CryptoCurrency

Crypto Price Analysis 12-11 BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, DOGWIFHAT: WIF, CARDANO: ADA, APTOS: APT, FANTOM: FTM

Bitcoin (BTC) reported another plunge below $95,000 late on Tuesday, falling to a low of $94,435 before recovering and climbing back above $97,000. The cryptocurrency is up marginally over the past 24 hours, trading around the $97,500 mark.

The decline comes shortly after the markets witnessed $1.5 billion in liquidations, impacting over 500,000 traders. BTC’s sudden drop also significantly impacted the rest of the market, with the total market capitalization shrinking by over 7%.

Meanwhile, Ethereum (ETH) continued to trade in the red, with the price marginally down at $3,660. Ripple (XRP) has recovered from its recent drop, with the price up almost 8% and trading at $2.33. Dogecoin (DOGE) and Polkadot (DOT) also registered notable declines. Meanwhile, Tron (TRX), Cardano (ADA), Toncoin (TON), Stellar (XLM), and Uniswap (UNI) registered notable increases.

Google Unveils New Quantum Chip. Can It Crack Bitcoin?

Google has just announced its latest supercomputer chip, Willow. Willow can perform computations that would take today’s supercomputers years in minutes. The chip garnered significant attention from the crypto community, which discussed its ability to crack secure blockchain networks and render the security of public key cryptography useless. The chip has led to considerable anxiety in some sections of the Bitcoin community, thanks to its potential to compromise Bitcoin’s security and cryptographic techniques.

Willow boasts 105 qubits and an astonishing ability to minimize computational errors. According to a Google post, it can perform a benchmark test in under five minutes, a task that would take today’s supercomputers around 10 septillion years to complete. The crypto community has mixed views about Willow and its potential to impact BTC and crypto. Some feel the technology could end encryption and crack Bitcoin. On the other hand, most of the community believes Willow has several shortcomings when tested with Bitcoin’s security.

Bitcoin advocate Ben Sigman pointed out that BTC uses two types of encryption: The Elliptic Curve Digital Signature Algorithm (ECDSA) and the SHA-256 secure hashtag algorithm. Sigman pointed out that both encryptions require millions of qubits to break through, meaning Willow, with 105 qubits, is far from cracking Bitcoin’s encryption.

“Q: Can Google’s Willow crack Bitcoin? Estimates indicate that compromising Bitcoin’s encryption would necessitate a quantum computer with approximately 13 million qubits to achieve decryption within 24 hours. In contrast, Google’s Willow chip, while a significant advancement, comprises 105 qubits. We have a ways to go… Nonetheless, this is a remarkable leap forward in quantum computing.”

Others pointed out that crypto should be the least of worries if Willow or similarly capable chips can break encryption standards, stating,

“If quantum computing breaks encryption, crypto would be the least of your worries. It will – expose government & military secrets – exploit banking systems – and turn private chats public, but Google’s Willow is at 105 qubits. Breaking bitcoin needs 13 million qubits – still a long way.”

Microsoft Shareholders Reject Bitcoin Reserve

Microsoft shareholders voted against a resolution to add Bitcoin (BTC) to the company’s balance sheets. The resolution was proposed by The National Center for Public Policy Research (NCPPR), a think-tank based in Washington DC framing it as a corporate duty to provide value to shareholders through profit diversification. The NCPPR submitted a video outlining the proposal that played during the meeting. The video, peppered with charts and figures, discussed BTC’s potential and the advantages of adding it to the company’s balance sheets.

“The institutional and corporate adoption of Bitcoin is becoming more commonplace. Microsoft’s second-largest shareholder, BlackRock, offers its clients a Bitcoin ETF.”

The proposal also discussed BTC’s volatility, stating it was more volatile than corporate bonds, and advised against holding too much of the asset. However, it advised against ignoring Bitcoin altogether.

“As the proposal itself notes, volatility is a factor to consider in evaluating cryptocurrency investments for corporate treasury applications that require stable and predictable investments to ensure liquidity and operational funding.”

Trump To Make Bitcoin (BTC) A Central Focus

President-elect Donald Trump will make Bitcoin (BTC) a central focus of his administration as he aims to push its price to $150,000. According to sources from Trump’s transition team, the president-elect views BTC as another stock market and anticipates a potential price surge to $150,000 early in his term. Trump’s interest in BTC and crypto is part of a broader initiative to position the US as the global leader in crypto and other emerging technologies. David Sacks, a former PayPal executive, has been appointed as the White House AI and Crypto Czar and tasked with creating a clear regulatory framework for the industry.

The incoming administration hopes to promote regulations that provide clarity for crypto and crypto businesses while fostering innovation.

Bitcoin (BTC) Price Analysis

Bitcoin (BTC) fell sharply at the beginning of the week as sellers drove the price to a low of $94,177. While it has recovered from this level, BTC is still struggling to get back above $98,000, a level where sellers are active. BTC and the crypto market hit a significant bump over the past few days. Prices crashed abruptly, shaving off billions in value, with the crypto market cap dropping over 8% in 24 hours. Despite dropping significantly on Monday, BTC made an impressive recovery and has weathered the storm well, but the same cannot be said about other altcoins like Ethereum (ETH) and Solana (SOL). The crash was due to high leverage, liquidity issues, and market weakness.

The market selloff began with aggressive selling on Coinbase as traders started offloading their assets an hour before the crash began. The selling pressure gradually pushed BTC into a liquidation cascade. Looking at the price chart, we can see BTC’s momentum waning as it entered the current week. BTC rebounded from an intraday low of $93,665 on Tuesday, registering an increase of almost 3% on Wednesday and settling at $98,581. BTC experienced significant volatility on Thursday, creating history by moving past the $100,000 mark and setting a new all-time high of $103,900. However, buyers lost momentum after reaching this level, and BTC crashed to a low of $92,285, briefly dipping below the 20-day SMA. BTC recovered from this level to go above $95,000 and settle at $97,023, ultimately registering a decline of 1.51%.

Source: TradingView

BTC recovered on Friday as it rose by almost 3%, reaching a high of $101,913 before settling at $99,695. Buyers maintained control on Saturday as BTC registered a marginal increase before climbing above $100,000 again on Sunday and settling at $101,043. Markets suffered a dramatic collapse on Monday, and BTC plummeted to an intraday low of $94,177 before settling at $97,434, ultimately registering a drop of almost 4%. Sellers retained control on Tuesday as BTC registered a marginal drop to settle at $96,914 after recovering from an intraday low of $94,307. The current session sees BTC up almost 1% as buyers look to reclaim $98,000 and push toward $100,000.

BTC is facing immediate resistance at $98,000. If buyers can go above this level, BTC will look to retest $100,000. On the other hand, a drop could drop BTC to $95,000.

Ethereum (ETH) Price Analysis

Ethereum (ETH) is looking to recover after facing a substantial drop at the beginning of the current week as sellers attempted to drag it below $3,500. ETH was quite bullish last week as it rebounded from a low of $3,504, registering an increase of over 6% on Wednesday to go past $3,700 and settle at $3,844. Sellers attempted to drive ETH below $3,500 on Thursday as it fell to an intraday low of $3,644. However, buyers propped up the price from this level, and ETH ultimately settled at $3,787 after a decline of 1.48%. Despite considerable bearish sentiment and volatility, ETH recovered on Friday, registering an increase of almost 6% to go above $4,000 and settling at $4,003 after reaching an intraday high of $4,093.

Source: TradingView

With sellers active at this level, momentum waned over the weekend, as ETH registered a marginal drop on Saturday before rising by 0.19% on Sunday to reclaim $4,000 and settle at $4,007. With the markets suffering a sudden crash on Monday, ETH collapsed, falling to an intraday low of $3,504 and slipping below the 20-day SMA. However, it found support at this level and recovered to climb above the 20-day SMA and settle at $3,716, registering a drop of over 7%. Sellers retained control on Tuesday as they attempted to drive ETH below the 20-day SMA. As a result, the price fell to a low of $3,519 before settling at $3,630. The current session sees ETH up over 1% as buyers look to reclaim $3,700 and push towards $4,000. On the other hand, if sellers regain control and drive ETH below $3,500, it could fall as low as $3,200.

Solana (SOL) Price Analysis

Solana (SOL) is attempting a recovery as it rebounds from its support levels and counter growing selling pressure. SOL is struggling to go above the 20-day SMA, which acted as a dynamic level of resistance and prevented a move past $240. After dropping to an intraday low of $219 on Monday, SOL made a strong recovery on Tuesday, rising almost 4% from a low of $215 to settle at $234. Sellers regained control on Wednesday, driving SOL down nearly 2% to $229. The price rebounded on Thursday despite facing significant volatility, registering an increase of 2.84% and settling at $236 after rising to an intraday high of $244 and dropping to an intraday low of $221.

Source: TradingView

Buyers retained control on Friday as SOL rose to an intraday high of $246. However, it could not stay at this level and dropped below $240 to settle at $237, registering only a marginal increase. The weekend was mixed for SOL as it registered a marginal rise on Saturday and a slight decrease on Sunday to end the weekend at $237. Selling pressure increased substantially on Monday as SOL dropped to an intraday low of $205 as sellers attempted to drive the price below $200. However, SOL made somewhat of a recovery and climbed above the 50-day SMA to settle at $216 after a drop of almost 9%. Selling pressure persisted on Tuesday as SOL fell to $213 after a fall of 1.47%. The current session sees SOL up nearly 3% as buyers look to reclaim $220 and begin a push towards the 20-day SMA.

Dogwifhat (WIF) Price Analysis

Dogwifhat (WIF) experienced a significant rally last week, surging past the resistance at $3.50 and briefly surpassing $4 before retreating. WIF recovered from an intraday low of $2.99 to register an increase of over 5% on Tuesday. However, it could not move above the 20-day SMA and fell back on Wednesday, dropping almost 3% and settling at $3.19. Sellers drove WIF to an intraday low of $3.04 on Thursday as selling pressure persisted. However, WIF recovered from this level to register an increase of almost 5% to go above the 20-day SMA and settle at $3.35. Buyers retained control on Friday as WIF rose by 4.07% and settled at $3.48, testing the resistance at $3.50.

Source: TradingView

WIF rallied impressively on Saturday as it surged past the resistance at $3.50 after an increase of over 11% and settled at $3.87. WIF attempted to go above $4 but lost momentum. As a result, it fell on Sunday, dropping 3.68% to $3.73. Bearish sentiment intensified significantly on Monday as WIF dropped over 18% to go below the 20-day SMA and settle at $3.05. Sellers retained control on Tuesday and drove WIF below $3 and the 50-day SMA to $2.84 after a drop of 6.69%. The current session sees WIF up by 2.35% as buyers look to reclaim $3 and push the price above the 50-day SMA.

Cardano (ADA) Price Analysis

Cardano (ADA) has been facing considerable selling pressure since last week as sentiment changed to bearish after it reached an intraday high of $1.32 last Tuesday. ADA declined marginally after reaching this level and continued to drop on Wednesday, dropping 0.50% after experiencing considerable volatility. Selling pressure and volatility registered an uptick on Thursday as ADA fell after reaching an intraday high of $1.24, eventually settling at $1.16 after a drop of 2.27%. ADA recovered on Friday, rising almost 6% and settling at $1.22 but fell back in the red over the weekend, dropping by 1.38% on Saturday and 1.40% on Sunday to settle at $1.19.

Source: TradingView

Bearish sentiment intensified substantially on Monday as markets witnessed a selloff. As a result, ADA plummeted almost 16%, going below the 20-day SMA and falling to an intraday low of $0.91 before recovering to reclaim $1. Sellers made another attempt to drag ADA lower as it fell to a low of $0.91 on Tuesday. However, it recovered from this level to register an increase of 1.69% and settle at $1.02. The current session sees ADA marginally down as buyers and sellers struggle to establish control.

Aptos (APT) Price Analysis

Aptos (APT) started the previous week on a bullish note, reaching a high of $14.75 on Tuesday. However, sentiment changed on Wednesday as selling pressure and volatility registered a considerable increase. As a result, APT fell almost 3% to $14.13. Selling pressure persisted on Thursday as sellers drove APT to a low of $13.08. However, it recovered from this level to settle at $13.62, ultimately registering a decline of 3.59%. Despite considerable selling pressure, APT registered a sharp increase on Friday, rising almost 8% and settling at $14.68 as buyers attempted to overwhelm the resistance at $14.50.

Source: TradingView

APT surged to an intraday high of $15.37 on Saturday. However, buyers lost momentum after reaching this level, and the price fell to register a marginal decline and settle at $14.58. Selling pressure persisted as the price dropped marginally on Sunday, ending the weekend at $14.54. Bearish sentiment intensified considerably on Monday as APT plummeted almost 18% to slip below the 20-day SMA and the $13 support level to settle at $11.97, but not after hitting an intraday low of $10.49. Bearish sentiment persisted on Tuesday as APT briefly slipped below the 50-day SMA before recovering to settle at $11.64, ultimately registering a drop of 2.76%. The current session sees APT marginally up as buyers look to reclaim $12 and push toward the 20-day SMA.

Fantom (FTM) Price Analysis

Fantom (FTM) started the previous week on a bullish note, surging almost 14% and settling at $1.24. Despite a strong start to the week, FTM fell back into the red on Tuesday after considerable volatility. FTM ultimately registered a marginal drop to remain at $1.24. Buyers attempted to go above the resistance at $1.30 on Wednesday as FTM reached an intraday high of $1.29. However, buyers lost momentum after reaching this level, and the price fell back, dropping 2.41% and settling at $1.21. Buying activity picked up on Thursday as FTM rose 8% to move above $1.30 and settled at $1.31. Sellers attempted to drag the price below $1.30 on Friday. However, buyers prevented a decline, and FTM registered only a marginal drop to remain above $1.30.

Source: TradingView

Buyers regained control over the weekend as FTM registered a marginal increase on Saturday before rising by 1.12% on Sunday to settle at $1.33. Bearish sentiment registered a substantial jump on Monday as markets collapsed. As a result, FTM dropped almost 17%, falling to an intraday low of $1 before settling at $1.12. The price recovered on Tuesday despite considerable selling pressure and registered an increase of 3.19% to settle at $1.15. The current session sees FTM marginally up as buyers and sellers struggle to take control.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

CryptoCurrency

Chinese traders made millions from TRUMP, Coinbase in Philippines? Asia Express

Top Chinese crypto traders earn millions on TRUMP, Coinbase may expand to Philippines, what on Earth is Bimcoin? Asia Express.

CryptoCurrency

Coinbase Rolled Out the Newest State of Crypto Report

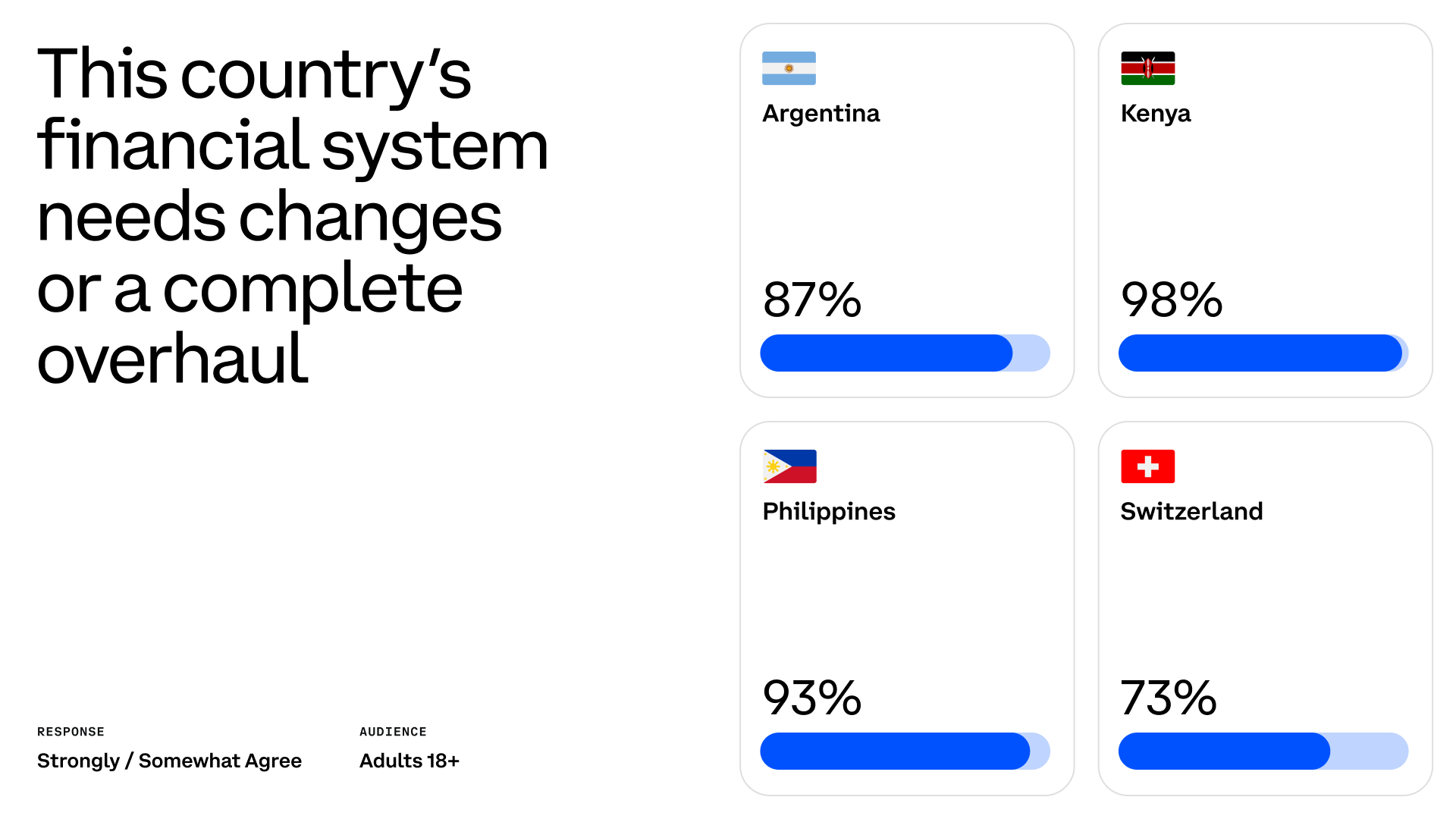

Coinbase rolled out the newest State of Crypto report. The study was conducted by Ipsos. It observes how crypto and blockchain technology are viewed in Argentina, Kenya, the Philippines, and Switzerland and how it impacts the lives of people in these countries.

For most of the part, the study is based on surveys with 4,000 adults (not specifying the age rates) in Argentina, Kenya, the Philippines, and Switzerland conducted on behalf of Coinbase. The choice of countries aims to give an outlook of societies living in markedly different socioeconomic conditions in different parts of the world (none of these countries belong to the same continent, with the Philippines being an archipelago-based country).

The similarities between these countries are the mostly Christian populations and the government systems revolving around the republic model. Nevertheless, the countries have strikingly different areas, positions on the map, historical experiences, cultures, languages, climates, economic states, etc.

Coinbase, however, outlines another similarity between Argentina, Kenya, the Philippines, and Switzerland: according to the exchange team, the residents of these countries feel that the local financial systems need to be improved. More than that, generally, the polled residents see cryptocurrencies and blockchain as tools that may enhance their lives in terms of financial wealth and overall give more freedom and independence.

The state of economy in these countries

The report starts with the statistics demonstrating that in each country, less than a half of all respondents believe that the current financial direction in their country will make them live better than the previous generation. However, even fewer people believe that they will live worse than their parents in Argentina and the Philippines.

So it’s fair to say that in Kenya and Switzerland, people don’t approve of the current financial politics in contrast to the past years, while Argentina and the Philippines rather dislike both the current and the previous efforts, believing that nowadays things are a bit better than before. Respondents in all these countries agree that the local financial system should be changed or overhauled completely. They refer to the financial systems of their countries as “slow,” “expensive,” and “unstable.” They also cited a lack of innovation as one of the problems.

The study reveals four main concerns of the respondents named in the surveys: lack of fairness (discrimination), centralization, decreasing value of the national currency, and too much hard work to earn enough or save money.

The distribution of concerns varies from country to country, with Kenya and the Philippines being most critical towards centralization, discrimination, and wage slavery. Switzerland is least concerned about many of these issues while being cautious towards the government’s dependency on banks. Argentinians have the biggest trust issues with their financial institutions and a problem with saving money.

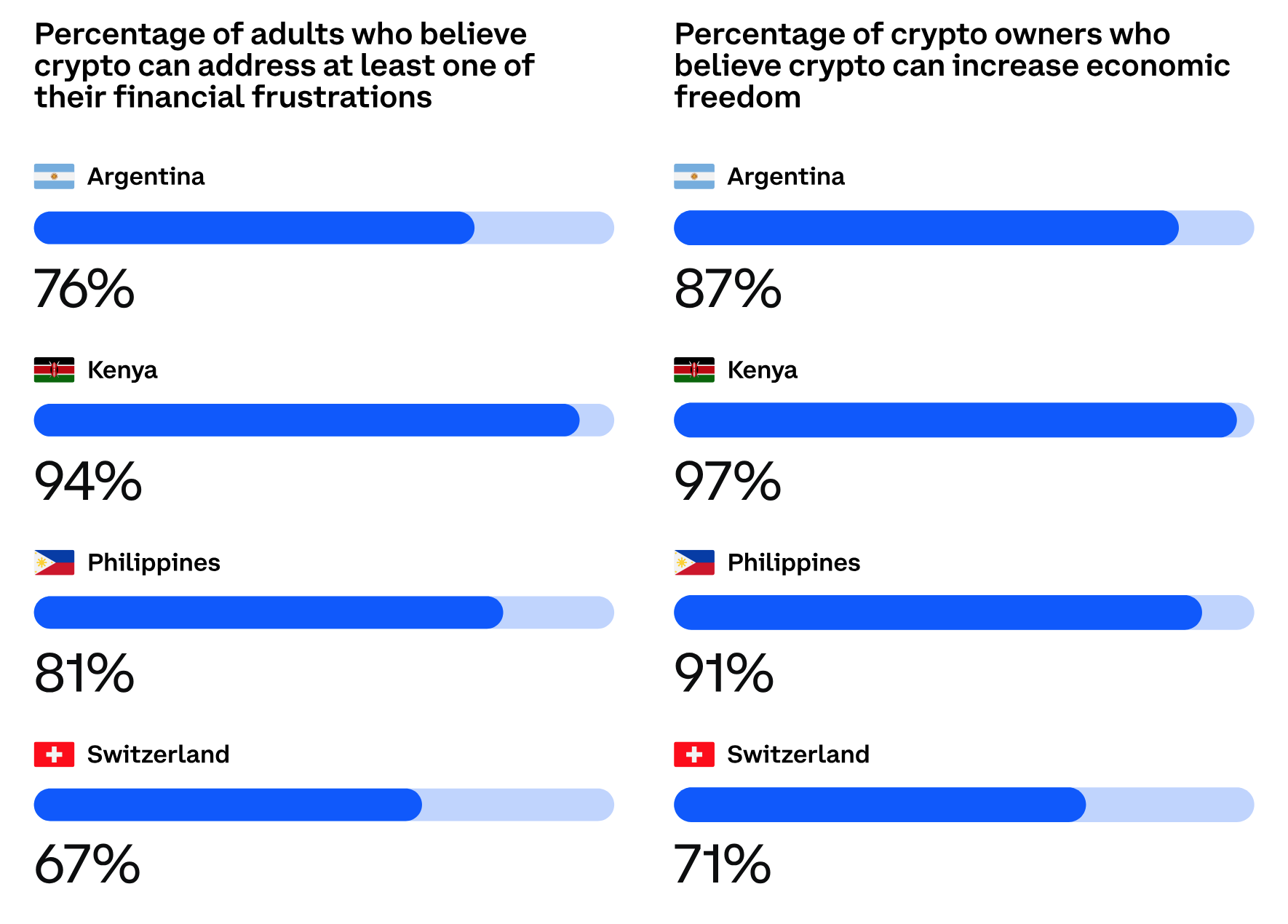

Crypto as a remedy

Most people polled by Ipsos for the study want to be in charge of their financial state and gain more freedom and control over their money. 7 in 10 respondents see cryptocurrency and blockchain as the way to achieve these goals. More than that, both crypto owners and those who don’t have crypto agree that digital currencies can help them gain more freedom and control over their wealth.

Switzerlanders are markedly less interested in crypto than respondents from other countries. However, over 70% of crypto owners in Switzerland believe that crypto offers them more control and freedom. Less than half of the surveyed Switzerlanders with no crypto believe that they need it.

Wider blockchain adoption is also viewed as a favorable factor that may improve the local financial systems and individual wealth. Most respondents believe that blockchain promotes innovation and facilitates control over individual finances. Respondents hope that blockchain will make the system faster and more accessible.

In all polls, Switzerland is presented with lower numbers. It reflects the lower expectations associated with Bitcoin and blockchain and the lower level of dissatisfaction with the financial status quo.

Looking into this study, you may notice a strong connection between the level of satisfaction with the country’s financial direction and the level of support for cryptocurrencies and blockchain. The residents of Switzerland and Argentina are less concerned with the current financial state of their countries, and they are less into crypto than Kenya and the Philippines. Probably, that’s one of the reasons why not only Kenya but Africa in general, where the population has little to no access to banking services but has smartphones, are usually seen as the driver of the mass adoption of cryptocurrency and blockchain-based solutions as the substitute of traditional banks.

CryptoCurrency

Harry Jung Appointed to Guide CFTC’s Crypto and Digital Asset Strategy

In a leadership shakeup at the Commodity Futures Trading Commission (CFTC), Acting Chair Caroline Pham appointed Harry Jung as Acting Chief of Staff on Wednesday.

Jung, who previously served as Pham’s Counselor and Senior Policy Advisor, will lead the agency’s crypto and digital assets engagement and will build on his experience at Citigroup and prior regulatory roles.

CFTC’s Crypto Engagement

The appointment comes as part of broader leadership changes shortly after Pham’s interim appointment by President Donald Trump.

Pham has been involved in several digital asset initiatives at the CFTC, including the creation of a Digital Asset Markets subcommittee. In 2023, she proposed the establishment of a regulatory sandbox to develop a framework for emerging technologies and outlined plans for a digital asset pilot program.

The Trump administration has not yet named a permanent replacement for Rostin Behnam, who will leave the CFTC on February 7th. Former CFTC Commissioner Brian Quintenz is reportedly a top contender for the position.

Throughout his four years at the CFTC, Behnam strongly advocated for the agency to lead the regulation of Bitcoin and other digital currencies. He emphasized the importance of robust oversight as the digital asset market grew rapidly. Under his leadership, the CFTC took major enforcement measures, such as reaching a $2.7 billion settlement with Binance.

In its final push, the agency subpoenaed crypto exchange, Coinbase for customer information tied to Polymarket, a prediction market platform accused of regulatory violations. This last-ditch effort just before the Trump takeover came amidst allegations of market manipulation and gambling law breaches at Polymarket.

SEC, FDIC Shuffle

Besides Pham for CFTC, Mark Uyeda was appointed as the acting chair of the US Securities and Exchange Commission (SEC) by President Donald Trump, replacing Gary Gensler. A vocal critic of Gensler’s crypto policies, Uyeda will serve in this role until the Senate confirms a permanent successor. The American attorney has a history of advocating for a more lenient regulatory approach to crypto, particularly against enforcement actions targeting non-fraudulent crypto firms. Paul Atkins, a pro-crypto figure, is Trump’s nominee for permanent SEC chair.

At the Federal Deposit Insurance Corporation (FDIC), on the other hand, Travis Hill has been named temporary chair following Marty Gruenberg’s resignation. The FDIC has faced criticism, including allegations from Senator Cynthia Lummis, over its handling of digital asset records tied to “Operation Choke Point 2.0.”

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

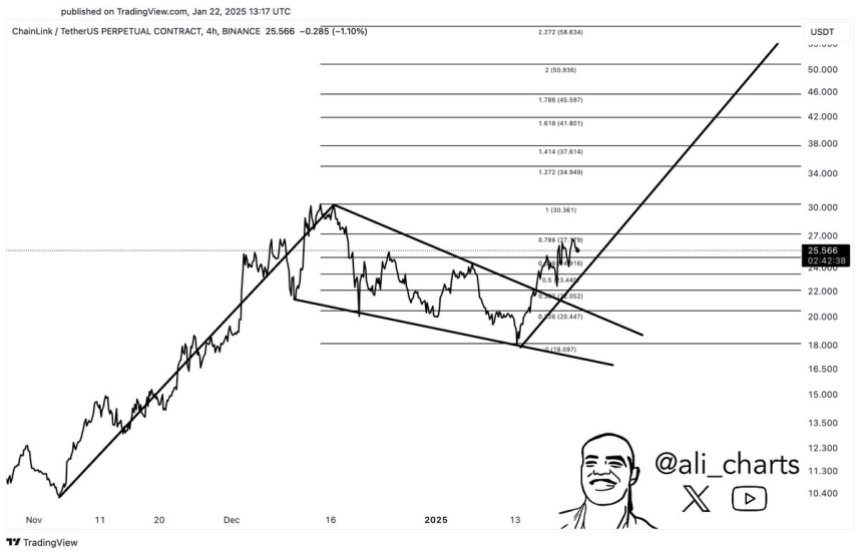

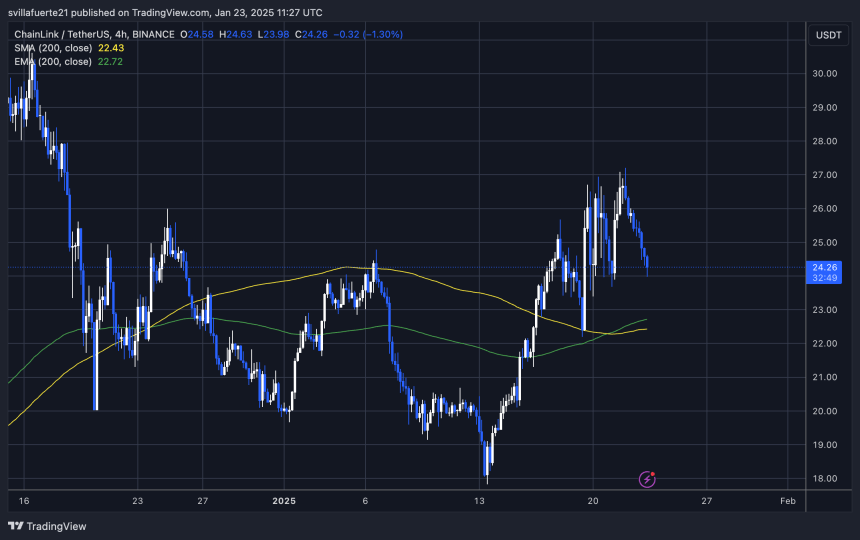

Chainlink Is In The Middle Of A Bullish Breakout – Analyst Sets $50 Target

Chainlink (LINK) is navigating a turbulent market phase, recently experiencing an 11% decline after reaching a local high of $27 yesterday. This pullback reflects the heightened volatility sweeping through the cryptocurrency market, particularly affecting altcoins. Many altcoins, including Chainlink, are facing sharp declines and aggressive price swings as traders respond to uncertain conditions and Bitcoin’s consolidation near all-time highs.

Related Reading

Despite the recent dip, optimism remains among analysts and investors. Top analyst Ali Martinez shared a technical analysis on X, highlighting a bullish perspective for Chainlink. According to Martinez, LINK is currently in the midst of a bullish breakout that, if sustained, could propel the price toward a $50 target. This long-term outlook offers hope for those concerned about the recent retracement, positioning Chainlink as a potential standout in the altcoin market.

As volatility continues to dominate, Chainlink’s ability to navigate these conditions and hold above key levels will be crucial for its bullish trajectory. With analysts pointing to the potential for significant upside, the market is closely watching LINK’s price action in anticipation of its next move. The coming days will reveal whether Chainlink can capitalize on its current setup and emerge as a leader in the altcoin space.

Chainlink Prepares For A Breakout

Chainlink (LINK) has emerged as a bullish standout amid a volatile crypto market, displaying resilience and strength even as altcoins face aggressive selling pressure and uncertainty. With its price maintaining a clear bullish structure, Chainlink appears poised for another upward move, signaling confidence among investors despite broader market turbulence.

Renowned crypto analyst Ali Martinez recently shared a technical analysis on X, highlighting Chainlink’s strong position. According to Martinez, LINK is currently in the midst of a bullish breakout, with a target set at $50. This optimistic projection is supported by the token’s ability to consolidate above critical demand levels, further reinforcing its bullish outlook.

Beyond the technicals, Chainlink’s strong fundamentals add to its appeal. As a pioneer in Oracle blockchain technology, Chainlink continues to cement its leadership in the Real-World Assets (RWA) sector. Its cutting-edge solutions, which enable seamless data integration between blockchains and traditional systems, have garnered widespread adoption and positioned Chainlink as an indispensable part of the decentralized finance ecosystem.

Related Reading

As Chainlink consolidates its gains and prepares for the next leg higher, all eyes are on its ability to maintain its structure and capitalize on its bullish momentum. With both technical and fundamental indicators aligning, LINK is well-positioned to weather market volatility and lead the altcoin recovery. Investors are watching closely as Chainlink continues to set itself apart in the evolving crypto landscape, with its $50 target representing a potential milestone in its ongoing growth.

LINK Holding Strong Above Key Level

Chainlink (LINK) is currently trading at $24.26, a pivotal level that has transitioned from a stubborn resistance to a strong support zone. This shift marks a significant milestone for LINK, as the $24 level had acted as a supply zone for weeks. Now holding firmly as support, it signals that bulls have regained control, setting the stage for a potential surge.

The price action suggests that LINK is building momentum to break above the $27 mark, a critical level that could trigger a more explosive rally. With the broader market facing uncertainty and heightened volatility, LINK’s ability to maintain key demand zones showcases its relative strength and investor confidence.

This bullish setup positions Chainlink as a standout performer among altcoins, as it continues to weather market turbulence. If bulls can maintain control and push above $27 with conviction, the next rally could propel LINK into higher targets, potentially sparking renewed interest and activity in the altcoin market.

Related Reading

As traders closely monitor these developments, Chainlink’s resilience at the $24.26 level underscores its potential for significant upside. The coming days will be crucial in determining whether LINK can sustain its bullish structure and capitalize on this opportunity to lead the market higher.

Featured image from Dall-E, chart from TradingView

CryptoCurrency

The Protocol: Ethereum Foundation Fracas

Welcome to The Protocol, CoinDesk’s weekly wrap-up of the most important stories in cryptocurrency tech development. I’m Ben Schiller, CoinDesk’s Opinion and Features editor.

In this issue:

- DAO governance tool merger

- Ethereum Foundation drama

- Stablecoin USDh comes to Bitcoin

- $25 million grant program for DePIN

Network News

DAO GOVERNANCE PLATFORM ACQUIRES RIVAL: Agora, a blockchain governance startup, is set to acquire its competitor Boardroom. The company framed the acquisition as a strategic move to enhance governance within the broader Ethereum ecosystem, citing expectations of renewed growth in decentralized governance due to President Trump’s promise of regulatory clarity for the blockchain industry. “2025 is the year we make good governance the standard for all protocols in Ethereum,” Agora co-founder Yitong Zhang told CoinDesk. Agora was founded in 2022 by Zhang, Charlie Feng, and Kent Fenwick. The trio initially started working on governance tooling at Nouns DAO, one of the buzzier blockchain protocols to emerge from 2021’s DAO and NFT hype cycle. Agora was founded on the premise that token governance is central to the value of crypto protocols. It aims to provide user-friendly, open-source governance tools for DAOs like Uniswap and Optimism, which both currently use Agora to organize token holders and hold governance votes.Boardroom, which predated Agora and has similar goals, took a more horizontal approach to blockchain governance. Boardroom has gradually transitioned from an Agora-style DAO tooling software to a data feed — similar to a “Bloomberg” for crypto governance data. Agora declined to disclose how much it paid to acquire Boardroom. Boardroom’s employees have been offered roles at Agora, and Boardroom’s founder, Kevin Nielsen, will remain as an advisor. “There’s no plan to deprecate” Boardroom, according to Zhang. Rather, the Agora team will keep both platforms running and will work with users to determine how the tools might gradually be integrated. Read more. – Sam Kessler

ETHEREUM TURMOIL: Konstantin Lomashuk, the founder of the Lido staking protocol, has teased his intention to build a “Second Foundation” to advance Ethereum’s ecosystem. Over the past several days, Ethereum co-founder Vitalik Buterin has outlined plans for a major restructuring of the Ethereum Foundation (EF), the nonprofit organization responsible for supporting Ethereum’s development. In a series of posts on X (formerly Twitter), Buterin shared details of the reorganization, which he said would streamline decision-making processes and address inefficiencies. The announcement has sparked criticism, with some arguing that Buterin’s central role in the restructuring process undermines Ethereum’s ethos of decentralization. The EF has long been scrutinized for its own centralizing influence. Over the past year, the organization has faced mounting pressure to define a clearer vision for Ethereum’s future as competing networks like Solana make strides. Read more. – Sam Kessler

BITCOIN GETS NEW STABLECOIN: The developers of USDh, a stablecoin built on Bitcoin layer 2 Stacks, have completed a deal to bring around $3 million in liquidity to the token. Decentralized finance (DeFi) protocol Hermetica has secured the liquidity, which it says will make it the largest stablecoin on Stacks, through collaboration with Bitcoin lending protocol Zest. The two plan to offer yield on USDh through lending against sBTC, the bitcoin-backed bridging asset that users can use to put their bitcoin wealth in the Stacks ecosystem. The initial liquidity boost could create a short-term window of higher yields, Hermetica said, with projections of an annual percentage yield (APY) as high as 50%. It currently provides an average APY of 18%, Hermetica said in an emailed announcement on Wednesday. Stablecoins play an integral role in the crypto economy, giving users a means of holding their assets in a token that isn’t prone to such significant ebbs and flows in value, because they are pegged to a fiat currency (usually the U.S. dollar). Provision for stablecoins therefore would naturally be an important development in Bitcoin’s evolution into a network that can support DeFi capabilities, a trend that has gathered momentum in the last couple of years. It should be pointed that, however, that the $3 million in liquidity that USDh provides is tiny compared to the dominant stablecoins in crypto. USDT and USDC have market caps of over $138 billion and $51 billion respectively, highlighting the relative infancy of the Bitcoin DeFi sector. Read more. – Jamie Crawley

DEPIN GRANT PROGRAM: World Mobile, a decentralized wireless network, has announced a $25 million grant program aimed at fostering Decentralized Physical Infrastructure Network (DePIN) projects. Tenity, an early-stage investor and global leader in innovation programs and startup acceleration, is a partner in the initiative, which will make available its six international hubs. “By partnering with Tenity, we’re ensuring that the World Mobile Chain Grant Program doesn’t just fund projects but provides the guidance and resources necessary to drive scalable, impactful innovation,” said Micky Watkins, CEO of World Mobile Group. The $25 million offers funding starting at $5,000 and has a focus on decentralized communications, on-chain governance, and the tokenization of real-world assets. World Mobile is an EVM-compatible “Layer 3” developed on Base. Read more.

In Other News

L2s Getting Faster

Letters of Credit for DeFi

Regulatory and policy

Calendar

- Jan. 20-24: World Economic Forum, Davos, Switzerland

- January 21-25: WAGMI conference, Miami.

- Jan. 24-25: Adopting Bitcoin, Cape Town, South Africa.

- Jan. 30-31: PLAN B Forum, San Salvador, El Salvador.

- Feb. 1-6: Satoshi Roundtable, Dubai

- Feb. 19-20, 2025: ConsensusHK, Hong Kong.

- Feb. 23-24: NFT Paris

- Feb 23-March 2: ETHDenver

- March 18-19: Digital Asset Summit, London

- May 14-16: Consensus, Toronto.

- May 27-29: Bitcoin 2025, Las Vegas.

CryptoCurrency

BofA CEO Predicts ‘Banks Will Adopt Crypto Aggressively,’ and Graphite Network Offers the Solution

“Once regulations make it clear, banks will jump in hard on crypto transactions,”

said Bank of America CEO Brian Moynihan in an interview at the World Economic Forum in Davos, Switzerland, an annual event where corporate leaders and policymakers gather to discuss global economic issues and emerging trends.

Moynihan signaled a strong shift toward crypto adoption in the banking sector just a day after President Trump’s inauguration, emphasizing that with the right regulatory framework, banks would eagerly embrace cryptocurrency payments, integrating them alongside existing systems like Visa and Apple Pay. Bank of America is ready to jump in, he said, with hundreds of blockchain patents and a strong plan to dive into the world of digital finance as it keeps evolving.

Regulation is key, but it’s not the whole story – banks need solid infrastructure, too, and the truth is, blockchain infrastructure isn’t fully prepared to handle the shift to traditional finance (TradFi) integration on its own. That’s exactly what new-generation blockchain platforms like Graphite Network are bringing to the table.

Crypto Daily, which previously spoke to Marko Ratkovic, CTO at Graphite Network, reached out to him again for his thoughts on Bank of America CEO’s recent comments.

“Graphite Network, with its bank-compliant infrastructure and projects like the Bank Integration Demo, is ready to drive this shift forward,” says Ratkovic. “Our blockchain is designed to help traditional financial institutions connect to the Web3 world, giving them the tools to enhance their services with greater stability, scalability, and security.”

The Bank Integration Demo is an initiative focused on enabling smooth bank integration, setting up the infrastructure, establishing partnerships and communication with financial institutions, and onboarding them into the blockchain ecosystem. The demo version acts as a proof of concept, showcasing how everything works before full-scale deployment.

Essentially, it’s Graphite Network’s way of laying the groundwork for integrating banks into the blockchain world – step by step, and with progress that can be seen along the way. However, the platform comes with a set of other TradFi-ready features.

How Graphite Network Makes Blockchain Work for TradFi

No other blockchain currently offers, and Graphite Network does, the option for banks and other financial institutions to create custom reputational smart contracts and offer loans exclusively to users that match predefined criteria, ensuring compliance with regulatory and business requirements, putting reputation and trust at the core of its ecosystem.

Accountability Through Verified Users

First off, the setup fee, paid in @G, Graphite Network’s native token, enforces a ‘One User, One Account’ policy, reducing fraud risks and ensuring only verified accounts are active. This makes it easier for banks to work with blockchain users without worrying about duplicate or suspicious accounts.

By the way, @G Ticker System provides clarity by showing which network a token is linked to, reducing confusion and ensuring transparent, traceable transactions for banks.

KYC That Balances Security and Privacy

Graphite Network’s ZK-Proof-based KYC system simplifies user verification while focusing on privacy. Starting with social media verification and with more advanced levels coming in future updates, it allows banks to verify identities without storing sensitive customer data. This approach is far less intrusive, helping banks meet regulatory standards while providing a reliable framework for adopting blockchain technology.

Unlike traditional banks, which often use customer data for marketing, Graphite Network really minimizes data usage and ensures that third-party platforms can verify users without exposing their sensitive information.

Building Trust With Trust Score

The Trust Score adds another layer of security, giving users a credibility rating based on factors like KYC level, transaction history, and account age. For banks, this means a transparent way to assess trustworthiness while dealing with blockchain transactions.

Ensuring Proper Fund Use with Tagged Addresses

Graphite Network is planning to introduce tagged addresses to make blockchain activity more transparent and accountable. These addresses will be linked to specific purposes, like donations to charity organizations, so it’s clear where funds are meant to go. For example, if someone sends money to a charity-tagged address, everyone can see it’s for that cause. If the funds, for instance, are spent on gambling, the system will flag it right away.

On top of that, smart contracts will be able to block transactions from suspicious addresses, adding another layer of security. This feature isn’t live yet, but it’s a solid step toward making blockchain more secure and something people can trust.

A Balanced Reward System and the Ability to Earn Directly from the Blockchain

It’s not just banks Graphite Network is helping but this revolutionary L1 blockchain is also removing barriers for everyone else.

Most L1s and L2s favor validators with costly setups, leaving average users behind. Graphite Network changes that with a reward system where transport nodes (known as entry-point nodes within the ecosystem) earn a portion of transaction fees.

These fees are split 50/50 and paid in @G, half goes to the node operator, and half to the block sealer, while authorized nodes earn 100% for transactions without a transport node and 50% for those with one. This system increases accessibility and drives adoption because it allows more people to get involved and earn.

“It’s ridiculous that integrators couldn’t make a dime straight from the blockchain before – it’s been a huge headache for the industry,” Marko explained earlier. “But we’ve finally got a blockchain where that’s actually possible now.”

Graphite Network’s top-performing nodes get priority to validate, and an Oracle randomly selects the node to seal each block, reducing bias.

Touching upon the Trust Score topic once again, Graphite Network’s system rewards validators with high rank and high-quality services by giving them more transactions and better rewards. This focus on trust and reliability helps make the blockchain feel safer and more approachable for everyone.

As Brian Moynihan pointed out, the banking sector is ready to embrace crypto payments once regulations are clear. Yet, clear regulation alone won’t be enough – solid infrastructure is equally vital. Graphite Network is putting in the work to build the strong foundation needed for fair, secure and scalable crypto transactions, and their new Bank Integration Demo and everything else they’re working on shows just how serious they are.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

CryptoCurrency

SEC cancels controversial crypto accounting rules

The SEC published a new Staff Accounting Bulletin revoking SAB 121, rules that governed how financial firms should hold crypto criticized by the industry.

CryptoCurrency

Pepe faces rising threat from 1Fuel, the potential next big crypto opportunity

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

1Fuel enters the crypto scene, challenging the dominance of meme coins like Pepe, SHIB, and Dogecoin.

Pepe rose from obscurity to become a household name in the cryptocurrency market. The meme coin market was largely dominated by Pepe, Shiba Inu, and Dogecoin. However, things are changing with the entry of a new player in the cryptocurrency market — 1Fuel (OFT).

The meme coin market soared without Pepe

2025 has been an amazing year for the meme coin market, albeit less than a month in. The introduction of meme coins like $Trump Coin and $Melania Coin to the mainstream was unexpected. While many cryptocurrency traders have made a fortune, there is an issue: older, more recognized meme coins did not budge, and Pepe fared even worse — it started a downtrend.

On the daily chart, Pepe has formed a classic pattern of lower highs and lower lows. This indicates a greater probability of a downtrend to the $0.000008 mark, and with liquidity being drawn away from the market for newer projects, the outlook could worsen for Pepe.

Long-term Pepe traders are taking a contrarian approach. Instead of increasing selling pressure on Pepe, they are investing in another cryptocurrency. Sentiment has shifted from supporting a community-oriented project to backing one with the technical infrastructure to be viable several years down the line.

This new cryptocurrency is 1Fuel, and it is a major competitor to popular meme coins with no use case.

What is interesting about 1Fuel?

While not a meme coin, 1Fuel has captured the attention of even the Pepe whales. Its presale has raised over $1.3 million, with over 143 million tokens sold, and social media chatter suggests this is just the beginning.

1Fuel’s unique selling proposition lies in its simplicity and ease of use. Key features of this project include multi-chain transactions, military-grade security, and a user-friendly interface.

Currently in the third phase of its presale, early 1Fuel investors have already secured a 17x return on their investments, as the price during the first presale was $0.001, while the current price is $0.017.

Although the launch price for the token is still unknown, crypto commentators believe 1Fuel could increase by as much as 50x before the end of 2025.

The primary reasons are

- Its unique one-click technology will make crypto trading seamless.

- It is in line for the Alt season where many altcoins will rally

- The race for the next big cryptocurrency to buy is on, and investors are seeking new projects

Interested investors wouldn’t want to miss this chance to stack up on 1Fuel tokens during the ongoing presale at $0.017. Its current growth rate suggests that the price won’t remain this low for long.

To learn more about 1Fuel, visit the presale website, Telegram, and Twitter.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Trump’s Digital Asset Executive Order: Here’s What’s Inside

Donald Trump’s executive order on crypto, titled “Strengthening American Leadership in Digital Financial Technologies,” has been signed.

Here’s exactly what’s inside the order – which utterly revokes that of the more crypto-hostile Biden administration from two years ago.

- Broadly, the order establishes the “President‘s Working Group on Digital Asset Markets.” It will be chaired by David Sacks – the special advisor for AI and crypto – and include heads of several other agencies like the Treasury Secretary, Attorney General, SEC chairman, and CFTC chairman.

- Next, the order tasks the DOJ, Treasury, and SEC to identify all recommendations and policies made to crypto within 30 days, and to submit recommendations for whether they should be revised or kept within 60 days.

- Within 180 days, the Working Group must submit a report to the President with policy recommendations surrounding crypto.

- In particular, they must propose a regulatory framework for the “issuance and operation of digital assets, including stablecoins.”

- It must also “evaluate the potential creation and maintenance of a national digital asset stockpile” – reminiscent of the stockpile Trump promised to establish for Bitcoiners in July 2024.

- This stockpile would potentially be “derived from cryptocurrencies lawfully seized by the Federal Government,” the order stated.

- The working group will hold public hearings gathering input from crypto industry leaders and experts in establishing their framework.

- Finally, the order prohibits federal agencies from “undertaking any action to establish, issue, or promote CBDCs within the jurisdiction of the United States or abroad.” The Republican Party – now controlling the House, Senate, and Presidency – has long opposed Democrats’ desire to establish a CBDC.

- Trump has already followed through on several promises to the Bitcoin community, including granting a pardon to Silk Road founder Ross Ulbricht.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

SEC Withdraws Controversial Crypto Tax Accounting Bulletin

The U.S. Securities and Exchange Commission published a new Staff Accounting Bulletin Thursday withdrawing its controversial SAB 121.

SAB 121 directed banks and other public companies that they had to mark any customers’ crypto assets on their own balance sheets. SAB 122 “rescinds the interpretive guidance” and instead directs firms to use Financial Accounting Standards Board rules or International Accounting Standard provisions.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login