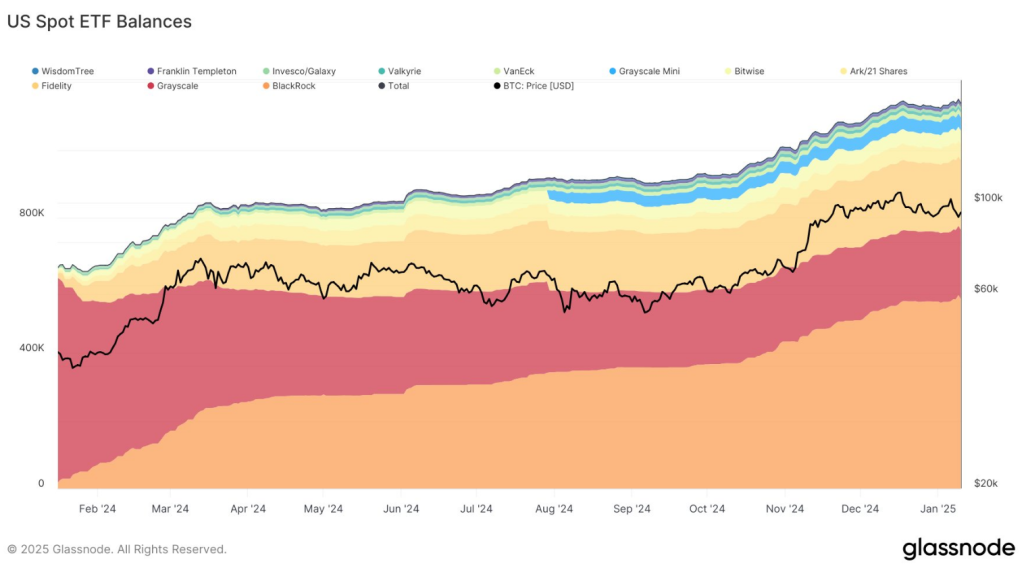

Demand for US Bitcoin ETFs has significantly increased as we enter 2025, signifying a notable reversal following a lackluster start to the year.

Related Reading

Based on recent figures from Glassnode, net inflows for the week ending January 6 amounted to 17,567 BTC, equivalent to around $1.7 billion.

This increase surpasses the weekly average inflows of 15,900 BTC documented in the final quarter of 2024 and indicates a resurgence of investor enthusiasm.

A Turbulent Journey Of Inflows

Inflows into Bitcoin ETFs have shown an erratic pattern. These inflows showed notable fluctuations in late 2024. In September, there was a significant decline as Bitcoin prices dropped below $64,000, leading to large withdrawals.

Nevertheless, things began to change by October. Inflows increased dramatically; in few weeks, they topped 24,000 BTC. With the average weekly inflow settling at around 15,900 BTC, the increase continued into November and December, demonstrating the high demand for Bitcoin investments.

After a slow start to the year, demand for US spot #Bitcoin ETFs has normalized. In the week of January 6, inflows reached 17,567 #BTC ($1.7B), which is slightly higher than the weekly average of 15.9K $BTC ($1.35B) from October to December 2024: https://t.co/0Cpfm8lpak pic.twitter.com/u4FksOSLuZ

— glassnode (@glassnode) January 13, 2025

As the price of Bitcoin increased, so did ETF inflows. In December 2024, the most popular digital asset in the world reached a record-breaking high of $108,135.

This association suggests that as more people switched to exchange-traded funds, investors’ confidence in Bitcoin’s worth grew, leading to a positive market sentiment.

Bitcoin ETFs: Who Possesses The Most?

The total holdings of US spot Bitcoin ETFs as of early January 2025 are approximately 1.13 million BTC. Grayscale has 204,300 BTC, Fidelity holds 205,488 BTC, and BlackRock has 559,673 BTC, making it the largest holding.

In 2024, BlackRock’s Bitcoin ETF (IBIT) garnered attention by accumulating $37.25 billion in assets during its inaugural year, securing the third position on the Top 20 ETF Leaderboard for that year. This significant surge highlights the rising institutional demand for cryptocurrency-backed financial solutions.

Will 2025 Be A Good Year For ETFs?

Bitcoin ETFs look like they will do well in 2025. Experts in the field think that this year there may be a lot of new, innovative offerings on the market.

There will be at least 50 new bitcoin ETFs this year, according to Nate Geraci of the ETF Store. These will cover a wide range of strategies, such as covered call ETFs and Bitcoin-denominated equity ETFs.

Furthermore, there is conjecture that Bitcoin spot ETFs may soon exceed physical gold ETFs in asset size. This would represent a pivotal advancement in the development of digital assets as conventional investment instruments.

Such a change would highlight a rising confidence in Bitcoin as a valid store of value and investment tool, therefore challenging the long-held view of gold as the best hedge.

Related Reading

As financial institutions such as Vanguard investigate cryptocurrency ETF alternatives, it underscores a wider trend of acceptance and incorporation of cryptocurrencies into established financial systems.

Featured image from Reuters, chart from TradingView

+ There are no comments

Add yours