Entertainment

Iconic Sci-fi Series Predicts This Year Will Be The End Of The World

By Chris Snellgrove

| Published

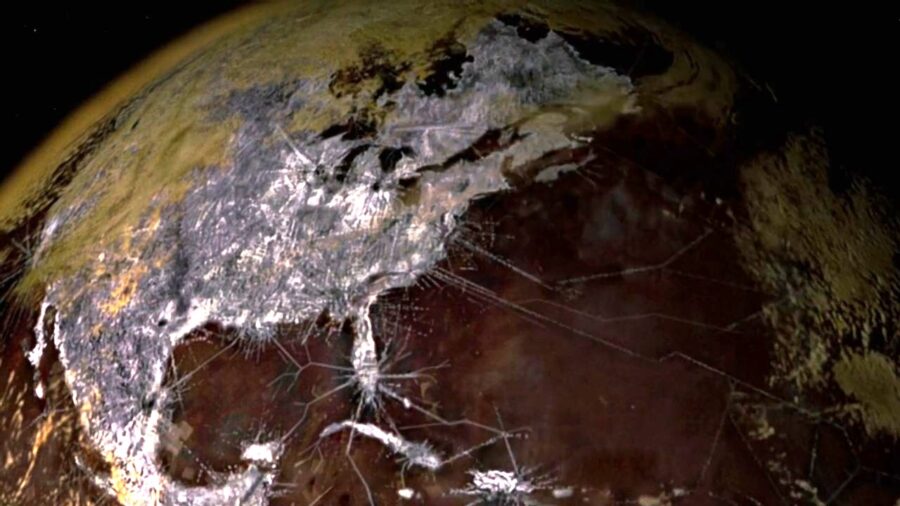

What if this year were the end of the world as you know it? That sounds like crazy talk, of course, but this is the year that has long been prophesied by one of the greatest sci-fi franchises as the beginning of World War III. That prophecy comes to us from the last IP you’d expect to predict the end of the world: Star Trek!

Obviously, Star Trek is known for its optimistic portrayal of a future where most people do not have to worry about modern concerns such as poverty, disease, and war. However, a major part of the franchise lore is that things have to get incredibly worse before they start to get better. Humanity doesn’t begin working towards its bright, shiny future until it survives World War III, a catastrophic global conflict that is supposed to start in 2026.

World War III Starts With One Man

Fittingly enough, much of our franchise knowledge of World War III comes from Star Trek: The Original Series. Classic episodes like “Bread and Circuses” and “The Savage Curtain” tell us that a man named Colonel Phillip Green was responsible for leading a bunch of ecoterrorists in attacks that ultimately claimed the lives of 37 million people. He may actually be the one responsible for causing this war, as it is mentioned in “The Savage Curtain” that he “led” a genocidal war, later identified as WWIII.

Frustratingly, The Original Series doesn’t tell us much more about Colonel Green except that he was infamous for striking his enemies in the midst of ostensibly peaceful negotiations. Later, Star Trek: Enterprise clarified that he used his troops to kill those affected with radiation sickness and other conditions that he considered “impurities.” He was worried about these traits being passed on to children, making Green an explicitly Hitler-like figure, right down to his obsession with eugenics.

And The Rockets’ Red Glare

It was the fan-favorite film Star Trek: First Contact that specified that World War III began in 2026, and the movie also put a name to one of the factions involved: the Eastern Coalition. The first episode of Star Trek: The Next Generation revealed that some of the different factions used drugs to control their soldiers. Discovery and Strange New Worlds specified that as late as 2053, nuclear bombs were being dropped on cities like Richmond, Washington, New York, and Paris.

Speaking of Strange New Worlds, that show used an interesting retcon to tie World War III with a major conflict first mentioned in The Original Series: the Eugenics Wars. During Earth’s troubled history, unethical scientists began experimenting with selective breeding and genetic editing, and their ultimate goal was to create a race of supersoldiers. Those soldiers were known as Augments, and their most famous member was Khan Noonien Singh, who would later go on to have multiple iconic fights with an equally legendary figure: Captain James T. Kirk.

A Real Khan Job

Predictably, these Augments tried to take over the world, seizing power in over 40 nations before they were ultimately overthrown by humanity. Most Augments were tried and executed as war criminals, but Khan and dozens of his followers escaped in a sleeper sheep, where they were later awoken from cryogenic stasis by Captain Kirk. In the classic episode “Space Seed,” Spock mentioned a very specific fact that Star Trek spent decades trying to run from: that the Eugenics Wars lasted from 1992-1996.

Why has Trek been running from this bit of trivia, and how does it connect to World War III? After Star Trek: The Next Generation came out in 1987, it became increasingly hard for the writers (especially after the end of the Cold War) to imagine the ‘90s as a period of major global upheaval. The best evidence of this is that in the Voyager episode where they traveled back to 1996 (“Future’s End”), and despite this being the last year of the Eugenics Wars, there is no sign that America had experienced any of the worldwide conflict that took the lives of over 30 million people.

Burned By The Retcon

Strange New Worlds addressed this matter in a very unexpected way. “Tomorrow and Tomorrow and Tomorrow” revealed that the Temporal War and assorted meddling time travelers ended up affecting Khan’s personal timeline. Now, the tyrant was born later in the timeline, but his rise to power is still inevitable: in the Picard episode “Farewell,” the mad scientist Doctor Adam Soong was last seen in 2024, examining a file (from 1996, no less) titled “Project Khan.”

That would put Khan on the right track to be a major player when World War III kicks off in 2026, but how do we know for sure that he was involved? In the premiere Strange New Worlds episode (“Strange New Worlds”), Captain Pike gave a speech to a group of aliens where he mentioned how Earth’s last major global conflict had gone by different names over the years. “We called it the Second Civil War, then the Eugenics War, and finally just World War III.”

