Two couples of vendors in Ballarat exhibited their 582m² land block for sale, accepting only Bitcoin payments. Why do people sell real estate for crypto, and how does the latter disrupt the real estate market?

The land in question

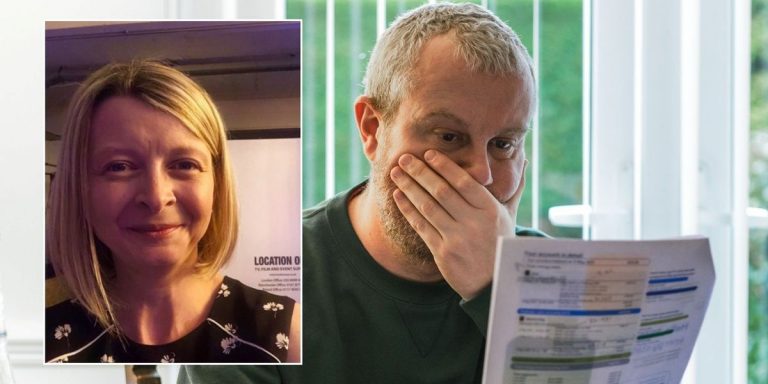

The block at 7 Magpie Street was bought by vendors Melissa Bower and Trudy Purcell in 2021 with plans of renovating and turning this place into “something magnificent.” Ballarat itself is a picturesque place that is not far away from several attractions like Sovereign Hill. However, the property itself needed some tweaking. At the time when the couple bought this land, it was just an old miners’ cottage, a relic of a gold rush-era Ballarat. The metamorphosis of this place into a beautiful spot proved to be a harder task than the couple thought.

While Bower, Purcell, and another couple of owners, Sasha Semjonov and Tessa Dunstan, did get the permit for building two townhouses on the vacant land, the economic outlook, including inflation and interests running high, proved these plans to be not suitable. They realized that they shouldn’t spend their money on materials and labor, and instead, they were better off selling the block.

Why did they sell it for Bitcoin?

Purcell and Bower provided a simple explanation of why they wanted to sell the land for Bitcoin, not for fiat money. The main reason is to reduce the middleman costs. Instead of losing time and money on estate agents and bank operations, they want a quick and safe transaction that won’t cost much, and Bitcoin is the way to go.

The block was sold. According to the vendors, everything took one hour, with no inspection or staging taking place. Bower said that today, social media platforms play a huge role in selling estate and pointed out TikTok as an example.

Do people often pay for real estate in crypto?

The Ballarat land trade turned heads, but we can’t say that Australians were the only ones to sell the estate for Bitcoin. Another notable case is the $22 million penthouse in Miami sold for cryptocurrency in 2021. At the time, it was considered the biggest real estate deal made via cryptocurrency.

Even though Bitcoin is not even a legal tender anywhere but in El Salvador, more and more people around the world use crypto to pay for real estate. If we factor in people who pay in fiat money but use blockchain to keep the real estate records, we will find out even more cases. For instance, the Republic of Georgia uses blockchain to maintain property registers on the national level.

Many choose crypto to pay for property because it allows them to save money on intermediaries and lifts the barriers associated with cross-border transactions.

Interestingly, some people buy real estate for fiat money, but they accumulate the necessary amounts through investment in crypto. The Fairway study revealed that in the fourth quarter of 2021 nearly 12% of all first-time homebuyers used the money they made via selling their crypto holdings. This shift illustrates how vital cryptocurrency became in the 2020s and how influential it is for the real estate market, even if the deals themselves take place off-chain for fiat money. The other report says that crypto is fueling the 2020s real estate boom in the United States. Not to mention, some people sell their houses to invest in Bitcoin.

The crazy fact is that real estate becomes increasingly cheap if we evaluate it in Bitcoin rather than fiat money, as the BTC price has been growing faster than the real estate prices in USD.

Blockchain and the real estate sector

Since the release of Ethereum whitepaper, blockchain has become a tool shaping the new reality. Any sector that involves data can benefit from blockchain. What’s more important is that blockchain does not make life easier for only one party involved. The best projects create a win-win balance. Probably, the middlemen are the only category that gets cut off.

The real estate market is one of the biggest markets in the world. Not only do we use real estate for life and work, but we also see real estate as an investment. That’s why this sector couldn’t go unnoticed by blockchain entrepreneurs. Moreover, real estate is notorious for savage intermediary fees and cumbersome bureaucracy. Looks like a job for a blockchain dApp!

The real estate deals with the ownership rights. Blockchain gives owners an easy tool to trade their estate without having to deal with such traditional entities as banks, agents, and so on. The trade is done through smart contracts embedded in the local legal space to ensure that the ownership will be passed to a buyer as soon as the payment takes place. As smart contracts are automatic, they don’t take agent fees.

Blockchain eliminates time-consuming, exhausting paperwork, allowing counterparts to trade property quickly as soon as they agree on the conditions. No bank or other entity can intervene and delay the process. The ownership is verified, and buyers can access all the necessary legal information about the estate they are going to buy. Through the tokenization of real estate, owners may sell fractions of their property in the form of digital tokens. This trend democratizes real estate trading.

Landlords are not left behind as well. There are apps that streamline rent collection and other matters via crypto payments.

In general, it’s safe to say that real estate gradually embraces crypto just like the other sectors do. Although some consider crypto price volatility to be a hurdle for the adoption of crypto as real estate money, others seek fortune, hoping the crypto they get in exchange for a house will rise in value in the future.

+ There are no comments

Add yours