their highest levels since 2022, while gold and commodities declined, and the Nasdaq fell significantly. Van de Poppe added that if the US stock market opens higher and oil prices begin to correct, Bitcoin could regain momentum toward $70,000.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Can you still mine Bitcoin on a PC in 2026? Here is the reality

Mining Bitcoin on a desktop in 2026 may sound simple, but is it profitable? Do rising network difficulty and energy costs mean the end of PCs as Bitcoin mining equipment?

-

Politics7 days ago

Politics7 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

News Videos10 hours ago

News Videos10 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Crypto World6 hours ago

Crypto World6 hours agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech5 days ago

Tech5 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports2 days ago

Sports2 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

Business1 day ago

Business1 day agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Sports7 days ago

Sports7 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Tech8 hours ago

Tech8 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech5 days ago

Tech5 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Business2 hours ago

Business2 hours agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs