Celsius Network has filed an appeal against a court ruling that dismissed its $444 million claim in the ongoing FTX bankruptcy proceedings. The appeal seeks to overturn the December decision by Judge John Dorsey, who disallowed Celsius’ claims due to procedural deficiencies and insufficient evidence.

Background of the Dispute

The defunct crypto lender initially sought $2 billion in damages from FTX, alleging that the exchange’s “unsubstantiated and disparaging statements” contributed to Celsius’ collapse. The claim was later revised to $444 million, focusing on “preferential transfers” that allegedly provided unfair advantages to certain creditors.

In his December ruling, Judge Dorsey found Celsius’ original proofs of claim insufficient, as they contained only a single sentence about investigating potential preference claims. The court ruled that the amended claims, filed in July 2024, were improper because Celsius failed to obtain permission to amend them. Additionally, the amendments were deemed unrelated to the original claims, and the delay in filing was not adequately explained.

Judge Dorsey stated that allowing the amendments could disrupt FTX’s ongoing reorganization efforts.

Celsius’s Position

Celsius argued that its original proofs of claim were adequate to notify debtors of potential avoidance claims. The company contended that these claims met the requirements of the Bankruptcy Code and should have been sufficient to preserve its position. However, the court dismissed this argument, emphasizing procedural and evidentiary shortcomings in Celsius’ filings.

On December 31, Mohsin Meghji, the litigation administrator for Celsius Network and its affiliated debtors, formally appealed Judge Dorsey’s decision. Celsius maintains that the court’s dismissal of its claims was unjustified and is seeking a reversal of the ruling.

Broader Implications

The legal battle unfolds as Celsius continues its efforts to repay creditors. Since 2023, the company has distributed over $2.5 billion to approximately 251,000 creditors, covering 84% of the owed assets. In November 2024, Celsius announced plans to distribute an additional $127 million from its litigation recovery account.

The company’s native token, CEL, temporarily surged 350% in September 2024 following the repayment milestone, reaching $0.56. However, it has since declined to below $0.20, representing a 97.5% drop from its all-time high.

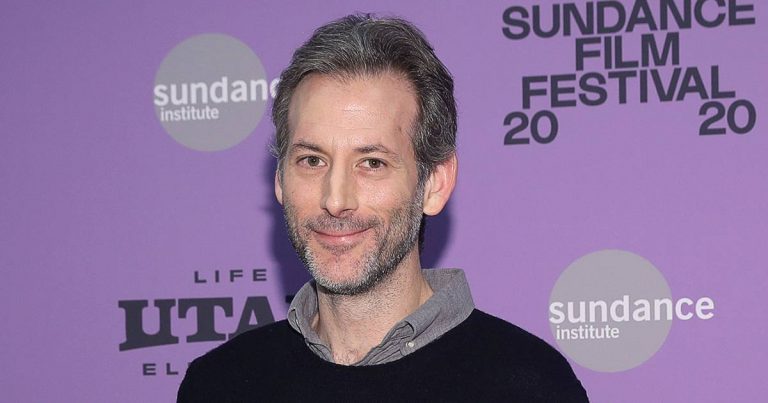

Celsius faces further scrutiny due to the legal troubles of its founder, Alex Mashinsky. Mashinsky pleaded guilty to fraud charges and is awaiting sentencing in April 2025. He could face up to 20 years in prison.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice

+ There are no comments

Add yours