Business

As the H-1B visa debate tears MAGA apart, Indian-Americans are shaping America’s future

Indian-Americans are not just participants in America’s story—they are at its forefront. Read More

CryptoCurrency

Bitcoin Price Likely To Fluctuate Between $100,000 And $110,000 Until FOMC Meeting, Says Analyst

After a flash crash to $89,256 earlier this month, Bitcoin (BTC) made a swift recovery, reaching a new all-time high (ATH) of $108,786 on January 20. However, according to a crypto analyst, further upside could be limited until the Federal Open Market Committee (FOMC) meeting later this month.

Bitcoin To Remain Range-Bound Until FOMC Meeting

The world’s largest cryptocurrency has been on a bullish trajectory since November, fueled by Donald Trump’s victory in the US presidential election. Over the past three months, BTC has surged from approximately $67,000 to $104,536 at the time of writing, posting gains of over 50%.

Related Reading

However, crypto analyst Krillin predicts that BTC may continue to “chop” in the $100,000 to $110,000 range until the FOMC meeting. The analyst suggests that unless the Bank of Japan takes extraordinary policy measures, BTC is unlikely to break out of this range before the end of the month.

At present, the CME FedWatch tool indicates a 99.5% probability that the US Federal Reserve (Fed) will not cut interest rates at the upcoming meeting. Krillin expects a market dump to follow the anticipated hawkish meeting, which may be partially offset by a dovish-sounding press conference hinting at future quantitative easing (QE).

For the uninitiated, QE is a monetary policy where central banks inject money into the economy by purchasing government bonds and other financial assets to lower interest rates and stimulate economic activity. This increased money supply can weaken fiat currencies, potentially driving investors toward assets like BTC, boosting its price as a hedge against inflation and currency devaluation.

Krillin’s prediction aligns with a recent market observation which states that BTC profit-taking has declined by 93% from its December peak, and that the long-term holders are back in accumulation mode, preparing for the next leg up. However, how long the current consolidation phase may last is anyone’s guess.

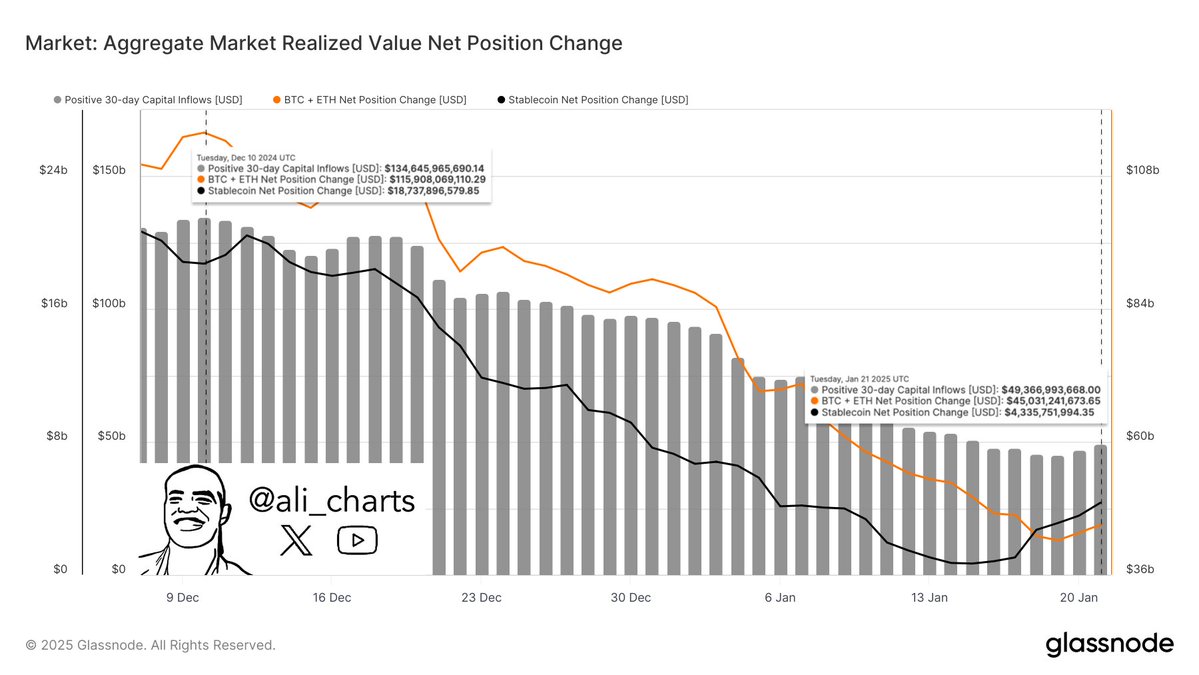

Meanwhile, crypto analyst Ali Martinez notes a sharp decline in capital inflows into the digital assets market, from $134 billion on December 10 to $43.37 billion. This low liquidity could result in sharp price swings, increasing the risk of liquidations for leverage traders.

