CryptoCurrency

CoinDesk Indices Rolls Out New Index That Diversifies Exposure Beyond the Top 20 Digital Assets

CoinDesk Indices, a subsidiary of CoinDesk, has introduced the CoinDesk 80 Index to address the increasing institutional demand for liquidity across diverse digital assets.

The new offering is designed to track the performance of the next 80 digital assets beyond the CoinDesk20 Index, according to a press release. The Bullish exchange, which has surpassed $1 trillion in cumulative trading volume since its inception in November 2021, has listed a perpetual futures contract tied to the new index under the ticker CD80/USDC-PERP. Bullish is the parent company of CoinDesk.

The index currently counts crypto market makers GSR and STS Digital among its clients. “We’re excited about the broader opportunity this brings to expand liquidity, empower informed trading strategies, and further the maturation of the crypto ecosystem,” Jon Loflin, Chief Investment Officer, GSR, told CoinDesk.

With rising demand from institutional investors for digital assets derivative markets, the new index will provide traders with broader market exposures in the altcoin sector. “The CoinDesk 80 Index Perpetual Future will enable us to efficiently manage market exposure arising from our wide-ranging altcoin option offering to our clients. It is another innovative product from Bullish, enhancing their strong product suite and bringing index derivatives forward,” Maxime Seiler, CEO of STS Digital Ltd, said.

Key features of the CoinDesk 80 Index include a focus on liquid and large-market assets, with minimal exclusions for stablecoins and wrapped tokens alongside comprehensive liquidity screening. The index constituents are weighted by market cap, with a 5% cap per asset to ensure diversification.

“The demand for index products is growing as digital assets become an established part of global financial markets,” said Tom Farley, CEO of Bullish. “We are excited to launch the CoinDesk 80 Index Perpetual Futures Contract on our platform, leveraging our tight spreads, deep liquidity, and robust regulatory framework to support market participants.”

A year ago, CoinDesk Indices debuted the CoinDesk20 Index, a benchmark for larger-cap digital assets. Since then, it has seen over $12 billion in total trading volume and is linked to a dozen investment products globally.

CryptoCurrency

Ripple vs. SEC Settlement Rumors Gain Momentum: Here’s Why

TL;DR

- Speculation is rising that the SEC’s upcoming closed meeting under new Acting Chairman Mark Uyeda might address the Ripple lawsuit, but experts warn against expecting major developments.

- Despite Gensler’s exit, the Ripple-SEC legal battle continues, with disputes over XRP’s classification and an ongoing appeal delaying resolution.

Incoming Resolution or Just Another Speculation?

The lawsuit between Ripple and the US Securities and Exchange Commission (SEC) remains ongoing despite numerous legal developments and changes in the agency’s leadership. Recall that the regulator’s Chairman, Gary Gensler, officially stepped down on January 20 and was replaced by crypto proponent Mark Uyeda.

The Commission has scheduled its first closed meeting under the new Acting Chairman for January 23, causing the XRP Army to speculate that the case against Ripple might be on the agenda this time. Some of the most optimistic predictions include a dismissal of the lawsuit.

It is worth mentioning that the SEC conducts such meetings quite frequently, and there are no public records showing that it has touched upon the aforementioned legal tussle in any of them.

Marc Fagel – a former regional director of the SEC for the San Francisco office – claimed that those expecting “something monumental to happen” at the upcoming gathering “are about to be disappointed.”

“This is the same meeting they hold nearly every week. They will vote on recommendations calendared weeks ago,” he assumed.

Not so Fast

The anti-crypto Gensler might be out of the SEC, but the official resolution of the case against Ripple remains challenging. After all, the entities have been confronting each other in court for over four years, throwing punches at each other on every possible occasion.

The core issue in the lawsuit is whether XRP (Ripple’s native token) should be classified as a security. The SEC argues it was sold as an unregistered investment, while the company insists it is a digital asset used for payments and not subject to securities laws.

In 2023, Judge Analisa Torres ruled that XRP sales on public exchanges to retail investors did not constitute securities transactions. A year later, she ordered Ripple to pay a fine of $125 million for violating certain rules.

The penalty represented just a fraction of the $2 billion the SEC initially asked for, and somewhat expected, the firm was ready to settle it.

However, the watchdog appealed the 2023 verdict and recently filed the necessary opening brief, thus prolonging the lawsuit indefinitely.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Historical Patterns Hint At A Blow-Off Top Above $50

As XRP, currently the third-largest cryptocurrency by market capitalization, navigates recent fluctuations, analysts and market experts are optimistic about its potential for significant price growth.

After experiencing a brief dip toward $2.83 over the weekend, following an unsuccessful attempt to breach its all-time high of $3.40 set seven years ago, the sentiment surrounding XRP remains bullish.

Market Expert Foresees XRP Propelling To $53

In a recent post on X (formerly Twitter), market expert and technical analyst Egrag Crypto shared encouraging price targets for XRP investors, suggesting that historical price patterns indicate a possible blow-off top that could drive the token into double-digit territory.

Egrag highlighted three historical blow-off tops, demonstrating impressive percentage increases that XRP has experienced in the past: one saw a rise of 1,068%, another 2,636%, and a third recorded an increase of 406%.

Related Reading

By analyzing these surges alongside corrective phases, Egrag Crypto formulated potential price targets for the next blow-off top for the altcoin, suggesting levels of $53, $32, and $9.70, all of them surpassing by clear difference the tokne’s current record peak.

Egrag previously noted the importance of a critical price range between $4 and $5, indicating that once XRP reaches approximately $4.40, it will enter a “powerful energy field” that could significantly propel prices higher.

The analyst emphasized that traders should closely monitor price action, candle formations, and oscillator behaviors in this range to determine whether the market is poised for a substantial rally or facing a potential correction.

Despite the optimistic outlook, Egrag urged caution, stating, “I’m still feeling #BULLISHAF, but it’s crucial to remain level-headed when trading and investing, especially with #XRP.”

He expressed concern that market dynamics might be encouraging retail investors to exit, which could be a strategy to enable the emergence of two-digit prices.

Aiming For A 40% Surge Amid Impressive Monthly Performance

Supporting this bullish sentiment, market analyst Ali Martinez has also weighed in on XRP’s trajectory, noting that the cryptocurrency has recently broken out of a bullish flag and is now targeting the $4.40 mark.

Related Reading

This indicates a near-term uptrend of nearly 40% for the altcoin, complementing its impressive monthly performance, which has already seen a surge of 43%. However, despite these positive figures, XRP is currently trading at $3.16, still 7.2% below its all-time high.

The price levels of $3.35 and $3.40 have proven to be significant hurdles for the altcoin, representing crucial barriers that must be overcome to initiate a price discovery phase.

On the downside, the token has established a significant price support range between $2.70 and $2.80 over the past week. This area has become a notable buying zone for investors anticipating further price increases.

Featured image from DALL-E, chart from TradingView.com

CryptoCurrency

CME Bitcoin (BTC) Options Show Most Bullish Sentiment Since Trump Election Victory, ETF Inflows Surge

On Tuesday, bitcoin (BTC) options trading on the Chicago Mercantile Exchange (CME) showed the strongest bullish sentiment since Donald Trump’s Nov. 5 election victory.

Traders scrambled to buy calls, or options offering asymmetric upside exposure, driving the skew higher to 4.4%, the most since early November, according to data tracked by digital assets index provider CF Benchmarks.

Skew is the difference in implied volatility between calls and puts, or options offering downside protection, and positive values represent a bullish sentiment.

“Thirty-day topside skew in the bitcoin options market has reached levels not seen since the November election results,” Thomas Erdösi, head of product at CF Benchmarks, told CoinDesk. “This reflects a strong bullish sentiment, with traders actively positioning for upside exposure across both short- and long-term maturities.”

Bitcoin’s price rose as much as 5%, briefly topping $106,000 Tuesday after buyers defended the $100,000 support level despite President Trump failing to mention crypto or strategic bitcoin reserve in his inaugural speech the day before.

The bounce was accompanied by renewed uptake for the U.S.-listed spot ETFs, which registered a cumulative net inflow of $802 million, according to data from SoSoValue. BlackRock’s IBIT drew $661.8 million alone, helping solidify the bullish sentiment.

“ETF inflows have continued their impressive accumulation streak, marking four consecutive days of significant inflows, amounting to over $3 billion for Bitcoin alone. Bitcoin ($802M) and Ethereum ($74M) are receiving robust institutional backing, which could propel digital assets to new highs,” Valentin Fournier, an analyst at BRN, said in an email to CoinDesk.

Besides, long-term holders — wallets with a history of holding coins for over 155 days — are scaling back their profit-taking activities, according to blockchain data tracking firm Glassnode.

“Looking ahead, it’s possible that volatility levels might moderate slightly towards the end of the month, but we anticipate that the skew for topside will probably remain, barring any surprise policy developments. This will likely provide continued upward price pressure for the foreseeable future,” Erdösi said.

CryptoCurrency

Top 3 Market Makers Rising to the Challenges of Volatility and Cutthroat Competition

The financial landscape is in constant flux, with market makers playing a pivotal role in ensuring trading liquidity and efficiency. Moving into 2025, choosing a suitable platform for one’s trading needs is as relevant as ever. This article looks at three market-making companies to consider for one’s trading strategies and investments. They stand out in this crowded field by ensuring seamless transactions and providing the liquidity required in a wide range of financial markets.

1. Gravity Team

Gravity Team is an algorithmic crypto trading company that underscores efficiency and liquidity in crypto markets, rapidly setting the standard for crypto market makers. Its team of around 60 experts is growing in parallel with its global reach and market volume. The company has achieved a cumulative trading volume of approximately $400 billion since it was founded by a crypto-native team in 2017. It accounts for 1% of the crypto spot trading volume worldwide, is active on more than two dozen prominent crypto exchanges, and offers access to over 1,400 crypto asset pairs.

However, its dominance in emerging markets is its main advantage over competitors, of whom there is no shortage. On the market-making side, large-scale projects in need of liquidity in markets they wish to enter choose this platform to gain exposure. Users can avail themselves of fiat liquidity within exotic markets.

Gravity Team helps achieve equilibrium through high-frequency trading and by cooperating with various industry stakeholders. Its roles are carefully selected to contribute to this overarching goal. It works with projects in the Web3 space to market-make their coins or tokens and with CEXs to provide liquidity. Gravity Team attains its targets by leveraging innovative tools, a tightly-knit team of seasoned professionals, and extensive experience. As an ethical liquidity partner, Gravity Team mitigates risk concerns and attracts more customers to create even more liquidity.

2. Wintermute

Wintermute, a global algorithmic trading platform specializing in digital assets, aims to create efficient, highly liquid markets on and off centralized and decentralized exchanges. The platform provides liquidity on dozens of exchanges and trading platforms and boasts a pronounced impact on digital asset markets. The firm improves liquidity by partnering with promising projects. It supports many highly lucrative trading pairs and cooperates with all major exchanges.

Among its main advantages are 24/7/365 token liquidity, an absence of monthly or integration fees, and competitive spreads, even in the most dynamic markets. Wintermute’s talented DeFi team helps bridge tokens from other blockchains to Ethereum.

3. Keyrock

Highly liquid assets are behind many flourishing markets. Keyrock boosts its clients’ liquidity to create fair and efficient markets and put digital assets on a promising trajectory. Its expert team and algorithms constantly scan platforms to provide additional support where needed. Their market-making algorithms ensure reliable pricing and performance monitoring around the clock. Clients receive a wide range of trading insights and statistics on demand. The market maker guarantees transparency by aggregating price data and liquidity from almost 100 exchanges. The infrastructure attracts traders through market-wide quotes.

The platform facilitates trades and unifies prices, eliminating price discrepancies across markets. As a result, clients benefit from harmonized prices and tightened bid-ask spreads. A smooth trading experience is ensured, with clients readily entering and exiting trading positions. The algorithms guarantee markets can absorb an optimal number of trades, with high-volume ones becoming a trust factor at the right price.

The challenges: market volatility, relentless innovation, and regulatory pressures

Modern market makers face a plethora of challenges that test their flexibility, adaptability, and resilience. While market volatility creates profit opportunities, it can also lead to substantial risks. Bid-ask spreads widen during periods of high volatility, resulting in an increased risk of losing the assets one holds. The three market makers reviewed leverage advanced risk management strategies to mitigate volatility, such as dynamic pricing models that analyze real-time market conditions and adjust bid-ask spreads correspondingly. They hedge their positions and manage their inventory levels efficiently via algorithmic trading strategies. Diversification across different markets and assets is another strategy leveraged to extenuate risk.

Innovation is considered a plus, with new technologies and products constantly entering financial markets. Market makers cannot stay competitive if they’re not on board with this trend. They explore emerging markets, adopt bleeding-edge technologies, and develop new trading algorithms to remain relevant. They make substantial investments in research and development to foster innovation. Their teams expand to include talented developers and traders who build new algorithms and trading strategies. They also stay abreast of the latest technological advancements by collaborating with solution providers and taking part in industry consortia. Market makers embrace AI, cloud computing, and blockchain technology to enhance their operations.

One final challenge involves regulatory pressures. The rules governing financial markets differ depending on the jurisdiction. Regulatory compliance entails significant expenditure, which is unavoidable as legitimate market makers realize non-compliance will result in reputational damage and even more significant fines. The reviewed market makers navigate regulatory pressures by investing in specialized legal and compliance teams. They implement sophisticated compliance software to monitor real-time transactions, ensuring all trades comply with the applicable regulations. Continuous staff training on best practices and regulatory changes also mitigates compliance risks.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

CryptoCurrency

Bitcoin ETFs by Calamos offer capped upside and risk mitigation

Calamos Investments launches Bitcoin ETFs with capped returns and downside protection, offering investors regulated exposure to Bitcoin with risk management options.

CryptoCurrency

Santander boss speaks out after growing fears of bank pulling out of UK

Santander’s executive chairman Ana Botin has firmly rejected speculation about the bank’s potential exit from Britain, declaring “we love the UK” at the World Economic Forum in Davos.

Botin stated that Britain “is a core market and will remain a core market for Santander fullstop.”

The Spanish banking giant’s boss moved swiftly to quash recent reports suggesting the lender was considering leaving the UK market after two decades.

She blamed fee-seeking investment bankers for stirring up the rumours about Santander’s possible departure.

Botin said: “You know the army of investment bankers that wants to get fees? So if they start, these kinds of people start looking at M&A, they start looking around. It’s definitely not coming from us.”

The bank operates 444 branches nationwide and holds £200 billion in customer lending, making it one of Britain’s largest lenders

GETTY

The strong denial comes after reports emerged that Santander was reviewing strategic options for its UK business, including a potential complete exit from the market.

Such a move would have affected 14 million customers and approximately 20,000 employees across Britain.

The bank operates 444 branches nationwide and holds £200billion in customer lending, making it one of Britain’s largest lenders.

Reports had suggested the review was driven by mounting frustrations over UK regulations, including costly post-financial crisis rules requiring banks to separate their retail and investment operations.

The Spanish banking group, which first entered the UK market through its acquisition of Abbey National in 2004, was reportedly examining options to focus on regions with higher growth potential, such as the United States.

Far from expressing frustration with Britain, Botin highlighted the country’s post-Brexit advantages at Davos.

“The UK has a huge opportunity. Why? Because it can move faster. The UK does not have to agree with 27 countries now,” she told the World Economic Forum.

While she acknowledged regulatory challenges, her concerns extended beyond Britain’s borders saying: “Let’s take a pause on regulation because that is constraining growth, big time.”

LATEST DEVELOPMENTS:

The bank has consistently maintained its commitment to the UK market throughout the speculation.

A Santander spokesman reiterated: “We remain focused on providing excellent products and services to our 14 million customers in the UK.”

Despite Botin’s optimistic outlook, Santander has faced recent challenges in its UK operations.

In October 2024, the bank announced 1,400 job cuts across its British business as part of cost-reduction efforts.

Speculation grew that santander could quit the UK High Street

GETTY

The lender has also set aside £295million to cover potential compensation costs related to a car finance commission scandal.

This provision contributed to a significant decline in the bank’s third-quarter profits, which fell to £143million from £413million in the previous quarter.

However, Santander maintains its commitment to the UK market remains unchanged.

A Santander spokesman emphasised: “The UK is a core market for Santander and this has not changed.”

CryptoCurrency

What Is GME Crypto – Coinlabz

In the realm of cryptocurrencies, GME Crypto can be likened to a newly emerged digital asset that has garnered significant attention due to its recent price surge and increased trading activity. Investors are increasingly curious about its potential and are delving deeper into its characteristics and trading possibilities.

However, a comprehensive examination of GME Crypto reveals a complex landscape that goes beyond its surface appeal.

GME Crypto Launch

Since its launch on January 28, 2024, GME Crypto, also known as GameStop, has gained attention as a meme coin on the Solana network. The introduction of the GME/SOL pair through a fair crypto launch attracted over 15,000 holders within a week, indicating initial interest in the coin. This development is noteworthy due to GME’s association with the GameStop meme stock saga, which had significant implications in financial markets.

Influenced by figures like Keith Gill, known as Roaring Kitty, and events such as the ‘Dumb Money’ Netflix movie, GME’s emergence as a memecoin mirrors a trend challenging conventional financial systems. The coin has experienced a notable increase in value, rising over 30 times since May 13.

Additionally, GME Crypto has demonstrated a substantial trading volume and achieved a market capitalization exceeding $100 million.

GME Crypto Key Features

GME Crypto is a unique cryptocurrency operating on the Solana network, inspired by the GameStop meme stock saga. It aims to symbolize a form of rebellion against financial institutions, similar to the events surrounding GameStop.

With a market cap surpassing $100 million and a rapidly growing community of over 15,000 holders within a week of its launch, GME Crypto has garnered significant attention. Since May 13, its value has increased by over 30 times, leading to a 24-hour trading volume of $147,644,110 and impacting other meme coins like AMC.

Key figures such as Roaring Kitty and events like the launch of the GME/SOL pair on Raydium and the ‘Dumb Money’ Netflix movie have contributed to GME’s rise in popularity.

The tokenomics of GME involve approximately 6.9 billion tokens in circulation, with no mechanism for additional minting. The introduction of the GME/SOL trading pair on January 28, 2024, further established its presence in the market. GME Crypto’s growth reflects the spirit of defiance seen in the GameStop narrative within the stock market.

GME Crypto Current Price

The current price of GME Crypto is $0.005896. This digital asset, also known as GameStop coin, has experienced a 14.91% price increase in the last 24 hours, reaching a peak of $0.006474.

With a circulating supply of 6.899 billion tokens, GME is tradable on platforms like BC.Game, Ourbit, Bitrue, BITmarkets, and Raydium, offering trading pairs such as GME/USDT and GME/SOL.

Monitoring the current price of GME Crypto is essential for individuals interested in this digital asset, as price fluctuations can present trading opportunities or risks.

GME Crypto Price Prediction

The GME Crypto, inspired by the GameStop saga and associated with notable figures like Keith Gill, has gained significant attention in the market. With a market cap surpassing $134 million and a recent trading volume of $147,644,110, investor interest in GME has been notable.

Since May 13, the value of GME has surged over 30 times, leading to a market cap exceeding $100 million. This remarkable growth hasn’t only influenced other meme coins like AMC but has also attracted a growing number of holders, surpassing 20,000 by March 2, 2024.

The impact of social media attention and influential endorsements on GME’s price dynamics is considerable, adding complexity to predicting its future price accurately.

It’s advisable for investors to stay updated on market trends and developments to make well-informed decisions regarding GME’s price movements.

Should you Buy GME Crypto

If you’re considering investing in GME Crypto, it’s advisable to carefully assess recent market trends and developments before making a decision. GME, drawing inspiration from the GameStop saga, has experienced notable growth, driven in part by events such as Keith Gill’s participation and a resurgence in social media attention. Since May 13, the value of this memecoin has increased over 30 times, reflecting the strong community engagement and backing it has received.

The involvement of Roaring Kitty has played a key role in attracting holders and boosting the coin’s market capitalization. The success of GME Crypto is closely linked to the GameStop narrative, an active presence on social media platforms, and the steadfastness of digital communities. Technical analysis suggests a bullish trend for GME, positioning it as a potential investment prospect.

However, it’s essential to acknowledge the volatility associated with memecoins and the potential impact of external factors such as Wall Street. Conducting thorough research and carefully assessing the risks are important steps to consider before determining whether to invest in GME Crypto.

Where to Buy GME Crypto

When looking to purchase GME Crypto, also known as GME Memecoin, several platforms offer trading opportunities for this digital asset.

Some of the platforms where you can buy GME tokens include BC.Game, Ourbit, Bitrue, BITmarkets, and Raydium. These platforms support trading pairs like GME/USDT and GME/SOL to accommodate different trading preferences and volumes.

The transparency of liquidity, bid, and ask values varies across these platforms, although the availability of order books may differ. Raydium, for instance, facilitates trading GME against SOL with a 24-hour trading volume of $147,644,110, providing flexibility in trading options.

Frequently Asked Questions

Is GME a Good Stock to Buy?

You should totally consider buying GME! Its recent surge and the community support make it an exciting investment. Keep an eye on the market trends, and remember to do your research before making any decisions.

How Much Is GME Crypto Worth?

GME Crypto is currently priced at $0.005896, with a trading volume of 5.5 million in the last 24 hours. It has seen a 14.91% increase, hitting $0.006474. With a circulating supply of 6.899 billion, it’s available on various platforms for trading.

What Does GME Stand for Stocks?

When you ask about GME stocks, remember GameStop. Dive into the world of meme coins, like GME Crypto, inspired by rebellious tales against financial giants.

What Is the Supply of GME Coin?

GME has approximately 6.9 billion tokens in circulation, contributing to its market cap exceeding $134 million.

Conclusion

If you’re interested in exploring GME Crypto, it’s important to understand its current market dynamics. GME has experienced a significant price surge recently, attracting attention from traders and investors. This surge has led to increased trading activity and volatility in the market.

Before considering any investment in GME Crypto, it’s advisable to conduct thorough research and analysis. Understand the risks involved in trading digital assets and ensure that you have a clear investment strategy in place. It’s essential to stay informed about market trends, regulatory developments, and any news that may impact the value of GME.

As with any investment in the cryptocurrency market, it’s crucial to exercise caution and make informed decisions.

While GME Crypto may present trading opportunities, it’s important to approach this market with a well-informed and rational mindset. Consider consulting with financial advisors or experts in the field to gain a better understanding of the potential risks and rewards associated with GME Crypto.

Other Cryptocurrencies you should check:

GPT Protocol Crypto, Popcat Crypto, ElmoERC Crypto, MultiBit Crypto and HOPR Crypto.

Angel Marinov is the Managing Editor at Coinlabz. With extensive knowledge of crypto payments and blockchain use cases, Angel is a trusted source of accurate and timely information

CryptoCurrency

VeThor VTHO trading volume jumps 80,000% after Upbit listing

VeThor token is witnessing a surge of over 80,300% after the token was listed on South Korea’s largest crypto exchange by trading volume, Upbit.

On Jan. 21, Upbit launched trading support for VeThor Token (VTHO) in both the Korean Won (KRW) and Tether (USDT) markets. As of Jan. 22, VTHO’s trading volume has surged by over 88,000% in the past 24 hours. According to CoinMarketCap, Upbit accounts for more than 66% of VTHO’s trading volume, with over $2.1 billion traded in just 24 hours.

As of this writing, VTHO is priced at $0.008981, reflecting over 300% increase in its value over the last 24 hours. However, it remains roughly 80% below its all-time high of $0.042, which was reached in August 2018.

VTHO was launched in July 2018 as part of the first phase of the VeChainThor blockchain, following its initial release as an ERC-20 token in 2015.

VeChainThor uses VTHO to power transactions and smart contract executions on the network. VTHO is generated by holding VeChain Tokens (VET) and is consumed during blockchain operations, ensuring efficiency and scalability within the ecosystem.

