Business

10 Must-Know Facts About Golf’s Most Dominant Champion

Scottie Scheffler is the dominant force in men’s golf right now, and his rise has been one of the most remarkable stories in modern sports. Here are 10 essential things you need to know about the world No. 1.

1. He is a multiple major champion

Scottie Scheffler has already built a major-championship résumé that puts him in elite company. He owns multiple Masters Tournament titles, winning his first green jacket in 2022 and adding a second Masters victory in 2024. In 2025 he captured the PGA Championship, giving him at least three majors before turning 30 and placing him alongside some of the game’s greatest early-career performers. At The Open, he has also contended on links golf’s biggest stage and is now recognized as a complete player across all major setups.

2. He has already dominated a full PGA Tour season

Scheffler’s 2024 campaign is widely viewed as one of the best single seasons of the modern era. That year he won the Arnold Palmer Invitational for a second time, then became the first back‑to‑back winner in the history of The Players Championship, a tournament often called the sport’s “fifth major.” He followed that with a second Masters title and a win at the RBC Heritage, giving him four victories in five starts during an astonishing spring run. Later that stretch of dominance helped propel him to the FedEx Cup title and the season‑ending Tour Championship, cementing his status as the game’s standard‑bearer.

3. He’s a former world No. 1 with a historic reign

Scheffler is not just a one‑year wonder; he has sat atop the Official World Golf Ranking for a sustained period. After his breakout wins in 2022, he ascended to world No. 1 and has repeatedly reclaimed and extended that position. By 2025 he became the first player since Tiger Woods in 2007 to reach 100 consecutive weeks as world No. 1, a milestone that underscores how completely he has separated himself from his peers. As of early 2026, official profiles still list him at No. 1 in the world rankings, with a sizable cushion in advanced statistical metrics and points systems.

4. His college roots are at the University of Texas

Before he was the dominant pro on television, Scheffler was a standout at the University of Texas, one of the premier college golf programs in the United States. At Texas he collected wins and top finishes in major collegiate events, including a Big 12 Championship title and strong showings in NCAA regional and national championships. His performances for the Longhorns confirmed what junior and amateur observers already suspected—that he had the temperament and ball‑striking to thrive against the very best.

5. He tore through the Korn Ferry Tour on his way up

Scheffler did not skip steps on his way to the PGA Tour. After turning professional in late 2018, he spent a full season on the Korn Ferry Tour, the main developmental circuit for PGA Tour hopefuls. There he won multiple titles, finished at the top of the points list and comfortably secured his PGA Tour card for the 2020 season. His dominance at that level hinted that his ceiling was far higher than simply keeping a card; it foreshadowed a quick leap into the game’s top tier.

6. His breakout PGA Tour season came in 2022

Although Scheffler’s rookie year on the PGA Tour in 2020 brought plenty of promise—including a final‑round 59 at The Northern Trust—2022 was the year he became a superstar. That season he picked up his first PGA Tour win at the WM Phoenix Open in February, defeating Patrick Cantlay in a playoff. He followed with victories at the Arnold Palmer Invitational and the WGC‑Dell Technologies Match Play before winning the Masters for his first major championship. The run earned him Player of the Year honors and vaulted him to No. 1 in the world, transforming him from promising talent to the face of men’s golf.

7. He is a prolific winner with huge career earnings

By mid‑2025 Scheffler had compiled 15 PGA Tour wins and 20 professional victories overall, including titles on the Korn Ferry Tour and at the limited‑field Hero World Challenge. Those tallies include his three majors and one World Golf Championship, plus multiple wins in signature events like The Players and the Arnold Palmer Invitational. Official PGA Tour records show that he has surpassed $100 million in career earnings, making him one of the highest‑earning players in tour history at a relatively young age. His victory at the 2024 Tour Championship alone delivered a $25 million FedEx Cup bonus, highlighting the financial scale of his dominance in the current era.

8. He is an Olympic gold medalist

Scheffler’s résumé is not limited to the PGA Tour and majors—he has also succeeded on one of the biggest global stages in sports. At the 2024 Paris Olympics he captured the gold medal in men’s golf, representing the United States. The victory added a unique line to his legacy, placing him among the rare modern golfers who can claim both major titles and Olympic hardware. That performance reinforced his reputation as a player who thrives under pressure and delivers when national pride is on the line.

