Business

As AI clouds future of IT, Indian firms adapt to new game

Both large and mid-tier IT firms have been exploring ways-through internal initiatives as well as acquisitions and collaborations-to adapt to evolving technology that can strengthen their offerings. The rapid progress in AI is expected to enhance efficiency across the vendor-client ecosystem by shortening project timelines and enabling faster delivery of products and services to target markets. Viewed in this context, the current sell-off in IT stocks appears more a knee-jerk reaction rather than a sign of any fundamental shift to defensive sectors.

Last week, two major AI labs, OpenAI and Anthropic, released their latest models touting advanced capabilities to build software programming codes with greater accuracy than previous models. This sent ripples across tech and investor communities, forcing them to question the relevance of traditional software development companies that have so far thrived by employing legions of programmers. The tremors were felt on Dalal Street as the BSE IT index lost 15% in eight trading sessions to February 13, the biggest loss among sectoral indices on the exchange.

While uncertainties over the exact impact of AI capabilities will likely loom on IT stocks in the short term, the medium-to-long-term scenario appears less gloomy given the agility shown by IT exporters in aligning their offerings with the latest technology trends. Apart from training staff on AI platforms and forging ties with global tech partners, Indian IT exporters have been quick to share productivity gains with clients, which should retain their relevance.

Agencies

AgenciesThe traction in new deal wins reported by IT companies over the past few quarters ensures that they continue to offer valuable services to clients. The aggregate total contract value (TCV) of order bookings by the top five Indian IT exporters, including Tata Consultancy Services (TCS), Infosys, HCL Technologies, Wipro, and Tech Mahindra, remained above $20 billion in each of the five quarters to December 2025. It rose to $21.5 billion in the December 2025 quarter from $17.4 billion two years ago.

On the valuation front, too, comfort is setting in as the current selling spree is driving the trailing price-earnings multiples farther away from historical averages.

Business

Zurn Elkay water solutions officer sells $195k in stock

Zurn Elkay water solutions officer sells $195k in stock

Business

Leveraging Business Intelligence to Assess Workforce Availability and Wage Trends in Indonesia

Indonesia’s workforce exceeds 153 million, mainly in Java; wages vary by province, significantly impacting labor costs, with mandatory contributions and allowances adding fixed costs to employment expenses.

Indonesia’s Workforce and Industrial Regions

As of February 2025, Indonesia’s labor force consisted of approximately 153 million people, with 145.77 million employed. The majority of this workforce, about 56–58 percent, is concentrated on the island of Java, which serves as the country’s economic hub. Java hosts the primary manufacturing and service corridors, especially in the Jakarta metropolitan area, West Java, Central Java, and East Java, making it central to Indonesia’s industrial activity and labor markets.

Variations in Minimum Wages Across Provinces

Minimum wages in Indonesia are set at the provincial level and act as mandatory cost floors for employers. In 2026, Jakarta’s minimum wage is IDR 5,729,876 (US$339) monthly, about 130–150% higher than wages in key Java provinces like West Java (IDR 2,317,601), Central Java (IDR 2,327,386), and East Java (IDR 2,446,880). This wage disparity can significantly impact payroll expenses, especially for labor-intensive businesses with large entry-level workforces, potentially adding over IDR 20–22 billion (US$1.3–1.4 million) annually.

Long-term Employment Costs and Statutory Contributions

Beyond base wages, employers must account for additional statutory costs that elevate employment expenses. Mandatory social security contributions include the Old Age Security (JHT) at 3.7% and the Pension program (JP) at 2%, along with an annual religious holiday allowance (THR) equal to one month’s wage. These fixed-multiplier costs must be incorporated into operating budgets from the start, influencing the total cost of employment and workforce planning.

Read the original article : Using Business Intelligence to Evaluate Workforce Availability and Wage Levels in Indonesia

Other People are Reading

Business

Alphabet bonds’ lack of guardrails highlights investor confidence

Google parent Alphabet raised $31.51 billion across U.S. dollar, sterling and Swiss franc bond markets in a global bond raise on Monday and Tuesday, as artificial intelligence-driven spending sparks a surge in borrowing at U.S. tech giants.

