CryptoCurrency

5 hottest cryptos for millionaire status this Christmas

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

DOGEN, SOL, TRON, DOGE, and TURBO rank among hottest cryptos for millionaire status this Christmas.

With the festive season near, the chance for transformative crypto investments arises. As markets evolve rapidly, these five cryptos might set the path to millionaire status this Christmas, turning a modest investment into significant wealth.

DOGEN: The ultimate meme token

DOGEN is here to take the crown as the alpha of the meme coin world. Built for the boldest holders, DOGEN seeks to dominate with no drama — just an unstoppable march toward new all-time highs.

Powered by Solana, DOGEN is primed for a great surge, with a 700% gain projected in the coming months. This beast is set to provide significant returns for those who join its ranks early.

For the true believers, DOGEN’s airdrop and referral program are as rewarding as they come. The investors will earn 20% golden points from their recruits’ token buys and stack up profits with a multi-level referral system that keeps on giving — 7% for the direct referrals and even more as their network grows.

As altseason approaches, DOGEN holders are set to lead the charge, claiming the perks and profits that come with being part of a winning community. Whether it’s exclusive campaigns, luxury rewards, or a lifestyle that screams success, DOGEN is for those who aim for the top and settle for nothing less.

Interested investors can flex hard and potentially earn big through the DOGEN presale.

SOL: Fueling scalable dApps

Solana is a blockchain platform focused on scalability, offering a foundation for decentralized applications (dApps). It differentiates itself with architectural choices aimed at faster transactions and flexible development options across multiple programming languages.

SOL, Solana’s native cryptocurrency, plays a central role in its ecosystem by facilitating transactions, running custom programs, and rewarding network participants. The coin underpins the operation of Solana’s high-capacity network, which avoids sharding or second-layer solutions for scalability. This design aims to attract developers and investors interested in hosting high-activity products and services.

In the current market cycle, Solana’s technology and the utility of SOL may appeal to those looking for scalable blockchain solutions.

TRON: Empowering content creators

TRON is a decentralized blockchain-based operating system launched by the Tron Foundation in 2017. It was created to give content creators full ownership rights, allowing them to receive direct rewards from consumers without intermediaries like YouTube or Facebook.

TRON supports smart contracts, various blockchain systems, and dApps. It uses a transaction model similar to Bitcoin, where transactions are recorded on a public ledger. The platform aims to build a decentralized Internet, serving as a tool for developers to create dApps and share content openly without transaction fees.

In the current market cycle, TRON’s focus on decentralization and empowering creators highlights its potential in the blockchain industry.

Dogecoin: Meme coin turned top crypto

Dogecoin was launched in 2013 as a fun alternative to other cryptocurrencies, featuring a Shiba Inu dog logo. Unlike Bitcoin, Dogecoin has no maximum supply, with 10,000 new coins mined every minute.

In 2021, DOGE reached the top ten cryptocurrencies by market cap. This rise was driven by social media buzz and support from figures like Elon Musk. Dogecoin showcases the power of community and social media in financial markets.

In the current market cycle, Dogecoin remains a notable player due to its popularity and continued interest from investors.

Turbo: The first AI meme coin

Turbo is the first meme coin developed entirely by artificial intelligence. Conceived when its founder challenged GPT-4 to create the next big meme coin, TURBO represents a fusion of AI innovation and cryptocurrency culture.

As a coin made by AI for the people, it symbolizes a new era where technology drives creative financial instruments. The potential of Turbo lies in its unique origin and the growing interest in AI applications within blockchain technologies.

In the current market cycle, TURBO stands out as a novel concept that captures the imagination of both crypto enthusiasts and AI supporters.

Conclusion

Although SOL, TRX, DOGE, and TURBO show promise, they may offer less short-term potential. DOGEN stands out for those seeking luxury and success. Expected to grow 700% by the end of the presale, with potential for thousand-fold returns, DOGEN follows the path of successful tokens like BONK and Popcat, building a community of market leaders and offering benefits to early adopters.

For more information on DOGEN, visit their website, Twitter, or Telegram.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Semler Scientific to raise $75M to fund Bitcoin buys as paper gains near $30M

Semler Scientific is planning to raise $75 million through a private offering of convertible senior notes, which will help fund further Bitcoin purchases.

