CryptoCurrency

A Game-Changer for Modern Financial Advising

In today’s issue, Alec Beckman from Advantage Blockchain explains stablecoins and their growing use cases for institutions and advisors.

Then, CK Zheng from ZX Squared Capital shares tips on preparing for tax season in Ask and Expert.

You’re reading Crypto for Advisors, CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to get it every Thursday.

Stablecoin Use Case for Advisors

One of the primary hurdles for blockchain adoption to date has been utility, especially when looking through the lens of financial advisors and how these public blockchains and decentralized finance (DeFi) protocols can impact their clients.

Stablecoins – digital currencies pegged to stable assets like the U.S. dollar – have emerged as a powerful tool for modernizing savings, payments, and settlement processes. These innovations present a significant opportunity for advisors to enhance the value they offer to clients while staying ahead of market trends.

How can advisors leverage stablecoins to streamline operations, reduce costs, and provide cutting-edge financial solutions? Here’s how stablecoins can become a transformative tool for your clients:

Savings account / going bankless

- Financial Inclusion: Stablecoins provide a way for clients to store value outside of traditional banking systems, granting access to financial services for the unbanked or underbanked. Anyone with an internet connection can use stablecoins.

- Stability: Unlike volatile cryptocurrencies, full-reserve, dollar-backed stablecoins maintain a consistent value (ex. USDC is tied to the value of $1).

- Liquidity & Accessibility: Funds in stablecoins are globally accessible 24/7, offering liquidity without dependence on conventional banking hours.

- Better Yield: Using on-chain finance, stablecoins can generate significantly more yield than a savings account (Ex. Coinbase offers slightly over 4% APY, beating traditional savings accounts).

- Self Custody: Many people, including myself, have been held up by a third-party custodian or bank. If someone can keep you from spending/sending money, it is not your money. The ability to self custody your own assets provides a more seamless way of transacting your own funds.

Payments

- Efficiency: Transactions using stablecoins are fast and cost-effective with no global restrictions, relevant for those sending payments domestically or cross-border.

- Value Retention: The stability of these digital assets ensures that the amount sent is equal to the amount received.

- Adoption by Institutions: Financial institutions are recognizing stablecoins as a complementary payment system, signaling growing mainstream acceptance.

- Adoption by Commerce: Stablecoins are less costly and more efficient than credit card payments for merchants.

Settlement

- Instantaneous Transactions: Settlements via stablecoins are near instantaneous, improving liquidity and reducing counterparty risks for clients managing high-value transactions.

- Lower Costs: By eliminating traditional clearing and settlement processes, stablecoins significantly reduce fees.

- Global Versatility: Whether your clients are trading internationally or managing investments across borders, stablecoins streamline and simplify the settlement process.

Real-world application: SpaceX’s strategic use of stablecoins

SpaceX uses stablecoins to manage foreign exchange (FX) risks from its global Starlink operations. SpaceX shields itself from FX volatility by collecting payments in various currencies and converting them into stablecoins. The stablecoins, pegged to the U.S. dollar, provide a stable intermediary before being converted back to dollars.

This approach offers several advantages:

- Reduced Currency Risk

- Enhanced Efficiency

- Liquidity Preservation

This strategy demonstrates how stablecoins can be a powerful tool for multinational corporations and can be applied to managing client portfolios.

Why This Matters to You and Your Clients For financial advisors, stablecoins can elevate portfolios and modernize financial strategies. These assets aren’t just a novelty – they’re a bridge to a more inclusive, efficient, and adaptable financial future. By integrating stablecoins into conversations about savings, payments, or settlements, you position yourself as a forward-thinking advisor prepared to navigate these changes.

– Alec Beckman, president, Advantage Blockchain

Ask an Expert

Q: What’s the 101 on stablecoins and liquidity?

The stablecoin market cap has reached a record $215 billion, predominantly concentrated in the two coins Tether and USDC, having a combined 85% of the market cap. The liquidity of the stablecoin market stays healthy as more stablecoin issuers such as Visa, Stripe, and PayPal enter this unique digital asset sub-class. Given the new Trump administration’s pro-crypto attitude, we expect more crypto-friendly rules and regulations for this asset in the coming months, which will support the further growth of the stablecoin market.

