- Syntilay has launched AI-designed, 3D-printed shoes.

- The footwear was designed with a mix of Midjourney and Vizcom AI

- The $150 shoes use smartphone foot scans for a fully customized fit.

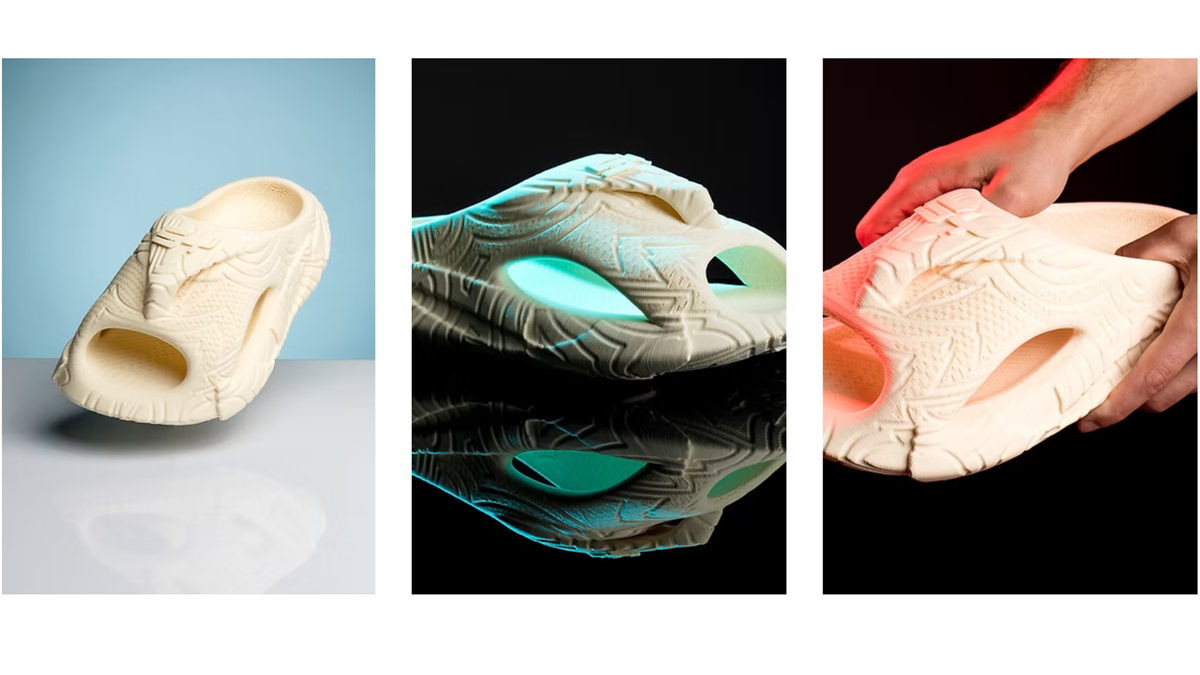

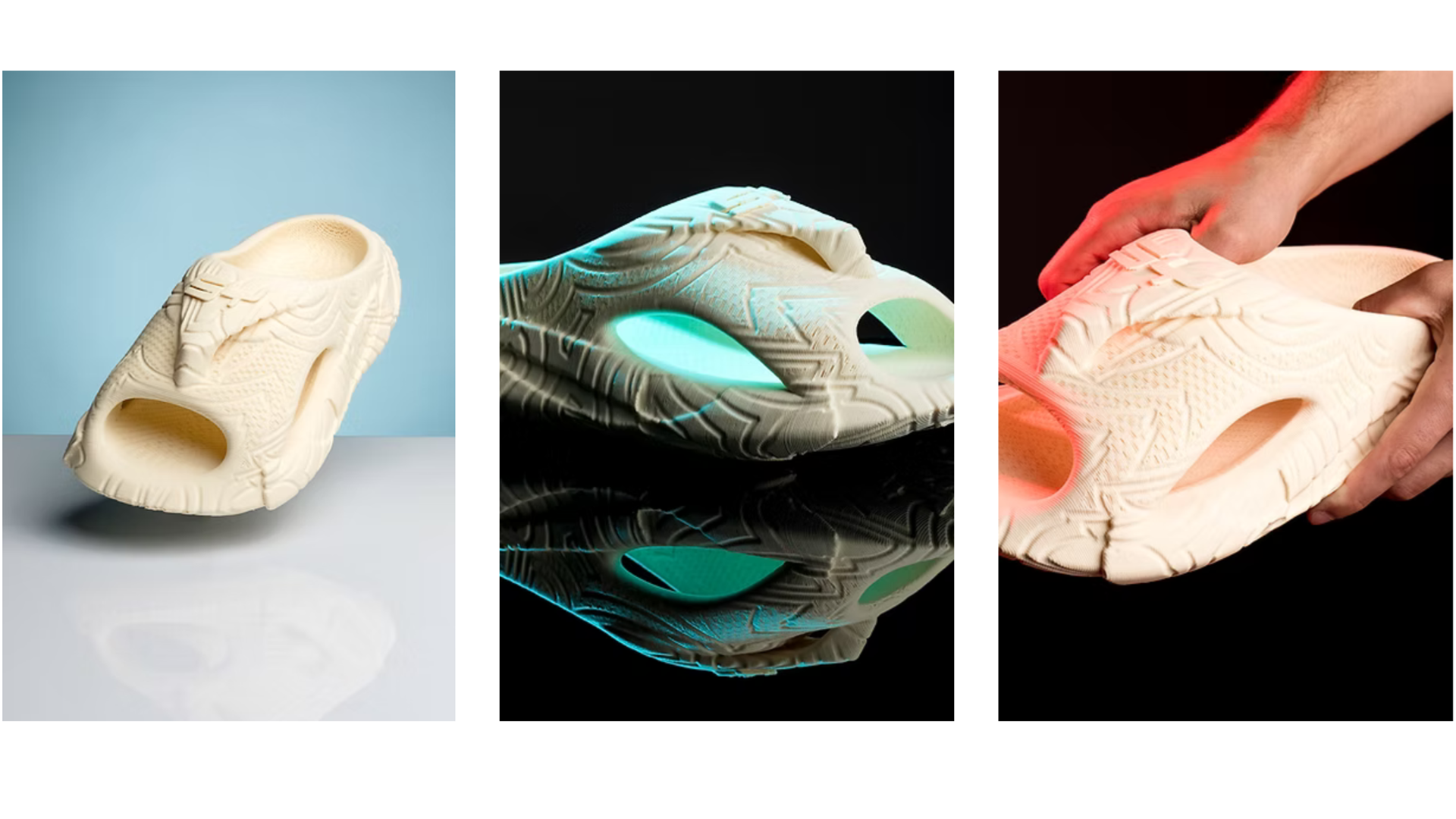

If you like Crocs but wish they had more of a science-fiction backstory, you’re in luck. A startup company named Syntilay is using AI and 3D printing to produce a new line of shoes. The futuristic footwear is available now for $150 a pair. These slides aren’t cheap, but innovation rarely is.

Syntilay uses a mix of AI tools supplemented by human artistry to create its shoes, which look more than a little like a deep sea fish at first glance. The designers relied on Midjourney to develop the basic shape of the shoe. After that, a human artist refined the idea with a sketch for inspiration uploaded to Vizcom AI, which produced a 3D model based on the sketch. AI then helped design and embed textures and patterns into the shoe design, completing their look.

Entrepreneur Ben Weiss founded Syntilay, but it has the backing of Reebok co-founder Joe Foster, who added some credibility to the idea. The shoes come in five colors: orange, red, beige, black, and blue. They are supposed to evoke the work of Syd Mead, the artist behind the iconic visuals in Blade Runner and Aliens.

AI shoes

The $150 shoes are 3D printed in Germany and specially made for each customer, shipping out after about three weeks. If you want to buy a pair, you are asked to scan your feet with a smartphone camera so that the shoes will fit perfectly, even adjusting for the usual slight differences between people’s right and left feet.

There’s also the matter of practicality. While scanning your feet with a phone camera sounds straightforward, not everyone is eager to go full techie just to buy shoes. And what happens if the fit isn’t quite right after all that scanning and printing? These are hurdles Syntilay will need to address as it scales its operations.

The question, of course, is whether the market is ready for AI-driven footwear. Syntilay’s shoes will have to prove they are worth the expense and wait when it comes to things like comfort and durability.

$150 is a pretty big price tag when generic slides similar to Crocs can cost $20 or even less. Syntilay has to hope its design, custom-fit promise, and the gimmick of AI design win over early adopters.

There have certainly been personalized shoes before, but combining AI and 3D printing may entice those looking to be trendsetters.

You must be logged in to post a comment Login