CryptoCurrency

Emerging markets lead crypto adoption, according to Consenys survey

According to a survey from blockchain firm Consensys, half of the population of Nigeria, South Africa, Vietnam, the Philippines and India already own a crypto wallet.

CryptoCurrency

Solana Price Jumps 9% as New L2 Project Solaxy Banks $14M in Presale

Solana (SOL) is showing no signs of slowing down in 2025.

Its native token, SOL, is up 9% in the past 24 hours – erasing most of the losses from yesterday.

Alongside SOL’s surge, a new Layer-2 solution called Solaxy (SOLX) has just blown past the $14 million mark in its presale.

Solana Price Rebounds as Spot Trading Volumes Surge

Solana is back on track after a brief dip.

After testing a minor support level yesterday, SOL has rebounded, climbing to $267 at the time of writing.

That puts SOL back where it was on Wednesday, and it’s now leading all the major altcoins in terms of gains.

But what’s really interesting are the factors behind this rebound.

Looking at spot trading volumes, it’s clear that interest in SOL is surging again.

Spot volumes soared past $10 billion in the past 24 hours, even passing XRP, marking a 10% increase from the previous day.

On top of that, open interest has climbed to $4.1 billion, which suggests that traders are betting on SOL going even higher.

The token’s technicals look good, too.

On the 4-hour chart, SOL rejected the 50-period EMA, and since then, it has followed an upward trendline that formed earlier this week.

This solid support and the uptick in trading volume hint that the bulls are back in control for Solana.

Beyond the Price – Why Solana’s Fundamentals Are Stronger Than Ever

Several factors are lining up that could send SOL even higher in the coming months.

The big one everyone’s watching is today’s Solana ETF decision.

This potential approval comes as big money is pouring into the ecosystem, with over $3.5 billion in stablecoins flowing in the past ten days.

Solana’s fundamentals are also getting stronger.

Over 7,600 new developers joined the network last year, and this influx of talent is fueling innovation across the board, from new DeFi protocols to AI projects and even platforms for real-world assets (RWAs).

DEXs like Raydium and Jupiter are also seeing huge traction.

And Solana’s not resting on its laurels when it comes to tech, either.

The upcoming “Firedancer” upgrade promises to boost transaction speeds, potentially to one million per second.

On top of that, Solana is getting even more political backing, with venture capitalist David Sacks being given a role as a crypto advisor in the Trump administration.

Sacks is famously a big supporter of Solana.

Could Solaxy be the Next Big Layer-2 Network? SOLX Token Presale Passes $14M Mark

Another factor playing into Solana’s bullishness is all the buzz around Solaxy and its presale.

This new Layer-2 project just hit a huge milestone – raising over $14 million from early investors.

Clearly, many people believe Solaxy could be the key to solving Solana’s scaling challenges.

The timing of its emergence couldn’t be better.

As Solana gets more popular, the need for effective scaling solutions is becoming urgent.

Solaxy’s approach, which involves processing transactions off-chain and then settling them in batches, could help things run much smoother during peak times.

However, there’s more to Solaxy than just scaling.

The platform also has a staking program for the native SOLX token, which currently offers annual yields of 274%.

Investors have already locked up more than 4.1 billion tokens in this program.

But the most exciting thing is all the hype that Solaxy is getting from popular crypto influencers.

For example, Austin Hilton released a video analysis of Solaxy last week – stating that it’s a “major” project.

He also believes the planned bridge between Solana and Ethereum could unlock access to the latter’s huge liquidity base.

With the SOL price rising and institutional interest in Solana growing, Solaxy could be in the right place at the right time.

And with SOLX tokens on presale for just $0.001612, this might be the last chance to grab them at such a low price.