Q: Are stablecoins risky compared to traditional finance (TradFi)?

Stablecoins are typically designed to stay pegged to the U.S. dollar (though they don’t need to be). The functionality of stablecoins in the crypto market is comparable to money market funds in the traditional financial market. The money market funds have reached a $10 trillion market cap, which serves the purpose of short-term investment and a place to park money. Stablecoins will serve a similar purpose in the digital asset space. The quality and liquidity of the issuer’s holdings of fiat-denominated short-term assets are some of the critical risks associated with stablecoins, especially when the financial market is under great stress.

Q: Do country borders matter when it comes to stablecoins?

Country borders matter greatly as different countries may have different rules, regulations and license requirements for the stablecoin market. One of the key regulatory requirements associated with stablecoins is around the stability, liquidity, disclosure and transparency of the short-term assets the issuers hold for the underlying stablecoins.

– CK Zheng, co-founder & CIO, ZX Squared Capital

Keep Reading

CryptoCurrency

Circle launches Paymaster to allow users pay gas fees with USDC

Stablecoin issuer Circle has introduced a new feature called Circle Paymaster, enabling users to pay gas fees using the USDC stablecoin.

The USDC (USDC) issuer said in an announcement that the on-chain utility solution Circle Paymaster was now live on Arbitrum and Base, two leading Ethereum (ETH) layer-2 solutions.

With this product, users on the L2s can now use USDC rather than ETH when paying for transaction fees.

In the crypto market, blockchain users need transaction fees often paid via a chain’s native token. This gas fees requirement has typically meant users must hold tokens such as Ether and others on-chain, with transaction failures likely when one has no funds to cover gas fees.

Paymaster removes this challenge by allowing users to pay with USDC, removing the need for one to have the required native token. The feature is permissionless and composable, which means developers can work with any wallet compatible with the ERC-4337 token standard.

Circle’s launch of Paymaster adds to the company’s Gas Station offering.

While Paymaster users utilize their USDC to pay for gas fees, Gas Station allows developers to pay for gas costs for users. Developers who sign up for the Gas Station feature offer a gasless experience for users across their decentralized applications.

Gas Station works with Circle’s programmable wallets and requires developers to create a Circle Console account.

Circle will expand access to Paymaster beyond Arbitrum and Base in coming months, with additional networks including Ethereum, Solana and Polygon PoS.

Transaction charges across Paymaster will be 10% of gas fees per transaction. However, Circle is waiving this charge until June 30, 2025 to incentivize adoption.

CryptoCurrency

Whales Dominate TRUMP and MELANIA Meme Coin Ecosystems: Chainalysis

US President Donald Trump’s surprising launch of the Official Trump (TRUMP) meme coin fueled a frenzy as fans and day traders pushed billions of dollars in trading volume. A day later, First Lady Melania Trump joined the trend with her own meme coin, Official Melania (MELANIA), which added to the cryptocurrency craze.

But the result was damaging. Both the meme coins crashed soon. In fact, TRUMP and MELANIA coins were still down by over 50% and 80% since their peaks, respectively.

TRUMP, MELANIA On-Chain Activity

Recent findings from Chainalysis reveal a sharp contrast in the distribution and profitability of TRUMP and MELANIA token holders. While the majority of wallets containing TRUMP are retail buyers with small holdings, a select group of whales has seen significant gains. Approximately 50 wallets have realized profits of more than $10 million at the wallet level, which essentially depicted the outsized influence of these early or high-volume investors.

On-chain data from Chainalysis Reactor shows that after the minting of 1 billion TRUMP tokens, four wallets received the majority of the supply. This stash was either for direct holding or to provide liquidity on exchanges. Despite the concentrated distributions, the broader holder base largely consists of retail investors.

As of January 21, most wallets holding TRUMP or MELANIA contained less than $100 in tokens, which is indicative of widespread but modest retail interest. Over 80% of these investors hold under $1,000 in assets on the Solana blockchain, and half are new to Solana altcoins, creating wallets specifically to purchase TRUMP or MELANIA.

While retail participation is high, profits remain modest for most. Over 77% of wallets holding TRUMP have realized gains of less than $100. However, the dominance of whales continues, with 40 wallets holding over $10 million in TRUMP or MELANIA tokens, accounting for 94% of the total supply.

Increased Scrutiny

Despite the popularity of the two tokens, the move by the President and his wife has attracted significant criticism.

James Thurber, the founder and former director of the Center for Congressional and Presidential Studies, accused Trump of using his pro-cryptocurrency advocacy as a personal profit-making strategy. In a statement to the Guardian, Thurber said,

“There are shameful and major conflicts of interest with respect to his family business benefiting from his cryptocurrency policies. (Trump) does not seem to worry about the public interest with respect to cryptocurrency. He seems to be driven by profit and wanting to be a major part of the billionaire class in the US.”

Meanwhile, FinTAX’s comprehensive analysis observed that there are legal, tax, and political risks for the TRUMP meme coin. Key concerns include SEC regulatory scrutiny (using the Howey Test), tax compliance challenges with 80% token ownership, and potential political finance violations. Risks include possible security classification, tax complications from token unlocking, and potential disruption of political donation norms.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Will Solaxy Be the Next Presale to Explode While the Solana Bulls Are Winning?

Bitcoin, XRP, and Solana have held their support levels even when the global crypto market fell by 1.7%, now sitting at a market cap of $3.5T.

Bitcoin ETFs have seen four consecutive inflow days led by BlackRock. The investment giant has gobbled up $3.2B worth of BTC. CEO Larry Fink suggests that BTC can reach $700,000 if funds increase allocation to 5% from 2%.

This ETF influx stems from the hopes of Solana ETF getting approvals in 2025. Market data suggests a 97% probability of that happening, too. Solana has also seen a significant surge since 15th January. It currently stands at 34% gains from the lows of $181.88 on 14th Jan.

During this time, it reached a high of $295.83, gaining almost 60% in 5 days. The price has since stabilized at around $240.

XRP also saw a similar price boost as it rose from $2.3545 on January 1 to a high of $3.4 on 16th Jan – a gain of almost 62%. XRP’s price has also since been steady and is now trading at around $3.0886.

Ever since Trump won the presidential elections, the crypto market has seen quite a significant boom. Bitcoin reached an all-time high, crossing the $109,000 mark.

Trump’s pro-crypto approach and promises to bring in crypto-friendly legislation have kept the hopes of crypto enthusiasts high.

There are already early signs of that happening. For instance, Trump’s decision to pardon Ross Ulbricht is being viewed as good news for privacy-preserving technology advancement in the crypto field.

The launch of $TRUMP, the US president’s official meme coin, has also drawn the attention of investors. Soon after its launch last week, $TRUMP quickly shot up by over 12,000% overnight.

With the influx of various projects, the meme coin market looks bullish for the next year. If you’re looking to ride this upcoming bull run, we’ve got a project you can invest in – Solaxy ($SOLX).

What is Solaxy?

Solaxy ($SOLX) is Solana’s first Layer-2 solution that looks to solve the issues of failed transactions, congestion, and scalability bottlenecks in the Solana Layer-1 chains.

With time, Solana has become slow as the traffic has increased, leading to longer wait times. Solaxy looks to solve this through bundling transactions.

Another unique thing about $SOLX is that it’s a one-of-a-kind multi-chain solution that works on both Solana and Ethereum networks.

This way, $SOLX combines the best of both networks – Ethereum’s liquidity and Solana’s transaction speeds, easily making it one of the best meme coins.

Having already raised over $13M, the $SOLX presale is off to a flier; here’s a guide on how to buy $SOLX if you want to grab some for $0.001612 per token. The next price increase is set to take place within 2 days from now.

So, this is the lowest you may get $SOLX for — a coin that could potentially make you a crypto millionaire in 2025.

Why Can Solaxy Be the Next 100X Meme Coin?