No Place On Earth Was Safe

Previously, in The Original Series episode “Space Seed,” Spock claimed (while admitting that records of the time period were “fragmentary”) that the Eugenics Wars simply took place during World War III. Now, Pike is retroactively claiming that the Eugenics Wars and World War III are considered the same conflict. However, we do know that these different names likely referred to distinct periods of time during this overall conflict.

That’s because the first name for what would be called a global conflict was “the Second Civil War;” at this point, the presentation Pike is showing to a group of aliens shows footage of the January 6th attack on the United States Capitol. Putting aside the wacky politics of this as a creative decision (is Star Trek really linking Khan and Donald Trump in official canon?!?), this gives us an approximate timeline of events. The Second Civil War starts in early 2021, the Eugenics Wars begin sometime after 2024, and World War III breaks out in 2026.

2026: The End Of The World As We Know It

Hey, that’s this year! Since Star Trek has predicted that this is the end of the world, you should probably take the time to put your affairs in order. Tell your loved ones how much they mean to you, make time for your own needs, and remove anything from your life that no longer sparks joy.

After the last episode of Starfleet Academy, that probably includes your Paramount+ subscription. Trust me: even if the world doesn’t end in apocalyptic disaster, you don’t need a streamer whose exclusives feel like every single biblical plague, all rolled into one!

Continue Reading

Entertainment

Tense Survival Thriller Pushes Suspense Into Extreme New Heights

By Robert Scucci

| Published

I can finally end my search for an action adventure thriller set entirely in a hot air balloon after watching 2019’s The Aeronauts. While we can get into the nitty gritty about how it’s “based on true events,” as depicted in the 2013 Richard Holmes book Falling Upwards: How We Took to the Air, anybody with access to Wikipedia can do that. Instead, let’s talk about the film itself. Since we’re ultimately dealing with a fictional piece of cinema inspired by multiple real-life balloon ascents, it’s all but expected that creative liberties are taken, and composite characters are stitched together from their historical counterparts for the sake of a cleaner, more dramatic story.

The Aeronauts, like most films that carry the biographical label, is no exception. As long as you’re not treating it like a history lesson, it’s well worth your time for the visuals and sheer level of suspense alone. I never thought a movie about a giant balloon could be this intense, but here we are, watching two deeply committed people float through the troposphere without even packing proper winter coats.

Floating High And Above

Set in 1862 London, The Aeronauts centers on scientist James Glaisher (Eddie Redmayne) and balloon pilot Amelia Wren (Felicity Jones). James believes that ascending to unprecedented heights will allow him to study atmospheric patterns in a way that could eventually make weather prediction possible. When the Royal Society refuses to take him seriously enough to fund the project, he turns to Amelia, whose skill and nerve make the entire expedition feasible. Through a series of flashbacks, we learn about the political resistance and personal motivations surrounding the journey, but that groundwork is not the main reason you’re here.

The real spectacle unfolds once James and Amelia leave the ground, rising beyond 30,000 feet and shattering the standing record for balloon travel. Completely devoted to his research, James pushes forward as Amelia repeatedly urges him to descend. Awestruck by the vast skyscape around them, James loses track of the balloon’s physical limitations and just how drastically the temperature has dropped while he continues taking notes and running tests.

When it becomes clear they’ve gone far too high for their own good, Amelia takes decisive action after recognizing the signs of James’ worsening hypoxia. That plan immediately falls apart when she realizes the gas release valve at the top of the balloon has frozen shut. Reduced to a speck drifting through the sky, Amelia braves brutal conditions in her attempts to bring both of them back to land. The elements are not on her side, and she soon begins suffering from frostbite as well. With their lives and James’ research hanging in the balance, every split-second decision carries real consequences, and the margin for error disappears fast.

Stunning Cinematography All Around

While the flashback sequences in The Aeronauts are necessary for context, they lean into familiar tropes tied to dangerous missions. Both characters are haunted by their pasts and repeatedly revisit traumatic moments while grappling with their present situation. If I’m being completely honest, I have a hard time taking people in top hats seriously, so these scenes occasionally play as unintentionally funny for me. I fully recognize that I might be a sample size of one here, and your mileage may vary.

What truly impressed me were the sequences that take place inside and around the balloon itself. The horizon, the clouds, and even butterflies drifting through air currents at what were once unheard-of altitudes are the real draw of The Aeronauts. Ice crystallizing across the balloon as Amelia struggles with the frozen gas valve, along with wide shots that emphasize how small she and James are against the open sky, are genuinely striking. The storms that threaten to consume them as they push higher in the name of science add another layer of tension, made all the more effective by how grounded and tactile everything looks.

It’s safe to assume The Aeronauts received a healthy dose of VFX in post-production, but it’s difficult to spot while watching. The visuals feel real and cohesive, creative liberties with characterization aside, and the result is an immersive experience even from your couch. If you’re looking to challenge your fear of heights, or you’re simply in the mood for historical fiction that focuses on discovery rather than warfare, you can stream The Aeronauts on Prime Video as of this writing.

Entertainment

Kim Kardashian Weighing Ye Concerns Amid New Romance

![Drew Barrymore arriving to the 2022 White House Correspondents' dinner held at the Washington Hilton Hotel on April 30, 2022 in Washington, D.C. © Tammie Arroyo / AFF-USA.com. 30 Apr 2022 Pictured: Pete Davidson and Kim Kardashian. Photo credit: Tammie Arroyo / AFF-USA.com / MEGA TheMegaAgency.com +1 888 505 6342 (Mega Agency TagID: MEGA852841_013.jpg) [Photo via Mega Agency]](https://wordupnews.com/wp-content/uploads/2026/02/kim-kardashian-pete-davidson-1-scaled.jpg)

The rumored couple has reportedly slowed down their alleged romance, with the rapper’s feelings among the top reasons they chose to remain silent.

Kim Kardashian and Lewis Hamilton have been friends for decades, but recently sparked speculation that they might be taking things further after a few sightings in the United Kingdom and Paris.

Article continues below advertisement

How Are Kim Kardashian And Lewis Hamilton Choosing To Handle Things?