CryptoCurrency

Bitcoin ETFs face slowdown as Trump’s crypto executive order falls short on BTC-specific strategic reserve

Inflows into spot Bitcoin ETFs in the U.S. remained sluggish on Jan. 23 as President Donald Trump’s efforts to form a working group on digital assets under an executive order failed to meet market expectations.

According to data from SoSoValue, the 12 spot Bitcoin ETFs recorded $188.65 million in net inflows on Thursday, marking their fourth consecutive day of declining inflows since the beginning of the week, when they recorded over $1 billion in inflows.

BlackRock’s IBIT attracted the lion’s share of inflows, totaling $154.6 million, leading Bitcoin ETFs in inflows for the fifth consecutive day while Bitwise’s BITB followed with inflows of $42.15 million.

More modest inflows that contributed to the positive momentum came from Invesco Galaxy’s BTCO, Grayscale’s mini Bitcoin Trust, Fidelity’s FBTC and ARK 21Shares’ ARKB which logged inflows of $12.38 million, $11.9 million, $9.16 million and $8.35 million respectively.

Grayscale’s GBTC, which stood out as the only outlier on the day, recorded $49.94 million in outflows, offsetting some of the inflows from the other ETFs. The remaining five BTC ETFs saw zero inflows.

The total daily trading volume for Bitcoin investment vehicles reached $9.59 billion on Jan. 23, marking the second-highest level ever recorded, just behind the $10.39 billion peak seen on March 5.

Notably, the dip in inflows to Bitcoin ETFs coincided with a shift in Bitcoin’s price momentum after President Donald Trump signed an executive order on Thursday that is aimed at establishing a working group focused on digital assets that fell short of expectations.

While the order set out to advise the White House on digital asset policy and evaluate the creation of a government-held digital asset stockpile—comprising cryptocurrencies seized during investigations—it stopped short of establishing a dedicated strategic Bitcoin reserve, a move many crypto advocates had been hoping for.

Initially, Bitcoin responded positively to the announcement, climbing as much as 2.7% to reach $106,732. However, after the full details of the executive order were released, sentiment shifted, and the largest cryptocurrency by market value dropped nearly 4%, hitting $102,517. Since then, Bitcoin (BTC) has shown signs of recovery, gaining 2.1% to trade at $104,991 per coin.

CryptoCurrency

US Bitcoin Reserve ‘Pretty Much Confirmed’

Sen. Cynthia Lummis (R-WY) chairs the US Senate panel on crypto assets. She has promised some big changes in government policy for the sector.

A Bitcoin sovereign wealth fund Republicans are calling a “strategic national reserve” is only one of Lummis’ promises for blockchain. But markets are thrilling with bullish activity on that prospect alone.

Over the weekend, Bitcoin whales were insatiable in their accumulation.

After Republicans retook control of Congress following November’s election, the US Senate Banking Committee opened its first subcommittee panel on cryptocurrencies Thursday.

Binance Founder: Strategic Bitcoin Reserve Alert!

US Strategic Bitcoin Reserve, pretty much confirmed.

Crypto moving at crypto speed again. https://t.co/8qWlt65ARE

— CZ BNB (@cz_binance) January 23, 2025

The idea of a national Bitcoin reserve is so popular at the moment among US policymakers that several states are considering establishing state reserves.

Congress Convenes First Subcommittee on Crypto

The Senate Banking digital asset subcommittee will:

✔️ Pass legislation promoting responsible innovation and consumer protection

✔️ Eradicate Operation Chokepoint 2.0

✔️ Make America the bitcoin and digital asset capital of the world— Senator Cynthia Lummis (@SenLummis) January 23, 2025

The new Senate subcommittee on digital assets has a host of issues to tackle with normalizing US government policy over blockchain. In an X post on Thursday afternoon, Sen. Lummis promised a three-point crypto agenda in 2025:

- Pass legislation promoting responsible innovation and consumer protection

- Eradicate Operation Chokepoint 2.0

- Make America the bitcoin and digital asset capital of the world

Popular crypto markets analyst Crypto Beast replied, “we’re going much higher.” The strategic Bitcoin reserve has backing from President Trump, according to recent reports and the fact that he signed the documents.

