As the very first nontheatrical Star Trek feature (one that’s debuting almost a decade after Star Trek Beyond), Star Trek: Section 31 seems like the sort of project that could have easily felt too “made for TV” to tell a satisfying story that does its characters justice. But Section 31 is firing on just about all of its cylinders, and even though Discovery is behind us at this point, the movie charts an exciting new course for Star Trek’s potential future.

Business

A hard message to stomach on sewage from Thames Water boss | Money News

Eliminating all pollution incidents in the Thames Water network will be “almost impossible” and a public debate is needed about the real cost of ending all sewage outflows, chief executive Chris Weston has said.

Speaking as the company’s interim results revealed pollution incidents were up 40%, Mr Weston said “rising expectations” from customers about water quality and pollution were unlikely to be fully addressed in the next five years.

Thames faces a crucial 10 days in which it hopes to receive court approval for the first step in securing a £3bn loan to keep the company afloat, and two days later will discover by how much regulator Ofwat will let it increase customer bills.

That decision will determine what return potential new investors can expect, and how much creditors holding almost £16bn of the company’s debt will be prepared to lose in a restructuring.

Money latest: Inflation-busting rise in cost of Christmas dinner

Mr Weston is confident the first step, a High Court hearing over a £3bn bridging loan, will pass.

As for Ofwat, he told a media call it was crucial the regulator allowed a rate of return to investors that reflected “the risk that investors will take in respect of the sector as a whole, and the company”.

“Without this, neither Thames Water or the sector will attract the investment the companies need,” Mr Weston said.

Increasing returns to investors funded by bills rising as much as 50% will not be popular. Mr Weston’s message on pollution will be hard to stomach too, but it reflects the reality of underinvestment in an ageing system that’s increasingly overwhelmed.

Public anger about sewage outflows – where effluent is deliberately discharged from overflowing sewers into rivers as a failsafe to avoid it backing up into homes – has increased both political pressure and the cost of borrowing for water companies.

Whatever Ofwat allows, Mr Weston said even the £23.7bn he wants to invest will not clean up the system entirely.

“It is important to remember the system is working as it was designed to,” he said of outflows, which were built in as a failsafe to the Victorian network.

Read more from Sky News:

Rupert Murdoch loses legal bid to wrestle control of his empire

Man charged over Unitedhealthcare CEO murder

Starmer places economy first on Saudi visit

The Thames Tideway, a 25km tunnel beneath the river in London will open next year, diverting much of the sewage that ends up in the Thames from Acton to Beckton, but even that will not eliminate incidents.

“Some are very very minor, some are serious, so there has to be a priority to how we address this, there has to be a debate about the costs of meeting these pollution incidents,” he said.

“It’s not going to eliminate all pollutions, to do that will be almost impossible. So we need to have a debate about the cost.”

If financial engineering will determine whether Thames Water survives in its current form, the physical engineering of the ageing sewage system is another matter.

Technology

Star Trek: Section 31 is firing on all cylinders

Michelle Yeoh was an icon long before Star Trek: Discovery, but her performance as Captain Philippa Georgiou was part of what reenergized her career and put her on track to win a much-deserved Oscar in 2023. Though Discovery changed after Yeoh’s exit in season 3, there was hope that Georgiou’s story might continue on when news first broke about CBS being interested in another spinoff series with her as its centerpiece. Because of delays related to the covid-19 pandemic, Paramount Plus’ Star Trek: Section 31 from director Olatunde Osunsanmi was reworked into a movie rather than a show — a move that gelled with Discovery executive producer Alex Kurtzman’s optimistic vision for further explorations into this era of the franchise.

You don’t really need to have seen Discovery to dive into Section 31. But it definitely helps to know a bit about how, after the original Philippa Georgiou’s death in season 1, her alternate-universe counterpart took her place and brought an entirely different kind of energy to the USS Discovery. While the Prime universe’s Georgiou was a compassionate leader who believed in the United Federation of Planets and Starfleet’s mission to peacefully explore the galaxy, her Mirror universe double was a ruthless tyrant who embodied the fascism of the Terran Empire.

By the end of Discovery’s first season, it was clear that Emperor Georgiou was turning a new leaf and sticking around to become part of Section 31, a covert team of operatives tasked with missions that run counter to Starfleet’s professed beliefs. Georgiou and the rest of Section 31 frequently returned in Discovery’s subsequent seasons as morally dubious allies / foils to the show’s heroes. But Star Trek: Section 31 explains how exactly Georgiou was convinced to join Starfleet’s clandestine team of lethal space spies.

