CryptoCurrency

Altcoins that are not SOL and XRP for major gains over the next few months

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

As Solana and Ripple face stagnation, investors are turning to rising altcoins like Lightchain AI and Pepe Coin, which are showing immense growth potential.

With Solana (SOL) and Ripple (XRP) dominating headlines, savvy investors are exploring other high-potential altcoins to maximize returns.

Among the rising stars, Lightchain AI and Pepe Coin stand out as lucrative investments capable of delivering impressive growth. Here’s why these two altcoins could create huge gains in just a few months.

Pepe meme magic backed by market momentum

Pepe Coin (PEPE) has become a well-known joke money, drawing a big market focus. As of January 20, 2025, PEPE is selling for about $0.000017 USD with a daily trade amount of $1.35 billion USD. The coin has seen a 5.42% drop in the last day, and it now has a market value of $7.34 billion bucks, putting it at the 25th spot in crypto.

New whale ͏moves show big money going into PEPE, with large buys reaching millions. This rush of cash hints at more trust from big investors in the coin’s chance to grow.

Even with its meme start, Pepe Coin’s growing spot in the market and large trade amounts show a wider pattern of meme coins getting more popular in the crypto world. Yet, possible buyers should be careful because of the natural ups and downs and the speculative nature of these types of assets.

Lightchain AI: AI-driven crypto powerhouse

Lightchain AI is redefining the altcoin game, blending cutting-edge artificial intelligence with blockchain technology to create real-world value. Unlike meme coins like Pepe, this is where innovation meets utility.

From powering smarter decision-making to delivering real-time analytics and safeguarding data privacy, Lightchain AI is built for impact. And the buzz is real; its presale has already raked in $12 million, with tokens priced at just $0.00525. Both retail and institutional investors are taking notice.

What sets Lightchain AI apart? Its unique tokenomics reward validators and developers for meaningful contributions, bringing in big players and fueling long-term growth. Add to that a scalable architecture and developer-friendly platform, and it’s clear why this altcoin is poised to leave its competition in the dust by year-end.

LCAI gains traction

Lightchain AI presale is LIVE and moving faster than most other presales. Stage 12 is just a heartbeat away from a price bump. Here’s how easy it is to claim LCAI tokens.

- Head over to the official Lightchain AI website.

- Connect user wallet.

- Swap the desired amount for LCAI tokens.

- Users are officially on board.

To learn more about Lightchain AI, visit their website, whitepaper, X, or Telegram.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Long-Term Bitcoin (BTC) Holder Sales Seem to Have Bottomed Out: Van Straten

