Business

Breaking Career Plateaus for Senior London Professionals Kasia Siwosz

A career plateau at senior level rarely reflects declining capability. More often, it signals a mismatch between role complexity and how contribution is perceived.

The work associated with life coaches in London increasingly intersects with structured career progression for experienced professionals facing this challenge.

In London’s competitive environments, sustained performance alone is insufficient for advancement. Senior professionals must translate output into organisational leverage. Career coaching addresses this conversion problem directly.

Why Senior Professionals Hit a Career Plateau

At senior levels, career plateaus are rarely caused by a lack of capability. More often, progress stalls because perception, leverage, and visibility no longer scale with responsibility. What appears to be a personal limitation is usually a structural misalignment between contribution and recognition.

Capability problem vs perception and leverage problem

| Situation | What it looks like | What it usually means | What changes it |

| Stalled promotion | Strong delivery with repeated deferrals | Value is recognised but not positioned as enterprise-level impact | Reframe work in outcomes, risk, and organisational leverage |

| Constant firefighting | Always busy, little strategic airtime | Leader is seen as an operator, not a shaper | Redesign role boundaries; protect decision-making capacity |

| “Reliable but not visible” | Trusted internally, overlooked externally | Contribution lacks narrative ownership | Increase selective visibility; control the performance story |

| Unclear authority | Decisions questioned or revisited | Authority signals are weak or inconsistent | Clarify decision rights; strengthen declarative communication |

| Stakeholder resistance | Progress blocked despite logical arguments | Influence mechanisms do not match stakeholder incentives | Map power dynamics; adjust engagement strategy |

This framing shifts the plateau from a personal failing to a solvable leadership design problem. It also makes clear why executive presence and leverage, not additional effort, are usually the limiting factors.

More responsibility with less clarity

As roles expand, responsibility often increases faster than decision authority. Senior professionals inherit ambiguity without clear prioritisation logic. This erodes effectiveness despite continued effort.

The result is operational overload rather than strategic contribution. A career plateau emerges even while performance remains high.

Performance without visibility or sponsorship

Many senior professionals deliver results without controlling the narrative around those results. Without sponsorship, impact remains localised and advancement stalls. Visibility gaps are structural, not personal.

This is especially common in matrixed organisations. Influence without authority becomes a limiting factor.

What Career Progression Requires at Senior Level

Strategic scope and stakeholder influence

Career progression at senior level depends on visible ownership of strategic scope, not just functional execution. Influence must extend across boundaries, where stakeholder management becomes a core leadership capability. This shift separates reliable operators from promotable leaders; execution alone no longer differentiates.

A practical sequence:

- Identify decision-makers and blockers: Map who formally decides and who can delay or dilute outcomes. Do not assume authority follows the org chart.

- Define what each stakeholder values: Clarify incentives, risks, and success metrics from their perspective. Influence begins with relevance.

- Align deliverables to stakeholder outcomes: Translate your work into what advances their priorities. Strategic scope is recognised when others see their interests reflected.

- Create visibility moments: Choose forums, updates, or decision points where contribution is observed, not inferred. Visibility must be intentional.

- Confirm sponsorship signals: Secure explicit backing before escalation or exposure. Sponsorship converts influence into institutional support.

This sequence provides a compact operating model for expanding scope and influence without increasing effort or complexity.

Executive communication and decision ownership

Senior progression depends on how decisions are framed, defended, and carried under scrutiny. Executive communication must signal judgement rather than compliance, especially in moments of escalation. Authority is communicated behaviourally through boundary setting, pacing, and ownership of risk.

Executive framing that signals judgement:

| Weak framing | Strong framing |

| “Here are all the details.” | “Here is the decision, the rationale, the key risk, and the next step.” |

| “I’m waiting for alignment before moving.” | “I will proceed unless there are material objections.” |

| “We explored a few options.” | “We evaluated two viable options and selected one.” |

| “I need further guidance on this.” | “I recommend this course of action based on current constraints.” |

| “This is outside my remit.” | “This decision sits here; escalation is required only if X occurs.” |

| “I’ll follow up if needed.” | “I will return with an update by Friday.” |

This contrast illustrates how framing converts expertise into perceived authority. Strong framing compresses complexity into judgement and makes decision ownership explicit.

