CryptoCurrency

Bitcoin Realized Cap Hits $832B As $100K Inflows Begin To Slow

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn.

Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer for his college paper. This early love for storytelling paved the way for a successful stint as an editor at a data engineering firm, where his first-month essay win funded a months-long supply of doggie and kitty treats – a testament to his dedication to his furry companions (more on that later).

Christian then roamed the world of journalism, working at newspapers in Canada and even South Korea. He finally settled down at a local news giant in his hometown in the Philippines for a decade, becoming a total news junkie. But then, something new caught his eye: cryptocurrency. It was like a treasure hunt mixed with storytelling – right up his alley!

So, he landed a killer gig at NewsBTC, where he’s one of the go-to guys for all things crypto. He breaks down this confusing stuff into bite-sized pieces, making it easy for anyone to understand (he salutes his management team for teaching him this skill).

Think Christian’s all work and no play? Not a chance! When he’s not at his computer, you’ll find him indulging his passion for motorbikes. A true gearhead, Christian loves tinkering with his bike and savoring the joy of the open road on his 320-cc Yamaha R3. Once a speed demon who hit 120mph (a feat he vowed never to repeat), he now prefers leisurely rides along the coast, enjoying the wind in his thinning hair.

Speaking of chill, Christian’s got a crew of furry friends waiting for him at home. Two cats and a dog. He swears cats are way smarter than dogs (sorry, Grizzly), but he adores them all anyway. Apparently, watching his pets just chillin’ helps him analyze and write meticulously formatted articles even better.

Here’s the thing about this guy: He works a lot, but he keeps himself fueled by enough coffee to make it through the day – and some seriously delicious (Filipino) food. He says a delectable meal is the secret ingredient to a killer article. And after a long day of crypto crusading, he unwinds with some rum (mixed with milk) while watching slapstick movies.

Looking ahead, Christian sees a bright future with NewsBTC. He says he sees himself privileged to be part of an awesome organization, sharing his expertise and passion with a community he values, and fellow editors – and bosses – he deeply respects.

So, the next time you tread into the world of cryptocurrency, remember the man behind the words – the crypto crusader, the grease monkey, and the feline philosopher, all rolled into one.

CryptoCurrency

Binance Labs rebrands to YZi Labs with CZ at the helm

Binance Labs, the venture capital arm and incubator of Binance Holdings, is getting a fresh start as Changpeng Zhao transitions it into a family office.

On Jan. 23, Binance Labs announced its rebranding to YZi Labs and unveiled a new leadership team led by Binance founder and former CEO Changpeng Zhao, known also as CZ.

According to the announcement, CZ will run YZi Labs alongside Ella Zhang, who co-founded Binance Labs in 2018. During her tenure at the VC platform, Zhang oversaw the incubation of multiple crypto projects that have grown into top ecosystems in the market, including Polygon, Injective, Dune Analytics, Certik, and SafePal.

Under its new family office initiative, YZi Labs will expand its focus beyond cryptocurrency and blockchain. The announcement highlighted new areas of investment, including artificial intelligence, web3 and biotechnology.

“Rebranding to YZi Labs is more than a name change—it signifies an expanded vision as we broaden our horizons to include transformative sectors like AI and biotech,” CZ said.

Zhao stepped down as Binance CEO in 2023 after reaching a settlement with U.S. authorities. He also served a four-month prison sentence in the U.S. before returning to the industry following his release from a correctional facility in California on Sept. 27, 2024.

Binance’s decision to sever ties with its VC arm began taking shape after CZ’s release. In a post on X following his incarceration, Zhao stated that he would focus on “impact” investments rather than financial returns. He also announced plans for an educational project called Giggle Academy.

With YZi Labs, CZ plans to refine the venture capital unit’s incubation program, which will include reintroducing residency initiatives for project founders. The firm will also continue to support its existing portfolio of 250 projects.

CryptoCurrency

BTC Faces Massive Volatility Above $100K as Liquidations Surge to $300M

Bitcoin’s price actions were somewhat dull for most of the day, but the asset went on a wild rollercoaster in the past hour or so, pumping and dumping by several grand.

This has caused a lot of pain for over-leveraged traders, with more than 120,000 such market participants getting wrecked in the past 24 hours.

As reported earlier today, the primary cryptocurrency had started to lose traction following the Monday drop, subsequent all-time high, and yet another decline, and stood at $102,000. Its value decreased a bit more as the day progressed and slipped to $101,200.

It recovered some ground to $102,000 but then exploded out of the blue to $106,000 within minutes. This somewhat surprising rally was met by a steep rejection that pushed it south to $102,500 before the bulls sent it to $104,000 as of now.

Perhaps the most evident reason behind this substantial volatility is a cryptic couple of tweets by US Senator from Wyoming – Cynthia Lummis. The long-term BTC supporter, who has actively been pushing for a Bitcoin reserve in the US, used the asset’s logo to say, “₿ig things are coming” at 10 AM (probably EST).

Although that time has passed and there’s no big announcement yet, her comments were seen by almost 4 million people in an hour, which could explain the hype around BTC.

Fox Business’ Eleanor Terrett picked up the post and said that Lummis is likely to be voted in to become the chair of the digital asset subcommittee.

The Senate Banking Committee is set to vote at a 10AM EST markup on @SenLummis becoming chair of the digital assets subcommittee.

Unclear if anything else will be announced. https://t.co/OfTE4WHd7I

— Eleanor Terrett (@EleanorTerrett) January 23, 2025

Data from CoinGlass shows that the total value of liquidations is up to $300 million on a daily scale, with 124,000 traders wrecked within the same timeframe. The biggest liquidated position took place on OKX and was worth almost $6 million.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Best Crypto Presales to Buy Now for 100x — Larry Fink’s $700K Bitcoin Prediction

BlackRock, one of the biggest investment companies in the world, has given crypto enthusiasts a new reason to be excited. Its CEO, Larry Fink, has said that Bitcoin can be expected to make huge price moves, potentially reaching the $700K mark soon.

The BlackRock CEO explained how political and economic instability is acting as a catalyst for Bitcoin, which serves as an internationally recognized currency free from any local fears. What’s more, Bitcoin is still holding steady above $104K, with a 12% uptick in the last month.

With all the signs looking positive for BTC, and keeping in mind that the overall crypto market follows Bitcoin’s footprints, now is one of the best times to be a crypto investor. To help you out, here are 5 crypto presales that can offer up to a 100x return.

1. Wall Street Pepe ($WEPE) – Overall Best Crypto Presale for First-Time Investors

Wall Street Pepe ($WEPE) has undoubtedly been one of the best crypto presale performances to date. Launched just over a month ago, $WEPE’s presale has already raised over $57.5M, with both retailers and whales gobbling it up at a breakneck pace.

The presale ends in 24 days, so this could be your last chance to grab one of the best meme coins.

What makes Wall Street Pepe stand out is its personal vendetta against crypto whales, who have been abusing insider information to manipulate the crypto market and feast on innocent retailers.

The project aims to eliminate this lopsidedness by creating a frog army of retail investors and providing them with unique market insights, trading strategies, and real-time alpha calls.

If you, too, want to beat the market and become a profitable crypto investor, join the $WEPE army for just $0.0003665 per token. For more, here’s how to buy $WEPE.

2. Solaxy ($SOLX) – World’s First-Ever Layer 2 Solana Ecosystem

Solaxy ($SOLX) has been created to unlock the full potential of Solana, which currently struggles with issues like network congestion, failed transactions, and limited scalability. Solaxy has set aside a healthy 30% of its total token supply to resolve these issues.

After raising $350K in the first 24 hours, the $SOLX presale is still going strong, with the total presale purse reaching over $13M. Don’t miss out on one of the next 100x meme coins, and get some for only $0.001612 each. Here’s a guide on how to buy $SOLX.

3. Mind of Pepe ($MIND) – AI Agent Offering Crypto Investment Advice

MIND of Pepe ($MIND) is a self-sovereign AI agent with the ability to adapt and form his own opinions, as well as drive conversations and trends on dApps and online platforms such as X.

$MIND uses hive-mind analysis to identify market trends before anybody else. He’ll then share his insights and access to new investment opportunities on his X and Telegram channels, giving token holders a real edge in the market.

You can grab the best AI agent coin for just $0.0031762 if you get in now — here’s how to buy $MIND. Prices increase in the next 11 hours, so interested investors should hurry up.

4. Rexas Finance ($RXS) – Transforming Real-World Asset Tokenization

$RXS is the native currency of Rexas Finance, an interesting crypto project that’s tokenizing real-world assets, such as real estate, gold, art, and commodities. The biggest benefit of this platform is that it simplifies investments.

Investing in gold and other precious metals, for instance, will no longer be difficult and will involve just a few clicks.

Plus, token holders will get to participate in fractional ownership. For example, let’s say there’s a massive mansion spread across multiple acres of land, and you don’t have enough funds to buy it all by yourself.

In that case, you can use Rexas to own a fraction of the property for a fraction of the price. Speaking of $RXS’s presale, it’s coming to an end, meaning prices aren’t as low as they were, say, a couple of months ago.

However, they’re still the lowest you’ll ever get them for. Each token is priced at $0.200, with the total presale funding at $43M so far. Out of the 500,000,000 total token supply, 434,925,318 have already been sold.

5. LuckHunter ($LHUNT) – Online Casino Where You Can Create a Custom Metaverse

$LHUNT is the official token of the LuckHunter online casino. The platform itself is like any other: you can play casino games, bet, and win. However, what makes it unique is it lets you create a metaverse of your own digital casinos that you can rent.

These casinos will be based in different cities, Las Vexus and Utlantic City (modeled after the real Las Vegas and Atlantic City), and you can lease the tables at your virtual casino for short-term or long-term profits.

You can also customize the tables and ambiance and create your own gaming rules. What’s more, you can even host VIP events involving high-stakes games and special tournaments to earn luxurious rewards.

1 $LHUNT is currently available for $0.00138, but the price will increase by 10.5% as it enters the next stage of presale in just a couple of hours from now.

Having already raised $1.1M in its ongoing presale, $LHUNT’s official website mentions that its potential listing price will be $0.005, which is more than 260% of the current price.

Bottom Line

While there’s little doubt that the above-mentioned crypto presales can go to the moon in 2025, it’s important to mix caution with chaos and only invest an amount you’re comfortable losing. There will be ups and downs, so make sure you do enough cardio to prepare your heart!

Also, none of the above is financial advice, and we highly recommend doing your own research (DYOR) before investing.

CryptoCurrency

A Game-Changer for Modern Financial Advising

In today’s issue, Alec Beckman from Advantage Blockchain explains stablecoins and their growing use cases for institutions and advisors.

Then, CK Zheng from ZX Squared Capital shares tips on preparing for tax season in Ask and Expert.

You’re reading Crypto for Advisors, CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to get it every Thursday.

Stablecoin Use Case for Advisors

One of the primary hurdles for blockchain adoption to date has been utility, especially when looking through the lens of financial advisors and how these public blockchains and decentralized finance (DeFi) protocols can impact their clients.

Stablecoins – digital currencies pegged to stable assets like the U.S. dollar – have emerged as a powerful tool for modernizing savings, payments, and settlement processes. These innovations present a significant opportunity for advisors to enhance the value they offer to clients while staying ahead of market trends.

How can advisors leverage stablecoins to streamline operations, reduce costs, and provide cutting-edge financial solutions? Here’s how stablecoins can become a transformative tool for your clients:

Savings account / going bankless

- Financial Inclusion: Stablecoins provide a way for clients to store value outside of traditional banking systems, granting access to financial services for the unbanked or underbanked. Anyone with an internet connection can use stablecoins.

- Stability: Unlike volatile cryptocurrencies, full-reserve, dollar-backed stablecoins maintain a consistent value (ex. USDC is tied to the value of $1).

- Liquidity & Accessibility: Funds in stablecoins are globally accessible 24/7, offering liquidity without dependence on conventional banking hours.

- Better Yield: Using on-chain finance, stablecoins can generate significantly more yield than a savings account (Ex. Coinbase offers slightly over 4% APY, beating traditional savings accounts).

- Self Custody: Many people, including myself, have been held up by a third-party custodian or bank. If someone can keep you from spending/sending money, it is not your money. The ability to self custody your own assets provides a more seamless way of transacting your own funds.

Payments

- Efficiency: Transactions using stablecoins are fast and cost-effective with no global restrictions, relevant for those sending payments domestically or cross-border.

- Value Retention: The stability of these digital assets ensures that the amount sent is equal to the amount received.

- Adoption by Institutions: Financial institutions are recognizing stablecoins as a complementary payment system, signaling growing mainstream acceptance.

- Adoption by Commerce: Stablecoins are less costly and more efficient than credit card payments for merchants.

Settlement

- Instantaneous Transactions: Settlements via stablecoins are near instantaneous, improving liquidity and reducing counterparty risks for clients managing high-value transactions.

- Lower Costs: By eliminating traditional clearing and settlement processes, stablecoins significantly reduce fees.

- Global Versatility: Whether your clients are trading internationally or managing investments across borders, stablecoins streamline and simplify the settlement process.

Real-world application: SpaceX’s strategic use of stablecoins

SpaceX uses stablecoins to manage foreign exchange (FX) risks from its global Starlink operations. SpaceX shields itself from FX volatility by collecting payments in various currencies and converting them into stablecoins. The stablecoins, pegged to the U.S. dollar, provide a stable intermediary before being converted back to dollars.

This approach offers several advantages:

- Reduced Currency Risk

- Enhanced Efficiency

- Liquidity Preservation

This strategy demonstrates how stablecoins can be a powerful tool for multinational corporations and can be applied to managing client portfolios.

Why This Matters to You and Your Clients For financial advisors, stablecoins can elevate portfolios and modernize financial strategies. These assets aren’t just a novelty – they’re a bridge to a more inclusive, efficient, and adaptable financial future. By integrating stablecoins into conversations about savings, payments, or settlements, you position yourself as a forward-thinking advisor prepared to navigate these changes.

– Alec Beckman, president, Advantage Blockchain

Ask an Expert

Q: What’s the 101 on stablecoins and liquidity?

The stablecoin market cap has reached a record $215 billion, predominantly concentrated in the two coins Tether and USDC, having a combined 85% of the market cap. The liquidity of the stablecoin market stays healthy as more stablecoin issuers such as Visa, Stripe, and PayPal enter this unique digital asset sub-class. Given the new Trump administration’s pro-crypto attitude, we expect more crypto-friendly rules and regulations for this asset in the coming months, which will support the further growth of the stablecoin market.

Q: Are stablecoins risky compared to traditional finance (TradFi)?

Stablecoins are typically designed to stay pegged to the U.S. dollar (though they don’t need to be). The functionality of stablecoins in the crypto market is comparable to money market funds in the traditional financial market. The money market funds have reached a $10 trillion market cap, which serves the purpose of short-term investment and a place to park money. Stablecoins will serve a similar purpose in the digital asset space. The quality and liquidity of the issuer’s holdings of fiat-denominated short-term assets are some of the critical risks associated with stablecoins, especially when the financial market is under great stress.

Q: Do country borders matter when it comes to stablecoins?

Country borders matter greatly as different countries may have different rules, regulations and license requirements for the stablecoin market. One of the key regulatory requirements associated with stablecoins is around the stability, liquidity, disclosure and transparency of the short-term assets the issuers hold for the underlying stablecoins.

– CK Zheng, co-founder & CIO, ZX Squared Capital

Keep Reading

CryptoCurrency

Bitcoin Deep Dive Data Analysis & On-Chain Roundup

Bitcoin appears poised for significant upside movement following a strong start to 2025. However, questions remain about the market’s overall health and whether the current bullish momentum can be sustained over the coming weeks and months. Here, we’ll take an unbiased and data-driven look into the underlying numbers supporting our current trend.

For a more in-depth look into this topic, check out a recent YouTube video here: Bitcoin Data Driven Analysis & On-Chain Roundup

Miner Recovery

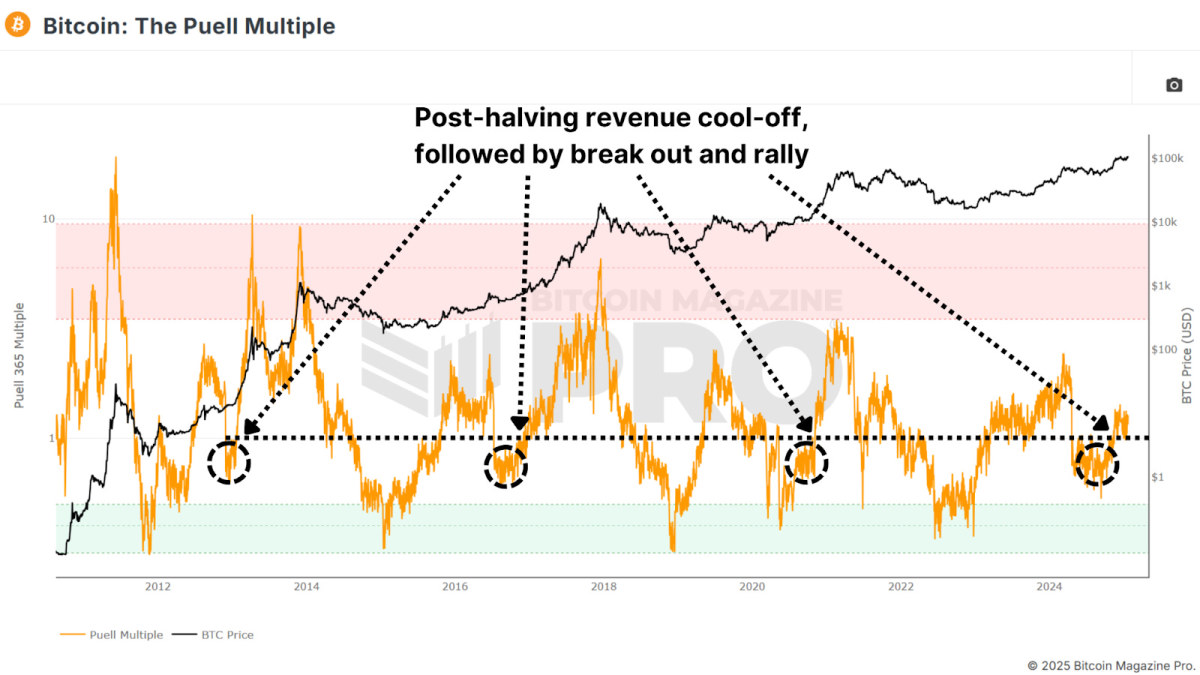

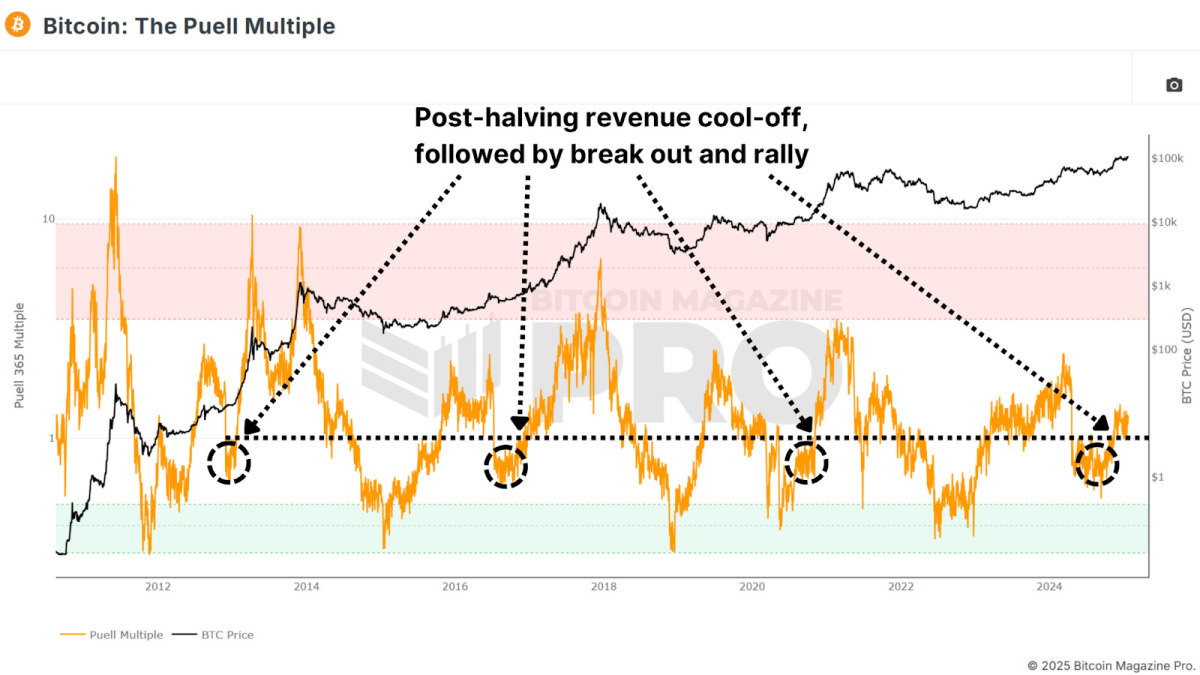

The Puell Multiple, a measure comparing miners’ daily USD revenue to its yearly average, suggests that Bitcoin’s fundamental network strength remains strong. Historically, after a halving event, miner revenue experiences a significant dip due to the 50% block reward reduction. However, the Puell Multiple recently climbed above the key value of 1, indicating a recovery and a potentially bullish phase.

Previous cycles show that crossing and retesting the value of 1 often precedes major price rallies. This pattern is repeating, signaling strong market support from mining activity.

