CryptoCurrency

Binance Takes Lead In Institutional Surge, Sui Hosts First Ever P2E Game, As New ERC-20 Altcoin Brings DeFi To Masses

With the breakout to an all-time high, Binance (BNB) has attracted buyers, while the broader market is facing weakness. A follow-through in BNB can take the price to a fresh high in uncharted territory. Sui blockchain recently hosted its first Play-to-Earn (P2E) game, Kage, developed by Chirp, an IoT-focused decentralized platform. This launch highlights Sui’s role as a fast and secure blockchain for innovative Web3 applications.

Meanwhile, Cutoshi, an ERC-20 token, is bridging the gap between conventional and digital finance and bringing it to the masses with the advanced platform. Cutoshi is not only a memecoin, bringing various utilities that solidifies its position in the market.

Binance Retest Breakout Zone: Will It Continue The Momentum?

Binance recently broke out of the multi-year resistance it has been facing since 2021. In June this year, it attempted another breakout; however, sellers took control immediately after the breakout. BNB was also lagging in this bull market but has now given a strong breakout associated with strong volume. On Tuesday, BNB took out the $700 psychological zone, increasing nearly 15% intraday.

On Friday, Binance retested the breakout level and saw demand picking up from the breakout level. This is a clear sign of strength in Binance, indicating that momentum could soon increase. BNB is currently the sixth-largest cryptocurrency, with a market cap of $108.38 billion, according to CoinMarketCap. It ranks just behind USDT and Solana.

In November, reports revealed that sandwich attacks targeted 35.5% of the BNB Chain’s blocks, according to Decrypt. These attacks manipulate markets by exploiting decentralized exchange systems, highlighting security concerns on the BNB Chain. Despite the rise in sandwich bot activity, BNB’s price showed little to no impact.

Sui Blockchain Unveils Revolutionary DePIN Play-to-Earn Game

The Sui blockchain has launched its first Decentralized Physical Infrastructure Network (DePIN) Play-to-Earn (P2E) game, bringing a fresh perspective to decentralized gaming. This groundbreaking game blends blockchain technology with physical infrastructure, allowing players to earn rewards by supporting decentralized networks.

Using Sui’s advanced features, the game connects real-world physical infrastructure with its ecosystem. Players can earn rewards through gaming and completing tasks that help operate and maintain decentralized networks. This adds a practical, real-world utility to P2E gaming while enhancing the in-game experience.

Cutoshi: The Most Promising Crypto For Bull Run

Cutoshi is making waves in the crypto world by blending the fun of meme coins with the innovation of DeFi. Inspired by the cultural charm of the Chinese Lucky Cat and Satoshi Nakamoto’s visionary ideas, Cutoshi has built an ecosystem focused on security, privacy, and user engagement.

The platform offers a unique exchange that allows users to swap crypto assets across multiple blockchains, solving key interoperability issues. It also introduces a farming protocol where community members can complete quests and earn rewards, making the experience interactive and engaging—far beyond what typical meme coins offer.

The Cutoshi Learning Academy provides educational resources on DeFi and cryptocurrency for new investors, empowering them to navigate their journey toward financial freedom. CutoshiAcademy delivers tools and lessons on everything from basic crypto concepts to advanced trading strategies to bridge the gap between beginners and seasoned traders. This initiative aims to boost cryptocurrency adoption and bring it closer to the mainstream.

Cutoshi’s presale has already raised over $1.3 million, offering its CUTO token at just $0.031. With its limited supply and ambitious vision, this project is shaping up to be the next big thing, mirroring the success of BNB and PEPE.

For more information on the Cutoshi (CUTO) Presale:

Join and become a community member:

https://twitter.com/CutoshiToken

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

SEC Withdraws Controversial Crypto Tax Accounting Bulletin

The U.S. Securities and Exchange Commission published a new Staff Accounting Bulletin Thursday withdrawing its controversial SAB 121.

SAB 121 directed banks and other public companies that they had to mark any customers’ crypto assets on their own balance sheets. SAB 122 “rescinds the interpretive guidance” and instead directs firms to use Financial Accounting Standards Board rules or International Accounting Standard provisions.

CryptoCurrency

ADA and XRP Backers Bet Big on Remittix: The Future of Global Crypto Transactions

The crypto market is full of new opportunities, especially with the ongoing bull run set for another massive pump. As the bull run hits up, Cardano and Ripple investors have spotted a new cryptocurrency, Remittix, that is poised to offer explosive gains in the 2025 bull run.

With innovative blockchain-powered solutions for cross-border payments, Remittix (RTX) is gently transforming the financial scene. Many analysts consider it the best crypto to buy now for huge gains.

Cardano Faces Market Volatility

After a period of strong performance, Cardano has experienced a significant decline, falling by 1.9% in the last seven days. Macroeconomic issues including inflation worries driven on by better-than-expected U.S. employment data mostly drove the slide. With $1.16 billion in open interest, which points to investor optimism, Cardano is still a major participant in the cryptocurrency market even with the ADA price decline.

Future events, particularly the expected crypto tax changes of the next U.S. government, are fueling hopes for a future comeback. Analysts believe that if ADA price maintains support at $0.90, it may shortly rise even more.

Cardano’s durability shows its ability to resist market volatility, therefore stressing the significance of diversification. As they negotiate this storm, many ADA holders are seeking fresh options like Remittix to improve their portfolios.

Analysts See A Decline On Ripple Despite Bullish Sentiment

Currently trading at $3.16, Ripple’s XRP has increased by 12.5% over the past seven days. Experts credit numerous factors for the current increase.

One is the recent introduction of Ripple USD (RLUSD), a stablecoin connected to the US dollar. This stablecoin could increase XRP’s utility and attract more users to the Ripple ecosystem.

Consequently, crypto researcher Javon Marks sees Ripple’s XRP rising to $16.50 with gains of over 7,200%, possibly propelling prices as high as $168. This makes Ripple’s XRP one of the the top altcoins to buy in the DeFi rally. Despite this, XRP holders are eyeing a new gem, Remittix, that is poised for a huge price move in the coming bull run.

Remittix Set For a Massive Surge

From their 2017 worth of roughly $150 trillion to $250 trillion by 2027, cross-border payments under creative swap-in exchange are estimated to have grown significantly. By fusing the strength of blockchain technology with conventional banking systems, Remittix is gaining market share in this enormous industry and developing a smooth and effective solution for international transactions.

Remittix allows customers to exchange more than 40 cryptocurrencies into fiat money swiftly. Then, these monies may be sent straight to any bank account worldwide. Remittixstands out for its simplicity. Recipients receive a usual bank transfer, unaware that it began as a cryptocurrency payment. Thanks to its innovative features, users can handle their funds with total autonomy and flexibility.

The platform targets prominent rivals such as Coinbase, Wise and Stripe. However, unlike these traditional competitors, Remittix has the unique capability of sending money via cryptocurrency, converting it, and depositing it immediately into a bank account.

Businesses may now accept cryptocurrency payments from clients and process fiat transactions to a specified bank account thanks to Remittix’s Pay API. Companies may also set up merchant accounts, which give them complete control over how they pay out their cryptocurrency and provide them access to more than 50 cryptocurrency pairings and more than 30 fiat currencies.

Remittix (RTX) is seeing a sharp increase in investor interest. The enthusiasm is evident with tokens priced at only $0.0282 and over $5.3 million raised in the $RTX presale. Experts in the market predict a stunning 5,000% increase after launch and an 800% jump before the conclusion of the presale. With Remittix at the forefront, now is the perfect time to explore the possibilities of cross-border payments.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Elizabeth Warren proposes Elon Musk pay more taxes for gov’t efficiency

Senator Elizabeth Warren urged DOGE Chair Elon Musk to cut wasteful spending, proposing full IRS funding and closing the carried interest loophole.

