CryptoCurrency

Analyst With a 71.6% Accuracy Recommends Holding XRP and Lightchain AI for Wealth in 2025

An analyst with an impressive 71.6% accuracy rate has recommended XRP and Lightchain AI as must-hold assets for building wealth in 2025. While XRP continues to gain traction for its advancements in cross-border payments, Lightchain AI is emerging as a transformative player in the crypto space.

The Lightchain AI Presale has already raised $12.5 million at $0.005 per token, showcasing strong investor confidence in its innovative AI-blockchain integration. With these two projects driving momentum, they are positioned to deliver significant returns in the upcoming market cycle.

Analyst’s Track Record- Why 71.6% Accuracy Matters

An analyst’s forecast accuracy of 71.6% is significant, as it surpasses the commonly accepted benchmark of 70% for reliable predictions.

Accurate forecasts are crucial for informed decision-making, enabling businesses to anticipate market trends, manage resources effectively, and maintain a competitive edge.

While a 71.6% accuracy rate indicates a strong predictive capability, it also highlights the inherent uncertainties in forecasting, underscoring the need for continuous refinement of predictive models.

XRP’s Continued Potential- Strong Hold for 2025

XRP has demonstrated significant growth, currently trading at $3.10. This upward trend is bolstered by Ripple’s partial legal victory in July 2023, where a federal judge ruled that XRP is not a security when sold to the general public on digital-asset exchanges.

The anticipated appointment of Paul Atkins as SEC Chair under President Donald Trump suggests a more crypto-friendly regulatory environment, potentially leading to the dismissal of the SEC’s appeal against Ripple.

Analysts project XRP could reach $5 to $7 by mid-2025, driven by these favorable regulatory developments and Ripple’s technological advancements. These factors position XRP as a strong hold for investors eyeing substantial returns by 2025.

Lightchain AI’s Rising Promise- Why It’s Key to Wealth in 2025

Lightchain AI is redefining wealth creation in 2025 with an innovative ecosystem that tackles blockchain’s biggest challenges head-on. By integrating Privacy-Preserving Data Utilization, it keeps sensitive data secure using cutting-edge tech like zero-knowledge proofs and federated learning—making it a trusted choice for both enterprises and individuals.

What really sets Lightchain AI apart is its approach to Aligning Incentives to Drive Participation. Developers, validators, and token holders are all rewarded fairly, creating a vibrant, thriving community built for sustained growth.

And the best part? Lightchain AI doesn’t settle. Its Iterative Evolution, rolling out in November 2025, reflects a relentless commitment to improvement. Regular updates driven by community feedback and the latest tech advancements ensure it stays ahead of the curve.

With innovation, inclusivity, and a forward-thinking vision, Lightchain AI isn’t just a blockchain platform—it’s a game-changer in the crypto market and a powerful engine for wealth creation.

https://lightchain.ai/lightchain-whitepaper.pdf

https://t.me/LightchainProtocol

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Trump backs US leadership in crypto at Davos, Lummis chairs new Senate crypto panel

President Donald Trump emphasized U.S. leadership in cryptocurrency and artificial intelligence as Senator Cynthia Lummis was sworn in as chair of the Senate’s new digital assets subcommittee.

During the 2025 World Economic Forum in Davos, President Donald Trump said in a virtual speech the United States would lead in artificial intelligence and cryptocurrency. In his address, Trump emphasized the need for the U.S. to dominate emerging technologies, including blockchain and crypto.

President Trump told the WEF that he wants America to be “the world capital of AI and crypto.”

He also urged lower interest rates and called for a $1 trillion Saudi investment to bolster economic cooperation, signaling his administration’s focus on innovation and global partnerships.

Lummis sworn in

Meanwhile, on Capitol Hill, Senator Cynthia Lummis was sworn in as the first chair of the Senate Banking Subcommittee on Digital Assets, a historic move reflecting the growing importance of cryptocurrencies in U.S. financial policy.

Lummis, a vocal advocate for Bitcoin (BTC) and blockchain technology, pledged to advance bipartisan legislation that establishes a comprehensive regulatory framework for digital assets.

In her statement, Lummis highlighted the potential for digital assets to secure America’s financial future, calling for a strategic Bitcoin reserve to strengthen the U.S. dollar.

The new subcommittee will focus on passing legislation promoting responsible crypto innovation while protecting consumers and ensuring regulatory agencies comply with the law.

The initiative aligns with Trump’s vision of positioning the U.S. at the forefront of digital asset adoption on the global stage.

CryptoCurrency

Meme Coin Momentum Fades After Trump Inauguration but Wall Street Pepe ICO Continues to Pump

The meme coin hype is cooling after Donald Trump’s inauguration celebrations.

Over the past 24 hours, big names like DOGE, PEPE, and SHIB have taken a nosedive.

But while most meme coins are selling off, one project continues to impress – Wall Street Pepe (WEPE).

Its ICO has passed $57 million in early contributions, setting the stage for a highly-anticipated exchange debut in just over three weeks.

Meme Coin Market Sees Major Correction as Trading Volumes Plummet

Nearly every major meme coin is in the red right now.

What started as minor profit-taking has snowballed into a broader sell-off, dragging the meme coin sector’s market cap back to $102 billion.

Meanwhile, trading volumes have dropped by more than 50% since yesterday.

Tokens that were rallying earlier in the week are now feeling the heat.

SHIB is down 2%, DOGE has dropped 4%, and TRUMP coin – last weekend’s breakout star – has plunged 14%.

But the biggest loser is AI16Z, down 25% in the past 24 hours.

The only real standout was PENGU – managing to post a small gain.

This kind of pattern is nothing new in the meme coin space, where sharp corrections often follow massive rallies.

Still, not everyone is spooked by the price action.

Well-known meme coin trader Murad called the sell-off an “opportunity of a lifetime” for those willing to stomach the volatility.

Crypto Market Sells Off While Bitcoin ETF Inflows Drop

The broader crypto market is also showing some cracks.

Bitcoin has slipped to $101,800, Ethereum is down to $3,200, and XRP has dropped to $3.

LINK took the biggest hit among the top altcoins, falling 6% since yesterday.

Things are clearly cooling off – and total spot trading volumes have slumped 16%, with open interest also dropping.

At the same time, demand for the spot Bitcoin ETFs is fading slightly.

Total inflows dropped 69% yesterday to $248 million, and BlackRock’s IBIT fund was the only one to see meaningful gains.

GBTC led the way in terms of outflows with $47 million.

Some analysts believe this is a “sell the news” moment, claiming Trump’s inauguration buzz was already priced into the market.

The optimism around this colossal event may have already run its course.

However, things change fast in crypto – so even though the market is red today, it could quickly flip green tomorrow.

Wall Street Pepe ICO Passes $57M Despite Market Downturn – Next Big Meme Coin Opportunity?

Wall Street Pepe’s ICO is defying all this bearishness.

The project has now raised over $57 million, and more than $1 million is coming in daily – even as the broader market sells off.

With the ICO running until February 16, Wall Street Pepe’s momentum does not show signs of stopping.

So, why all the hype?

For starters, the project has positioned itself as an aid for retail traders, targeting the dominance of crypto whales in the meme coin space.

That approach is hitting home, as evidenced by Wall Street Pepe’s Telegram channel reaching 17,300 subscribers.

The project’s Twitter following has also exploded recently.

Wall Street Pepe’s team will give WEPE holders access to market insights, trading tools, and real-time signals.

They’ll also host trading competitions where the winners receive WEPE prizes.

And if that wasn’t enough, there’s even a built-in staking app for WEPE, offering higher yields than most crypto staking coins.

Big-name YouTubers have praised the project’s setup.

For example, NASS CRYPTO released a video about Wall Street Pepe last month, which has been viewed over 86,000 times.

Given that he has more than one million YouTube subscribers, his endorsement has given the project a massive boost.

So, with 24 days left in its ICO, things are looking positive for Wall Street Pepe.

Despite the ongoing meme coin sell-off, WEPE seems to be holding up quite well.

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Dogecoin ETFs Will Skyrocket Price To $15, Forecasts Analyst

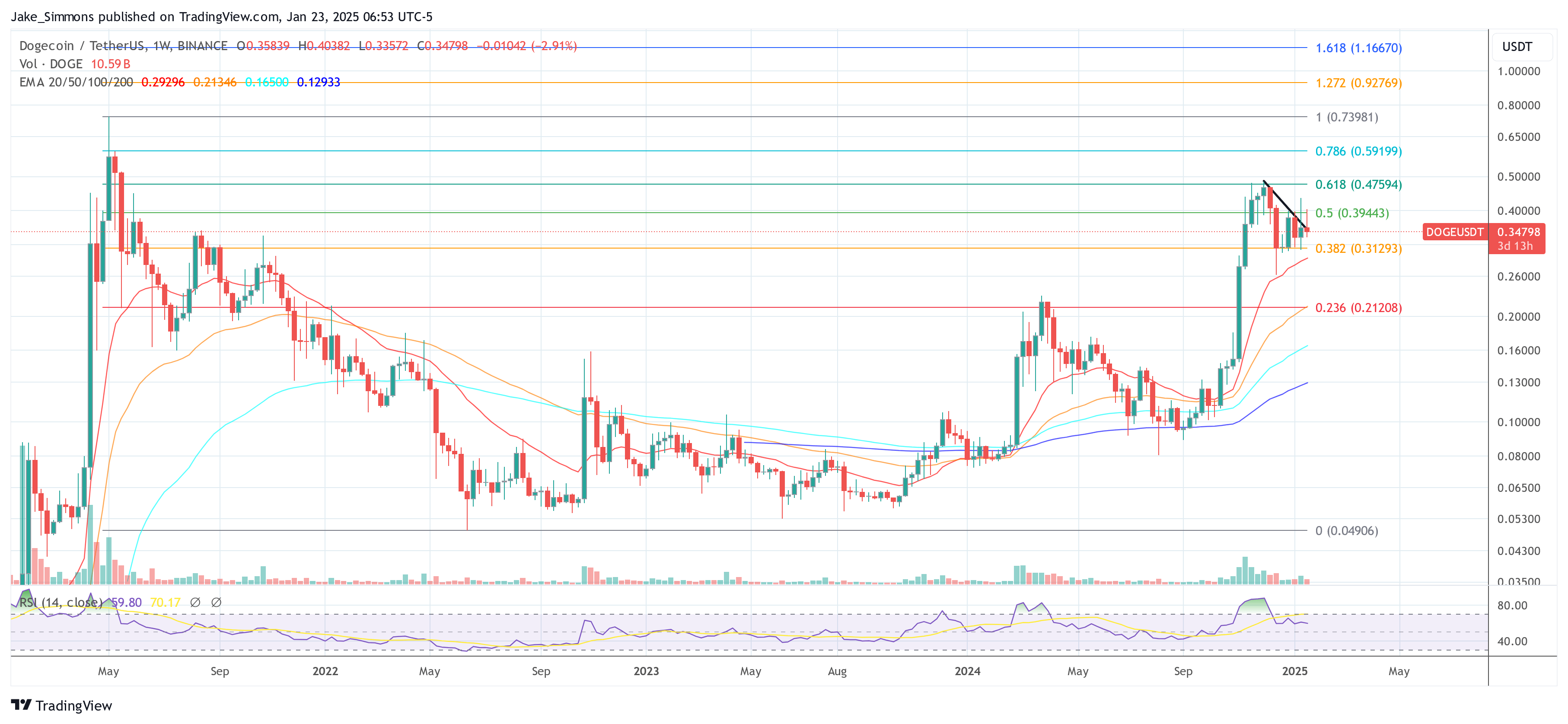

Following Bitwise’s and Rex Shares’ recent application for spot Dogecoin ETFs in the United States, crypto analyst Ali Martinez has provided a technical outlook suggesting Dogecoin (DOGE) could ascend to $15. His analysis, detailed in a logarithmic chart spanning from 2017 to 2025, captures a massive ascending channel that highlights the potential upward trajectory for DOGE.

Dogecoin Targets $15

Martinez’s chart delineates a long-term ascending channel where Dogecoin’s price action is bounded by a structure consisting of three parallel trendlines. The lowest of these lines has consistently served as a firm support since 2017, aiding the price to stabilize during significant downturns, notably in early 2019 and again in mid-2022. The median line of the channel, which presently hovers around $0.40 to $0.45, has just been tested by DOGE as it recently surged to this level, marking a critical inflection point that was last touched in early 2022.

Related Reading

The upper boundary of the channel, which is the focus of Martinez’s bullish forecast, is projected to climb well above $10, touching as high as $15 by late 2025. This top trendline is not just a theoretical limit but has proven to be the bull run top twice for the Dogecoin price, once in January 2018 and then in May 2021. At the last all-time high in May 2021, Doge even significantly exceeded the channel.

Martinez’s prediction highlights the spot Dogecoin ETFs as potential market catalysts. He suggests that the approval and launch of such financial products could channel fresh institutional and retail investment into DOGE, propelling it towards these higher valuations.

In trading terms, the current position of DOGE below the median line is pivotal. This price level has historically acted as a springboard for upward movement when sustained buying pressure is present. Should DOGE maintain its footing above this zone, the pathway to higher resistance levels around $1.00, and potentially the channel’s upper echelon near $15, appears technically feasible.

Related Reading

Notably, the spot Doge ETFs could hit the market as early as April, according to Bloomberg’s ETF specialist Eric Balchunas. Bitwise officially lodged the application to register a Dogecoin ETF on Wednesday.

The company submitted its proposal, named the “Bitwise Dogecoin ETF,” to the Delaware Division of Corporations, which is part of the U.S. Department of State. Although such registrations can occasionally be misleading, Balchunas confirmed via X: “Bitwise Doge ETF likely coming soon.. and yes I checked and this is def legit (vs some whack job committing forgery for a quick pump a la BlackRock XRP that one time).”

Registering in Delaware represents an initial step before advancing to a formal ETF submission with the Securities and Exchange Commission (SEC). This registration process sets up the legal structure that would manage the proposed ETF but does not constitute a direct application for SEC approval.

This initiative follows an earlier application by investment firms Rex Shares and Osprey Funds, both of which have also filed applications for multiple cryptocurrency ETFs, including one focused on Dogecoin.

At press time, DOGE traded at $0.34.

Featured image created with DALL.E, chart from TradingView.com

CryptoCurrency

DAO Governance Platform Agora Acquires Older Competitor, Boardroom

Agora, a blockchain governance startup, is set to acquire its competitor Boardroom. The company framed the acquisition as a strategic move to enhance governance within the broader Ethereum ecosystem, citing expectations of renewed growth in decentralized governance due to President Trump’s promise of regulatory clarity for the blockchain industry.

“2025 is the year we make good governance the standard for all protocols in Ethereum,” Agora co-founder Yitong Zhang told CoinDesk.

Agora was founded in 2022 by Zhang, Charlie Feng, and Kent Fenwick. The trio initially started working on governance tooling at Nouns DAO, one of the buzzier blockchain protocols to emerge from 2021’s DAO (decentralized autonomous organization) and NFT hype cycle.

The term “DAO” generally describes crypto communities that are governed by their token holders. They’re a favorite among those who believe crypto’s decentralization ethos can be a world-changing force, albeit an unwieldy way to run a pseudo-company. That’s created an opening for support projects like Agora.

Agora was founded on the premise that token governance is central to the value of crypto protocols. It aims to provide user-friendly, open-source governance tools for DAOs like Uniswap and Optimism, which both currently use Agora to organize token holders and hold governance votes.

Boardroom, which predated Agora and has similar goals, took a more horizontal approach to blockchain governance. Boardroom has gradually transitioned from an Agora-style DAO tooling software to a data feed—similar to a “Bloomberg” for crypto governance data.

Agora declined to disclose how much it paid to acquire Boardroom. Boardroom’s employees have been offered roles at Agora, and Boardroom’s founder, Kevin Nielsen, will remain as an advisor. “There’s no plan to deprecate” Boardroom, according to Zhang. Rather, the Agora team will keep both platforms running and will work with users to determine how the tools might gradually be integrated.

A new day for DAOs?

“DAO” is less of a buzzword in 2025 than it was a few years ago. They were pitched as a way to leverage blockchain’s core strengths in decentralized coordination to advance a new kind of community-owned company, but they’ve been implemented in various ways and to varying degrees of success.

Many DAOs have floundered due to organizational difficulties; it can be hard to coordinate thousands of token-holders around a single goal. Improving DAO tooling can help to address this, but it is only one side of the equation. Another barrier for DAOs has been a lack of regulatory clarity, which has left open questions of legal liability and has made it difficult for DAOs to determine how tokens should be issued, and how decisions should be divided between token holders and a platform’s core developers.

“From a business perspective, DAOs are coming back in a really, really large way,” said Zhang, who says his own business has grown “10X” over the past year. “People haven’t noticed yet because people have so much trauma over DAO bulls**t.”

The Trump administration has signaled its intention to create clearer guidelines for cryptocurrency issuance, which has led to optimism among Zhang and some of his competitors.

“I think we’re gonna finally get reasonable definitions for sufficient decentralization, security, and compliant ways of doing a token,” said Zhang.”

CryptoCurrency

Ross Is Free, But This Is Far From Over

Ross is now free. I predict this will be the one good thing to come out of this administration in the grand scheme of things. The reasons behind this pardon were purely political, but regardless of that I am incredibly happy to see Ross reunited with his family and loved ones. Even taking all the accusations against him at prima facie, both those actually charged and those not, Ross has unquestionably served his time.

Actual murders and rapists serve a tiny fraction of the sentence that was levied against Ross, even after multiple offenses in some cases. His sentencing was entirely political, and in no way proportional to the charges brought against him. The severity was so high for one reason: to set an example.

He is not the only example governments have tried to make since 2013. The Samourai Wallet team are currently under house arrest awaiting trial for hosting the backend for a 100% self-custodial service. Roman Sterlingov is in jail for running a centralized mixer, with no evidence other than flawed blockchain heuristics. The Tornado Cash case has developers dealing with cases and jail time in multiple jurisdictions.

All of these go far beyond the pale of what happened to Ross, in terms of legal standing. Ross’s sentence was insanely disproportionate, but the legal basis itself for these other cases is non-existent. They charged them anyway. Some of them, they convicted them anyways. These people are sitting in jail, just like Ross, anyways.

The government is not going to stop making examples. It doesn’t matter that Trump enjoys the benefits of the unregulated monetary extraction possible in this space, it doesn’t matter that Wall Street and D.C. see value they can take advantage of, none of that matters.

These power brokers and figure heads realizing they can set up a grift, or skim money out of the economy being built here, doesn’t change anything. It doesn’t make them fans of privacy. It doesn’t make them fans of true sovereignty for the individual. It doesn’t make them fans of actually free markets that don’t cater to corporate interests preferentially.

We need tools to actually facilitate all of these things, but building them means you are a potential target.

If you actually care about these things, you know this isn’t over. One man who was unjustly imprisoned is free, and that is an amazing thing. He can see his parents again, his wife, his friends, and that is truly a priceless accomplishment.

But this is not over. Not by a long shot. The music came on, people switched chairs, and it stopped again. But it’s still the same game being played, and we can’t lose sight of that.

CryptoCurrency

LBank Introduces Red Packet with 100 Million Giveaway to Cheer 2025

Singapore, Singapore, January 23rd, 2025, Chainwire

LBank, a leading global cryptocurrency exchange, is thrilled to announce the launch of its Red Packet alongside a 100 Million Giveaway valued at $5 Million which is set to take place from January 24 to January 27, 2025. This exciting event marks a celebration of LBank’s latest achievements and reaffirms its commitment to delivering exceptional value to its growing global user base.

