HODLing bitcoin is so simple, yet it’s one of the most difficult and challenging things to do.

HODLing bitcoin is a choice. You have to wake up every day and choose to continue HODLing BTC. When you have every reason to sell bitcoin, you have to continue HOLDing. This is where most people fail.

The anxiety of losing money kicks in. The fear of being wrong becomes a cloud over your head and you start to wonder if you’re wasting your time and ruining your future by HOLDing bitcoin.

It really isn’t for the weak, so I understand why so many people could not fathom holding onto an asset this volatile, this early into its existence. It makes sense why most people were not ready to go all in on bitcoin, but those who did were highly rewarded for their efforts.

This American HODL thread sums up HODLing bitcoin perfectly.

Here’s a story for $106,600 per Bitcoin.

6 years ago in 2018 I stacked cash all year knowing I would rebuy bitcoin at the “bottom”.

We spent 3 months or so consolidating around $6,600.

I got impatient and was like fuck it this is my moment and deployed half my stack.…

— AMERICAN HODL 🇺🇸 (@americanhodl8) December 17, 2024

I remember what it was like back in 2018 when the price of bitcoin dropped by 50%. Only at the time, I was a young college student working in physical therapy. I was in a position to take on as much risk as possible because taking care of myself was my only responsibility, so that giant drop did not affect me mentally too much. But for American HODL, as well as many other Bitcoiners who had wives and children to take care of, the stakes here were raised significantly.

Many Bitcoiners want the price to drop lower, so they can accumulate cheaper BTC. But for many Bitcoiners who have already accumulated bitcoin at cheaper prices, it can be soul crushing to watch the price of bitcoin drop by 70-80% in the bear markets. Bitcoiners, after all, are in this for wealth preservation and to increase their purchasing power. So when bitcoin dramatically drops in price, many feel like it’s a punch in the gut. Losing money sucks.

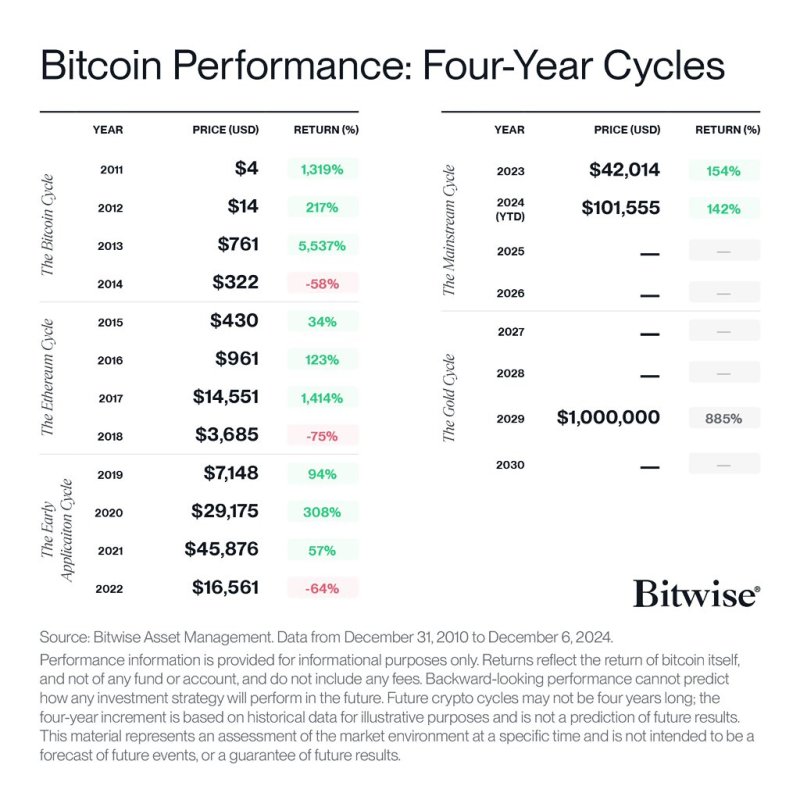

However, if you can withstand the brutal bear markets, the bull markets reward those who sheltered the storm, those who put in the effort to understand this asset and why it has these intense drops and rises. Historically, the price of bitcoin rises for three years in a row, then dumps for one year.

HODLing bitcoin is not easy. It is normal and human to feel the depression of the bear market and the euphoria of the bull. So when bitcoin inevitably dumps in the future after the bull market, be prepared to HODL.

Don’t put yourself in a position where you cannot withstand a 70-80% correction.

Understand the asset you got into and realize this is normal and everything is OK. If you can do that, you will make it out of the bear market alive, and be in prime position to take advantage of the next bull market.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

+ There are no comments

Add yours