Business

Agrochem stocks surge on strong Q3, trade deal

Avanti Feeds surged 20%, hitting the maximum tradable limit of the day. Godrej Agrovet rose 6.5%, and Mukka Protein gained 3.5%. Among agrochemical stocks, Sharda Cropchem jumped 9.6%, while Sikko Industries, Aristo Bio-Tech and Lifescience advanced 6.1% and 5%, respectively.

“There was uncertainty earlier, which is out now since there is clarity on tariffs, and most of these companies have reported a better set of earnings on a lower base, which the investors are rewarding,” said Anita Gandhi, institutional head, Arihant Capital.

Business

Trupanion, Inc. 2025 Q4 – Results – Earnings Call Presentation (NASDAQ:TRUP) 2026-02-12

Seeking Alpha’s transcripts team is responsible for the development of all of our transcript-related projects. We currently publish thousands of quarterly earnings calls per quarter on our site and are continuing to grow and expand our coverage. The purpose of this profile is to allow us to share with our readers new transcript-related developments. Thanks, SA Transcripts Team

Business

The US economy is growing – so where are all the jobs?

As hiring rates and job openings drop, some worry a tough job market could be here to stay.

Business

Japan says issues remain in finalising first deals under US trade package

Japan says issues remain in finalising first deals under US trade package

Business

November, December Job Growth 17,000 Lower Than Previously Reported

Along with the annual benchmark revisions, the Bureau lowered its initial estimates for November and December job growth by about 17,000 combined.

Total nonfarm payroll employment for December was lowered by 2,000 positions. That took the initially reported 50,000 jobs added in the final month of the year to now just 48,000.

November payroll growth was revised down by 15,000 to 41,000 jobs added.

Business

Rain and politics driving up half-term holiday bookings, travel agents say

The Advantage Travel Partnerships says rain plus the political environment is creating a “powerful psychological need for escape”.