Alphabet’s bond sale stood out in several ways, including its use of a so-called 100-year “century” bond in the sterling market.

These and other hyperscalers’ recent bond sales have garnered strong reception with Alphabet’s $20 billion U.S. bond sale drawing over $100 billion in demand. But the growing hyperscaler debt pile has raised concerns about their lack of investor protections compared to other bonds.

“What stands out is what’s missing,” said Julia Khandoshko, the CEO of Cyprus-based broker Mind Money. “Once a big name gets covenant-light terms through, others will try the same.”

“Naturally, that creates a second-market problem, where the next buyer has fewer ‘rules’ to rely on, while prices will swing more on rates, mood, and liquidity,” she added.

Investment-grade borrowers with strong credit profiles typically include fewer covenants in debt agreements than their junk-rated counterparts. Yet most include basic investor guardrails, especially a standard change-in-control covenant protecting investors in the event of M&A or another change in ownership. Alphabet’s bonds do not carry these protections, noted Anthony Canales, head of global research at New York-based Covenant Review.

The five major AI hyperscalers – Amazon, Alphabet, Meta, Microsoft, and Oracle – issued $121 billion in U.S. corporate bonds last year, according to a January report by BofA Securities. Alphabet and Amazon did not respond to requests for comment, while Oracle, Meta and Microsoft declined to comment.

Oracle’s $25 billion note offering on February 2, and Meta’s $30 billion bond offering in October, similarly lacked change-in-control and other basic covenants, Canales noted.

“In most IG covenant packages you would expect to see a change-in-control covenant,” Canales said. “But these are huge companies where the investors don’t believe there’s great risk they’ll need these protections.” Future tech issuers, especially smaller and lower-rated companies, could run into obstacles if they attempt to model their covenants after Alphabet, he added.

New debt issuance in 2026 from the five major hyperscalers could reach more than $300 billion as their spending needs around AI buildout increase, BofA Securities analyst Tom Curcurro wrote in a January 12 report. “This massive AI infrastructure buildout requires so much capex from the hyperscalers that they want to reduce the technical impact on their bonds,” said Jordan Chalfin, senior analyst at the New York-based research firm CreditSights, noting the benefits to issuers from flexible covenant structures.

Business

uniqure investor lawsuit deadline set for April 13 following FDA setback

uniqure investor lawsuit deadline set for April 13 following FDA setback

Business

Lumentum director Herscher sells $2.39 million in stock

Lumentum director Herscher sells $2.39 million in stock

Business

Freight Brokers Are the Latest AI Victims. These Other Stocks Look Safe.

Freight Brokers Are the Latest AI Victims. These Other Stocks Look Safe.

Business

US Stocks Today | S&P 500 ends up slightly as tech dips, inflation cools

The S&P 500, the Nasdaq and the Dow all declined for the week with technology stocks on a roller-coaster ride due to uncertainty about the extent to which profits could be disrupted due to AI competition and the hefty spending needed to support the technology.

Equities had started the session strong after data showed U.S. consumer prices increased less than expected in January. This prompted traders to slightly raise the chance of a 25 basis point interest-rate cut in June to 52.3% from 48.9%, according to the CME Group’s FedWatch tool.

But heavyweight technology and communications services ended the session lower as investors were jittery ahead of Monday’s U.S. holiday for Presidents Day.

“Large cap tech stocks continue to be an anchor on the market and any whiff of optimism continues to get rejected,” said Michael James, managing director, at Rosenblatt Securities, Los Angeles.

“We’ve been on wobbly legs a couple of weeks now and with the three-day weekend approaching, it’s not surprising to roll over into the end of the day.”

