CryptoCurrency

Why Turkey’s Inflation Crisis Demands a White-Label Crypto Wallet?

Turkey’s crypto story over the last decade reads less like a tech fad and more like a national hedge. When your currency loses value, people stop asking whether crypto is “innovative” and start asking whether it protects their savings. That simple incentive-preservation of wealth- turned millions of Turks into active crypto users and pushed the market into the billions.

For many workers and small businesses, preserving purchasing power is now a daily operational requirement, not a speculative choice. Crypto, and particularly stablecoins, have emerged as a pragmatic tool for value preservation and fast settlement. Recent surveys show a majority of adults in Turkey are already engaging with crypto, which underscores a clear product-market fit for customized Web3 crypto mobile wallets built to protect income, enable instant conversion, and integrate with payroll and payment systems. For serious investors, the opportunity lies in deploying compliant, locally branded white label wallets that combine institutional-grade security, deep liquidity, and regulatory alignment to capture a rapidly expanding market whose primary demand is stability and utility.

Billion-Dollar Turkey’s Crypto Market Built on Necessity

Turkey has emerged as one of the world’s most active crypto adoption markets, driven by sustained inflation and rapid depreciation of the Turkish Lira. Recent surveys show that over half of Turkish adults have engaged with cryptocurrencies, and market behavior makes clear that crypto is being used primarily as a store of value rather than pure speculation. Stablecoins- principally USDT and USDC- dominate local activity, with USDT/TRY frequently appearing among the highest-volume trading pairs on major platforms; this reflects a practical shift toward preserving purchasing power.

Local exchanges and white label crypto wallet providers (including Binance TR, Paribu, and BtcTurk) collectively serve millions of registered users and hundreds of thousands of monthly active wallets, and independent market estimates place the Turkish crypto market value in the tens of billions of USD. Analysts and trade reports further project that active crypto users in Turkey could reach 10–15 million within a few years as mobile-first adoption and payroll use cases expand. Taken together, these trends position stablecoin-enabled wallets, notably compliant, locally branded customzied blockchain wallet solutions, as essential financial infrastructure for everyday value preservation, salary conversion, remittance,s and frictionless domestic payments in Turkey’s high-inflation environment.

Turkey’s Crypto Investors: Young, Bold & Accelerating

Turkey’s crypto surge is driven largely by younger adults: a KuCoin survey found 52% of Turkish adults (18–60) have invested in crypto, up from 40% in Nov 2021. The largest investor cohort is 31–44 (48%), followed by 18–30 (37%), showing strong millennial and Gen-Z participation. Female involvement is notable – 47% of 18–30 investors are women, and 37% are among those over 45. Primary motivations are long-term wealth (58%), value preservation (37%), and diversification (25%). Asset preferences: Bitcoin (71%), Ethereum (45%), and stablecoins (33%), the latter often used as a hedge. Adoption is accelerating- 31% of investors began within the last three months, with younger adopters investing larger amounts and 57% joining via friends or family, underlining strong retail-driven momentum. Which, in turn, also increases the demand for crypto wallet development solutions to store and manage these assets safely.