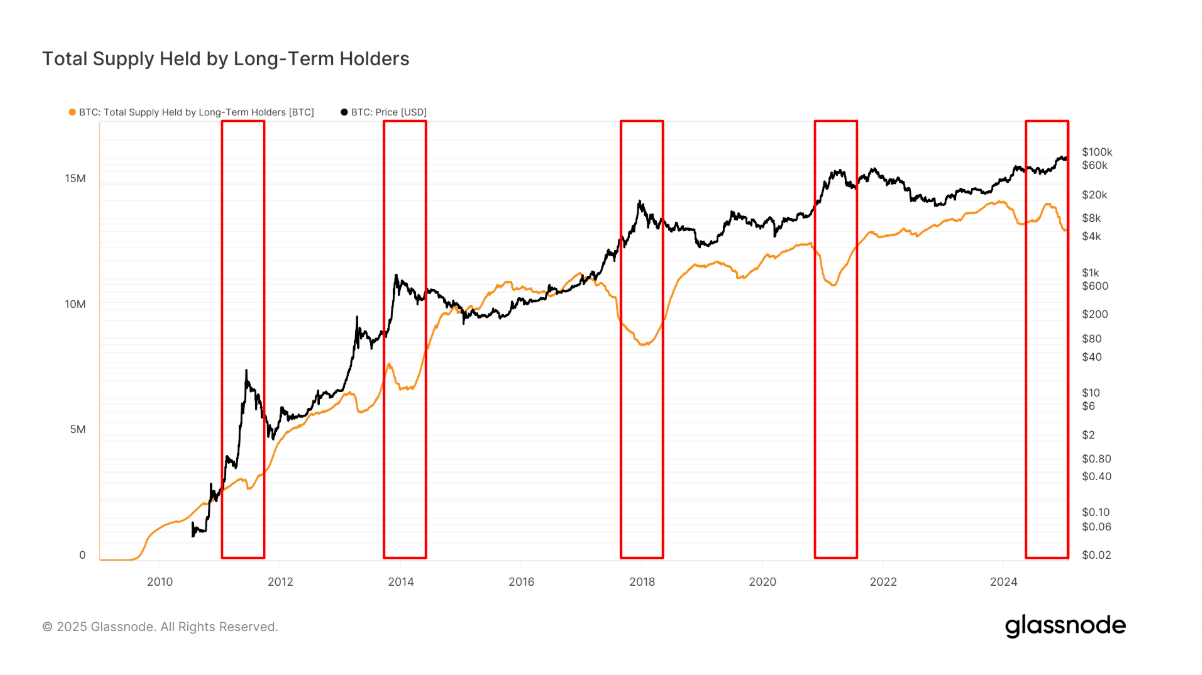

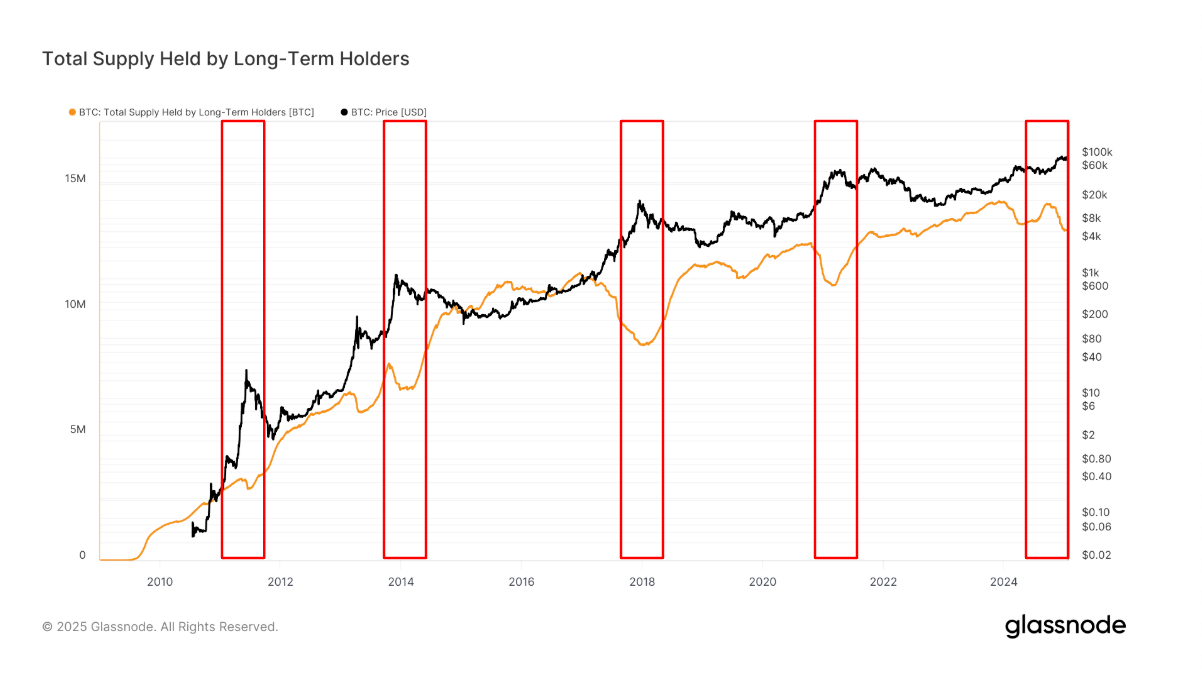

Long-term holders of bitcoin (BTC) seem to ended their selling spree, a change in strategy that’s helped convert the psychological $100,000 resistance price into a support level for the first time.

With one, short-lived exception, the largest cryptocurrency has held above $100,000 since Jan. 17. The past few days have been extremely volatile due to President Donald Trump’s inauguration, which saw a spike in volatility.

Long-term holders, or investors who have held bitcoin for over 155 days, have been among the biggest contributors to selling pressure on the market, according to CoinDesk research in December. They are deemed “smart money” because they tend to buy when bitcoin prices are depressed and sell into strength, a pattern that’s been observed over the past four months.

In September, this cohort held 14.2 million BTC. It now holds 13.1 million BTC. While the investors held back around the start of the year, sales have picked up again in recent days as the price rose, though at a reduced pace.

The trend to watch out for is when they stop selling. This tends to mark a top in the cycle, which has occurred in 2013, 2017, 2021 and 2024.

CryptoCurrency

Jellyverse Launches its Synthetic Assets Protocol jAssets

Sei Network-based (SEI) community-led decentralized finance (DeFi) platform Jellyverse is launching its own synthetic assets protocol, jAssets.