The Dow Jones Industrial Average rose 48.95 points, or 0.10%, to 49,500.93, the S&P 500 gained 3.41 points, or 0.05%, to 6,836.17 and the Nasdaq Composite lost 50.48 points, or 0.22%, to 22,546.67. For the week, the S&P 500 fell 1.39%, the Nasdaq declined 2.1%, and the Dow fell 1.23% for their biggest weekly losses since November. Equity markets have pulled back from record levels recently as AI fears fueled worries in sectors spanning from software and insurance to trucking companies. However, the S&P 500 software and services index closed up 0.9% on Friday while the S&P 500 tech sector fell 0.5%.

Despite improving inflation trends, Phil Orlando, chief market strategist at Federated Hermes, predicted more choppy trading ahead as investors deal with the looming U.S. midterm elections in November and the expected replacement of Fed Chair Jerome Powell by Kevin Warsh in May.

Historically when a Fed leadership transition happens in a midterm year, the market has hit a “double-digit air-pocket every time that’s occurred,” Orlando said.

Megacap tech stocks were weak with Nvidia and Apple Inc providing the biggest drags to the S&P 500 while Applied Materials provided the strongest boost.

Defensive utilities ended up 2.69% and real estate added 1.48%, making them the top gainers among S&P 500’s 11 major industry indexes. Healthcare was also a boost with Dexcom rising 7.6% and Moderna rising 5.3% after both companies’ fourth-quarter earnings reports impressed.

Applied Materials shares jumped 8.1% after the chipmaking-equipment firm forecast second-quarter revenue and profit above Wall Street expectations. Networking equipment provider Arista Networks gained 4.8% during the session after forecasting annual revenue above expectations.

White House trade adviser Peter Navarro said there was no basis to reports that the administration was planning to reduce steel and aluminum tariffs.

Still, some steelmakers came under pressure with Nucor falling just under 3% and Steel Dynamics slipping 3.9%. Also aluminum producer Alcoa fell 0.9% while Century Aluminum shares tumbled 7.4%.

Advancing issues outnumbered decliners by a 2.57-to-1 ratio on the NYSE where there were 392 new highs and 93 new lows. On the Nasdaq, 3,156 stocks rose and 1,646 fell as advancing issues outnumbered decliners by a 1.92-to-1 ratio.

The S&P 500 posted 34 new 52-week highs and 6 new lows.

On U.S. exchanges 18.61 billion shares changed hands compared with the 20.75 billion moving average for the last 20 sessions.

