CryptoCurrency

A New (Digital) Age at the SEC

As technology evolves, the U.S. Securities and Exchange Commission (SEC) must evolve with it. Nowhere is this truer than in crypto, and now: The market for crypto assets has grown in size and sophistication such that the SEC’s recent harmful approach of enforcement and abdication of regulation needs urgent updating.

While the long-term future of the crypto industry in the U.S. will likely require Congress to sign a comprehensive regulatory framework into law, here are six steps the SEC could immediately take to create “fit-for-purpose” regulations – without sacrificing innovation or critical investor protections.

#1 Provide guidance on ‘airdrops’

The SEC should provide interpretive guidance for how blockchain projects can distribute incentive-based crypto rewards to participants — without those being characterized as securities offerings.

Blockchain projects typically offer such rewards — often called “airdrops” — to incentivize usage of a particular network. These distributions are a critical tool for enabling blockchain projects to progressively decentralize, as they disseminate ownership and control of a project to its users.

If the SEC were to provide guidance on distributions, it would stem the tide of these rewards only being issued to non-U.S. persons — a trend that is effectively offshoring ownership of blockchain technologies developed in the U.S., yet at the expense of U.S. investors and developers.

What to do:

Establish eligibility criteria for crypto assets that can be excluded from being treated as investment contracts under securities laws when distributed as airdrops or incentive-based rewards. (For example, crypto assets that are not otherwise securities and whose market value is, or is expected to be, substantially derived from the programmatic functioning of any distributed ledger or onchain executable software.)

#2 Modify crowdfunding rules

The SEC should revise Regulation Crowdfunding rules so they are suitable for crypto startups. These startups often need a broader distribution of crypto assets to develop critical mass and network effects for their platforms, applications, or protocols.

What to do:

Expand offering limits so the maximum amount that can be raised is on par with crypto ventures’ needs (e.g., up to $75 million or a percentage of the overall network, depending on the depth of disclosures).

Exempt crypto offerings in a manner similar to Regulation D, allowing access to crowdfunding platforms beyond accredited investors.

Protect investors through caps on the amounts any one individual may invest (as Reg A+ currently does); robust disclosure requirements that encompass the material information relevant to the crypto venture (e.g. relating to the underlying blockchain, its governance, and consensus mechanisms); and other safeguards.

These changes would empower early-stage crypto projects to access a wide pool of investors, democratizing access to opportunities while preserving transparency.

#3 Enable broker-dealers to operate in crypto

The current regulatory environment restricts traditional broker-dealers from engaging meaningfully in the crypto industry — primarily because it requires brokers to obtain separate approvals to transact in crypto assets, and imposes even more onerous regulations around broker-dealers who wish to custody crypto assets.

These restrictions create unnecessary barriers to market participation and liquidity. Removing them would enhance market functionality, investor access, and investor protection.

What to do:

Enable registration so broker-dealers can deal in – and custody – crypto assets, both securities and nonsecurities.

Establish oversight mechanisms to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Collaborate with industry authorities like FINRA to issue joint guidance that addresses operational risks tailored to crypto assets.

This approach would promote a safer and more efficient marketplace, enabling broker-dealers to bring their expertise in best execution, compliance, and custody to the broader crypto market.

#4 Provide guidance on custody and settlement

Ambiguity over regulatory treatment and accounting rules has deterred traditional financial institutions from entering the crypto custody market. This means that many investors are not getting the benefit of fiduciary asset management for their investments, and instead are left investing on their own and arranging their own custody alternatives.

What to do:

Clarify guidance on how investment advisers can custody crypto assets under the Investment Advisers Act, ensuring adequate safeguards such as multi-signature wallets and secure offchain storage. Also provide guidance on staking and voting on governance decisions for crypto assets in the custody of investment advisers.

Develop specific guidance on settlement for crypto transactions – including timelines, validation processes, and error resolution mechanisms.

Establish a flexible, technology-neutral framework that can adapt to custody solution innovations, meeting regulatory standards without imposing prescriptive technological mandates.

Rectify accounting treatment by repealing SEC Staff Accounting Bulletin 121 and its handling of balance sheet liabilities for custodied crypto assets. (SAB 121 moves custodied crypto assets onto the custodian’s balance sheet — a practice that is at odds with the traditional accounting treatment of custodied assets.)