9. He has been a key figure in U.S. team golf

Scheffler has become a fixture on American Ryder Cup and Presidents Cup teams. He made his Ryder Cup debut in 2021, contributing to a record‑setting U.S. victory and impressing observers with his poise in the intense match‑play environment. Since then, he has been viewed as a cornerstone of U.S. team lineups, often slotted into crucial singles and pairing positions thanks to his reliable tee‑to‑green game. His success at the WGC‑Dell Technologies Match Play further underscores his comfort in one‑on‑one showdowns, a critical asset in team competitions.

10. His game is built on elite ball‑striking and improved putting

Statistical profiles consistently show Scheffler near the top of the PGA Tour in strokes gained tee‑to‑green, reflecting his exceptional driving, iron play and short‑game control. For much of his early career, analysts viewed putting as the one relative weakness in an otherwise complete package. That narrative shifted in 2024, when he changed to a mallet putter—reportedly after a suggestion from fellow star Rory McIlroy—and transformed his performance on the greens, draining virtually everything inside 15 feet during his win at the Arnold Palmer Invitational. With his putting upgraded to match his ball‑striking, Scheffler’s margin over the field widened dramatically, fueling the historic win streaks that defined his mid‑2020s peak.

Scottie Scheffler’s story is still being written, but the outline is already clear: a college standout who dominated the developmental tour, exploded into multiple‑major stardom, anchored U.S. teams and put together a world‑No.‑1 reign that draws direct comparisons to the game’s all‑time greats.

Business

Trump’s Iran strike tests MAGA unity ahead of midterms

Trump’s Iran strike tests MAGA unity ahead of midterms

Business

Online travel agencies may emerge as AI winners, Morgan Stanley says

Online travel agencies may emerge as AI winners, Morgan Stanley says

Business

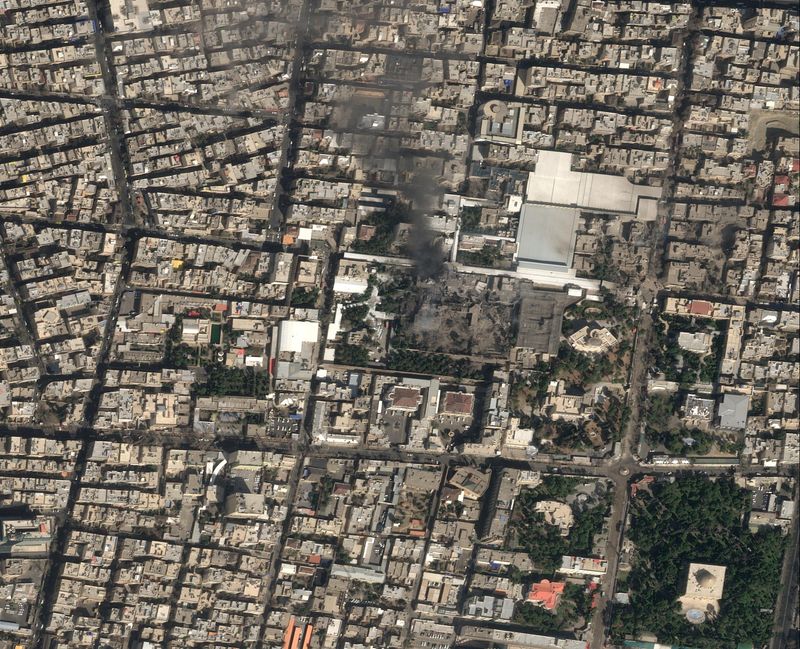

Global reaction to US, Israeli attacks on Iran

Global reaction to US, Israeli attacks on Iran

Business

What The Attacks on Iran Mean for Oil and Stocks

What The Attacks on Iran Mean for Oil and Stocks

Business

Chris Pratt Return for Cosmic Adventure

Illumination and Nintendo unleashed the latest promotional piece for *The Super Mario Galaxy Movie* on February 27, 2026, with the official “Heroes” teaser trailer spotlighting Mario and his allies in high-stakes galactic action. The 30-second clip, shared across YouTube channels including IGN and the official movie page, emphasizes teamwork, new worlds and returning voices as the sequel builds hype ahead of its April 1, 2026, theatrical debut.

Directed by Aaron Horvath and Michael Jelenic — the duo behind 2023’s blockbuster *The Super Mario Bros. Movie* — the film follows Mario (Chris Pratt), Luigi (Charlie Day), Princess Peach (Anya Taylor-Joy) and their friends venturing into space to confront cosmic threats. Produced by Chris Meledandri of Illumination and Shigeru Miyamoto of Nintendo, the project adapts elements from the beloved 2007 Wii game *Super Mario Galaxy*, blending gravity-defying platforming, star-powered exploration and whimsical storytelling.

