Business

Beyond Venezuela: How Donald Trump’s oil power play could reshape inflation, interest rates and emerging market returns

On 3 January, the US carried out military strikes in Venezuela, with US special forces capturing President Nicolás Maduro and extraditing him to face ‘narco-terrorism’ charges. US President Donald Trump has since announced that the US will oversee Venezuela’s transition of power, take control of its vast oil reserves, and encourage US companies to invest in and revive the country’s flailing oil industry. The move marks a significant geopolitical shift, reshapes global oil dynamics, and injects fresh uncertainty into an already turbulent world. Should global investors brace for a storm?

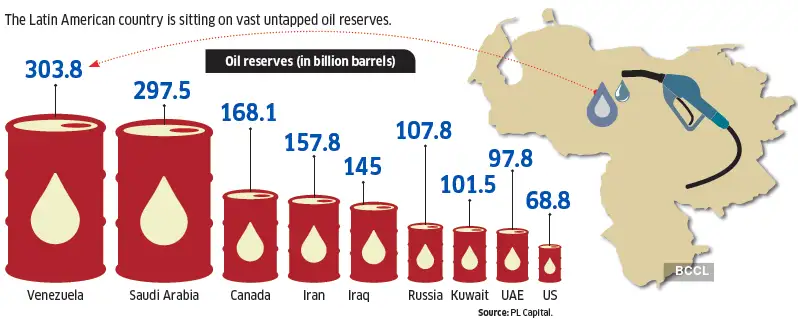

Venezuela ranks first in proven oil reserves

The Latin American country is sitting on vast untapped oil reserves

Oil’s not well

Here is what makes this US takeover a big game-changer. Venezuela is home to the largest proven oil reserves on earth. According to estimates, Venezuela holds 303 billion barrels of crude—the world’s largest stockpile and nearly a fifth of global oil reserves. The US effectively gains unfettered access to this trove of oil, extending its already vast oil empire that runs from Alaska to Patagonia (a South American region covering parts of Argentina and Chile).

This gives the US unprecedented leverage in the global energy market. It further buttresses its position as a de facto pricesetter, and not a price-taker. With nearly 30% of the world’s total oil reserves now under its influence, it marks a notable shift in global energy dynamics, analysts at JP Morgan wrote in a note.

What’s more, most US refineries are specifically equipped to process the heavy-grade crude oil that Venezuela produces. “The capture of Nicolás Maduro by US forces on 3 January 2026, marks the most significant geopolitical shift in Latin America since the 1989 invasion of Panama,” observes Ankita Pathak, Head – Global Investments, Ionic Asset. However, this power shift in the US’s favour will not happen overnight. Venezuela’s oil industry, despite its vast potential riches, has waned over the years.

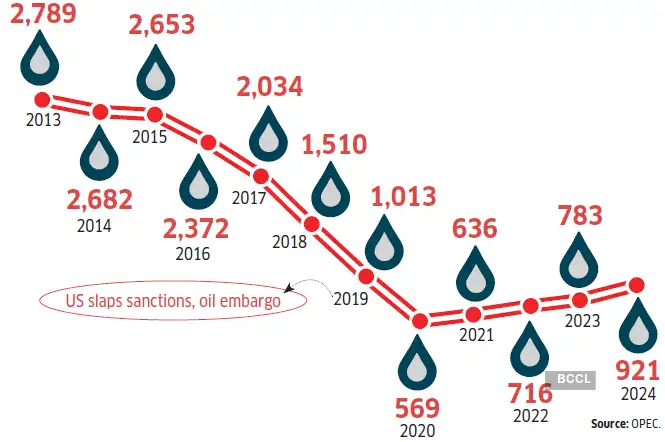

The Latin American country was once the world’s largest oil exporter, ahead of Saudi Arabia. But the advent of socialist regimes under Hugo Chavez and subsequently Maduro put the brakes on its oil output. From a peak of 3.7 million barrels a day in the 1970s, Venezuela now churns out less than 1 million barrels a day—a mere 0.8% of the world’s oil production.

A series of missteps has left Venezuela’s oil infrastructure creaking and output shackled. “Lack of expertise, under-investment, political interference, mismanagement, corruption and then sanctions have paralysed the exploitation of its oil reserves,” remarks Swarnendu Bhushan, Research Analyst, PL Capital. For now, the US intervention alone cannot immediately unlock Venezuela’s massive crude oil reserves, wrote Stephen Dover, Chief Market Strategist, Head of Franklin Templeton Institute, in his recent market update.

“Venezuela has the world’s largest reserves of crude oil, but the poor state of its ageing oil extraction and transportation infrastructure, coupled with the low quality of its ‘heavy’ crude, suggests that even the arrival of political stability will not quickly increase its crude oil output or exports,” indicates Dover.

Oil prices may see a short-term spike due to uncertainty. “The risk premium is expected to rise with global uncertainties, and there may be a minor spike as well depending upon how Russia and China respond to this,” says Bhushan.

But in the medium term, Venezuela’s return to global oil markets could pressure prices downward. “The medium-term outlook appears bearish as the removal of Maduro may unleash Venezuela’s significant reserves, potentially increasing production by 500,000 to 1 million barrels per day within two years if US companies resume operations,” observes Aamir Makda, Commodity & Currency Analyst, Choice Broking.