CryptoCurrency

Made in USA altcoins like XRP and Solana poised for growth under Trump’s shadow

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Donald Trump’s return ignites a crypto bull run, with meme coin XYZ set for a 99,900% surge, surpassing past performers.

Trump’s inauguration sparks crypto surge: XYZ meme coin set for 99,900% growth

Donald Trump’s return to the political spotlight has sent shockwaves through the crypto market, paving the way for an unprecedented bull run. While established coins scrape by with modest gains, meme coins are stealing the limelight with jaw-dropping potential.

Recent performers like PNUT with its 4,500% climb and FRED’s 6,000% explosion have faded into memory, unable to sustain their momentum. But the crypto world thrives on evolution, and a new contender has entered the arena, ready to redefine profit potential. Meet XYZ, the meme coin phenomenon set to obliterate records with a meteoric 99,900% surge.

XYZ: The new king of meme coins

XYZ isn’t just another meme coin — it’s a game-changer for sports and crypto enthusiasts. Built for true competitors, XYZ is the ultimate token for those who live for the thrill of winning.

As Trump reshapes the market dynamics, XYZ steps into the ring as the coin for fearless investors. With its sports-driven identity and relentless growth, XYZ is here to dominate, leaving weaker tokens in the dust.

Presale gains signal monumental potential

The XYZ presale is already a roaring success:

- Launch Price: $0.0001

- Current Price: $0.002 (+2,000% increase)

- Next Stage: $0.0025 (+25%)

- Final Goal: $0.1

With a planned 99,900% growth trajectory, XYZ is destined to become the crown jewel of meme coins.

Why XYZ is different

Fueled by the competitive spirit of sports and a commitment to game-changing gains, XYZ offers investors a chance to ride the next crypto tidal wave. The token embodies strength, ambition, and the pursuit of excellence, making it the ideal asset for bold traders who thrive on action.

Don’t miss out

The XYZ presale is moving fast, with early adopters already seeing exponential returns. Secure your position now and be part of the next crypto success story.

XRP

Over the past six months, XRP has surged by 425.54%. In the last month alone, it grew by 43.19%, and this past week, it climbed another 18.19%. These impressive gains have placed XRP in a current price range between $2.39 and $3.46.

The consistent upward trend suggests that XRP’s price may continue to rise. The simple moving averages over 10 and 100 days are closely aligned at around $3.17 and $3.16, indicating a stable growth pattern. The Relative Strength Index is at 47.93, which is near neutral, suggesting there’s room for further upward movement before reaching overbought levels.

Looking ahead, the nearest resistance level is at $3.97. Breaking through this could see XRP aiming for the second resistance level at $5.03, potentially yielding an increase of about 45%. On the downside, the nearest support level is at $1.83. If the price dips to this point, it would represent a decrease of roughly 23%. Traders will be watching these levels closely as XRP continues its dynamic performance.

Solana

Solana (SOL) has seen impressive gains recently. In the past week, its price jumped by 35.68%. Over the last month, it increased by 41.10%, and in the past six months, it grew by 48.00%. This consistent upward trend shows strong interest from investors.

Currently, SOL is trading between $182.53 and $308.44. The nearest resistance level is at $364.82. If the price moves above this point, it could aim for the next resistance at $490. The nearest support level is at $113. If the price drops below this, it might see further declines.

Technical indicators suggest potential for growth. The 10-day simple moving average is $254.24, slightly higher than the 100-day average of $252.18. This indicates short-term bullish momentum. The Relative Strength Index (RSI) is at 56.03, suggesting the price is in a stable zone. The MACD level is positive at 2.935, supporting a possible upward movement. Based on this data, Solana’s price may continue to rise, possibly breaking through current resistance levels.

