CryptoCurrency

Dogecoin ETF Filing Takes Market By Storm, Can Positive Sentiment Trigger 200% Rise To $1 ATH?

REX Shares, a financial services company known for its innovative approach to ETFs, recently submitted filings for ETFs tied to a few cryptocurrencies, including Dogecoin. These filings mark a pivotal moment for Dogecoin amidst the current excitement in the crypto market, with the positive sentiment now at a multi-year high.

New ETF Filings Take The Market By Storm

The crypto industry has been filled with excitement in the past few days leading to and after the inauguration of new US president Donald Trump. This excitement has brought alongside it an intense volatility to the price action of many cryptocurrencies.

Related Reading

Amidst this intense volatility, asset management firms REX Advisers and Osprey Funds have jointly submitted filings to the U.S. Securities and Exchange Commission (SEC) seeking approval to launch seven new cryptocurrency ETFs. These ETFs are designed to provide exposure to a range of digital assets, including established tokens like Solana and Ripple’s XRP, as well as meme coins such as Dogecoin and even the recently launched TRUMP coin.

ETFs are currently the rave in the crypto industry due to the success of the Spot Bitcoin ETFs that were launched in the US early last year. Their widespread success marked a turning point for institutional investment in crypto. Following their success, Spot Ethereum ETFs also entered the market, paving the way for discussions about spot ETFs for other digital assets, mostly XRP and Solana.

Interestingly, the new ETF filings by REX could be seen as an effort to capitalize on the growing interest in diverse crypto assets and to test the SEC’s evolving stance under its new crypto-friendly leadership. Bloomberg senior ETF analyst Eric Balchunas highlighted the growing interest in this space, noting that the number of crypto ETF filings with the US SEC has now reached 33, essentially doubling since Gary Gensler stepped down as the regulator’s chairman last Friday.

What Does A Dogecoin ETF Mean For Dogecoin?

Specifically, the nature of the filings means that these proposed could hit the market very quickly in the next 75 days. Dogecoin, for one, is projected to benefit the most from an ETF hitting the market. This is because recent crypto market dynamics have caused Dogecoin to become the go-to cryptocurrency for retail investors since Bitcoin is increasingly becoming the choice for institutional investors.

Related Reading

Historically, Dogecoin has shown its ability to rally sharply on the back of positive trends, such as Elon Musk’s tweets and listings on major exchanges. If the Dogecoin ETF gains approval, it could attract substantial inflows from new investors. This, along with the community support for Dogecoin, could pave the way for a significant price surge above $1. Crypto analysts are already predicting that Dogecoin will break the $1 mark this cycle, noting various technical indicators and patterns to back this prediction.

At the time of writing, Dogecoin is trading at $0.364, up by 5.1% in the past 24 hours. Reaching $1 from the current level would represent a 175% price increase.

Featured image from Unsplash, chart from Tradingview.com

CryptoCurrency

New Calamos ETF Promises 100% Downside Protection Against Bitcoin (BTC) Price Volatility

A new exchange-traded fund (ETF) by global investment management firm Calamos that promises to protect investors from the volatility in bitcoin’s price hit the market on Wednesday.

CBOJ, the first of three ETFs, provides investors with 100% downside protection while offering 10% to 11.5% upside potential over a one-year period, according to a press release. A representative of Calamos told CoinDesk that as of 12:11 p.m. ET, the ETF traded roughly 635,714 shares.

The other two funds, CBXJ and CBTJ, set to launch on Feb. 4, will provide 90% and 80% protection, respectively, with capped upside of 28% to 30% and 50% to 55%.

Downside protection is achieved through investments in U.S. Treasuries and options on Bitcoin index derivatives. The upside cap is set annually, and the period is reset every year with new terms.

In simple terms, if an investor bought $100 worth of shares in the ETF, Calamos would put a percentage of that in Treasury bonds that would grow back to $100 over a one-year period, ensuring that regardless of where the price of bitcoin stands at the time, the investor has the full $100.

The rest is used to buy options linked to the price of bitcoin, allowing exposure to the cryptocurrency while not directly owning it.