In addition, it has a strong group of pro-crypto delegates to Congress in the new subcommittee. That includes Sen. Ruben Gallego (D-AZ), who received strong backing from the pro-crypto Fairshake PAC.

Plus, there’s Sen. Bernie Moreno (R-OH), a freshman senator who prevailed in the ballot count over the Banking Committee’s previous chair, Sen. Sherrod Brown (D-OH).

Bitcoin’s price had a somewhat unexpected reaction to the aforementioned news. The asset started to lose value after the document’s signing and dropped to $102,400 before it recovered some ground to nearly $105,000 now.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

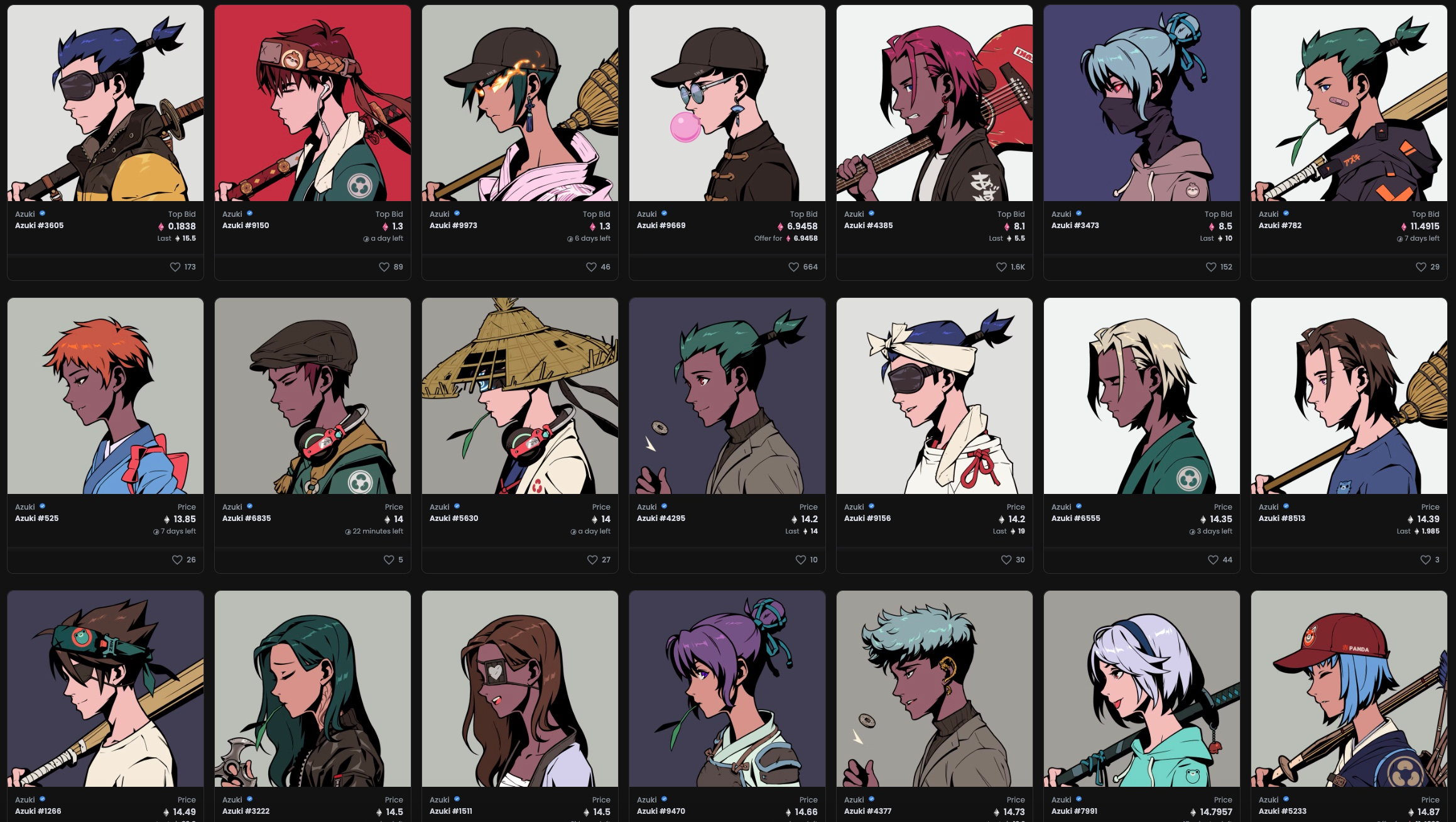

Azuki Airdrops Animecoin, Debuts at $1.2B FDV

Animecoin, the governance token tied to non-fungible token (NFT) project Azuki, has debuted at a fully diluted value (FDV) of $1.2 billion with tokens trading at $0.12 on HyperLiquid.

The total supply of the token is set at 10 billion, and holders of the Azuki NFT can claim the airdrop.

Users reported that the official airdrop claims website suffered downtime moments after it went live.

CryptoCurrency

This Under $0.25 Crypto May Crush Shiba Inu and Pepe Coin in 2025

The rapidly changing crypto market has a new under-$0.25 token gaining attention as a potential disruptor, set to surpass Shiba Inu and Pepe coin by 2025. Lightchain AI, now in its presale stage at $0.005625 per token, has already secured $12.7 million in funding, reflecting strong support from investors.

By merging blockchain technology with artificial intelligence, Lightchain AI introduces innovative solutions that move beyond the speculative nature of meme coins. With its forward-thinking strategy and advanced capabilities, it’s positioned for significant growth in the years ahead.

Why Shiba Inu and Pepe Coin Could Face Challenges in 2025

In 2025, Shiba Inu (SHIB) and Pepe Coin (PEPE) may encounter several challenges impacting their growth. A significant concern is their vast token supplies, which can hinder substantial price appreciation. Despite community-driven token burn initiatives, reducing the circulating supply to a level that meaningfully affects price remains a formidable task.

Additionally, the meme coin market is becoming increasingly saturated, intensifying competition and making it difficult for individual tokens to maintain investor interest. The speculative nature of these coins, often lacking intrinsic utility, subjects them to heightened volatility and susceptibility to market sentiment shifts.

Moreover, the evolving regulatory landscape poses potential risks, as increased scrutiny could lead to restrictions or decreased investor confidence in meme-based cryptocurrencies. These factors collectively suggest that SHIB and PEPE may face significant hurdles in sustaining their growth trajectories in 2025.

How Lightchain AI Plans to Stand Out

Lightchain AI stands out by combining innovative technology with a sustainable ecosystem supported by thoughtful tokenomics and advanced solutions. Its total token supply of 10 billion LCAI is strategically allocated; 40% for presale, 28.5% for staking rewards to incentivize network participation, 15% for liquidity to ensure smooth transactions, and the remainder for marketing, treasury, and team incentives. This distribution ensures ecosystem growth while rewarding both early adopters and long-term contributors.

The platform’s low-latency architecture enhances performance, enabling real-time execution of tasks, even during high network demand. To address risks like scalability and resource constraints, Lightchain AI employs mitigation strategies, including sharding for parallel processing and dynamic resource allocation. These robust features position Lightchain AI as a leader in blockchain innovation.

Rise of Lightchain AI in 2025

Lightchain AI is poised to dominate 2025 with its groundbreaking approach to blockchain and AI integration. By combining innovative tokenomics and advanced technology, Lightchain AI offers unique solutions that set it apart from traditional cryptocurrencies.

Its focus on scalability, security, and real-world applications positions it as a leader in the evolving crypto landscape. With growing investor interest and strong presale momentum, Lightchain AI is set to redefine the future of blockchain innovation.

Its potential for widespread adoption and practical use cases make it a strong contender to surpass meme coins like SHIB and PEPE in the coming years. As more industries embrace blockchain technology, Lightchain AI is well-positioned to capitalize on this growing market and solidify its place as a top crypto player. Invest in Lightchain AI today and be part of the next generation of blockchain revolution.

https://lightchain.ai/lightchain-whitepaper.pdf

https://t.me/LightchainProtocol

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Ether set for ‘potential tactical breakout’ after SEC kills SAB 121

A crypto analyst says ETH is signaling a potential “low-risk, high-reward opportunity” after the Securities and Exchange Commission killed a controversial accounting rule.

CryptoCurrency

SEC scraps SAB 121, making crypto custody easier

The Securities and Exchange Commission (SEC) has repealed a controversial rule requiring financial firms holding cryptocurrency for customers to report those assets as liabilities on their balance sheets.

In a bulletin issued on Jan. 23, the SEC announced that Staff Accounting Bulletin (SAB) 122 officially rescinds SAB 121, a policy introduced in March 2022 that faced significant pushback from the crypto industry.

SAB 121 had drawn criticism for its cumbersome reporting requirements, with industry leaders arguing it made custody of digital assets unnecessarily complicated.

The rule’s removal was met with relief, as highlighted by SEC Commissioner Hester Peirce’s celebratory Jan. 23 post on X: “Bye, bye SAB 121! It’s not been fun.”

Last year, Congress also enacted a joint expression opposing SAB 121, but then-President Joe Biden vetoed it.

Now, as the ‘pro-crypto’ Republican government has set foot, many disobliging rules within the crypto industry are starting to be revoked. A day after Donald Trump signed into his second term as President, he appointed SEC Commissioner Mark Uyeda as interim SEC chair. Uyeda commented last October on how SEC’s take under Gary Gensler was nothing short of a disaster.

Interestingly, Cornerstone Research reported on Jan. 23 that the SEC under Gary Gensler initiated just 33 actions involving cryptocurrencies in his final year as SEC chairman — down from 47 in the year prior, which saw the largest amount of enforcement activity. Last year, the SEC sued 90 bitcoin defendants or respondents, comprising 57 persons and 33 companies.

What SAB 121 repeal means for the crypto community?

SAB 121 revocation by the SEC will serve the common by enabling custodians for Bitcoin (BTC) through regulated banks and financial institutions. This shift could also improve security and trust, providing a more secure alternative for those new to self-custody or cryptocurrency wallets. It could also spur greater adoption, as users may find it easier to interface with crypto through trusted institutions.

Moreover, institutional custody also helps mitigate the risk of losing private keys and provides improved financial inclusion for people who are not able to create secure digital wallets. This revocation can instill confidence and even greater participation in the cryptocurrency ecosystem as regulatory clarity born from it continues.

While most within the crypto community have been celebrating this revokement, some critics are rather weary.

Jacob, the WhaleWire CEO, posted on X expressing and criticizing the response from the BTC community to the SEC’s recent revocation of SAB 121. He adds that the BTC community is homing in on the news that banks can now hold BTC, even though SAB 121 doesn’t actually mention BTC at all.

Satoshi Nakamoto stated at the time that the goal of the original BTC protocol was to eliminate the need for third-party control, says Jacob. According to him, this year, 2025, is when the BTC ecosystem feels just a bit counterintuitive since it wants banks to store their BTC. Ultimately, he claims BTC itself has succumbed to greed and delusion and forebodes ill for the community.

CryptoCurrency

How Will Crypto Markets React as $3B in Bitcoin Options Expire Today?

Around 30,000 Bitcoin options contracts will expire on Friday, Jan. 24, and they have a notional value of roughly $3.1 billion.

This week’s expiry event is slightly larger than last week’s, but it is unlikely to have any major impact on spot crypto markets, which have calmed following a volatile week.

Bitcoin Options Expiry

This week’s batch of Bitcoin options contracts has a put/call ratio of 0.48, which means that there are more than twice as many call (long) contracts expiring than puts (shorts). Open interest, or the value or number of BTC options contracts yet to expire, is highest at the $120,000 strike price, which has $2.4 billion in OI, according to Deribit.

There is also around $1.7 billion in OI at the $110,000 strike price, as derivatives traders remain bullish.

The anticipated announcements and crypto executive orders following US President Donald Trump’s inauguration on Monday did not materialize, causing cryptocurrency market indicators to stabilize, reported Deribit this week.

While Bitcoin options markets still show some unusual trading patterns, overall market excitement has subsided, it added.