According to a Jan. 21 announcement, jAssets will allow users to mint their own synthetic asset tokens that would approximately track the value of traditional assets. The value of those tokens would be tied to real-world assets like stocks, commodities and precious metals.

Jellyverse moved ahead with the implementation of the new feature following a proposal seeing a positive outcome in an integration vote by the protocol’s decentralized autonomous organization (DAO.) Minting jAssets by locking up crypto as collateral allows for on-chain portfolio diversification.

Benedikt Keck, co-founder at Jellyverse developer Blkswn, explained that the new product will allow for “portfolio diversification in DeFi by offering a range of innovative investment strategies, including long, short, and leveraged positions.” The new synthetic assets protocol also allows for multi-collateral troves, with support for “wETH, wBTC, JLY, SEI, USDC, USDT, FRAX or GEM or a combination of these assets as collateral,” he explained.

Jellyverse relies on decentralized oracles and over-collateralization to ensure that the value of the collateral exceeds the synthetic assets and prevent the protocol from losing assets. The oracles in question are based on Pyth Network (PYTH).

A blockchain oracle is a tool or service that feeds external, real-world data into a blockchain so smart contracts can act on it. Usually, data that is external to blockchains cannot be accessed in the smart contracts that govern the DeFi space.

Oracles serve as a bridge providing up-to-date data — in this case real-worAld asset pricing data. This bridge is also a potential centralized point of failure in a decentralized system, which is why a lot of effort has been dedicated to developing decentralized oracles such as Chainlink (LINK) and Pyth Network.

Jellyverse runs on the Sei Network, a layer one blockchain with parallel Ethereum Virtual Machine (EVM) execution. This allows the smart contracts that the DeFi space relies on to run much faster and allow for faster trades.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

CryptoCurrency

US court overturns Tornado Cash sanctions in pivotal case for crypto

In a win for crypto privacy technologies, a US court in Texas has overturned Tornado Cash sanctions.

CryptoCurrency

Labour to force grieving military families to pay inheritance tax in ‘corrosive’ rule change

Labour MPs have voted to impose inheritance tax on death-in-service payments for military families for the first time, as part of changes backed by Rachel Reeves.

The new rules will force children and unmarried partners of deceased service personnel to pay death duties on the benefit from April 2027.

Death-in-service payments, which are currently tax-free lump sums given to families of deceased Armed Forces members, will now go into probate if not left to a spouse or civil partner.

The payments typically amount to four times the late individual’s salary and are paid whether the service member was on or off duty at the time of death.

The Head of the Forces Pension Society has urged the Government to reverse the decision

PA/Getty

Under the changes, military personnel who die while “off duty” – such as from sudden illness or accident – will see their death-in-service payments subject to inheritance tax. Those who die “on duty” will continue to benefit from separate tax-free arrangements.

The new rules mean that payments intended as compensation for families could be reduced by up to 40 per cent in inheritance tax.

Military servicemen and women cannot avoid this tax by putting the payment into trust, as they are part of the Armed Forces pension scheme.

The head of the Forces Pension Society, which represents more than 66,000 members, has written to HMRC urging the Government to reverse the decision.

LATEST DEVELOPMENTS

Mark Francois said the decision was “deeply regrettable”

GB NEWS

Major General Neil Marshall, chief executive of the Forces Pension Society, warned that the rule change would be “corrosive” and undermine trust among Armed Forces personnel towards the Government.

“If service people are thinking ‘What if? What if? What’s the Government going to do next to undermine the offer to undermine my commitment to service?’ It’s corrosive,” he told The Telegraph.

In a letter to HMRC, Major General Marshall expressed serious concerns about the policy’s impact on military effectiveness.

“Given the high-risk nature of military service… a policy that discriminates against those who are not married or in a civil partnership poses a serious threat to morale, team cohesion and ultimately operational effectiveness,” he wrote.

Shadow Armed Forces Minister Mark Francois also criticised Labour’s inheritance tax changes as “deeply regrettable” and against the spirit of the Armed Forces Covenant.

The spokesman from the Treasury confirmed that existing inheritance tax exemptions would continue for those who die from wounds, accidents or diseases contracted on active service.

A spokesman said: “We value the immense sacrifice made by our brave Armed Forces, that is why existing inheritance tax exemptions will continue to apply, meaning that if a member of the Armed Forces dies from a wound inflicted, accident occurring or disease contracted on active service, they will be exempt.

“Any pension funds left to a spouse or civil partner in this scenario will also be exempt.”

CryptoCurrency

What Is Qubic (Qubic) Crypto

Qubic (Qubic) crypto is a digital coin made by Sergey, a famous person in blockchain. It’s set up as a cool layer-1 protocol, aiming to shake up the usual ways in the cryptocurrency world.