This clarity would provide greater institutional confidence, increasing market stability and competition among service providers while improving protections for both retail and institutional crypto investors.

#5 Reform ETP standards

The SEC should adopt reform measures for exchange-traded products (ETPs) that can foster financial innovation. The proposals promote broader market access to investors and fiduciaries used to managing portfolios of ETPs.

What to do:

Revert to the historical market-size test, requiring only that sufficient liquidity and price integrity for the regulated commodity futures market exists to support a spot ETP product. Currently, the SEC’s reliance on the “Winklevoss Test” for surveillance agreements with regulated markets that satisfy arbitrary predictive price discovery has delayed approval of bitcoin and other crypto-based ETPs. This approach overlooks the significant size and transparency of current crypto markets, their regulated futures markets, and creates an arbitrary distinction in the standards applicable to crypto-based ETP listing applications and all other commodity-based listing applications.

Permit crypto ETPs to settle directly in the underlying asset. This will result in better fund tracking, reduce costs, provide greater price transparency, and reduce reliance on riskier derivatives.

Mandate robust custody standards for physically settled transactions to mitigate risks of theft or loss. Additionally, provide for the option of staking idle underlying assets of the ETP.

#6 Implement certification for ATS listings

In a decentralized environment where the issuer of a crypto asset may play no significant continuing role, who bears responsibility for providing accurate disclosures around the asset? There’s a helpful analog from the traditional securities markets here, in the form of Exchange Act Rule 15c2-11, which permits broker-dealers to trade a security when current information for the security is available to investors.

Extending that principle into crypto asset markets, the SEC could permit regulated crypto trading platforms (both exchanges and brokerages) to trade any asset for which the platform can provide investors with accurate, current information. The result would be greater liquidity for such assets across SEC-regulated markets, while simultaneously ensuring that investors are equipped to make informed decisions.

What to do:

Establish a streamlined 15c2-11 certification process for crypto assets listed on alternative trading system (ATS) platforms, providing mandatory disclosures about the assets’ design, purpose, functionality, and risks.

Require exchanges or ATS operators to perform due diligence on crypto assets, including verifying issuer identity as well as important feature and functionality information.

Mandate periodic disclosures to ensure investors receive timely and accurate information. Also, clarify when reporting by an issuer is no longer necessary due to decentralization.

This framework would promote transparency and market integrity while allowing innovation to flourish.

***

By taking the above steps now, the SEC can begin to rotate away from its historic and heavily contested focus on enforcement efforts, and instead add much-needed regulatory guidance. Providing practical solutions for investors, fiduciaries, and financial intermediaries will better balance protecting investors with fostering capital formation and innovation — achieving the SEC’s mission.

A longer version of this post originally appeared on a16zcrypto.com.

CryptoCurrency

Lummis to Lead Crypto-Vital U.S. Senate Panel With Digital Assets Industry Defenders

The U.S. Senate Banking Committee has officially set its roster for the new digital assets committee, putting Senator Cynthia Lummis at the top, as expected. But it also includes two names that received heavy backing from the crypto political action committee Fairshake in the 2024 elections.

New Senator Bernie Moreno, the Ohio blockchain entrepreneur who knocked off former Democratic Chairman Sherrod Brown, is among the panel’s five Republicans. The crypto super PAC devoted a towering $40 million to back Moreno in that contest.

And among the four Democrats, the ranking senator is Arizona Democrat Ruben Gallego, who received about $10 million in ad support from Fairshake.

The subcommittee is likely to represent the tip of the spear for crypto legislation in this session of Congress. The House of Representatives had been far ahead of the Senate last year in approving digital assets measures, but the Senate Banking Committee led by Brown had resisted taking up the bills.

With the new subcommittee in place, led by Wyoming Republican Lummis, the industry is likely to soon take up bills. Lummis has authored a few herself in previous sessions.

CryptoCurrency

Debifi and Berglinde Join Forces to Redefine Bitcoin-Backed Fiat Lending with Loans in USD, EUR, and CHF

[Lugano, January 23, 2025] – Debifi, the leading platform in non-custodial Bitcoin-backed lending, has announced a strategic partnership with Berglinde, a recognized innovator in Bitcoin-centered investment solutions. This alliance signifies a major step in connecting the traditional financial landscape with the Bitcoin economy. Together, they will offer fiat loans in USD, EUR, and CHF, providing users with expanded financial options while safeguarding their Bitcoin holdings.