Will BTC Peak In Q2 2025?

As BTC awaits the FOMC meeting to determine its next price trend, some analysts remain optimistic that the cryptocurrency could hit its market cycle peak in Q2 2025 as more institutions embrace the asset under favourable regulations.

Related Reading

For example, crypto analyst Dave The Wave recently predicted that BTC will likely peak in the summer of 2025. A report by Bitfinex supports this outlook, forecasting that Bitcoin could surge to $200,000 by mid-2025, albeit with minor corrections along the way.

That said, Bitcoin must defend the $100,000 price level, as failure to do so could see the asset drop to as low as $97,500. At press time, BTC trades at $104,536, up 1.4% in the past 24 hours.

Featured image from Unsplash, Charts from X and TradingView.com

Business

It’s not just Netflix. Here’s how much streaming prices have gone up in the past 5 years

© 2024 Fortune Media IP Limited. All Rights Reserved. Use of this site constitutes acceptance of our Terms of Use and Privacy Policy | CA Notice at Collection and Privacy Notice | Do Not Sell/Share My Personal Information

FORTUNE is a trademark of Fortune Media IP Limited, registered in the U.S. and other countries. FORTUNE may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.

Technology

The Trump Cryptonaissance Is Here

The wheels are already beginning to turn on Donald Trump’s plan to make the US into the “crypto capital of the planet” following his return to the White House.

In an executive order signed Thursday, Trump established a “working group on digital asset markets,” which will be responsible for weighing the possibility of the US forming a “strategic national digital asset stockpile,” among other things.

The promise to establish a stockpile was one of numerous commitments made by Trump to the crypto industry before he was reelected. Though the idea stumped economists, it received a rapturous reception among bitcoiners. As rumors of an impending announcement spread Thursday, the price of bitcoin climbed to $105,000 per coin, just short of the record high.

The order also requires the working group—which will comprise the leaders of various government branches, financial regulatory bodies, and the attorney general—to come up with an appropriate set of regulations and laws governing the use of crypto.

Earlier in the week, on Trump’s second day in office, the Securities and Exchange Commission (SEC) —the US regulatory body that brought a volley of lawsuits against crypto firms under the Joe Biden administration—established a “crypto task force.” Under new leadership following the departure of former chair Gary Gensler, who was widely demonized in the cryptosphere, the SEC will develop a “comprehensive and clear regulatory framework for crypto assets,” the agency stated.

Later the same day, Trump granted clemency to Ross Ulbricht, who was serving life in prison for crimes committed while running the infamous darknet marketplace Silk Road, one of the first websites to accept bitcoin as payment. After being arrested in 2013, Ulbricht became something of a martyr in crypto circles for his part in spreading the bitcoin gospel.

These initial gestures signal Trump’s willingness to follow through on earlier campaign promises: to pass various crypto-related legislation, reform the financial regulatory apparatus in the US, and knit crypto into the US national treasury. The effects will be extensive, crypto figures believe, reverberating far beyond US shores and creating the conditions for a new golden era for the industry.

“Our technology is very powerful and transformative. We need to land it in different societies,” says Joseph Lubin, cofounder of Ethereum and chief executive at software company Consensys. “And America is a standard-setter for the rest of the world.”

Despite having previously spurned bitcoin as a “scam,” Trump now has extensive ties to the crypto industry, many high-profile members of which came out in support of his reelection campaign.

In the lead-up to the 2024 election, crypto organizations donated hundreds of millions of dollars to crypto-focused super political action committees, which spent the funds in support of crypto-friendly congressional candidates, many of them Republican.

On the campaign trail, Trump began to bill himself as the first “crypto president.” In July, in front of a rabid crowd of bitcoiners, Trump promised to turn the US into a crypto mining powerhouse and establish a national bitcoin stockpile if reelected. In the same speech, he pledged to fire Gensler, the SEC chair, prompting the most rapturous applause of the night.