The Red Packet activity comes as part of LBank’s broader push to enhance user experience. Designed to promote social sharing and community engagement, this feature allows users to send and share red packets, creating a more interactive and enjoyable experience.

To celebrate this launch, LBank is introducing a 100 Million red packet giveaway valued at $5 Million, featuring rewards in a variety of tokens. The event will run from January 24 to January 27, 2025, and is open to all LBank users.

Now serving over 15 million users globally, LBank’s position as a leading exchange has been further validated by being awarded Crypto.news’ Best CEX Award. These achievements highlight the platform’s growing presence and impact within the cryptocurrency industry.

As LBank continues to grow its ecosystem, the platform remains committed to offering a wide range of assets and services. By introducing innovative features and providing robust trading solutions, LBank seeks to strengthen its position in the cryptocurrency industry while supporting users in navigating the evolving landscape of crypto innovation.

About LBank

Founded in 2015, LBank is a leading global cryptocurrency exchange, serving over 15 million registered users in more than 210 countries and regions. With daily derivatives trading volume of more than $67 billion, LBank is committed to delivering a comprehensive and user-friendly trading experience. Through innovative trading solutions, LBank has helped users achieve average returns of over 130% on newly listed assets.

As a pioneer in the Meme coin market, LBank has listed over 240 mainstream Meme coins and 40 Meme gems, with several achieving gains of over 500%. As the industry leader in first-time Meme coin listings, LBank has become the go-to platform for Meme coin investors.

Users can follow LBank for Updates

Website: https://www.lbank.com/

Twitter: https://twitter.com/LBank_Exchange

Telegram: https://t.me/LBank_en

Instagram: https://www.instagram.com/lbank_exchange

LinkedIn: https://www.linkedin.com/company/lbank

ContactPR & Communications TeamLBankpress@lbank.com

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Bitcoiners donated $270K to fund Ross Ulbricht’s ‘personal expenses‘

The Silk Road founder’s financial status was unclear, but many crypto users have donated to his ”transition into his new life” since he received a presidential pardon.

CryptoCurrency

DWP warning: State pensioners in poverty continue to rise as thousands miss out on £3,900 annual boost

The Department for Work & Pensions has issued an urgent warning after new figures revealed the number of pensioners pushed in poverty continues to rise.

Around 800,000 of those affected are missing out on a crucial benefit which could help top up income and provide a yearly boost worth £3,900.

This morning, the DWP published figures showing that 13 per cent of pensioners are in poverty. The number of single pensioners struggling financially has increased, with 18 per cent now living in low resources, up from last year.

David Brooks, Head of Policy at leading independent financial services consultancy Broadstone, said: “Today’s data is well timed as the Work and Pensions Committee has begun its review of pensioner poverty, and the Government is expected to kick off a review of adequacy in pensions later this year.

“Understanding the causes of pensioner poverty will be key to ensuring the system is working as it should and supporting those in need.

“For example, increasing the take up of benefits that pensioners are entitled to, particularly those targeted at poorer retirees like Pension Credit, will be critical to lifting more people out of poverty in later-life.”

Around 800,000 people are missing out on Pension Credit worth an average of £3,900 per year

GETTY

The figures highlight ongoing concerns about financial hardship among the UK’s retired population, with nearly two million pensioners facing poverty.

Around 800,000 people are missing out on Pension Credit worth an average of £3,900 per year, according to the DWP. The benefit tops up weekly income to £218.15 for single pensioners and £332.95 for couples.

Those eligible can also receive additional support with housing, council tax and heating bills. Over-75s who qualify are also entitled to a free TV licence, which will cost £174.50 from April 2025.

Pensions Minister Torsten Bell said that the Government is taking action to raise awareness of the benefit. The lack of awareness about Pension Credit’s existence is believed to be the main reason for low take-up rates among eligible pensioners.

Recipients could get an extra £81.50 weekly if they have qualifying disabilities or receive certain benefits like Attendance Allowance or Personal Independence Payment.

The DWP has launched a major awareness campaign this month, writing to 11 million pensioners about Pension Credit eligibility. The letters will be sent as part of the annual state pension uprating exercise, including leaflets promoting Pension Credit.

From April, the State Pension will increase by 4.1 percent to £230.30 per week. Guaranteed Pension Credit payments will also rise, with single pensioners receiving £221.86 weekly, up from £218.15.

Couples will see their Pension Credit increase from £332.95 to £338.61 per week.

LATEST DEVELOPMENTS:

The initiative aims to boost benefit uptake, as research shows 77 percent of pensioners living in poverty currently receive neither pension credit nor housing benefits.

Pensioner poverty is particularly severe among those in rented accommodation, affecting 34 per centof pensioner renters compared to the overall 16 per cent rate.

Research from the Fabian Society shows that those who retired before April 2016 on the basic state pension face higher poverty levels.

The old pension rules made it more difficult to qualify for the full amount, while some on the new state pension also struggle due to housing costs and National Insurance gaps.