Sources very close to the budding romance between the pair revealed that they are pulling out all the stops and being very careful not to anger Ye, given his unpredictable nature and the history of friendship between him and Hamilton.

The rumored couple is well aware of how volatile Ye is and how much the news could trigger a reaction from him, which is why they are keeping this partly casual. Kardashian and Hamilton are just having fun together as they continue their friends-with-benefits relationship.

“Lewis and Kim are not dating exclusively. He’s not looking to settle down with anyone, including Kim,” a first source explained to The Daily Mail, while a second source emphasized that, “Lewis isn’t looking to be a stepdad. [He’s] not looking to be the ‘it’ couple with Kim.”

Article continues below advertisement

Kardashian and Hamilton had spent time together last year, before their sighting, at Kate Hudson’s New Year’s Eve party in Aspen, Colorado.

Article continues below advertisement

The Duo Had A Blast Over The Past Weekend In The United Kingdom

Hamilton and Kardashian fueled speculation when the business mogul’s private jet landed at an airport in the United Kingdom.

The purpose of her visit? It was reported that they were to spend quality time with the Formula 1 race car driver while engaging in several activities at the exclusive Estelle Manor in the Cotswolds.

As shared by The Blast, their time together was very romantic, as the couple enjoyed all the goodies, with bodyguards providing full protection along the way.

Hamilton and Kardashian were first pictured together at the 2014 GQ Men of the Year ceremony alongside her then-husband, Ye, and his then-partner, Nicole Scherzinger.

Article continues below advertisement

Kardashian and the racecar driver reportedly enjoyed an intimate dinner at a private room in the hotel and settled in for a spa massage for just the two of them.

The mother-of-four reportedly jetted out of the United Kingdom at 11 am on Sunday morning, and they were later spotted together at an airport lounge in Paris.

Article continues below advertisement

Kim Kardashian Has Featured On The Dating Scene A Few Times Since Divorcing Ye

![Drew Barrymore arriving to the 2022 White House Correspondents' dinner held at the Washington Hilton Hotel on April 30, 2022 in Washington, D.C. © Tammie Arroyo / AFF-USA.com. 30 Apr 2022 Pictured: Pete Davidson and Kim Kardashian. Photo credit: Tammie Arroyo / AFF-USA.com / MEGA TheMegaAgency.com +1 888 505 6342 (Mega Agency TagID: MEGA852841_013.jpg) [Photo via Mega Agency]](https://theblast.prod.media.wordpress.mattersmedia.io/brand-img/123/0x0/2025/02/17124021/kim-kardashian-pete-davidson-1-scaled.jpg?)

The socialite ventured into the high waters of dating in October 2021, and her first call was with Pete Davidson. Kardashian and Davidson were together for a year, during which he bonded with her kids and even got a special tattoo.

Following their split, the reality star reportedly tried again with pro footballer Odell Beckham, although nothing was confirmed from either quarter. However, a source shared that it was never a serious deal with Kardashian and Beckham, and that both understood this.

“It was always casual, but Kim has been really busy with other priorities and isn’t putting in as much effort. The dynamic lost its spark, but they are still friends,” the insider stated. The SKIMS founder went through a tumultuous divorce from Ye and eventually put everything behind her in 2022.

Kardashian, on her part, has been pretty vocal about her desire to couple up with a man who has good morals and values, and who exhibits calmness and dependability. In her words: “Takes accountability. I think that’s my number one thing.”

Article continues below advertisement

Lewis Hamilton Was Previously Linked With This Kardashian’s Sister

Kardashian is not the first member of the reality TV family the athlete has been rumored to be with. In 2015, the F1 racer had to explain to news sources that he and Kendall Jenner were just friends at the New York Fashion Week.

As noted by The Blast, the F1 champ reinstated his admiration for Jenner and her work ethic, calling her an incredible, level-headed, and focused model who exhibits such grown-up traits despite being a young woman.

Jenner was present at Hamilton’s 2015 event in Monaco alongside her pals Bella and Gigi Hadid, Kylie Jenner, and Hailey Baldwin. Before his latest sighting with Kardashian, Hamilton was linked to actress Sofia Vergara and even Shakira.

Sources close to both women, however, denied ever sharing anything romantic with the athlete, stating that their public sightings were far from dates and that they are just friends.

Article continues below advertisement

Kim Kardashian And Kanye West Reportedly Have A Smoother Co-Parenting Relationship

The mother-of-four gave an update on how far she and Ye have come in repairing their relationship after years of media drama and clashes. Kardashian told Khloé, during her appearance on the “Khloé In Wonderland” podcast, that she was relieved to see how things had turned around in recent months.

Khloé had noted that the former couple may have bonded over North West’s newfound love for producing music, to which Kardashian revealed that it is actually what North and her dad have in common.

“Even just coming up with stuff, we have to communicate about how North moves through that world and all these opportunities that come her way, and having to filter that and respecting his opinion on the things that go on with his kids is really important,” the SKIMS founder expressed.

She emphasized that she is a very empathetic person who prioritizes family over everything, despite their differences, but there were times she had to be super protective with the kids.

Entertainment

TMZ Sports Streaming Live From Newsroom, Join The Conversation!

TMZ Sports Live Stream

Join The Conversation!!!

Published

TMZ Sports is going live from the newsroom to discuss the day’s biggest stories … but we don’t just want folks to watch and enjoy the conversation, we want y’all to get involved!!

Hit the comment section as Babcock, Lucas, Dylan, Luca, and the whole crew break down the most important topics of the day … and we’ll be interacting with viewers throughout the program between 1 and 2:30 PM PT.

YouTube, X, TikTok … we’re everywhere.

So tune in, make fun of us, share your two cents, sound off about your favorite team … nothing is out of bounds.

Wednesday’s show will include an interview with Warren Moon, the big James Harden news, a big update on the Megan Thee Stallion and Klay Thompson relationship and so much more!!