What distinguishes Qubic from other projects is its focus on distributed computing and finance. By leveraging its unique features, Qubic has the potential to make significant strides in these areas.

Key Takeaways

- Qubic (Qubic) crypto is a project that seeks to enhance blockchain technology through the integration of artificial intelligence (AI) capabilities. By combining AI with blockchain technology, Qubic aims to improve the efficiency and functionality of decentralized systems. This integration has the potential to bring about new solutions and advancements in the cryptocurrency space. Qubic’s approach aligns with the ongoing trend of exploring innovative methods to optimize blockchain technology.

Qubic Founders

Qubic, established by CFB and Sergey Ivancheglo, introduces a novel approach to cryptocurrencies by incorporating AI training. Emphasizing artificial neural networks and smart contracts, Qubic tokens function as the foundation of this innovative system. Leveraging computational power from a vast network of nodes, Qubic distinguishes itself in the cryptocurrency sphere for its distinct consensus mechanisms and distributed computing methods.

The collaborative work of CFB and Sergey Ivancheglo has positioned Qubic to redefine the landscape of blockchain technology. Their combined expertise has led to the creation of a platform that not only enables secure and decentralized smart contracts but also boosts the efficiency of AI training activities.

By integrating artificial neural networks, Qubic optimizes its computational network’s capabilities, ensuring that each node plays a significant role in enhancing the network’s overall performance. This strategic approach to utilizing computational power establishes Qubic as an innovative player in the cryptocurrency realm.

The first ever useful PoW L1 Blockchain

The first ever useful PoW L1 Blockchain, established by Sergey, incorporates AI training to improve the efficiency and practical applications of cryptocurrencies. Qubic’s Useful Proof-of-Work consensus mechanism utilizes 676 Computors for smart contract execution, emphasizing energy efficiency and tangible results. The network’s top 451 performing Computors are regularly assessed to ensure optimal performance. By leveraging computational power for training Artificial Neural Networks, Qubic enhances the productivity of computational energy, yielding valuable outcomes.

QU tokens serve as utility tokens within the network and are burned to mitigate inflationary pressures, promoting ongoing stability. Through AI training activities, Qubic aims to reduce energy wastage typically associated with traditional Proof-of-Work mining, potentially leading to lower energy expenses as AI models progress.

The platform also supports secure and decentralized smart contracts and oracle services using IOTA’s Tangle, positioning Qubic as a pioneering platform for diverse real-world applications in decentralized finance, supply chain management, data-driven smart contracts, and IoT device support.

Key Features of Qubic Crypto

These components are designed to improve the network’s efficiency, security, and ability to integrate digital and real-world data seamlessly.

Smart Contracts

Qubic Crypto integrates AigarthAI and implements a burn mechanism in its Smart Contracts to improve efficiency and security. These Smart Contracts utilize Useful Proof of Work with AI tasks, ensuring a secure and efficient execution process.

By incorporating AI training tasks into the consensus mechanism, Qubic enhances the overall performance of smart contract operations. The quorum-based computation on the Qubic network further boosts the speed and reliability of these contracts.

Through Oracles that connect digital and real-world data, Qubic facilitates a wide range of applications for its Smart Contracts. This strategic approach not only addresses scalability issues in cryptocurrencies and enhances the IOTA ecosystem but also paves the way for innovative AI applications in the blockchain domain.

Useful Proof of Work

Qubic Crypto utilizes AI tasks in its Useful Proof of Work system to enhance computational efficiency and produce meaningful outcomes. This innovative approach redefines traditional Proof of Work mining by not only verifying transactions but also generating practical results through AI training tasks.

The integration of AI into the consensus mechanism improves the network’s energy efficiency and fosters advancements in real-world applications. Through collaboration between Miners and Computors, Qubic ensures optimal utilization of computational resources, promoting a more sustainable blockchain ecosystem.

The focus on energy-efficient AI tasks distinguishes Qubic in the crypto industry, positioning it as a leader in leveraging advanced technologies to address scalability issues and explore new opportunities for machine learning and AI applications.

Quorum

The quorum mechanism in Qubic Crypto plays a crucial role in enhancing computational efficiency and enabling real-world applications. By leveraging a quorum, Qubic ensures the swift and accurate execution of smart contracts.

This consensus mechanism improves the network’s performance and facilitates the seamless integration of real-world data. The quorum-based computation model in Qubic Crypto utilizes the collective agreement of a subset of nodes to efficiently validate transactions.