The “Heroes” teaser opens with sweeping shots of orbiting planets and comet-streaked skies, then cuts to Mario leaping across floating islands while collecting Power Stars. Brief glimpses show Luigi piloting a starship, Peach wielding a spin attack and Yoshi (voiced in prior trailers) devouring enemies before spitting out eggs. A quick montage highlights the core group — Mario, Luigi, Peach, Toad and Yoshi — uniting against shadowy foes, with orchestral swells and the iconic Mario theme underscoring their resolve. The tagline “See the good guys in action!” flashes as the heroes strike heroic poses amid exploding galaxies.

Voice cast returns include Pratt as Mario, Taylor-Joy as Peach, Day as Luigi, Jack Black as Bowser, Keegan-Michael Key as Toad, Kevin Michael Richardson as Kamek and newcomer Brie Larson as Rosalina, the ethereal guardian of the cosmos introduced in the source game. Benny Safdie also joins in an undisclosed role. Recent trailers have teased Yoshi’s debut, Birdo’s appearance and potential cameos from other Nintendo characters, including fan speculation about a mysterious figure possibly tied to Star Fox.

The teaser arrives less than six weeks before the film’s wide release on April 1, 2026 — a date that coincides with April Fool’s Day but has been confirmed as intentional by Universal Pictures. Marketing has ramped up steadily: an initial teaser dropped during a January 2026 Nintendo Direct, followed by a Yoshi-focused first-look clip and a “Level Up” spot showcasing boss Megaleg from the original game. A separate trailer hinted at an “evil alliance” involving Bowser Jr. and possibly Wario, though the latter remains unconfirmed in official footage to preserve surprises.

*The Super Mario Bros. Movie* grossed over $1.36 billion worldwide in 2023, proving the viability of Nintendo’s cinematic universe and setting high expectations for the sequel. Analysts project similar or stronger performance for *The Super Mario Galaxy Movie*, given the source material’s popularity and the expanded scope of space-faring adventures. The film targets families with its colorful animation, humor and heart, while packing Easter eggs for longtime fans — from Luma collectibles to gravity switches and orchestral remixes of classic tracks.

Social media erupted following the “Heroes” drop, with #SuperMarioGalaxyMovie trending on platforms like X and Reddit. Fans praised the visuals, Yoshi’s charm and the promise of deeper lore involving Rosalina. Some speculated on unannounced characters based on leaked descriptions from cinema chains, including a potential Wario role alongside Bowser Jr. Nintendo and Illumination have kept plot details guarded, focusing promotions on spectacle and character reunions.

Tickets are now on sale through major chains like Fandango and AMC, with premium formats including IMAX and Dolby Cinema expected to showcase the cosmic scale. The official website, thesupermariogalaxymovie.com, hosts the trailer alongside posters and behind-the-scenes glimpses.

As the countdown to April 1 continues, the “Heroes” teaser reinforces the film’s core message: even in the vastness of space, Mario’s courage, friendship and ingenuity shine brightest. With Nintendo’s creative oversight ensuring fidelity to the games, the sequel aims to capture the wonder that made *Super Mario Galaxy* a landmark title while delivering fresh cinematic thrills.

Business

Novo Nordisk receives FDA approval for Sogroya in three new pediatric indications

Novo Nordisk receives FDA approval for Sogroya in three new pediatric indications

Business

(VIDEO) Gwen Stefani Sparks Debate with Lent Prayer Challenge Promotion

Singer Gwen Stefani is once again at the center of online controversy after teaming up with the Catholic prayer app Hallow to promote its 2026 Lent prayer challenge, prompting a mix of praise for her open faith and sharp criticism accusing her of undergoing a politically charged “MAGA makeover.”

The 56-year-old artist shared an Instagram post on February 18, 2026, announcing her participation in Hallow’s 40-day Lent program alongside Bible scholar Jeff Cavins. “Joining @jeffcavins this Lent on the @hallowapp as part of their prayer challenge leading up to Easter,” Stefani wrote in the caption, describing the experience as a meaningful way to prepare spiritually for the season. The post, a paid collaboration, quickly drew thousands of reactions — both supportive and critical — from her 17.7 million followers.

Critics seized on the partnership to question whether Stefani has shifted from her No Doubt-era punk-rock image to a more conservative, religiously focused persona. Several social media users labeled the change a “MAGA makeover,” pointing to Hallow’s associations with conservative figures and causes. The app has previously featured endorsements from personalities such as Tucker Carlson, JD Vance and Mark Wahlberg, and it has received funding from investors with right-leaning ties, including Peter Thiel. Commenters accused Stefani of aligning with “MAGA values” through her choice of platform and her increasingly visible Catholic devotion.