Entertainment

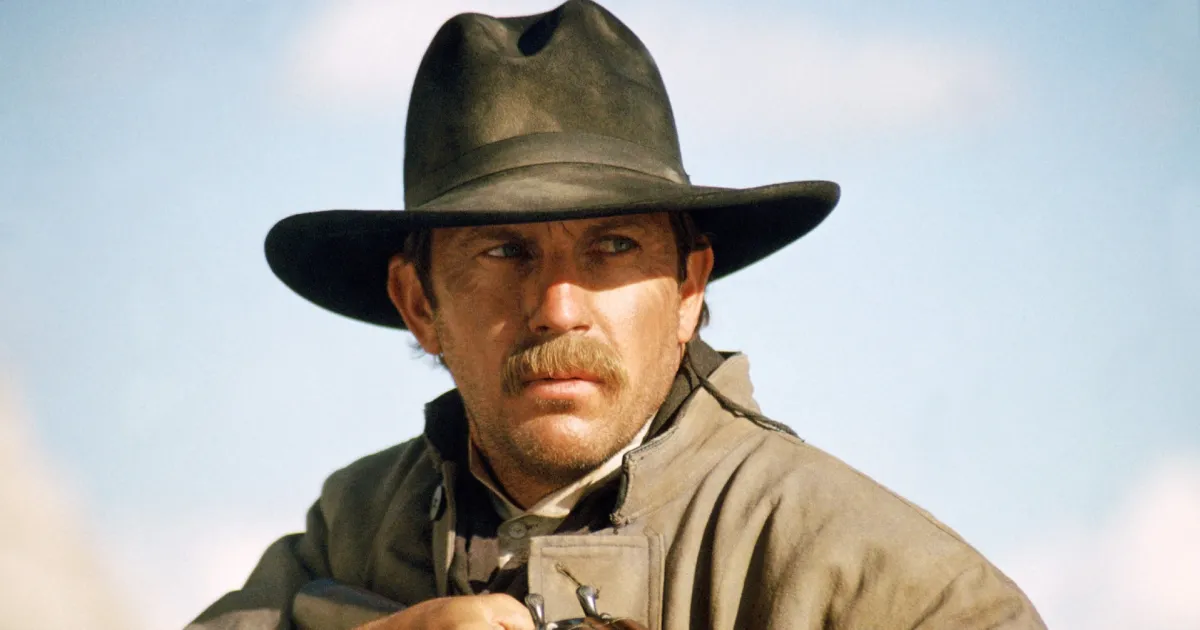

This Kevin Costner Western is Netflix’s Newest Hit — and It’s Better Than Yellowstone

If you love Yellowstone and Kevin Costner, then you may just love this Western drama that’s currently trending on Netflix.

Released in 1994, Wyatt Earp stars Costner as the eponymous, real-life lawman who would go on to be involved in the O.K. Corral gunfight in 1881. The movie is a biographical epic of Earp’s life.

The film features a terrific ensemble cast that includes the late Catherine O’Hara, and while it received mixed reviews from critics at the time, it’s found more favor with fans over time.

Watch With Us breaks down why Wyatt Earp deserves its spot in the Netflix Top 10.

‘Wyatt Earp’ Chronicles the Life of a Fascinating Real-Life Figure

Wyatt Earp takes an in-depth look at Earp’s life from his teenage years during the Civil War, living on his family’s farm in Iowa, to becoming a lawman in towns like Wichita and Dodge City in Kansas and Tombstone, Arizona. From a young age, Earp is taught that only two things really matter in life: family and the law. Thus, Earp is flanked by his brothers James (David Andrews), Morgan (Linden Ashby) and Virgil (Michael Madsen), in addition to friend Doc Holliday (Dennis Quaid), in their eventual confrontation with outlaws at the climactic O.K. Corral, involving the Clanton and McLaury gangs.

As opposed to taking a more mythical or fantastical approach to this real-life material, director Lawrence Kasdan and co-writer Dan Gordon instead give Earp’s life a grittier, more realistic feel in addition to being a psychological portrait of the famous lawman. Rather than being a simple action epic, Wyatt Earp is far more interested in details and nuance, and the internal burden that Earp carries throughout his life — which includes a violent, dark side to Earp’s character.

The Long Runtime Gives Earp’s Life the Richness It Deserves

While some biographical films attempt to sum up a celebrity or important historical figure in just one or two short hours, Wyatt Earp gives its subject the courtesy of a more than three-hour film. Because of this ample runtime, more care is given to the historical detail and accuracy, giving way to more comprehensive storytelling. We’re given this excess time with Earp’s life from adolescence through middle age, and it allows for a deeper understanding of his psychology and his evolution of self, leading up to the major historical event that everyone knows him for.

Thus, far from a fast-paced epic, Wyatt Earp is a slow-burn character study with a Western setting that feels authentic instead of romanticized. Earp’s character arc is incredibly thorough, and the approach to depicting his character even has something of a documentary feel to it. While the slow pacing and occasionally disorganized narrative may turn some people off, those who enjoy biographical films that are concerned with the facts in addition to telling a compelling story will appreciate the lengths that Wyatt Earp goes to achieve this.

‘Wyatt Earp’ Is Character-Driven With a Strong Supporting Cast

While a movie like Tombstone — also about Wyatt Earp and the O.K. Corral — is more centered on the immediate lead-up to and action of the conflict at the O.K. Corral, Wyatt Earp gives a deeper focus to its sprawling cast of characters covering multiple eras of Earp’s life. For instance, Gene Hackman gives a terrific performance as Nicholas Earp, Wyatt’s stern and influential father, while Quaid infuses Doc Holliday with a vulnerability that rings true to the character.

In contrast to Tombstone and Kurt Russell‘s charisma-driven portrayal of Earp, Wyatt Earp finds strength in Costner’s more reserved depiction, more suited for a biopic approach. But besides Costner, the cast of Wyatt Earp is ridiculously stacked. The rest of the supporting cast includes the always-great O’Hara, who portrays Allie Earp, in addition to Bill Pullman, Mark Harmon, Isabella Rossellini, Tom Sizemore and Adam Baldwin.