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

CryptoCurrency

Bitcoin Enthusiasm Peaks At $100K, Yet Veteran Eyes A $95K Dip

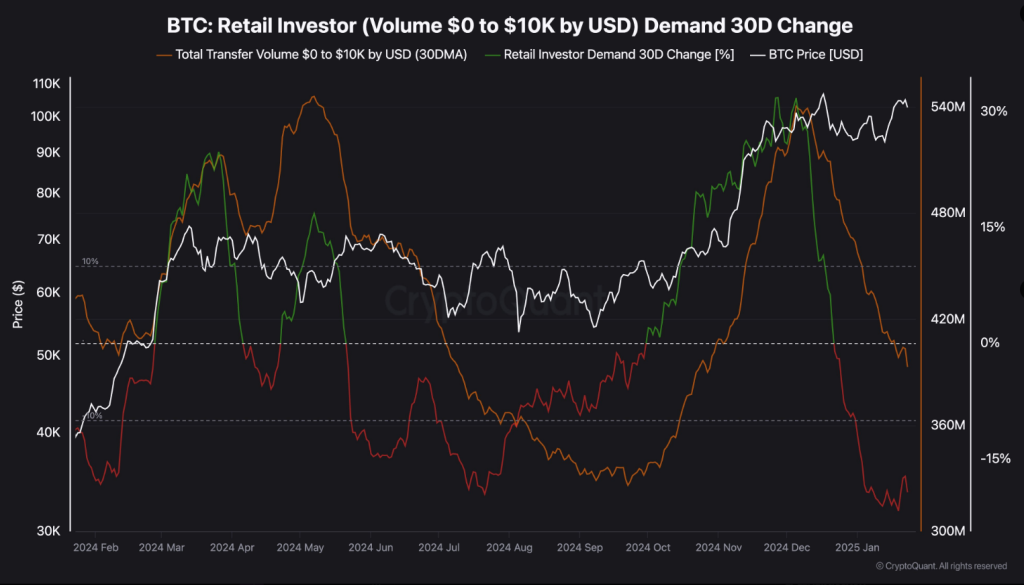

The consistent retail demand for Bitcoin at the $100,000 mark, which indicates high investor confidence, has recently drawn notice. However, because short-term holders are driving the present accumulating trend, market watchers are warning of a possible fall to $95,000.

Related Reading

Retail Investors Accumulate At Record Pace

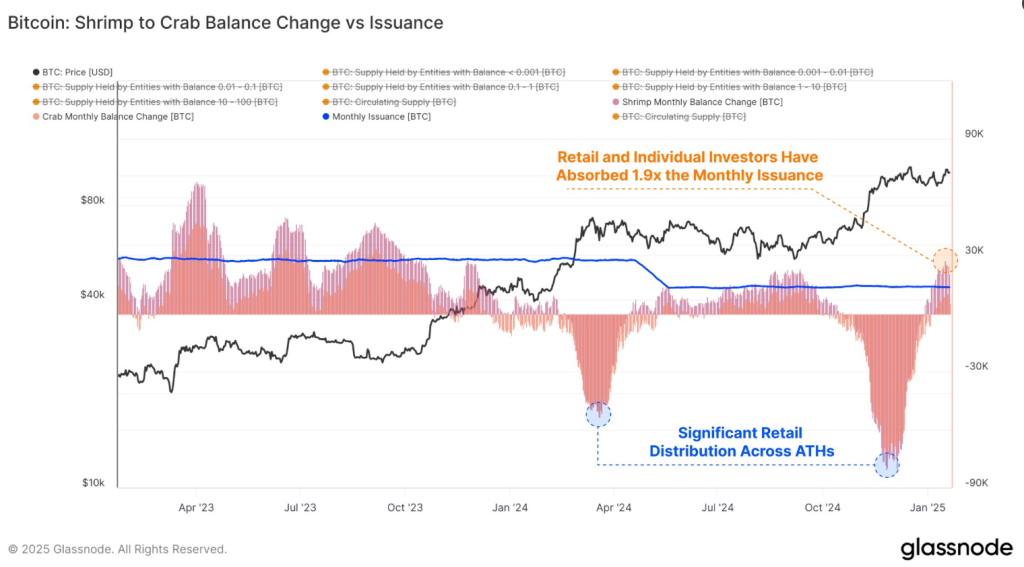

Retail investors, which include smaller holders termed as “Shrimps” and “Crabs,” have been enthusiastically accumulating Bitcoin. In the last month, Glassnode reports that these groups collectively added 25,600 BTC to their portfolios. That’s nearly twice the amount of newly mined Bitcoin over the same period, a sign of significant demand for the “digital gold” at its price peaks.