Most of Section 31 takes place in Georgiou’s present, where she has become the owner of a seedy nightclub (which is also a spaceship) parked somewhere beyond Starfleet’s jurisdiction. But the movie opens in the past when young Georgiou (Miku Martineau) was one of the many Terran children locked in a battle royale meant to decide who would become the Empire’s next leader.

Other than her fellow contestant San (James Hiroyuki Liao / James Huang in flashbacks), no one understands the pain that defined Georgiou’s adolescence. And while adult Georgiou has come a long way since her days of ruling the Terran Empire with an iron fist, she is still haunted by her memories of San and the things she did in her quest for power. Digging a bit deeper into Georgiou’s backstory is one of the ways Section 31 sets itself up to work as both a continuation of threads from Discovery and a jumping-off point for this era of Star Trek. It gives you a taste of the darkness that made her such a compelling Discovery villain and the internal turmoil that lent itself to her eventual antihero turn. But it also helps you understand why Section 31 agent Alok (Omari Hardwick) comes looking to recruit Georgiou to his team for a top-secret mission that could use her special skills.

For all of the thorny philosophical questions about Starfleet and Star Trek’s core ideals that Section 31 (the organization) raises, there is a comedic lightheartedness to the film’s presentation of Alok’s team. Like Georgiou, Shapeshifter Quasi (Sam Richardson), ersatz Vulcan Fuzz (Sven Ruygrok), and telepath Melle (Humberly González) each have unique talents and iffy principles that make them perfect for doing Starfleet’s off-the-books dirty work. But the goofy way they clash with exoskeleton pilot Zeph (Robert Kazinsky) and human Starfleet officer Rachel Garrett (Kacey Rohl) often makes this iteration of Section 31 feel more like a Guardians-style group of ragtag misfits than an elite squad of wetworks soldiers.

That energy serves Section 31 fairly well as it lays out the high-stakes heist Alok needs Georgiou’s expertise to pull off. There’s a bioweapons engineer who has cooked up something so dangerous that Starfleet (unofficially) sees killing him as an acceptable measure if it means Section 31 can secure his creation. But the movie’s tendency to err on the comedic side makes it feel a little awkward in moments when it tries to get serious about Georgiou’s personal demons and what Section 31’s existence really says about Star Trek’s framing of the Federation as a utopian society.

Image: Jan Thijs / Paramount Plus

Yeoh is clearly having a ball chewing every bit of scenery she can get her hands on as Section 31 plucks Georgiou out of her club — a place that looks like a glitzy fusion between The Fifth Element’s Fhloston Paradise and Star Wars’ Galactic Senate — and drops her into the proverbial deep end. At times, the movie’s blend of humor and flashy action sequences that result in a few Section 31 members’ deaths makes it seem like Paramount wants this to play like Star Trek’s answer to Warner Bros.’ Suicide Squad franchise.

It’s a fun vibe that gives the entire cast a chance to ham things up, but whenever Section 31 slows down to zoom in on Georgiou’s inner turmoil, you can sense how much more substance there could have been to these characters if they were fleshed out over the course of a series.

To its credit, Star Trek: Section 31 doesn’t entirely feel like a movie cobbled together from scrapped TV show ideas. It works as a standalone story and leaves its surviving characters with a new status quo that feels primed for more exploration in future projects. With so many newer Star Trek shows having recently been canceled, it’s easy to imagine Paramount looking at its Section 31 feature as an experiment to see how interested viewers might be in seeing Georgiou mix it up from week to week.

This trial run feels like a success because of the way Star Trek: Section 31 leaves you wanting more, and while a full-on follow-up series might not be in the cards, it could very well be the beginning of a new era of streaming surprisingly fun Star Trek features.

Star Trek: Section 31 hits Paramount Plus on January 24th.

CryptoCurrency

Ledger co-founder released after days in captivity in France: Report

Ledger co-founder David Balland was kidnapped in France and safely released after police intervention. The incident involved a cryptocurrency ransom demand.

Business

Rachel Reeves to soften UK non-dom tax reforms

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Rachel Reeves is set to make a change to the UK government’s crackdown on non-domiciled residents in an attempt to allay concerns about the tax reforms announced in October’s Budget.

