CryptoCurrency

Bitcoin Next Big Move? Key Metric Reveals When to Cash In Profits

Meet Samuel Edyme, Nickname – HIM-buktu. A web3 content writer, journalist, and aspiring trader, Edyme is as versatile as they come. With a knack for words and a nose for trends, he has penned pieces for numerous industry player, including AMBCrypto, Blockchain.News, and Blockchain Reporter, among others.

Edyme’s foray into the crypto universe is nothing short of cinematic. His journey began not with a triumphant investment, but with a scam. Yes, a Ponzi scheme that used crypto as payment roped him in. Rather than retreating, he emerged wiser and more determined, channeling his experience into over three years of insightful market analysis.

Before becoming the voice of reason in the crypto space, Edyme was the quintessential crypto degen. He aped into anything that promised a quick buck, anything ape-able, learning the ropes the hard way. These hands-on experience through major market events—like the Terra Luna crash, the wave of bankruptcies in crypto firms, the notorious FTX collapse, and even CZ’s arrest—has honed his keen sense of market dynamics.

When he isn’t crafting engaging crypto content, you’ll find Edyme backtesting charts, studying both forex and synthetic indices. His dedication to mastering the art of trading is as relentless as his pursuit of the next big story. Away from his screens, he can be found in the gym, airpods in, working out and listening to his favorite artist, NF. Or maybe he’s catching some Z’s or scrolling through Elon Musk’s very own X platform—(oops, another screen activity, my bad…)

Well, being an introvert, Edyme thrives in the digital realm, preferring online interaction over offline encounters—(don’t judge, that’s just how he is built). His determination is quite unwavering to be honest, and he embodies the philosophy of continuous improvement, or “kaizen,” striving to be 1% better every day. His mantras, “God knows best” and “Everything is still on track,” reflect his resilient outlook and how he lives his life.

In a nutshell, Samuel Edyme was born efficient, driven by ambition, and perhaps a touch fierce. He’s neither artistic nor unrealistic, and certainly not chauvinistic. Think of him as Bruce Willis in a train wreck—unflappable. Edyme is like trading in your car for a jet—bold. He’s the guy who’d ask his boss for a pay cut just to prove a point—(uhhh…). He is like watching your kid take his first steps. Imagine Bill Gates struggling with rent—okay, maybe that’s a stretch, but you get the idea, yeah. Unbelievable? Yes. Inconceivable? Perhaps.

Edyme sees himself as a fairly reasonable guy, albeit a bit stubborn. Normal to you is not to him. He is not the one to take the easy road, and why would he? That’s just not the way he roll. He has these favorite lyrics from NF’s “Clouds” that resonate deeply with him: “What you think’s probably unfeasible, I’ve done already a hundredfold.”

PS—Edyme is HIM. HIM-buktu. Him-mulation. Him-Kardashian. Himon and Pumba. He even had his DNA tested, and guess what? He’s 100% Him-alayan. Screw it, he ate the opp.

CryptoCurrency

Vitalik Regains Leadership In Ethereum Foundation, Meanwhile Yeti Ouro Could Explode To $20 In 2025

Ethereum is once again making headlines as co-founder Vitalik Buterin states that going forward, he will unilaterally head the Ethereum Foundation (EF) and will choose its leadership until sufficient measures are put in place. Some members of the community argue that there is no sufficient activity in the EF, but Buterin does not accept any movement in the direction of lobbying or centralization. Aside from these institutional changes, fresh ERC-20 projects like Yeti Ouro (YETIO) are poised to leverage the renewed enthusiasm of Ethereum.

Ethereum Overhaul Gains Traction: Focus Shifts To Creating Value

The restructuring of Ethereum leadership is proceeding at full pace with, Vitalik Buterin stating in an X post that the Foundation’s aims include increasing internal technical capabilities, supporting innovation in a decentralized way, and refraining from active political lobbying. Buterin’s stance is strongly supported by Ki Young Ju, CEO of CryptoQuant, who claims that, although Ethereum may be under heavy pressure in the short term, the focus of the network should be on building real value instead of shallow financial captures.

This is also what is driving the plan to create a “proper board” for the Foundation, which Buterin hopes will improve cooperation with wallet providers, L2s, and application developers. On the other hand, the promised additional Pectra upgrade that is claimed to introduce major speed and efficiency improvements points to the fact that Ethereum’s roadmap is still very much innovation focused.