Sasjkia Otto, Fabian Society senior researcher, said: “Neither the state pension nor benefits guarantee protection from poverty, and many are falling through the cracks, especially those renting.”

The situation could worsen as the number of pensioners in rented accommodation increases, with 40 per centof all pensioners in poverty being renters.

The state pension remains “too low” according to researchers, despite previous improvements in pensioner poverty rates.

CryptoCurrency

The Legal Challenges Facing DOGE and Musk

What Is the Federal Advisory Committee Act?

FACA, established in 1972, aims to ensure that federal advisory committees operate transparently and accountably. Key requirements include:

- Balanced Representation: Committees must represent diverse viewpoints relevant to their purpose.

- Transparency: Meetings and decisions must be publicly accessible, with notices published at least 15 days prior.

- Accountability: Committees must file reports and maintain records.

These regulations are designed to prevent undue influence and promote public trust in governance.

The Lawsuits Against DOGE

Three lawsuits filed in the US District Court for the District of Columbia accuse DOGE of FACA violations:

- Public Citizen Inc. v. Trump et al

- Lentini et al v. Department of Government Efficiency et al

- American Public Health Association v. Office of Management and Budget et al

The plaintiffs argue that DOGE lacks fair representation and fails to meet FACA’s transparency requirements. Notably, these lawsuits do not include injunctions to halt DOGE’s operations, allowing it to continue functioning while the legal process unfolds.

Challenges in Enforcing Compliance

Legal experts believe enforcing compliance could be difficult for several reasons:

- Speed of Operations: DOGE’s fast-paced approach, reflective of Silicon Valley’s “move fast and break things” ethos, may outpace legal challenges.

- Executive Power: The enforcement of court rulings depends on the executive branch, led by President Trump, who has shown a willingness to bypass norms.

- Historical Precedents: Comparisons to Andrew Jackson’s defiance of the Supreme Court highlight the potential vulnerabilities in the enforcement process.

The Role of Courts in Balancing Speed and Accountability

The courts have become a critical arena for addressing these legal disputes. While the Supreme Court currently leans conservative, legal scholars argue that justices prioritize institutional trust over political loyalty. This balance could influence the outcome of challenges to DOGE and similar initiatives.

Key Issues Highlighted by FACA Violations

The lawsuits show the importance of balancing innovation with democratic accountability. DOGE’s critics emphasize that federal advisory committees must:

- Ensure diverse representation.

- Adhere to transparency standards.

- Avoid favoring private interests over public welfare.

Failure to meet these standards undermines public trust and creates legal vulnerabilities.

Table: Key FACA Requirements vs. Allegations Against DOGE

|

FACA Requirement |

Allegations Against DOGE |

|

Balanced representation |

Committee lacks diverse viewpoints, favoring tech executives. |

|

Transparent decision-making |

Insufficient public access to meetings and records. |

|

Accountability through reporting |

Inadequate compliance with filing and reporting rules. |

The Broader Implications

This case highlights the friction between rapid technological progress and the deliberate pace of government processes. While DOGE aims to streamline governance, ignoring legal frameworks could lead to long-term challenges for similar initiatives.

Legal and political systems must adapt to innovations without sacrificing democratic values. Whether DOGE can align its operations with FACA remains to be seen, but the outcome will set a precedent for future tech-driven advisory committees.

CryptoCurrency

Why “Made in USA” is the Next Big Narrative

Bitcoin and cryptocurrencies kicked off a new era with the inauguration of the first-ever pro-crypto president. The key question is whether the shift towards crypto-positive regulation and rising market activity is a sustainable one or a temporary reaction to changing political tides.

Made in USA crypto tokens have performed well this week, emerging as the most relevant narrative in the sector.

Bitcoin and crypto markets break record in market activity

Donald Trump’s election as U.S. President fueled hopes of crypto traders and firms. A pro-crypto administration supported the narrative of a new age for cryptocurrencies paved with greater certainty and higher market activity.

According to CCData’s latest exchange review report, one of the key measures of market participation hit a milestone in 2024. Aggregated spot and derivatives trade volume climbed to $75 trillion against the 2021 record of $64 trillion.

The two key catalysts were the speculation surrounding the November 2024 election and the Bitcoin bull run, at the end of 2024. Both November and December were record breaking months for crypto with $10.51 trillion and $11.31 trillion in monthly volumes.

Stablecoin market capitalization helps identify market activity, participation and onboarding of new users within the ecosystem. Stablecoins act as fiat on and off ramp for new traders and beginners in crypto, therefore representing market participation and adoption. Data from DeFi tracker DeFiLlama shows a large spike in stablecoin market capitalization on President Trump’s inauguration day.

Market cap crossed $210 billion and observed a year-to-date increase of 3.3% as liquidity and trade volume across centralized and decentralized exchanges spiked. A massive influx of capital from traders supported the spike.

As of Thursday, January 23, stablecoin market capitalization is $214.407 billion, as seen in the DeFiLlama chart below.