The chancellor told a fringe event at the World Economic Forum in Davos on Thursday that the government would soon table an amendment to its own finance bill.

This will enable easier access to the temporary repatriation facility, which allows non-doms to bring foreign income and gains made before April 2025 into the UK and pay tax at a discounted rate of 12 per cent in the 2025-26 and 2026-27 tax years, rising to 15 per cent in 2027-28 — compared with the maximum income tax rate of 45 per cent.

The change planned by the government would make it easier for certain funds to access the facility’s flat tax rates. But while the measure may be useful for some non-doms, it is unlikely to move the dial for many.

Reeves said at The Wall Street Journal’s Davos event on Thursday the government had been “listening to the concerns that have been raised by the non-dom community”, responding to a question about an increase in the net number of millionaires leaving the UK in recent months.

Jonathan Reynolds, business secretary, later confirmed the planned change, first reported by The Times, telling journalists in the Swiss mountain resort: “There is a tweak to the finance bill . . . when you’re changing a tax regime, people will want to know, and there’ll be some uncertainty there, so we’ve got to get that message out.”

Reeves announced in the Budget that she was abolishing the non-dom regime, which allows UK tax residents whose permanent home or “domicile” is overseas to avoid paying British tax on their foreign income or capital gains for 15 years.

It will be replaced from April 6 2025 by a four-year residence-based scheme to offer “internationally competitive arrangements for people coming to the UK on a temporary basis”.

Downing Street said the change would not lead to a fall in the tax take from replacing the non-dom regime, and the Treasury still expects to raise £33.8bn over the next five years from the reforms.

Non-doms have been most concerned about changes to inheritance tax on existing trusts, with the issue often mentioned as the key factor driving them to leave the country.

Rachel de Souza, tax partner at RSM UK, said that while an increase to the temporary repatriation facility was “a good move” it is “woefully inadequate” to prevent wealthy non-doms from leaving the UK.

“The way to stem this exodus would be to maintain the exemption from IHT to offshore trusts but also reverse the proposed changes to agricultural and business property relief which impacts the farmers and entrepreneurs.”

Robert Brodrick, a partner at law firm Payne Hicks Beach, said: “It’s reassuring to see that they are at last responding to the concerns of the many people who are affected by this, but I don’t think this is going to be enough to stem the tide . . . It’s helpful but the inheritance tax exposure is the biggest nail in the coffin.”

The chancellor also said on Thursday she wanted to allay concerns from countries including India that the rules changes would not affect double-taxation agreements: “That’s not the case: we are not going to be changing those double-taxation conventions.”

A Treasury figure said: “We’re always interested in hearing ideas for making our tax regime more attractive to talented entrepreneurs and business leaders from around the world to help create jobs and wealth in the UK.”

