Business

Apple News accused of left-leaning bias in new study of 620 stories

Fitz-Gerald Group CIO Keith Fitz-Gerald breaks down anticipated earning reports and gives his outlooks for Apple and Tesla on ‘Varney & Co.’

Apple’s popular news app has been aggressively promoting articles from left-leaning news outlets – even as it has all but shut down posts from more conservative publications, according to an explosive study.

The Media Research Center, a conservative watchdog group focused on tracking media bias, analyzed a total of 620 stories that were featured by Apple News in high-traffic morning time slots between Jan. 1 and 31. The Apple News feed is a mixture of stories curated by a team of in-house editors and some by algorithm.

Of the 620 stories, a whopping 440 came from outlets that are rated as left-leaning, while the remaining 180 were published by centrist outlets. Meanwhile, outlets which are considered right-leaning – including The Post – were shut out entirely.

In January, Apple News featured a total of 72 articles by The Washington Post, 54 articles by The Associated Press, 50 by NBC News, 34 by The Guardian and 25 by NPR, according to MRC’s data. It published 54 Wall Street Journal articles. The numbers for The Post and Fox News were zero and zero, respectively.

GOOGLE, APPLE URGED BY HOUSE COMMITTEE TO PULL APPS TRACKING ICE AGENTS

The Media Research Center found a whopping 440 out of 620 Apple News stories studied came from left-leaning outlets. (Sean Gallup/Getty Images / Getty Images)

MRC’s researchers relied on media bias ratings compiled by AllSides, a nonpartisan organization that uses a multi-partisan panel of experts – with two members from the left, two from the center and two from the right – that are trained to spot media bias.

It also conducts blind surveys of ordinary Americans, then averages both sets of results to come up with a rating.

AllSides’s experts did not participate in the MRC study or have any advance knowledge about its findings. Nevertheless, Julie Mastrine, who serves as director of AllSides’ media bias rating system, said she was “not surprised at all” by the results.

“The bottom line is that Americans that are relying on these Big Tech companies to provide them with news are not getting a balanced view and they’re not getting the full scope of perspectives available,” Mastrine said in an interview.

VARNEY: BIASED MEDIA NEEDS A COMPLETE CULTURE CHANGE

In a statement provided after this story was published, an Apple spokesperson said the News app “provides access to news spanning a wide range of topics from more than 3,000 publications including the Wall Street Journal, Fox News, Bloomberg, USA Today, Washington Examiner, New York Post, CBS News, local outlets, and more.”

“Apple News users can tailor the app to their interests by choosing to follow or block specific publications or topics,” the spokesperson added.

As of Monday, Apple News had gone 96 consecutive days without showcasing a story from a conservative publication in its top stories.

MRC alleged that Apple News “broadly focused on President Donald Trump’s foreign policy and immigration policy in negative ways” during the analysis period. (Al Drago/Getty Images)

MRC, which began publishing data on news aggregators in November, said Apple News last published an article by a right-leaning source on Nov. 5, when it ran a story by British outlet The Telegraph about the civil war in the Sudan.

MRC noted that the Apple News feed “broadly focused on President Donald Trump’s foreign policy and immigration policy in negative ways” during that time period, including selecting “provocative headlines that raised doubts about Trump’s actions” as it related to immigration and foreign policy.

“Almost half of voting-age Americans own an Apple iPhone,” MRC’s Dan Schneider told The Post. “Of course, all its phones come pre-installed with Apple News. Swipe right and you’re inundated with Apple’s cherry-picked news stories. Most people don’t even know they are being fed a steady stream of leftist narratives.”

In 2023, AllSides conducted its own study of bias at the 10 most popular news aggregations services. Apple News was given a “lean left” rating, with only Yahoo News and Bing News deemed to be more skewed toward liberal views when curating stories.

“Right-leaning media is really underrepresented,” Mastrine said.

APPLE STRIKES MAJOR DEAL WITH GOOGLE TO POWER SIRI WITH GEMINI AI

From Jan. 1 to 12, MRC tracked the top 20 stories from AllSides-rated news outlets that appeared on Apple News at approximately 10 a.m. ET. From Jan. 12 to 31, MRC did the same, but checked the Apple News app at 8:30 a.m. ET.