United by a Commitment to Financial Empowerment

This collaboration unites two forward-thinking firms driven by a mission to enable financial sovereignty. By merging Debifi’s pioneering lending infrastructure with Berglinde’s regulatory expertise, they aim to create a dynamic ecosystem that underscores Bitcoin’s role as a premier global asset for collateralization.

Why This Partnership Changes the Game

Opening Institutional Liquidity Channels

Debifi’s secure, non-custodial, multisig lending system will integrate with Berglinde’s regulated financial frameworks, unlocking institutional liquidity for Bitcoin-backed loans. This synergy ensures a secure and transparent gateway for capital flows.

Elevating Bitcoin’s Position in Global Markets

By leveraging Berglinde’s expertise in compliance and investment management, this partnership supports Debifi’s mission to scale globally, allowing Bitcoin to penetrate deeper into capital markets and diversify its utility.

Setting a Benchmark for Lending Excellence

The partnership is dedicated to establishing a gold standard in Bitcoin-backed lending. Their approach emphasizes security, transparency, and non-rehypothecation practices, reinforcing Bitcoin’s reputation as “super collateral” for both traditional and decentralized financial systems.

This collaboration highlights how the convergence of visionary companies can expand the potential of Bitcoin as a transformative force in global finance.

Comments from Leadership

Max Keidun, CEO of Debifi:”The partnership with Berglinde marks a significant milestone for Debifi, as it unlocks seamless fiat loan access for our platform users. By combining Bitcoin’s unmatched value as collateral with Berglinde’s financial expertise, we’re bridging the gap between Bitcoin economy and traditional finance, creating unparalleled opportunities for our users. Berglinde is one of the first fiat lenders on our platform, and we’re excited to announce more partnerships in the coming months.”

Phil Lojacono, Co-Founder of Berglinde:“Our mission at Berglinde has always been to drive innovation at the intersection of Bitcoin and traditional finance. Debifi’s groundbreaking approach to Bitcoin lending aligns perfectly with our vision of empowering institutions to invest in Bitcoin with confidence and integrity. This partnership sets the stage for a prosperous Bitcoin economy.”

About Debifi

Debifi is a non-custodial lending platform designed to unlock Bitcoin’s potential as a superior collateral asset. Through secure multisig escrow and no-rehypothecation lending, Debifi offers individuals and institutions unmatched borrowing solutions.

About Berglinde

Berglinde bridges traditional finance and the Bitcoin economy, offering secure, regulated, and innovative investment opportunities. The firm is committed to empowering institutions to embrace Bitcoin and its transformative potential.

For more information, visit Debifi.com and Berglinde.com.

Debifi social media: https://x.com/debificom and https://linkedin.com/company/debifi

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Trump promises to make US ’world capital’ of AI, crypto at Davos

The virtual speech to the World Economic Forum reiterated Donald Trump’s pledge to an audience at a July 2024 Bitcoin conference.

CryptoCurrency

This meme coin index presale could be next

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

With OSOL AI index pumping 135%, experts suggest MEMEX’s new meme coin index presale could be next to surge.

OSOL (OSOL), the AI Index token on the Solana blockchain, has experienced a dramatic price surge, climbing 135% in recent trading sessions.

The token, designed to provide AI-powered insights and investment tools, saw its price soar from $0.02599 to a peak of $0.08461 within 24 hours. At the time of writing, OSOL is trading at $0.04847, still maintaining an impressive 76.20% increase over the day. With a market cap of $48.23 million and 24-hour trading volume of $792,269, the token’s liquidity and demand indicate strong market engagement.

Meanwhile, a new meme coin index platform is also turning heads. Meme Index (MEMEX) has now raised over $2.7m through its presale as it seeks to provide traders with a solution to market volatility.

OSOL showcases volatile price movements

From a technical perspective, the OSOL/USDT trading chart on the hourly timeframe showcases volatile price movements.

After the token hit its peak, it retraced to $0.04720, aligning closely with its 9-period SMA ($0.04779) and EMA ($0.04929).