Technology

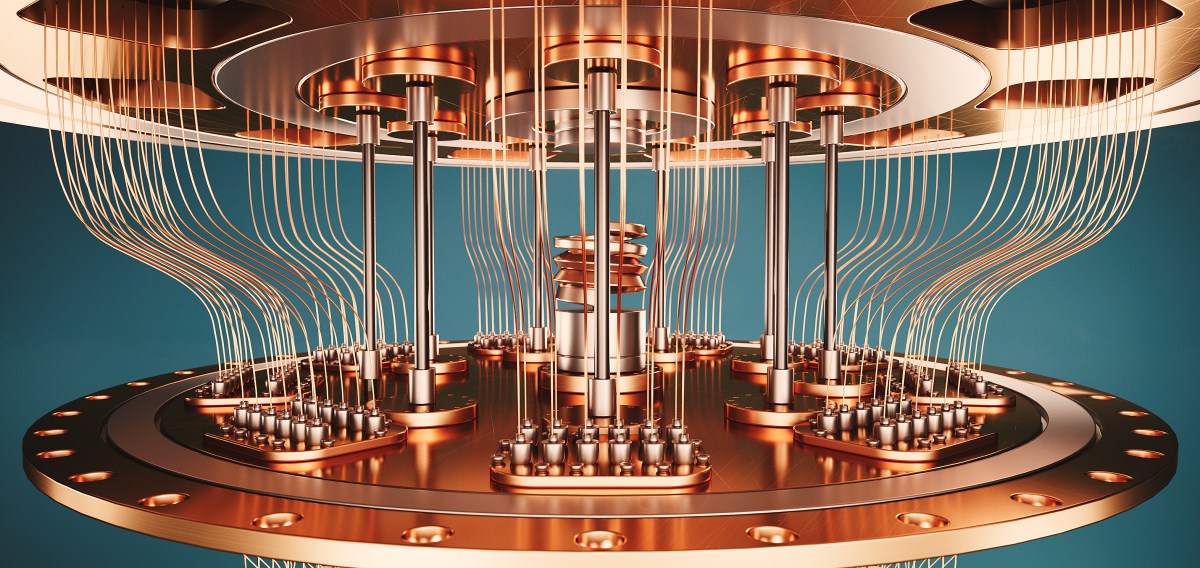

Quantum VC QDNL hits €25M first-close on new fund

VC investment into Quantum computing declined by 50% last year according to the ‘State of Quantum 2024’ report, dropping from $2.2bn in 2022 to $1.2bn, with funds switching in favour of Generative AI. However, government spending on quantum was predicted to hit $40 billion over the next decade. Now a new VC European fund hopes to capitalise on that trend.

The idiosyncratically named QDNL Participations has reached a €25 million first close on a proposed €60m global fund for early-stage quantum startups.

However, QDNL plans to expand outside the country and make investments more internationally.

The firm’s previous €15 million fund focused on the Dutch quantum ecosystem, backing startups including Qblox, QuantWare, QphoX, and Q*Bird.

Speaking to TechCrunch, Ton van ‘t Noordende, General Partner at QDNL Participations, said: “Quantum is a global field. There’s been incredible research done in the past decade or so and we’ve seen the emerging of a new, startup ecosystem, with 600 or more companies coming up. There’s also been more than $42 billion invested by over 20 governments in the last two or three years. So this has built up the infrastructure, the clean rooms, the facilities, and essentially de-risking the technology.”

QDNL’s appearance is the latest sign that the Netherlands is making a play to be a key Quantum computing ecosystem, and the government (with EU financial backing) has already backed an entire initiative called Quantum Delta NL, which also just happens to be an investor in QDNL.

Its team includes quantum computing pioneer Chad Rigetti as venture partner in the US and specialist quantum VC Kris Kaczmarek in London, who joined as investment director from quantum VC firm 2xN. They join advisors, Nadia Carlsten (CEO of the Danish Centre for AI Innovation) and Charles Marcus of the University of Washington.

Quantum computing had a tricky start to the year with both Mark Zuckerberg and Nvidia’s Jensen Huang sounding downbeat on when Quantum would arrive. But Nvidia did a quick about-turn and announced a Quantum exclusive Nvidia Day at its upcoming event in March.

CryptoCurrency

Rachel Reeves makes shocking U-turn on non-dom rules after ‘concerns’

Chancellor Rachel Reeves has indicated the Labour Government will be making an U-turn on one of her controversial tax decisions which was announced during the Autumn Budget.

Specifically, Reeves has asserted she is open to relaxing the rules impacting the “non dom community” in a move to stop wealthy taxpayers fleeing the UK while appearing at the World Economic Forum in Davos earlier today.

Under the current HM Revenue and Customs (HMRC) regime, non-doms are able to avoid pauing UK tax on their overseas earnings in exchange for frees for up to 15 years.

Non-domiciled individuals are usually wealthy people who live in the country but are not legally domiciled, providing them with certain tax advantages.

During her fiscal statement in October 2024, the Chancellor announced plans to replace current rules with a shorter residence-based regime from April 2025.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The Chancellor is making a shocking U-turn on one of her more controversial tax proposals

GETTY

During an interview with The Wall Street Journal’s editor-in-chief Emma Tucker, the Chancellor said: “We have been listening to the concerns that have been raised by the non-dom community.”

Under the proposed changes, the tax rules relating to the temporary reparation facility would be altered. This is a transitional agreement that will last for three years from April.

Previously announced by her predecessor, Conservative Chancellor Jeremy Hunt, this facility will allow non-dom individuals to come in with foreign income into Britain and pay a reduced tax rate.

As part of her Autumn Budget, Rachel Reeves extended the facility from two to three years, however her latest comments suggest the policy change is not set in stone.