CryptoCurrency

Crypto Critic Elizabeth Warren Probes Trump’s Meme Coin Venture ($TRUMP)

Senator Elizabeth Warren is calling foul on President Donald Trump’s meme coin, pressing for the U.S. Office of Government Ethics and financial regulatory agencies to dig into the ethical and regulatory details around the $TRUMP token.

Warren, who is the top Democrat on the Senate Banking Committee that oversees U.S. financial regulators, says the assets, including First Lady Melania Trump’s own eponymous meme coin, pose conflict-of-interest hazards for the president and highlight the most destructive and volatile corner of the crypto sector.

“Nearly overnight, President Trump and his wife’s net worth skyrocketed to $58 billion,” Warren wrote in the letter alongside Representative Jake Auchincloss, a fellow Massachusetts Democrat who serves on the House Energy and Commerce Committee. “Anyone, including the leaders of hostile nations, can covertly buy these coins, raising the specter of uninhibited and untraceable foreign influence over the President of the United States, all while President Trump’s supporters are left to shoulder the risk of investing in $TRUMP and $MELANIA.”

Launched the Friday before his inauguration this week, Trump’s token — for which his company retains some 80% of the coins in circulation — rose rapidly from about $3 last week to almost $37 on Thursday. It’s opened a possibility for Trump to make “extraordinary profits off his presidency,” the lawmakers noted.

The letter was sent to the Treasury Department, Securities and Exchange Commission and the Commodity Futures Trading Commission — each of which now has a new Trump pick at the helm. Warren and Auchincloss raised the point that Trump is in charge of appointing the permanent heads of these regulatory agencies that will make decisions affecting the future of his crypto tokens.

None of the three federal agencies immediately responded to CoinDesk’s requests for comment on the letter, or whether they’re reviewing the tokens in any other capacity.

“$TRUMP and $MELANIA present grave risks to President Trump’s ability to impartially govern our nation — and to investors in these coins, who may be made victims of a rug pull scheme orchestrated by the Trump family,” Warren’s letter concluded.

The lawmakers join other Democrats who have similarly raised concerns about Trump issuing these assets right before taking office. Representative Gerry Connolly, the top Democrat on the House Oversight Committee, called for an investigation in a letter sent to his committee’s Republican chairman one day into Trump’s new term, additionally raising issues with World Liberty Financial and its ties to Tron blockchain founder Justin Sun. And Representative Maxine Waters, the ranking Democrat on the House Financial Services Committee, also shared her alarm about Trump’s coin.

Read More: House Dems Warn of Corruption in Trump’s Crypto Business Moves

Business

Boeing expects $4 billion loss for fourth quarter after chaotic 2024

An aerial view of the engines and fuselage of an unpainted Boeing 737 MAX airplane parked in storage at King County International Airport-Boeing Field in Seattle, Washington.

Lindsey Wasson | Reuters

Boeing said Thursday that it likely lost about $4 billion in the fourth quarter, adding to troubles at the manufacturer, which began 2024 with a midair accident and ended it with a crippling labor strike and layoffs.

The company said it expects to post a loss of $5.46 per share for the fourth quarter. It said it expects its revenue to be $15.2 billion, less than analysts’ expectations, according to LSEG estimates. Boeing said it likely burned through $3.5 billion in cash during the quarter. The company raised more than $20 billion in the quarter to boost liquidity during its crises.

Boeing has not posted an annual profit since 2018.

The company expects to take a $1.1 billion charge on its 777X and 767 programs because of the strike and new contract.

“Although we face near-term challenges, we took important steps to stabilize our business during the quarter including reaching an agreement with our IAM-represented teammates and conducting a successful capital raise to improve our balance sheet,” Boeing CEO Kelly Ortberg said in a news release.

Boeing has struggled to regain its footing after a door plug blew out midair in January 2024, sparking a new safety crisis at the company that was trying to put behind it the fallout from two fatal crashes in 2018 and 2019.

The near-catastrophic accident brought new federal scrutiny and a slowdown of deliveries of new planes. A nearly two-month machinists strike that started in September shut down most of its commercial aircraft production. The workers, mostly in the Puget Sound area, won a new contract in November.

The all-important commercial airplane unit revenue will likely come in at $4.8 billion, with a negative operating margin of nearly 44%.