From Banning to Licensing: Turkey’s Crypto Rules

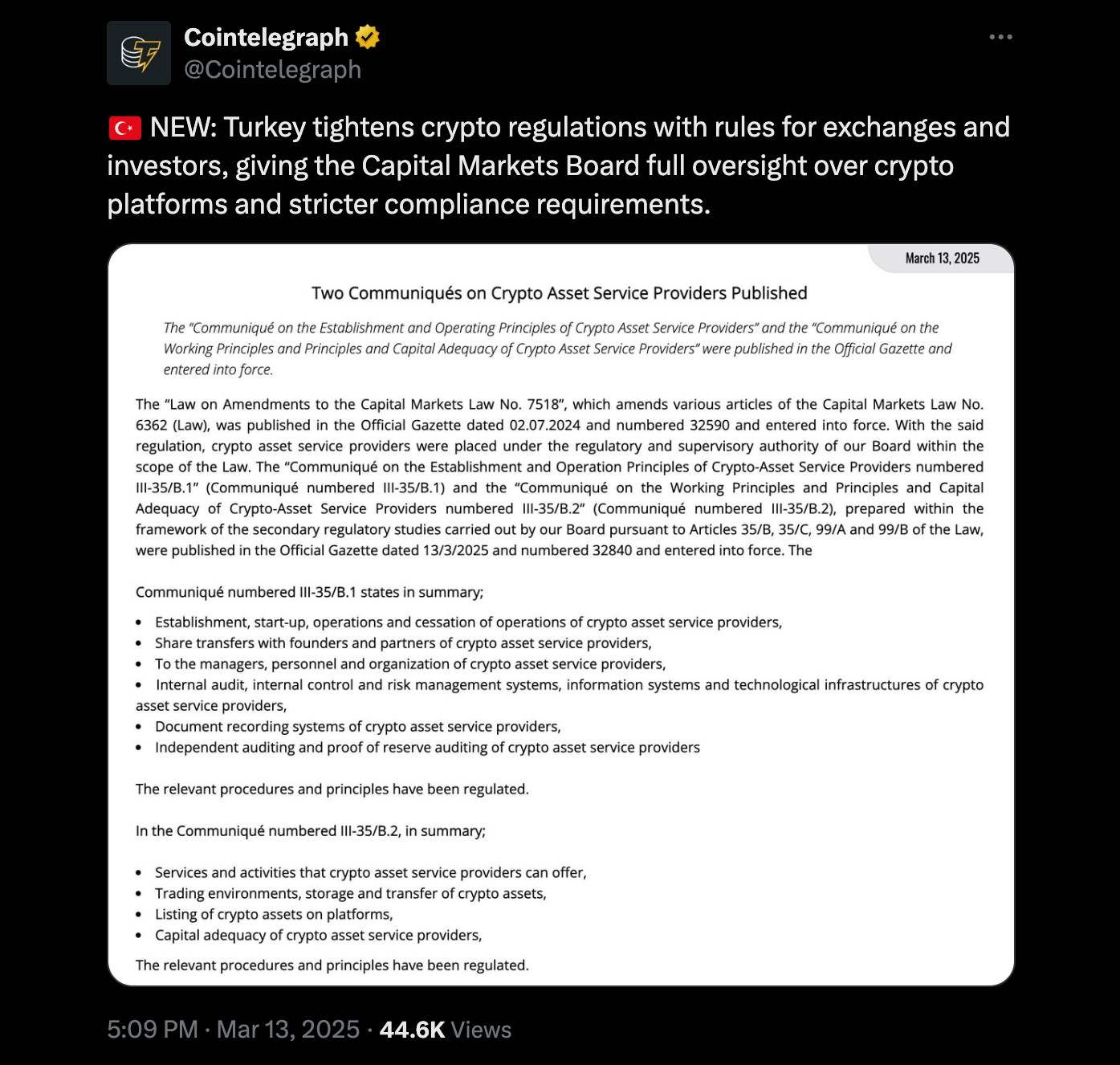

Turkey’s crypto policy has shifted rapidly from prohibition to regulation. After the central bank banned crypto payments in April 2021 to “protect the lira,” lawmakers pivoted toward oversight rather than outright bans. On July 2, 2024, Parliament amended the crypto-assets law to grant crypto firms legal status, require registration and licensing with the Capital Markets Board (CMB), enforce AML/KYC, and impose an annual fee of roughly 2% of trading income. In March, CMB Communiqués III-35/B.1 and B.2 clarified licensing: high minimum capital, robust security and asset segregation, transaction monitoring, and internal controls. Only licensed Crypto Asset Service Providers, including foreign platforms serving Turkish users, may operate; regulators say this aligns Turkey with FATF standards and aids removal from the “gray list.”

There’s a trade-off. Strong regulation raises operational costs and can chill startups. But at scale, the net effect is credibility: fewer scams, more institutional on-ramps, and a more stable market, which Turkey badly needed to attract larger domestic players and foreign capital.

Turkey’s Core Pain Points

1. Salary erosion between payday and the next bill cycle.

2. Savings are losing real value in fiat on short-time horizons.

3. Limited low-friction onramps to stable assets for payroll.

4. High FX and remittance costs for cross-border transfers.

5. Slow settlement and reconciliation in domestic payments.

6. Limited options for instant peer payments that preserve value.

7. Retail users’ distrust of traditional financial products for preservation.

8. Fragmented access to stablecoin liquidity at local price levels.

9. Lack of programmable payroll and compliance-friendly payroll rails.

10. Operational risk for businesses juggling volatile treasury exposures.

How a White-Label Crypto Wallet Solves Turkey’s Payroll & Inflation Challenges?

Let us now scroll through the blog to have a closer look at how a Turkey-focused white-label web3 crypto wallet converts market demand into enterprise outcomes and measurable returns.

| Business/Consumer Challenge | White-label Wallet Solution |

|---|---|

| Salary value erosion between paydays | Instant payroll conversion: auto-convert a predefined portion of payroll into USDT/USDC at receipt |

| Difficulty holding value in local fiat | Stablecoin custody with optional insured custodial and noncustodial models |

| Liquidity shortfalls and poor pricing during bulk conversions | Real-time liquidity aggregation across exchanges and OTC desks to ensure tight spreads |

| Payroll reconciliation complexity | Reconciliation engine that outputs standard accounting entries and audit trails |

| Lack of merchant acceptance for crypto | Merchant rails and local settlement partners to enable stablecoin acceptance and settlement in TRY |

| Regulatory friction around payments | Structure as a custody and conversion service with clear disclosures to avoid payment-processor classification |

| User friction in onboarding and spending | Localized UX, fiat on/off ramps, card issuance, or virtual accounts for everyday spending |

| Compliance and audit needs | Built-in AML/KYC, transaction monitoring, and regulator-ready reporting exports |

However, it is always suggested that a serious and decisive enterprise must partner with an experienced cryptocurrency wallet development company that boasts a vast team of blockchain experts to help you launch a business-tailored and market-fit wallet platform.