THIS IS A BREAKING NEWS STORY…MORE TO FOLLOW

The Chancellor has announced various changes to tax policy during her short tenure

GETTY

CryptoCurrency

What Is Grok Crypto – Coinlabz

Grok Crypto, a platform that mixes funny memes with cryptocurrency, creates a special place where digital assets meet internet culture. The **GROK token** runs this space, thriving in an environment shaped by viral content and blockchain tech. Folks like Grok Crypto because it combines humor with financial tools, providing a fresh take on digital money.

This platform allows users to engage with memes while also participating in the cryptocurrency market, combining entertainment with potential financial opportunities. By exploring the intersection of memes and blockchain technology, Grok Crypto provides a distinctive approach to understanding and navigating the ever-changing landscape of digital assets.

While the surface of Grok Crypto may appear light-hearted and meme-centric, delving deeper reveals a complex ecosystem that involves community engagement, market dynamics, and technological innovation. Through its unique blend of humor and finance, Grok Crypto offers a fresh take on the evolving world of digital currencies.

Key Takeaways

- Grok Crypto is a meme-based cryptocurrency that has gained attention within the crypto community. The GROK token is known for its incorporation of humor and novelty, distinguishing it from other cryptocurrencies.

- Whether individuals choose to invest in $GROK or not, it is important to recognize that the cryptocurrency market is constantly changing, presenting opportunities for those who can navigate its volatility.

- Similar to Dogecoin’s journey from a meme to a prominent player in the crypto sphere, Grok Crypto has the potential to establish itself within the industry.

The Meaning of Grok

Grok Crypto’s significance lies in its connection to Elon Musk’s AI project and its incorporation of meme culture elements within the cryptocurrency space. The GROK token, inspired by Musk’s AI program Grok, aims to infuse a sense of playfulness into the realms of artificial intelligence and cryptocurrency.

Functioning as a meme coin, GROK seeks to generate interest and enhance its value, while also emphasizing transparency standards. Despite lacking explicit endorsement from Musk, GROK benefits from the public’s curiosity about Musk’s Grok project, using humor and community involvement as key elements in its marketing approach.

The name ‘GROK’ is a nod to Musk’s vision of humor in AI chatbots and aligns its launch with Musk’s Grok initiative to leverage interest in Musk’s diverse projects. The term ‘grok,’ derived from Robert A. Heinlein’s novel, ‘Stranger in a Strange Land,’ conveys a profound, intuitive comprehension through empathy, making it a fitting choice for an AI tool striving for comprehensive understanding.

Understanding GROK

GROK distinguishes itself in the cryptocurrency sphere through its humorous and engaging approach to AI and blockchain technology. The GROK token, inspired by Elon Musk’s Grok AI program, pays tribute to Musk’s concept of integrating humor into AI chatbots. This cryptocurrency, renowned for its meme-centric marketing strategy, aims to inject a light-hearted element into the typically serious realm of AI and cryptocurrency. While it lacks official endorsement from Musk, GROK capitalizes on public interest in Musk’s Grok project, indirectly enhancing its appeal.

GROK’s infrastructure exhibits potential for market expansion by tapping into the public’s intrigue with Musk’s initiatives. The distribution and circulation of the GROK cryptocurrency are influenced by its meme-driven status, sparking conversations on the significance of meme coins within the broader cryptocurrency landscape. By examining the connections between Elon Musk’s Grok AI, the GROK token, and the meme-driven nature of GROK cryptocurrency, one can gain a deeper understanding of this distinctive digital asset.

Understanding the Tokenomics of GROK

GROK functions as a cryptocurrency token, similar to Shiba Inu, attracting crypto investors interested in distinct market opportunities. The token operates on the Ethereum network through its ERC-20 contract address, facilitating transactions and user interactions.

Understanding GROK’s tokenomics involves grasping its buy/sell tax mechanisms, which influence its value and circulating supply. By engaging with the GROK token, investors become part of a community-driven ecosystem rooted in meme culture and internet trends, akin to successful meme coins.

The Price of Grok Crypto

The recent price rally of GROK tokens in the cryptocurrency market can be attributed to various factors, including increased investor interest, the utilization of language models in meme creation, and the general enthusiasm surrounding meme-based cryptocurrencies. This surge led to GROK tokens reaching an all-time high, reflecting the unique positioning of GROK as a meme coin influenced by internet culture trends and humor.

As of today, the 29th of April 2024, GROK ‘s price stands at $0.01312 with an all-time high at $0.02982 achieved on the 28th of November, 2023.