A Career Progression Framework That Creates Momentum

Audit of role, strengths, and gaps

Progression begins with a structured audit of role expectations and actual contribution. Strengths are mapped against future requirements, not past success. Gaps are defined operationally.

This prevents unfocused development activity. Precision matters at senior level.

Priorities for the next 90 days

Momentum requires short execution horizons. A ninety-day window forces prioritisation of actions that shift perception and leverage. Only high-impact initiatives are selected.

This cadence supports decision velocity. Progress becomes observable.

Weekly execution and accountability

Weekly accountability ensures that strategic intent converts into action. Each review examines decisions taken, influence exercised, and trade-offs made. Behaviour is the unit of progress.

This structure supports work life balance for leaders. Effort becomes directional.

How Career Coaching London Supports Breakthroughs

Repositioning without job-hopping focus

Career coaching London engagements often redirect focus from external moves to internal repositioning. Advancement is achieved by altering contribution patterns, not titles. Job-hopping is treated as a last resort.

This approach preserves institutional capital. It aligns with senior-level reality.

Building a measurable leadership narrative

Senior professionals require a coherent leadership narrative grounded in evidence. Coaching helps articulate this narrative through outcomes, not adjectives. Promotion readiness depends on this clarity.

Narratives are tested against stakeholder feedback. Adjustments are data-led.

How Kasia Siwosz Works With Senior London Professionals

One to one approach and confidentiality

All engagements are conducted through a confidential one to one model. This allows sensitive dynamics involving boards, founders, and senior peers to be addressed directly. Relevance is preserved.

Selective engagement protects outcome quality. Trust is foundational.

Progress tracking and review points

Progress is reviewed against predefined indicators tied to career progression. These include executive presence, delegation framework adoption, and improved time management for executives. Review points are scheduled and objective.

This evidence-led approach distinguishes structured coaching from advisory conversations. Measurement governs direction.

- Proven Performance Background

- Cross-Sector Expertise

- Results-Oriented 1:1 Format

- Tailored for High Performers

- Central London Focus

- Evidence-Led Approach

- Confidential and Selective Engagements

- Trusted by Executives and Founders

- Clarity, Cadence, and Confidence Framework

- No-Fluff, Practical Coaching Philosophy

These criteria define effective career coaching for senior professionals. They are particularly relevant when evaluating a life coach London, executive coach London, founder coach London, career coach London, performance coach London, confidence coach London, or burnout coach London offering.

Summary and Next Step

A career plateau at senior level reflects structural misalignment, not personal failure. When addressed through a clear career progression framework, momentum can be restored without disruption.

Senior professionals seeking career progression, improved executive presence, or readiness for increased scope should engage with Kasia Siwosz to discuss career coaching London aligned with their role demands and long-term objectives.

Business

President Trump says oil price surge ‘small price to pay’ for peace

A ‘Barron’s Roundtable’ panel analyzes the Iran conflict, its impact on crude prices and shipping through the Strait of Hormuz.

As gas prices surge while the U.S. wages war against Iran, President Donald Trump suggested in a Sunday Truth Social post that the short-term rise is a “small price” for peace.

“Short term oil prices, which will drop rapidly when the destruction of the Iran nuclear threat is over, is a very small price to pay for U.S.A., and World, Safety and Peace. ONLY FOOLS WOULD THINK DIFFERENTLY!” the president declared in the post.

Americans have been facing rising gas prices at home as the U.S. attacks the Islamic nation..