Boeing’s problems also extend to its defense unit, for which it expects to record pretax charges of $1.7 billion on the KC-46A tanker, and the long-delayed 747s that will service as the new Air Force One aircraft, as well as its space programs.

Technology

Everything we saw at Xbox’s Developer Direct 2025

Though Nintendo can technically claim it had the first big gaming news event of the year, at least Xbox’s Developer Direct actually showed off some games and let us know when we can play them. The showcase was anchored by deep dives into the biggest games coming down the green pipe like Doom: The Dark Ages and Compulsion Games’ South of Midnight, with a couple of surprises to fill out the nearly one-hour-long runtime. Here are the highlights from the show.

Xbox kicked off the Direct with the surprise reveal of Ninja Gaiden 4. The game is being codeveloped by Koei Tecmo’s Team Ninja and Bayonetta studio PlatinumGames. Ninja Gaiden 4 revives the series’ bloody, fast-paced combat and high-stakes (but often frustrating) platforming with a new face, the ninja Yakumo. Yakumo will use his unique fighting styles to defeat the Divine Dragon Order that’s turned Tokyo into a dystopian, crumbling mess. Gaiden’s former protagonist, Ryu Hayabusa, will also make an appearance as a playable character and Yakumo’s rival.

Ninja Gaiden 4 will launch in the fall of this year, but if you don’t want to wait for your bloody ninja action, you don’t have to. Xbox stealth dropped Ninja Gaiden 2 Black, a remake of Ninja Gaiden II, and it’s available right now on Xbox and Game Pass.

The developers at Compulsion Games went into detail about South of Midnight’s gameplay and story. You play as Hazel who must use her powers as a Weaver, fighting monsters and traversing the haunted landscape, to rescue her mother who gets swept away in a hurricane. With this, everything I’ve seen about South of Midnight makes it seem like it’ll be one of my games of the year. It’s got a Black protagonist, features characters and tropes that harken to Southern gothic folklore, and its stop-motion art style makes it immediately stand out. I cannot wait to get my hands on this game when it releases on April 8th.

Sandfall Interactive was founded in Montpellier, France, in 2020 with a team led by former Ubisoft developers. Clair Obscur: Expedition 33 is the studio’s first game — a turn-based RPG with a compelling narrative hook. The world has been ravaged by a being known as the Paintress. Every year, she writes down a number, and everyone older than that number disappears. Expeditions are sent out to stop the Paintress, and the game will follow Expedition 33 in their attempt to save humanity. In addition to an interesting Persona 5-style take on turn-based combat, Expedition 33 features some serious voice acting talent, starring Charlie Cox, Jennifer English, Ben Starr, and Andy Serkis. Can’t wait to hear them perform when Clair Obscur: Expedition 33 launches on April 24th.

To close out the Direct, Xbox gave us another look at Doom: The Dark Ages, the prequel to id Software’s 2016 Doom reboot and Doom Eternal. It will, of course, feature all the ripping and tearing a Doom enjoyer could want, along with an interesting focus on narrative — something the series isn’t really known for. But I suspect folks are far more interested in piloting a 30-story Doomguy-shaped mech suit when the game releases on May 15th.

CryptoCurrency

President Trump Signs Executive Order To Ban Central Bank Digital Currencies (CBDC)

Today, U.S. President Donald Trump signed an executive order (EO) related to Bitcoin and cryptocurrency, titled “Strengthening American Leadership In Digital Financial Technology”. This EO officially banned the creation and issuance of a central bank digital currency (CBDC) in the United States, defining a CBDC as “a form of digital money or monetary value, denominated in the national unit of account, that is a direct liability of the central bank.”

“Except to the extent required by law, agencies are hereby prohibited from undertaking any action to establish, issue, or promote CBDCs within the jurisdiction of the United States or abroad,” the order announced. “Except to the extent required by law, any ongoing plans or initiatives at any agency related to the creation of a CBDC within the jurisdiction of the United States shall be immediately terminated, and no further actions may be taken to develop or implement such plans or initiatives.”

The new EO will also establish a presidential working group to create a federal regulatory framework governing digital assets (including stablecoins), and evaluate the creation of a strategic national digital assets stockpile.

“The Working Group’s report shall consider provisions for market structure, oversight, consumer protection, and risk management,” stated the order. “The Working Group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.”

The EO defines the term “digital asset” as any digital representation of value that is recorded on a distributed ledger — which would include cryptocurrencies such as bitcoin, digital tokens, and stablecoins.