For starters, Solaxy isn’t just another hype-based meme coin. It solves a very important issue faced by crypto investors.

By sharing the burden of Solana 1 layer, it batch processes transactions, leading to lower costs and quick turnaround time. This utility puts it in a unique position, making it one of the hottest meme coin presales in January.

Also, a new Bitwise report has predicted that the price of Solana ($SOL) can reach $6,636 by 2030 – a massive 3,000% increase. The same report states that Solana’s Layer 1 is far more efficient than the Layer 2 Ethereum chain.

Going by the indications, if Solana is able to draw a price prediction this huge, Solaxy soaring by 100x doesn’t look a far stretch.

With 30% of the token supply reserved for development and 10% for listing, the developers have shown signs of long-term commitment.

Solaxy’s official X page currently has 62.5K followers, which is in line with its aim of building a strong investor community. If you’re looking to take advantage of the crypto and meme coin bull run that’s to come, buy $SOLX now from its official website.

However, please note that investments in crypto assets are subject to market conditions. It’s important to do your own research and only consider the above as our well-calculated opinion (and not financial advice).

CryptoCurrency

Binance Labs Gets Major Overhaul With CZ Taking Active Role in Investments

Binance Labs, the former investment arm of exchange giant Binance, gets a major overhaul under a new name, YZi Labs, with former Binance CEO Changpeng “CZ” Zhao being closely involved in the operations, the firm announced on Thursday.

The rebrand means that the investment firm turns from being the exchange’s venture capital arm into the family office of CZ and Binance co-founder Yi He, Bloomberg reported.

“Under this rebranding, [CZ] will take a more active role in investment activities, directly engaging with founders and offering mentorship and coaching,” YZi Labs said in an X post. The firm also expands its investment focus beyond web3 to artificial intelligence and biotech.

Zhao co-founded and led Binance to become the world’s top crypto exchange by trading volume. Last April, Zhao was sentenced to four months in prison for violating the Bank Secrecy Act (BSA) by failing to set up an adequate know-your-customer (KYC) program at Binance. As part of his guilty plea, he agreed to pay a $50 million fine and step down as CEO of the crypto exchange. He was released in September.

Read more: Freed From Prison, Binance Founder CZ Gets Ovation in Dubai and Talks New Educational Venture

CryptoCurrency

Lightchain AI Is the Crypto Presale Everyone’s Talking About in 2025, Here’s Why Cardano Bulls Can’t Stop Buying

In 2025, Lightchain AI has become the crypto presale capturing everyone’s attention, including Cardano bulls eager to diversify their portfolios.

With its innovative fusion of artificial intelligence and blockchain technology, Lightchain AI is redefining what’s possible in the decentralized space. Currently in its presale phase at $0.005625 per token, it has already raised $12.7 million, reflecting robust investor confidence.

Offering advanced features and a sustainable growth model, Lightchain AI stands out as a game-changing opportunity, attracting both seasoned investors and those seeking long-term potential in the evolving crypto market.

Why Lightchain AI’s Presale is Center of Attention in 2025

In 2025, Lightchain AI’s presale has become a focal point in the cryptocurrency community, raising over $12.7 million with tokens priced at $0.005625. This significant achievement underscores strong investor confidence in its innovative approach to integrating artificial intelligence (AI) with blockchain technology. Central to its appeal is the Proof of Intelligence (PoI) consensus mechanism, which rewards nodes for executing AI computations, enhancing both network security and efficiency.

Additionally, the Artificial Intelligence Virtual Machine (AIVM) provides a dedicated environment for deploying AI applications, facilitating seamless integration within the blockchain ecosystem. The project’s clear roadmap, including a testnet launch in January 2025 and mainnet activation by March 2025, further solidifies its potential.

These factors collectively position Lightchain AI as a transformative force, attracting substantial attention during its presale phase.