This safety blanket doesn’t come cheap, however. The management fee for the ETFs is set at 0.69%, higher than that of other ETFs that invest in bitcoin. The average fee for U.S.-based ETFs is about 0.51%, making these ETFs a bit expensive for investors. However, the higher price might be worth paying for investors looking for safety from the volatile digital assets market.

While “bitcoin maxis” and other investors believe in the long-term value increase of bitcoin, many, especially traditional institutional investors, worry about bitcoin’s volatility and periods of complete free-fall.

One question that may arise from the mechanics of the ETF is whether it would compete with MicroStrategy’s (MSTR) convertible bonds, as both offer some downside protections. However, according to CoinDesk analyst James VanStraten, that’s not the case. MSTR’s notes differ from Calamos’ ETF in that they don’t have a cap on the upside potential. If certain criteria are met, those get converted into equities, resulting in potentially higher risk but more upside.

ETFs protecting against the downside have, therefore, become a popular innovation by issuers in recent months, leading up to crypto-friendly President Donald Trump’s inauguration. This has spurred hope that many of those ETF applications will receive approval under the new Securities and Exchange Commission.

Crypto asset manager Bitwise revamped three of its futures-based crypto ETFs in October to include exposure to Treasuries to protect against crypto price drops. The funds will, therefore, rotate between investing in crypto and Treasuries depending on market signals.

CryptoCurrency

Kraken ramps up donations to Ulbricht amid $47M wallet rumors

The Silk Road creator walked free on Jan. 22 after 12 years in prison. Wallets tied to him are rumored to be worth around $47 million.

CryptoCurrency

Church hit with £1,172 bill after installing smart meter, despite using heat just one hour a month

A tiny Peak District church serving just six worshippers has seen its monthly electricity bills inexplicably surge from £15 to as high as £1,172 after installing a smart meter.

Saint Mary and Saint John Berkhamsytch in the hamlet of Bottomhouse has been hit with thousands in charges despite only using power for one hour each month.

Pam Ramsay, the church treasurer has spent the past year trying to convince Utility Warehouse to address the “nonsensical” bills.

The energy supplier insists the readings are accurate, even though the church only switches on electricity for its monthly 3pm service of hymn and prayer. The church has no plumbing or running water and relies solely on ten single-bar heaters to warm the congregation during services.

Reverend Jane Held, who oversees this church along with eight others said: “It simply makes no sense as the church electricity is only turned on for about an hour every month.”

Held ensures the power supply is turned off at the main junction box after every service to prevent any additional usage

GETTY

The vicar explains that these “unbelievable bills” are paid using money from collection plates passed around during services.

Held explained she ensures the power supply is turned off at the main junction box after every service to prevent any additional usage.

Chris Ramsay, 75, a retired electrical engineer tested the church’s actual power consumption using a basic £20 power meter from Amazon. The readings showed each heater used between 1,211 and 1,217 watts during operation.

He said: “If the meter shows 1,000 watts it is equivalent to a 1kWh reading. That is the amount of electricity used in an hour.”

LATEST DEVELOPMENTS:

With all ten heaters running for one hour monthly, the church uses approximately 12kWh per month.

While domestic users pay around 25p per kWh according to Ofgem, the church faces higher ‘non-domestic’ rates of 67p per kWh – meaning the actual monthly heating cost should be about £8.

The church’s standing charge has more than tripled, rising from 41p to £1.26 per day last May. This adds £39 to the monthly bill, even when the church is not using electricity.

Despite the total monthly costs logically remaining under £50, the church faced shocking bills throughout 2024: £1,172 in March, £568 in February, £385 in August, and £254 in December.

The church estimates it has been overcharged by £3,000 in the past year alone.

Ramsay said: “What is actually going on is hard to fathom because when the meter was installed four years ago everything was fine. As recently as September 2023, we were being charged £14.16.

“But then readings started to go haywire. My own suspicion is there is something wrong with the way the meter is sending signals for what is used to the energy supplier.

“Radio wave messages are somehow getting scrambled and not properly read – perhaps due to the church being situated in an isolated spot that is far from communication masts.”

Smart meter readings are transmitted via mobile phone and radio masts to Data Communications Company servers linked to energy suppliers.

Energy UK has revealed a regional divide in signal transmission methods, with the Midlands using cellular technology while northern England relies on radio frequencies. The church’s location may straddle both networks, potentially causing signal interference.

The £13.5billion smart meter rollout has faced various challenges, with one in ten meters going ‘dumb’ due to poor reception, thick walls, or battery failures.

A Utility Warehouse spokesman responded: “We are sorry to hear about Ramsay’s concerns regarding the church’s bills. Following an engineer’s visit, we can confirm the smart meter is working correctly and recording energy usage accurately.”

The company says its customer service team has contacted Ramsay to discuss the account and arrange a manageable payment plan.

CryptoCurrency

Shiba Inu whales rotate into PropiChain, bet on its AI edge

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Shiba Inu whales are rotating their profits into PropiChain, betting on its AI features and potential to rise.

Shiba Inu (SHIB) whales make strategic moves by cashing out and rotating profits into new opportunities. As a result, SHIB has experienced a 3.12% dip in the past 24 hours. This shift in focus indicates a growing interest in projects that promise higher returns.

PropiChain (PCHAIN) is catching investors’ attention due to its unique AI features. The project has raised $2 million during the presale, with its token selling at $0.01.

Shiba Inu sees 883% outflows

Shiba Inu experienced a massive 883% increase in outflows, with large investors pulling out over 460 billion SHIB. Between January 15 and 16, the total Shiba Inu outflows grew from 647 billion to 1.11 trillion SHIB. This large-scale movement has left investors worried about its future price movement.

The significant outflows were driven by big investors cashing out and adjusting their positions. Some investors sold out their Shiba Inu holdings to protect their gains. This pushed Shiba Inu to drop, denoting a 10.84% decrease in the past week.

Analysts believe Shiba Inu might have limited upside potential as new meme coins take the spotlight.

Whales bet on PropiChain and its AI features

Shiba Inu whales are betting big on PropiChain’s AI-driven altcoin. The project has raised $2 million during the presale and this is only scratching the surface as new investors join the fold.

At $0.01, PropiChain could be undervalued, making it a favorite among investors in the crypto space.

Its appeal comes from real estate tokenization and fractional ownership features. This will create new opportunities for PropiChain’s users, as many of them will be able to buy portions of properties. The true impact of this model is that it allows them to diversify their portfolios and earn passive income through rental income.

However, PropiChain’s AI features are its secret weapon. The platform will allow for predictive market analysis, helping users spot lucrative real estate investments and capitalize on them before anyone else.

With its automated valuation models, users will benefit from fair and accurate property appraisals. This will allow buyers and sellers to close real estate deals faster as the pricing is provided by AI algorithms.

Additionally, smart contracts will be used to automate transactions such as auto-leasing and lease renewals. This process handles transactions on behalf of landlords and tenants, improving efficiency and reducing costs.

PropiChain also incorporates the metaverse for virtual property viewing, allowing users to walk through properties in the digital space.

To maintain the safety of users and investors, PropiChain’s smart contracts have been rigorously audited by BlockAudit, a reputable Web3 security firm.

Shiba Inu and PCHAIN in 2025

While Shiba Inu has surged thanks to the hype around meme coins, PropiChain is counting on its AI features for a significant edge in 2025.

The new altcoin is also benefiting from bull market rotations, where smart money rotates their profits from established altcoins. With a growing community of investors, PropiChain could be the dark horse of this bull market.

Investors scoop the PCHAIN token

PCHAIN could currently be one of the most undervalued tokens in the market. At $0.01, PropiChain provides growth investors with a low entry for potentially massive gains.

Due to its promising AI features, PropiChain has raised $2 million in its ongoing token presale. This is considered a stepping stone as it has been listed on CoinMarketCap, opening up an avenue to attract more investors. The listing serves as a reminder the AI-driven altcoin is committed to transparency and growth.