Crypto traders are optimistic on made in USA tokens

President Donald Trump’s statement that he wanted all remaining Bitcoin to be “made in the USA” led to the rise of a new crypto narrative, the made-in-USA tokens. CoinMarketCap and CoinGecko have launched a category of tokens under “made in USA.”

XRP (XRP), Solana (SOL), Cardano (ADA), Chainlink (LINK) and Avalanche (AVAX) are the top five altcoins in the list, and the category’s market capitalization exceeds $541 billion.

CCData report states that the basket of crypto tokens in this category has outperformed the remainder of the market. The coins are up 360% since the election, as traders anticipate a positive regulatory environment and more favorable conditions for the tokens made in the states.

The narrative depends on policy and actions of the CFTC and the SEC, and whether President Trump delivers a strategic Bitcoin reserve during his time in office. Four-year crypto market cycle could see a shift and stray from historical trends.

Made in USA vs. China coins narrative

In 2024, the China coins narrative trended on X and other social media platforms as traders flocked to buy cryptocurrencies made in China, like Neo (NEO), VeChain (VET), Huobi (HTX), Filecoin (FIL), Qtum (QTUM), and Ontology (ONT), among others.

With the shifting tides in politics and regulation, the made-in-USA narrative has the potential to compete with Chinese coins. President Trump appointed SEC Commissioner Hester Peirce as head of a new “crypto task force” to provide clarity and support to the industry. There is an expectation that the new task force will support gains for made-in-USA tokens.

Bitcoin traders could gain from these 5 tokens

Solana, XRP, Sui (SUI), Aptos (APT) and Injective (INJ) could rally in the coming weeks, building on the made in USA narrative. Solana was conceptualized in California and is popular for its fast transactions and scalability.

The issuance of President Trump and First Lady Melania’s meme coins on the Solana blockchain has contributed to the rising activity on the chain.

Crypto firm Ripple was fined $125 million for violation of securities laws in its institutional sales of XRP, both sides (SEC and Ripple) appealed the ruling and the SEC has argued that XRP’s institutional and secondary market sales should be treated in a similar manner.

While XRP traders await an outcome in the appeals process, XRP holds steady above $3, after hitting a new all-time high in January 2025.

SUI and APT are US-backed Layer 1 tokens that enable higher scalability and faster transactions for traders while deriving security from the Ethereum base chain.

INJ is a DeFi token with a focus on innovation and AI, the project is made in the USA and could benefit from the DeFAI narrative.

