Business

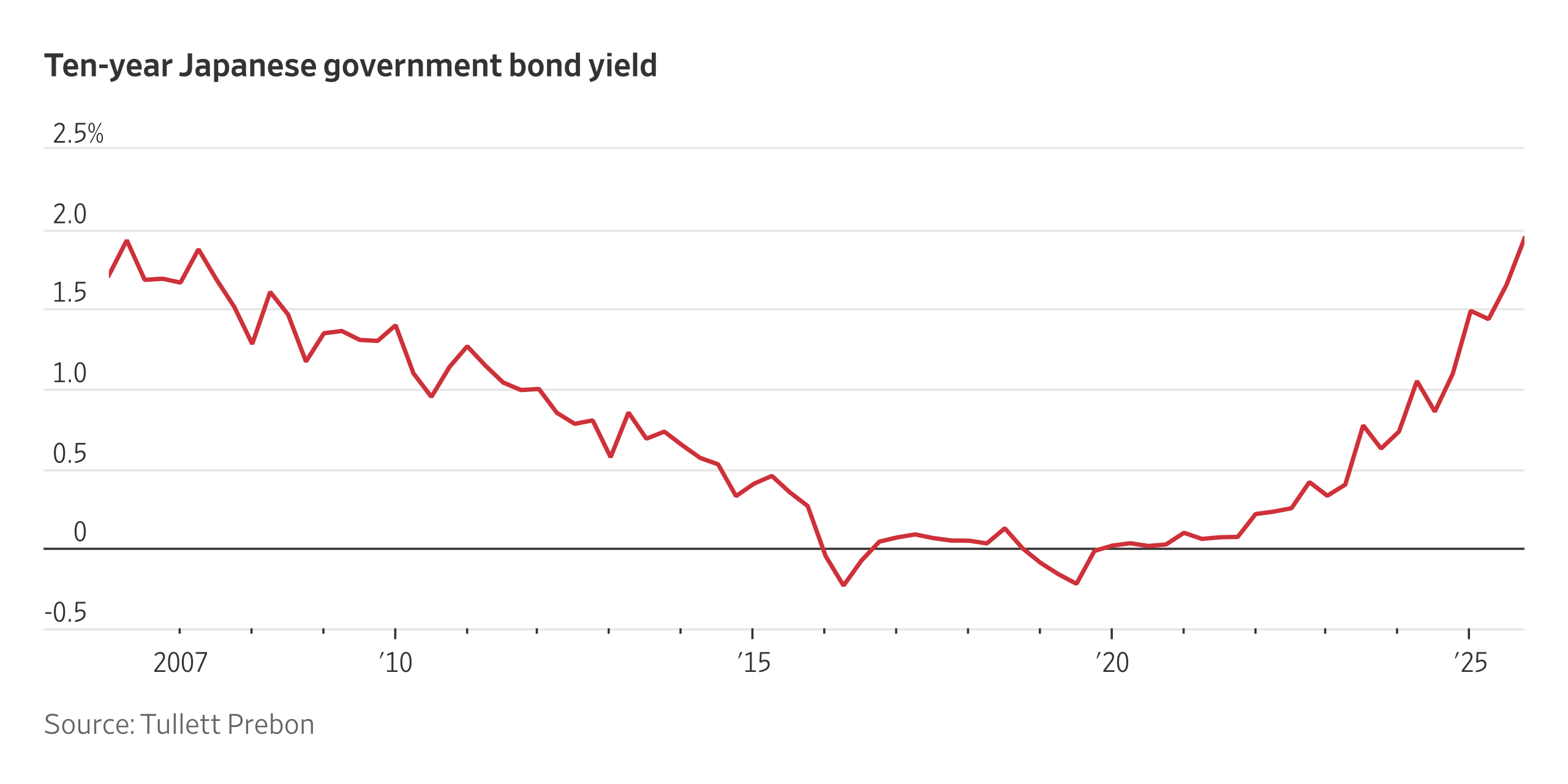

Bond Yields in Japan Hit Highest Since 2007

Another day, another milestone for Japan’s bond markets, where borrowing costs keep marching higher. It comes just a few days after rising Japanese yields rumbled through global markets.

The 10-year government-bond yield settled at 1.941%, the highest since July 2007. Yields rise as prices fall.

Yields for bonds of other maturities also mostly rose.

A notable exception: the long end of the yield curve. Thirty-year rates, which have hit records this week, retreated after a well-recieved auction of new bonds.

Some worry that rising Japanese bond yields will draw cash away from U.S. investments, pushing up American borrowing costs. Early Thursday, U.S. Treasury yields rose modestly.

Bank of Japan Gov. Kazuo Ueda has indicated a December rate increase is a live possibility. On Thursday he said there was “some uncertainty” about the so-called neutral rate of interest, implying the bank isn’t sure how many more hikes might be required.