Ethereum News: ETH Technical Outlook

Ethereum price continues to be above $3,100 on Coinmarketcap, having defended the support at $3,216 several times, all of which is happening despite the leadership tussles within the organization. Analysts observe a new emerging inverted head-and-shoulders pattern, which could push Ethereum price above $3,550, with the next critical area of concern around $4,100.

Yeti Ouro: Meme Appeal Meets Real Utility

Ever since Ethereum has changed its direction, the users of Ethereum ecosystem have focused on Yeti Ouro’s ability to infuse meme coin culture with actual P2E offerings. This “Hot New Utility Meme Coin” is employing a 5% burn of tokens out of the total supply of 1 billion while setting aside some tokens for the community, which helps in making the tokens scarce over time.

One thing that has investors attracted to Yeti Ouro presale is its successful audit by SolidProof. This extensive auditing has built trust among the investors as it confirms its smart contracts, and general infrastructure of the project.

Possible Growth Of 1,000 Times

Some analysts suggest that Yeti Ouro could rise as high as $20 in 2025. This bold projection hinges on the continued growth of presales selling more than 131 million tokens. Such presale momentum shows its ability to attract significant inflows. Early investors have already experienced a rise in price. With the impending reveal of Yeti Go; a mindless racing game on unreal engine which incorporates PvP alongside in-game tokens, the project is gaining more traction.

The end product aims to deliver high end gameplay features:

-

Destructive PvP Racing: Users can shove people off of platforms, use power-ups, and even immerse themselves fully with advanced audio such as Spatial Audio and Dolby Atmos.

-

Staking and Marketplace: Players can stake YETIO and buy powerful assets.

-

It’s AAA: The environment has gone through a polished, ever evolving design. The game is processed through an iterative design that just finished its second revision.

The dev recently released a video showcasing glimpses of the level 1 map of Yeti Go game.

A report from Research and Markets indicates that the P2E gaming market currently standing at $8.5 billion is predicted to grow over $300 billion by 2030 which represents a Yeti Ouro phenomenon which empowers its P2E projects with disclosure.

Conclusion

If ETH begins to surge and the blockchain gaming market continues inflating, Yeti Ouro will make a $20 price claim which will remain unrestricted on how fast strong crypto projects can grow in a shifting market.

Yeti Ouro’s presale success will lead to bigger price rallies in the upcoming weeks, making it a prime investment. Early investors in YETIO, especially during its presale phase will see significant returns, as it will likely top presale charts.

Join The Yeti Ouro Community

Website: https://yetiouro.io/

X (Formally Twitter): https://x.com/yetiouro

Telegram: https://t.me/yetiouroofficial

Discord:https://discord.gg/YtUsEZ2Zr

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Semler Scientific to raise $75M to fund Bitcoin buys as paper gains near $30M

Semler Scientific is planning to raise $75 million through a private offering of convertible senior notes, which will help fund further Bitcoin purchases.

CryptoCurrency

Bitcoin ETFs face slowdown as Trump’s crypto executive order falls short on BTC-specific strategic reserve

Inflows into spot Bitcoin ETFs in the U.S. remained sluggish on Jan. 23 as President Donald Trump’s efforts to form a working group on digital assets under an executive order failed to meet market expectations.

According to data from SoSoValue, the 12 spot Bitcoin ETFs recorded $188.65 million in net inflows on Thursday, marking their fourth consecutive day of declining inflows since the beginning of the week, when they recorded over $1 billion in inflows.

BlackRock’s IBIT attracted the lion’s share of inflows, totaling $154.6 million, leading Bitcoin ETFs in inflows for the fifth consecutive day while Bitwise’s BITB followed with inflows of $42.15 million.

More modest inflows that contributed to the positive momentum came from Invesco Galaxy’s BTCO, Grayscale’s mini Bitcoin Trust, Fidelity’s FBTC and ARK 21Shares’ ARKB which logged inflows of $12.38 million, $11.9 million, $9.16 million and $8.35 million respectively.

Grayscale’s GBTC, which stood out as the only outlier on the day, recorded $49.94 million in outflows, offsetting some of the inflows from the other ETFs. The remaining five BTC ETFs saw zero inflows.

The total daily trading volume for Bitcoin investment vehicles reached $9.59 billion on Jan. 23, marking the second-highest level ever recorded, just behind the $10.39 billion peak seen on March 5.

Notably, the dip in inflows to Bitcoin ETFs coincided with a shift in Bitcoin’s price momentum after President Donald Trump signed an executive order on Thursday that is aimed at establishing a working group focused on digital assets that fell short of expectations.

While the order set out to advise the White House on digital asset policy and evaluate the creation of a government-held digital asset stockpile—comprising cryptocurrencies seized during investigations—it stopped short of establishing a dedicated strategic Bitcoin reserve, a move many crypto advocates had been hoping for.

Initially, Bitcoin responded positively to the announcement, climbing as much as 2.7% to reach $106,732. However, after the full details of the executive order were released, sentiment shifted, and the largest cryptocurrency by market value dropped nearly 4%, hitting $102,517. Since then, Bitcoin (BTC) has shown signs of recovery, gaining 2.1% to trade at $104,991 per coin.

CryptoCurrency

US Bitcoin Reserve ‘Pretty Much Confirmed’

Sen. Cynthia Lummis (R-WY) chairs the US Senate panel on crypto assets. She has promised some big changes in government policy for the sector.

A Bitcoin sovereign wealth fund Republicans are calling a “strategic national reserve” is only one of Lummis’ promises for blockchain. But markets are thrilling with bullish activity on that prospect alone.

Over the weekend, Bitcoin whales were insatiable in their accumulation.

After Republicans retook control of Congress following November’s election, the US Senate Banking Committee opened its first subcommittee panel on cryptocurrencies Thursday.

Binance Founder: Strategic Bitcoin Reserve Alert!

US Strategic Bitcoin Reserve, pretty much confirmed.

Crypto moving at crypto speed again. https://t.co/8qWlt65ARE

— CZ BNB (@cz_binance) January 23, 2025

The idea of a national Bitcoin reserve is so popular at the moment among US policymakers that several states are considering establishing state reserves.

Congress Convenes First Subcommittee on Crypto

The Senate Banking digital asset subcommittee will:

✔️ Pass legislation promoting responsible innovation and consumer protection

✔️ Eradicate Operation Chokepoint 2.0

✔️ Make America the bitcoin and digital asset capital of the world— Senator Cynthia Lummis (@SenLummis) January 23, 2025

The new Senate subcommittee on digital assets has a host of issues to tackle with normalizing US government policy over blockchain. In an X post on Thursday afternoon, Sen. Lummis promised a three-point crypto agenda in 2025:

- Pass legislation promoting responsible innovation and consumer protection

- Eradicate Operation Chokepoint 2.0

- Make America the bitcoin and digital asset capital of the world

Popular crypto markets analyst Crypto Beast replied, “we’re going much higher.” The strategic Bitcoin reserve has backing from President Trump, according to recent reports and the fact that he signed the documents.

In addition, it has a strong group of pro-crypto delegates to Congress in the new subcommittee. That includes Sen. Ruben Gallego (D-AZ), who received strong backing from the pro-crypto Fairshake PAC.

Plus, there’s Sen. Bernie Moreno (R-OH), a freshman senator who prevailed in the ballot count over the Banking Committee’s previous chair, Sen. Sherrod Brown (D-OH).

Bitcoin’s price had a somewhat unexpected reaction to the aforementioned news. The asset started to lose value after the document’s signing and dropped to $102,400 before it recovered some ground to nearly $105,000 now.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

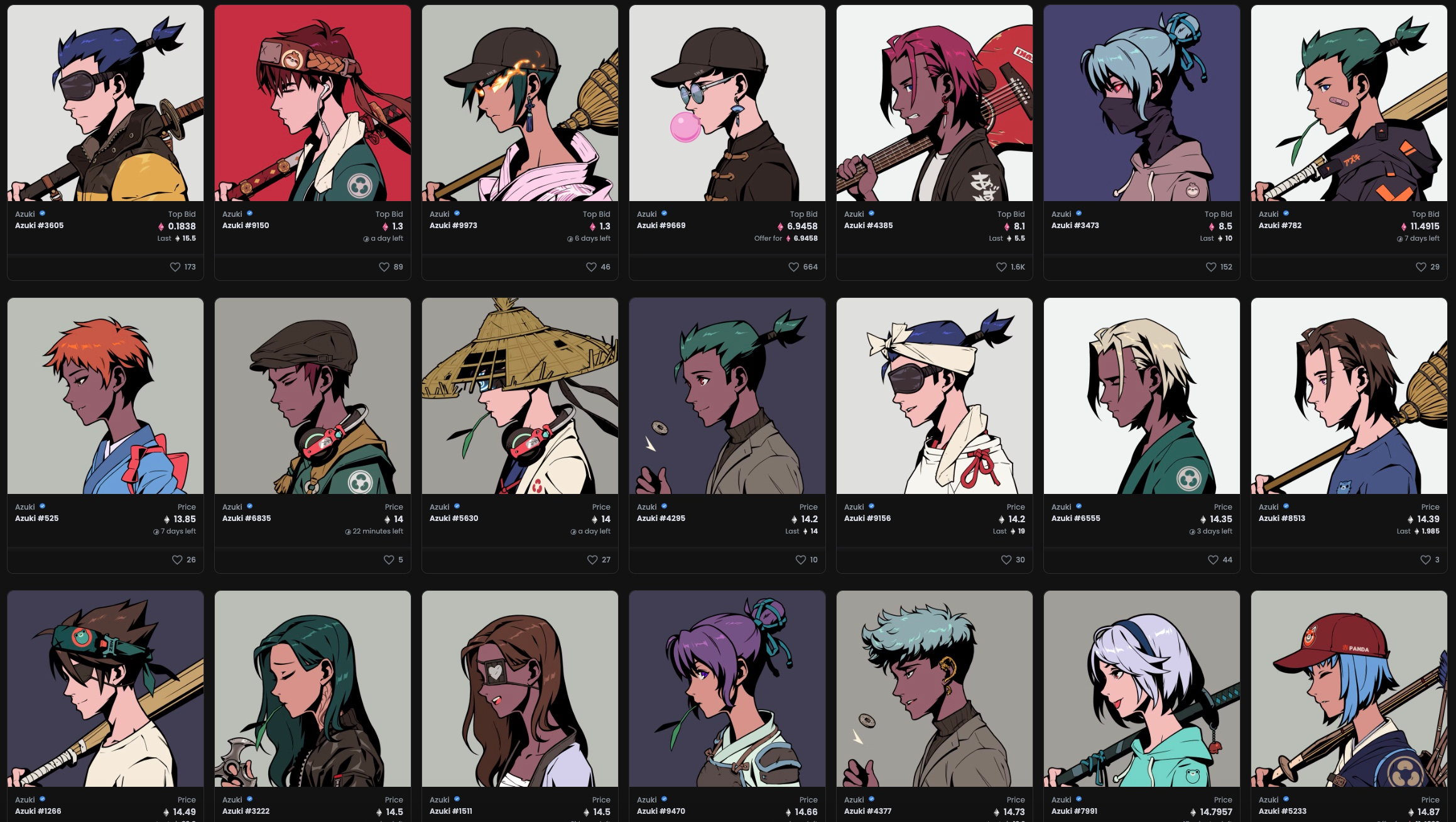

Azuki Airdrops Animecoin, Debuts at $1.2B FDV

Animecoin, the governance token tied to non-fungible token (NFT) project Azuki, has debuted at a fully diluted value (FDV) of $1.2 billion with tokens trading at $0.12 on HyperLiquid.

The total supply of the token is set at 10 billion, and holders of the Azuki NFT can claim the airdrop.

Users reported that the official airdrop claims website suffered downtime moments after it went live.

CryptoCurrency

This Under $0.25 Crypto May Crush Shiba Inu and Pepe Coin in 2025

The rapidly changing crypto market has a new under-$0.25 token gaining attention as a potential disruptor, set to surpass Shiba Inu and Pepe coin by 2025. Lightchain AI, now in its presale stage at $0.005625 per token, has already secured $12.7 million in funding, reflecting strong support from investors.

By merging blockchain technology with artificial intelligence, Lightchain AI introduces innovative solutions that move beyond the speculative nature of meme coins. With its forward-thinking strategy and advanced capabilities, it’s positioned for significant growth in the years ahead.

Why Shiba Inu and Pepe Coin Could Face Challenges in 2025

In 2025, Shiba Inu (SHIB) and Pepe Coin (PEPE) may encounter several challenges impacting their growth. A significant concern is their vast token supplies, which can hinder substantial price appreciation. Despite community-driven token burn initiatives, reducing the circulating supply to a level that meaningfully affects price remains a formidable task.

Additionally, the meme coin market is becoming increasingly saturated, intensifying competition and making it difficult for individual tokens to maintain investor interest. The speculative nature of these coins, often lacking intrinsic utility, subjects them to heightened volatility and susceptibility to market sentiment shifts.

Moreover, the evolving regulatory landscape poses potential risks, as increased scrutiny could lead to restrictions or decreased investor confidence in meme-based cryptocurrencies. These factors collectively suggest that SHIB and PEPE may face significant hurdles in sustaining their growth trajectories in 2025.

How Lightchain AI Plans to Stand Out

Lightchain AI stands out by combining innovative technology with a sustainable ecosystem supported by thoughtful tokenomics and advanced solutions. Its total token supply of 10 billion LCAI is strategically allocated; 40% for presale, 28.5% for staking rewards to incentivize network participation, 15% for liquidity to ensure smooth transactions, and the remainder for marketing, treasury, and team incentives. This distribution ensures ecosystem growth while rewarding both early adopters and long-term contributors.

The platform’s low-latency architecture enhances performance, enabling real-time execution of tasks, even during high network demand. To address risks like scalability and resource constraints, Lightchain AI employs mitigation strategies, including sharding for parallel processing and dynamic resource allocation. These robust features position Lightchain AI as a leader in blockchain innovation.

Rise of Lightchain AI in 2025

Lightchain AI is poised to dominate 2025 with its groundbreaking approach to blockchain and AI integration. By combining innovative tokenomics and advanced technology, Lightchain AI offers unique solutions that set it apart from traditional cryptocurrencies.

Its focus on scalability, security, and real-world applications positions it as a leader in the evolving crypto landscape. With growing investor interest and strong presale momentum, Lightchain AI is set to redefine the future of blockchain innovation.

Its potential for widespread adoption and practical use cases make it a strong contender to surpass meme coins like SHIB and PEPE in the coming years. As more industries embrace blockchain technology, Lightchain AI is well-positioned to capitalize on this growing market and solidify its place as a top crypto player. Invest in Lightchain AI today and be part of the next generation of blockchain revolution.

https://lightchain.ai/lightchain-whitepaper.pdf

https://t.me/LightchainProtocol

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Ether set for ‘potential tactical breakout’ after SEC kills SAB 121

A crypto analyst says ETH is signaling a potential “low-risk, high-reward opportunity” after the Securities and Exchange Commission killed a controversial accounting rule.

CryptoCurrency

SEC scraps SAB 121, making crypto custody easier

The Securities and Exchange Commission (SEC) has repealed a controversial rule requiring financial firms holding cryptocurrency for customers to report those assets as liabilities on their balance sheets.

In a bulletin issued on Jan. 23, the SEC announced that Staff Accounting Bulletin (SAB) 122 officially rescinds SAB 121, a policy introduced in March 2022 that faced significant pushback from the crypto industry.

SAB 121 had drawn criticism for its cumbersome reporting requirements, with industry leaders arguing it made custody of digital assets unnecessarily complicated.

The rule’s removal was met with relief, as highlighted by SEC Commissioner Hester Peirce’s celebratory Jan. 23 post on X: “Bye, bye SAB 121! It’s not been fun.”

Last year, Congress also enacted a joint expression opposing SAB 121, but then-President Joe Biden vetoed it.

Now, as the ‘pro-crypto’ Republican government has set foot, many disobliging rules within the crypto industry are starting to be revoked. A day after Donald Trump signed into his second term as President, he appointed SEC Commissioner Mark Uyeda as interim SEC chair. Uyeda commented last October on how SEC’s take under Gary Gensler was nothing short of a disaster.

Interestingly, Cornerstone Research reported on Jan. 23 that the SEC under Gary Gensler initiated just 33 actions involving cryptocurrencies in his final year as SEC chairman — down from 47 in the year prior, which saw the largest amount of enforcement activity. Last year, the SEC sued 90 bitcoin defendants or respondents, comprising 57 persons and 33 companies.

What SAB 121 repeal means for the crypto community?

SAB 121 revocation by the SEC will serve the common by enabling custodians for Bitcoin (BTC) through regulated banks and financial institutions. This shift could also improve security and trust, providing a more secure alternative for those new to self-custody or cryptocurrency wallets. It could also spur greater adoption, as users may find it easier to interface with crypto through trusted institutions.

Moreover, institutional custody also helps mitigate the risk of losing private keys and provides improved financial inclusion for people who are not able to create secure digital wallets. This revocation can instill confidence and even greater participation in the cryptocurrency ecosystem as regulatory clarity born from it continues.

While most within the crypto community have been celebrating this revokement, some critics are rather weary.

Jacob, the WhaleWire CEO, posted on X expressing and criticizing the response from the BTC community to the SEC’s recent revocation of SAB 121. He adds that the BTC community is homing in on the news that banks can now hold BTC, even though SAB 121 doesn’t actually mention BTC at all.

Satoshi Nakamoto stated at the time that the goal of the original BTC protocol was to eliminate the need for third-party control, says Jacob. According to him, this year, 2025, is when the BTC ecosystem feels just a bit counterintuitive since it wants banks to store their BTC. Ultimately, he claims BTC itself has succumbed to greed and delusion and forebodes ill for the community.

CryptoCurrency

How Will Crypto Markets React as $3B in Bitcoin Options Expire Today?

Around 30,000 Bitcoin options contracts will expire on Friday, Jan. 24, and they have a notional value of roughly $3.1 billion.

This week’s expiry event is slightly larger than last week’s, but it is unlikely to have any major impact on spot crypto markets, which have calmed following a volatile week.

Bitcoin Options Expiry

This week’s batch of Bitcoin options contracts has a put/call ratio of 0.48, which means that there are more than twice as many call (long) contracts expiring than puts (shorts). Open interest, or the value or number of BTC options contracts yet to expire, is highest at the $120,000 strike price, which has $2.4 billion in OI, according to Deribit.

There is also around $1.7 billion in OI at the $110,000 strike price, as derivatives traders remain bullish.

The anticipated announcements and crypto executive orders following US President Donald Trump’s inauguration on Monday did not materialize, causing cryptocurrency market indicators to stabilize, reported Deribit this week.

While Bitcoin options markets still show some unusual trading patterns, overall market excitement has subsided, it added.

In addition to today’s batch of Bitcoin options, around 168,000 Ethereum contracts are expiring as well. These have a notional value of $543 million and a put/call ratio of 0.47. This brings Friday’s combined crypto options expiry notional value to around $3.5 billion.

Crypto Market Outlook

Spot markets have remained relatively stable over the past 24 hours, with total capitalization at $3.7 trillion following a volatile week. The market cap is exactly where it was last week, so the Trump pump following the US president’s inauguration on Monday was very short-lived.

Bitcoin has dropped 4% from this week’s all-time high, which was almost revisited on Thursday. The asset was trading up 3% on the day at $105,000 at the time of writing, having held above six figures for most of this week.

Ethereum is up 5% on the day at $3,370, but it remains deflated following dissent and infighting at the Ethereum Foundation.

Altcoins remain mixed with minor gains and losses across the board during the Friday morning Asian trading session.

Nevertheless, market sentiment is strengthening as the first crypto-related executive order gets the approval signature from President Trump.

I told you this was the year for Bitcoin and digital assets.

— Senator Cynthia Lummis (@SenLummis) January 24, 2025

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Consolidation or Calm Before the Next Move?

Bitcoin price settled above the $100,500 resistance zone. BTC is consolidating gains and might aim for a fresh increase above the $105,000 zone.

- Bitcoin started a downside correction from the $106,800 zone.

- The price is trading below $104,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $102,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $102,000 support zone.

Bitcoin Price Eyes Fresh Increase

Bitcoin price started a decent upward move above the $104,500 zone. BTC was able to climb above the $105,500 and $106,000 levels.

The bulls even pushed the price above the $106,500 level. However, the bears were active near the $106,800 zone. A high was formed at $106,833 and the price is now correcting gains. There was a move below the $105,000 level.

There was a move below the 50% Fib retracement level of the upward move from the $101,281 swing low to the $106,833 high. Bitcoin price is now trading below $104,000 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $102,000 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $104,000 level. The first key resistance is near the $105,500 level. A clear move above the $105,500 resistance might send the price higher. The next key resistance could be $106,800.

A close above the $106,800 resistance might send the price further higher. In the stated case, the price could rise and test the $108,200 resistance level and a new all-time high. Any more gains might send the price toward the $110,000 level.

More Losses In BTC?

If Bitcoin fails to rise above the $104,500 resistance zone, it could start a downside correction. Immediate support on the downside is near the $102,500 level or the 76.4% Fib retracement level of the upward move from the $101,281 swing low to the $106,833 high. The first major support is near the $101,250 level.

The next support is now near the $100,500 zone. Any more losses might send the price toward the $88,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $102,500, followed by $101,250.

Major Resistance Levels – $104,500 and $105,500.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login