The stockpile is expected to include or be fully in bitcoin. Last summer at The Bitcoin 2024 Conference in Nashville, Donald Trump pledged to create a national strategic bitcoin stockpile using the bitcoin already held by the government obtained from hacks and seizures. According to Arkham Intelligence data, the U.S. currently holds 198,109 bitcoin worth over $20.1 billion.

BREAKING: 🇺🇸 DONALD TRUMP PLEDGES TO NEVER SELL #BITCOIN AND HOLD IT AS A STRATEGIC RESERVE ASSET IF ELECTED PRESIDENT pic.twitter.com/bbPRxlZfGZ

— Bitcoin Magazine (@BitcoinMagazine) July 27, 2024

Following Trump’s speech at the conference, U.S. Senator Cynthia Lummis presented legislation to also create a Strategic Bitcoin Reserve, but in a different manner. Her bill would see the U.S. government purchase 200,000 bitcoin per year, for 5 years, until it has bought a total of 1,000,000 BTC. This legislation, however, would have to pass through both the House of Representatives and the Senate before making its way to the president’s desk for final approval.

So far, President Trump has kept his word on the Bitcoin related promises he made on the campaign trail. Earlier this week, President Trump gave a full and unconditional pardon to Bitcoin pioneer and Silk Road founder Ross Ulbricht, which Trump pledged to accomplish in addition to creating a Strategic Bitcoin Reserve, banning CBDC, creating a working group/advisory council, and more.

The full details of the executive order can be found here.

CryptoCurrency

Why Are Litecoin Investors Turning To New Viral PayFi Altcoin Remittix Over Shiba Inu In 2025

There have been significant losses for Litecoin and Shiba Inu in the last 24 hours as many holders look to new projects hoping for better returns. Among these is Remittix (RTX), a PayFi project that raised over $5.2 million in its presale in just a few weeks. The project tackles problems that have been plaguing the global payments sector for many years now, offering a modern alternative. This is a market worth $190 trillion and Remittix could grab a big slice. So how will Shiba Inu (SHIB), Litecoin (LTC) and Remittix (RTX) fare in Q1 of 2025?

Shiba Inu (SHIB) Plummets 7% Overnight

Shiba Inu has kept its holders guessing with major fluctuations through most of January so far. In just 24 hours, Shiba Inu (SHIB) has plummeted by 7.3%, putting Shiba Inu at a value of $0.00002026, dipping to 0.00002040 earlier today. The MACD still signals a slight bullish crossover despite the asset’s losses, so some upward movement or at least some consolidation could be coming soon. On-chain activity too is up, with active addresses up 15% last week, which is at least a sign of healthy network engagement for Shiba Inu (SHIB).

Litecoin (LTC) Sees 24 Hour Dip After Strong Weekly Gain

Litecoin (LTC) too has been facing fluctuations. The asset had a strong week, with a net gain of 15.81%, but it has hurtled down in the last 24 hours, losing 4.06% of its value. Litecoin (LTC) is now trading around the $120 mark, climbing as high as $128.23 earlier today before dipping to $114.44. Litecoin’s RSI is at 62, which means it’s creeping toward overbought territory, but there’s still room for growth. On the contrary, Litecoin’s MACD shows some solid bullish momentum, lining up with the recent price jumps. Looking ahead, Litecoin’s big play for 2025 is getting a U.S.-based ETF approved, and if that happens, it could be a game-changer.

Remittix Switches Things Up in the Global Payments Space

With Remittix, users can convert over 40 cryptocurrencies into fiat and transfer money to any global bank account. By removing hidden fees and implementing transparent flat-rate pricing, Remittix tackles common frustrations associated with traditional international payments. Its rapid transaction processing positions it as a cost-effective and efficient alternative to existing solutions.

The entire process is simple. Users can send funds to any global bank account, with transactions typically completed in under 24 hours. For those weary of navigating complex banking systems, Remittix offers a straightforward yet powerful alternative.

Businesses can also derive great benefit from Remittix, particularly through the Remittix Pay API. This powerful piece of tech enables businesses to receive cryptocurrency payments and settle them in fiat currency. Eliminating digital asset management headaches, the platform supports more than 30 fiat currencies and 50 cryptocurrency pairs, enabling smooth financial operations across regions. Freelancers and merchants with global clients will find this function particularly useful to simplify payments and cut costs.