Schneider said MRC “experimented with different times” to see if it altered the results, but aimed to review Apple News in the morning for consistency.

The 620 articles included in MRC’s breakdown for January includes 30 stories by The Athletic, the sports site owned by the New York Times. The Times itself stopped participating with Apple News in 2020. The number also includes 27 pieces of original Apple content, most of which were links to its “Apple News Today” daily podcast.

“It is a subliminal form of propaganda, paid for with corporate dollars but without campaign finance disclosures,” Schneider added. “It could be illegal.”

MRC’s Dan Schneider told the New York Post that Apple News’ behavior “is a subliminal form of propaganda.” (iStock)

The allegations are a potential headache for Apple and its CEO Tim Cook, who has cozied up to President Trump since he re-entered office last year. Key Trump-appointed federal regulators are actively looking to crack down on media bias in Big Tech and beyond.

In February 2024, FTC Chairman Andrew Ferguson launched an inquiry into tech censorship and said his agency wanted to “better understand how these firms may have violated the law by silencing and intimidating Americans for speaking their minds.”

The FTC also cleared a major merger between ad giants Omnicom and Interpublic on the condition that they refrain from anything resembling politically-motivated ad boycotts in the future.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Elsewhere, FCC Commissioner Brendan Carr, a fierce Trump ally, infamously blasted Jimmy Kimmel last September over inflammatory comments he made about the killing of conservative influencer Charlie Kirk.

This week, Carr’s FCC opened a probe into ABC’s “The View” and whether it has broken rules requiring equal time for interviews with political candidates.

Business

Ford Motor (F) earnings Q4 2025

2026 Ford Mustang Dark Horse SC on display during the Media Preview of the 2026 Chicago Auto Show at McCormick Place on February 6, 2026, in Chicago, Illinois.

Jacek Boczarski | Anadolu | Getty Images

DETROIT – Ford Motor reported its largest quarterly earnings miss in four years in its fourth-quarter results released Tuesday, while guiding for 2026 to be a rebound year for the automaker.

Ford’s 2026 guidance includes adjusted EBIT of between $8 billion and $10 billion, up from $6.8 billion last year; adjusted free cash flow of between $5 billion and $6 billion, up from $3.5 billion in 2025; and capital expenditures of $9.5 billion to $10.5 billion, up from $8.8 billion.

Here’s how the company performed in the fourth quarter compared with average estimates compiled by LSEG:

- Earnings per share: 13 cents adjusted vs. 19 cents expected

- Automotive revenue: $42.4 billion vs. $41.83 billion expected

The EPS coming in 32% below consensus was the company’s first quarterly miss since 2024 and its worst since a 42% difference when reporting its 2021 fourth-quarter results, according to LSEG.

The earnings miss was largely due to unexpected tariff costs of roughly $900 million related to credits for auto parts not taking effect as early as expected, the company said. Ford, as of Dec. 15, had confirmed $7.7 billion in earnings before interest and taxes for the fourth quarter, but the additional costs dropped that to $6.8 billion.

Ford CFO Sherry House said the lower-than-expected earnings were also related to additional impacts from fires at a Novelis aluminum supplier plant last year in New York, which now isn’t expected to be fully operational until the middle of this year. The plant supplies Ford’s lucrative F-Series pickup trucks.

“We will see a billion-dollar benefit roughly in 2026; however, this year, due to the Novelis impact, we’re going to have tariffs increasing in order to secure aluminum that is roughly the same amount of that savings,” House told reporters.

Ford’s net tariff impact is expected to be roughly flat year-over-year at $2 billion in 2026, she said. The Novelis fire had an impact of $2 billion during the second half of the year for Ford, she added.

House and Ford CEO Jim Farley said the company’s 2025 results continue to demonstrate the company’s underlying business is improving despite the special items impacting results.

The company’s 2025 revenue was a record $187.3 billion, up 1% from $185 billion a year earlier. That includes $45.9 billion during the fourth quarter, down 5% from a year before.

On a business unit level, the automaker’s traditional and fleet operations are expected to offset an expected $4 billion to $4.5 billion in losses this year for its “Model e” electric vehicle unit. Pre-tax earnings from its “Ford Pro” fleet business are expected to be between $6.5 billion to $7.5 billion, followed by $4 billion to $4.5 billion for its traditional “Blue” business.