CRUDE OIL PRICES EXCEED $100 A BARREL AS WAR IN IRAN DISRUPTS PRODUCTION, SHIPPING

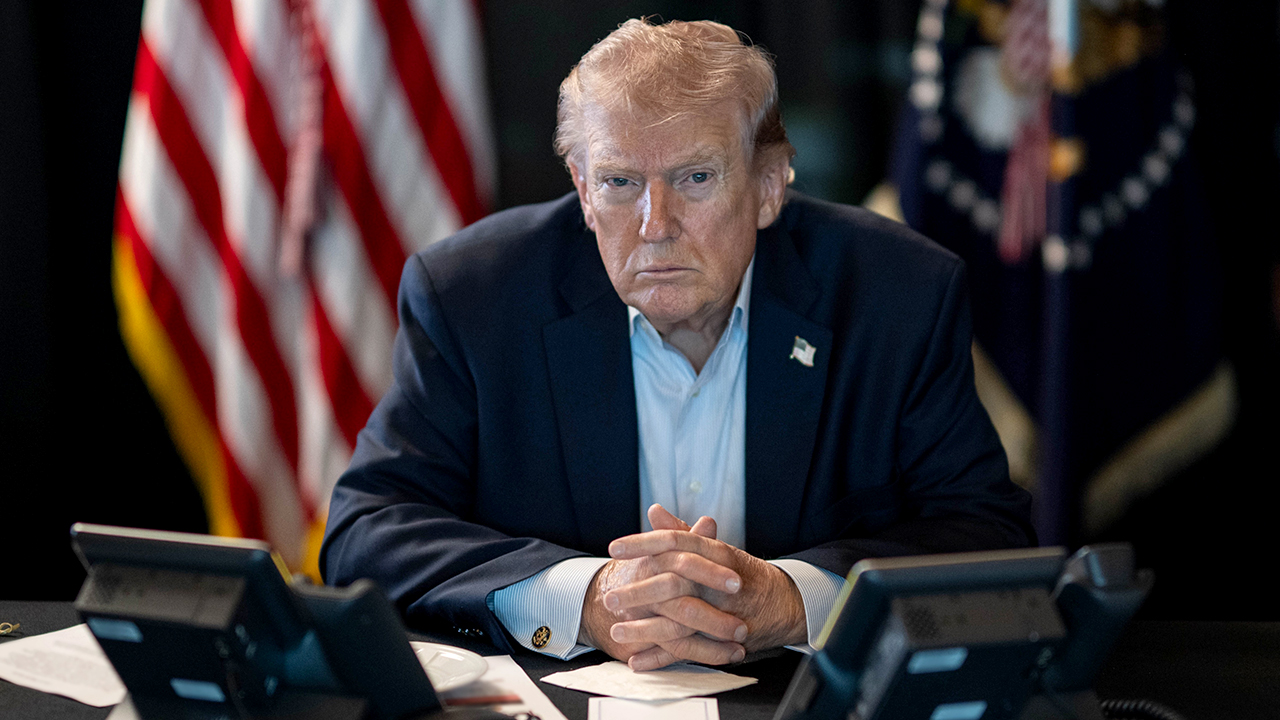

President Donald Trump monitors military operations during Operation Epic Fury against Iran on March 2, 2026. (The White House via X Account/Anadolu via Getty Images)

The AAA national average price for a gallon of regular gas is $3.478 as of Monday, significantly higher than average one week ago of $2.997.

Rep. Thomas Massie, R-Ky., highlighted rising fuel prices amid the war in a Sunday post on X, and said that “waging war costs American taxpayers about $1 billion per day,” asserting, “This isn’t America First.”

Rep. Thomas Massie questions Attorney General Pam Bondi during a House Judiciary Committee hearing in Washington, D.C., on Feb. 11, 2026. (Nathan Posner/Anadolu via Getty Images)

Trump, an outspoken critic of Massie, is backing challenger Ed Gallrein in the Republican primary in Massie’s congressional district.

Senate Minority Leader Chuck Schumer, D-N.Y., has called for the president to tap the Strategic Petroleum Reserve to help tackle the price surge.