Business

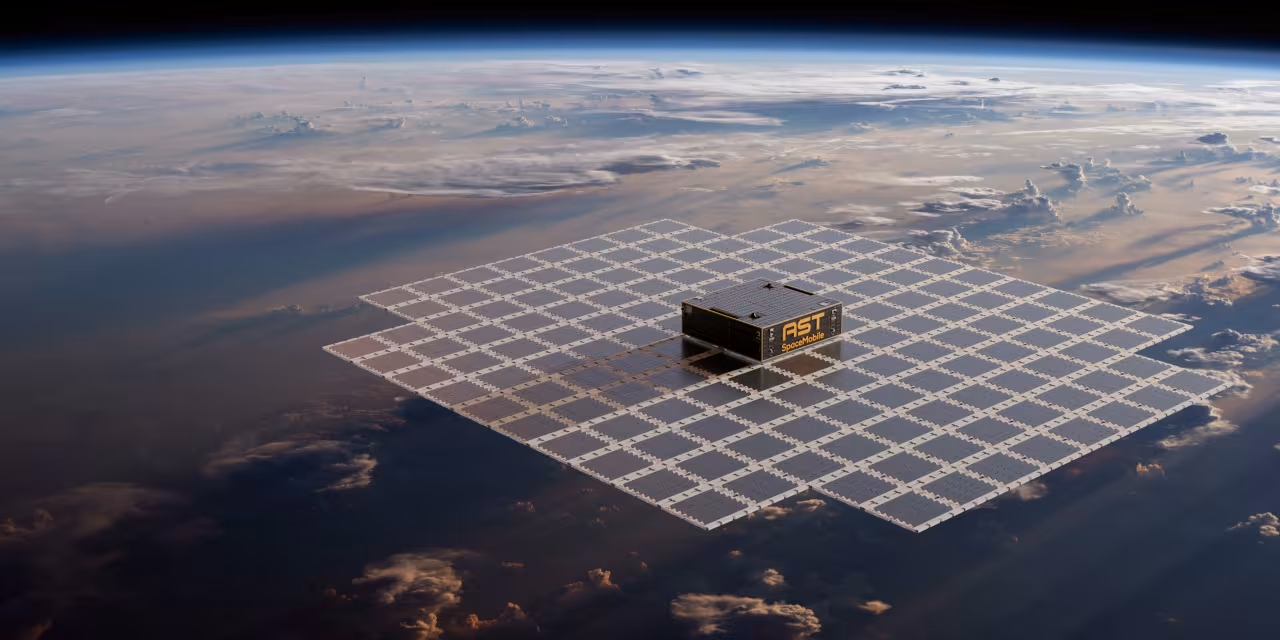

AST SpaceMobile Stock Sinks. What’s Bringing the Satellite Player Down to Earth.

AST SpaceMobile Stock Sinks. What’s Bringing the Satellite Player Down to Earth.

Business

AI offers powerful tools for fraud detection, but has risks too: Sebi Chief

“AI offers powerful tools for surveillance and fraud detection… But it also brings risks – opacity, bias, and concentration of technological power,” Pandey said. “Regulation must therefore evolve from supervising institutions to supervising systems and technology.”

The top boss at the regulatory body added that technology is reshaping markets faster than any rulebook. Algorithmic trading, digital platforms, and AI-driven decision-making are now part of everyday market functioning.

“We must address concentration and interconnectedness risks. Strengthen data governance and consent architectures. And manage the boundary between regulated finance and unregulated digital spaces,” he said, speaking at the summit.

Sebi is, therefore, responding through supervisory technology (SupTech), and RegTech (regulatory technology), stronger cybersecurity frameworks, and improved data governance, Pandey said.

Adding that the regulator sets direction and guardrails after due consultations but the industry has to innovate responsibly.

SEBI has also set up a high- level expert working group to develop a short-term and a long-term strategic technology roadmap for the securities market ecosystem. Talking about India’s next regulatory frontier, he said that regulation can no longer be only reactive but must become anticipatory. “It must move with markets, not behind them.”

“We need markets that are resilient by design, capable of navigating geo-fragmentation, technological shifts, and other emerging risks, while continuing to support growth and innovation,” he said.

India’s market capitalisation has grown more than four-fold in the last ten years, to over ₹4.7 lakh crore today. As a share of GDP, it has risen from around 81% in FY15 to 138% today.In FY25, equity and debt issues together amounted to about ₹14.3 lakh crore, while in FY26 from April to January, ₹11.6 lakh crore has been mobilised. In 2025, India led in IPO activity globally with a record number of IPOs and stood third in terms of IPO proceeds, he said.

The Sebi chief added that the ownership structure of listed companies is also changing. Individuals and mutual funds together now own around 21% of listed equity, compared to 13% in FY15. “This means the Indian household is no longer a peripheral participant. It is now central to the equity story of India,” he said.

He further said that regulation has evolved over the years, it has moved from a framework that focused largely on entities to one that focuses on their activities and risks.

“We are moving from silo oversight to a more coordinated regulatory architecture. We are also moving from static rules to dynamic supervision,” Pandey said.

“As markets scale, the quality of regulation becomes as important as the quantity of capital they attract.”

Business

Instacart Profit Falls Following $60 Million Settlement With FTC

Instacart CART 0.94%increase; green up pointing triangle reported lower fourth-quarter profit dragged down by a $60 million settlement with the Federal Trade Commission in connection with claims that it used deceptive practices to raise costs for shoppers.

The food-delivery platform, also known as Maplebear, on Thursday posted net income of $81 million, or 30 cents a share, down from $148 million, or 53 cents a share, from the same period a year earlier.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports7 days ago

Sports7 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video16 hours ago

Video16 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports7 days ago

Former Viking Enters Hall of Fame

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?