Why Cardano Bulls are Flocking to Lightchain AI

Lightchain AI is drawing attention from Cardano bulls, offering a compelling investment opportunity through its innovative and forward-looking ecosystem. With its successful presale, priced at $0.005625 per token and raising $12.7 million, Lightchain AI showcases strong investor confidence. Its roadmap-driven development, from the testnet rollout to ecosystem expansion in 2025, ensures steady progress and scalability.

Unlike many platforms, Lightchain AI prioritizes seamless interoperability, enabling integration with other blockchains for broader utility. Its community-driven governance model promotes transparency and inclusivity, giving investors an active role in shaping the ecosystem.

By focusing on efficiency, privacy-preserving technologies, and robust performance metrics, Lightchain AI positions itself as a dynamic alternative for Cardano enthusiasts seeking innovation and long-term growth in the crypto market.

Invest Today in Lightchain AI for Massive Gain Potential

As the cryptocurrency market continues to evolve, Lightchain AI stands out as a promising investment opportunity. With its groundbreaking fusion of AI and blockchain technology, it offers unique features and potential for long-term growth. The success of its presale further cements Lightchain AI’s appeal, with significant attention from both seasoned investors and those seeking innovative projects in the crypto space.

With its clear roadmap and dedicated team, Lightchain AI is well-positioned for success in 2025 and beyond. Don’t miss out on this exciting opportunity – invest today in Lightchain AI for massive gain potential.

https://lightchain.ai/lightchain-whitepaper.pdf

https://t.me/LightchainProtocol

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Cardano Foundation research shows ‘fundamental shift’ in blockchain use

The majority of projects involved the authenticity vertical, establishing confirmed identity and legitimacy through secure verification.

CryptoCurrency

Trump backs US leadership in crypto at Davos, Lummis chairs new Senate crypto panel

President Donald Trump emphasized U.S. leadership in cryptocurrency and artificial intelligence as Senator Cynthia Lummis was sworn in as chair of the Senate’s new digital assets subcommittee.

During the 2025 World Economic Forum in Davos, President Donald Trump said in a virtual speech the United States would lead in artificial intelligence and cryptocurrency. In his address, Trump emphasized the need for the U.S. to dominate emerging technologies, including blockchain and crypto.

President Trump told the WEF that he wants America to be “the world capital of AI and crypto.”

He also urged lower interest rates and called for a $1 trillion Saudi investment to bolster economic cooperation, signaling his administration’s focus on innovation and global partnerships.

Lummis sworn in

Meanwhile, on Capitol Hill, Senator Cynthia Lummis was sworn in as the first chair of the Senate Banking Subcommittee on Digital Assets, a historic move reflecting the growing importance of cryptocurrencies in U.S. financial policy.

Lummis, a vocal advocate for Bitcoin (BTC) and blockchain technology, pledged to advance bipartisan legislation that establishes a comprehensive regulatory framework for digital assets.

In her statement, Lummis highlighted the potential for digital assets to secure America’s financial future, calling for a strategic Bitcoin reserve to strengthen the U.S. dollar.

The new subcommittee will focus on passing legislation promoting responsible crypto innovation while protecting consumers and ensuring regulatory agencies comply with the law.

The initiative aligns with Trump’s vision of positioning the U.S. at the forefront of digital asset adoption on the global stage.

CryptoCurrency

Meme Coin Momentum Fades After Trump Inauguration but Wall Street Pepe ICO Continues to Pump

The meme coin hype is cooling after Donald Trump’s inauguration celebrations.

Over the past 24 hours, big names like DOGE, PEPE, and SHIB have taken a nosedive.

But while most meme coins are selling off, one project continues to impress – Wall Street Pepe (WEPE).

Its ICO has passed $57 million in early contributions, setting the stage for a highly-anticipated exchange debut in just over three weeks.

Meme Coin Market Sees Major Correction as Trading Volumes Plummet

Nearly every major meme coin is in the red right now.

What started as minor profit-taking has snowballed into a broader sell-off, dragging the meme coin sector’s market cap back to $102 billion.

Meanwhile, trading volumes have dropped by more than 50% since yesterday.

Tokens that were rallying earlier in the week are now feeling the heat.

SHIB is down 2%, DOGE has dropped 4%, and TRUMP coin – last weekend’s breakout star – has plunged 14%.