This approach allows Qubic to achieve consensus quickly and securely, opening up possibilities for innovative applications in decentralized finance, supply chain management, and IoT devices. The involvement of the quorum in the network’s operations underscores Qubic’s focus on efficiency and practicality.

Oracles

Oracles play a critical role in the Qubic cryptocurrency ecosystem by acting as intermediaries that connect digital smart contracts with real-world data sources in a secure and decentralized manner.

These oracles facilitate the integration of external data into the Qubic network, ensuring the accuracy and reliability of information used in smart contract execution.

By utilizing oracles, Qubic smart contracts gain access to real-time data streams, enabling a wide array of applications such as decentralized finance, supply chain management, and the integration of IoT devices.

This incorporation of oracles enhances the functionality and practicality of Qubic, enabling the seamless execution of sophisticated and data-driven smart contracts that cater to diverse industries and applications.

Should you Invest in Qubic

Qubic’s market performance shows a mix of volatility and growth potential. As of the latest data, Qubic’s price has seen fluctuations, with recent predictions suggesting possible significant increases in its value over the coming years.

Currently at the price of $0.000004579 is not that far from its all-time high at $0.00001244 achieved on March 2nd, 2024.

For instance, price predictions for 2050 suggest a substantial increase, indicating a long-term positive outlook. However, the cryptocurrency market is inherently volatile, and such predictions should be approached with caution.

Where to Buy Qubic Crypto

To acquire Qubic (QUBIC) tokens, users can utilize various cryptocurrency exchanges that support this digital asset. Qubic Crypto is currently listed on platforms such as Bitfinex, HitBTC, and Exrates, enabling individuals to buy and trade QUBIC tokens.

Prior to selecting an exchange, it’s recommended to conduct thorough research on factors such as security measures, trading volume, and overall user experience.

Once a suitable exchange is chosen, users can create an account, deposit funds, and proceed with purchasing Qubic tokens to engage with the Qubic ecosystem and its blockchain technology.

Frequently Asked Questions

Is Qubic Coin a Good Investment?

Investing in Qubic may be considered a strategic choice due to its unique combination of AI training and Useful Proof-of-Work consensus mechanism. The platform’s emphasis on practical applications and energy efficiency indicates potential for long-term development.

When Was Qubic Crypto Launched?

Qubic crypto was launched in 2018, representing a significant advancement in blockchain technology. This launch marked a notable integration of artificial intelligence and finance within the realm of cryptocurrencies.

Conclusion

Qubic (QUBIC) is a unique cryptocurrency designed to combine blockchain technology with artificial intelligence (AI). This digital asset uses a specialized consensus mechanism called Useful Proof-of-Work (PoW), where computational tasks generate practical outputs, like AI training. The goal is to improve energy efficiency in mining and create a more sustainable ecosystem.

Founded by Sergey Ivancheglo, Qubic employs 676 Computors to execute smart contracts and AI tasks. The top 451 Computors are regularly evaluated to ensure optimal performance, aiming to reduce energy wastage associated with traditional PoW. This system also enhances the security and scalability of the blockchain, making it more adaptable to real-world applications.

Investors interested in Qubic should note that its unique approach has the potential for growth, but like all cryptocurrencies, it can be volatile. Key features like its Useful PoW mechanism and AI integration are what set Qubic apart in the cryptocurrency space.

Qubic (QUBIC) presents a compelling option for those interested in innovative blockchain technology, with a focus on AI integration and energy efficiency. However, like all cryptocurrency investments, thorough research and caution are recommended before committing funds.

Other cryptocurrencies to check:

BigEyes Crypto, Renq Crypto, Digitoads Crypto, TitanX Crypto and BurgerCities Crypto.

Angel Marinov is the Managing Editor at Coinlabz. With extensive knowledge of crypto payments and blockchain use cases, Angel is a trusted source of accurate and timely information

CryptoCurrency

Whales pour into this altcoin positioned to surpass SOL and XRP by 2026

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Rollblock, a smart altcoin set to disrupt the $540 billion gambling industry, is gaining big backing and could surpass SOL and XRP by 2026.

Big players in the crypto world are betting on a new altcoin that is set to disrupt the market. With massive potential and new technology, this rising star, called Rollblock, is gaining traction fast. In fact, experts predict that it could outperform giants like SOL and XRP by 2026.

Does Rollblock have what it takes to be a top crypto?

Rollblock is flipping the script on the $540 billion online gambling industry with a new approach. This top crypto casino isn’t just shaking up the game, it’s tearing down the walls of secrecy that have haunted the sector for decades. For years, the gambling world has been plagued by trust issues, with reports revealing that gambling platforms manipulate bets to exploit players.