On platforms like Instagram, X and Reddit, detractors expressed disappointment. “How she went from being the coolest woman ever to this MAGA Barbie is beyond me,” one user wrote. Another commented, “I loved Gwen when she was rebellious and authentic — now it’s all white blonde hair, subdued clothes and endless prayer app ads.” Some fans declared they were “done” with her, citing what they perceived as a departure from the edgy, independent spirit that defined her early career.

The backlash echoes similar reactions from December 2025, when Stefani first promoted Hallow’s “Pray25: Be Still” initiative. At that time, users flagged the app’s pro-life content and conservative leanings, with one writing, “Love you Gwen but unfortunately I ain’t no Hallow app girl.” The repeated promotion has fueled perceptions that her faith journey is being packaged for a specific ideological audience.

Despite the criticism, a significant portion of her fanbase has rallied in support. Defenders argue that Stefani has always been open about her Catholic upbringing and that her current expressions of faith are genuine rather than politically motivated. “She’s been Catholic her whole life — this isn’t new,” one supporter posted. Others praised her courage in sharing spirituality publicly at a time when religious figures in entertainment often face scrutiny. “God bless her for being bold in her faith,” read one popular comment.

Hallow, launched in 2018, has become one of the most downloaded Catholic apps, offering guided prayers, meditations, Bible studies and celebrity collaborations. Its Lent challenge includes daily reflections designed to deepen users’ spiritual lives leading to Easter on April 5, 2026. The company has partnered with high-profile Catholics including Chris Pratt, Jonathan Roumie and Mark Wahlberg, positioning itself as a modern tool for prayer in a digital age.

Stefani has not directly responded to the “MAGA makeover” accusations. Her recent social media activity continues to blend family moments, music updates and faith-based content without engaging the political framing. Married to country singer Blake Shelton since 2021, she has spoken in past interviews about how faith has helped her navigate personal challenges, including divorce and motherhood.

The polarized response highlights broader cultural dynamics: celebrity expressions of Christianity frequently spark debate when perceived as intersecting with conservative politics. For some fans, Stefani’s Hallow partnership feels like a natural extension of her beliefs; for others, it represents an unwelcome pivot that clashes with the rebellious identity she cultivated in the 1990s and early 2000s.

As Lent continues, the conversation shows no signs of slowing. The challenge has reportedly attracted thousands of new users to Hallow, according to promotional metrics shared by the app. Meanwhile, online discourse remains split between admiration for her authenticity and frustration over what some see as performative or ideologically loaded spirituality.

With No Doubt’s planned reunion tour set for May 2026, fans will soon see whether Stefani’s current phase influences her stage presence or setlist choices. For now, the Lent promotion has turned a personal spiritual commitment into a public flashpoint, illustrating how faith, fame and politics continue to collide in the digital era.

Business

Exclusive-Prior to Iran attacks, CIA assessed Khamenei would be replaced by IRCG elements if killed, sources say

Exclusive-Prior to Iran attacks, CIA assessed Khamenei would be replaced by IRCG elements if killed, sources say

Business

China may trim 2026 growth target, keep policy supportive, BofA says

China may trim 2026 growth target, keep policy supportive, BofA says

Business

Oil and gas majors and traders suspend shipments via Hormuz as US attacks Iran, sources say

Oil and gas majors and traders suspend shipments via Hormuz as US attacks Iran, sources say

-

Politics6 days ago

Politics6 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports5 days ago

Sports5 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion24 hours ago

Fashion24 hours agoWeekend Open Thread: Iris Top

-

Business4 days ago

Business4 days agoTrue Citrus debuts functional drink mix collection

-

Politics5 days ago

Politics5 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Politics2 days ago

Politics2 days agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World4 days ago

Crypto World4 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Sports14 hours ago

The Vikings Need a Duck

-

Business6 days ago

Business6 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Tech4 days ago

Tech4 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

Business6 days ago

Business6 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat6 hours ago

NewsBeat6 hours agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat3 days ago

NewsBeat3 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat5 days ago

NewsBeat5 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech6 days ago

Tech6 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat6 days ago

NewsBeat6 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics6 days ago

Politics6 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

NewsBeat4 days ago

NewsBeat4 days agoPolice latest as search for missing woman enters day nine

-

Business3 days ago

Business3 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026