On an unadjusted basis, the company’s net loss of $8.2 billion last year was its largest since the Great Recession in 2008, according to FactSet. That included $15.5 billion in special charges during the fourth quarter largely related to a pre-announced pullback in its all-electric vehicle plans.

Automakers commonly exclude “special items” or one-time charges from their adjusted financial results to provide investors with a clearer picture of their core, ongoing business operations.

Ford reported a fourth-quarter net loss of $11.1 billion, or a loss of $2.77 per share, compared with net income of $1.8 billion, or 45 cents per share, in the same period in 2024. Adjusted for the one-time charges, the company reported earnings of 13 cents per share.

Business

Australia's biggest bank posts strong half-year profits

Commonwealth Bank shares have hit a three-month high after the largest bank lifted earnings and boosted its dividend payout.

Business

Ford says it took an extra $900m Trump tariff hit last year

The vehicle manufacturer had said it was backing away from plans to make large EVs, citing lacklustre demand and recent regulatory changes under Trump. The business case for leaning heavily into EV production, specifically large-sized EV models, has “eroded”, the company had said.

Business

Steve Pantalemon on Real Estate, Media, and Long-Term Thinking

Steve Pantalemon is a Southern California–based entrepreneur, real estate investor, and media business owner. His career has been built through steady growth, hands-on work, and a long-term view of value creation.

Born in New York and raised in Orange County, Steve grew up with older sisters who shaped his early outlook. He credits that experience with developing a strong sense of empathy and responsibility, qualities that later influenced both his leadership style and philanthropic priorities.

Steve attended Esperanza High School before earning two bachelor’s degrees from California State University, Long Beach, in Marketing and Business. He later completed one year of MBA coursework at Pepperdine University. His education gave him a practical understanding of how businesses operate and how stories are communicated.

His professional career centres on residential real estate investment. Steve has acquired, remodelled, and managed a portfolio of 13 homes, using a mix of short-term and long-term rental strategies. He is closely involved in property evaluation, renovation decisions, and ongoing management. He believes real estate rewards discipline and patience over speed.

Alongside real estate, Steve is the owner of P5 Video Production. The company focuses on video storytelling, branding, and content creation. For Steve, media is another form of structured problem-solving, where clarity and purpose matter.

Philanthropy is a constant thread in his work. Through personal giving and the P5 Group foundation, Steve supports organisations including Laura’s House, Children in Toyland, St. Jude Children’s Research Hospital, and sober living initiatives. His career reflects a balance of business leadership, creative thinking, and community responsibility.

An Interview with Steve Pantalemon on Business, Real Estate, and Building Value

Q: Let’s start at the beginning. How did your early life shape your career mindset?

I was born in New York but raised in Southern California. Growing up with older sisters had a big impact on me. You learn empathy early. You pay attention to how people are affected by decisions. That carries into business whether you plan for it or not.

Q: You studied both marketing and business. Why that combination?

I liked understanding both sides. Marketing is about how ideas are communicated. Business is about how decisions hold up over time. I saw early on that you need both. One without the other usually falls apart.

Q: What drew you into residential real estate?

Real estate felt tangible. You can see the asset. You can improve it. You can manage it directly. I started focusing on acquiring, remodelling, and holding properties rather than chasing quick turnover.

Q: You now manage a portfolio of 13 homes. What did that process teach you?

Patience. Every property has its own challenges. Renovations never go exactly as planned. Tenants have different needs. Over time, you learn that consistency matters more than speed.

Q: How do you approach decision-making in real estate?

I try to stay close to the details. Location, layout, long-term use. I do not rush decisions. Real estate punishes impatience.

Q: Alongside real estate, you run P5 Video Production. How did that come about?

I’ve always been interested in storytelling. Video allows you to communicate clearly if it’s done well. P5 lets me work creatively while still applying business discipline.

Q: Do you see similarities between media and property investment?

More than people think. Both require structure. Both fail when you cut corners. And both work best when the goal is long-term value, not attention.

Q: What does leadership mean to you today?

Being involved. Not disappearing behind a title. I like to understand what’s happening on the ground. That keeps decisions honest.

Q: Philanthropy plays a visible role in your life. Why is that important?