In addition to today’s batch of Bitcoin options, around 168,000 Ethereum contracts are expiring as well. These have a notional value of $543 million and a put/call ratio of 0.47. This brings Friday’s combined crypto options expiry notional value to around $3.5 billion.

Crypto Market Outlook

Spot markets have remained relatively stable over the past 24 hours, with total capitalization at $3.7 trillion following a volatile week. The market cap is exactly where it was last week, so the Trump pump following the US president’s inauguration on Monday was very short-lived.

Bitcoin has dropped 4% from this week’s all-time high, which was almost revisited on Thursday. The asset was trading up 3% on the day at $105,000 at the time of writing, having held above six figures for most of this week.

Ethereum is up 5% on the day at $3,370, but it remains deflated following dissent and infighting at the Ethereum Foundation.

Altcoins remain mixed with minor gains and losses across the board during the Friday morning Asian trading session.

Nevertheless, market sentiment is strengthening as the first crypto-related executive order gets the approval signature from President Trump.

I told you this was the year for Bitcoin and digital assets.

— Senator Cynthia Lummis (@SenLummis) January 24, 2025

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Consolidation or Calm Before the Next Move?

Bitcoin price settled above the $100,500 resistance zone. BTC is consolidating gains and might aim for a fresh increase above the $105,000 zone.

- Bitcoin started a downside correction from the $106,800 zone.

- The price is trading below $104,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $102,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $102,000 support zone.

Bitcoin Price Eyes Fresh Increase

Bitcoin price started a decent upward move above the $104,500 zone. BTC was able to climb above the $105,500 and $106,000 levels.

The bulls even pushed the price above the $106,500 level. However, the bears were active near the $106,800 zone. A high was formed at $106,833 and the price is now correcting gains. There was a move below the $105,000 level.

There was a move below the 50% Fib retracement level of the upward move from the $101,281 swing low to the $106,833 high. Bitcoin price is now trading below $104,000 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $102,000 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $104,000 level. The first key resistance is near the $105,500 level. A clear move above the $105,500 resistance might send the price higher. The next key resistance could be $106,800.

A close above the $106,800 resistance might send the price further higher. In the stated case, the price could rise and test the $108,200 resistance level and a new all-time high. Any more gains might send the price toward the $110,000 level.

More Losses In BTC?

If Bitcoin fails to rise above the $104,500 resistance zone, it could start a downside correction. Immediate support on the downside is near the $102,500 level or the 76.4% Fib retracement level of the upward move from the $101,281 swing low to the $106,833 high. The first major support is near the $101,250 level.

The next support is now near the $100,500 zone. Any more losses might send the price toward the $88,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $102,500, followed by $101,250.

Major Resistance Levels – $104,500 and $105,500.

CryptoCurrency

Bitcoin (BTC) Price Steady Near $104K After Bank of Japan Delivers Hawkish Rate Hike

Bitcoin (BTC) held steady during Friday’s Asian hours after Bank of Japan (BOJ) lifted the benchmark borrowing cost to the highest in 17 years while raising inflation forecasts.

“If the outlook presented in the January Outlook Report will be realized, the Bank will accordingly continue to raise the policy interest rate and adjust the degree of monetary accommodation,” the policy statement said, citing positive outlook on wages and maintaining guidance to keep raising rates, according to ForexLive.

The anti-risk Japanese yen rose over 0.6% to 155.12 against the U.S. dollar following the rate decision. Still, risk assets remained resilient. Bitcoin showed no signs of stress, trading little changed on the day above $104,000. The futures tied to the S&P 500 also traded flat.

This resilience in risk assets suggests that market attention is increasingly centered on potential policy developments under Donald Trump’s presidency. In comparison, the Bank of Japan’s rate hike in late July had previously shaken risk assets, including cryptocurrencies.

On Thursday, President Trump signed an executive order to ban digital dollar and promote crypto and AI innovation in the U.S. Meanwhile, the U.S. data released recently showed “all tenant rent” index, which leads shelter inflation in the CPI, rose at a slower pace last quarter. That has raised hopes that the Fed will walk back on its hawkish December rate forecasts.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login