Substantial Upside Potential

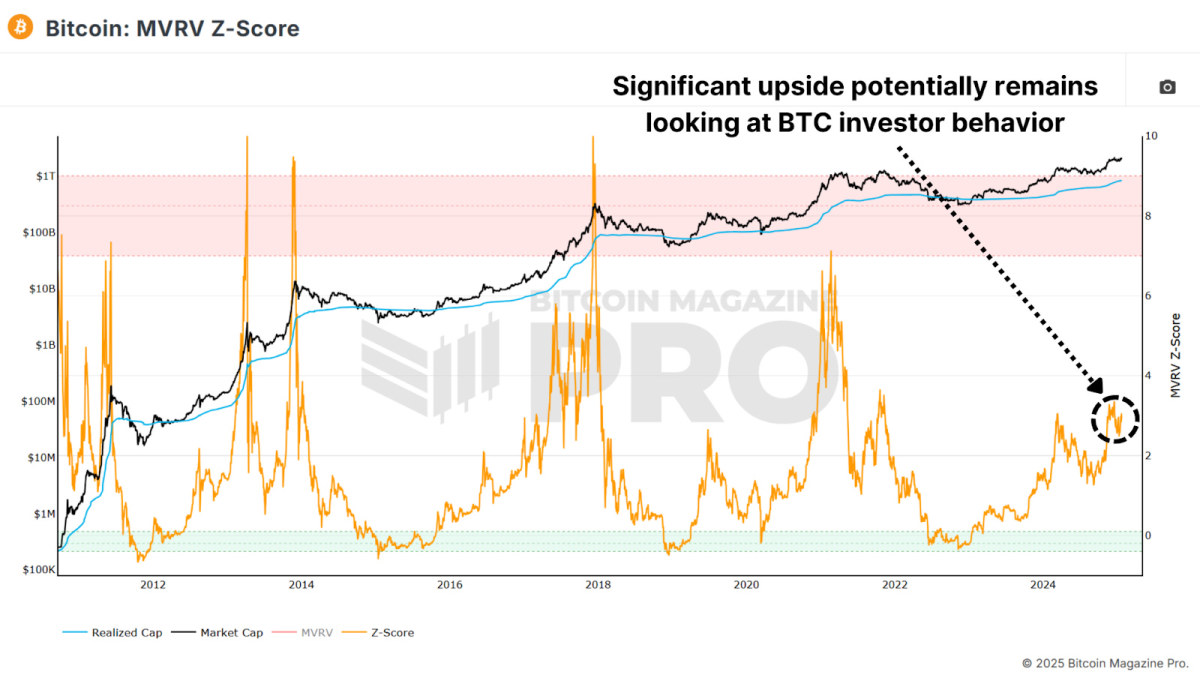

The MVRV Z-Score, a metric analyzing Bitcoin’s market value relative to its realized value, or average accumulation price for all BTC, suggests current values remain well below historical peak regions, outlining considerable room for growth.

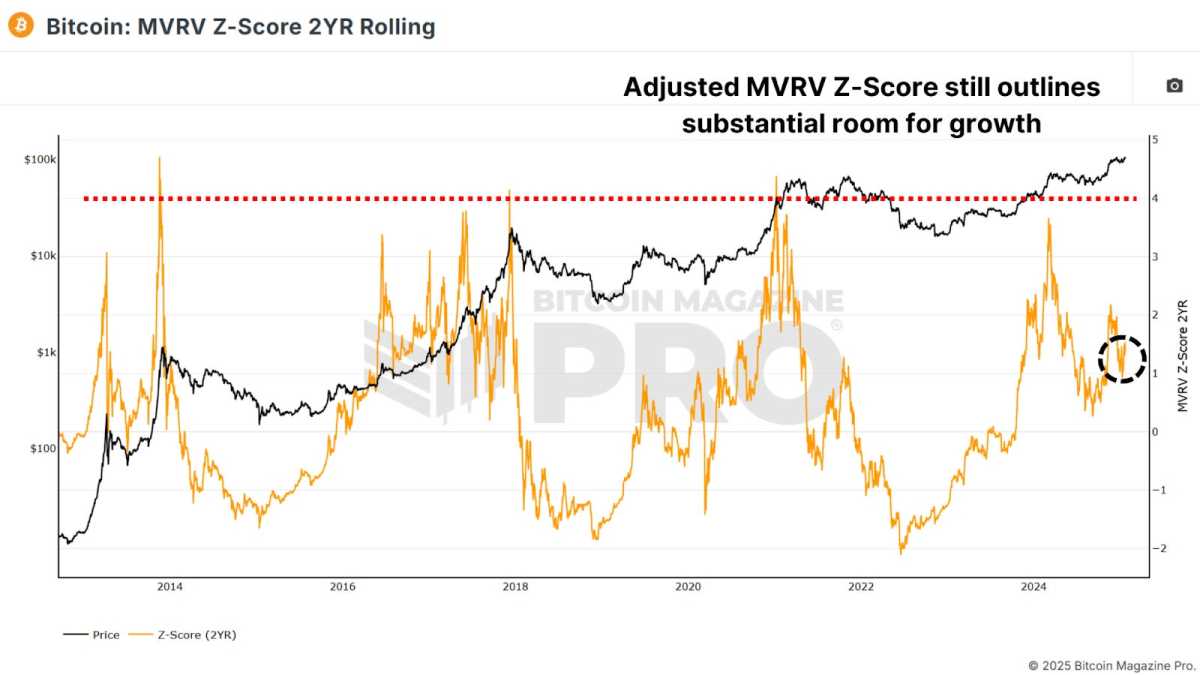

A two-year rolling version of the MVRV Z-Score, which adjusts for evolving market dynamics, also shows bullish potential. Even by this adjusted measure, Bitcoin is far from previous cycle peak levels, leaving the door open for further price appreciation.

Related: We’re Repeating The 2017 Bitcoin Bull Cycle

Sustainable Sentiment

The Bitcoin Fear and Greed Index is currently at a healthy and sustainable amount of Greedy sentiment, indicating greedy but sustainable sentiment. Historical data from the 2020-2021 bull cycle shows that greed levels around 80-90 can persist for months, supporting prolonged bullish momentum. Only when values approach extreme levels (95+) does the market typically face significant corrections.

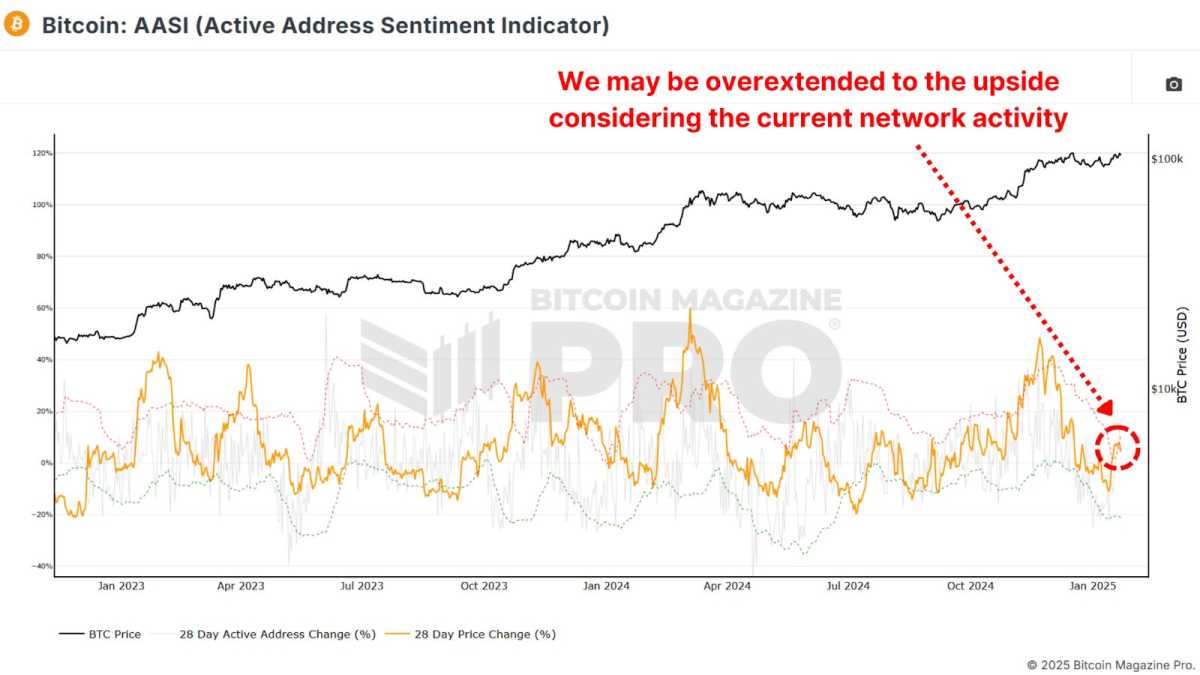

Network Activity

The Active Address Sentiment Indicator reveals a slight dip in network activity, suggesting retail investors have yet to fully re-enter the market. However, this could be a positive sign, indicating untapped retail demand that might fuel the next leg of the rally.

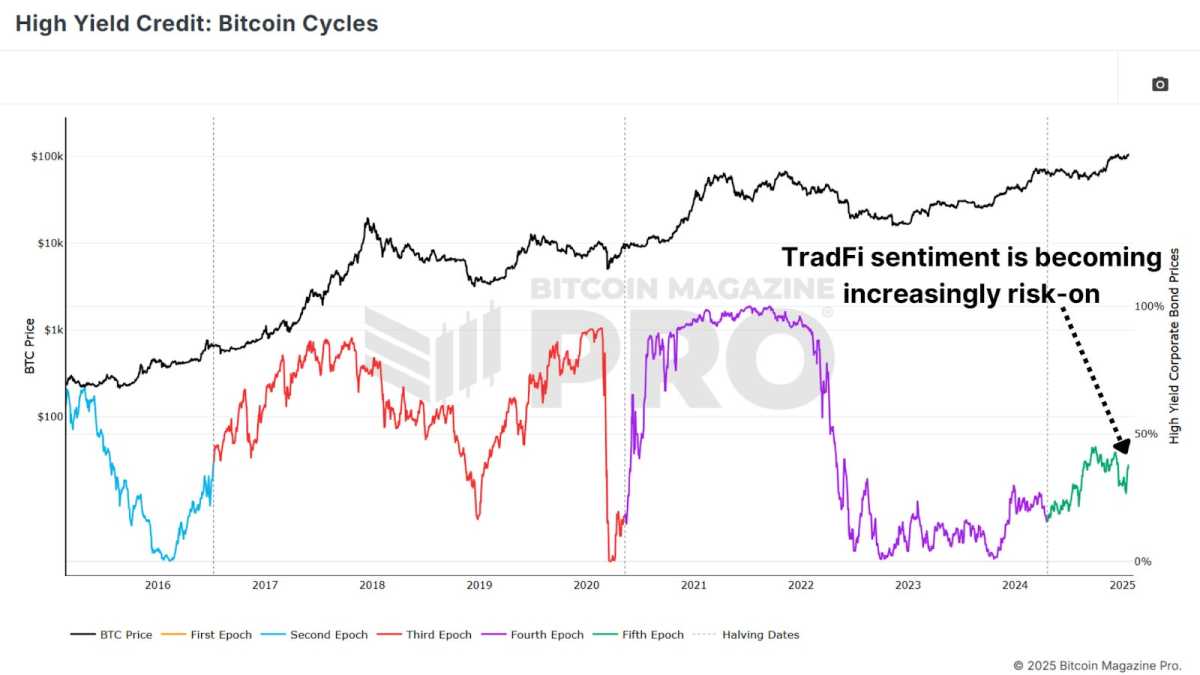

Risk Appetite Shifts

Traditional market sentiment is showing improving signals. High Yield Credit appetite is increasing as the macro-economic environment shifts to a more risk-on outlook. Looking at corporate bonds that offer higher interest rates due to their lower credit ratings compared to investment-grade bonds. Historically, there has been a strong correlation between Bitcoin’s performance and periods of heightened global risk appetite, which have often aligned with bullish phases in Bitcoin’s price.

Related: What Bitcoin Price History Predicts for February 2025

Conclusion

Bitcoin’s on-chain metrics, market sentiment, and macro perspective all point to a continuation of the current bull market. While short-term volatility is always possible, the convergence of these indicators suggests that Bitcoin is well-positioned to reach and potentially surpass our current all-time high in the near future.

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

CryptoCurrency

Bitcoin Could Hit $250k, Price Projections for Ethereum, Lightchain AI and Solana

With Bitcoin projected to hit $250K, the crypto market is abuzz with price predictions for leading projects like Ethereum, Solana, and Lightchain AI.

While Ethereum and Solana remain strong contenders, Lightchain AI is gaining traction as a revolutionary blockchain project integrating artificial intelligence. Currently in its presale phase at $0.005625 per token, Lightchain AI has already raised $12.7 million, reflecting strong investor confidence.

Its innovative approach positions it alongside major players, offering the potential for substantial growth in the rapidly evolving cryptocurrency landscape.

Bitcoin’s Path to $250k and Its Impact on Crypto Market

Bitcoin’s trajectory toward $250,000 is supported by several key factors. Fundstrat’s Tom Lee suggests that Bitcoin could reach $250,000 in 2025, attributing this potential surge to the cryptocurrency’s cyclical price patterns and the anticipated supply shock from the 2024 halving event.

Additionally, the pro-crypto stance of the incoming U.S. administration under President-elect Donald Trump is expected to foster a favorable regulatory environment, further boosting investor confidence. However, it’s important to note that the cryptocurrency market remains volatile, and while these factors contribute to a bullish outlook, investors should exercise caution and conduct thorough research before making investment decisions.

Price Projections for Ethereum, Solana, and Other Key Players

Ethereum (ETH) is currently trading at $3,218.67. Analysts suggest that if current demand and supply dynamics persist, ETH could surpass $5,000 in 2025. However, internal challenges within the Ethereum Foundation may impact investor confidence and price performance.

Solana (SOL) is priced at $251.28. Projections for 2025 vary, with some analysts forecasting a rise to $500, while others anticipate a more conservative estimate of around $257.33. Factors influencing SOL’s price include technological advancements and potential regulatory changes.

It’s important to note that the cryptocurrency market is highly volatile, and these projections are speculative. Investors should conduct thorough research and consider multiple perspectives before making investment decisions.

Why Lightchain AI Stands Out Among 2025’s Top Price Predictions

Lightchain AI stands out among 2025’s top price predictions due to its strategic roadmap and focus on delivering real-world value. The roadmap highlights steady growth, beginning with the prototype development phase (November 2024) and progressing to the testnet rollout (January 2025) for real-world testing. The mainnet launch in March 2025 activates decentralized functionality, followed by ecosystem growth and global adoption later in the year.

Its low-latency infrastructure ensures efficient, real-time processing, making it ideal for demanding applications. To address scalability and resource constraints, Lightchain AI employs sharding and dynamic resource allocation, ensuring consistent performance under heavy workloads. This combination of innovation and sustainability positions it as a standout project for long-term success.

Invest today in Lightchain AI’s presale and join the journey toward a more efficient and scalable blockchain ecosystem. As always, remember to conduct thorough research before making investment decisions. Let’s see where the future of cryptocurrency takes us!

https://lightchain.ai/lightchain-whitepaper.pdf

https://t.me/LightchainProtocol

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

BTC price whipsaws to $106K as US strategic reserve rumors return

BTC price volatility returns with a vengeance as US Senator Cynthia Lummis leaks a cryptic 10am announcement.

CryptoCurrency

Britain to face ‘more frequent’ downturns in blow to economy, analysts warn

Britain is projected to face more frequent technical recessions in the coming years as the economy’s growth potential has significantly slowed, new analysis from Bloomberg Economics has revealed.

The study suggests the UK’s reduced economic capacity has made it more vulnerable to growth shocks, painting a concerning picture for the nation’s financial future.

A recession is defined as happening when a nation’s economy experiences two consecutive quarters of negative gross domestic product (GDP) growth.

While these more frequent downturns may not necessarily lead to major job losses, they represent a significant challenge for both Government and Bank of England policymakers.

The analysis reveals a dramatic decline in Britain’s trend growth rate – the sustainable pace at which the economy can expand without triggering inflation

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Analysts are warning the UK faces multiple recessions

GETTY

From 1955 to 2009, the UK’s trend growth rate averaged 2.5 per cent annually but this has now halved to just 1.2 per cent for the years ahead.

Bloomberg Economics identified 15 episodes since 1955 when the economy experienced shocks substantial enough to trigger a technical recession, based on current trend growth rates.

The frequency of these downturns is expected to increase significantly, with recessions potentially occurring every five years and marks a concerning shift from the historical pattern, where recessions typically happened once every eight years.

Bloomberg Economics’ chief UK economist Dan Hanson said: “There are good reasons to think technical recessions will be more frequent in coming years than in the past.

Experts are warning the UK economy could take a hit GETTY

Experts are warning the UK economy could take a hit GETTY “The UK’s trend rate of growth has fallen, meaning the shocks that would previously have prompted growth just to slow, are now enough to generate a fall in output.”

However, Hanson offered some reassurance, noting that these more frequent technical recessions are unlikely to result in major economic downturns accompanied by surging unemployment.

The UK economy has already shown signs of this increased vulnerability to downturns, having experienced a mild recession in the latter half of 2023.

This downturn was primarily driven by the combined pressures of inflation and higher interest rate with more recent data showing the economy continued to struggle, as GDP showed no growth in the third quarter of 2024.

The Bank of England’s outlook remains cautious, with expectations of zero growth for the fourth quarter of 2024 as well. While some improvement is anticipated for 2025, growth is expected to remain significantly below pre-financial crisis levels.

These recent economic indicators appear to support Bloomberg Economics’ analysis of a more fragile British economy, increasingly susceptible to periods of negative growth.

LATEST DEVELOPMENTS:

Starmer has promised to grow the UK economy

KEIR STARMER

Labour’s Chancellor Rachel Reeves has emphasised her commitment to addressing these economic challenges. Speaking at Davos on Wednesday, Reeves highlighted the need to “turbocharge the economy” in an interview with Bloomberg News Editor-in-Chief John Micklethwait.

She specifically pointed to the importance of infrastructure projects and planning decisions, arguing that Britain needs to change its approach.

“That’s been the problem in Britain for a long time,” Reeves said. “That when there was a choice between something that would grow the economy and sort of anything else, anything else always won.”

The Chancellor also stressed that the “answer can’t always be no” when it comes to major infrastructure projects. This comes as Prime Minister Keir Starmer’s Labour Government, which took power last July, faces pressure over a sharp economic slowdown during their tenure.

CryptoCurrency

Ethereum, Solana, XRP, and Rollblock compete to dominate in 2025

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Rollblock, with its GambleFi solutions, may outshine Ethereum, Solana, and XRP in the race to dominate crypto in 2025.

Things are heating up in the crypto arena, with top tokens rushing to amazing returns. Ethereum is still the second-placed token, but it is losing the market cap race to XRP and the growth rate to Solana. However, Ethereum is still a massive DeFi token and, therefore, cannot be overlooked. However, for great gains, it would be foolish to overlook the smaller tokens appearing in the crypto arena. These tokens may be giant killers, none more so than the new crypto casino Rollblock.

Rollblock: Innovating DeFi with GambleFi

Rollblock is carving out a unique niche in the crypto arena by merging decentralized finance (DeFi) with the rapidly growing online gambling sector. It’s a marriage made in heaven, as Rollblock already promises massive wealth created through a weekly dividend from the income generated by its online casino to its token holders.

But now Rollblock is adding a DeFi element, too. RBLK tokens can be staked for APY rates unmatched by anything in the TradFi sector, making Rollblock a surefire winner.

Ethereum: Strong on DeFi, but struggles to hold place

Looking at the Ethereum market cap’s size, it would seem foolish to see it as an underperforming token. Ethereum’s DeFi holdings alone are 6x that of Solana’s. But Ethereum is struggling. Its growth rate is far lower than that of Solana’s and XRPs, and XRP is already creeping up on Ethereum’s market cap. And if Solana continues to do what it is doing, Ethereum can expect to drop not just one spot on the market cap rankings but even two.

Solana: Securing a top-5 spot in the crypto arena

Solana has flipped BNB again to now occupy the number 5 spot. If not for XRP’s incredible gains, it would be at number 4, breathing down the neck of Tether. Solana’s slow-but-steady market cap growth is an existential threat to Ethereum. Solana, after all, is a direct competitor to Ethereum but is much faster and cheaper to operate. Over the last 4 years, Solana has outpaced Ethereum in year-on-year growth, with the mathematical inevitability that Solana will replace Ethereum at the number two spot behind Bitcoin. Solana is a strong DeFi player, too, sitting number two behind Ethereum.

XRP: Punching above its weight

As little as three months ago, XRP struggled to be in the top ten tokens by market cap. Now, it is at number three, threatening to take Ethereum’s coveted number 2 spot. The good news for Ethereum is that XRP is less than half the market cap of ETH. XRP’s market cap must double to take the crown from Ethereum. Considering how well XRP has done to date, doubling again is a tall order. But XRP’s global mass adoption is imminent, which may give it enough clout to get it past the $400 billion market cap mark.

Conclusion

The stiff competition at the head of the crypto arena is great news for crypto, as it gives legitimacy to the assets. Any of the tokens discussed here will make a valuable addition to a crypto portfolio, and as DeFi markets and crypto adoption grow, so will these tokens. It is Rollblock, however, that promises to deliver the greatest returns of any of the tokens currently in the crypto arena. Rollblock is now available at $0.046.

To learn more about Rollblock, visit the website and socials.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Scammers Prey on Trump-Themed Meme Coin Frenzy

TL;DR

- Scammers are targeting TRUMP and MELANIA investors with fake websites, tricking them into linking their wallets to dubious resources.

- With TRUMP’s price down from its peak and multiple crypto experts bashing the asset’s launch, further big rallies may be limited, so careful research is essential before investing.

Investors, Beware

This bull cycle will be remembered for the solid performance of the meme coin niche. Just a few days ago, the Trump family jumped on the bandwagon, making huge waves in the entire crypto space.

On January 18, Donald Trump’s meme coin, Official Trump (TRUMP), saw the light of day, and shortly after, its price skyrocketed to spectacular levels. It briefly surpassed $70, with its market capitalization soaring past $14.5 billion.

Trump’s wife also launched a meme coin called Melania Meme (MELANIA), and at one point, its market cap soared above $2 billion.

Despite retracing substantially from their peak levels in the past several days, both tokens remain quite trending. This could explain why scammers have supposedly created numerous websites offering dubious services with TRUMP and MELANIA, with the sole purpose of conning unsuspecting victims.

According to a recent report, people visiting such malicious addresses are offered to connect their wallets to the resource to check their right to participate in transactions with the new tokens.

“The official address of the token is indicated on all websites, but when connecting, the victim is asked for the seed phrase from the wallet. Fraudsters can also “hijack” a crypto wallet or connect malware to withdraw funds,” said Maria Sinitsyna, a senior analyst working for a Russian cybersecurity company called F.A.C.C.T.

Is It too Late to Deal With TRUMP?

The impressive price increase of Donald Trump’s meme coin allowed savvy traders to make huge profits overnight due to entering and eventually exiting the ecosystem at the right time.

Currently, TRUMP’s valuation stands far from the peak level registered on January 19, suggesting that the hype could have gradually decreased. In addition, many leading cryptocurrency exchanges (including Binance, Coinbase, Bybit, and more) allowed trading services with the asset.

Separately, many industry insiders were against the TRUMP token launch, indicating that such zero-value assets only harm the industry instead of legitimizing it.

Investors who are still contemplating joining the ecosystem should consider the risks involved and the enhanced volatility of that type of asset. Upon making a final decision, they must conduct proper due diligence and distribute only as much as they are ready to lose.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login