TRAVEL IS ABOUT TO GET MORE EXPENSIVE AS IRAN CONFLICT SPARKS JET FUEL CRUNCH

Senate Minority Leader Charles Schumer speaks to the media at the U.S. Capitol on March 3, 2026. (Anna Moneymaker/Getty Images)

TRAVEL IS ABOUT TO GET MORE EXPENSIVE AS IRAN CONFLICT SPARKS JET FUEL CRUNCH

“The Strategic Petroleum Reserve exists for moments exactly like this,” Schumer said in a statement. “When wars and global crises disrupt energy markets, the United States has the ability to act, but President Trump and his administration are refusing to do so. Trump should release oil from the SPR now to stabilize markets, bring prices down, and stop the price shock that American families are already feeling thanks to his reckless war.”

Business

Form 6K Zeta Network Group For: 9 March

Form 6K Zeta Network Group For: 9 March

Business

Levi Strauss & Co. (LEVI) Presents at Citi’s 2026 Global Consumer & Retail Conference 2026 Transcript

Unknown Attendee

All right. Welcome to the Global Consumer and Retail Conference. Please welcome Levi Strauss and Paul, over to you.

Paul Lejuez

Citigroup Inc., Research Division

Thank you. It’s Paul Lejuez, Citigroup. Thanks, everybody, for joining. And with me, CFO of Levi, Harmit Singh. I really appreciate you being here. I know that you might want to start with just some quick opening remarks, just to make sure we get that out of the way, and then I’ll dive into some questions.

Harmit Singh

Executive VP & Chief Financial & Growth Officer

Paul, thanks for having us. Yes, my opening remarks were largely — given the fact that we are in a quiet period, we’re closing our first quarter of ’26. I’m not going to get into current trends, latest financial outlook. In my remarks, I’m essentially going to reflect what we talked about in Q4 ’25 in the results late in January, we will be reporting results early April.

But overall, we had a very strong year in ’25. We’re entering ’26 with momentum. Our guidance reflects it. The company is transforming into more of a denim lifestyle company. And I’d say our past was denim bottoms. Our future is more denim lifestyle. I’m happy to talk about the new, what I call a very different addressable market going forward. Overall strategies are working.

Our strategy is all about first, being brand-led, Super Bowl was a good example of brand demonstrated the strength and momentum being DTC first. Our DTC margins are growing, our DTC business is

Business

Oil prices surge as G7 nations weigh reserve releases to ease gas price spike

A ‘Barron’s Roundtable’ panel analyzes the Iran conflict, its impact on crude prices and shipping through the Strait of Hormuz.

The ongoing conflict in the Middle East has sent oil prices soaring and has prompted G7 leaders to consider the potential release of emergency oil reserves to provide relief to consumers facing higher gasoline prices.

Gas prices have risen in response to the rapid increase in oil prices, with the national average price of gas rising from $3 a gallon last week to $3.48 a gallon on Monday, according to AAA data. Oil futures have surged over 48% in the last month after trading in the range of $60-70 a barrel during February to over $95 on Monday, when futures prices were briefly above $115 before declining.

French finance minister Roland Lescure on Monday told reporters after a meeting of G7 finance ministers that leaders “are not there yet” on deciding whether to conduct an emergency release, as there aren’t current supply problems in the U.S. or Europe.

“What we’ve agreed upon is to use any necessary tools if need be to stabilize the market, including the potential release of necessary stockpiles,” Lescure added.

AMID IRAN WAR, PRESIDENT TRUMP SUGGESTS SHORT-TERM OIL PRICE SPIKE IS ‘SMALL PRICE TO PAY’ FOR PEACE

Rising oil prices can prompt an increase in the gasoline prices paid by consumers. (Al Drago/Getty Images)

Western economies develop strategic oil reserves in response to the 1970s oil crisis, with stockpiles like the U.S. government’s Strategic Petroleum Reserve serving as a backstop to address disruptions in the energy market that would otherwise harm the economy or imperil national security.

Phil Flynn, senior market analyst at the Price Futures Group and FOX Business contributor, said that the “mere mention” of strategic releases was enough to pull oil prices down off of their highs, as such releases of reserves “would ease markets’ concerns of tightness of supply.”

“Historically, releases from the strategic reserve, especially in coordination with other countries, have always been successful in cooling down fear in the market place,” Flynn said. “The market has to be convinced that the transportation of that oil is going to be safe, because even if you release oil from the reserve, it’s still going to take time to get to its destination, such as the refineries.”