Entertainment

Extreme Post-Apocalyptic Thriller Will Either Cure You Or Break You

By Robert Scucci

| Published

One of the common pitfalls post-apocalyptic thrillers run into is trying to do too much at once, because there are a lot of angles to consider. The Mad Max franchise works because there is dense, folklore-driven worldbuilding that we’re made aware of as a smaller group of people navigate the wasteland looking for answers. The 28 Days Later films handle this well too. We’re briefed on what’s happening globally, and then things are handled locally.

2025’s Uncontained, despite the fact that it has a lot going for it, struggles with this balance. The result is a tonally inconsistent film that I wish stuck the landing better, because the potential is clearly there.

Found Family During End Times

Billed as a zombie horror drama, Uncontained tells a much more personal story through the eyes of Dan (portrayed by writer director Morley Nelson). Dan is a drifter who appears to be immune to the zombie virus that has decimated society, and he eventually happens upon a smart house occupied by two children, Jack (Jack Nelson) and Brooke (Brooke Nelson).

Their mother, simply billed as The Woman (Nicole Nelson), works for Homeland Security and is desperately searching for a cure, because Jack carries a latent version of the infection.

Dan, initially just looking for shelter, slowly becomes a surrogate father figure for Jack and Brooke. The Woman is also glad to have him around, mostly because he’s able to clock an intimidating amount of time on the treadmill that doubles as a power source for the house.

Jack handcuffs himself to the bed before going to bed, because he occasionally turns into a bloodthirsty zombie in his sleep and needs to wait out his episodes so he doesn’t harm his family. He also sets elaborate snare traps in the backyard and spends his time studying captured zombies, which initially disgusts Dan, who doesn’t yet realize that he and Jack have more in common than either of them would like to admit.

The B Story

Meanwhile, Uncontained introduces additional conflict in the form of militia leader Brett Carson (Peter O’Meara), who refuses to leave the property because he’s searching for his missing daughter, Melanie (Courtney Blythe Turk). This entire plot line feels largely unnecessary, as it neither helps nor meaningfully disrupts the dynamic inside the house that Dan and the family are occupying.

The limited value these scenes provide comes mostly from comic relief, particularly when Brett talks shop with a police officer who grows more visibly concerned with each passing exchange, as if silently thinking, “dude, you need to go home before you get killed.”

Speaking of comic relief, Uncontained earns genuine points for the dynamic it establishes between Dan, Jack, and Brooke, and The Woman. Dan has a gruff exterior and doesn’t look like the kind of guy who enjoys screwing around. But the moment Brooke offers him her hair clips, he immediately takes her up on it just to be kind. These subtle moments are both funny and disarming, and they say a lot about Dan’s character. The world is effectively ending, and nobody is obligated to be pleasant if they don’t want to be.

Uncontained ultimately leaves a lot on the table, and it’s because it tries to think globally and locally at the same time. Had the film committed to being a bottle story focused on the house and its occupants, I think it would have landed more cleanly. It simply tries to do too much at once, when the initial survival story is already compelling on its own. The moments I enjoyed most came directly from this central dynamic. The idea that an infected child could be the key to a cure while the family battens down the hatches and rides out the proverbial storm is strong enough without a side story pulling attention away from it.

Uncontained is streaming for free on Tubi.

Entertainment

Pedro Pascal saves Todd Haynes' gay romance after Joaquin Phoenix's controversial exit

:max_bytes(150000):strip_icc():format(jpeg)/Pedro-Pascal-01-020426-69c395c061394f9499b52f2d32406c25.jpg)

Phoenix infamously left the project just five days before it was set to begin filming.

Entertainment

Dave Coulier’s Tongue Cancer Is In Remission 4 Months After Diagnosis

Dave Coulier’s tongue cancer is officially in remission, two months after going public with his diagnosis.

“It’s been a roller-coaster ride for sure,” Coulier, 66, said during a Wednesday, February 4, appearance on Good Morning America. “I’m in remission with both cancers. And what a journey this has been.”

The Full House alum announced in December 2025 that doctors had diagnosed him with HPV-related oropharyngeal tongue cancer that October. The illness was “totally unrelated” to his previous battle with stage III non-Hodgkin lymphoma.

“To go through chemotherapy and feel that relief of, ‘Whoa, it’s gone.’ And then to get a test that says, ‘Well now you’ve got another kind of cancer,’” said on the Today show in December 2025. “It is a shock to the system.”

Coulier announced his non-Hodgkin lymphoma diagnosis in November 2024. He was cancer free by March 2025, after several rounds of chemotherapy.

“It was a really tough year, chemotherapy was grueling,” Coulier told Today late last year. “A couple of months ago, I had a PET scan, and something flared on the scan. The doctor said, ‘We don’t know what it is, but there’s something at the base of your tongue.’”

Coulier explained that it was a “very painful” experience.

“It’s like if you bit your tongue, but the pain just lasted every single day,” the actor shared during his Today interview.

Oropharyngeal tongue cancer is considered rare, with the American Cancer Society estimating that it only impacts 53,000 people a year. The illness “forms in your oropharynx, the middle section of your throat,” according to an article by the Cleveland Clinic. While it is treatable, it “can come back,” the same article claimed. Coulier’s specific type of tongue cancer impacted the P16 protein, a marker for human papillomavirus (HPV), a sexually transmitted infection that can turn into cancer if untreated.

In December 2025, Coulier revealed that he planned to undergo 35 radiation treatments. The “prognosis is good,” his medical team said at the time.

“It’s a whole different animal than chemo,” he explained. “It doesn’t feel as aggressive, but there are still side effects.”

Coulier has stayed in high spirits during his overall cancer battle. However, the actor has spoken candidly about the toll it’s taken on his mental health.

“It’s emotional. It’s psychologically draining,” Coulier told Today, explaining that it has also impacted his wife, Melissa Bring. “I’m going to get on the other side of this. The silver lining here is that I had cancer, which helped me detect my other cancer. It seems crazy to be making that statement, but it’s true.”