For more information on PropiChain, visit their website or online community.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

CLS Global Admits to Wash Trading on Uniswap Following FBI Probe

Dubai-based crypto market maker CLS Global will plead guilty to charges related to wash trading on the decentralized exchange Uniswap.

Federal prosecutors in Boston announced Wednesday that the company will face market manipulation and wire fraud charges after falling victim to an FBI sting operation.

$428K Fine and U.S. Market Ban

As part of the plea agreement, the financial services firm will pay penalties and forfeited assets totaling over $428,000. The company will also be barred from offering services to U.S. investors and will be required to file annual compliance certifications.

A press release shows that CLS Global had been providing market-making services and other related offerings for crypto companies. The investigation specifically focused on its involvement with NexFundAI, a fake digital currency company set up by the FBI that had token trading on Uniswap.

The firm admitted that it had agreed to provide services for NexFundAI, which included wash trading to fraudulently generate trading volume and attract investors.

During several video conferences between July and August 2024, an employee explained that CLS used an algorithm for self-trading, buying, and selling from multiple wallets so that the activity was not visible and appeared organic. The worker revealed, “I know that it’s wash trading, and I know people might not be happy about it.”

The UAE-based firm then proceeded to buy and sell the token on Uniswap using its own wallets, creating fake trading volume to meet exchange listing requirements and bring in potential investors.

FBI Sting Operation

CLS Global is registered in the United Arab Emirates and has more than 50 employees based outside the U.S. It provided crypto-related services accessible to American investors, with the company’s official website listing partnerships with major centralized exchanges such as Binance, Bybit, KuCoin, Bitfinex, OKX, and Bitget.

The charges against it followed an undercover law enforcement operation targeting crypto “wash trading,” a practice where assets are bought and sold by the same party to create the illusion of market activity.

The company was one of three market makers investigated in the initiative, which also led to charges against several individuals involved in manipulating digital assets that were offered and sold as securities. This case marked the first set of criminal charges against financial services firms for market manipulation and wash trading in the industry.

Meanwhile, the Securities and Exchange Commission (SEC) also filed a related civil enforcement action against CLS Global, alleging violations of securities laws. The agency is seeking permanent injunctions, disgorgement of allegedly ill-gotten gains plus interest, and civil penalties, with any money seized from the crypto firm credited to the SEC resolution.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Ethereum Is Ready For The Next Big Move – Analyst Shares Bullish Target

Ethereum (ETH) has been underperforming in recent weeks, with its price action leaving investors disappointed following last week’s flash crash and heightened volatility. Despite initial hopes for a recovery, ETH has struggled to regain momentum, trending downward since mid-December. This lack of bullish movement has left investors eager for a surge that could break Ethereum out of its current slump.

Related Reading

Adding to the anticipation, top analyst Carl Runefelt recently shared a technical analysis suggesting that Ethereum may be preparing for its next significant move. According to Runefelt, ETH is forming a 4-hour symmetrical triangle, a pattern often associated with periods of consolidation before a breakout. While the direction of the breakout remains uncertain, the formation indicates that a decisive move could be on the horizon.

As Ethereum hovers near key levels, market participants are closely monitoring the triangle’s resolution. A breakout to the upside could reignite bullish sentiment, while a breakdown may signal continued struggles for the largest altcoin. With the broader crypto market showing signs of recovery, the coming days will be crucial for Ethereum to prove its resilience and reestablish its position as a leading performer in the space. All eyes are now on ETH’s next move.

Ethereum Consolidates Before A Move

Ethereum is currently in a short-term consolidation phase, trading between key demand and supply levels as the market grapples with uncertainty. While analysts are anticipating a major move, the direction remains unclear due to heightened volatility and mixed sentiment among investors. ETH’s price action reflects a market in wait-and-see mode, with traders closely monitoring key technical levels for signs of a breakout.

Top analyst Carl Runefelt recently shared his technical analysis on X, highlighting Ethereum’s preparation for its next significant move. According to Runefelt, ETH is forming a 4-hour symmetrical triangle, a pattern that often precedes a decisive breakout. He noted that this setup comes with both bullish and bearish scenarios, depending on the direction of the breakout.

If ETH breaks above the triangle, the bullish target is set around $3,900, signaling the potential start of a new bullish phase. Conversely, a breakdown below the triangle would point to a bearish target near $2,720, indicating further downside. Runefelt emphasized the importance of monitoring this pattern as it unfolds, as the outcome could set the tone for Ethereum’s next trend.

Related Reading

With market sentiment still uncertain and volatility remaining high, Ethereum’s symmetrical triangle offers a clear framework for traders. Whether the breakout is upward or downward, it will likely mark the beginning of a significant move, shaping Ethereum’s trajectory in the weeks to come. For now, investors are keeping a close eye on this critical technical formation.

Volatility Driving The Market

Ethereum is currently trading at $3,317, navigating a market dominated by massive volatility. This heightened price action has become the primary force driving speculation and uncertainty among traders. As Ethereum struggles to stabilize, holding above critical support levels is essential to maintaining a bullish structure and avoiding further downside.

The $3,300 level has emerged as a key area of support that bulls need to defend to sustain momentum. If ETH can hold this mark and push above the $3,550 resistance with strength, it could solidify a bullish outlook and potentially lead to a stronger recovery. Breaking this level would also signal renewed confidence among investors, opening the door to a more sustained upward trend.

However, the market’s uncertainty also carries the risk of a deeper correction. Losing the $3,000 psychological level could trigger additional selling pressure, leading to a dramatic drop and testing lower support zones. Such a move would challenge ETH’s resilience and likely extend its consolidation phase.

Related Reading

As the market waits for clearer signals, Ethereum’s ability to hold above key levels will be closely watched. The coming days are critical for determining whether ETH can maintain its structure or face further volatility and downside pressure.

Featured image from Dall-E, chart from TradingView.

CryptoCurrency

Prices Rise After Report of Leaked CME Futures Addition

Payments-focused cryptocurrency XRP and world’s most-used blockchain Solana (SOL) prices spiked on Wednesday afternoon, after report that the Chicago Mercantile Exchange (CME) is adding futures contracts of both.

According to a post on X, CME have posted the futures page for XRP and SOL in their “staging subdomain.”

A screenshot of the website shows that the regulated futures could start trading on Feb. 10 pending regulatory approval. The website was not accessible at the time of publication. CoinDesk reached out to CME for comments.

“We’ve seen a slew of ETF filings for SOL and XRP futures ETFs. Typically these would use CME or CBOE futures but we don’t have any yet,” Bloomberg Intelligence ETF analyst James Seyffart told CoinDesk. “I would expect CME to list those futures in the next month assuming those issuers know something we don’t.”

XRP and SOL jumped as much as 3% in the minutes after the post started circulating on social media, TradingView data showed.

UPDATE (Jan. 22, 10:09 UTC): Adds comments from Bloomberg ETF analyst.

Read More: Solana Bull Bets Big on SOL Rallying to $400

CryptoCurrency

Ethereum's Looming Collapse Is A Lesson In Blockchain Integrity

In the world of decentralized networks, the battle lines are drawn not just between different blockchains but within the communities they spawn. Bitcoin, having weathered its own civil war, has emerged stronger, proving its resilience and commitment to the principles of decentralization, freedom, and Truth. Ethereum, on the other hand, is currently embroiled in internal strife, revealing a stark contrast in community ethos and leadership philosophy.