On-chain analysis of top 5 made-in-USA tokens

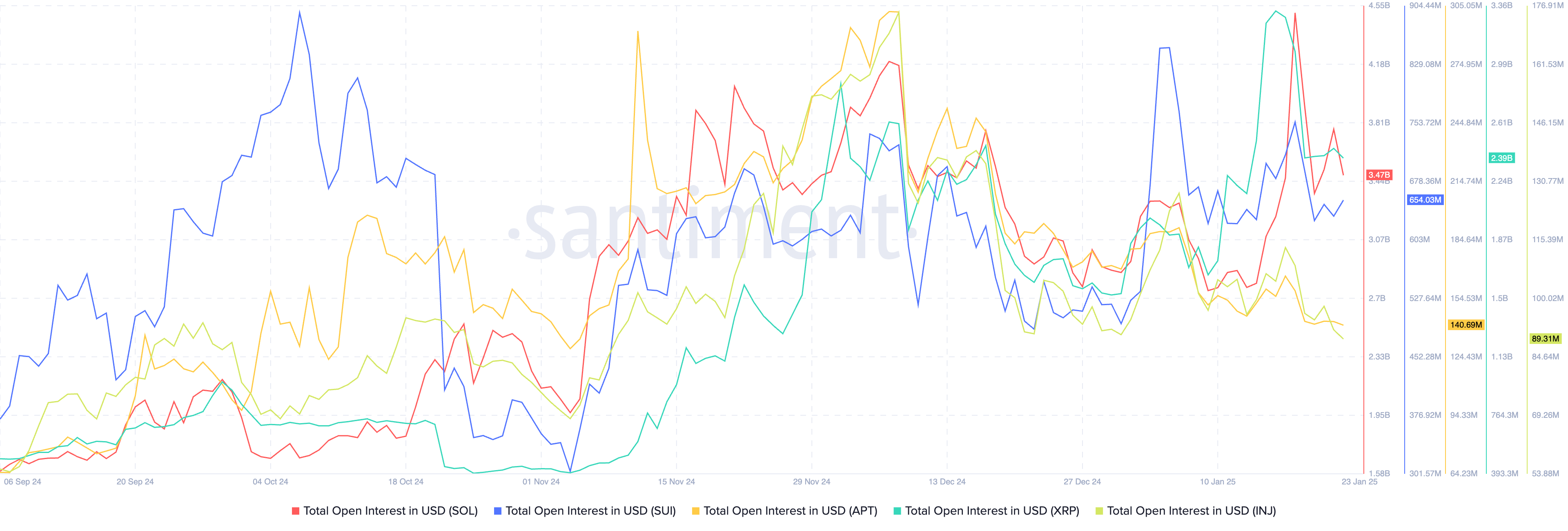

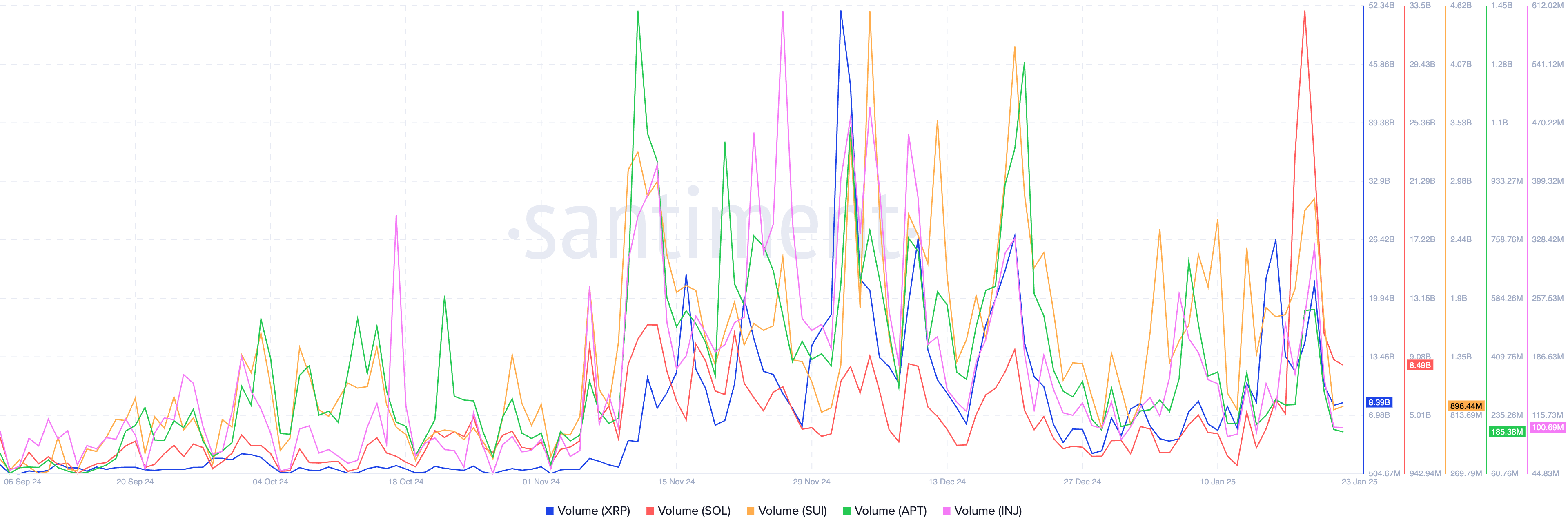

Santiment data shows that the total open interest in USD in the top 5 made in USA tokens noted considerable spikes in January, closer to the inauguration. Even as OI drops from its highest level in assets, it is above the 2024 average, supporting a bullish thesis for the tokens.

Similarly, volume in the top 5 made in USA tokens recorded a spike earlier in January, since then volume remains above the average levels.

Solana is holding on to double-digit gains for the last seven days while other cryptocurrencies in the top 5 struggle, alongside Bitcoin, on Thursday.

Ruslan Lienkha, chief of markets at YouHodler told Crypto.news:

“We may see an accelerated pace of cryptocurrency ETF approvals. However, the more significant development lies in the potential establishment of a comprehensive legal framework for the cryptocurrency industry in the U.S. This could lead to the full recognition of cryptocurrencies as a distinct asset class. Previously, attempts were made to classify cryptocurrencies under existing asset categories, such as securities or commodities, which did not fully capture their unique characteristics.”

Tim Ogilvie, Global head of institutional at Kraken, said that:

“Bitcoin’s bullish momentum still has room to grow, as indicated by the relative strength index (RSI), which currently sits at 65. Generally, an RSI above 70 is considered overbought.

Solana (SOL) hit an all-time high of $260 this week. However, technical analysis suggests that it is now in overbought territory, with an RSI around 75. While there may still be bullish momentum, this could also signal caution for short-term traders. They will be watching to see if SOL can close above $260 to confirm renewed bullish momentum.”

In the Crypto Regulatory Affairs newsletter, experts at Elliptic said:

“On January 20, US President Donald Trump was sworn into office for his second term in office, a moment the cryptoasset industry has been awaiting with high expectations. Prior to his inauguration, recent news reports had indicated that President Trump – who campaigned on a promise to make the US a leader in cryptoasset innovation – planned to issue executive orders upon taking office that would declare crypto to be a national strategic priority, appoint a crypto czar and establish a crypto council to effect policy changes, and repeal a controversial accounting rule on crypto established by the Securities and Exchange Commission (SEC), known as Staff Accounting Bulletin (SAB) 121.

However, in his first twenty four hours in office, President Trump did not sign any executive order pertaining to crypto.”

Crypto traders and experts maintain optimism of positive action within the first 100 days of Trump’s return to office.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login