Because success means very little if it only benefits you. Supporting organisations like Laura’s House or sober living programmes affects families and communities. That matters.

Q: How do you define progress in your career now?

Stability. Impact. Building things that last. I’m less interested in noise and more interested in results that hold up over time.

Business

Senior Co-op staff complain of ‘toxic’ culture at the top

A spokesman for the Co-op told the BBC: “Our culture, as a co-operative, ensured decision-making throughout has listened to views from leaders and colleagues across our food and wider business, whilst simultaneously acknowledging when a wide range of views are expressed, not everybody will always agree with the final decisions and actions taken.”

Business

HUDCO, NaBFID and SIDBI to tap bond market for Rs 13,500 cr

Investor focus is likely to be on NaBFID’s planned ₹4,000 crore 10-year bond sale, which comes at a time when the benchmark 10-year benchmark government security is trading at 6.75%. Market participants expect the NaBFID paper to be priced at a spread of roughly 100 basis points over the sovereign yield.

One basis point is a hundredth of a percentage point.

Three major public sector companies, HUDCO, NaBFID, and SIDBI, are set to raise a significant ₹13,500 crore from the corporate bond market. This move comes as wholesale bank lending rates show signs of easing. Investors will be closely watching NaBFID’s ₹4,000 crore bond sale. This borrowing activity highlights the companies’ strategy to tap into the bond market for funding.

“Pricing of these bonds is complicated because the 10 year g-sec yield is also quite high. I expect NaBFID to get rates below the state bond rate,” said Venkatakrishnan Srinivasan, managing partner at Rockfort Fincap, a debt advisory firm. “HUDCO, for a three-year tenure, should get a rate of around 7.75%-8%.”

Agencies

Agencies“These attractive rates are available only for highly rated or public sector companies. But as bank loans are also providing competitive rates, issuers tapping the bond market have become more stringent on market borrowings,” Srinivasan said. Corporates raised ₹26,752 crores in January this year, versus ₹29,798 crores in December 2025, BSE data showed.

On the other hand, wholesale loans by banks climbed, with State Bank of India (SBI) seeing a 3.4% year-on-year rise in its ₹13.33 lakh crore corporate loan book for the quarter ended December.

HDFC Bank posted a 10.3% growth in its ₹7.7 lakh crore corporate loan book and ICICI Bank’s domestic corporate portfolio of about ₹3 lakh crore grew 5.6% year-on-year.

Business

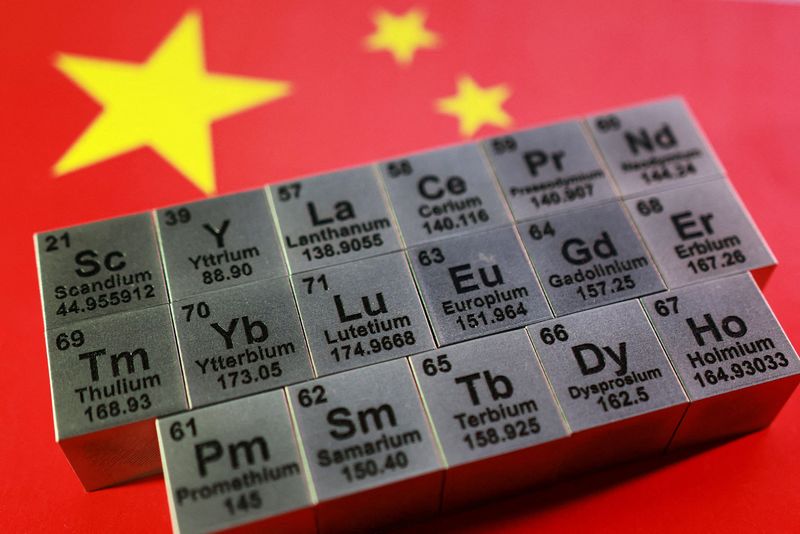

China’s Li inspects rare earth facilities, hints at leverage in US rivalry

China’s Li inspects rare earth facilities, hints at leverage in US rivalry

Business

Freedom To Act: Europe Inc pushes plans to list in India

Investment bankers said they are already seeing a clear uptick in enquiries for initial public offerings (IPOs) from European industrial companies, particularly in auto components, speciality chemicals and clean energy, especially after the trade deal. More notably, the vibrant domestic fund-raising market – where multinational companies have been able to sell shares at eye-popping valuations in the last two years – is also encouraging them to explore domestic listings.