Cardano

Cardano’s ADA token has been on a notable journey lately. In the past week, its price dipped by a modest 1.50%, settling within a range of $0.86 to $1.15. Zooming out, the picture brightens: over the past month, ADA’s price has climbed by 11.45%, and over the last six months, it has surged an impressive 148.86%. This growth reflects a strong upward trend in the medium term.

Technical indicators paint an interesting scenario. The Relative Strength Index (RSI) sits at 40.23, inching toward the oversold threshold, which could suggest an upcoming bullish reversal. The Simple Moving Averages over 10 and 100 days are close, at $1.00 and $1.04 respectively, indicating that the current price is hovering around these averages. Additionally, the Stochastic oscillator is low at 11.70, and the MACD level is slightly negative at -0.00345, both hinting at potential upward momentum if buying interest increases.

Looking ahead, the nearest resistance level for ADA is at $1.30. Breaking through this point could open the path toward the second resistance at $1.59, representing possible gains of around 13% to 38% from current prices. On the flip side, the first support level is at $0.72, with a deeper support at $0.43. Investors are watching these levels closely, as holding above support may sustain confidence, while surpassing resistance could signal further growth. The coming weeks will reveal whether ADA can capitalize on this setup amid the dynamic crypto market.

Chainlink

Chainlink (LINK) has been on a noteworthy upward trajectory recently. In the past week, its price surged by 25.67%, while over the last month, it climbed 15.99%. Even more impressively, LINK’s price has nearly doubled in the past six months with a 97.88% increase. This consistent growth suggests a strong market interest and potential for continued expansion.

Currently trading between $19.23 and $28.02, LINK is approaching its nearest resistance level at $31.74. If it breaks through this point, the next target could be the second resistance level at $40.52, marking a significant gain from current prices. On the downside, the nearest support level is at $14.16, providing a cushion against potential price drops.

Technical indicators provide additional insight. The Relative Strength Index (RSI) stands at 45.24, indicating that LINK is neither overbought nor oversold. The 10-day Simple Moving Average (SMA) is $26.28, slightly above the 100-day SMA of $24.90, suggesting a modest short-term upward trend. The MACD level is positive at 0.1368, hinting at bullish momentum. However, the Stochastic value is low at 6.5768, which could imply that the coin is oversold and may be poised for a rebound. Considering these factors, LINK’s price may continue to rise, but traders should watch the resistance and support levels closely.

Conclusion

Altcoins like XRP, SOL, ADA, and LINK show promise, but XYZVerse stands out as a pioneering sports meme coin with massive growth potential and a unique, community-driven ecosystem.

To learn more about XYZVerse, visit their website, Telegram, or X.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Frax Finance Targets ‘Made in USA’ DeFi Ecosystem with Investment in Trump-Affiliated WLFI

Frax Finance has proposed a $5 million investment in WLFI – the native token of World Liberty Financial (WLFI), a decentralized finance (DeFi) platform tied to US President Donald Trump. The main objective behind this move is to position itself as a leading player in the “Made in USA” DeFi ecosystem.

The proposal, which was presented for community feedback, also includes an additional $5 million follow-on investment subject to the partnership’s success. This makes a potential total commitment of $10 million.

Fuels Frax Finance’s Bet on WLFI

Frax Finance claims that World Liberty Financial (WLFI), which is built on Aave, is well-positioned to benefit from the Trump administration’s pro-crypto stance. WLFI is described as a key project aimed at introducing millions of Americans to DeFi, focusing on US-based initiatives and partnerships with companies like Chainlink and Ethena Labs. With $70 million invested in prominent DeFi assets such as Ethereum (ETH), Wrapped Bitcoin (WBTC), and Chainlink (LINK), WLFI has established a notable presence in the sector in a very short duration.

In addition to Frax Finance’s strategic alignment with WLFI to strengthen its status as a premier US-origin stablecoin, the decentralized stablecoin protocol is also co-founded by Stephen Moore, who happens to be a former economic advisor to President Trump.