But the biggest loser is AI16Z, down 25% in the past 24 hours.

The only real standout was PENGU – managing to post a small gain.

This kind of pattern is nothing new in the meme coin space, where sharp corrections often follow massive rallies.

Still, not everyone is spooked by the price action.

Well-known meme coin trader Murad called the sell-off an “opportunity of a lifetime” for those willing to stomach the volatility.

Crypto Market Sells Off While Bitcoin ETF Inflows Drop

The broader crypto market is also showing some cracks.

Bitcoin has slipped to $101,800, Ethereum is down to $3,200, and XRP has dropped to $3.

LINK took the biggest hit among the top altcoins, falling 6% since yesterday.

Things are clearly cooling off – and total spot trading volumes have slumped 16%, with open interest also dropping.

At the same time, demand for the spot Bitcoin ETFs is fading slightly.

Total inflows dropped 69% yesterday to $248 million, and BlackRock’s IBIT fund was the only one to see meaningful gains.

GBTC led the way in terms of outflows with $47 million.

Some analysts believe this is a “sell the news” moment, claiming Trump’s inauguration buzz was already priced into the market.

The optimism around this colossal event may have already run its course.

However, things change fast in crypto – so even though the market is red today, it could quickly flip green tomorrow.

Wall Street Pepe ICO Passes $57M Despite Market Downturn – Next Big Meme Coin Opportunity?

Wall Street Pepe’s ICO is defying all this bearishness.

The project has now raised over $57 million, and more than $1 million is coming in daily – even as the broader market sells off.

With the ICO running until February 16, Wall Street Pepe’s momentum does not show signs of stopping.

So, why all the hype?

For starters, the project has positioned itself as an aid for retail traders, targeting the dominance of crypto whales in the meme coin space.

That approach is hitting home, as evidenced by Wall Street Pepe’s Telegram channel reaching 17,300 subscribers.

The project’s Twitter following has also exploded recently.

Wall Street Pepe’s team will give WEPE holders access to market insights, trading tools, and real-time signals.

They’ll also host trading competitions where the winners receive WEPE prizes.

And if that wasn’t enough, there’s even a built-in staking app for WEPE, offering higher yields than most crypto staking coins.

Big-name YouTubers have praised the project’s setup.

For example, NASS CRYPTO released a video about Wall Street Pepe last month, which has been viewed over 86,000 times.

Given that he has more than one million YouTube subscribers, his endorsement has given the project a massive boost.

So, with 24 days left in its ICO, things are looking positive for Wall Street Pepe.

Despite the ongoing meme coin sell-off, WEPE seems to be holding up quite well.

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Dogecoin ETFs Will Skyrocket Price To $15, Forecasts Analyst

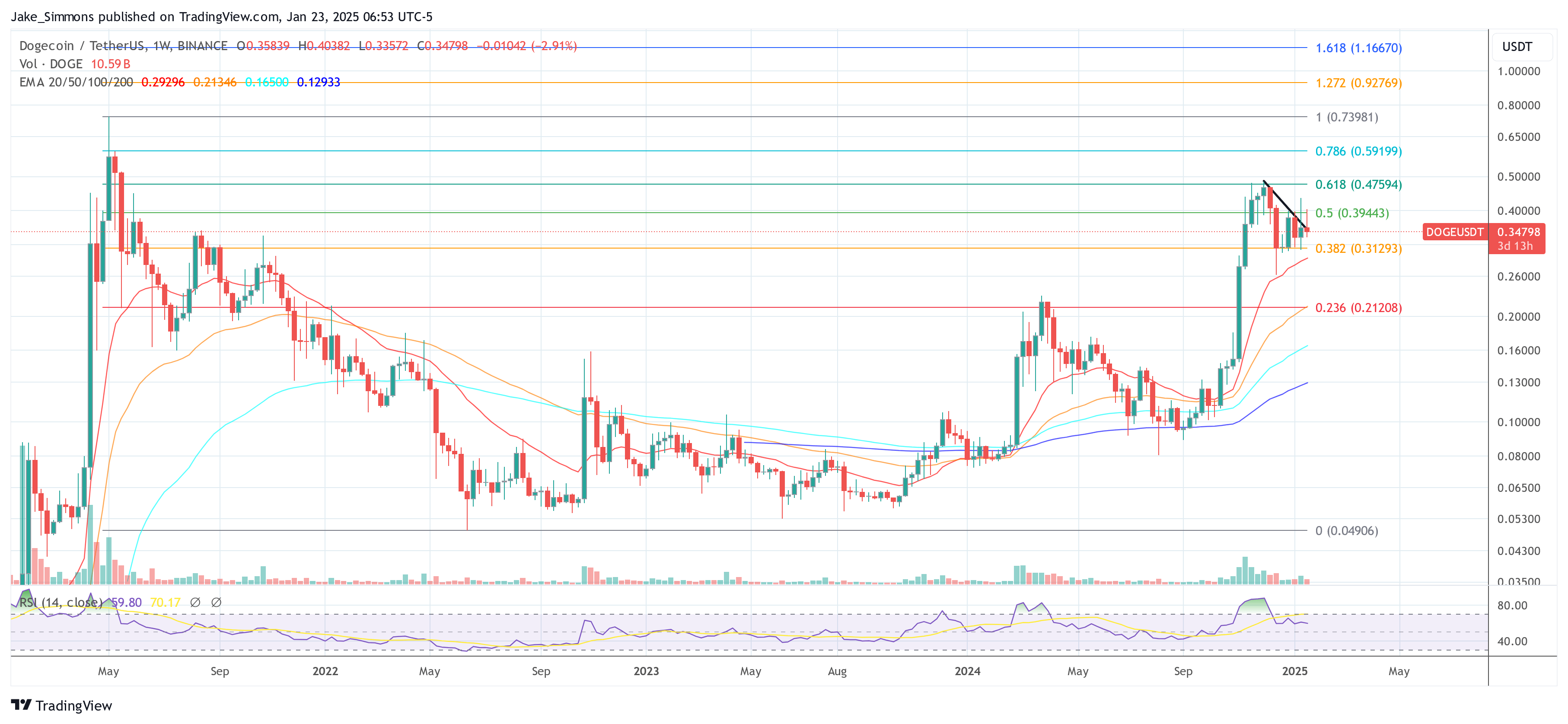

Following Bitwise’s and Rex Shares’ recent application for spot Dogecoin ETFs in the United States, crypto analyst Ali Martinez has provided a technical outlook suggesting Dogecoin (DOGE) could ascend to $15. His analysis, detailed in a logarithmic chart spanning from 2017 to 2025, captures a massive ascending channel that highlights the potential upward trajectory for DOGE.

Dogecoin Targets $15

Martinez’s chart delineates a long-term ascending channel where Dogecoin’s price action is bounded by a structure consisting of three parallel trendlines. The lowest of these lines has consistently served as a firm support since 2017, aiding the price to stabilize during significant downturns, notably in early 2019 and again in mid-2022. The median line of the channel, which presently hovers around $0.40 to $0.45, has just been tested by DOGE as it recently surged to this level, marking a critical inflection point that was last touched in early 2022.

Related Reading

The upper boundary of the channel, which is the focus of Martinez’s bullish forecast, is projected to climb well above $10, touching as high as $15 by late 2025. This top trendline is not just a theoretical limit but has proven to be the bull run top twice for the Dogecoin price, once in January 2018 and then in May 2021. At the last all-time high in May 2021, Doge even significantly exceeded the channel.

Martinez’s prediction highlights the spot Dogecoin ETFs as potential market catalysts. He suggests that the approval and launch of such financial products could channel fresh institutional and retail investment into DOGE, propelling it towards these higher valuations.

In trading terms, the current position of DOGE below the median line is pivotal. This price level has historically acted as a springboard for upward movement when sustained buying pressure is present. Should DOGE maintain its footing above this zone, the pathway to higher resistance levels around $1.00, and potentially the channel’s upper echelon near $15, appears technically feasible.