G7 FINANCE MINISTERS TO DISCUSS EMERGENCY OIL RESERVE RELEASE AMID PRICE SURGE: REPORT

The U.S. and its G7 partners are considering potential releases of emergency oil reserves to ease the market turmoil. (Reuters/Todd Korol)

Andy Lipow, president of Lipow Oil Associates, told FOX Business that he expects “countries in the G7 will be forced to release oil reserves to show their public that they are taking some action to mitigate the rapid rise in prices.”

He added that he anticipates the releases will occur within the next two weeks if the conflict hasn’t reached a resolution by that time.

“Whether or not the release will have an impact will depend on if the de facto blockade of the Strait of Hormuz continues to impact oil tanker loadings and if additional oil infrastructure is damaged.”

CRUDE OIL PRICES EXCEED $100 A BARREL AS WAR IN IRAN DISRUPTS PRODUCTION, SHIPPING

Oil tankers have faced the threat of attack from Iran in the Strait of Hormuz, causing a decline in shipping traffic. (Reuters/Hamad I Mohammed)

How much could reserve releases impact gas prices?

The Treasury Department in 2022 analyzed the impact of SPR releases carried out by the Biden-era Energy Department in response to oil disruptions caused by Russia’s invasion of Ukraine on gas prices.

The U.S. released 180 million barrels from the SPR over six months in 2022, while International Energy Administration partners released an additional 60 million barrels.

It found that the U.S. SPR releases alone lowered gas prices by a range of $0.13 to $0.31 per gallon, whereas the oil reserve releases done by the U.S. in tandem with IEA partners had a larger effect by reducing prices $0.17 to $0.42 per gallon.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The findings of Treasury’s analysis were similar to those from a 2017 study by Richard Newell and Brian Priest, who found that a U.S. only release would lower gas prices by $0.33 per gallon while releases by the U.S. and IEA partners would yield a larger reduction of $0.38 a gallon.

Reuters contributed to this report.

Business

Freightcar earnings missed by $0.01, revenue fell short of estimates

Freightcar earnings missed by $0.01, revenue fell short of estimates

Business

Discovery Limited (DCYHY) Q2 2026 Earnings Call Transcript

Adrian Gore

Founder, Group Chief Executive & Executive Director

Good morning. It’s really a wonderful pleasure and an honor for me, as always, to present Discovery’s interim results to 31 December 2025 this morning. I appreciate your time. We should spend, I guess, about an hour on the results. I’m joined by our Group CFO, Deon Viljoen, who is with me here. David Danilowitz, who is Head of our Investor Relations and Strategy, will anchor later the Q&A session and all of our key executives are online who will take questions. So once again, thanks from all of us for your time, and I hope we give you insight into what has been a very, very good period for our group.

So let me begin by just showing the numbers. I think they are hopefully self-evident. It has been an excellent, strong and robust period for our group. You can see normalized operating profit up 24%, normalized headline earnings up 27%, new business up 12%, and I’ll take you through obviously a lot of that through the presentation.

I thought, obviously, to provide some context, it’s almost axiomatic to say that we live in a complex and changing and volatile environment. But certainly, 2 dramatic forces are shaping virtually everything we do and to an extent, how things play out going forward will be determined by these 2 very substantial

Business

Bluesky CEO Jay Graber steps down, advisor Toni Schneider named interim chief

Bluesky CEO Jay Graber steps down, advisor Toni Schneider named interim chief

Business

The Tech and Design Behind Slots, Cards, and Live Events

Inside Social Casino Games: The Tech and Design Behind Slots, Cards, and Live Events

Social casino games look simple: spin, tap, win virtual coins, repeat. But the strongest titles are built like modern mobile games. Under the hood, they rely on live-service tooling, data pipelines, and carefully tuned virtual economies.

The sector’s growth is one reason the design conversation keeps widening beyond “gameplay.” As the audience expands, players pay more attention to how systems work: event pacing, fairness cues, security, and user controls.

What makes a game a “social casino game”?