The Bollinger Bands indicate high volatility, with the price hovering near the lower band at $0.03659, suggesting potential support.

On the 1-minute chart, OSOL displays a rebound from intraday lows, reflecting short-term buying pressure.

Key indicators such as the 9-period SMA ($0.04675) and EMA ($0.04679) suggest a stabilizing trend, though the Bollinger Bands remain wide, signaling ongoing fluctuations.

As OSOL approaches its next phase, its transformative AI Index platform continues to attract investor attention.

However, its network-specific approach has sparked discussions about the need for broader solutions that cater to multi-chain ecosystems.

MEMEX: Expanding horizons beyond Solana

The recent 135% price surge of OSOL showcases the potential of indexing solutions. However, its exclusive focus on Solana presents limitations for those seeking broader exposure across multiple blockchain ecosystems.

This is where Meme Index sets itself apart.

Unlike OSOL, which operates solely within the Solana network, MEMEX will span a variety of blockchains, offering a cross-chain investment platform that provides unparalleled diversification.

Meme Index could transform the way investors approach the highly volatile meme coin market.

By offering a cross-chain index platform, MEMEX will eliminate the guesswork and risks associated with chasing individual tokens. Within just one month of its presale, the project has raised over $2.7 million, cementing its position as a game-changer in the crypto space.

The platform introduces four tailored indexes to cater to varying risk profiles and investment goals.

The Meme Titan Index focuses on established tokens like DOGE, SHIB, and PEPE, offering stability and gradual growth.

For those seeking higher returns, the Moonshot Index includes emerging tokens with market caps under $1 billion, while the Midcap Index targets mid-tier tokens poised for significant growth.

Risk-tolerant investors can opt for the Meme Frenzy Index, which features volatile and unconventional tokens, providing opportunities for exponential gains while minimizing the impact of individual token failures.

Meme Index’s adaptability extends beyond its index offerings. Token holders can customize their portfolios, vote on which tokens are included in the indexes, and participate in governance decisions, ensuring the platform evolves with market trends.

This community-driven approach enhances the relevance and effectiveness of each index.

Priced at $0.0154693, MEMEX provides an accessible entry point for early adopters. Holders also benefit from staking with an APY of up to 846%, adding significant passive income potential.

While single-chain solutions like OSOL may appeal to Solana enthusiasts, MEMEX’s cross-chain reach and tiered risk options position it as a potentially superior choice.

By combining diversification, adaptability, and community governance, Meme Index aims to redefine how investors engage with the meme coin market, offering a safer and smarter path to potential returns.

For more information on Meme Index, visit their website.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Crypto Exchange Phemex Suspends Withdrawals After $30M Hack

Crypto exchange Phemex appears to have been the victim of a multi-million exploit on Thursday, according to online reports. Millions worth of USDT, USDC, Ethereum (ETH), and other crypto assets were stolen from the exchange’s hot wallets, resulting in a temporary half of withdrawals.

Related Reading

Phemex Suffers First Crypto Exchange Hack Of 2025

On Thursday morning, the first crypto exchange hack of the year hit the industry. Multiple reports revealed suspicious activity involving Phemex’s hot wallets was taking place over several chains.

Blockchain security firm Cyvvers shared on X it had detected multiple transactions to several suspicious wallets on different chains, “including BNB, ETH, OP, POL, BASE, and ARB.”

The security firm’s initial report stated that over $29 million worth of crypto had been transferred to the suspicious addresses, later raising the sum. “Upon deeper analysis, it has come to light that both BTC and TRON blockchains have also been impacted, with the estimated total loss now reaching approximately $37 million,” the update read.

Cyvvers seemingly identified around 125 suspicious transactions spread across the different blockchains and noted that the attackers had started swapping the tokens to Ethereum (ETH) to avoid potential freezing measures.