Related Reading

Notably, the spot Doge ETFs could hit the market as early as April, according to Bloomberg’s ETF specialist Eric Balchunas. Bitwise officially lodged the application to register a Dogecoin ETF on Wednesday.

The company submitted its proposal, named the “Bitwise Dogecoin ETF,” to the Delaware Division of Corporations, which is part of the U.S. Department of State. Although such registrations can occasionally be misleading, Balchunas confirmed via X: “Bitwise Doge ETF likely coming soon.. and yes I checked and this is def legit (vs some whack job committing forgery for a quick pump a la BlackRock XRP that one time).”

Registering in Delaware represents an initial step before advancing to a formal ETF submission with the Securities and Exchange Commission (SEC). This registration process sets up the legal structure that would manage the proposed ETF but does not constitute a direct application for SEC approval.

This initiative follows an earlier application by investment firms Rex Shares and Osprey Funds, both of which have also filed applications for multiple cryptocurrency ETFs, including one focused on Dogecoin.

At press time, DOGE traded at $0.34.

Featured image created with DALL.E, chart from TradingView.com

CryptoCurrency

DAO Governance Platform Agora Acquires Older Competitor, Boardroom

Agora, a blockchain governance startup, is set to acquire its competitor Boardroom. The company framed the acquisition as a strategic move to enhance governance within the broader Ethereum ecosystem, citing expectations of renewed growth in decentralized governance due to President Trump’s promise of regulatory clarity for the blockchain industry.

“2025 is the year we make good governance the standard for all protocols in Ethereum,” Agora co-founder Yitong Zhang told CoinDesk.

Agora was founded in 2022 by Zhang, Charlie Feng, and Kent Fenwick. The trio initially started working on governance tooling at Nouns DAO, one of the buzzier blockchain protocols to emerge from 2021’s DAO (decentralized autonomous organization) and NFT hype cycle.

The term “DAO” generally describes crypto communities that are governed by their token holders. They’re a favorite among those who believe crypto’s decentralization ethos can be a world-changing force, albeit an unwieldy way to run a pseudo-company. That’s created an opening for support projects like Agora.

Agora was founded on the premise that token governance is central to the value of crypto protocols. It aims to provide user-friendly, open-source governance tools for DAOs like Uniswap and Optimism, which both currently use Agora to organize token holders and hold governance votes.

Boardroom, which predated Agora and has similar goals, took a more horizontal approach to blockchain governance. Boardroom has gradually transitioned from an Agora-style DAO tooling software to a data feed—similar to a “Bloomberg” for crypto governance data.

Agora declined to disclose how much it paid to acquire Boardroom. Boardroom’s employees have been offered roles at Agora, and Boardroom’s founder, Kevin Nielsen, will remain as an advisor. “There’s no plan to deprecate” Boardroom, according to Zhang. Rather, the Agora team will keep both platforms running and will work with users to determine how the tools might gradually be integrated.

A new day for DAOs?

“DAO” is less of a buzzword in 2025 than it was a few years ago. They were pitched as a way to leverage blockchain’s core strengths in decentralized coordination to advance a new kind of community-owned company, but they’ve been implemented in various ways and to varying degrees of success.

Many DAOs have floundered due to organizational difficulties; it can be hard to coordinate thousands of token-holders around a single goal. Improving DAO tooling can help to address this, but it is only one side of the equation. Another barrier for DAOs has been a lack of regulatory clarity, which has left open questions of legal liability and has made it difficult for DAOs to determine how tokens should be issued, and how decisions should be divided between token holders and a platform’s core developers.

“From a business perspective, DAOs are coming back in a really, really large way,” said Zhang, who says his own business has grown “10X” over the past year. “People haven’t noticed yet because people have so much trauma over DAO bulls**t.”

The Trump administration has signaled its intention to create clearer guidelines for cryptocurrency issuance, which has led to optimism among Zhang and some of his competitors.

“I think we’re gonna finally get reasonable definitions for sufficient decentralization, security, and compliant ways of doing a token,” said Zhang.”

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login