Bring, who has been married to Coulier since 2014, also addressed her husband’s lengthy cancer journey in a January 2025 interview.

“He has some really tough days, and as the chemo has been accumulating it gets a little tougher and more difficult,” she said at the time. “He has such a positive attitude, and you need that in order to really fight it.

Bring recalled, “Every morning, if he’s feeling up for it, we try to put on a song and do a little dance party with the dogs, because when you do feel good, you have to celebrate that too.”

Entertainment

Catherine O’Hara’s 10 Best ‘Schitt’s Creek’ Episodes, Ranked

When you have a long-spanning, well-established, illustrious career, creating another iconic character in your later years may not be realistic. But then, Catherine O’Hara defied that. She didn’t just play another significant role; she crafted what is perhaps her most beloved character of all time. When you see an image of Moira Rose, you can hear it. From her distinct made-up dialect with signature cadence to memorable quotes that live rent-free in the pop culture lexicon, O’Hara’s role on Schitt’s Creek was a glorious celebration of comedy.

O’Hara’s passing came as quite a shock to all who loved her. It’s allowed us to reflect on her brilliant career and the impact she made on our lives. When it came to Schitt’s Creek, from start to finish, it was a pitch-perfect comedy, produced in part by O’Hara’s Moira. Throughout her six seasons, these Moira episodes stand out as, well, simply the best.

10

“Motel Review”

Season 3, Episode 8

One thing we know Moira Rose is not is a working woman in menial jobs. Don’t ever expect her to do a job a pedestrian might take on. But sometimes, hard times require hard decisions. In this Season 3 episode, the motel receives a particularly negative review: “I was served by an intimidating woman at the front desk, with an unrecognizable accent, and scary-looking attire.” Well, while the first part could have been about Stevie Budd (Emily Hampshire), the second part is most certainly about Moira. So, what is she doing manning the front desk? With Johnny Rose (Eugene Levy) running an errand and Stevie forcing a reluctant Moira to help out with the easy task of simply sitting at the front desk and helping guests, our beloved Moira botches it hardcore.

Moira is of no particular help when a guest seeks to check in, sloughing off that guest’s many requests. When Johnny learns how this review might negatively affect the motel, he forces his wife to make amends with the guest. Moira’s highest points in the episode are watching her muster up enough of a facade to keep the catty side at bay. This is not a position she wants to be put in, but this motel is their only hope. She must right her wrongs. Most employees offer service with a smile. Moira provides service with a smirk. A big part of this episode is seeing Moira and Johnny work through their marital issues in this new confined situation. They need their space! An episode built on relationships and the frustrations that come with them; even our favorite couple had their ups and downs.

9

“RIP Moira Rose”

Season 4, Episode 5

It might be hard to find the humor of this episode, given O’Hara’s passing, but this Season 4 episode epitomized the Moira we grew to love. Rumors circulate that TV’s Moira Rose died. As the news spreads, it brings worry to the citizens of Schitt’s Creek, only for immense joy to come when they learn she’s alive and well. Online, the instant attention brings flattering condolences and complimentary messages, which, of course, she adores. But when a reporter arrives in town for a story, Moira is forced to reconcile her life in Schitt’s Creek.

Moira must decide what’s worse: that there is only one reporter, or that the reporter will see that she lives, in her own words, in “a Podunk motel”. Using a darker tone to discuss mortality, Schitt’s Creek puts death on display through the lens of celebrity. Watching Moira’s downward spiral from joy to sadness is quite genuine and honest. While we all may wish to know how our loved ones may react to our own passing, the reality might end up being a tough pill to swallow. Moira’s descent into her downward spiral is one of the rare moments when the show balances a range of emotions to convey something refreshing.

8

“The Rollout”

Season 4, Episode 11

Generally, no one wants to do jury duty, so the concept of Moira having to sit through jury duty in this community is hilarious in and of itself. Upon learning that she and Jocelyn Schitt (Jennifer Robertson) have to sit through jury duty, she prepares every excuse in the book to get herself out of it. That is, until the case piqued her interest. So, what could this case be about that Moira no longer wants to perjure herself for? Embezzlement. Well, this one hit close to home! Moira has a mission on her mind, and she’s not going to go down easy.

Since this is Schitt’s Creek, Moira is absolutely not going to get what she wants. Moira so desperately wants vicarious revenge on the business manager who robbed the Roses that she overcompensates. Fortunately for the Canadian justice system, she loses her temper, tells the truth, and gets dismissed. This episode was a fun buddy moment for the mothers of the town as they continue to develop their bond as an odd couple. Moira’s engagement with the mundane is part of what makes the latter seasons special. Moira is an example of the extreme actions we wish we could achieve but never dare execute.

7

“Moira’s Nudes”

Season 2, Episode 9

The concept of our nudes leaking and circling the World Wide Web is terrifying. Now, when it’s Moira Rose, it’s just a brilliantly funny concept. During Season 2, Moira goes up against Jocelyn for a town council position. Upon learning that her nudes are out, the technologically inept Moira tasks David (Dan Levy) and Stevie to find and delete them. But when they can’t find them, Moira’s true feelings come out. She’s not necessarily upset that her nudes may be circulating; she’s distressed that they’re missing. Why? If they’re missing, the memorial to her youth is lost.

The premise of asking her son to even locate those photos is funny. But to then see them as a highlight of her past is a pretense to her personality and mindset. As Moira comes to realize the impact of these lost photos, she wants to prevent anyone else from enduring this pain. So, she gives young Stevie advice. She famously tells Stevie to take a thousand naked pictures of herself and post them online, so her future self and children can look back fondly. Moira had given out a lot of advice throughout the series, but this one takes the cake.

6

“Finding David”

Season 2, Episode 1

Not everyone took to relocating to Schitt’s Creek well. Case in point, David Rose. In the Season 2 premiere, the Roses are on the hunt to find David. The reason he disappears is that, believing he’d be escaping Schitt’s Creek soon, the sale of the town doesn’t go through. While some genuinely care about David’s whereabouts, Moira is also concerned that he’s supporting himself at her expense. In her mind, that cannot happen. Further, what’s more distressing than her missing son is her missing bag. We’ve seen her in hysterics over her prized possessions before, but this one was peak Moira.