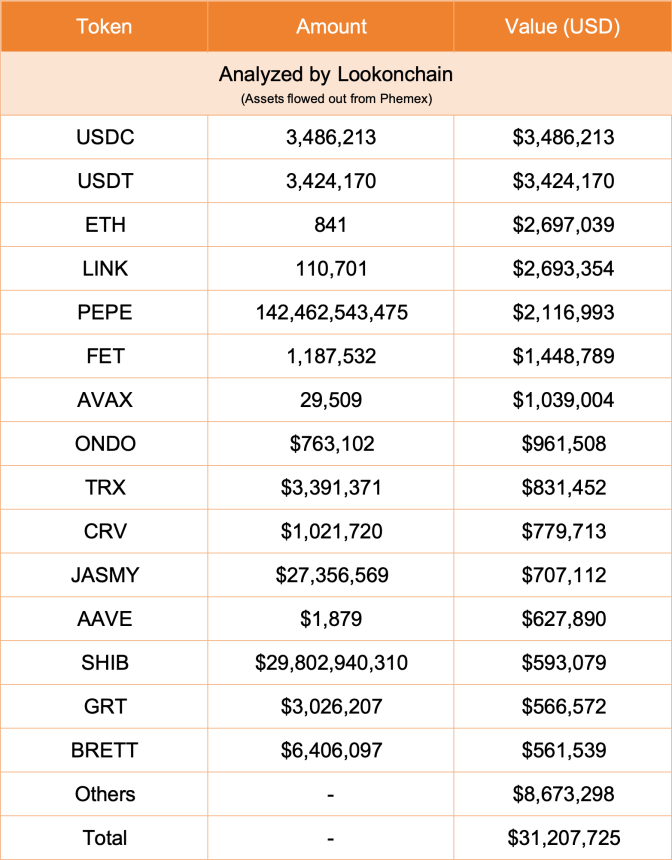

Meanwhile, on-chain data analysis firm Lookonchain broke down the crypto heist, stating that the hack had taken around $31 million worth of crypto assets. According to the analysis, 3.48 million USDC, 3.42 million USDT, and 841 ETH, worth $2.7 million were drained from the exchange’s hot wallet.

Additionally, the attackers took 110,701 LINK, 142 billion PEPE, 1.19 million FET, and 29,509 AVAX, valued at around $7.3 million combined. Lookonchain also listed ONDO, TRX, CRV, JASMY, AAVE, SHIB, GRT, and BRETT, as part of the stolen crypto assets.

Compensation Plan In The Works

After the news, Phemex CEO Federico Variola confirmed the attack on one of the crypto exchange’s hot wallets. Variola assured users that Phemex’s cold wallets remained safe and that they were investigating the reports.

The exchange then announced on X the temporary halt of withdrawals due to the emergency inspection and strengthening of the security measures but did not offer further details about the incident.

To ensure security, withdrawals have been temporarily suspended while we conduct an emergency inspection and strengthen wallet services. We sincerely apologize for the inconvenience. Withdrawals will be restored soon. Phemex and the development team apologize for the disruption. Our mission to provide a seamless and trusted trading environment remains firm.

Nonetheless, the post stated that ongoing business operations were fine and that trading services continued as usual. Phemex’s team also revealed they are working on a compensation plan, which will be announced soon.

It’s worth noting that, in 2024, the number of hacks and total value lost increased from the year prior. According to Chainalysis data, 2024 was the fourth consecutive year in which the funds stolen from crypto hacks exceeded the billion-dollar mark.

Related Reading

Additionally, the total value stolen surged to $2.2 billion last year, and it became the year with the most individual hacks, reaching 303 incidents by December.

Centralized exchanges (CEXs) were the most targeted platforms in Q2 and Q3, recording some of the largest incidents in the industry’s history, while Decentralized finance (DeFi) platforms accounted for the largest share of stolen assets in Q1, like most quarters between 2021 and 2023.

Featured Image from Unsplash.com, Chart from TradingView.com

CryptoCurrency

Morgan Stanley (MS) Figuring Out How to Act as Transactors of Crypto, Says CEO

Morgan Stanley (MS) is figuring out how it can act as a transactor in the crypto market, CEO Ted Pick said.

The bank, which has some $1.6 trillion of assets under management, will work with the U.S. Treasury and other regulators to figure out how it can offer crypto in a safe way, Pick said in an interview with CNBC at the World Economic Forum in Davos, Switzerland on Thursday.

“For us, the equation is really around whether we, as a highly-regulated financial institution, can act as transactors,” he said.

Pick had been asked about his views on cryptocurrency in the U.S. under the supposedly pro-crypto presidency of Donald Trump.