Recognizing the need for user independence, Remittix ensures that recipients do not know that payments were sent via its platform or that the transactions originated in cryptocurrency.

Remittix Storms Through Presale, Surpassing $5.2 Million

So far, Remittix has raised $5.2 million during its presale, which continues to gain traction. With a focus on privacy, efficiency, and user autonomy, Remittix is positioned to disrupt the $190 trillion cross-border payments market. Some analysts predict significant gains for Remittix (RTX), with forecasts of an 800% price surge during the presale and a potential 5,000% rally post-launch, as the project prepares to lead the PayFi sector.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

Business

Davos delegates leave World Economic Forum under no illusion of Trump disruption ahead | Money News

For three days Donald Trump dominated Davos from a distance.

On the fourth, he did it in person, albeit virtually, with a speech that took his threats of economic conflict with Europe directly to its political leaders.

Beamed from the White House to the World Economic Forum, he delivered a message of total confidence in American might, and a direct challenge to those that do not play along.

Money blog: Could Santander really walk away from UK?

Initially, he stuck to the inauguration script and his domestic program but, teed up by a question from his Mar-a-Lago neighbour and former adviser Stephen Schwarzman, co-founder of the Blackstone Group, he let rip.

Mr Schwarzman identified a theme of this week, frustration at EU regulation among businesses, and the president took full advantage.

He criticised taxes on American companies, and what he sees as a trade imbalance. “They don’t take our food, they don’t take our cars, but they send us cars by the million.”

EU demands for $15bn in back taxes from Apple, as well as investigations into Google and Facebook, were also slammed. “These companies, like them or not, these are American companies.

“Nobody’s happy with it and we are going to do something about it. I’m trying to be constructive, I love Europe, but they treat the US very unfairly.”

Read more from Sky News:

Chancellor’s Heathrow third runway hint

Trump has everyone in Davos guessing

His counter-offer to the businesses listening; corporation tax of just 15% for companies that shift their manufacturing to the US, and tariffs for those that don’t, a position that would inevitably bring retaliation.

In the audience, the heads of the European Central Bank, the World Trade Association, the International Money Fund and sundry cabinet ministers and central bankers, shifted in their seats.

As if to emphasise what Europe is up against, Mr Trump cited a $600bn investment promised by Saudi Arabia’s Crown Prince Mohammed bin Salman, and suggested “he round it up to a trillion”.

Having parked metaphorical tanks on chancellery lawns, he offered some hope, but not detail, on how he might address the real ones rolling across Ukraine.

Referring to “millions of dead bodies lying on the flat fields” he said efforts to secure peace “should be under way”. Asked when that might happen, he said the answer lay with Russia. “Ukraine is ready.”

Having started the week guessing what Trump 2.0 might mean, Davos’ delegates, that unique mix of money, power, civil society and celebrity, leave the Alps under no illusion of the disruption ahead.

Technology

JetBrains launches Junie, a new AI coding agent for its IDEs

JetBrains, the company behind coding tools like the IntelliJ IDE for Java and Kotlin (and, indeed, the Kotlin language itself), on Thursday launched Junie, a new AI coding agent. This agent, the company says, will be able to handle routine development tasks for when you want to create new applications — and understand the context of existing projects you may want to extend with new features.

Using the well-regarded SWEBench Verified benchmark of 500 common developer tasks, Junie is able to solve 53.6% of them on a single run. Not too long ago, that would have been the top score, but it’s worth noting that at this point, the top-performing models score more than 60%, with Weights & Biases “Programmer O1 crosscheck5” currently leading the pack with a score of 64.6%. JetBrains itself calls Junie’s score “promising.”

But even with a lower score, JetBrains’ service may have an advantage because of its tight integration with the rest of the JetBrains IDE. The company notes that even as Junie helps developers get their work done, the human is always in control, even when delegating tasks to the agent.

“AI-generated code can be just as flawed as developer-written code,” the company writes in the announcement. “Ultimately, Junie will not just speed up development — it is poised to raise the bar for code quality, too. By combining the power of JetBrains IDEs with LLMs, Junie can generate code, run inspections, write tests, and verify they have passed. “

It may be a bit before you can try that out yourself, though. The service is only available through an early access program behind a waitlist. For now, it also only works on Linux and Mac, and in the IntelliJ IDEA Ultimate and PyCharm Professional IDEs, with WebStorm coming soon.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login