This flawed system is a gambler’s worst nightmare, as its whole functionality is based on rigging the gambling process. With Rollblock, gamblers can rest assured that transparency is built into the system. Every bet, every transaction, is securely encrypted and recorded on the Ethereum blockchain. Players no longer have to take the casino’s word for it, they can verify every move themselves.

This approach has ignited a frenzy of interest. In December 2024 alone, Rollblock saw a staggering 600% surge in new users, with over $1.75 million in bets placed. Thankfully, this momentum isn’t slowing down. January’s numbers are set to double, proving that when you put players first, everyone wins.

Solana faces a future filled with green charts

Excitement has been high in the SOL altcoin community recently as it reached an ATH of $293.79. Although this rise shows increased investor confidence in its high-performance blockchain, the main attributing factor is likely Donald and Melania Trump’s new TRUMP and MELANIA crypto launch.

This positive news surrounding SOL has pushed CoinCodex analysts to make predictions that SOL could fall between the $377.43 and $407.39 price marks by December 2025. Given that SOL has risen more than 190% from this time last year, if everything goes well for SOL, its 2025 price trend could mirror that of 2024.

XRP set to skyrocket before Q1 ends

Like SOL, XRP has also witnessed an uptrend due to the positive sentiment around Donald Trump’s inauguration. In the past week alone, XRP has witnessed a 21.76% surge, which is in line with predictions from altcoin experts like Lai Jr. A week before Trump’s presidential inauguration, Lai Junior made a post on his X page, predicting that XRP could reach $10–$34 by March.

From the look of things, XRP might hit and even cross the $34 price mark before March. This prediction is backed up by its technical data charts, which show that it has RSI at 70. With this value, it is evident that XRP might witness another sharp rise soon.

Conclusion

While the sentiment around SOL and XRP is positive, their growth cannot be compared to that of Rollblock. Rollblock is getting set to take over crypto headlines by selling its native RBLK tokens via its presale. These tokens, which are now valued at $0.046 each, might soon be the face of the crypto gambling industry.

To learn more about Rollblock, visit the website and its socials.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Ripple vs. SEC Settlement Rumors Gain Momentum: Here’s Why

TL;DR

- Speculation is rising that the SEC’s upcoming closed meeting under new Acting Chairman Mark Uyeda might address the Ripple lawsuit, but experts warn against expecting major developments.

- Despite Gensler’s exit, the Ripple-SEC legal battle continues, with disputes over XRP’s classification and an ongoing appeal delaying resolution.

Incoming Resolution or Just Another Speculation?

The lawsuit between Ripple and the US Securities and Exchange Commission (SEC) remains ongoing despite numerous legal developments and changes in the agency’s leadership. Recall that the regulator’s Chairman, Gary Gensler, officially stepped down on January 20 and was replaced by crypto proponent Mark Uyeda.

The Commission has scheduled its first closed meeting under the new Acting Chairman for January 23, causing the XRP Army to speculate that the case against Ripple might be on the agenda this time. Some of the most optimistic predictions include a dismissal of the lawsuit.

It is worth mentioning that the SEC conducts such meetings quite frequently, and there are no public records showing that it has touched upon the aforementioned legal tussle in any of them.

Marc Fagel – a former regional director of the SEC for the San Francisco office – claimed that those expecting “something monumental to happen” at the upcoming gathering “are about to be disappointed.”

“This is the same meeting they hold nearly every week. They will vote on recommendations calendared weeks ago,” he assumed.

Not so Fast

The anti-crypto Gensler might be out of the SEC, but the official resolution of the case against Ripple remains challenging. After all, the entities have been confronting each other in court for over four years, throwing punches at each other on every possible occasion.

The core issue in the lawsuit is whether XRP (Ripple’s native token) should be classified as a security. The SEC argues it was sold as an unregistered investment, while the company insists it is a digital asset used for payments and not subject to securities laws.

In 2023, Judge Analisa Torres ruled that XRP sales on public exchanges to retail investors did not constitute securities transactions. A year later, she ordered Ripple to pay a fine of $125 million for violating certain rules.

The penalty represented just a fraction of the $2 billion the SEC initially asked for, and somewhat expected, the firm was ready to settle it.

However, the watchdog appealed the 2023 verdict and recently filed the necessary opening brief, thus prolonging the lawsuit indefinitely.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Historical Patterns Hint At A Blow-Off Top Above $50

As XRP, currently the third-largest cryptocurrency by market capitalization, navigates recent fluctuations, analysts and market experts are optimistic about its potential for significant price growth.

After experiencing a brief dip toward $2.83 over the weekend, following an unsuccessful attempt to breach its all-time high of $3.40 set seven years ago, the sentiment surrounding XRP remains bullish.