By integrating FRAX’s frxUSD stablecoin as collateral within WLFI’s platform, Frax said that the focus is also on expanding its distribution, gaining access to millions of potential users, as well as influencing key governance decisions within the WLFI framework.

With WLFI’s valuation already surging from $1.5 billion to $5 billion, the investment offers potential for significant appreciation, particularly if WLFI succeeds in its mission to drive mass DeFi adoption under the Trump administration’s pro-crypto stance.

Justin Sun Deepens Ties with WLFI

Trump unveiled World Liberty Financial in September last year to simplify access to financial services by removing intermediaries. Despite a rocky start, the project’s cumulative sales soared to $300 million by January 23, according to data compiled by Dune Analytics.

This week, Tron founder Justin Sun announced increasing TRON DAO’s stake with an additional $45 million investment, bringing the total to $75 million. Previously, Sun made a $30 million token purchase in November last year which made him the biggest stakeholder in the platform. WLFI later confirmed his appointment as an adviser the next day.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Bitcoin Price Likely To Fluctuate Between $100,000 And $110,000 Until FOMC Meeting, Says Analyst

After a flash crash to $89,256 earlier this month, Bitcoin (BTC) made a swift recovery, reaching a new all-time high (ATH) of $108,786 on January 20. However, according to a crypto analyst, further upside could be limited until the Federal Open Market Committee (FOMC) meeting later this month.

Bitcoin To Remain Range-Bound Until FOMC Meeting

The world’s largest cryptocurrency has been on a bullish trajectory since November, fueled by Donald Trump’s victory in the US presidential election. Over the past three months, BTC has surged from approximately $67,000 to $104,536 at the time of writing, posting gains of over 50%.

Related Reading

However, crypto analyst Krillin predicts that BTC may continue to “chop” in the $100,000 to $110,000 range until the FOMC meeting. The analyst suggests that unless the Bank of Japan takes extraordinary policy measures, BTC is unlikely to break out of this range before the end of the month.

At present, the CME FedWatch tool indicates a 99.5% probability that the US Federal Reserve (Fed) will not cut interest rates at the upcoming meeting. Krillin expects a market dump to follow the anticipated hawkish meeting, which may be partially offset by a dovish-sounding press conference hinting at future quantitative easing (QE).

For the uninitiated, QE is a monetary policy where central banks inject money into the economy by purchasing government bonds and other financial assets to lower interest rates and stimulate economic activity. This increased money supply can weaken fiat currencies, potentially driving investors toward assets like BTC, boosting its price as a hedge against inflation and currency devaluation.

Krillin’s prediction aligns with a recent market observation which states that BTC profit-taking has declined by 93% from its December peak, and that the long-term holders are back in accumulation mode, preparing for the next leg up. However, how long the current consolidation phase may last is anyone’s guess.