Having a conniption that her brown crocodile bag, which her mother gave her, had been stolen by her missing son, it’s telling what her priorities lie. As much as Johnny attempts to calm her down, alerting her to the many other brown bags she owns, it’s this bag she demands. The hysterics are part of the character because most of us understand the absurdity of her situation and how she’s simply overreacting. But the way she alludes to the bag as if it were one of her children, even though her actual kid is missing, makes it simply hilarious. These early moments are crucial to her eventual character building.

5

“Life Is a Cabaret”

Season 5, Episode 14

There’s something so endearing about our favorite characters putting on a show. Whether it be the kids of Glee or the kids of High School Musical: The Musical the Series, it brings us back to our own high school theater days. Now, imagine that type of scotch tape production in a community theater lens. Schitt’s Creek lets the adults live out their theater fantasies. Schitt’’ Creek opted to put on a production of the John Kander and Fred Ebb classic Cabaret. A very meta selection, the lead-up to the production featured some brilliant moments, including Alexis Rose (Annie Murphy) auditioning with “A Little Bit Alexis.” In the Season 5 finale, it’s opening night, and like any production, nothing can actually go perfectly. With Stevie suddenly going MIA, director Moira Rose is ready and able to step into the role of Sally Bowles.

TV’s Moira Rose had been chomping at the bit to prove she’s a star, but for this production, she kept her expertise lead her to direct. No one was going to steal her thunder. Not even the announcement of David and Patrick Brewer’s (Noah Reid) engagement. But with Stevie missing, in the mother-of-the-year’s opinion, because David spilled his secret, Moira could be the hero without looking like an egomaniac in the lead role. Moira arrives in full costume because the show must go on! But as Stevie finally returns, ready to bring the house down with “Maybe This Time,” there’s a sense of disappointment from Moira.

In perfect Moira fashion, she passes off her costume as silly, awkward cosplay. But as everyone else revels in praise and glory, opening night also becomes closing night for her big film comeback, as she learns it has been shelved. Having divulged that it was the only thing saving her from an emotional spiral, you can’t help but feel for Moira. This episode, which has some funny moments, is Moira at her most vulnerable. O’Hara’s ability to open Moira up to genuine pain and disappointment through the guise of humor is the work of an extraordinary performer. Moira’s depth had been fully achieved.

4

“The Crowening”

Season 5, Episode 1

As Schitt’s Creek delighted devoted fans, the team began sprinkling in running gags that became a gift every time they popped up. For Moira, and her acting career, the best running bit came with her involvement with The Crows Have Eyes film franchise. Highlighting the lengths to which Moira would go to resurrect her career, the first time the fictional horror film appears is in Season 3, when she auditioned for The Crows Have Eyes II. We know she turned it down as she’d have to pay her way to the filming location and live with a local family. Flash forward to the Season 5 premiere, and Moira is back in action as she’s accepted the role of Dr. Clara Mandrake, a respected ornithologist turned human-crow hybrid. Not only is this our favorite mother’s big comeback vehicle, but we also get to see her filming the low-budget project in Bosnia, The Crows Have Eyes III: The Crowening.

As expected, Moira is Moira. She has numerous script revisions that the young director has no interest in taking on. While he claims it’s “an apocalyptic fantasy about mutant crows,” Moira sees it as “a timely allegory about prejudice.” Bless her heart. As she tries to litter her soap opera experience, it just makes the viewing experience even more bizarre. Watching O’Hara decked out like a bird, playing it up in a nest in front of a green screen, was comedy gold. In a feature with Vulture at the time, O’Hara was revealed to have had “free rein” to create Dr. Mandrake’s look. Learning how much input the actress had with this arc was extraordinary. What made it better was seeing the payoff in Season 6, with the local premiere, which was simply divine. Decked out with a Merlot carpet and the support of the town, it truly was a full-circle moment.

3

“Our Cup Runneth Over”

Season 1, Episode 1

Schitt’s Creek would not be the legendary series it became without a pitch-perfect pilot. A good pilot must set up the series to come and entice us to become invested. Diving straight into the raid of the Rose’s mansion, we saw the high-strung anxiety from the quartet as all of their beloved belongings were ripped from their hands. As we watch the wealth disappear before their eyes, we begin to learn about each character’s quirks and how they react to tragedy. O’Hara brought instant hysteria. First, we see her with designer bags on her person, only for us to see her servants packing up her personal items. And by that, I mean her many wigs. And no, the wigs don’t get along with one another. When the Roses learn that there is one asset remaining, and no, not the kids, the entire series officially begins.

Johnny purchased the town as a joke for David, and now that joke was their saving grace. Schitt’s Creek became their home and our place to join our new favorite revision family. By the time we reach the town, we get to see Moira on full display in her complete disgust, insults flying in only a manner Moira could hurl. Yet it was all part of the comedy, watching his wealthy woman try to get used to her biggest fear—being poor. From watching her maneuver a lightbulb in a drawer to living so close to her kids, Moira is being Moira. Though she jokes about not waking up and about nailing the coffin shut, if only Episode 1 Moira could see herself in Met Gala-inspired regalia in the finale.

2

“Family Dinner”

Season 2, Episode 2

While we eventually saw the Roses develop into a beautiful family unit, it was during the first few seasons that we saw the quartet’s disconnect. Yet, the more that they were forced to spend time together, the closer they eventually became. In the Season 2 episode, Moira chose to cook dinner to prove she could indeed cook. In an attempt to continue a family tradition, Moira planned to prepare her “family’s” enchilada recipe. Enlisting David to be her essentially sous chef, resulting in a chaotic scene that left us all in stitches.