Market Expert Foresees XRP Propelling To $53

In a recent post on X (formerly Twitter), market expert and technical analyst Egrag Crypto shared encouraging price targets for XRP investors, suggesting that historical price patterns indicate a possible blow-off top that could drive the token into double-digit territory.

Egrag highlighted three historical blow-off tops, demonstrating impressive percentage increases that XRP has experienced in the past: one saw a rise of 1,068%, another 2,636%, and a third recorded an increase of 406%.

Related Reading

By analyzing these surges alongside corrective phases, Egrag Crypto formulated potential price targets for the next blow-off top for the altcoin, suggesting levels of $53, $32, and $9.70, all of them surpassing by clear difference the tokne’s current record peak.

Egrag previously noted the importance of a critical price range between $4 and $5, indicating that once XRP reaches approximately $4.40, it will enter a “powerful energy field” that could significantly propel prices higher.

The analyst emphasized that traders should closely monitor price action, candle formations, and oscillator behaviors in this range to determine whether the market is poised for a substantial rally or facing a potential correction.

Despite the optimistic outlook, Egrag urged caution, stating, “I’m still feeling #BULLISHAF, but it’s crucial to remain level-headed when trading and investing, especially with #XRP.”

He expressed concern that market dynamics might be encouraging retail investors to exit, which could be a strategy to enable the emergence of two-digit prices.

Aiming For A 40% Surge Amid Impressive Monthly Performance

Supporting this bullish sentiment, market analyst Ali Martinez has also weighed in on XRP’s trajectory, noting that the cryptocurrency has recently broken out of a bullish flag and is now targeting the $4.40 mark.

Related Reading

This indicates a near-term uptrend of nearly 40% for the altcoin, complementing its impressive monthly performance, which has already seen a surge of 43%. However, despite these positive figures, XRP is currently trading at $3.16, still 7.2% below its all-time high.

The price levels of $3.35 and $3.40 have proven to be significant hurdles for the altcoin, representing crucial barriers that must be overcome to initiate a price discovery phase.

On the downside, the token has established a significant price support range between $2.70 and $2.80 over the past week. This area has become a notable buying zone for investors anticipating further price increases.

Featured image from DALL-E, chart from TradingView.com

CryptoCurrency

CME Bitcoin (BTC) Options Show Most Bullish Sentiment Since Trump Election Victory, ETF Inflows Surge

On Tuesday, bitcoin (BTC) options trading on the Chicago Mercantile Exchange (CME) showed the strongest bullish sentiment since Donald Trump’s Nov. 5 election victory.

Traders scrambled to buy calls, or options offering asymmetric upside exposure, driving the skew higher to 4.4%, the most since early November, according to data tracked by digital assets index provider CF Benchmarks.

Skew is the difference in implied volatility between calls and puts, or options offering downside protection, and positive values represent a bullish sentiment.

“Thirty-day topside skew in the bitcoin options market has reached levels not seen since the November election results,” Thomas Erdösi, head of product at CF Benchmarks, told CoinDesk. “This reflects a strong bullish sentiment, with traders actively positioning for upside exposure across both short- and long-term maturities.”

Bitcoin’s price rose as much as 5%, briefly topping $106,000 Tuesday after buyers defended the $100,000 support level despite President Trump failing to mention crypto or strategic bitcoin reserve in his inaugural speech the day before.

The bounce was accompanied by renewed uptake for the U.S.-listed spot ETFs, which registered a cumulative net inflow of $802 million, according to data from SoSoValue. BlackRock’s IBIT drew $661.8 million alone, helping solidify the bullish sentiment.

“ETF inflows have continued their impressive accumulation streak, marking four consecutive days of significant inflows, amounting to over $3 billion for Bitcoin alone. Bitcoin ($802M) and Ethereum ($74M) are receiving robust institutional backing, which could propel digital assets to new highs,” Valentin Fournier, an analyst at BRN, said in an email to CoinDesk.

Besides, long-term holders — wallets with a history of holding coins for over 155 days — are scaling back their profit-taking activities, according to blockchain data tracking firm Glassnode.

“Looking ahead, it’s possible that volatility levels might moderate slightly towards the end of the month, but we anticipate that the skew for topside will probably remain, barring any surprise policy developments. This will likely provide continued upward price pressure for the foreseeable future,” Erdösi said.