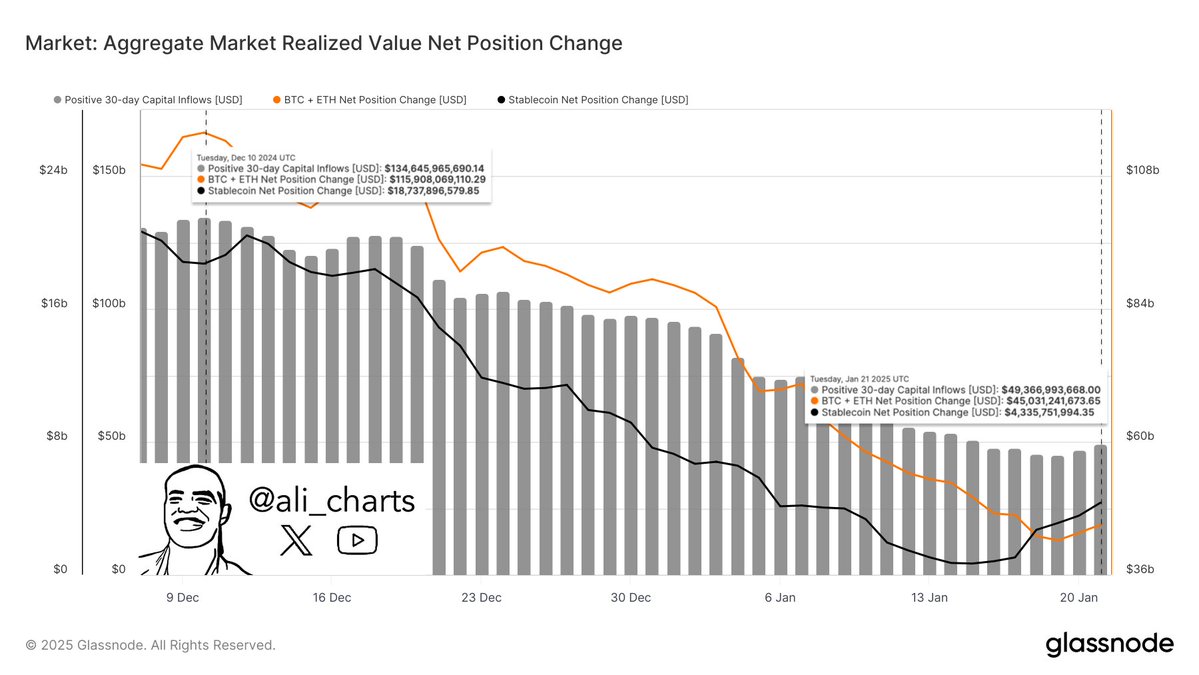

Meanwhile, crypto analyst Ali Martinez notes a sharp decline in capital inflows into the digital assets market, from $134 billion on December 10 to $43.37 billion. This low liquidity could result in sharp price swings, increasing the risk of liquidations for leverage traders.

Will BTC Peak In Q2 2025?

As BTC awaits the FOMC meeting to determine its next price trend, some analysts remain optimistic that the cryptocurrency could hit its market cycle peak in Q2 2025 as more institutions embrace the asset under favourable regulations.

Related Reading

For example, crypto analyst Dave The Wave recently predicted that BTC will likely peak in the summer of 2025. A report by Bitfinex supports this outlook, forecasting that Bitcoin could surge to $200,000 by mid-2025, albeit with minor corrections along the way.

That said, Bitcoin must defend the $100,000 price level, as failure to do so could see the asset drop to as low as $97,500. At press time, BTC trades at $104,536, up 1.4% in the past 24 hours.

Featured image from Unsplash, Charts from X and TradingView.com

CryptoCurrency

Crypto Critic Elizabeth Warren Probes Trump’s Meme Coin Venture ($TRUMP)

Senator Elizabeth Warren is calling foul on President Donald Trump’s meme coin, pressing for the U.S. Office of Government Ethics and financial regulatory agencies to dig into the ethical and regulatory details around the $TRUMP token.

Warren, who is the top Democrat on the Senate Banking Committee that oversees U.S. financial regulators, says the assets, including First Lady Melania Trump’s own eponymous meme coin, pose conflict-of-interest hazards for the president and highlight the most destructive and volatile corner of the crypto sector.

“Nearly overnight, President Trump and his wife’s net worth skyrocketed to $58 billion,” Warren wrote in the letter alongside Representative Jake Auchincloss, a fellow Massachusetts Democrat who serves on the House Energy and Commerce Committee. “Anyone, including the leaders of hostile nations, can covertly buy these coins, raising the specter of uninhibited and untraceable foreign influence over the President of the United States, all while President Trump’s supporters are left to shoulder the risk of investing in $TRUMP and $MELANIA.”

Launched the Friday before his inauguration this week, Trump’s token — for which his company retains some 80% of the coins in circulation — rose rapidly from about $3 last week to almost $37 on Thursday. It’s opened a possibility for Trump to make “extraordinary profits off his presidency,” the lawmakers noted.

The letter was sent to the Treasury Department, Securities and Exchange Commission and the Commodity Futures Trading Commission — each of which now has a new Trump pick at the helm. Warren and Auchincloss raised the point that Trump is in charge of appointing the permanent heads of these regulatory agencies that will make decisions affecting the future of his crypto tokens.

None of the three federal agencies immediately responded to CoinDesk’s requests for comment on the letter, or whether they’re reviewing the tokens in any other capacity.

“$TRUMP and $MELANIA present grave risks to President Trump’s ability to impartially govern our nation — and to investors in these coins, who may be made victims of a rug pull scheme orchestrated by the Trump family,” Warren’s letter concluded.

The lawmakers join other Democrats who have similarly raised concerns about Trump issuing these assets right before taking office. Representative Gerry Connolly, the top Democrat on the House Oversight Committee, called for an investigation in a letter sent to his committee’s Republican chairman one day into Trump’s new term, additionally raising issues with World Liberty Financial and its ties to Tron blockchain founder Justin Sun. And Representative Maxine Waters, the ranking Democrat on the House Financial Services Committee, also shared her alarm about Trump’s coin.

Read More: House Dems Warn of Corruption in Trump’s Crypto Business Moves

CryptoCurrency

President Trump Signs Executive Order To Ban Central Bank Digital Currencies (CBDC)

Today, U.S. President Donald Trump signed an executive order (EO) related to Bitcoin and cryptocurrency, titled “Strengthening American Leadership In Digital Financial Technology”. This EO officially banned the creation and issuance of a central bank digital currency (CBDC) in the United States, defining a CBDC as “a form of digital money or monetary value, denominated in the national unit of account, that is a direct liability of the central bank.”

“Except to the extent required by law, agencies are hereby prohibited from undertaking any action to establish, issue, or promote CBDCs within the jurisdiction of the United States or abroad,” the order announced. “Except to the extent required by law, any ongoing plans or initiatives at any agency related to the creation of a CBDC within the jurisdiction of the United States shall be immediately terminated, and no further actions may be taken to develop or implement such plans or initiatives.”

The new EO will also establish a presidential working group to create a federal regulatory framework governing digital assets (including stablecoins), and evaluate the creation of a strategic national digital assets stockpile.

“The Working Group’s report shall consider provisions for market structure, oversight, consumer protection, and risk management,” stated the order. “The Working Group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.”

The EO defines the term “digital asset” as any digital representation of value that is recorded on a distributed ledger — which would include cryptocurrencies such as bitcoin, digital tokens, and stablecoins.

The stockpile is expected to include or be fully in bitcoin. Last summer at The Bitcoin 2024 Conference in Nashville, Donald Trump pledged to create a national strategic bitcoin stockpile using the bitcoin already held by the government obtained from hacks and seizures. According to Arkham Intelligence data, the U.S. currently holds 198,109 bitcoin worth over $20.1 billion.

BREAKING: 🇺🇸 DONALD TRUMP PLEDGES TO NEVER SELL #BITCOIN AND HOLD IT AS A STRATEGIC RESERVE ASSET IF ELECTED PRESIDENT pic.twitter.com/bbPRxlZfGZ

— Bitcoin Magazine (@BitcoinMagazine) July 27, 2024

Following Trump’s speech at the conference, U.S. Senator Cynthia Lummis presented legislation to also create a Strategic Bitcoin Reserve, but in a different manner. Her bill would see the U.S. government purchase 200,000 bitcoin per year, for 5 years, until it has bought a total of 1,000,000 BTC. This legislation, however, would have to pass through both the House of Representatives and the Senate before making its way to the president’s desk for final approval.

So far, President Trump has kept his word on the Bitcoin related promises he made on the campaign trail. Earlier this week, President Trump gave a full and unconditional pardon to Bitcoin pioneer and Silk Road founder Ross Ulbricht, which Trump pledged to accomplish in addition to creating a Strategic Bitcoin Reserve, banning CBDC, creating a working group/advisory council, and more.

The full details of the executive order can be found here.

CryptoCurrency

Why Are Litecoin Investors Turning To New Viral PayFi Altcoin Remittix Over Shiba Inu In 2025

There have been significant losses for Litecoin and Shiba Inu in the last 24 hours as many holders look to new projects hoping for better returns. Among these is Remittix (RTX), a PayFi project that raised over $5.2 million in its presale in just a few weeks. The project tackles problems that have been plaguing the global payments sector for many years now, offering a modern alternative. This is a market worth $190 trillion and Remittix could grab a big slice. So how will Shiba Inu (SHIB), Litecoin (LTC) and Remittix (RTX) fare in Q1 of 2025?

Shiba Inu (SHIB) Plummets 7% Overnight

Shiba Inu has kept its holders guessing with major fluctuations through most of January so far. In just 24 hours, Shiba Inu (SHIB) has plummeted by 7.3%, putting Shiba Inu at a value of $0.00002026, dipping to 0.00002040 earlier today. The MACD still signals a slight bullish crossover despite the asset’s losses, so some upward movement or at least some consolidation could be coming soon. On-chain activity too is up, with active addresses up 15% last week, which is at least a sign of healthy network engagement for Shiba Inu (SHIB).

Litecoin (LTC) Sees 24 Hour Dip After Strong Weekly Gain

Litecoin (LTC) too has been facing fluctuations. The asset had a strong week, with a net gain of 15.81%, but it has hurtled down in the last 24 hours, losing 4.06% of its value. Litecoin (LTC) is now trading around the $120 mark, climbing as high as $128.23 earlier today before dipping to $114.44. Litecoin’s RSI is at 62, which means it’s creeping toward overbought territory, but there’s still room for growth. On the contrary, Litecoin’s MACD shows some solid bullish momentum, lining up with the recent price jumps. Looking ahead, Litecoin’s big play for 2025 is getting a U.S.-based ETF approved, and if that happens, it could be a game-changer.

Remittix Switches Things Up in the Global Payments Space

With Remittix, users can convert over 40 cryptocurrencies into fiat and transfer money to any global bank account. By removing hidden fees and implementing transparent flat-rate pricing, Remittix tackles common frustrations associated with traditional international payments. Its rapid transaction processing positions it as a cost-effective and efficient alternative to existing solutions.

The entire process is simple. Users can send funds to any global bank account, with transactions typically completed in under 24 hours. For those weary of navigating complex banking systems, Remittix offers a straightforward yet powerful alternative.

Businesses can also derive great benefit from Remittix, particularly through the Remittix Pay API. This powerful piece of tech enables businesses to receive cryptocurrency payments and settle them in fiat currency. Eliminating digital asset management headaches, the platform supports more than 30 fiat currencies and 50 cryptocurrency pairs, enabling smooth financial operations across regions. Freelancers and merchants with global clients will find this function particularly useful to simplify payments and cut costs.

Recognizing the need for user independence, Remittix ensures that recipients do not know that payments were sent via its platform or that the transactions originated in cryptocurrency.

Remittix Storms Through Presale, Surpassing $5.2 Million

So far, Remittix has raised $5.2 million during its presale, which continues to gain traction. With a focus on privacy, efficiency, and user autonomy, Remittix is positioned to disrupt the $190 trillion cross-border payments market. Some analysts predict significant gains for Remittix (RTX), with forecasts of an 800% price surge during the presale and a potential 5,000% rally post-launch, as the project prepares to lead the PayFi sector.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Bitcoin drops after Trump signs executive order on crypto and ‘national digital asset stockpile’

Bitcoin price falls after President Trump signs an executive order creating a working body for researching and designing a “national digital asset stockpile.”

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login