CryptoCurrency

CEO Warns Bitcoin Must Drop To $16,500 To Trigger Collapse

MicroStrategy, the business intelligence firm co-founded by Bitcoin bull Michael Saylor, has significantly ramped up its Bitcoin acquisition strategy, surpassing 400,000 BTC in holdings.

However, concerns about the company’s financial stability tied to the Bitcoin price have emerged, particularly from Ki Young Ju, CEO of CryptoQuant. Ju cautioned that while the prospect of MicroStrategy facing bankruptcy is not impossible, it would require an event as unlikely as “an asteroid hitting Earth.”

MicroStrategy’s Financial Risks As Bitcoin Price Floor Holds At $30,000

In a recent post on X (formerly Twitter), Ju elaborated on the matter by stating that BTC has maintained a consistent price floor, never dropping below the long-term cost basis of major holders, which currently stands at $30,000. He noted:

MicroStrategy’s debt is $7 billion, while its Bitcoin holdings are valued at $46 billion. Based solely on Bitcoin, the liquidation price would be around $16,500. The last cycle’s bottom was at $16,000. Talking about a drop to that level now feels as improbable as predicting $3,000 when Bitcoin was at $60,000.

Related Reading

In the context of current price movements, CryptoQuant noted that the price surge toward BTC’s new all-time high above $108,000 on Tuesday was fueled by short liquidations totaling approximately $151 million over the past 12 hours,

The firm disclosed that the Bitcoin-to-gold ratio also reached an all-time high during this surge, reinforcing Bitcoin’s reputation as “digital gold” and affirming its role as a preferred store of value compared to traditional gold assets.

Additionally, MicroStrategy’s recent inclusion in the Nasdaq 100 has bolstered market sentiment. Saylor hinted at further Bitcoin purchases, even with spot prices exceeding $100,000.

CryptoQuant asserts that this inclusion could lead to passive fund inflows into MicroStrategy shares, providing the company with greater access to capital for its Bitcoin acquisitions.

BTC Purchases For Sixth Consecutive Weeks

Saylor stated on Monday that Microstrategy has purchased the market’s leading crypto for the sixth week in a row. This transaction adds to the firm’s considerable Bitcoin portfolio, which currently stands at 439,000 BTC, acquired for around $27.1 billion at an average price of $61,725 per coin.

Additionally, Saylor revealed that the firm’s Bitcoin assets have produced significant gains, with a 46.4% increase quarter-to-date (QTD) and a 72.4% gain year-to-date (YTD).

Related Reading

CryptoQuant also noted that this week’s central bank meetings appear to be secondary to market sentiment surrounding Bitcoin. While it remains highly unlikely, an “extremely dovish stance” from the Federal Reserve and Chairman Jerome Powell could provide the necessary momentum for BTC to rise even further.

At the time of writing, BTC is trading at $104,140, down 2.6% on the 24-hour time frame but still up 6.5% on the week.

Featured image from DALL-E, chart from TradingView.com

CryptoCurrency

President Trump Signs Executive Order To Ban Central Bank Digital Currencies (CBDC)

Today, U.S. President Donald Trump signed an executive order (EO) related to Bitcoin and cryptocurrency, titled “Strengthening American Leadership In Digital Financial Technology”. This EO officially banned the creation and issuance of a central bank digital currency (CBDC) in the United States, defining a CBDC as “a form of digital money or monetary value, denominated in the national unit of account, that is a direct liability of the central bank.”

“Except to the extent required by law, agencies are hereby prohibited from undertaking any action to establish, issue, or promote CBDCs within the jurisdiction of the United States or abroad,” the order announced. “Except to the extent required by law, any ongoing plans or initiatives at any agency related to the creation of a CBDC within the jurisdiction of the United States shall be immediately terminated, and no further actions may be taken to develop or implement such plans or initiatives.”

The new EO will also establish a presidential working group to create a federal regulatory framework governing digital assets (including stablecoins), and evaluate the creation of a strategic national digital assets stockpile.

“The Working Group’s report shall consider provisions for market structure, oversight, consumer protection, and risk management,” stated the order. “The Working Group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.”

The EO defines the term “digital asset” as any digital representation of value that is recorded on a distributed ledger — which would include cryptocurrencies such as bitcoin, digital tokens, and stablecoins.

The stockpile is expected to include or be fully in bitcoin. Last summer at The Bitcoin 2024 Conference in Nashville, Donald Trump pledged to create a national strategic bitcoin stockpile using the bitcoin already held by the government obtained from hacks and seizures. According to Arkham Intelligence data, the U.S. currently holds 198,109 bitcoin worth over $20.1 billion.

BREAKING: 🇺🇸 DONALD TRUMP PLEDGES TO NEVER SELL #BITCOIN AND HOLD IT AS A STRATEGIC RESERVE ASSET IF ELECTED PRESIDENT pic.twitter.com/bbPRxlZfGZ

— Bitcoin Magazine (@BitcoinMagazine) July 27, 2024

Following Trump’s speech at the conference, U.S. Senator Cynthia Lummis presented legislation to also create a Strategic Bitcoin Reserve, but in a different manner. Her bill would see the U.S. government purchase 200,000 bitcoin per year, for 5 years, until it has bought a total of 1,000,000 BTC. This legislation, however, would have to pass through both the House of Representatives and the Senate before making its way to the president’s desk for final approval.

So far, President Trump has kept his word on the Bitcoin related promises he made on the campaign trail. Earlier this week, President Trump gave a full and unconditional pardon to Bitcoin pioneer and Silk Road founder Ross Ulbricht, which Trump pledged to accomplish in addition to creating a Strategic Bitcoin Reserve, banning CBDC, creating a working group/advisory council, and more.

The full details of the executive order can be found here.

CryptoCurrency

Why Are Litecoin Investors Turning To New Viral PayFi Altcoin Remittix Over Shiba Inu In 2025

There have been significant losses for Litecoin and Shiba Inu in the last 24 hours as many holders look to new projects hoping for better returns. Among these is Remittix (RTX), a PayFi project that raised over $5.2 million in its presale in just a few weeks. The project tackles problems that have been plaguing the global payments sector for many years now, offering a modern alternative. This is a market worth $190 trillion and Remittix could grab a big slice. So how will Shiba Inu (SHIB), Litecoin (LTC) and Remittix (RTX) fare in Q1 of 2025?

Shiba Inu (SHIB) Plummets 7% Overnight

Shiba Inu has kept its holders guessing with major fluctuations through most of January so far. In just 24 hours, Shiba Inu (SHIB) has plummeted by 7.3%, putting Shiba Inu at a value of $0.00002026, dipping to 0.00002040 earlier today. The MACD still signals a slight bullish crossover despite the asset’s losses, so some upward movement or at least some consolidation could be coming soon. On-chain activity too is up, with active addresses up 15% last week, which is at least a sign of healthy network engagement for Shiba Inu (SHIB).

Litecoin (LTC) Sees 24 Hour Dip After Strong Weekly Gain

Litecoin (LTC) too has been facing fluctuations. The asset had a strong week, with a net gain of 15.81%, but it has hurtled down in the last 24 hours, losing 4.06% of its value. Litecoin (LTC) is now trading around the $120 mark, climbing as high as $128.23 earlier today before dipping to $114.44. Litecoin’s RSI is at 62, which means it’s creeping toward overbought territory, but there’s still room for growth. On the contrary, Litecoin’s MACD shows some solid bullish momentum, lining up with the recent price jumps. Looking ahead, Litecoin’s big play for 2025 is getting a U.S.-based ETF approved, and if that happens, it could be a game-changer.

Remittix Switches Things Up in the Global Payments Space

With Remittix, users can convert over 40 cryptocurrencies into fiat and transfer money to any global bank account. By removing hidden fees and implementing transparent flat-rate pricing, Remittix tackles common frustrations associated with traditional international payments. Its rapid transaction processing positions it as a cost-effective and efficient alternative to existing solutions.

The entire process is simple. Users can send funds to any global bank account, with transactions typically completed in under 24 hours. For those weary of navigating complex banking systems, Remittix offers a straightforward yet powerful alternative.

Businesses can also derive great benefit from Remittix, particularly through the Remittix Pay API. This powerful piece of tech enables businesses to receive cryptocurrency payments and settle them in fiat currency. Eliminating digital asset management headaches, the platform supports more than 30 fiat currencies and 50 cryptocurrency pairs, enabling smooth financial operations across regions. Freelancers and merchants with global clients will find this function particularly useful to simplify payments and cut costs.

Recognizing the need for user independence, Remittix ensures that recipients do not know that payments were sent via its platform or that the transactions originated in cryptocurrency.

Remittix Storms Through Presale, Surpassing $5.2 Million

So far, Remittix has raised $5.2 million during its presale, which continues to gain traction. With a focus on privacy, efficiency, and user autonomy, Remittix is positioned to disrupt the $190 trillion cross-border payments market. Some analysts predict significant gains for Remittix (RTX), with forecasts of an 800% price surge during the presale and a potential 5,000% rally post-launch, as the project prepares to lead the PayFi sector.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Bitcoin drops after Trump signs executive order on crypto and ‘national digital asset stockpile’

Bitcoin price falls after President Trump signs an executive order creating a working body for researching and designing a “national digital asset stockpile.”

CryptoCurrency

Pepeto is poised to be the next meme coin giant

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

TRUMP and MELANIA tokens generate buzz, but PEPETO, with strong utility and growth, is quickly gaining momentum in the meme coin market.

Trump and Melania enter crypto, but Pepeto captures growing momentum

The cryptocurrency world was electrified as President-elect Donald Trump introduced the TRUMP token ahead of his inauguration. Initially capped at 200 million tokens, with plans to expand to 1 billion over the next three years, TRUMP saw a staggering $36.15 billion in 24-hour trading volume.

Not long after, First Lady-to-be Melania Trump unveiled her own token, MELANIA, built on the Solana blockchain. Early investors have already seen massive returns, with TRUMP’s market cap surpassing $9 billion. However, critics are questioning the longevity of these political meme coins due to their heavy centralization and lack of utility.

Meanwhile, a new contender is stealing the spotlight: PEPETO, the god of frogs. Unlike TRUMP and MELANIA, which rely heavily on branding and hype, PEPETO combines narrative-driven appeal with robust utility and a rapidly growing community. With over $3.7 million raised in its presale and a social media following exceeding 55,000 users, PEPETO is proving to be a force to reckon with in the meme coin space.

TRUMP & MELANIA: Hype vs. sustainability?

TRUMP and MELANIA have used their ties to the Trump name to create buzz. Early whales have already capitalized, with one investor reportedly turning $12 million into $23.8 million within hours of TRUMP’s launch. However, concerns about centralization loom large, as 80% of TRUMP tokens are controlled by affiliated organizations, leading to skepticism about its long-term potential.

Why PEPETO is winning over analysts and investors

In stark contrast, PEPETO is gaining traction for its emphasis on utility and sustainability. Here’s what sets it apart:

- High Staking Rewards: With annual returns of 387%, PEPETO provides an unmatched opportunity for passive income.

- Cross-Chain Bridge: Pepeto’s technology enables seamless 30-second transfers across blockchains, reducing fees and delays.

- PepetoSwap Exchange: A zero-fee platform designed to streamline meme coin trading, eliminating liquidity issues and high costs.

- Community Governance: Through its DAO model, PEPETO empowers its community with decision-making power, fostering transparency and trust.

- Low Entry Price: Currently priced at just $0.000000105 in presale, PEPETO offers an affordable opportunity for early investors to join a high-potential project.

A thriving community and growing hype

Unlike the centralized dynamics of TRUMP and MELANIA, PEPETO thrives on grassroots support. Its community has surpassed 55,000 across platforms like Twitter, Telegram, and Instagram, with daily growth reflecting its increasing popularity. This strong foundation not only boosts its credibility but also highlights its potential as a leader in the meme coin space.

Whales are betting big on PEPETO

Whale trackers have reported significant accumulation of PEPETO tokens, a strong indicator of confidence from high-net-worth investors. While TRUMP faces volatility due to its hype-driven nature, PEPETO’s utility-first approach offers a more sustainable path to growth. Analysts believe its upcoming exchange listings and groundbreaking features position PEPETO as a game-changer.

The next big meme coin?

As TRUMP and MELANIA dominate headlines, PEPETO quietly builds a foundation for long-term success. With its presale nearing conclusion and the launch of PepetoSwap and exchange listings imminent, PEPETO is not just a meme coin — it’s a movement.

How to join the PEPETO movement

Getting started with PEPETO is simple:

- Set Up a Wallet: Use MetaMask, Trust Wallet, or any Ethereum-compatible wallet.

- Fund a Wallet: Add ETH, USDT, or BNB.

- Connect to the Presale: Visit pepeto.io to purchase tokens.

- Stake Tokens: Start earning staking rewards right away.

About PEPETO

PEPETO combines the fun of meme coins with real-world utility, including a zero-fee exchange, cross-chain bridge, and lucrative staking rewards. As the god of frogs, PEPETO is redefining the meme coin space for 2025 and beyond.

For more information on PEPETO, visit their website, X, or Telegram.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Hackers Use Nasdaq’s X Account in $80M Fake Meme Coin Scam

The official X account of the global electronic marketplace Nasdaq was apparently hacked and used to promote a fake meme coin named STONKS.

Blockchain data shows that the bogus token’s market cap skyrocketed to $80 million before eventually collapsing.

How the Scam Unfolded

According to various reports, the attackers took control of the Nasdaq account and linked it to a fake X profile, @nasdaqmeme, complete with a gold verified badge marking it as an affiliate.

They then made a post promoting the fake STONKS coin and retweeted it with the Nasdaq account, which has over 133,000 followers. The retweet and the apparent connection between the two accounts created a facade of credibility, duping unsuspecting investors into buying the token.

Within hours, STONK’s value soared 390 times its original price, with data from DEXscreener showing that the token reached a market capitalization of $80 million and trading volumes in excess of $185 million.

However, the cryptocurrency’s meteoric rise ended abruptly as its value plummeted to zero, leaving investors with huge losses. Some accounts suggest that the scammers walked away with at least $4 million after rugging the coin.

Interestingly, the fraudulent profile used in the con was a copycat of an existing Solana meme coin, STNK, with the social media handle @STONKS_SOL.

The legitimate STONKS team has warned the crypto community about the rip-off and announced plans to sue the sham project.

STNK was launched in April 2021 as the first-ever joke token on the Solana network. It is based on the “Stonks” meme created in 2017 by Henry Hooper and made famous by the Gamestop short squeeze saga on r/wallstreetbets.

Social Accounts Under Threat

The hacking incident sparked widespread reactions across the community, with many expressing disbelief at its audacity and sophistication. Crypto trader CRG described it as the “best grift” they had ever seen, while other users pointed out the alarming ease with which the fraudsters secured a verified affiliate badge.

At the time of this writing, Nasdaq had not commented on the incident, although the offending post has been deleted, and the @nasdaqmeme account has been suspended.

Incidents of bad actors taking over social media accounts to promote phony cryptocurrencies have been on the rise lately. Towards the end of last year, blockchain investigator ZachXBT exposed an elaborate scheme where hackers compromised 15 X accounts and used them to promote fake coins. The criminals reportedly made away with at least $500,000 from the operation.

In another incident, a different group of scammers targeted the social media accounts of celebrities, including singer Usher, rapper Wiz Khalifa, and actor Dean Norris, to push a slew of counterfeit tokens on Pump.fun, stealing as much as $3.5 million in the process.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Solana Compresses Near Previous ATH – Gearing Up For The Next Leg Higher?

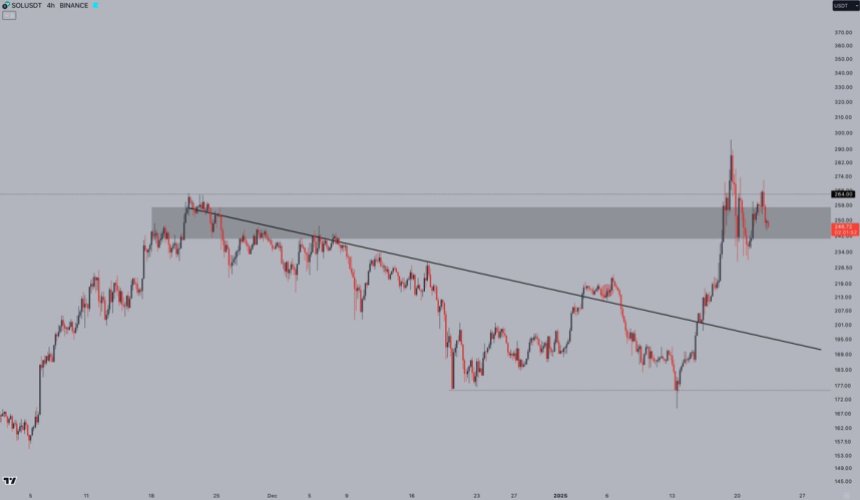

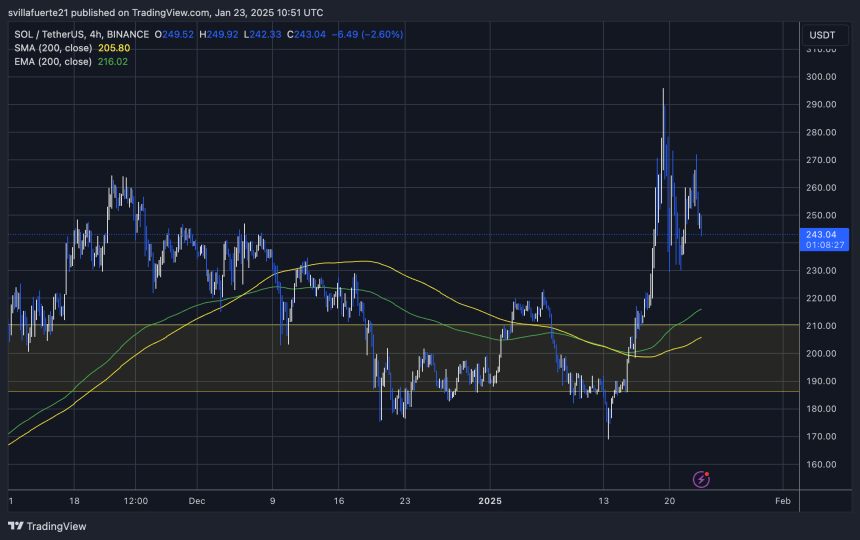

Solana (SOL) has been riding a wave of volatility, recently hitting a new all-time high of $295 before dropping over 22% amid market fluctuations. Despite this sharp correction, SOL has shown resilience by recovering much of its losses, leaving investors optimistic about its potential for further gains in the coming weeks.

Related Reading

Top analyst Jelle has weighed in on the situation, providing a detailed technical analysis that offers insight into SOL’s current price action. According to Jelle, Solana is experiencing “more violent moves, as expected,” while compressing around its previous all-time highs. This compression is a natural phase following such a significant rally and is seen as a healthy consolidation that could set the stage for the next leg higher.

With key levels holding firm and sentiment improving, Solana appears well-positioned for a potential breakout. Investors are closely monitoring the market dynamics as SOL prepares for what could be another major surge.

As one of the standout performers in the crypto market, Solana’s ability to navigate this volatility and push past resistance levels will be crucial in determining its trajectory in the weeks ahead. The coming days could mark the start of a new chapter in SOL’s impressive journey.

Solana Testing Crucial Liquidity

Solana has been making headlines with its aggressive price movements, especially after breaking its all-time high (ATH). Following its impressive rally, SOL has entered a phase of consolidation while holding key demand levels, signaling the potential for sustained bullish momentum. This period of compression is seen as a natural and healthy part of the market cycle, especially after such a strong upward move.

Crypto analyst Jelle recently shared a detailed technical analysis on X, shedding light on Solana’s current market behavior. According to Jelle, SOL has experienced violent price action moves as it compresses right around its previous all-time highs. This consolidation phase, while volatile, is necessary to build a solid foundation for the next leg higher. Jelle noted that it’s encouraging to see key levels holding firm, adding that it feels like it’s only a matter of time before Solana resumes its bullish trajectory.

Analysts across the board remain optimistic about Solana’s outlook, with many predicting that the coming months will be extremely bullish if SOL can maintain its current structure. Holding these key demand levels is critical to sustaining momentum, and a breakout from this consolidation phase could propel Solana into new price discovery.

Related Reading

As one of the most promising blockchain networks in the crypto space, Solana’s resilience amid aggressive price action highlights its strength and growing investor confidence. With technical and fundamental indicators aligning, Solana is poised to remain a standout performer as the market anticipates its next move. The coming weeks will be pivotal in determining whether SOL can capitalize on its strong foundation and deliver another wave of significant gains.

Price Action Details: Key Levels To Hold

Solana (SOL) is currently trading at $243, down over 10% since yesterday as the broader altcoin market faces selling pressure. This decline comes amid Bitcoin’s consolidation just below its all-time high (ATH), which has left altcoins struggling to maintain bullish momentum.

For SOL to recover and regain upward traction, it is crucial for bulls to defend the current price levels. Holding above $243 is key to preventing further downside, while a decisive push above the $265 resistance mark would signal a return to strength. Breaking this level with conviction could reignite investor confidence and set the stage for a renewed rally.

Related Reading

However, the risks of a deeper correction remain if SOL fails to hold support. A drop below $230 would likely trigger additional selling pressure, leading to extended losses and testing lower demand zones. Such a move would challenge Solana’s recent bullish structure and delay its chances of a recovery.

Featured image from Dall-E, chart from TradingView.

CryptoCurrency

Anvil Launches DeFi Protocol for Letters of Credit

Payments remain the big unsolved use case of the internet. When we buy something online, we generally use a traditional payment method, like a credit card, which isn’t “native” to the experience. Your ability to transact with a merchant is verified by a third-party (like a bank), which raises costs and adds a lot of inconvenience for buyers and sellers.

Despite the huge growth of commerce online in the last three decades, most transactions occur outside of the browser. Marc Andreessen, who created Netscape, has referred to this as the internet’s “original sin.” “One would think it was the most obvious thing to do to build into the browser the ability to spend money, but you may have noticed that didn’t happen,” he said in 2019. “I think the original sin was that we couldn’t actually build economics, which is to say money, at the core of the internet.”

This matters because the cost is massive and borne by all of us. Economists have calculated the total cost of retail payments in the United States at as much as 2% of GDP, which is almost as much as the U.S. defense budget. Merchants frequently cite the cost of processing credit cards as some of their highest operating expenses, which is why many will ask you to pay additional charges to use a card in a store, or place a minimum on the amount one should spend. The United States, for all its ingenuity, has some of the highest social cost of payments in the developed world, numerous studies show.

We tend to forget that bitcoin was first proposed by Satoshi Nakamoto as a “peer-to-peer electronic cash system” because a lot of crypto today isn’t focused on this use case. But maybe the next iteration of crypto development will help fix that.

That’s certainly the hope of Tyler Spalding, the founder of an Anvil, a new decentralized finance (DeFi) protocol that reconceptualizes credit, which is the basis of all monetary systems.

How it works

Anvil is a system of Ethereum smart contracts that manages collateral and secures credit. It lets individuals and companies create letters of credit (LOCs) in lieu of traditional forms of money. You use it by locking up ether or USDC in the Anvil vault and receive an LOC for the specified amount. In effect, the system is a lot like a bank check that’s cashed against your account, except there’s no paper, delays or worries about whether the money will clear.

Spalding sees Anvil as a new form of money collateralized with crypto. “By issuing transparent and generalizable credit, Anvil provides sustainable liquidity — essentially creating trusted money for the global economic system,” he said. “Permissionless decentralized technologies can transform how collateral is managed by making the process more secure and more transparent.”

At the protocol level, there are no fees to transact with Anvil, Spalding said, and the technology is open-source. It’s community owned with 60% of the governance token distribution to partners and users, who can vote on operational matters. Spalding, who previously co-founded Flexa, a blockchain-based payments network, sees use cases for Anvil in traditional loans, DeFi counterparty credit (for exchanges or liquidity providers), asset bridging and payments. Three partners have indicated they want to build services using the protocol: Amdax, a digital asset trading and custody provider; Empowermint, which provides retail cash loans; and Flexa, which is using the protocol for asset collateralization against payments on its network. Because Anvil is open-source, these partners use the protocol freely, building their own services.

Anvil has no investors. The protocol was bootstrapped by Spalding and his collaborators over two years of development. Its systems were audited by Open Zeppelin and Trail of Bits, and Immunefi organized two bug bounty programs to find flaws needing to be fixed. Spalding feels comfortable that the system is safe for its ambitious aim of disintermediating banks from the payments and traditional credit-issuing process.

“We’ve been doing it a long time. We love this stuff,” Spalding said of his goal of bringing native payments to the internet and atoning for Andreessen’s original sin. “We want to get other people to get to use this. It’s a real-world use case. That’s the only thing that matters to me.”

CryptoCurrency

Trump Signs Executive Order to Explore a U.S. Strategic Bitcoin Reserve

President Donald Trump has signed a Executive Order titled “Strengthening American Leadership in Digital Financial Technology.” The directive lays out a bold vision for bolstering the United States’ position in the global digital asset economy—most notably embracing open blockchain networks like Bitcoin while flatly prohibiting the development of Central Bank Digital Currencies (CBDCs).

A Major Shift Toward Bitcoin

At the core of the order is an explicit policy to support the responsible growth and use of digital assets, championing citizens’ right to access and utilize open public blockchain networks without interference. For Bitcoin enthusiasts, this represents a monumental endorsement from the highest levels of government. The Executive Order stipulates that no lawful activity on these decentralized networks should be censored, while also clarifying that individuals must be permitted to develop software, maintain self-custody of digital assets, and participate in mining or transaction validation.

New Life for Dollar-Backed Stablecoins

The administration also underscores the importance of legitimate dollar-backed stablecoins, highlighting them as a strategic asset to safeguard the sovereignty and global role of the U.S. dollar. With digital currency usage accelerating around the world, this renewed push for stablecoins signals a forward-thinking approach intended to keep America’s currency competitive in global markets.

Regulatory Clarity & Innovation-Friendly Framework

One of the key challenges the blockchain industry has faced is regulatory uncertainty. The Executive Order calls for technology-neutral regulations and clearly delineated roles for agencies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). By directing a cross-agency effort to rescind or modify outdated rules and develop more effective frameworks, the Trump Administration aims to foster an environment where blockchain startups and established companies can innovate without fear of sudden enforcement actions.

Prohibition of CBDCs

In a decisive move that sets the United States apart from many other nations, the order categorically prohibits the creation, issuance, and promotion of Central Bank Digital Currencies. Citing concerns over financial system stability, individual privacy, and national sovereignty, the Executive Order halts any ongoing or planned CBDC-related projects within federal agencies. This stance signals an unambiguous preference for open, permissionless blockchain networks—like Bitcoin—over government-controlled digital currencies.

Revoking Previous Policies

The order also revokes Executive Order 14067 of March 9, 2022, along with a corresponding Treasury Department framework published in July 2022—both from the previous administration. By rescinding these policies, President Trump is effectively clearing the path for a pro-crypto regulatory climate that prioritizes individual freedoms, innovation, and economic growth.

The President’s Working Group on Digital Asset Markets

To guide these efforts, the Executive Order establishes the President’s Working Group on Digital Asset Markets, chaired by the Special Advisor for AI and Crypto. This Working Group will include the Secretary of the Treasury, the Attorney General, and other top officials. Its mandate includes:

- Drafting a federal regulatory framework for digital assets and stablecoins, focusing on market structure, consumer protection, and oversight.

- Evaluating the creation of a national digital asset stockpile, derived from lawfully seized cryptocurrencies, to enhance the country’s strategic interests.

Within 180 days, the Working Group is expected to deliver a comprehensive report that will shape future legislative and regulatory proposals.

A Resounding Win for Bitcoin

For many within the Bitcoin community, this Executive Order marks a pivotal turning point. By ensuring the right to self-custody, explicitly protecting blockchain networks from censorship, and ruling out government-sponsored digital currencies, the Trump Administration has placed Bitcoin at the heart of the American digital economy.

As the United States steps confidently into this new era, both retail and institutional investors are poised to benefit from clearer rules and stronger protections—while innovative blockchain companies see a fertile environment for growth. By endorsing open, permissionless networks and stablecoins that reinforce the U.S. dollar’s global standing, the nation appears ready to embrace a future in which Bitcoin will play a leading role.

CryptoCurrency

PEPE and DOGE Investors Predict Remittix Will Dominate 2025’s Altcoin Market

Move over, meme tokens there’s a rising star drawing attention from even the biggest PEPE and DOGE enthusiasts. They say Remittix could claim the throne in the 2025 altcoin market, and it’s not just idle talk. Remittix’s presale has already brought in over $5.3 million and is tipped to surge 100x in 2024. Read on to find out why. If you’re on the lookout for the next big altcoin, check Remittix now and see if this real-world solution can beat the meme coin craze.

Why Meme Coin Fans Are Turning to Remittix

PEPE and DOGE once stole headlines with jaw-dropping gains. In early 2025, Dogecoin’s price moved +2.73% to $0.36, backed by a $4.20 billion trading volume. PEPE likewise pumped by 21% at its peak, riding a wave of social media hype. Yet, many of those investors now eye Remittix’s dominance, believing a real-world solution beats fleeting meme attention. By bridging crypto and fiat for cross-border transactions, Remittix could carve out a bigger slice of the 2025 altcoin market than purely speculative coins.

The Numbers Driving Meme Coin Migration

Recent data shows that over 274 million Remittix tokens have sold at $0.0272 each. With a goal to raise $36 million, Remittix has locked liquidity for three years and plans to renounce its contract post-presale. While DOGE soared past a $40 billion market cap in previous cycles, some see Remittix potentially eclipsing that feat through a massive remittance sector worth $700+ billion annually. This utility-based approach contrasts sharply with meme coins powered mostly by online chatter.

Remittix Dominance Hinges on Utility

Although meme tokens can explode overnight, they often fade fast if hype runs dry. Remittixdominance might hinge on consistent demand for fast, cheap transfers. If adoption keeps rising, Remittix could secure a lasting foothold in the 2025 altcoin market. The project tackles high wire fees and hidden costs, offering a service many believe is overdue. If you think that’s the next big altcoin pathway, check Remittix for presale info. It has already intrigued DOGE investors who recall wild price swings and want a steadier bet.

Why PEPE and DOGE Communities Are Watching

PEPE fans saw their coin skyrocket 21% in mere days, but a lack of use cases eventually cooled momentum. Championed by big personalities, DOGE still commands loyalty, yet some holders worry about saturating meme coin markets. As people question the long-term viability of hype-driven assets, Remittix offers an answer. By simplifying remittances, the platform might become the next big altcoin to overshadow meme-centric coins. Supporters point to real-user adoption instead of viral tweets, a factor that could sustain Remittix’s dominance when market fads fizzle.

Will Remittix Truly Conquer the 2025 Altcoin Market?

PEPE and DOGE Investors Predict Remittix Will Dominate 2025’s Altcoin Market because it solves real issues, not just internet jokes. Backers say harnessing a $700+ billion remittance space sets Remittix apart from tokens relying on momentary spikes. Meme coins can generate huge profits fast but many fizzle just as quickly. Remittix could forge a stable foundation for expansion by focusing on cost-effective crypto-to-fiat transfers. If you’re ready to explore a token that might outlast memes, visit Remittix now. Keep track of its growth or connect through their socials here:Linktree.

While PEPE and DOGE remain beloved, shifting sentiment suggests the 2025 altcoin market might favor tokens with tangible benefits. Whether Remittix dominance fulfills its promise depends on adoption, transparency, and a market hungry for real utility. Yet, if early indicators hold true, this could be the next big altcoin story that meme coin loyalists won’t want to miss.

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Trump signs executive order for working group on crypto

The working group established under the EO will explore federal regulations for stablecoins and a national digital asset stockpile.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login