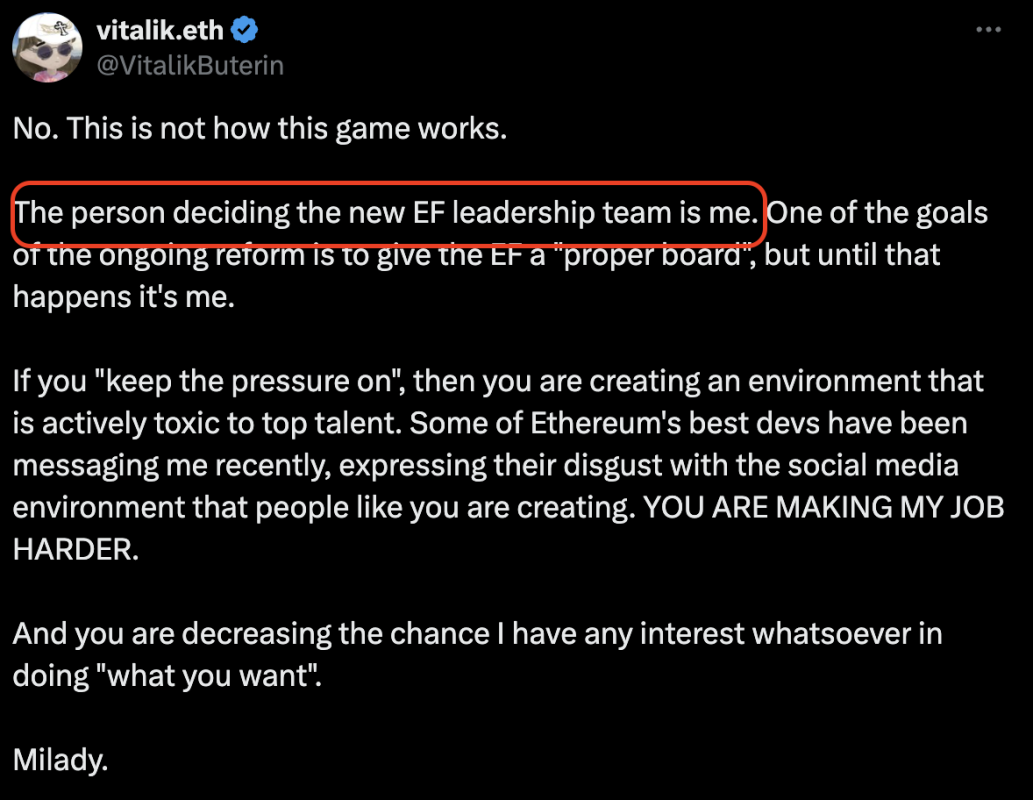

Vitalik Buterin’s recent tweets concerning the Ethereum Foundation drama are a testament to this. They expose a community that seems to prioritize PERCEPTION over substance, a hallmark of the bureaucratic and “woke” culture that has infiltrated society at large. Ethereum’s approach, under Buterin’s guidance, reflects a refusal to adopt the “bronze age mindset” that has been pivotal in Bitcoin’s success. This mentality, often derided as “toxic maximalism” by outsiders (the term “maximalism” was coined by Vitalik himself, by the way), champions unapologetic truths and a fierce defense of core values like decentralization and security.

Toxicity, in this context, becomes a virtue. It favors those willing to speak uncomfortable truths and maintain the integrity of the blockchain’s original vision. Choosing the path of bureaucratic, HR-friendly discussions leads to a landscape where managing perceptions overshadows achieving actual results. Ethereum’s current predicament is not just a long time coming but perhaps a necessary wake-up call for those who have strayed from the path of what blockchain technology was meant to achieve.

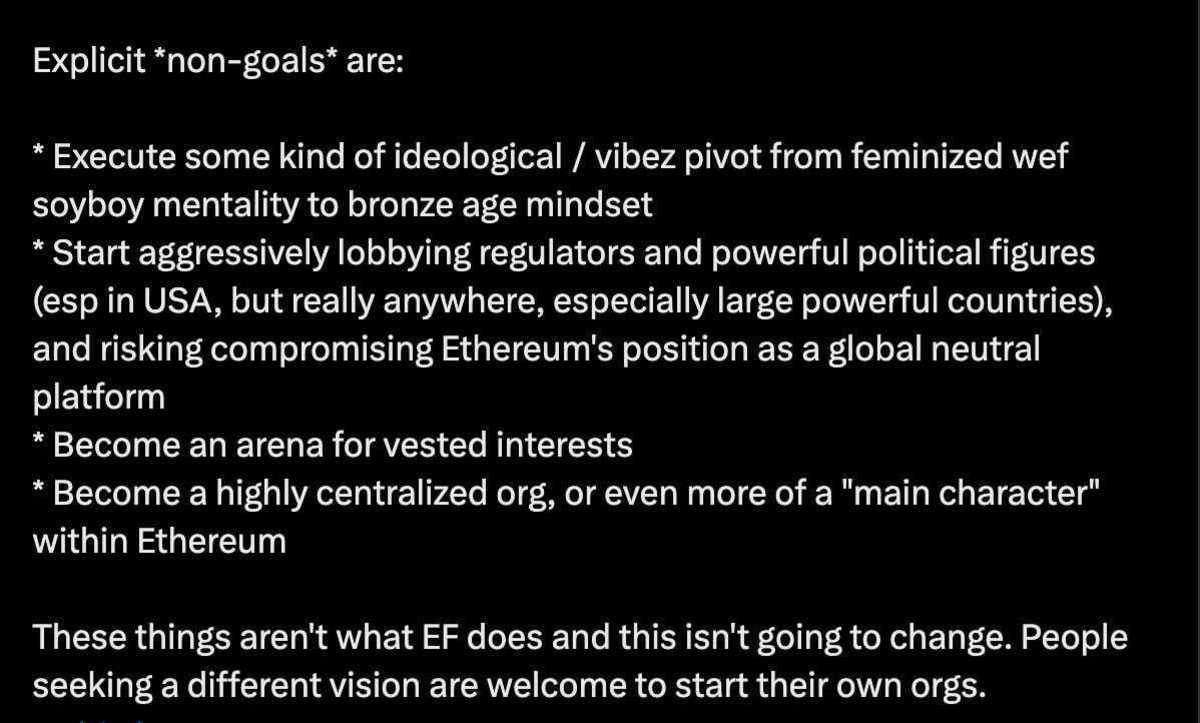

In contrast, Ethereum’s current turmoil showcases a leadership that is cracking under pressure, revealing Buterin’s true colors – not for the first time.

Bitcoin, unlike Ethereum, does not have a Foundation, and this is by design. Does this make our governance process a hundred times harder? Absolutely, and that’s precisely the point. Even though I might not always agree with the criticism leveled at Bitcoin Core, I recognize the value in knowing they can be replaced at any given moment. The Ethereum Foundation has always been a magnet for centralized control, and the power vacuum its collapse would leave will sow chaos. Bitcoin’s governance might be organized chaos, but Ethereum is now facing a spell of unorganized chaos that could further tarnish its reputation. I’d love to see Vitalik return to Bitcoin; he’s undeniably intelligent. Yet, his current role as the “man in control” is exactly why Bitcoin avoids having a public figurehead. The plebs, the node runners – are in control, and that’s the better way.

The “.ETH” community’s apparent lack of commitment to these foundational blockchain principles suggests a future where Ethereum might not just suffer greatly from its civil war but could also lose its relevance.

The irony here is palpable; while Ethereum struggles, other platforms like Solana stand to gain.

But it seems like those making this migration do not learn from their mistakes. They recognize the ugly side of Ethereum and Vitalik, but instead of seeking the true axioms of a good network, they move to an even more centralized alternative.

However, this shift is likely temporary. The so-called “On-Chain refugees” fleeing the chaos of Ethereum will eventually find their way back to Bitcoin, the original and only cryptocurrency that has consistently delivered on its promises without the drama. They need one more rug pull on the Solana side before they finally end their journey, like all of us – Bitcoin only.

This drama within Ethereum has been brewing for years, and while it might be late in coming, it’s not soon enough for Humanity. The time wasted building upon what some might argue is a fundamentally flawed system could have been better spent advancing technologies that genuinely uphold the ideals of decentralization and freedom.

As Ethereum continues to navigate its internal conflicts, it serves as a cautionary tale. It underscores the importance of a community that values Truth over narrative, freedom over control, and decentralization over centralized decision-making. Bitcoin emerging stronger from its civil war wasn’t just about survival; it was about proving the soundness of its principles. Ethereum’s ongoing struggle might just be the catalyst needed for the blockchain community to return to those roots, recognizing that in the realm of digital currencies, only those built on genuine, unyielding principles will stand the test of time.