While in the kitchen, mother dearest instructs her son to follow the recipe. Of course, he takes it all far too literally. Now, they may not be elite chefs, but the term “fold in the cheese” held them up as they could not fathom what it meant. As Moira tried to play coy, David grew angry. And as David’s rage rose, Moira began to panic. From literally believing one must fold the tiny shreds of cheddar like a piece of paper to Moira avoiding answering her son’s question, the scene played out exactly how you’d expect two individuals who never once stepped foot in a kitchen to occur. The zinger of the scene, “David, what does burning smell like?” served as a perfect button. This episode showcased Moira’s attempt at domesticity, which we all knew was a doomed venture. And that’s the comedy of Moira in the early seasons.

1

“Wine and Roses”

Season 1, Episode 6

There are quite a few iconic moments that came out of the first season of Schitt’s Creek, but the moment that put the series on the map was the Herb Ertlinger (Richard Waugh) wine commercial. The sixth episode put Moira back on screen only for her to own her flop. Specializing in fruit wine, Herb was eager to have Moira serve as the winery’s spokeswoman. With an ego boosted, Moira is all in, believing this would be her acting comeback. If only it were that easy. What resulted was one of the funniest scenes in the entire series.

The brilliance of the writing was the name of the man and his winery. An already peculiar name, even some of the best in diction might get tongue-tied while attempting to say “Herb Ertlinger.” But Moira, through all her delusional confidence, goes all in with the mispronunciation, causing a domino effect of flubs. The result was sheer hilarity. Now, mind you, the woman was quite tipsy, having sampled the vino at the unpretentious winery. O’Hara’s nuanced subtlety mirrors the brilliance we remember her bringing to the assortment of Christopher Guest films she starred in. Moira was a character we laughed at, but genuinely rooted for in the world of acting. Thanks to this commercial, it was a sweet taste of where the former soap star could go in the future. And as we’ve discussed, shine a spotlight on Moira, and she dazzles.

Entertainment

HBO Max's New Answer to 'The Bear' Sets the Stage for a 'Dawson's Creek' Reunion

The Bear has quietly become one of the biggest shows in the world in the last few years. The hit comedy, which is really more of a drama, has aired almost a new season every year since it first premiered in 2022, and it has left other streamers trying to replicate its Emmy-winning success. The show stars Jeremy Allen White (Deliver Me From Nowhere) and Ayo Edebiri (Opus) alongside Ebon Moss-Bachrach (The Fantastic Four: First Steps), and it follows a young chef from the fine dining world who returns home to Chicago after the death of his brother to take over his family’s sandwich shop.

Entertainment

Says She’s Not Transphobic (Video)

Nicki Minaj has sparked reactions after sharing why she believes she is not transphobic. Additionally, the rapper shared why she chose to place her support behind Donald Trump.

RELATED: Whew! Social Media Is Goin’ OFF After Nicki Minaj Called Herself Trump’s “Number One Fan” & Held His Hand At Account Summit (WATCH)

Nicki Minaj Says She’s Not Transphobic & Explains Trump Alignment

On Tuesday, February 3, a new episode of the ‘Katie Miller Pod’ was released via YouTube and featured Nicki Minaj as a guest. As the conversation opened, Minaj explained that she placed her support behind President Donald Trump after seeing “how he was being treated.”

“I felt that that same — a lot of that bullying and the smear campaigns, and all of that lying — I felt like that had been done to me for so many years. And I was watching it in real time happen to someone else, and I didn’t think he deserved it,” Minaj explained.

As the conversation continued, Minaj seemed to note that Trump expressed to her his respect for her fanbase and the LGBTQ+ community. Around nine minutes into the interview, Minaj shared her own stance, explaining that although she disagrees with pro-trans rhetoric being pushed in schools, she is not transphobic. Furthermore, she stated that she believes “adults” should be able to do what they’d like with their bodies.

See what she said below.

Social Media Is Sharing Reactions

Social media users reacted to Nicki Minaj’s comments about not being transphobic in TSR’s comment section.

Instagram user @1princessmehgann wrote, “Real barbz Know she isn’t transphobic”

While Instagram user @t.beezus added, “She literally said children … when was the community attacked ? Y’all lack basic comprehension !”

Instagram user @iyawoijebu wrote, “Nicky we judging you and we don’t care!”

While Instagram user @804.saucy added, “Yall not following … what she’s saying is kids shouldn’t have the option at such a young age to change their gender when they don’t even know what they want yet”

Instagram user @istayblessedxo wrote, “I think about 99% of America agrees with her on that. People should not be able to make a life changing decision like that until at least 21. If you’re can’t drink before 21 you shouldn’t be able to change your gender.”

While Instagram user @dijouncruz added, “The ‘Trans part of the LGBT’ pay attention ya’ll smh”

Instagram user @tarisunscripted wrote, “Please get her off my algorithm.”

While Instagram user @chanel__5 added, “She did say this but it’s the way you delivered it with a party that thrives off H8TE”

Before Nicki Minaj Shared That She’s Not Transphobic, She Sparked Reactions With Recent Donald Trump Alignment

Before Nicki Minaj shared that she’s not transphobic, she raised eyebrows with her apparent political alignment with Donald Trump. As The Shade Room previously reported, in November 2025, Minaj appeared at the United Nations. There, she noted her support of Donald Trump speaking on the alleged Christian persecution in Nigeria.

RELATED: Screenshot Appears To Show Tammy Rivera Calling Nicki Minaj A “Bootlicker” As Clip Resurfaces Of Charlie Kirk Saying Rapper Isn’t Good Role Model

Then, earlier this month, Minaj appeared at the Trump Account Summit. Additionally, she said she was the president’s “number one fan” and even held his hand.

RELATED: Birds Of A Feather? Waka Flocka Sparks Reactions With Message For Nicki Minaj Amid Shade Over Trump Support (PHOTO)

What Do You Think Roomies?

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech13 hours ago

Tech13 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World22 hours ago

Crypto World22 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards

![P Square - Taste the Money (Testimony) [Official Video]](https://wordupnews.com/wp-content/uploads/2026/02/1770240048_maxresdefault-80x80.jpg)