Tech

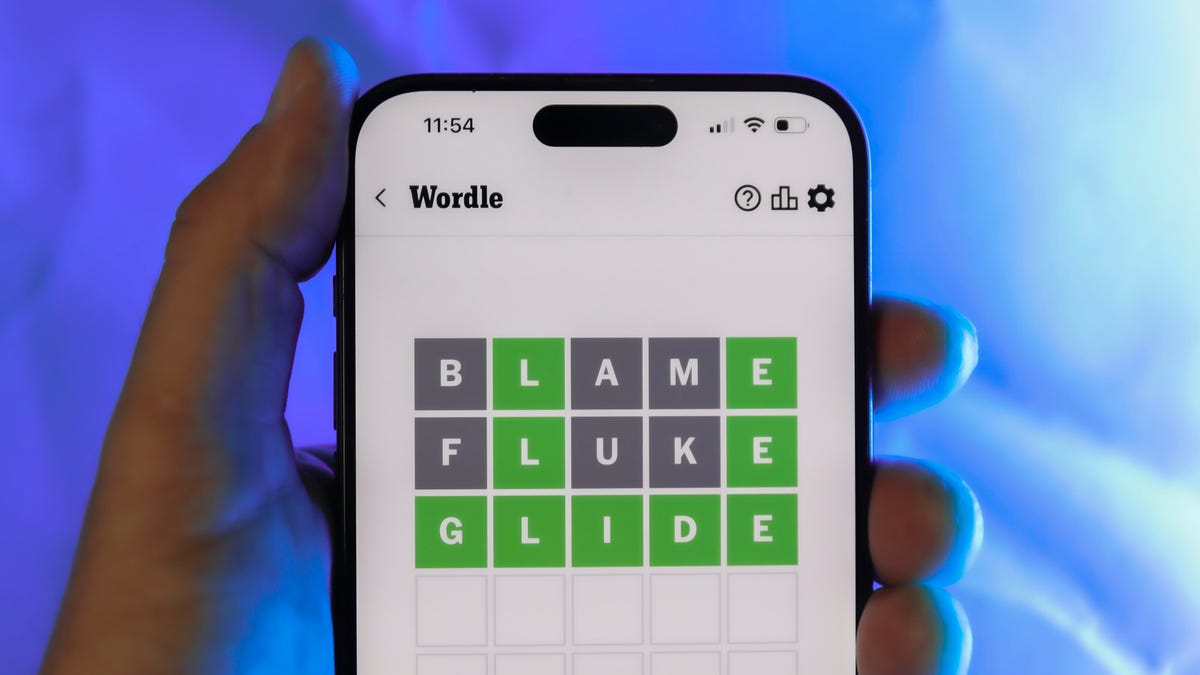

Today’s NYT Wordle Hints, Answer and Help for Nov. 17 #1612- CNET

Looking for the most recent Wordle answer? Click here for today’s Wordle hints, as well as our daily answers and hints for The New York Times Mini Crossword, Connections, Connections: Sports Edition and Strands puzzles.

Today’s Wordle puzzle is a fun one, if you’ve ever taken wood shop. If you need a new starter word, check out our list of which letters show up the most in English words. If you need hints and the answer, read on.

Today’s Wordle hints

Before we show you today’s Wordle answer, we’ll give you some hints. If you don’t want a spoiler, look away now.

Wordle hint No. 1: Repeats

Today’s Wordle answer has no repeated letters.

Wordle hint No. 2: Vowels

Today’s Wordle answer has one vowel.

Wordle hint No. 3: First letter

Today’s Wordle answer begins with C.

Wordle hint No. 4: Last letter

Today’s Wordle answer ends with P.

Wordle hint No. 5: Meaning

Today’s Wordle answer can refer to a brace-like tool that holds things together in a workshop.

TODAY’S WORDLE ANSWER

Today’s Wordle answer is CLAMP.

Yesterday’s Wordle answer

Yesterday’s Wordle answer, Nov. 16, No. 1611, was WIELD.

Recent Wordle answers

Nov. 12, No. 1607: DEUCE

Nov. 13, No. 1608: TINGE

Nov. 14, No. 1609: LURID

Nov. 15, No. 1610: CLUNG