Demand from retail investors for #Bitcoin at prices around $100K remains strong – The Shrimp-Crab cohort (up to 1 and 10 #BTC, respectively) absorbed 1.9x the newly mined Bitcoin supply last month, a total of +25.6k $BTC: https://t.co/l0sjVN2Toi pic.twitter.com/UdzcCWXAGo

— glassnode (@glassnode) January 23, 2025

The purchasing activity of these smaller investors highlights an even more general retail enthusiasm trend. Nonetheless, experts must still exercise caution. Although this degree of accumulation is remarkable, the dominance of short-term holders (STHs) in this surge introduces an element of risk for market stability.

Short-Term Holders Pose A Risk

Often selling off during slight declines to guarantee gains, STHs are renowned for their fast responses to market changes. Particularly in cases of unexpected volatility for Bitcoin, this reflexive behavior could set off higher selling pressure. Teddy, a market analyst, underlined that the existence of STHs might have a major impact on temporary price swings.

While STHs (Short-Term Holders) have indeed absorbed a significant portion of the newly mined Bitcoin supply, it’s crucial to consider the behavioral tendencies of this group. STHs are historically more susceptible to panic during minor market fluctuations, often resulting in… pic.twitter.com/dasfRgjOFR

— Teddy (@TeddyVision) January 23, 2025

Historically, the markets are also more sensitive to the downtrends with STH. Analysts feel that along with this prevailing trend, at such levels, caution for investors would be prudent.

Glassnode: Narrow Bitcoin Range

Another anomaly which Glassnode picked out in the price action of Bitcoin is an unusually tight range over the past 60 days. Such events have been precedents for volatile times ahead.

This coincides with historical trends, which suggest that the market will experience either a breakout or a breakdown soon. While the sustained $100,000 price level reflects optimism, the market’s narrow range adds an air of unpredictability.

Related Reading

A Possible Pullback Soon?

Given all of these factors, some experts believe Bitcoin may be due for a slight price adjustment in the near future. Some experts, like market veteran Michaël van de Poppe, predict a retreat to $95,000, primarily due to STHs selling in the face of market uncertainty.

For the time being, retail demand remains a solid source of support at $100,000. Investors should, however, brace themselves for volatility and keep an eye out for market indicators. As Bitcoin trades near its peak, the interaction of retail euphoria and market risks will determine its next moves.

At the time of writing, Bitcoin was trading at $105,141, up 3.2% and 3.2% in the daily and weekly timeframes.

Featured image from Vecteezy, chart from TradingView

CryptoCurrency

Ledger Co-Founder’s Kidnapping Highlights Threat of Crypto Robberies

David Balland, co-founder of cryptocurrency wallet developer Ledger, was rescued in a police operation after being kidnapped in a ransom attack in France, according to reports, putting an end to days of swirling rumors.

Paris Prosecutor Laure Beccuau said that Ballard and his wife were kidnapped on early Tuesday from their home in Central France and held captive at two separate addresses, Reuters reported on Friday. The prosecutor said that the kidnappers contacted another Ledger co-founder to demand ransom paid in cryptocurrencies.

A police operation involving French elite forces GIGN freed Ballard on Wednesday and his wife was found on Thursday, the prosecutor said. Ballard was taken to hospital to receive treatment to one of his hands, which was mutilated, Beccuau said, without revealing further details, according to Reuters. Local newspaper Le Parisien reported that the attackers severed Ballard’s finger and sent it to associates to extort a ransom.

“We are deeply relieved that David and his wife have been released, and are now safe,” Pascal Gauthier, chairman and CEO of Ledger, said in a statement shared with CoinDesk.

Rumors circulated on social media earlier this week that one of the co-founders of Ledger had been kidnapped. Reports alleging that Eric Larchevêque, another co-founder of the company, was the victim turned out to be false. CoinDesk reached out to Ledger for confirmation at the time, but the company didn’t comment.

“Our top priority was always to allow law enforcement to do their jobs and protect the integrity of the investigation,” CEO Gauthier said. “We respected law enforcement requests around safeguarding critical details of the ongoing investigation and appreciated members of the press who did the same.”