As with any cryptocurrency, the value of GROK tokens is subject to fluctuations, and it’s crucial to monitor market trends and developments closely. Understanding the dynamics of meme coins like GROK can provide valuable insights for investors navigating the cryptocurrency space.

Should I Buy $GROK?

When considering the potential purchase of $GROK, it’s important to approach it with caution due to the volatile nature of meme coins. $GROK operates on the Ethereum blockchain, allowing it to be traded on various centralized exchanges. Prior to making any investment in $GROK, it’s advisable to carefully evaluate factors such as the token’s trading volume, market trends, and the general sentiment surrounding meme coins.

Before deciding to buy $GROK, it’s crucial to consider the community’s perception and engagement, as these aspects can impact the token’s value. Monitoring how $GROK performs against Ethereum and other cryptocurrencies can also provide insights into its potential for growth or decline. It’s essential to bear in mind that meme coins, like $GROK, are characterized by rapid price fluctuations and speculative trading, so it’s wise to invest only what you can afford to lose.

The decision to invest in $GROK should align with your risk tolerance, investment objectives, and comprehension of the meme coin market. Engaging in thorough research, staying informed about market dynamics, and making well-informed decisions based on your financial circumstances are recommended steps to take before considering the purchase of $GROK.

Where to Buy GROK?

To acquire GROK, investors can access various centralized exchanges (CEXs) and decentralized exchanges (DEXs).

GROK has gained attention in the cryptocurrency community, drawing parallels to its origins in the satirical work ‘Hitchhiker’s Guide to the Galaxy.’

Uniswap emerges as a prominent platform for trading GROK, boasting the highest trading volume for this token.

For a swift acquisition of GROK, Moralis Money offers an instant crypto swap service. To purchase GROK on Moralis Money, users can visit the $GROK page, connect their Web3 wallet (such as MetaMask), select the token from their wallet, specify the desired amount for the swap, and securely complete the transaction.

GROKs Controversial Reputation

The controversial reputation surrounding the meme coin GROK has sparked debates within the cryptocurrency community. GROK’s involvement in various controversies, including its tumultuous financial performance and the revelation of a scam that caused a significant 74% value collapse, has led to mixed reactions among enthusiasts. While some view GROK skeptically as a dubious scheme, others defend it as a legitimate meme coin with potential for market growth.

The unique infrastructure of GROK has attracted interest, but concerns have been raised about its indirect association with Elon Musk‘s Grok project, leading to worries about misleading connections. Additionally, regulatory scrutiny following the scam incident has brought attention to the risks present in the cryptocurrency market, resulting in a loss of investor confidence in GROK.

The debates surrounding GROK continue, highlighting the divided perception of the coin within the cryptocurrency community. This underscores the importance of transparency and accountability in meme coin projects to address concerns and build trust among investors.

Leveraging the Musk Factor: GROKs Unofficial Connection

GROK cryptocurrency has an unofficial connection to Elon Musk’s AI program Grok, which has sparked interest within the crypto community due to Musk’s prominent reputation in the tech industry. While GROK isn’t officially endorsed by Musk, it leverages the association with his projects to attract attention and engage investors and enthusiasts.

This indirect link to Musk’s innovative work adds an element of intrigue to GROK’s brand, positioning it as a nod to the tech mogul’s impactful ventures in AI and other fields. By embracing the Musk factor, GROK aligns itself with the broader narrative of technological advancement and disruption promoted by Elon Musk.

The unofficial tie to Musk’s Grok project serves as a marketing strategy for GROK, enhancing its visibility and appeal within the crypto community, where connections to notable figures can influence sentiment and engagement.

Frequently Asked Questions

What Is the Use of Grok Coin?

Grok Coin’s utility stems from its meme-inspired community involvement and unconventional cryptocurrency model. It acts as a satirical reflection on established coins, prompting discussions and dialogues in the cryptocurrency sphere regarding the potential of meme-based tokens.

What Does a Grok Token Do?

A Grok token is a cryptocurrency issued by Grok Crypto, known as GROK token. As a meme coin, its value largely depends on trading activities and price fluctuations in the market. Unlike some other cryptocurrencies that have specific use cases or utility, the GROK token primarily serves as a speculative asset driven by market sentiment and trends in meme culture.