Venezuela’s oil output has shrunk

It currently contributes just 0.8% of the world’s oil production.

Average daily crude oil production (in million barrels)

ANKITA PATHAK

HEAD – GLOBAL INVESTMENTS, IONIC ASSET

“In the longer term, lower oil prices lead to lower US inflation, potentially more rate cuts, a weaker dollar, and therefore helps the EM trade.”

Geopolitical tensions

A bigger fallout is how this unilateral takeover of a sovereign nation is perceived by other global powers, mainly China and Russia. “The Trump Administration has reinforced the perception that the US is willing to act unilaterally and to use force. Other countries, with territorial interests elsewhere, could be emboldened by the US use of power,” points out Dover.

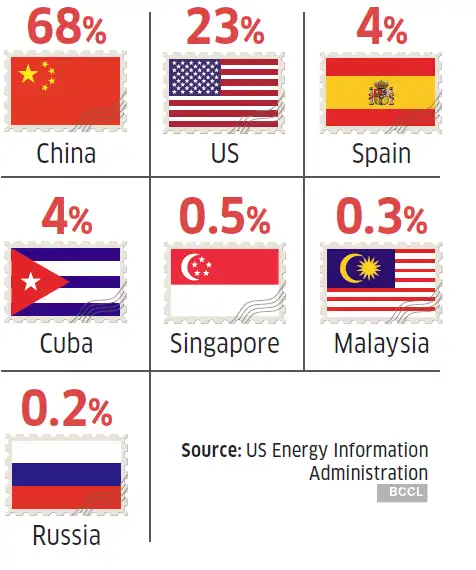

Beijing will be monitoring developments closely. The world’s second-largest economy has developed close ties to Caracas (capital city of Venezuela) in recent years. China is the biggest buyer of Venezuelan oil and its largest creditor. It has provided Venezuela, its “all-weather strategic partner”, with an economic lifeline since the US ramped up sanctions in 2017, purchasing roughly $1.6 billion worth of goods in 2024.

According to a Reuters report, almost half of China’s purchases were crude oil, even as its state-owned oil giants had invested around $4.6 billion in Venezuela by 2018. In fact, the Maduro regime’s move to sell its oil in Yuan was seen as a threat to US petro-dollar hegemony. The US intervention in Venezuela is bound to leave a sour taste in Beijing. “In the short-term, China will be under pressure both for its oil supply and for the loans it has granted to Venezuela in the past that may not be honoured,” points out Pathak of Ionic Asset.

It could spark fresh tensions between the world’s two biggest superpowers. Chinese officials have already said China does not accept any country acting as the “world’s judge” or “police”, without expressly mentioning the US.

Trump’s recent support for a bill proposing steeper 500% tariffs on countries purchasing Russian oil is another geopolitical risk to contend with. Markets will interpret this as a shift towards using trade instruments for geopolitical leverage, which increases risk pricing across equities, currencies, and commodities, observes Amit Jain, Co-Founder of Ashika Global Family Office Services.

Boost for emerging markets

In a world engulfed in trade wars and regional conflicts, this latest military adventure by the US and ensuing threats sows renewed chaos. The country’s past attempts to impose power shifts or rebuild ‘troubled’ nations have had limited success. “Transitioning of governments and investment by oil companies in less stable economies have proved to be a challenge over the past decade,” observe analysts at Choice Broking.

Experts reckon the event could further stoke geopolitical tensions. “This episode clearly lifts the geopolitical quotient higher. Similar military aggression by other global powers cannot be ruled out, now that there is a precedent, maintains Chirag Mehta, CIO, Quantum AMC.

So far, flare-ups in geopolitical tensions are not evident, but investors should remain wary. Worryingly, since the strike on Venezuela, President Trump has continued to threaten other nations with coercive action. Warnings have been issued to countries including Colombia, Cuba, Mexico, Iran, and Greenland, a self-governing territory of Denmark, a NATO (North Atlantic Treaty Organisation) ally.

Gold could see short-term gains from safe-haven demand. “This will lead to some bid-up in gold prices as the built-in risk premium rises,” says Mehta. If the US gains access to Venezuelan oil, it could lower energy costs and inflation, potentially accelerating Fed rate cuts, a medium-term positive for gold. “The Fed’s dovish stance remains the core driver for gold,” notes Makda. This also bodes well for emerging markets, say experts.

“In the longer term, lower oil prices lead to lower US inflation, potentially more rate cuts, a weaker dollar and therefore helps the EM trade,” mentions Pathak.

She adds that Latin American equities can potentially trade at higher multiples without the “Chavista ceiling”— the structural and ideological limit imposed by socialist regimes on Venezuela’s economic potential and, by extension, the broader region’s growth.

But for Indian equities, any impact is likely to be muted. The ongoing crisis in Venezuela is unlikely to have any material economic or energy effect on India, according to the India-based think tank Global Trade Research Initiative (GTRI). Apart from ONGC’s investment in its oil fields, India has sharply cut oil imports from Venezuela since the 2019 US sanctions on the country.

Eventually, refiners in India could benefit from importing heavier Venezuelan barrels, which are priced at a discount to Brent crude and enable companies to generate higher gross refining margins. Overall, domestic equity markets are likely to remain subdued till global uncertainty prevails and earnings do not pick up materially.