The incident was another example of an alarming trend of robberies and crime targeting crypto traders and industry figures as the crypto bull market marches on creating riches to investors. For example, Dean Skurka, the CEO of WonderFi, a publicly listed crypto holding company that owns one of Canada’s largest crypto exchanges, was kidnapped for a ransom in Toronto last year.

“Have seen an uptick in irl [real life] robberies targeting crypto traders located in Western Europe over the past few months,” popular blockchain sleuth ZachXBT posted on Telegram. “The cases all involve known people in the crypto community where they were held at gunpoint. As the rest of the cycle continues, be extra mindful of who you share your wins with and meet up with [in real life].”

CryptoCurrency

Trump’s Digital Assets Executive Order May Not Last — Senator Lummis is Doing it Right

Last night, President Trump signed the “Digital Assets” executive order (EO), and let’s just say Bitcoiners are feeling… sour. Initially, rumors swirled that this might be the long anticipated Strategic Bitcoin Reserve (SBR) legislation. But nope — not even close. Bitcoin reserve didn’t get a single mention.

Instead, the EO said:

“The Working Group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.”

Translation: This EO looks like a vague “let’s study shitcoins” roadmap rather than a bold step toward a Strategic Bitcoin Reserve. If you were hoping for a nation state orange pill moment, this ain’t it.

But before you rage tweet, take a deep breath. There is a silver lining. The EO does outlaw CBDCs — a huge win for freedom money and a more Bitcoin-aligned future.

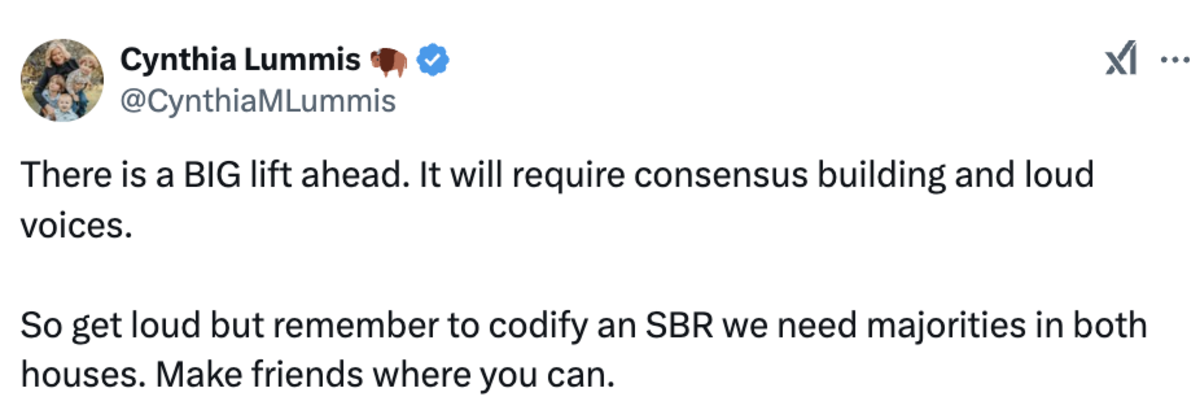

And, as Senator Cynthia Lummis reminded us yesterday, her Strategic Bitcoin Reserve Bill is “a BIG lift”:

Why is this good news? Let’s break it down:

- Executive Orders Are Fragile: EOs are quick to implement but can be easily reversed by the next administration. They’re political Post-it Notes, not permanent fixes.

- Legislation Is Durable: Laws passed through both houses of Congress are far harder to repeal. Lummis’ long term strategy aims to cement Bitcoin’s role in the U.S. economy for generations, not just the next election cycle. She is taking the low time preference route, and I salute her for that.

Senator Lummis said it herself in an X DM she allowed me to share:

“Even if the EO had been an outright Strategic Bitcoin Reserve, the next administration (after Trump) could undo it (what’s done administratively can generally be undone administratively). So, in order to get the 20-year minimum HODL, which my bill calls for, and meaningfully address America’s debt, we have to go through the legislative process (passage through both the House and Senate) to get it to the President’s desk for signature.