According to bankers, German auto components firm MAHLE GmbH and Swedish gaming company Modern Times Group, through its Indian mobile gaming subsidiary PlaySimple are preparing to file draft red herring prospectuses (DRHPs) with the market regulator for proposed IPOs soon. Danish brewer Carlsberg is also contemplating an IPO. Emails sent to the companies remained unanswered.

Agencies

AgenciesAuto parts, specialty chem & clean energy cos among those keen to unlock value

This week, Italian giant Bonfiglioli Transmissions filed a DRHP for a ₹2,000 crore IPO. Last year, German Green Steel & Power received Sebi nod to go ahead with the IPO and will be launching its IPO soon. SAEL Industries, an Indian renewable energy firm backed by Norwegian state-run fund Norfund, filed papers in November 2025 for an ₹4,575 crore IPO.

“The emerging interest from European industrial, auto-component and clean-energy firms signals a deeper level of confidence in India’s regulatory architecture, disclosure standards and institutional investor base,” said Bhavesh Shah, managing director and head – Investment Banking, Equirus Capital. “It is the growing base of the domestic institutional investors that is triggering this trend.”

Shah said if the momentum in the IPO market sustains, India could evolve into a preferred regional hub for multinational listings.

Several mandates are believed to be at the pre-filing stage, with listings expected over the next 12 to 18 months. The pipeline, according to bankers, spans sectors from precision engineering and renewable energy equipment to consumer-facing brands with deep European heritage. “The conclusion of the India-EU Free Trade Agreement, has turned India’s capital markets into a strategic expansion route for European multinationals specifically for European automakers,” said Neha Agarwal, MD and head, Equity Capital Markets, JM Financial Institutional Securities.

“Following the successful listings of Orkla India and Carraro India, we are seeing a structural shift where European parents no longer view India just as a manufacturing hub, but as a primary destination to unlock equity value,” according to Agarwal.

“With firms like Bonfiglioli now in the pipeline, the FTA acts as the ultimate ‘confidence bridge’, allowing European giants to tap into India’s high-valuation premiums and capital to fund their global green ambitions.”

Not all are convinced the floodgates’re about to open. Dev Chandrasekhar, partner at Mumbai-based valuations and branding advisory firm Transcendum, expects listings by European firms in India to be “selective and opportunistic rather than a stampede”. “For European companies seeking to de-risk supply chains away from China while accessing a $4 trillion economy, an Indian listing may no longer be optional, but it may be inevitable… let’s not get ahead of ourselves because the EU-India deal is still being negotiated.”

Also, many European firms may be sceptical of listing here “European companies are notoriously cautious about the governance dilution that comes with a public listing in an emerging market,” said Chandrasekhar. “The regulatory environment has improved, but Sebi’s disclosure norms, related-party transaction scrutiny and promoter lock-in requirements can be uncomfortable for European sponsors used to lighter-touch regimes.”

Business

CRAs need to maintain additional net worth: Sebi

At present, Sebi rules mandate CRAs to have a minimum net worth of ₹25 crore, and to undertake credit ratings of only listed or proposed to be listed securities, or rating of financial instruments under the guidelines of a regulator as specified by Sebi.

Sebi has received representation from the industry on permitting rating agencies to undertake rating of financial products under the purview of other financial sector regulators (FSR), even where no rating related guidelines may have been issued by the relevant FSR.

These include the rating of unlisted securities.

“It has also been represented that since rating of said products/entities is adjacent to the current business of credit rating agencies, permitting the same may lead to significant synergies, while also addressing a gap in the industry,” Sebi had said earlier in its discussion paper.

Business

‘Menacing’ Disney advert featuring severed body banned

Disney subsidiary Twentieth Century Studios, which produced the film, said it was rated 12A, and the advertisement had been designed with that in mind. The company argued the brief and stylised nature of the scene meant the alien character or other imagery used would be unlikely to cause harm or offence.

-

Tech7 days ago

Tech7 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat1 day ago

NewsBeat1 day agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World9 hours ago

Crypto World9 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World18 hours ago

Crypto World18 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports1 day ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World17 hours ago

Crypto World17 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition