On-chain data shows that long-term Bitcoin holders have been selling recently as their profits have ballooned to notable levels after the price surge.

Bitcoin Long-Term Holders Have Been In Huge Profits Recently

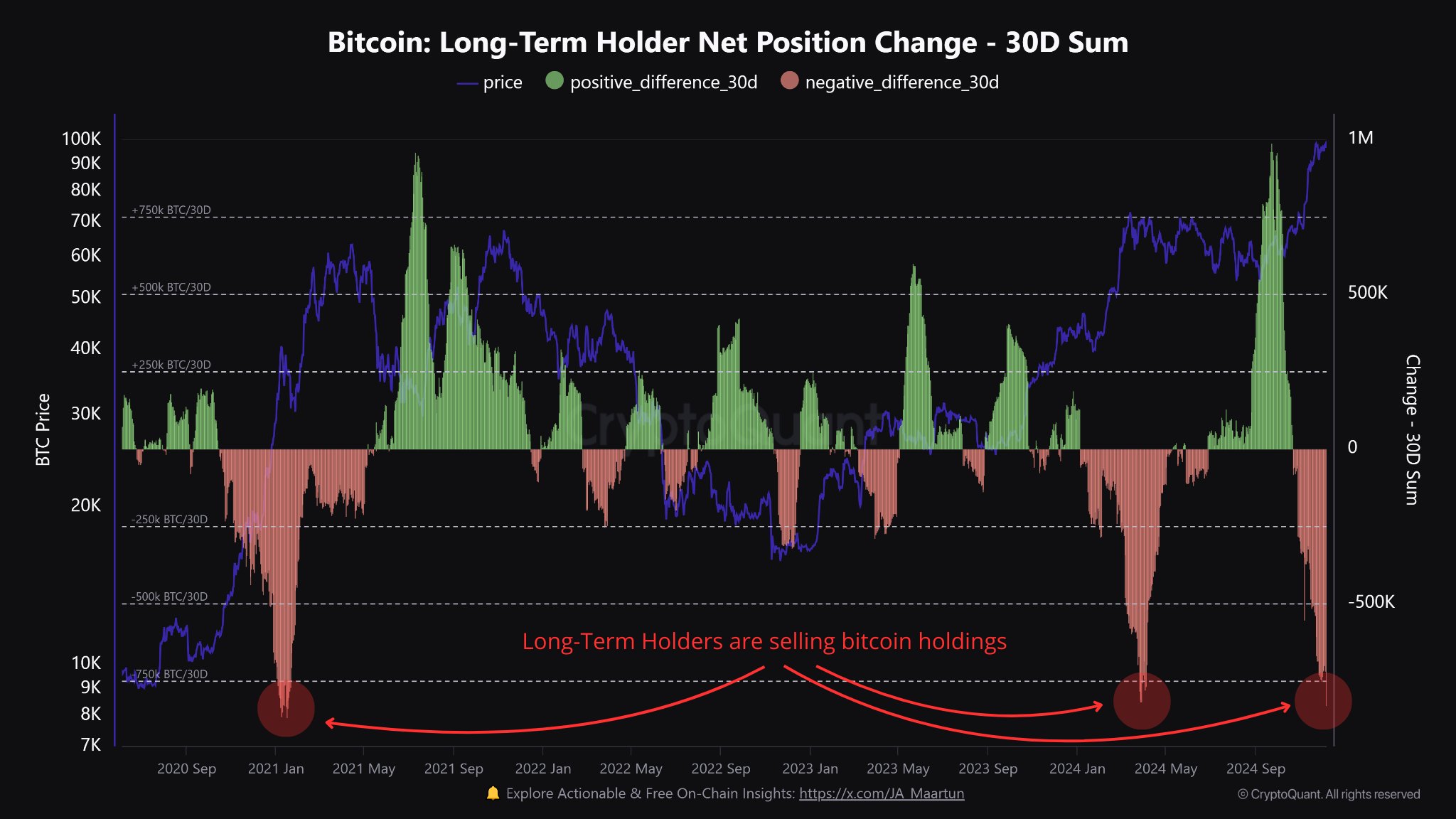

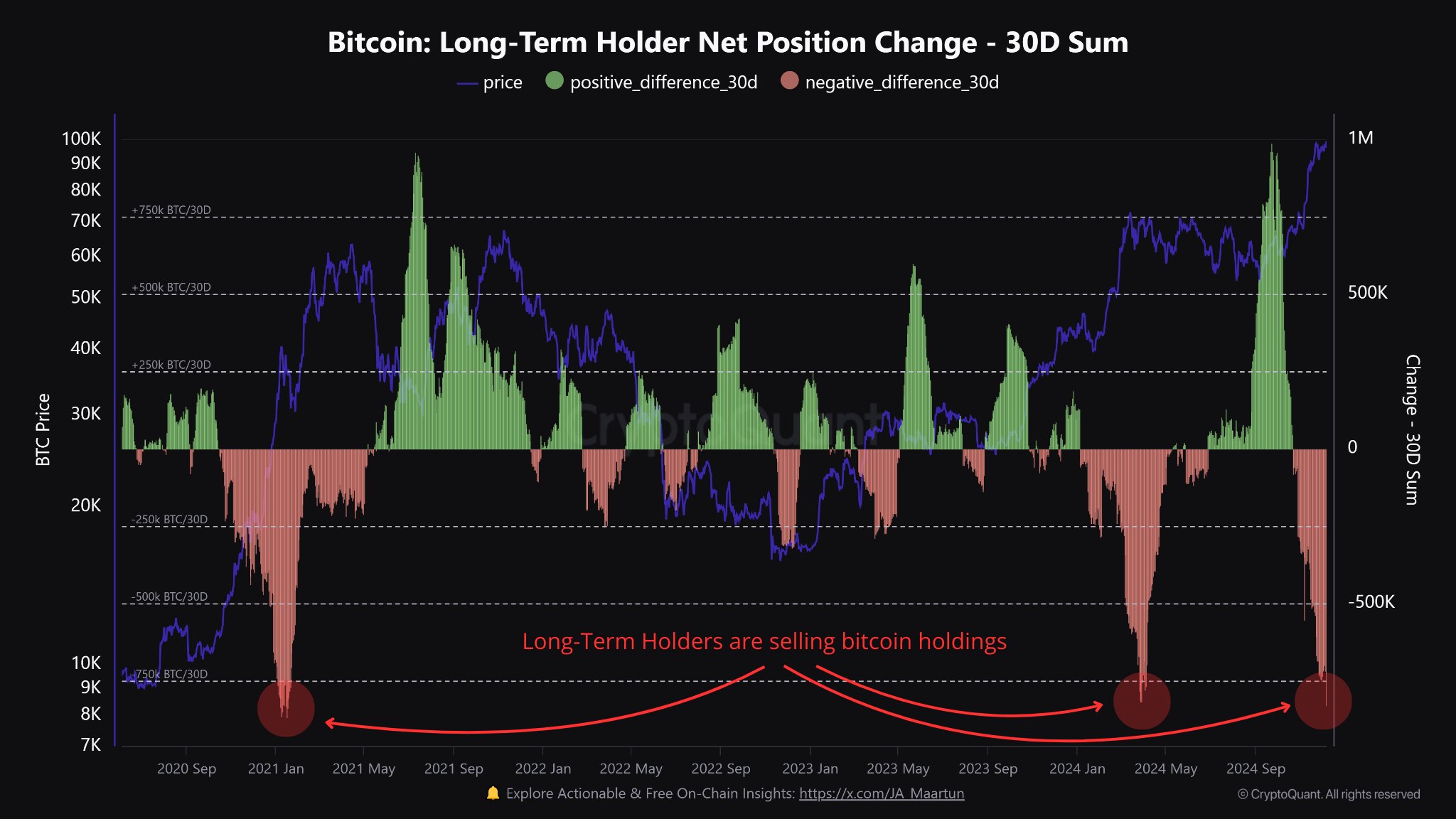

As CryptoQuant community analyst Maartunn explained in a new post on X, the long-term holders have sold big in the past month. The “long-term holders” (LTHs) refer to the Bitcoin investors who have been holding onto their coins for more than 155 days.

This cohort includes the most relentless hands of the market, who rarely sell regardless of whether a rally or crash is going on. These investors are in sharp contrast to the “short-term holders” (STHs), who generally react to any happening in the sector.

As such, the times that the LTHs decide to sell can be to watch out for since it means the market is at a stage where even these diamond hands have become tempted to part with their long-held coins.

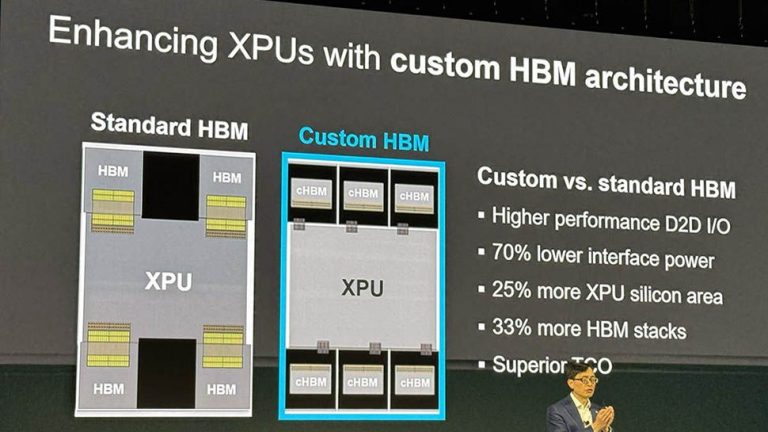

Bitcoin is currently experiencing one such instance, as the bull run to unseen highs has forced some LTHs into harvesting their hard-earned profits. Below is the chart shared by the analyst that shows the trend in the 30-day change for the LTH supply.

As displayed in the graph, the Bitcoin LTH supply has registered a large negative change during the past month, which suggests these HODLers have broken their silence.

In total, the diamond hands have transferred 827,783 BTC in this window. Naturally, not all transactions correspond to selling, but generally, there is a high chance of selling being the intent whenever the LTHs move their coins.

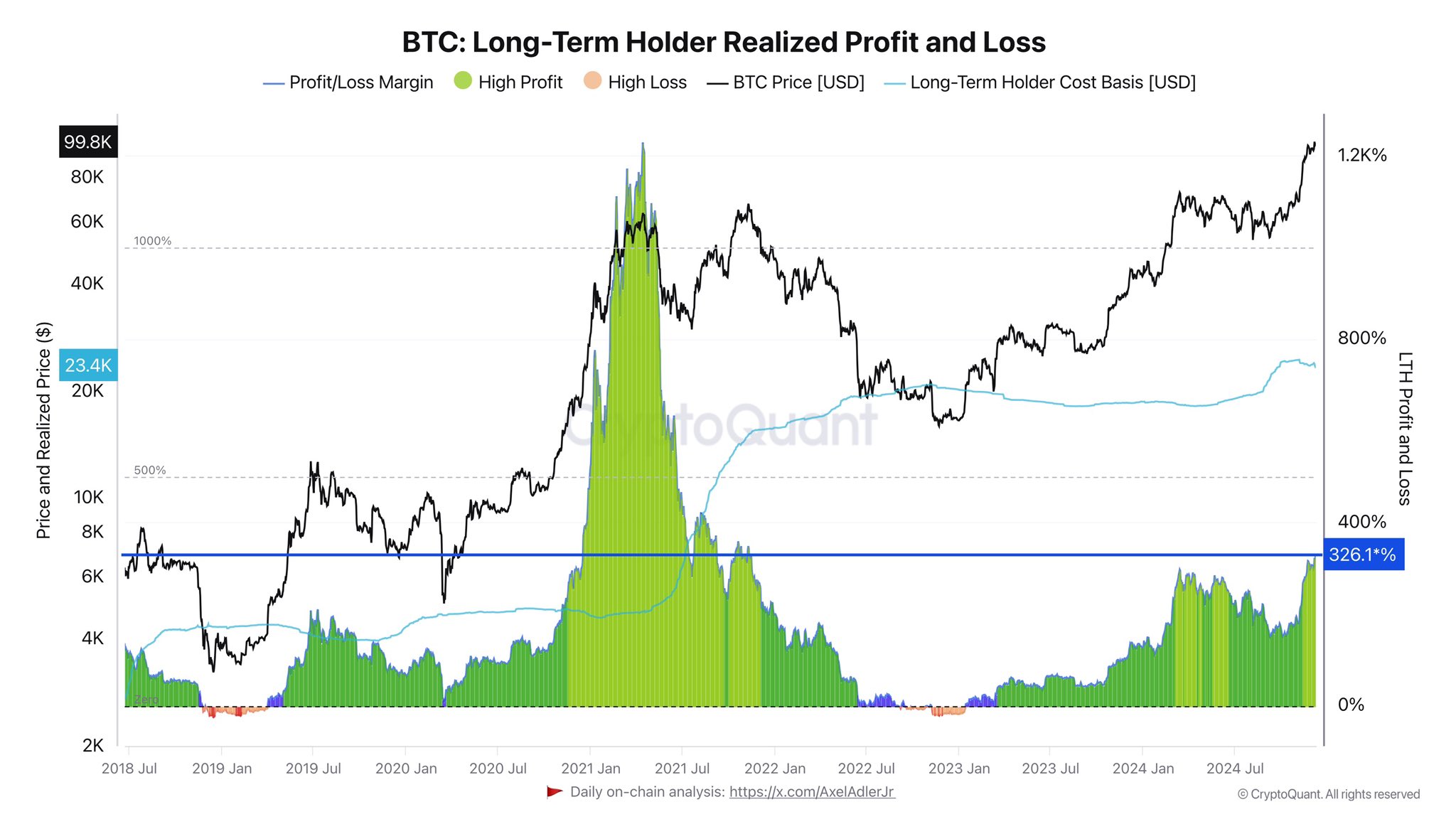

The reason behind the LTH selloff becomes apparent when considering the group’s profit-loss margin. As CryptoQuant author Axel Adler Jr pointed out in an X post, the group is sitting on average profits of 326%.

From the chart, it’s visible that while the profits of the Bitcoin LTHs are high on their own, they are still considerably less than the margin during the 2021 bull run.

This, of course, doesn’t mean that the current rally also has as much room left to go, as it’s very possible that this cycle would simply net these diamond hands fewer gains than last time.

While the LTHs have been spending significant amounts recently, Bitcoin hasn’t budged too much, which implies considerable new demand is still flowing into the sector that is absorbing this selling pressure. However, It remains to be seen how long this balance will be maintained.

BTC Price

Bitcoin had shown a brief break out of its consolidation phase earlier in the month, but it would appear the asset has found its way back into the range as its price is now trading around $98,200.

+ There are no comments

Add yours