CryptoCurrency

Top 3 Market Makers Rising to the Challenges of Volatility and Cutthroat Competition

The financial landscape is in constant flux, with market makers playing a pivotal role in ensuring trading liquidity and efficiency. Moving into 2025, choosing a suitable platform for one’s trading needs is as relevant as ever. This article looks at three market-making companies to consider for one’s trading strategies and investments. They stand out in this crowded field by ensuring seamless transactions and providing the liquidity required in a wide range of financial markets.

1. Gravity Team

Gravity Team is an algorithmic crypto trading company that underscores efficiency and liquidity in crypto markets, rapidly setting the standard for crypto market makers. Its team of around 60 experts is growing in parallel with its global reach and market volume. The company has achieved a cumulative trading volume of approximately $400 billion since it was founded by a crypto-native team in 2017. It accounts for 1% of the crypto spot trading volume worldwide, is active on more than two dozen prominent crypto exchanges, and offers access to over 1,400 crypto asset pairs.

However, its dominance in emerging markets is its main advantage over competitors, of whom there is no shortage. On the market-making side, large-scale projects in need of liquidity in markets they wish to enter choose this platform to gain exposure. Users can avail themselves of fiat liquidity within exotic markets.

Gravity Team helps achieve equilibrium through high-frequency trading and by cooperating with various industry stakeholders. Its roles are carefully selected to contribute to this overarching goal. It works with projects in the Web3 space to market-make their coins or tokens and with CEXs to provide liquidity. Gravity Team attains its targets by leveraging innovative tools, a tightly-knit team of seasoned professionals, and extensive experience. As an ethical liquidity partner, Gravity Team mitigates risk concerns and attracts more customers to create even more liquidity.

2. Wintermute

Wintermute, a global algorithmic trading platform specializing in digital assets, aims to create efficient, highly liquid markets on and off centralized and decentralized exchanges. The platform provides liquidity on dozens of exchanges and trading platforms and boasts a pronounced impact on digital asset markets. The firm improves liquidity by partnering with promising projects. It supports many highly lucrative trading pairs and cooperates with all major exchanges.

Among its main advantages are 24/7/365 token liquidity, an absence of monthly or integration fees, and competitive spreads, even in the most dynamic markets. Wintermute’s talented DeFi team helps bridge tokens from other blockchains to Ethereum.

3. Keyrock

Highly liquid assets are behind many flourishing markets. Keyrock boosts its clients’ liquidity to create fair and efficient markets and put digital assets on a promising trajectory. Its expert team and algorithms constantly scan platforms to provide additional support where needed. Their market-making algorithms ensure reliable pricing and performance monitoring around the clock. Clients receive a wide range of trading insights and statistics on demand. The market maker guarantees transparency by aggregating price data and liquidity from almost 100 exchanges. The infrastructure attracts traders through market-wide quotes.

The platform facilitates trades and unifies prices, eliminating price discrepancies across markets. As a result, clients benefit from harmonized prices and tightened bid-ask spreads. A smooth trading experience is ensured, with clients readily entering and exiting trading positions. The algorithms guarantee markets can absorb an optimal number of trades, with high-volume ones becoming a trust factor at the right price.

The challenges: market volatility, relentless innovation, and regulatory pressures

Modern market makers face a plethora of challenges that test their flexibility, adaptability, and resilience. While market volatility creates profit opportunities, it can also lead to substantial risks. Bid-ask spreads widen during periods of high volatility, resulting in an increased risk of losing the assets one holds. The three market makers reviewed leverage advanced risk management strategies to mitigate volatility, such as dynamic pricing models that analyze real-time market conditions and adjust bid-ask spreads correspondingly. They hedge their positions and manage their inventory levels efficiently via algorithmic trading strategies. Diversification across different markets and assets is another strategy leveraged to extenuate risk.

Innovation is considered a plus, with new technologies and products constantly entering financial markets. Market makers cannot stay competitive if they’re not on board with this trend. They explore emerging markets, adopt bleeding-edge technologies, and develop new trading algorithms to remain relevant. They make substantial investments in research and development to foster innovation. Their teams expand to include talented developers and traders who build new algorithms and trading strategies. They also stay abreast of the latest technological advancements by collaborating with solution providers and taking part in industry consortia. Market makers embrace AI, cloud computing, and blockchain technology to enhance their operations.

One final challenge involves regulatory pressures. The rules governing financial markets differ depending on the jurisdiction. Regulatory compliance entails significant expenditure, which is unavoidable as legitimate market makers realize non-compliance will result in reputational damage and even more significant fines. The reviewed market makers navigate regulatory pressures by investing in specialized legal and compliance teams. They implement sophisticated compliance software to monitor real-time transactions, ensuring all trades comply with the applicable regulations. Continuous staff training on best practices and regulatory changes also mitigates compliance risks.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login