Conclusion

Grok Crypto is a unique cryptocurrency platform that combines internet culture, memes, and blockchain technology, offering a distinct approach to digital assets. The platform’s central token, GROK, operates within this meme-centric environment, tapping into humor and novelty to attract attention in the cryptocurrency space.

While it lacks official endorsement from Musk, GROK has capitalized on public interest in Musk’s ventures, leveraging the “Musk factor” to boost its appeal.

Despite its playful and light-hearted surface, Grok Crypto’s deeper ecosystem involves community engagement, market dynamics, and technology innovation. The token’s price fluctuations and market performance reflect the speculative nature of meme coins, with potential risks and rewards.

Grok Crypto represents a fusion of entertainment and financial opportunity, inviting users to explore a playful yet complex space within the world of digital currencies.

Other cryptocurrencies that you might find interesting:

Qubic Crypto, PushD Crypto, TitanX Crypto, Renq Crypto and Retik Crypto.

Angel Marinov is the Managing Editor at Coinlabz. With extensive knowledge of crypto payments and blockchain use cases, Angel is a trusted source of accurate and timely information

Business

Green Investors Find a Silver Lining in Trump’s Presidency

Shares in clean energy companies have fallen every year since 2021, but some say the sector has hit bottom.

CryptoCurrency

Crypto fails as money and what needs to change

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

In December 2024, the price of Bitcoin (BTC) passed $100,000 for the first time. This surge, driven by optimism over a pro-crypto US administration, marked a historic moment. Yet, despite the excitement, it also highlighted an ongoing problem—cryptocurrencies still aren’t ready for everyday use.

Bitcoin and other cryptocurrencies have become popular as investments, similar to stocks or as some experts call it—Bitcoin is the ‘digital gold.’ But when it comes to being used as real money, they fall short. High fees, slow transactions, and often overcomplicated systems keep crypto from being practical for most people. If the industry wants to see mass adoption, it needs to fix these problems and focus on making crypto easy to use and accessible to everyone.

Old blockchain systems are holding crypto back

When Bitcoin launched, its decentralized design was groundbreaking. It showed the world a new way to secure and transfer money without relying on banks that are prone to external factors such as inflation and geopolitical constraints. Yet, over a decade later, its original system is struggling to keep up.

Bitcoin’s block creation process, which happens every 10 minutes, limits how many transactions it can handle. During busy times, fees go up, and transactions take longer to confirm. This makes using Bitcoin for small, everyday payments inconvenient and expensive.

L2 solutions like the Lightning Network try to make Bitcoin faster and cheaper, but such solutions still depend on the same slow base layer. This means the core problem remains unsolved. As a result, Bitcoin is mostly used as a store of value or an investment rather than as a way to pay for everyday commodities. For crypto to be widely adopted, it needs to move beyond this basic limitation.

Crypto needs to scale for everyday use

If cryptocurrencies are to work as money for everyone, they need to scale up in a big way. Today’s leading flagships like Bitcoin and Ethereum (ETH) can’t handle the volume of transactions that a global payment system requires. Congestion and high fees make them impractical for daily use.

Traditional payment systems like Visa and Mastercard, on the other hand, process millions of transactions every day with ease. For crypto to compete, it must match or exceed this level of performance. Small improvements aren’t enough. The industry needs bold new designs for blockchains that can handle massive transaction volumes without breaking a sweat.

Without this kind of scalability, crypto will stay stuck as a niche tool – good for speculation but not for replacing traditional financial systems.

The case for hybrid models and stablecoins

One way forward might be through hybrid systems that combine crypto’s strengths with the stability of fiat money. Stablecoins, which are tied to fiat currencies like the US dollar, already show promise. They provide the speed and privacy of crypto while avoiding the price swings of coins like Bitcoin.

Stablecoins are gaining traction in countries where local currencies are unstable, offering people a safe and practical way to store and transfer value. However, they’re only part of the solution. The industry needs a seamless system that integrates stablecoins, traditional cryptocurrencies, and even digital fiat currencies.

Such a system would give users the flexibility to choose what works best for them while keeping the key benefits of decentralization, speed, and security.

Changing how people see crypto

Another big hurdle to crypto adoption is how people view it. Bitcoin is often called ‘digital gold,’ which makes people think of it as an investment to hold onto rather than spend. While this idea has helped Bitcoin grow in value, it has also hurt its potential to be fully integrated into everyday transactions for lesser commodities.

