Check out what’s clicking on FoxBusiness.com.

Bill Gates apologized to staff of the Gates Foundation over his ties to Jeffrey Epstein, admitting he made mistakes that had cast a cloud over the philanthropic group while insisting he didn’t participate in Epstein’s crimes.

In a town hall on Tuesday, the Microsoft co-founder acknowledged that he had two affairs with Russian women that Epstein later discovered, but that they didn’t involve Epstein’s victims. “I did nothing illicit. I saw nothing illicit,” Gates said, according to a recording reviewed by The Wall Street Journal.

Gates said images in the recently released Epstein files showing him with women whose faces are redacted were pictures that Epstein asked him to take with Epstein’s assistants after their meetings. “To be clear I never spent any time with victims, the women around him,” Gates said.

“It was a huge mistake to spend time with Epstein” and bring Gates Foundation executives into meetings with the sex offender, Gates said. “I apologize to other people who are drawn into this because of the mistake that I made.”

CLINTONS TO TESTIFY IN EPSTEIN PROBE AFTER BRITISH POLICE ARREST PRINCE ANDREW, PETER MANDELSON

Microsoft co-founder Bill Gates attends a dinner hosted by President Donald Trump with technology leaders in the State Dining Room at the White House in Washington, D.C., Sept. 4, 2025. (Saul Loeb/AFP via Getty Images)

The billionaire said he met with Epstein starting in 2011, years after Epstein had pleaded guilty in 2008 to soliciting a minor for prostitution. Gates said he was aware of some “18-month thing” that had limited Epstein’s travel but said he didn’t properly check his background. Gates said he continued meeting with Epstein even after his then-wife Melinda French Gates expressed concerns in 2013.

“Knowing what I know now makes it, you know, a hundred times worse in terms of not only his crimes in the past, but now it’s clear there was ongoing bad behavior,” Gates told staff. Speaking of his ex-wife, he added: “To give her credit, she was always kind of skeptical about the Epstein thing.”

Gates told staff on Tuesday that he continued meeting with Epstein through 2014, flew on a private jet with Epstein and spent time with him in Germany, France, New York and Washington. “I never stayed overnight,” he said, or visited Epstein’s island.

BILL GATES PLEDGES TO GIVE AWAY NEARLY ALL HIS WEALTH AND CLOSE HIS FOUNDATION IN 2045

He said Epstein “talked about the kind of intimate relationship he had with a lot of billionaires, particularly Wall Street billionaires,” and that he could help raise money for causes like global health.

Gates said because Epstein had other prestigious people at these meetings, that “made it easier for me to feel like this was a normalized situation.” He said he realizes that his association with Epstein also helped the sex offender to burnish his reputation.

Gates admitted that his ties to Epstein and newly disclosed emails from the Justice Department files had cast a cloud over the Gates Foundation and its reputation.

BILL CLINTON COMES OUT SWINGING AGAINST COMER FOR REJECTING PUBLIC EPSTEIN HEARING: ‘STOP PLAYING GAMES’

“It definitely is the opposite of the values of the Foundation and the goals of the Foundation,” he said. “And our work is very reputational sensitive. I mean, people can choose to work with us or not work with us.”

The Department of Justice released a trove of Epstein documents on Dec. 19 following President Trump’s signature on the Epstein Files Transparency Act in November 2025. (Joe Schildhorn/Patrick McMullan via Getty Images)

A Gates Foundation spokesperson said Gates holds town halls twice a year and he “spoke candidly, addressing several questions in detail, and took responsibility for his actions.”

Among the recently disclosed emails were two messages Epstein sent to himself in July 2013 that appear to be drafts styled as a resignation letter from Gates’s then science adviser, Boris Nikolic. The second email referenced a Gates “marital dispute” and said the author had facilitated “illicit trysts.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

In the town hall, Gates opened up about his personal life. “I did have affairs, one with a Russian bridge player who met me at bridge events, and one with a Russian nuclear physicist who I met through business activities,” he told staff.

Gates said that Nikolic, who was close to both Gates and Epstein, knew of those affairs and told Epstein about them. The physicist worked at one of Gates’s companies, though it is unclear if he had that affair while she was his employee.