Business

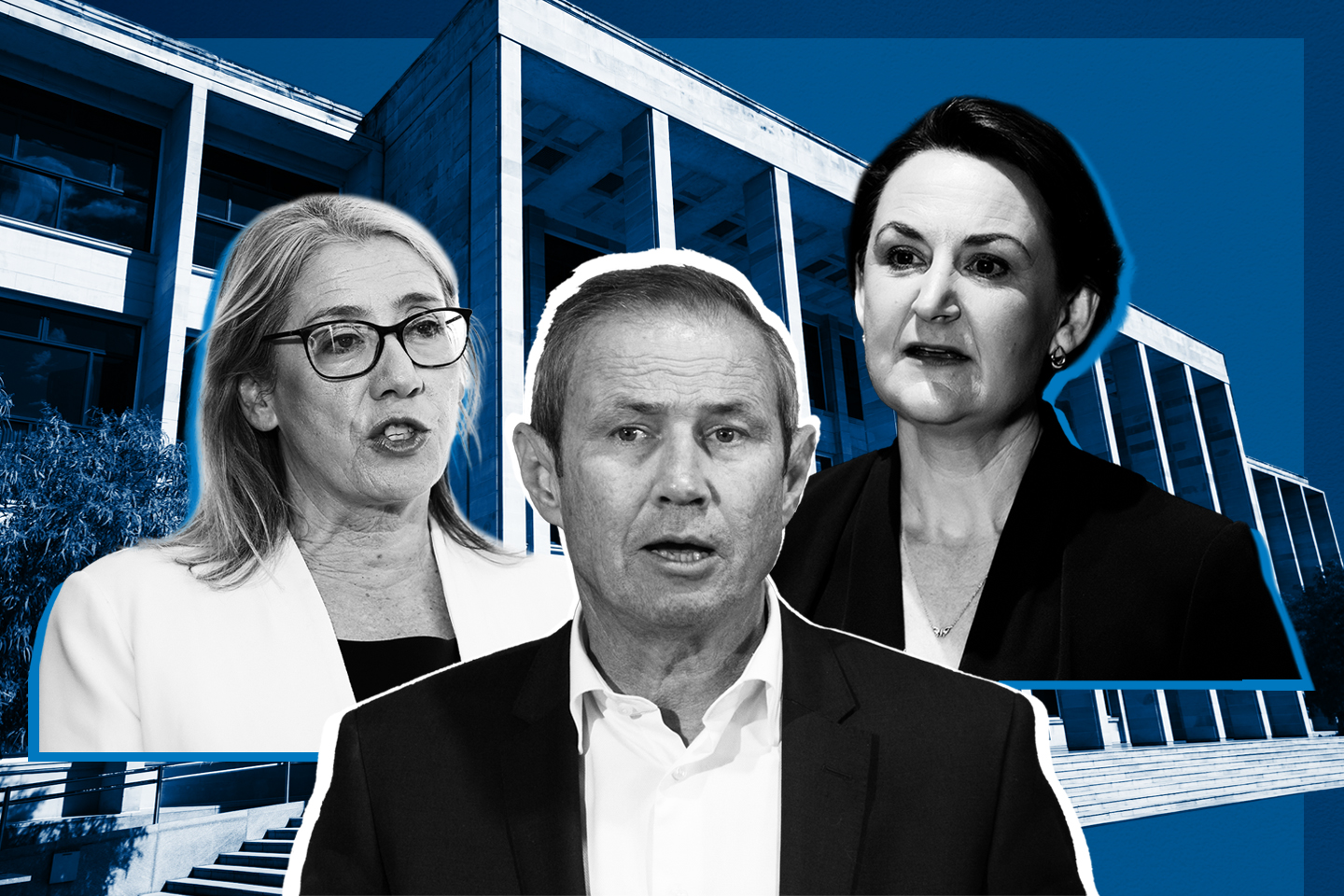

Sanderson or Saffioti: Labor insiders divide

Some of Labor’s most senior and influential figures are deeply divided about a succession plan if Roger Cook was to quit before the 2029 election.

Business

AI coding platform's flaws allow BBC reporter to be hacked

Vibe-coding tools – which let people without coding skills create apps using AI – are exploding in popularity.

Business

Global EV sales hampered by China, US slowdown in January

Global EV sales hampered by China, US slowdown in January

Business

Brazil Supreme Court’s Toffoli to step aside from Banco Master case

Brazil Supreme Court’s Toffoli to step aside from Banco Master case

Business

IHCL net jumps over 50% in Q3, new businesses boost revenue

The company said the profit was after exceptional items, which mainly included a ₹327 crore profit net of tax on the sale of its entire equity stake in a joint venture and a ₹37 crore impact from implementing new labour codes.

The quarter marked the fifteenth consecutive quarter of “record performance” with an Ebitda of ₹1,134 crore and an Ebitda margin of 39.1%, managing director and chief executive Puneet Chhatwal said.

The hotel segment reported ₹2,579 crore revenue, helping the chain post its best-ever segmental quarterly Ebitda of ₹1,050 crore.

Third-quarter revenue growth was supported by a 17% expansion in airline and institutional catering and 31% increase in new businesses, Chhatwal said.

He said IHCL continued its growth momentum in FY26 with 239 signings, taking its portfolio of 617 hotels, and opened and onboarded 120 hotels, led by ‘strategic’ partnerships and acquisitions.

As per an exchange filing, Roots Corporation (RCL), a wholly-owned subsidiary of IHCL, acquired a 51% stake in ANK Hotels and Pride Hospitality on December 1, 2025, for a total cash consideration of ₹190.5 crore. Under its Accelerate 2030 initiative, the chain expanded its brandscape with the acquisition of a controlling stake in wellness brand Atmantan, entered into definitive agreements to acquire a 51% stake in Brij, a boutique experiential leisure offering, and scaled the Ginger brand with 51% acquisition in ANK & Pride Hospitality.

IHCL had a gross cash balance of ₹3,877 crore as on December 31, he said, adding: “IHCL is well placed to deliver sustained performance enabled by a diversified top line across brands, geographies and contract types.”

He said the chain’s pipeline is as high as the number of rooms in operations.

“IHCL is probably the only company across sectors that is growing and still maintaining an increase in Ebitda and maintaining the Ebitda margins. We are scaling and we are scaling profitably,” he said.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 day ago

Sports1 day agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports7 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World1 day ago

Crypto World1 day agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video22 hours ago

Video22 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’