Most products combine three layers:

1) Casino-style core games

Slots, roulette-style formats, poker variants, blackjack/table games, plus hybrids.

2) Free-to-play economy

Virtual currency, daily bonuses, and optional purchases.

3) Social + live systems

Events, tournaments, clubs, gifting, chat, and seasonal challenges.

The casino theme is the surface. The “live” layer is what drives repeat play.

The virtual economy: pacing is the product

A social casino economy must answer basic questions:

- How many coins does a player earn per session?

- How fast do they spend them?

- How do rewards scale with level?

- How do events change the pace?

That balancing is typically managed with analytics and experimentation. Teams run A/B tests, adjust event reward tables, and segment players (new vs. veteran, casual vs. competitive) to keep the experience stable. If the economy is confusing, or feels suddenly “tighter”, players notice fast.

RNG, balancing, and the perception of “fairness”

Players often ask whether outcomes are random. In social casino games, results are usually driven by RNG combined with balancing parameters. But perceived fairness depends on communication as much as math:

- Clear rules for bonuses and event scoring

- Consistent behavior over time

- Transparent progression (what it takes to unlock, level, or qualify)

Even a technically sound system can feel unfair if it’s opaque.

LiveOps: the operational layer most players never see

LiveOps (live operations) is what turns a static app into a weekly routine. In practice, it includes:

- Daily missions

- Weekend events

- Limited-time tournaments

- Season-style progression tracks

- Club competitions and cooperative milestones

This requires internal tooling: scheduling dashboards, event configuration, reward systems, and real-time monitoring. The better the tooling, the more varied, and stable, the event calendar becomes.

Personalization and segmentation

Most mature products personalize the experience:

- Segmentation by skill, spend, and engagement

- Offers tuned to behavior

- Recommendations for rooms and modes

- Dynamic pacing to reduce churn

This is where social casino gamesintersect with broader mobile technology: instrumentation, data reliability, and rapid experimentation.

UX is a fairness feature

UX isn’t just aesthetics. It affects whether a system feels understandable:

- Onboarding that explains coins and bonuses

- Clear navigation between rooms and events

- Progress indicators that match real outcomes

- Notifications that inform rather than overwhelm

- Accessible settings for privacy and account controls

If players can’t understand what happened, or why they lost momentum, trust erodes.

Security, integrity, and anti-cheat

As products scale, abuse attempts increase: bots, event manipulation, account takeovers, and payment fraud. Strong platforms invest in:

- Bot detection and anti-cheat

- Fraud monitoring

- Rate limiting and exploit prevention

- Secure authentication and recovery

- Moderation for chat and clubs

These systems rarely make headlines. But they decide whether competition and community remain credible.

Social Casino Games in the U.S.: What Comes Next

In the United States, social casino games are increasingly shaped by the same forces driving mainstream mobile entertainment: live events, personalization, and fast iteration based on player behavior. As the category expands, the most successful experiences are likely to be those that pair engaging game loops with clearer transparency, stronger account protections, and more accessible user controls.

For players, that shift should translate into products that feel easier to understand, safer to navigate, and more sustainably enjoyable over time, while still delivering the quick, familiar fun that made the genre popular in the first place.

Disclosure: Social casino games are typically free-to-play and use virtual currency; they do not offer real-money gambling or cash winnings. This content is for informational purposes only, always review a platform’s terms, privacy policy, and responsible play options before participating.

Business

Reeves to look at how to help households with heating oil bills

The chancellor said a meeting on Wednesday will explore ways to help households.

Business

Analysis-Surging oil drives worries for US stock investors

Analysis-Surging oil drives worries for US stock investors

-

Politics7 days ago

Politics7 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

News Videos9 hours ago

News Videos9 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Crypto World6 hours ago

Crypto World6 hours agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech5 days ago

Tech5 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports2 days ago

Sports2 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

Business1 day ago

Business1 day agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Sports7 days ago

Sports7 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Tech7 hours ago

Tech7 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech5 days ago

Tech5 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Business2 hours ago

Business2 hours agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs