CryptoCurrency

David Bailey Forecasts $1M Bitcoin Price During Trump Presidency

In an in-depth discussion on the Hell Money Podcast, David Bailey, CEO of BTC Inc., shared insights into Bitcoin’s transformative potential, its geopolitical implications, and its role as a cornerstone of a new global economic framework.

“I see this happening so much faster than anyone can appreciate. Within 10 years, Bitcoin will become the reserve asset of the world.”

- 00:00 Intro

- 07:15 Bitcoin soft forks

- 11:00 Bitcoin vs. Crypto in US policy

- 19:20 How much political power does Bitcoin have?

- 23:50 Bitcoiners are politically homeless

- 26:20 Strategic Bitcoin Reserve

- 29:00 Bitcoin development and ossification

- 32:00 Separation of money and state

- 33:40 Raise your time preference

- 35:20 SBR as a way out of USD global reserve status

- 41:00 Will they eventually fight us?

- 43:00 Incentives as a political movement

- 46:30 What happens next?

- 49:15 Bitcoin Vegas & Inscribing Vegas 2025

The Political and Economic Power of Bitcoin

Bitcoin has evolved into a significant political and financial instrument. Its decentralized nature, immutable ledger, and finite supply make it an attractive alternative to traditional fiat currencies, particularly during periods of economic uncertainty. Bailey emphasizes that Bitcoin is no longer merely a speculative asset but has become a political force capable of influencing policy and elections.

“Within the next four years, Bitcoin will be the most widely held asset in the world. This isn’t a special one-off moment—it’s the changing of the guard of the world order.”

As Bitcoin gains adoption among individual investors, corporations, and governments, its ability to sway decisions in both the public and private sectors continues to grow. This makes Bitcoin a strategic tool for economic stability and a hedge against systemic risks such as inflation, currency devaluation, and geopolitical instability. Understanding this evolution is crucial for investors looking to align their strategies with Bitcoin’s increasing influence in global finance.

Strategic Bitcoin Reserve: A Game-Changer for Economies

Bailey highlights the concept of a Strategic Bitcoin Reserve (SBR) as a key driver in Bitcoin’s path to becoming a global reserve asset. If a major economy, such as the United States, were to adopt an SBR, it could trigger a domino effect, with other nations racing to establish their own reserves. This global competition could significantly accelerate Bitcoin’s transition from a speculative asset to a fundamental part of national and international financial strategies.

“If America gets an SBR, China gets an SBR. If America and China have an SBR, within 12 months every country on the planet will have an SBR. The game theory effects of us kicking this off, in my opinion, are like the biggest catalyst possible for hyperbitcoinization.”

An SBR offers governments the ability to hedge against inflation, protect their economies from devaluation, and diversify their reserves. Unlike gold, Bitcoin is easily transferable, highly divisible, and operates transparently on a decentralized network. For investors, national adoption of Bitcoin reserves signals long-term stability and growth potential, reinforcing the case for allocating a portion of portfolios to Bitcoin and related assets.

Related: From Laser Eyes to Upside-Down Pics: The New Bitcoin Campaign to Flip Gold

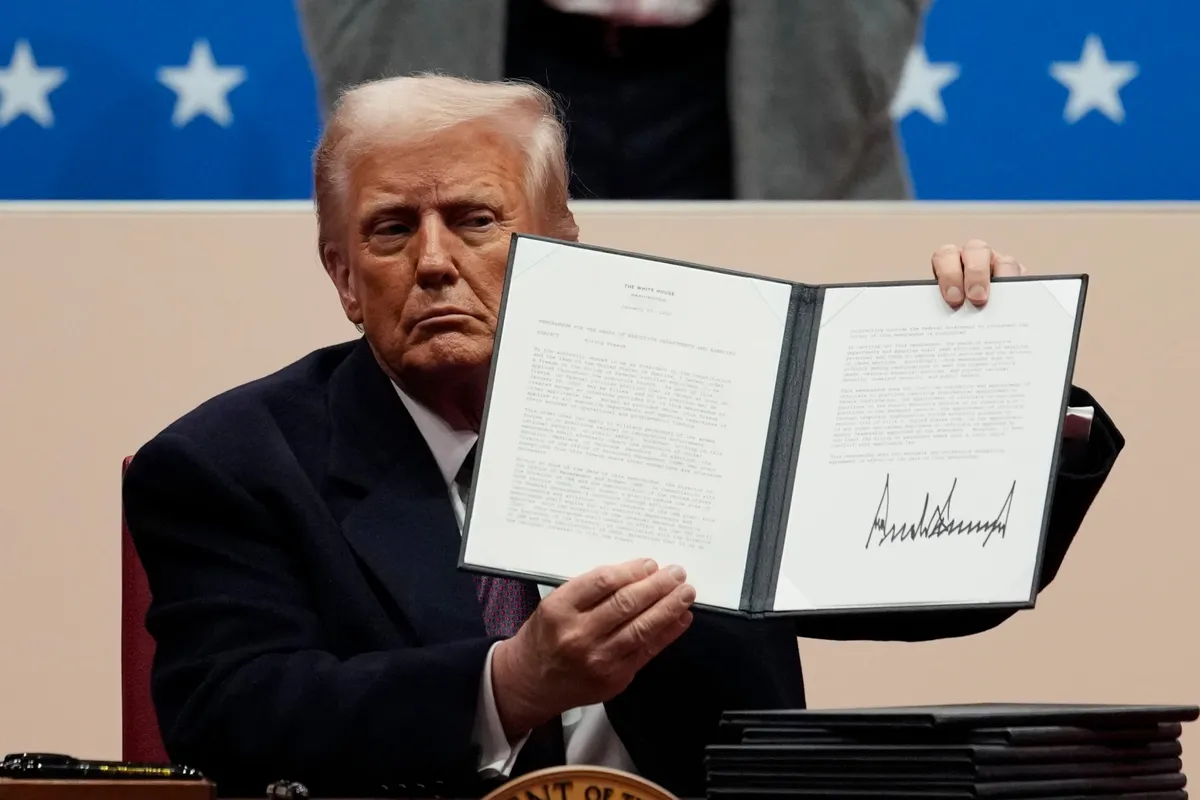

Orange-Pilling Trump: A Strategic Advocacy Moment

One of the most intriguing aspects of David Bailey’s efforts in advancing Bitcoin’s adoption was his strategic engagement with former President Donald Trump. Bailey discussed how Bitcoin advocates pitched Bitcoin to Trump as more than just a digital currency, emphasizing its economic and political advantages. By framing Bitcoin as a tool for strengthening American competitiveness and financial independence, Bailey and his team successfully captured Trump’s interest.

“We are within a couple of years of being the most powerful political faction in the United States. And not just the United States—there are bitcoiners embedded in power structures across the planet.”

Bailey’s team leveraged Bitcoin mining as a key entry point in their discussions, highlighting the economic benefits of Bitcoin mining operations in the United States, such as job creation and energy innovation. This approach aligned Bitcoin with Trump’s “America First” policies, presenting it as a way to bolster the nation’s energy independence and economic strength. These discussions laid the groundwork for a broader understanding of Bitcoin’s strategic value at the highest levels of government.

Governance and Innovation in Bitcoin

While Bitcoin’s decentralized nature is its greatest strength, it also presents challenges in governance and technological adaptability. Bailey underscores the importance of continuous innovation, particularly through mechanisms like soft forks, to ensure that Bitcoin remains scalable, secure, and competitive. Without these updates, the risk of ossification—where the network becomes resistant to necessary changes—could hinder Bitcoin’s evolution.

“Bitcoin gives governments a really elegant way out of the money-printing trap. They can print money, buy Bitcoin, and as the price of Bitcoin goes up, they’re still solvent. Later, they can peg their currency to Bitcoin.”

The Bitcoin community must navigate these governance complexities with a focus on collaboration and forward-looking solutions.

Hyperbitcoinization and the $1 Million Price Target

Bailey predicts that Bitcoin could reach a value of $1 million per coin within the next four years, driven by its growing adoption and the systemic challenges faced by traditional financial systems. This projection signifies more than just a price milestone—it represents a fundamental shift in the global economic order. Hyperbitcoinization, as Bailey describes it, involves Bitcoin becoming the default reserve currency, complementing or even replacing traditional fiat currencies.

“When we get to a million bucks, which I think can happen over the next four years—in my personal opinion, I think it’s possible—the Federal Reserve is, like, going to be completely impotent.”

This transition would have profound implications. Bitcoin’s decentralized nature would democratize access to financial systems, reduce reliance on central authorities, and promote greater economic inclusion. For investors, the journey toward hyperbitcoinization offers unparalleled opportunities as Bitcoin’s dual role as a store of value and medium of exchange becomes increasingly evident.

Related: Eric Trump Confident Bitcoin Price Will Hit $1 Million

Interview Key Takeaways

- Political Leverage: Bitcoin’s influence on policymaking and elections underscores its role as a hedge against political and economic risks.

- National Adoption Trends: The adoption of SBRs by major economies could catalyze global Bitcoin adoption, creating a favorable environment for long-term investment.

- Technological Resilience: Continuous innovation, including scalability solutions like the Lightning Network, is essential for sustaining Bitcoin’s growth and usability.

- Portfolio Diversification: Bitcoin’s uncorrelated performance relative to traditional assets makes it an attractive addition to diversified investment strategies.

- Economic Stability: In an era of rising inflation and monetary instability, Bitcoin provides a transparent, secure, and decentralized alternative to fiat currencies.

The Future of Bitcoin in the Global Economy

David Bailey’s insights provide a compelling vision of Bitcoin’s transformative potential, offering investors a clear opportunity to align their strategies with a rapidly evolving financial landscape. By understanding and leveraging Bitcoin’s role in fostering economic resilience and innovation, investors can position themselves to benefit from its adoption as a global reserve asset and a tool for long-term portfolio growth. As the world confronts challenges such as inflation, currency instability, and geopolitical uncertainty, Bitcoin emerges as a beacon of financial stability and innovation. For investors, the implications of Bitcoin’s growth extend far beyond speculative returns—it represents a strategic opportunity to participate in the evolution of the global financial system.

“It’s like, well, once that happens, then it’s not $1 million or $10 million. It’s like, it is the reserve asset of the world.”

In the coming decade, Bitcoin’s role as a stabilizing force and driver of innovation will become increasingly evident. Its seamless integration into national and corporate strategies, combined with its adaptability, positions Bitcoin as a cornerstone of future financial systems. Bailey’s vision challenges investors to consider the profound implications of a decentralized monetary system that prioritizes transparency, inclusion, and resilience.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

CryptoCurrency

Signs Of A Major Breakout Emerge

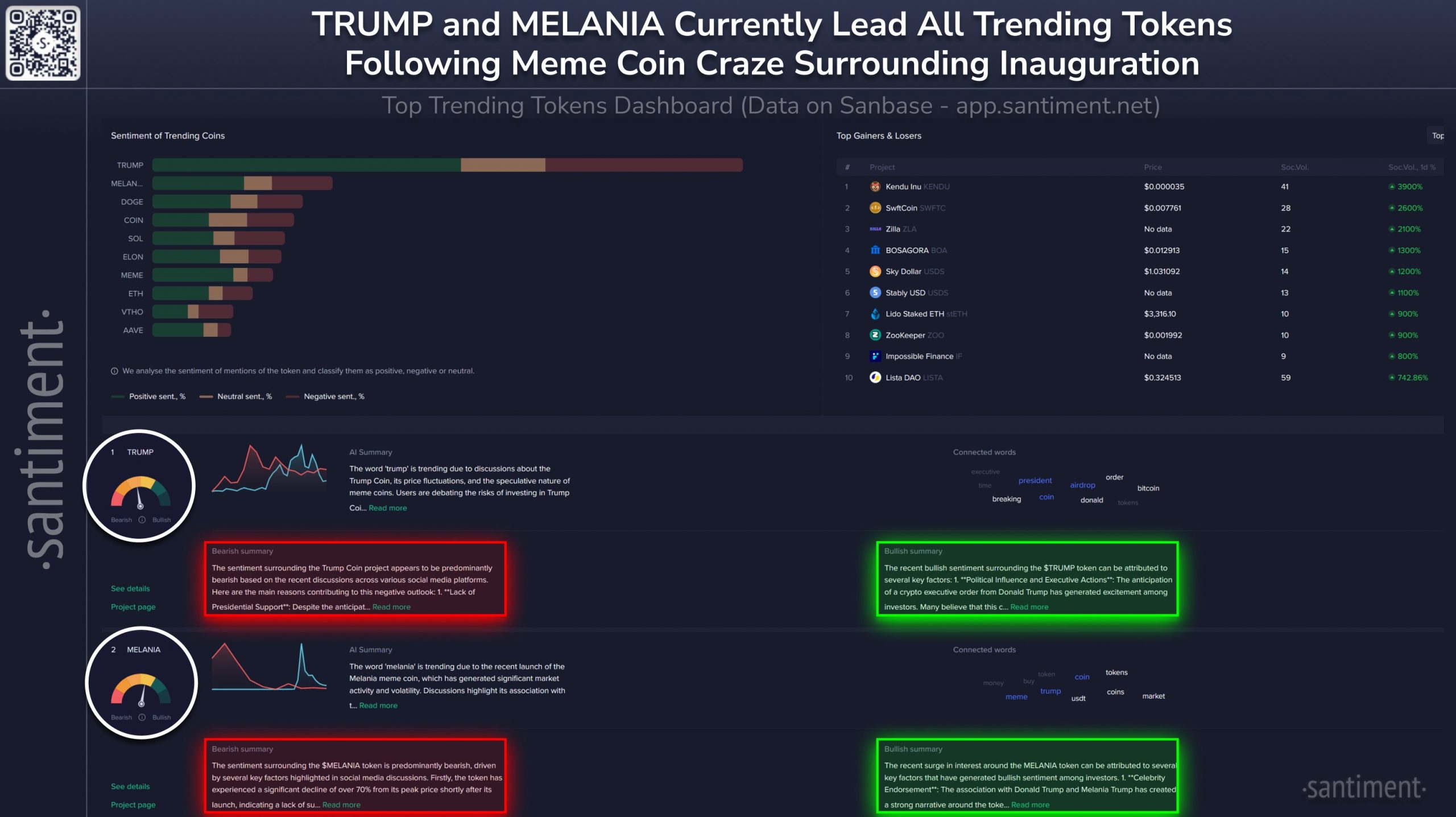

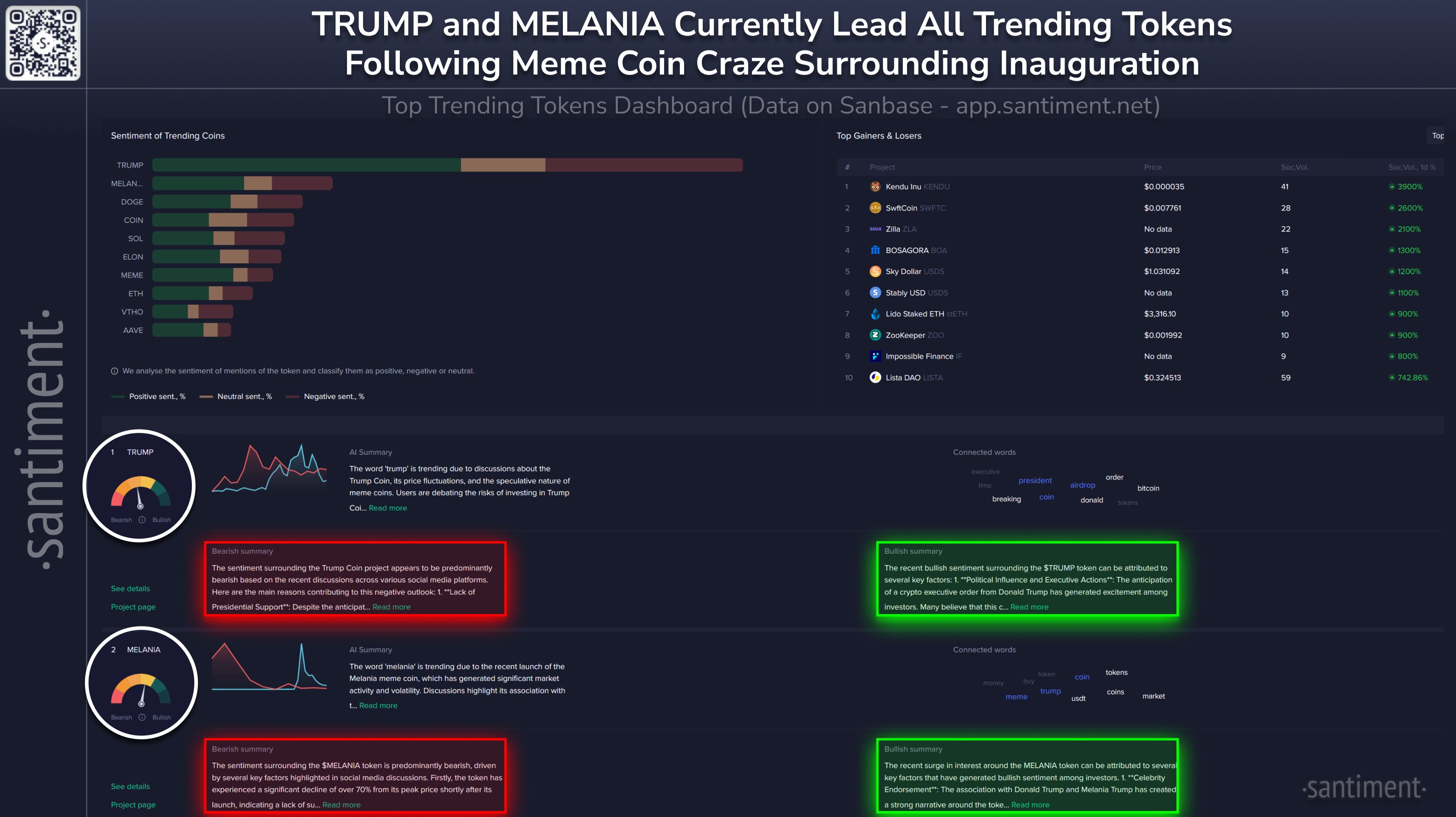

Dogecoin has emerged as a focal point of conversation, even amid a sudden wave of meme coins linked to Donald Trump’s return to the spotlight. On-chain analysis firm Santiment, which recently shared a sentiment dashboard on X, notes that “the top trending tokens” are all about meme coins following the “historic US inauguration of Donald Trump.”

In their latest post, Santiment emphasizes that “TRUMP is being discussed following its controversial listing on Coinbase, and the risks involved in investing during a volatile market,” while there is also “significant interest in airdrops of ‘TRUMP’ tokens, with a notable event securing $1M worth of tokens.”

MELANIA, another meme coin tied to the Trump brand, has caused a stir by briefly surpassing a $9 billion valuation, although it has endured “substantial fluctuations amid broader market uncertainty.”

Related Reading

Meanwhile, Dogecoin’s surge in social media mentions is attributed by Santiment to the newly established US Department of Government Efficiency (DOGE) led by Elon Musk, as the project uses Dogecoin as its avatar. On January 21, the US Government officially launched the Department of Government efficiency (DOGE) website which has the official Dogecoin logo on it.

“This initiative has sparked discussion as it intertwines cryptocurrency with government operations, generating buzz on social media. Additionally, discussions around the potential for new meme coins linked to public figures like Trump and Musk contribute to the speculation about Dogecoin’s future performance and relevance in the crypto space,” Santiment writes.

Despite the sudden attention on TRUMP and MELANIA, Santiment’s sentiment breakdown underscores mixed feelings for both tokens. Regarding TRUMP, the post states: “The word ‘trump’ is trending due to discussions about the Trump Coin. Its price fluctuations, and the speculative nature of meme coins, users are debating the risks of investing in Trump Coin.”

Santiment’s “positive” analysis points to “political influence and executive actions” as reasons for optimism, highlighting that “the anticipation of a crypto executive order from Trump has generated excitement among investors.”

Related Reading: Will Dogecoin Skyrocket Soon? Chart Pattern Suggests Yes

MELANIA’s sentiment likewise splits along bullish and bearish lines, with the negative view referencing a more than 70% drop from its initial peak price, and the bullish narrative noting “celebrity endorsement” from Donald and Melania Trump as a potential driver of renewed interest.

Technical Analysis: DOGE Confirms Breakout

At press time, Dogecoin (DOGE) was trading at around $0.367 after rebounding from a descending trendline dating back to early December. The breakout above the diagonal resistance occurred earlier this week, followed by a successful retest of the trendline yesterday, confirming it as new support.

Following the retest, DOGE is now contending with the 0.5 Fibonacci retracement level at $0.3943, which marks the next major overhead barrier. A clear break of this resistance could open the door to the higher 0.618 Fib level at $0.4759 and the 0.786 Fib at $0.5920.

On the downside, if DOGE fails to break the 0.5 Fib, the 0.382 Fib at $0.3129 may act as the most reliable support. Meanwhile, the Relative Strength Index (RSI) at around 51 remains neutral, reflecting balanced momentum and leaving room for a potential continuation to either side.

Featured image created with DALL.E, chart from TradingView.com

CryptoCurrency

Jupiter Decentralized Exchange to Issue $612M JUP Tokens in Wednesday Airdrop

Jupiter, a Solana-based decentralized exchange, will airdrop 700 million JUP tokens to its community on Wednesday in what it is calling the “largest airdrop in history.”

The airdrop is a part of the project’s annual “Jupuary” event, which was voted into existence alongside another event in 2026 in a governance vote in December. It is scheduled to start at 15:30 UTC.

Initial concerns were raised about the sustainability of supply increase, prompting the proposal to be amended to include a token audit and burn schedule over the next month.

At the time of writing JUP is trading at $0.87 after sliding by 2% over the past 24 hours. The total value of the airdrop is set to be $612 million.

CryptoCurrency

Watch these Bitcoin price levels next with 'door open' to $100K retest

Bitcoin bulls have their work cut out on both short and long timeframes, BTC price analysis shows.

CryptoCurrency

Trump Plans $500 Billion Investment in AI Initiative Stargate

Stargate is expected to involve major players, including OpenAI, Softbank, and Oracle. It remains unclear how much funding will come from the federal government versus private sector contributions.

According to CBS, the Trump administration might allocate $100 billion to the project in its first year. The total investment could reach $500 billion if approved by regulatory authorities. The initiative signals a potential shift in priorities, as some had speculated Trump might downplay AI and crypto sectors early in his term.

Stargate’s focus contrasts with Trump’s recent push for D.O.G.E. as a cost-cutting tool. Critics question whether such a significant AI investment aligns with Trump’s fiscal goals. Despite skepticism, the announcement has stirred excitement in tech circles.

AI-focused companies like OpenAI, valued at $150 billion, might struggle to match such large investments on their own. Still, industry watchers view Stargate as a positive move for AI innovation.

If the deal proceeds, it could reshape the AI and crypto markets. Early reactions show a shift in investor interest from meme coins to AI-driven projects, highlighting the potential impact of this initiative.

CryptoCurrency

Altcoins that are not SOL and XRP for major gains over the next few months

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

As Solana and Ripple face stagnation, investors are turning to rising altcoins like Lightchain AI and Pepe Coin, which are showing immense growth potential.

With Solana (SOL) and Ripple (XRP) dominating headlines, savvy investors are exploring other high-potential altcoins to maximize returns.

Among the rising stars, Lightchain AI and Pepe Coin stand out as lucrative investments capable of delivering impressive growth. Here’s why these two altcoins could create huge gains in just a few months.

Pepe meme magic backed by market momentum

Pepe Coin (PEPE) has become a well-known joke money, drawing a big market focus. As of January 20, 2025, PEPE is selling for about $0.000017 USD with a daily trade amount of $1.35 billion USD. The coin has seen a 5.42% drop in the last day, and it now has a market value of $7.34 billion bucks, putting it at the 25th spot in crypto.

New whale ͏moves show big money going into PEPE, with large buys reaching millions. This rush of cash hints at more trust from big investors in the coin’s chance to grow.

Even with its meme start, Pepe Coin’s growing spot in the market and large trade amounts show a wider pattern of meme coins getting more popular in the crypto world. Yet, possible buyers should be careful because of the natural ups and downs and the speculative nature of these types of assets.

Lightchain AI: AI-driven crypto powerhouse

Lightchain AI is redefining the altcoin game, blending cutting-edge artificial intelligence with blockchain technology to create real-world value. Unlike meme coins like Pepe, this is where innovation meets utility.

From powering smarter decision-making to delivering real-time analytics and safeguarding data privacy, Lightchain AI is built for impact. And the buzz is real; its presale has already raked in $12 million, with tokens priced at just $0.00525. Both retail and institutional investors are taking notice.

What sets Lightchain AI apart? Its unique tokenomics reward validators and developers for meaningful contributions, bringing in big players and fueling long-term growth. Add to that a scalable architecture and developer-friendly platform, and it’s clear why this altcoin is poised to leave its competition in the dust by year-end.

LCAI gains traction

Lightchain AI presale is LIVE and moving faster than most other presales. Stage 12 is just a heartbeat away from a price bump. Here’s how easy it is to claim LCAI tokens.

- Head over to the official Lightchain AI website.

- Connect user wallet.

- Swap the desired amount for LCAI tokens.

- Users are officially on board.

To learn more about Lightchain AI, visit their website, whitepaper, X, or Telegram.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Trump Downplays Meme Coin Profits in First Statement After Launch

The U.S. President has finally addressed the explosive success of his Official Trump (TRUMP) meme coin, admitting that he wasn’t involved much in the project beyond launching it.

The Solana-based token, touted as the fastest-growing meme coin in history, initially skyrocketed to a $15 billion market cap over the weekend before dropping to around $8 billion following the release of a competing coin by First Lady Melania Trump.

“I Don’t Know Much About It”

At a press briefing on Tuesday to announce a $500 billion joint venture between OpenAI, Oracle, and SoftBank, the President was asked by a reporter if he intended to continue selling products that benefited him in reference to the TRUMP token.

In response, the head of state said he didn’t know if he’d benefited, admitting that he had no knowledge about the status of the coin. “I don’t know if it benefited [me]. I don’t know where it is,” he said.

He further dismissed any suggestion that he had a deep understanding of the project. “I don’t know much about it other than I launched it,” he stated. “I heard it was very successful. I haven’t checked.”

Trump then inquired about the current value of the meme coin, with a reporter telling him he’d made a lot of money. “How much?” the President asked. “Several billion dollars,” the journalist replied, to which Trump responded, “That’s peanuts to these guys,” referring to people who were at the briefing with him, including Masayoshi Son of SoftBank, OpenAI’s Sam Altman, and the world’s fourth-richest man, Larry Ellison of Oracle.

Divisive Impact on the Crypto Space

The TRUMP meme coin has become a lightning rod for controversy, with critics warning it could undermine the credibility of the crypto market. Yesterday, billionaire investor Mark Cuban dismissed the project, describing it as a gamble that could harm the industry’s legitimacy without proper regulations. Before him, former Coinbase CTO Balaji Srinivasan highlighted the speculative nature of such assets, calling it a “zero-sum lottery.”

There is also a supposition that the ownership of the TRUMP token is dominated by insiders, further fueling concerns about transparency and market manipulation. Some also feel that the President having skin in the meme coin game could hinder bipartisan efforts to advance much-needed crypto legislation.

This view is shared by TD Cowen, with The Block reporting that the financial services firm had warned that possible investigations into TRUMP’s market influence might stall regulatory progress and deepen partisan divides.

At the time of writing, Official Trump was trading at $43.02, having gained 18% in the last 24 hours. The price is still 41% below the coin’s all-time high, but its $8.5 billion market cap places it as the third-largest meme token in the market, behind Dogecoin and Shiba Inu.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

MicroStrategy Expands Its Bitcoin Empire: Acquires 11,000 BTC For $1.1 Billion

On Tuesday, tech giant MicroStrategy purchased an additional 11,000 Bitcoin (BTC) for approximately $1.1 billion, as disclosed by its chair and co-founder Michael Saylor in a social media post on X (formerly Twitter).

This acquisition marks the company’s 11th consecutive week of Bitcoin purchases, reinforcing its status as a significant player in the digital currency space. Saylor has been at the forefront of this strategy, positioning the enterprise software company as a leveraged Bitcoin proxy.

MicroStrategy Bitcoin Holdings Surge

According to Microstrategy’s filing with the US Securities and Exchange Commission (SEC), the firm acquired the Bitcoin at an average price of about $101,191 per token between January 13 and January 20.

With this latest purchase, the firm now holds over 2% of all Bitcoin that will ever be mined, representing approximately $47.9 billion in total Bitcoin holdings. MicroStrategy has been funding these acquisitions through a combination of at-the-market stock sales and convertible debt offerings.

The timing of this latest purchase aligns with a broader shift in the regulatory environment under President Donald Trump, who has transitioned from being a crypto skeptic to a supporter of the industry.

This change is expected to create a more favorable regulatory framework for cryptocurrencies, prompting Saylor and MicroStrategy to accelerate their capital goals and Bitcoin buying efforts.

Ahead of Trump’s inauguration, the firm’s co-founder even attended the first ever “Crypto Ball” in Washington on Friday, where he engaged with key figures in the incoming administration.

New Shares To Support BTC Strategy

In a related development, MicroStrategy shareholders voted also on Tuesday to approve a staggering 30-fold increase in the number of authorized Class A common shares, raising it from 330 million to 10.3 billion.

According to a Bloomberg report, this decision, which passed with around 56% of the vote, is designed to facilitate further financing for the company’s Bitcoin purchases. Additionally, shareholders voted to increase the authorized shares of preferred stock from 5 million to 1 billion.

These amendments will take effect once MicroStrategy files the necessary certificate of amendment with the Delaware Secretary of State. The report notes that with Chairman Saylor holding about 47% of the voting power, the outcome was largely anticipated.

The newly authorized shares will also be utilized for various financial strategies, including private transactions of Class A stock, sales of at-the-market equity offerings, and settling redemptions or conversions of convertible notes. However, the company has indicated that it may choose not to sell all of the additional shares.

At the time of writing, Bitcoin continues to experience significant price volatility, with its price hinting at a new record high. It is currently trading at $106,400, representing a 2.5% increase in the 24-hour time frame.

Featured image from DALL-E, chart from TradingView.com

CryptoCurrency

Ethereum Core Developer Eric Conner Departs for AI Venture Freysa

Eric Conner, a prominent core developer at Ethereum, has left the ecosystem community after a nearly 11-year affiliation citing network co-founder Vitalik Buterin’s dismissal of a leadership shake-up proposal.

Conner is a co-author of EIP-1559, the major network change that shifted how transaction fees worked on Ethereum. He isn’t officially employed by Ethereum but has advised, invested, and was among those who led the charge on ecosystem growth since its early days.

Conner is joining AI-focused protocol Fresya.AI, he said in a follow-up X post.

Buterin swatted calls for changing the leadership structure at the Ethereum Foundation, which oversees the development of the second-largest blockchain by market cap.

Buterin said on X that he wants to create a “board” to manage the foundation, but until then he is the leader. Buterin’s comment came amid calls by ecosystem stakeholders for a change in the network’s leadership with founding member Anthony Donofrio opining that the blockchain has lost its way.

The network is also planning to roll-out its Pectra upgrade, which promises speed efficiency and other improvement, in March.

CryptoCurrency

Crypto Price Analysis 1-22: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, DOGWIFHAT: WIF, HEDERA: HBAR, STELLAR: XLM

Bitcoin (BTC) has gained nearly 3% over the past 24 hours, approaching its all-time high at one point as the Trump administration completed its first day in office. Markets were choppy but stabilized after the United States Securities and Exchange Commission unveiled plans to overhaul rules and regulations for the sector. BTC is trading around $105,846 and has registered gains of nearly 10% over the past week.

The crypto market has rebounded over the past 24 hours. Ethereum (ETH) rose nearly 3% to reclaim $3,300 and is currently trading around $3,342. Meanwhile, Ripple (XRP) is up 2.50%, while Solana (SOL) is up nearly 8%, remaining above $250. Dogecoin (DOGE), Cardano (ADA), Chainlink (LINK), Tron (TRX), Sui (SUI), Polkadot (DOT), and Litecoin (LTC) also registered substantial gains. The TRUMP meme coin is also up nearly 15%, gaining a staggering 530% since launch.

SEC Gives Crypto First Win Of Trump Presidency

The United States Securities and Exchange Commission’s new leadership has announced the creation of a task force to develop a clear regulatory framework for digital assets. This is the first attempt by the Trump administration to overhaul crypto policy. Coinbase Chief Legal Officer Paul Grewal said the SEC is moving quickly on Trump’s agenda, stating,

“The president has moved quickly on his agenda. The SEC has made it clear they understand that and want to be a part of that.”

The task force was created by the acting Chair of the SEC, Mark Uyeda. Its primary goal would be to develop a clear and comprehensive regulatory framework for crypto assets. SEC Commissioner Hester Pierce will lead the task force. Pierce has urged the public to collaborate with the SEC to shape the future of crypto. However, she added that the process would require significant time and effort.

“This undertaking will take time, patience, and much hard work. It will succeed only if the Task Force has input from a wide range of investors, industry participants, academics, and other interested parties.”

The task force was announced a day after former SEC Chair Gary Gensler stepped down, and President Trump nominated Uyeda as acting Chair. Trump has nominated Paul Atkins as the next Chair of the SEC. However, the pick is subject to approval from the US Senate. The SEC released a statement on its website regarding the task force, stating,

“Drawing from talented staff across the agency, the Task Force will collaborate with Commission staff and the public to set the SEC on a sensible regulatory path that respects the bounds of the law. To date, the SEC has relied primarily on enforcement actions to regulate crypto retroactively and reactively, often adopting novel and untested legal interpretations along the way. Clarity regarding who must register and practical solutions for those seeking to register have been elusive. The result has been confusion about what is legal, which creates an environment hostile to innovation and conducive to fraud. The SEC can do better.”

TRUMP, MELANIA Meme Coins Crash After Inauguration

The cryptocurrency market witnessed a sharp pullback on Tuesday following the inauguration of Donald Trump. Despite reaching a new all-time high on Monday, Bitcoin (BTC) registered a dramatic drop, falling to $102,408 before recovering on Tuesday. The sharp decline came after Trump emphasized his plans for imposing trade tariffs, amending immigration policy, and energy deregulation. However, Trump did not make any specific references to crypto. Failure to mention crypto in his inaugural speech has left some market watchers disappointed at a time when expectations from the Trump administration regarding digital assets were sky-high. Matthew Dibb, the Chief Investment Officer at Crypto Asset Manager Astronaut Capital, stated,

“I think in the short term there’s a chance this could be a sell-the-news event. The market has some great expectations about a Bitcoin strategic reserve and a loosening of regulations around digital assets, but it’s more likely these developments will be drip-fed over a series of months rather than days. Bitcoin has already retreated … We expect further volatility here and likely a selloff.”

The Trump administration is expected to introduce several regulatory changes and potentially create a Bitcoin strategic reserve. However, Trump’s involvement in the crypto market has led to ethical concerns and concerns about potential conflicts of interest.

Bitcoin (BTC) Price Analysis

Bitcoin (BTC) has registered a marginal dip during the ongoing session as it struggles to build momentum despite surging to an all-time high on Monday. BTC reached $109,350 on Monday but quickly plummeted to test the $100,000 support, dropping to an intraday low of $99,514 before recovering to settle at $102,408. BTC’s price action suggests that despite a bullish market, sellers are keeping pressure on the $100,000 price boundary. Trump’s inauguration day saw significant price volatility but disappointed many in crypto after the president failed to mention BTC, crypto, or a Bitcoin strategic reserve. As a result of the volatility, longs saw significant liquidations. One analyst on X stated,

“I’d take a long from 99.5K~ if offered. I think the gray box needs to hold for local bullishness, and sweeping all the Trump leadup/news PA makes sense. I’d also accept a sweep of the 97K low, but that’s the farthest it should go. Any good amount of time spent past 96-97K and my plan / read is likely off. Inval low 90’s, aiming for new ATH’s.”

The Bitcoin price chart suggests considerable choppiness in the market, and we could see a definitive trend emerge by the end of the week. While BTC has maintained an upward trajectory after recovering from last week’s collapse, it has faced increasing volatility over recent sessions. BTC plummeted to an intraday low of $89,397 on Monday as selling pressure peaked. However, it recovered to reclaim $90,000 and ultimately settled at $94,492. Markets recovered on Tuesday, and BTC registered an increase of 2.19%, going past the 20-day SMA and settling at $96,566. Bullish sentiment intensified on Wednesday as BTC crossed the 50-day SMA, registering an increase of 3.61% and settling at $100,051. Sellers returned to the market on Thursday as BTC dropped to an intraday low of $97,094. However, it recovered from this level and settled at $99,798, ultimately registering only a marginal decline.

Source: TradingView

BTC made a strong recovery on Friday, rising almost 4% to surge past $100,000 and settle at $103,732. However, bearish sentiment and volatility returned over the weekend as BTC plummeted to an intraday low of $101,591 on Saturday before ultimately settling at $103,579. Buyers attempted a recovery on Sunday as BTC surged to an intraday high of $106,552. However, it lost momentum after reaching this level and registered a drop of just over 2% to settle at $101,434. BTC rallied to a new all-time high on Monday when it hit $109,350. However, it rapidly declined after reaching this level and settled at $102,408, registering an increase of nearly 1%. Sellers attempted to drive BTC below $100,000 on Tuesday as the price dropped to an intraday low of $100,173. However, buyers bought the dip, allowing the price to recover. As a result, BTC rose 3.56% and ended the day at $106,054. The current session sees BTC marginally down as sellers look to drive the price below $105,000. However, if market sentiment changes and buyers regain control, BTC could see a move past $110,000.

Ethereum (ETH) Price Analysis

Ethereum (ETH) is trading close to the psychological $3,300 level as it continues to experience volatility, leading to a considerable lack of momentum. ETH’s price struggles come as Ethereum co-founder Vitalik Buterin lashed out at growing criticism of Ethereum Foundation executive director Aya Miyaguchi and calls for her to step down from her role. The ongoing tussle between the Ethereum Foundation and the Ethereum community has also had a detrimental impact on ETH, with the asset underperforming compared to BTC, XRP, and SOL over the past weeks.

ETH’s price chart shows the asset experiencing significant volatility since recovering from an intraday low of $2,927 on Monday. ETH recovered to reclaim $3,000 and settle at $3,137 before registering an increase of 2.85% on Tuesday and moving to $3,336. Bullish sentiment registered a substantial increase on Wednesday as ETH surged past the 20-day SMA, rising nearly 7% to $3,450. However, buyers lost momentum after reaching this level, and ETH dropped 4.10% on Thursday to slip below the 20-day SMA and settle at $3,308. Buyers returned to the market on Friday, with ETH registering an increase of nearly 5% to move past the 20-day SMA and settle at $3,473. Once again, ETH was back in the red on Saturday, dropping nearly 5% to slip below the 20-day SMA and settle at $3,305.