For crypto to succeed as money, this perception needs to change. People should see it as a tool for everyday transactions, whether they’re buying coffee or sending money abroad. This requires not just better technology but also better communication and transparency from the industry. The message should be clear—crypto is simple, reliable, and ready to use in the real world.

The path ahead

We should, of course, consider that the industry keeps focusing on speculation and addressing crypto as a stock market while playing around with price gains, in that case, the industry and crypto will fail to reach their full potential and remain as a niche tool. But if the priorities were to shift into practical solutions, crypto could truly become the money of the future.

The road ahead isn’t easy, but the goal is worth it. Crypto doesn’t just need new technology—it needs a new mindset. The question isn’t whether crypto can change the world. The question is whether we’re ready to make it happen.

CryptoCurrency

Nibiru EVM (Nibiru V2) Codebase Finalized Following Rigorous Security Audits

[PRESS RELEASE – Tortola, British Virgin Islands, January 23rd, 2025]

Nibiru, a secure and high-performance blockchain, has reached successful code completion for its upcoming Nibiru EVM (Nibiru V2) upgrade.

“This milestone marks a key step in the evolution of Nibiru. Smoothly launching an initiative like this is about doing small things right to make a big difference. Nibiru places a heavy emphasis on security for users and their digital assets. The audits and resulting mitigation changes help ensure that the new generation of apps on Nibiru will deploy in a secure and efficient environment, stated Unique Divine, Co-founder of Nibiru and CEO of Nibi, Inc.”

These security audits of Nibiru focused on the core L1 logic. The team started with a consultative security audit in October 2024 by Zenith, where Code4rena assembled a curated team of auditors tailored to the project’s specific codebase and needs. After addressing potential security findings from this audit, the team sponsored a competitive Code4rena audit in November 2024. This second audit expanded its scope to include Nibiru’s Ethereum JSON-RPC, in addition to the core L1 and the Nibiru EVM.

What is Nibiru EVM (Nibiru V2)?

The Nibiru EVM Upgrade, also called Nibiru V2, is a “purely additive” enhancement to Nibiru that makes it an EVM-equivalent execution engine. This allows Ethereum-based application development teams to more easily build on Nibiru and take advantage of widely used tools like MetaMask and Coinbase Wallet.

The team’s Jan 2025 Ecosystem Update also mentions the launch of several products on top of Nibiru V2, including a Uniswap V3 deployment by Oku, Astrovault’s cross-chain value capture DEX, tokenized private credit and T-bills, and Bridged USDC.

Nibiru Lagrange Point: A Glimpse into the Future

Building upon the progress of the Nibiru EVM upgrade, Nibiru is unveiling the initial stages of its ambitious “Nibiru Lagrange Point” roadmap. This roadmap outlines a series of innovative advancements designed to further enhance the scalability, decentralization, and user experience on Nibiru.

Nibiru Lagrange Point combines:

- FunToken Mechanism, a unification of EVM and non-EVM tokens that don’t rely on third-party bridges

- Pipeline-Aware Reordered Execution (PARE) for higher throughput

- Optimized validator dynamics in NibiruBFT, including Boneh–Lynn–Shacham (BLS) Signatures and novel grouping algorithms to reduce overhead and speed up block times.

- Mempool Lanes for orderly transaction flow

These design innovations are meant to “address bottlenecks across every layer of the stack, paving the way for advanced DeFi, real-world assets (RWAs), AI-driven bots, and high-traffic cultural projects—all running seamlessly on a single platform”, according to Harvey Liu, Research Engineer at Nibi, Inc.

About Nibiru

Nibiru is a high-performance MultiVM blockchain that achieves fast finality, a block time of less than 1.8 seconds, and robust security. Backed by $20.5 million in funding from NGC Ventures, HashKey Capital, Kraken Ventures, and Tribe Capital, Nibiru enables developers to build and deploy smart contract applications interoperable across multiple virtual machines, such as the Ethereum Virtual Machine (EVM) and WebAssembly (Wasm).

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Business

Stressed out business leaders are creating a breakdown in the management talent pipeline

© 2024 Fortune Media IP Limited. All Rights Reserved. Use of this site constitutes acceptance of our Terms of Use and Privacy Policy | CA Notice at Collection and Privacy Notice | Do Not Sell/Share My Personal Information

FORTUNE is a trademark of Fortune Media IP Limited, registered in the U.S. and other countries. FORTUNE may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login