Bonus Take – PLEASE make this happen Nic: https://x.com/nic__carter/status/1881029931011903772

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Articles Guillaume writes in particular may discuss topics or companies that are part of his firm’s investment portfolio (UTXO Management). The views expressed are solely his own and do not represent the opinions of his employer or its affiliates. He’s receiving no financial compensation for these takes. Readers should not consider this content as financial advice or an endorsement of any particular company or investment. Always do your own research before making financial decisions.

CryptoCurrency

Ethereum whales add $1B in ETH — Is the accumulation trend hinting at a $5K ETH price?

Numerous cohorts of Ethereum addresses added over 330,000 ETH in the last two weeks. Is this a sign that a $5,000 ETH price is in the making?

CryptoCurrency

Universal Credit update: DWP to overhaul benefit payment this year

The Department for Work and Pensions (DWP) has announced three significant changes to Universal Credit as part of a £240million package aimed at shifting focus from welfare to work.

The changes, outlined in the Get Britain Working White Paper, will affect millions of benefit claimants across the UK. Work and Pensions Secretary Liz Kendall said: “We promised change, and that is what we will deliver.

“For too long, millions of people have been denied opportunities to work and build a better life, and too many children are growing up in poverty, harming their life chances and our country’s future.”

The new measures will improve how the department detects and prevents fraud and error, ensuring support is targeted where needed most. The DWP expects these changes to save £7.6billion by 2029/30.

These reforms are part of the Labour Government’s broader strategy to increase employment opportunities and reduce poverty nationwide. Benefits will increase by 1.7 per cent from April 2025, worth an average of £12.50 per month for families on Universal Credit.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Massive changes are coming to Universal Credit

GETTY / PA

However, due to Universal Credit being paid monthly in arrears based on assessment periods, some claimants may not see the increase until June 2025. The new monthly standard allowance rates will see single people under 25 receive £316.98, while those 25 or over will get £400.14.

Joint claimants under 25 will receive £497.55 per month, with couples where one or both are 25 or over getting £628.10. The Secretary of State’s annual review has also confirmed a 4.1 per cent increase to the basic and new state pensions under the triple lock.

This means those in the full rate of the new state pension will see an increase of over £470 per year. Bank holiday payment dates may be affected, with benefits usually paid on the working day before if the regular payment date falls on a holiday.

A new Fair Repayment Rate will be introduced, reducing Universal Credit deductions from 25 per cent to 15 per cent of the standard allowance from April 2025. This change will benefit 1.2 million of the poorest households by an average of £420 a year.

Britons are being urged to calculate how much they could be entitled to from the DWP

GETTY

These deductions cover various debts impacting households, including energy bills, water bills, council tax, rent arrears, service charges, child maintenance and court fines.

Third-party deductions will be set at five per cent of the Universal Credit standard allowance, ranging from £15.85 for single people under 25 to £31.41 for joint claimants aged 25 or over.

Minimum deductions for rent and service charges will be reduced to 15 per cent of the Universal Credit standard allowance, down from the current level of 20 per cent.

The Government is also investing £1billion to extend the Household Support Fund in England by a full year and maintain Discretionary Housing Payments in England and Wales.

This additional funding aims to help struggling families and pensioners facing the greatest financial hardship. The DWP will continue moving claimants to Universal Credit throughout this year, with all managed migration notices expected to be sent by December 2025.

LATEST DEVELOPMENTS:

Changes are coming to Universal Credit

PA

The complete transition from legacy benefits to Universal Credit is scheduled to finish by March 2026. This migration affects claimants currently receiving Working Tax Credit, Child Tax Credit, Income Support, Income-based Jobseeker’s Allowance, Income-related Employment and Support Allowance and Housing Benefit.

Money expert Fiona Peake from Ocean Finance advises: “Universal Credit and other benefits will see updates, with new rules around work requirements. Keep track of any changes to your entitlements.

“The Government’s online benefits calculator is worth checking regularly, as you might become eligible for additional support.

“Consider using budgeting apps or speaking with a financial adviser to create a personalised action plan. The most important thing is not to bury your head in the sand – stay informed and take action early.”

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login