What Does An Enterprise Need to Launch a White-Label Crypto Wallet in Turkey?

- Clear market thesis that ties wallet KPIs to payroll and payroll-adjacent flows.

- Regulatory strategy and legal counsel with Turkey-specific crypto licensing experience.

- Minimum viable product that supports stablecoin conversion, custody options, and fiat on/off ramps.

- Local banking and payment partner integrations for KYC-compliant fiat flows.

- Liquidity partnerships with exchanges and OTC desks for tight spreads and deep pools.

- Enterprise-grade custody technology, including MPC or HSM for key management.

- AML and transaction monitoring stack with SAR/STR reporting capabilities.

- UX and onboarding experience localized for Turkish users and languages.

- Scalable backend for reconciliation, settlement, and audit trails.

- Commercial go-to-market plan with employer and payroll provider partnerships.

- Funding for capital adequacy requirements and contingency liquidity.

- Insurance partnerships for custodial risk mitigation.

Build Enterprise Web3 Wallets for Inflation Risk

Compliance and Regulatory Considerations for Turkey

- CMB licensing: mandatory registration as a Crypto Asset Service Provider to legally operate in Turkey.

- Capital adequacy: meet minimum capital thresholds defined by the Capital Markets Board.

- AML/KYC enforcement: risk-based onboarding, enhanced due diligence, and ongoing customer monitoring.

- Transaction surveillance: real-time monitoring and mandatory suspicious activity reporting.

- Client asset segregation: strict separation of user funds from operational accounts.

- Stablecoin custody rules: clearly defined custody model with transparent asset handling.

- Payment-use restrictions: comply with the crypto payment ban by structuring services as custody and conversion, not direct payments.

- Data security and auditability: encrypted storage, immutable logs, and regulator-ready reporting.

- Tax readiness: infrastructure to support transaction taxes and regulatory reporting if imposed.

- Foreign platform compliance: licensing or local partnerships required to serve Turkish residents.

Why is White Label Crypto Wallet Investable now?

Retail and payroll demand already exist. Survey data show substantial penetration of crypto among Turkish adults, and the combination of inflation and modern mobile adoption creates a large, addressable market for payroll-linked stablecoin services. The regulatory framework, though stringent, provides clarity that enables licensed products to scale with legal certainty.

Improving FATF alignment and focused regulator priorities increases the probability of stable, long-term market access for licensed providers. These structural conditions create an environment where a professionally executed white-label cryptocurrency wallet app with strong compliance and custody can achieve both meaningful user traction and attractive unit economics.

Hire 100% Efficient Crypto Wallet Development Experts

Turkey’s macroeconomic reality has made value preservation a product feature, not a niche. For serious investors looking to deploy capital into fintech and Web3 infrastructure, white-label cryptocurrency wallet solutions that prioritize payroll conversion, robust custody, and regulatory alignment represent a tangible, high-demand opportunity. Antier brings end-to-end product delivery experience across wallet engineering, institutional custody, liquidity integration, and Turkish regulatory compliance. Our certified and skilled team assists you in navigating licensing, capital adequacy, and AML requirements. We also provide turnkey technology stacks that accelerate time to market while maintaining enterprise security and auditability.

Apart from this, our wide range of crypto wallet developmet services include a tailored investor briefing that includes a product requirements document, a compliant go-to-market roadmap for Turkey, and an implementation timeline that aligns with CMB licensing milestones.

Get in touch with us today!

Frequently Asked Questions

01. Why has crypto adoption surged in Turkey over the last decade?

Crypto adoption in Turkey has surged primarily due to sustained inflation and the rapid depreciation of the Turkish Lira, leading people to use cryptocurrencies as a means to preserve their wealth rather than for speculation.

02. What role do stablecoins play in the Turkish crypto market?

Stablecoins, particularly USDT and USDC, dominate the Turkish crypto market as they provide a practical solution for preserving purchasing power and facilitating fast settlements, reflecting a shift towards using crypto as a store of value.

03. What is the projected growth of crypto users in Turkey?

Analysts project that active crypto users in Turkey could reach 10–15 million within a few years, driven by mobile-first adoption and the integration of crypto into payroll systems.