The Journal earlier this month reported that Epstein inserted himself into negotiations related to Nikolic’s departure from Gates’s private office and dangled allegations that Gates had engaged in extramarital affairs when he put the exit deal together. In a statement, Nikolic previously told the Journal the July 2013 emails “were not written on my behalf or at my request.”

Gates had an affair with a Russian bridge player and Epstein later appeared to use his knowledge to threaten Gates, the Journal reported in 2023. Gates met the woman around 2010, when she was in her 20s. Epstein met her in 2013 and later paid for her to attend software coding school. In 2017, Epstein emailed Gates and asked to be reimbursed for the course.

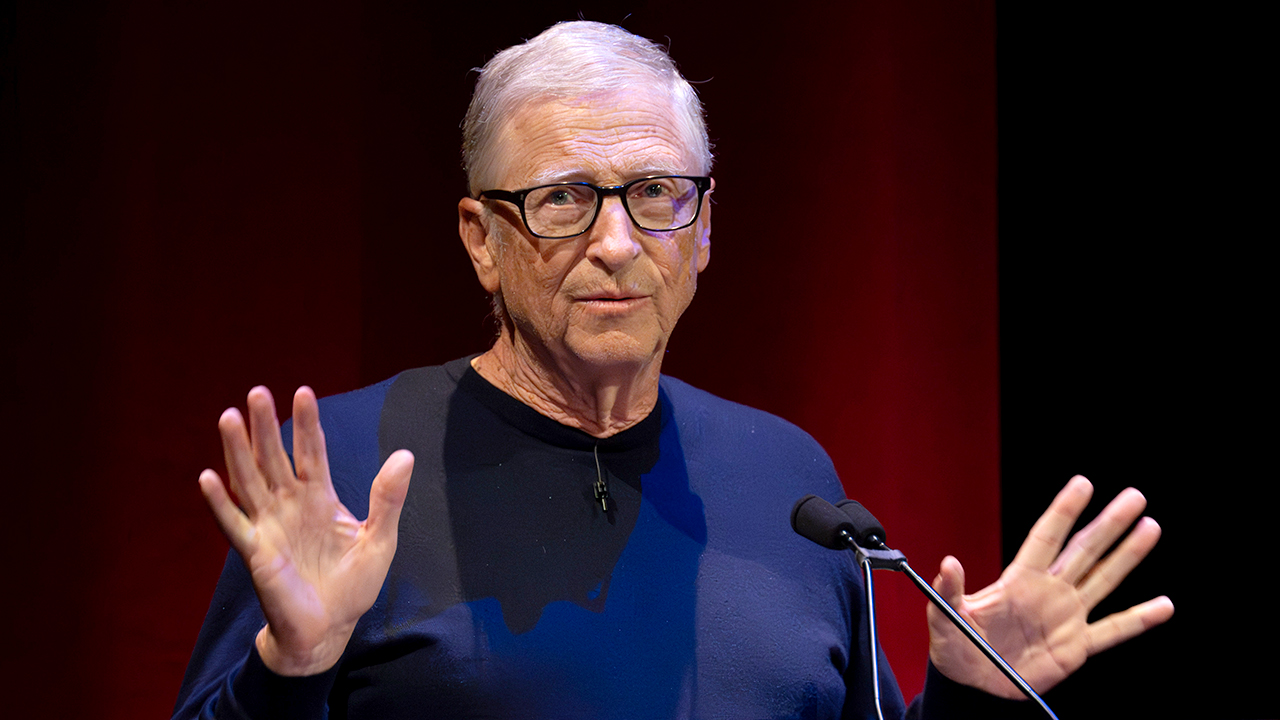

Microsoft co-founder Bill Gates speaks at the Gates Foundation’s inaugural global Goalkeepers event in the Nordics, held in Stockholm, Sweden, on Jan. 22, 2026. (Stefan JERREVANG / TT News Agency / AFP via Getty Images)

CLICK HERE TO READ MORE ON FOX BUSINESS

In a July 4, 2013, email to Nikolic, Epstein wrote: “Bill risks going from richest man to biggest hypocrite, melinda a laughing stock, pledges will disappear as a result.” Epstein continued, naming two women with whom Gates had affairs, saying they “risk becoming overnight sensations.”

Gates said in the town hall that 2014 was the last year he met with Epstein, though there were some “ancillary issues” Epstein brought up. “After that he continued to email me,” Gates said, adding that he didn’t respond.