He described how Morgan Stanley is assessing whether the crypto industry has come of age as an asset class.

“I think there is liquidity and that liquidity will express itself in all kinds of different ways,” Pick said in an apparent reference to the availability of crypto exchange-traded funds (ETFs) in the U.S.

U.S. spot bitcoin (BTC) ETFs now hold a combined $39 billion worth of the largest cryptocurrency and first started trading in early January last year.

Read More: New Bitcoin ETF Promises 100% Downside Protection Against Price Volatility. Here Is How

CryptoCurrency

Profits Continue To Rotate From XRP Into The Latest Crypto Titan In The Payments Sphere: Remittix (RTX)

The beginning of the New Year has seen some major fluctuations in the cryptoverse. Ripple, which had a wild 2024, posting a 497% net gain, experienced a small growth spurt in mid January but has now plateaued. Many holders are increasingly eyeing up a new project, Remittix (RTX), which is well on its way to disrupting the cross-border payments industry. This advanced PayFi project comes with a fresh approach to problems in the $190 trillion market, streamlining international transactions, cutting fees, and saving time for users. Its deep value proposition has seen it rack up momentum in presale, with over $5.2 million raised so far. So what is the next quarter likely to have in store for these two projects?

Ripple’s Momentum Plateaus Following 72 Hour Surge

Ripple (XRP) experienced some notable growth recently, posting a 24.16% gain in the last 7 days, and now trading at the $3.14 mark. It even peaked at $3.28, teasing the $3.50 critical support level. However, Ripple’s (XRP) momentum seems to be plateauting now. On the technical side, the Relative Strength Index (RSI) is hovering around 60, suggesting the market isn’t overbought or oversold—basically, it’s in a pretty balanced state. The Moving Average Convergence Divergence (MACD) has crossed above the signal line, indicating bullish momentum. When it comes to who holds Ripple (XRP) there’s a diverse mix. Whales control a significant portion of the supply, but there’s also a healthy number of smaller investors in the game. It looks for the moment that Ripple’s (XRP) growth spurt is over, but what direction it will go in next remains unclear.

Remittix Reinvents the Wheel for Global Payments

Gaining momentum by tackling inefficiencies in the $190 trillion cross-border payments market, Remittix (RTX) offers a transparent and reliable platform for simplifying international transactions. By providing a seamless solution for converting cryptocurrencies into fiat currencies, the platform stands out as an innovative tool in global finance.

Supporting the conversion of 40 cryptocurrencies into fiat, Remittix ensures fast, reliable transfers without hidden charges. Its flat-fee model is a major advantage, guaranteeing recipients receive the exact amount sent, no surprises, no deductions. This combination of transparency and efficiency appeals to both individuals and businesses navigating global payments.

For businesses, the Remittix Pay API enables easy acceptance of cryptocurrency payments while allowing fiat settlement. Furthermore, merchants can utilize dedicated accounts to manage over 50 crypto pairs and 40 fiat currencies, offering unparalleled flexibility and control in the digital economy.

What truly sets Remittix (RTX) apart is its accessibility. Designed for ease of use, it allows recipients to receive payments as standard bank transfers, eliminating the need for cryptocurrency expertise. This user-friendly approach makes it an ideal solution for individuals, businesses, and merchants looking to integrate digital assets into their financial processes effortlessly. By addressing key challenges in the space, Remittix is reshaping what global payment systems can achieve.

Presale Milestone: Remittix Surpasses $5.3 Million

At the core of the Remittix ecosystem is the RTX token, a versatile asset supporting staking, platform rewards, and governance. Currently, in the midst of its presale, RTX tokens are available at an attractive price of $0.0282, with the project already raising over $5.3 million.

Experts foresee an explosive 800% price increase during the presale, with additional growth likely as the platform gains traction for its practical applications. Positioned within the lucrative cross-border payments market, Remittix (RTX) is gearing up to dominate the PayFilandscape in 2025.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

SEC’s crypto actions dropped by 30% in Gensler’s final year

Cornerstone Research says the US Securities and Exchange Commission launched 33 crypto-related lawsuits last year, down from 47 in 2023.

CryptoCurrency

The altcoin set to change the future of global transfers

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Investors shift focus to Remittix, a new DeFi project raising millions in presale with hopes of changing global transfers.