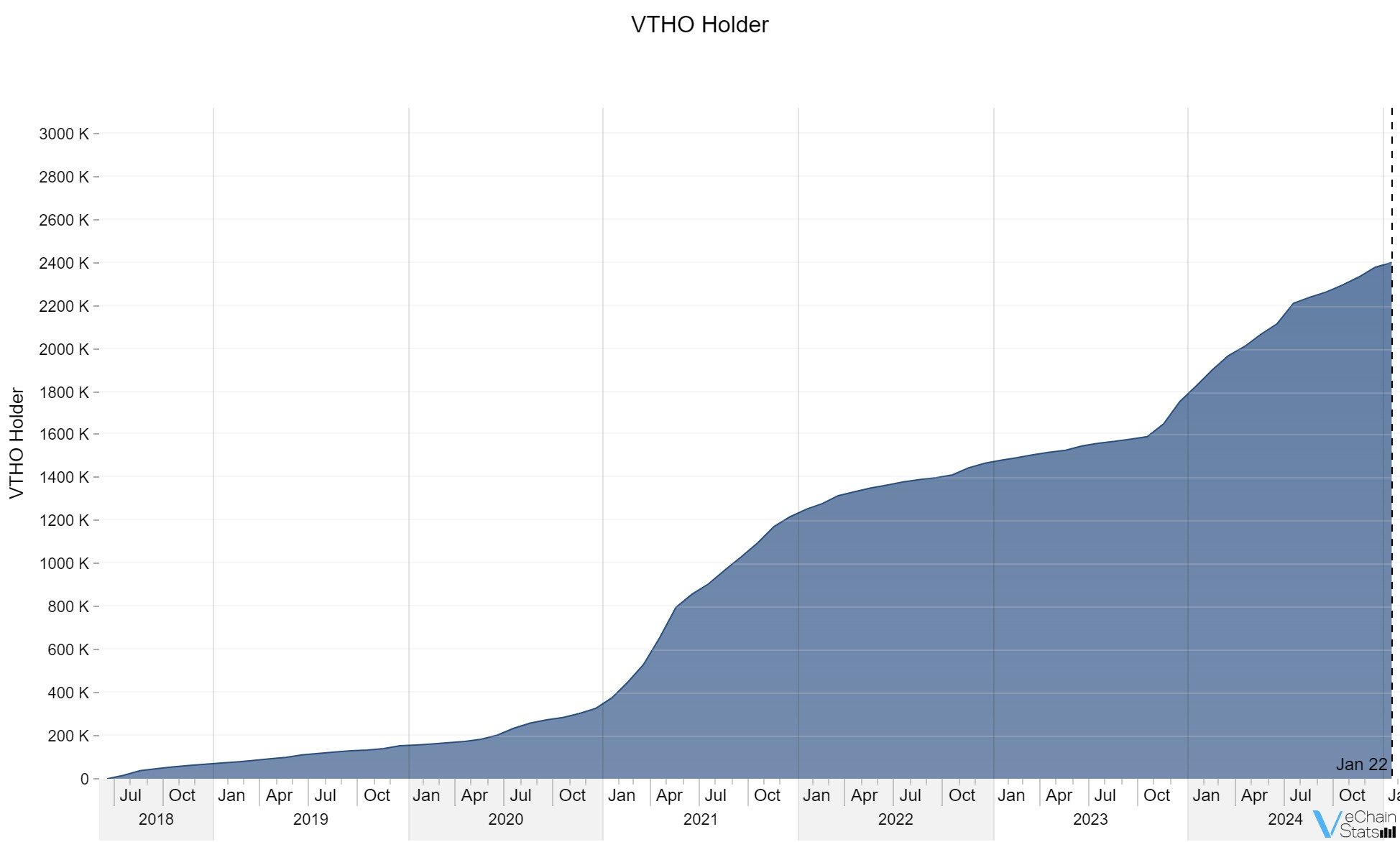

The number of unique addresses interacting with the VTHO on the VeChainThor blockchain continued to rise and in early January 2025 crossed the threshold of 2.9 million addresses as of this writing, as per VeChain Stats.

How far can VeThor rise this bull run?

The MACD is a technical indicator of bullish or bearish momentum, as well as trend direction. It includes MACD line, signal line, and histogram. The MACD analysis notes the recent crossover into bullish territory, which indicates an increase in bullish pressure.

As the histogram widens between the MACD and signal lines, bullish momentum continues to grow. This indicates an increased interest in VTHO which could continue driving performance in the near future. While it cannot predict specific prices, it does give insight into market directions.

Should momentum hold and the market remain bullish, the token may retest resistances in the $0.01–$0.015 range. These psychological barriers are common for tokens with prices below $0.01. However, nothing is certain. Do your own due diligence.

CryptoCurrency

Solana, Dogecoin Gain 6% Daily as Bitcoin Holds Steady at $105K (Market Watch)

After the recent enhanced volatility across the entire crypto market, bitcoin’s price has finally calmed and stands still at around $105,000.

Many altcoins have recovered some ground following yesterday’s declines, and the total market cap is close to $3.8 trillion.

BTC Calms at $105K

The primary cryptocurrency jumped past $100,000 at the end of the previous business week and went to a high of $105,000 on Friday. While the weekend was less eventful on the BTC front, despite the two Trump-related meme coins, the asset maintained its level and even surged to $106,000 on Monday morning.

Then came the volatile ride that pushed the asset to under $100,000. In minutes, it had recovered all losses and skyrocketed even further to just over $109,000 to register a new all-time high. All of these movements transpired in the span of just a few hours.

Once Trump’s inauguration began on Monday afternoon, BTC’s price started to tumble again and plunged to $100,000 once again as he failed to mention crypto even once. Nevertheless, the bulls intervened at this point and drove the cryptocurrency to $107,000 yesterday.

It has lost some ground since then and now trades a lot more calmly around $105,000. Its market capitalization has risen to $2.080 trillion on CG, and its dominance over the alts is still above 55%.

Alts in Recovery Mode

Most alternative coins have turned green today after yesterday’s retracements. Solana and Dogecoin have popped up as the top performers, with both gaining around 6%. As a result, SOL has risen to over $250, while DOGE, which exploded yesterday at one point, is now above $0.36.

ETH, XRP, BNB, and ADA have posted minor gains, while TRX, LINK, and AVAX have added around 3-4% of value.

Other notable price gainers since yesterday include HYPE and CRO, as the exchange behind the latter launched in the US.

The total crypto market cap has increased by over $100 billion on a daily scale and is close to $3.8 trillion on CG.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

CryptoCurrency

Signs Of A Major Breakout Emerge

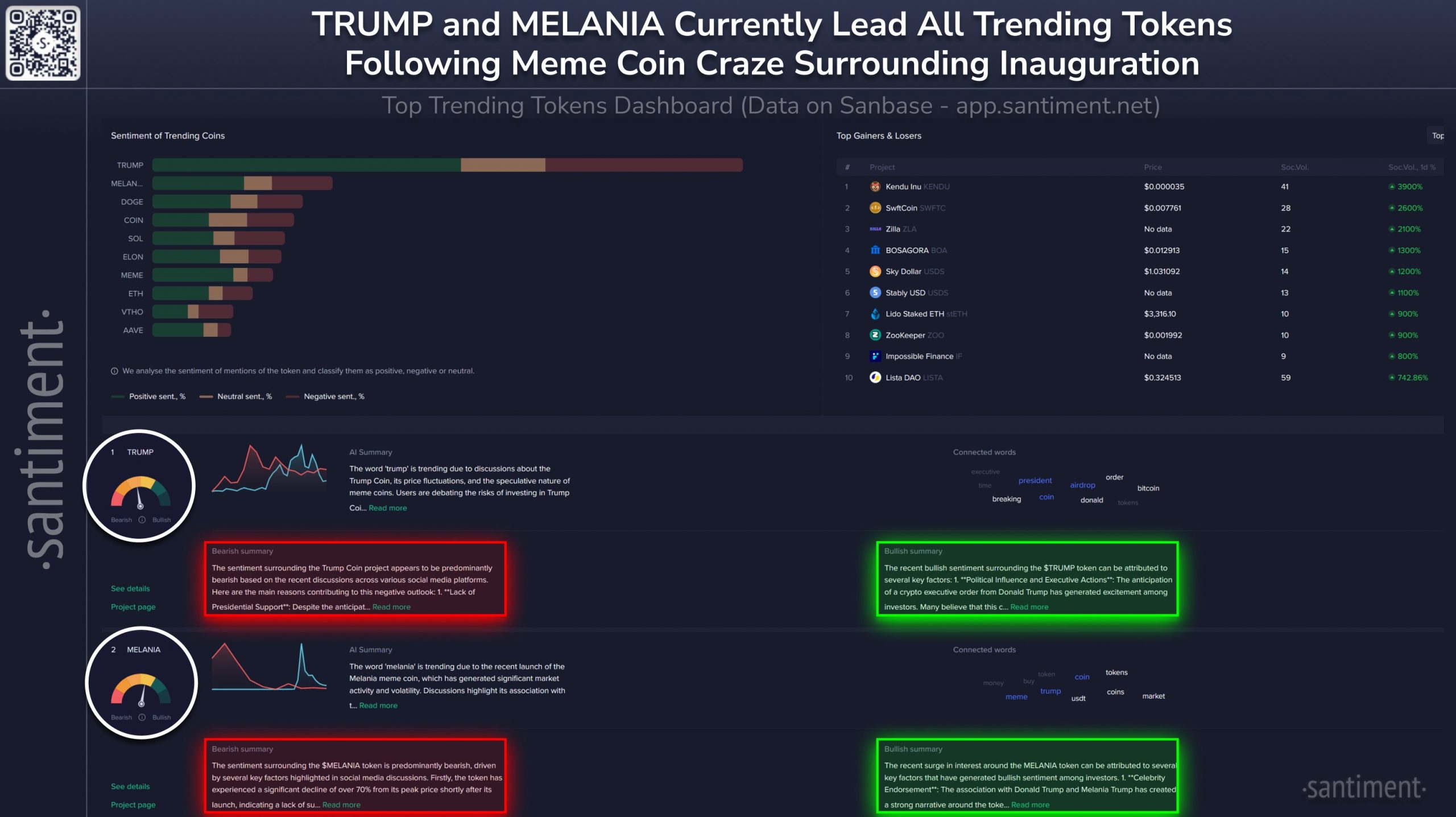

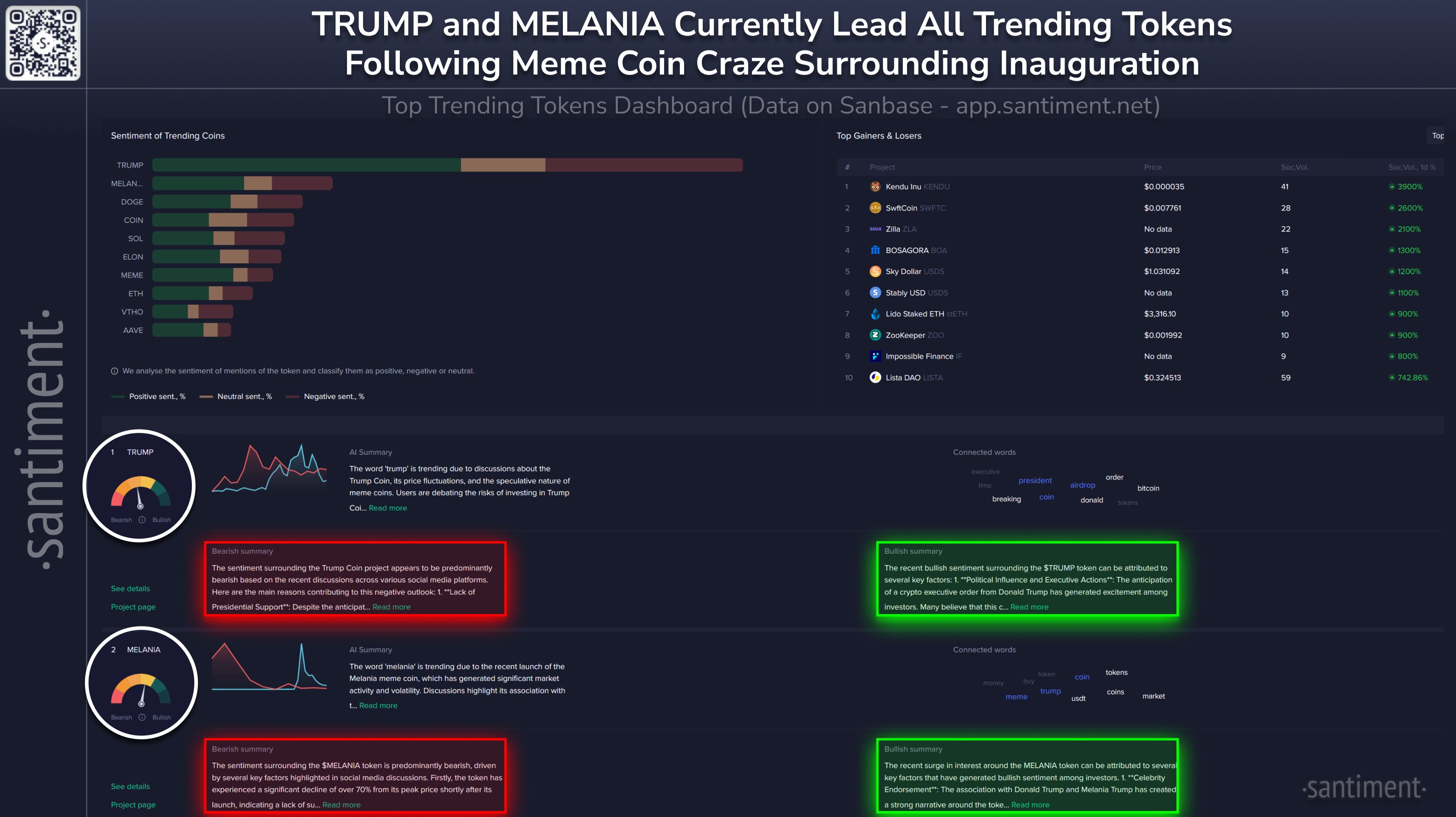

Dogecoin has emerged as a focal point of conversation, even amid a sudden wave of meme coins linked to Donald Trump’s return to the spotlight. On-chain analysis firm Santiment, which recently shared a sentiment dashboard on X, notes that “the top trending tokens” are all about meme coins following the “historic US inauguration of Donald Trump.”

In their latest post, Santiment emphasizes that “TRUMP is being discussed following its controversial listing on Coinbase, and the risks involved in investing during a volatile market,” while there is also “significant interest in airdrops of ‘TRUMP’ tokens, with a notable event securing $1M worth of tokens.”

MELANIA, another meme coin tied to the Trump brand, has caused a stir by briefly surpassing a $9 billion valuation, although it has endured “substantial fluctuations amid broader market uncertainty.”

Related Reading

Meanwhile, Dogecoin’s surge in social media mentions is attributed by Santiment to the newly established US Department of Government Efficiency (DOGE) led by Elon Musk, as the project uses Dogecoin as its avatar. On January 21, the US Government officially launched the Department of Government efficiency (DOGE) website which has the official Dogecoin logo on it.

“This initiative has sparked discussion as it intertwines cryptocurrency with government operations, generating buzz on social media. Additionally, discussions around the potential for new meme coins linked to public figures like Trump and Musk contribute to the speculation about Dogecoin’s future performance and relevance in the crypto space,” Santiment writes.

Despite the sudden attention on TRUMP and MELANIA, Santiment’s sentiment breakdown underscores mixed feelings for both tokens. Regarding TRUMP, the post states: “The word ‘trump’ is trending due to discussions about the Trump Coin. Its price fluctuations, and the speculative nature of meme coins, users are debating the risks of investing in Trump Coin.”

Santiment’s “positive” analysis points to “political influence and executive actions” as reasons for optimism, highlighting that “the anticipation of a crypto executive order from Trump has generated excitement among investors.”

Related Reading: Will Dogecoin Skyrocket Soon? Chart Pattern Suggests Yes

MELANIA’s sentiment likewise splits along bullish and bearish lines, with the negative view referencing a more than 70% drop from its initial peak price, and the bullish narrative noting “celebrity endorsement” from Donald and Melania Trump as a potential driver of renewed interest.

Technical Analysis: DOGE Confirms Breakout

At press time, Dogecoin (DOGE) was trading at around $0.367 after rebounding from a descending trendline dating back to early December. The breakout above the diagonal resistance occurred earlier this week, followed by a successful retest of the trendline yesterday, confirming it as new support.

Following the retest, DOGE is now contending with the 0.5 Fibonacci retracement level at $0.3943, which marks the next major overhead barrier. A clear break of this resistance could open the door to the higher 0.618 Fib level at $0.4759 and the 0.786 Fib at $0.5920.

On the downside, if DOGE fails to break the 0.5 Fib, the 0.382 Fib at $0.3129 may act as the most reliable support. Meanwhile, the Relative Strength Index (RSI) at around 51 remains neutral, reflecting balanced momentum and leaving room for a potential continuation to either side.

Featured image created with DALL.E, chart from TradingView.com

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login