Source: TradingView

Sellers retained control on Sunday after thwarting a recovery attempt. As a result, ETH dropped nearly 3% to $3,212. The current week began with ETH experiencing significant volatility as buyers and sellers attempted to establish control. Buyers ultimately gained the upper hand as ETH rallied to an intraday high of $3,446 before settling at $3,280. Buyers retained control on Tuesday, with ETH rising 1.44% to $3,327. However, ETH is struggling to move past the 20-day SMA, which acted as a dynamic resistance level. The current session sees ETH marginally down and trading just above the $3,320 level. If sellers continue to dominate the market, ETH could decline to $3,000. On the other hand, if buyers regain control, ETH could look to move past the 20-day SMA and push towards $3,500.

Solana (SOL) Price Analysis

Like Bitcoin (BTC), Solana (SOL) too surged to a new all-time high on Sunday, driven by the launch of the TRUMP and MELANIA meme tokens created on the Solana blockchain. The success of both meme coins generated considerable interest in SOL as well, helping boost the price. SOL has been bullish since recovering from an intraday low of $169 last Thursday. SOL recovered on Tuesday, rising 2.58% to $187. Bullish sentiment registered a substantial increase on Wednesday as SOL surged past the 20-day SMA and $200 to settle at $205 after rising nearly 10%. Buyers retained control on Thursday as SOL pushed above the 50-day SMA and settled at $211. Friday saw SOL register an increase of 4% and move to $219.

Source: TradingView

The weekend saw renewed buying activity as SOL surged a staggering 19.19% on Saturday to smash past $250 and settle at $261. Bulls retained control during the first half of Sunday as SOL surged to a new all-time high of $295. However, it could not get beyond this point as buyers lost momentum. As a result, sellers took over, and SOL dropped nearly 4% to $252. Buyers attempted a recovery on Monday as SOL reached an intraday high of $272. However, sellers took control and drove SOL below $250 to $241. The price recovered on Tuesday despite considerable volatility, rising 3.47% to reclaim $250. The current session sees SOL up by 2.31% and trading around $256. Buyers will look to build momentum and push towards $280-$290.

Dogwifhat (WIF) Price Analysis

Dogwifhat (WIF) has been trading in a downward trajectory since the weekend after failing to move past $2 on Sunday. WIF was quite bullish last week despite starting it on a bearish note. The meme coin recovered from Monday’s low to register an increase of nearly 4% on Tuesday and settle at $1.54. Bullish sentiment registered a substantial increase on Wednesday as WIF rallied a staggering 14% and settled at $1.76. With the 20-day SMA coming into play, WIF lost momentum on Thursday and registered a marginal decline. However, it recovered on Friday, rising 6.14% to move past the 20-day SMA and settle at $1.87.

Source: TradingView

Buyers attempted a move past $2 on Saturday as WIF reached an intraday high of $1.98. However, WIF lost momentum at this point and dropped over 5% to slip below the 20-day SMA and settle at $1.77. Bullish sentiment intensified on Sunday as WIF dropped nearly 14% to $1.53. The current week began with WIF firmly in the red, dropping over 9% to $1.38. Buyers returned to the market on Tuesday as WIF rose 4.50% to settle at $1.45. The current session sees WIF marginally down, trading around $1.43.

Hedera (HBAR) Price Analysis

Hedera (HBAR) surged to an intraday high of $0.402 on Friday but has since been trading primarily in the red as selling pressure intensifies. HBAR’s bullish momentum began on Tuesday when it registered a substantial increase of 4.25% to move past the 50-day SMA and settle at $0.287. Buying activity registered a significant increase on Wednesday as HBAR surged past the 50-day SMA and $0.30 to settle at $0.322 after an increase of 12.09%. Bullish sentiment persisted on Thursday as HBAR surged over 12% and moved to $0.361. The price reached an intraday high of $0.402 on Friday. However, buyers lost momentum at this point, and the price dropped to $0.373, an increase of 3.23%.

Source: TradingView

HBAR turned bearish over the weekend, dropping nearly 5% on Saturday and settling at $0.355. Bearish sentiment intensified on Sunday, with the price dropping 8.48% to $0.324. Buyers returned to the market on Monday as HBAR rose to an intraday high of $0.373. However, it could not go higher and ultimately settled at $0.342, registering an increase of 5.32%. HBAR registered a marginal decline on Tuesday, dropping nearly 3% during the ongoing session and trading around $0.327.

Stellar (XLM) Price Analysis

Stellar (XLM) surged past the 50-day SMA last Wednesday after registering a staggering rise of nearly 14% and moving to $0.488. Buyers pushed the price to an intraday high of $0.514 on Thursday. However, XLM lost momentum after reaching this level and dropped 1.28% to $0.482, but not before falling to an intraday low of $0.464. Buyers returned to the market on Friday as XLM rose 1.24% to $0.488. XLM dropped to an intraday low of $0.451 on Saturday as sellers attempted to drive the price below $0.45. However, XLM recovered from this level to register a marginal increase and end the day at $0.49.

Source: TradingView

Selling pressure returned on Sunday as the price plummeted over 11%, slipping below the 20-day SMA and settling at $0.433. The current week began with XLM rising to an intraday high of $0.477. However, the price could not push higher and ultimately settled at $0.445, registering an increase of nearly 3%. Bearish sentiment returned Tuesday as XLM dropped almost 1% to $0.441. The current session sees XLM down 2% and trading around $0,432.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

CryptoCurrency

Ethereum core developer departs for AI amid leadership concerns

Ethereum core developer Eric Conner exits, citing Vitalik Buterin’s leadership decisions, shifts focus to building AI tools like Freysa.ai.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login