Recent reports reveal that those who have invested in top altcoins, especially Solana, have turned towards new DeFi projects like Remittix (RTX). In their optimism about this debut crypto platform, these investors predict that it will perform impressively in the industry by potentially changing global transfers.

Interestingly, Remittix is already gaining traction, especially in its token presale, which has raised millions from investors. Keep reading and find out why Remittix is poised to meet expectations.

Solana stumbles after record high

Recently, Solana saw a significant surge with the altcoin price reaching a peak of $294.33 on January 19. However, it has since fallen by 14% from that level as it is currently trading at $251. Current analysis indicates that Solana may face more challenges ahead.

Notably, Solana’s network saw transaction fees surge to $1.4 million in 10 minutes after the TRUMP token launch, but transactions plummeted from 450,000 to 150,000. This decline indicates reduced activity and interest, contributing to the altcoin price decline from its all-time high.

Total Value Locked (TVL) in Solana liquidity pools also dropped substantially from $12.191 billion to $10.964 billion on January 19th because investors began to lose faith in the token.

As the TVL continues to decline, further drops in price are likely.

Analysts suggest that if SOL falls to a support zone between $222.80 and $210.10, it might bounce back from its recent decline. However, if negative sentiment grows and the support fails, SOL could drop even lower.

Remittix: The next-gen remittance token

Looking at the much support Remittix has gained from holders of top altcoins like Solana over the weeks, it is indeed not any regular cryptocurrency. In fact, some believe it embodies a forward-thinking approach to global transfers that prioritizes user experience, transparency and accessibility.

The core of this platform’s features is the RTX token which benefits both growth and practical use. The project design features a permanent 1.5 billion token limit to create scarcity that benefits users when others join the platform. When users own RTX they directly participate in the platform’s development process and management decisions as stakeholders.

Remittix stands out for its commitment to transparency. Traditional cross-border payment systems often hide true transaction costs behind opaque fees and inflated conversion rates. Remittix tackles this issue head-on, making sure that users are fully aware of what they are paying. This clarity builds trust and allows users to feel confident in their transactions.

The platform also excels by integrating cryptocurrencies with conventional banking systems, creating a quick, secure, and cost-effective method for international money transfers. Users can convert over forty different cryptocurrencies into fiat currency and send it directly to bank accounts around the globe. This capability not only simplifies the remittance process but also opens doors for those who may have felt excluded from the traditional financial system.

Excitingly, RTX is currently priced at just $0.0272 and the demand is now more noticeable than ever. With over 250 million tokens already sold, Remittix has raised more than $5.2 million in its presale. Analysts are buzzing about its potential, projecting an impressive 50x increase in the altcoin price, possibly before the year runs out. As Remittix solidifies its position in the financial landscape with its unique blockchain-powered payment solutions, early investors are poised to reap significant rewards.

To learn more about Remittix, visit the Remittix presale and join the Remittix community.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Bitcoin (BTC) Rises to $106K as Donald Trump Slated to Call El Salvador’s Nayib Bukele

Bitcoin (BTC) surged past $106,000 on Thursday morning in the U.S. on reports that U.S. President Donald Trump will talk later today with Nayib Bukele, president of bitcoin-friendly nation state El Salvador.

Bitcoin advanced more than 3% to session highs in the minutes after the report, erasing early morning losses. It was up 2.2% over the past 24 hours.

Earlier this morning, prices started to climb as U.S. Senator Cynthia Lummis posted on social media to “stay tuned for 10:00 a.m.” Eastern Time, only to gave back most of the gains after reports that the Senate Banking Committee would vote to confirm Lummis as chair of the panel’s new digital assets subcommittee.

Fueling the gains was speculation that bitcoin and crypto regulation might be among the talking points between the two leaders. El Salvador has become as a nascent crypto hub under Bukele’s leadership. It was the first nation state to adopt BTC as legal tender in 2021 and accumulated over 6,000 BTC worth $622 million as a strategic reserve.

Trump said last year on the campaign trail that, if elected, he aims to position the U.S. as a global leader in the digital asset space. He also made several crypto-specific promises including creating a national stockpile, or strategic reserve, of bitcoin.

He’ll speak to Bukele at 3:30 p.m. ET.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login