It’s really important that we have momentum for a marathon, not a sprint. I don’t want people getting discouraged. The trajectory is to the moon but we have to stick with it and work the process. Lots to do but the EO was a great jumping-off point to get us there.”

So yes, the EO feels like a quick win for crypto execs eager to pump their bags. But the real fight for Bitcoin’s future is just beginning.

A congressionally approved SBR is better than an SBR via Executive Order. Full stop!

Bitcoin has always thrived in adversity. Whether it’s bans, restrictions, or now the “national digital asset stockpile” nonsense, Bitcoin’s resilience is unmatched. As Senator Lummis works to push the Strategic Bitcoin Reserve Bill through Congress, individual states are already leading the charge. States are introducing Bitcoin-specific reserve legislation, not vague “digital asset” plans.

Meanwhile, global momentum is building. Putin didn’t say, “no one can control digital assets,” he said “no one can control Bitcoin”. Nation states aren’t about to FOMO into $TRUMP or FARTCOIN. They’re watching, learning, and inching closer to Bitcoin.

Bitcoin wins because it is superior money. Every piece of news, even setbacks, is ultimately bullish for Bitcoin because it exposes weaknesses in fiat and strengthens Bitcoin’s narrative. So stay patient. The slow burn will be worth it.

See you in Vegas — and remember: best money wins.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

CryptoCurrency

Solana and Chainlink Investors Add Lightchain AI, Eyeing an 11,090% Upside

Solana and Chainlink investors are now turning their attention to Lightchain AI, intrigued by the potential for explosive growth. With predictions pointing to an impressive 11,090% upside, this emerging cryptocurrency has quickly gained traction among the crypto community.

As seasoned investors look for the next big opportunity, Lightchain AI stands out as a promising option in 2025, attracting those who are seeking higher returns and a chance to capitalize on its early-stage momentum. The question is; will it outperform its rivals?

Why Solana and Chainlink Investors Are Turning to Lightchain AI

As Solana and Chainlink investors seek new opportunities in the evolving blockchain landscape, Lightchain AI is quickly emerging as a top choice. The project offers unique innovations like its Proof of Intelligence (PoI) consensus mechanism and decentralized governance, which are poised to address the scalability and efficiency challenges that current blockchain networks face.

Investors are drawn to Lightchain AI’s groundbreaking approach to smart contracts and decentralized applications, with the potential for faster transactions and lower costs. Additionally, its commitment to stability and steady growth during its ongoing presale has fostered confidence among those looking for long-term value.

With the presale price set at $0.005, Lightchain AI represents an exciting, promising opportunity for those seeking to diversify their portfolios in the blockchain space.

11,090% Upside- What Makes Lightchain AI Game Changer

Lightchain AI is ready to bring great chance for growth, with its aim to cut down delay and give special token plans that encourage all users of the network. Its token plan is made to help keep value over time for investors and builders, making sure a fair share of tokens goes to presale backers, validators, builders and helpers.

This model helps the platform’s aim of growing its system while keeping strong decentralization. With a focus on quick AI tasks, Lightchain AI makes sure transactions go faster, making it great for uses needing real-͏time answers.

Using new tech and improving the AI setup, the platform keeps wait times low, allowing smooth work. As Lightchain AI grows it its smart token plans and strong AI skills put it in place for a huge jump with maybe a 11,090% gain.

Lightchain AI’s Explosive Potential- What to Expect in the Coming Year

Lightchain AI is gearing up for a breakout year, and it’s catching everyone’s attention. With its presale price at just $0.005, this innovative blockchain project is quickly becoming a hot topic among savvy investors. So, what’s driving the buzz? Game-changing features like enhanced scalability, efficient decentralized governance, and unique AI-powered solutions are setting Lightchain AI apart from the competition.

This platform isn’t just keeping up with the blockchain revolution—it’s leading it. By tackling some of the biggest challenges in the space, Lightchain AI is positioning itself as a major player in the industry. And with global demand for faster, smarter, and more scalable blockchain networks on the rise, the timing couldn’t be better.

As Lightchain AI continues to evolve and attract attention, its value is expected to skyrocket in the years ahead. Don’t miss your chance to get in early on this emerging cryptocurrency—big things are on the horizon!

https://lightchain.ai/lightchain-whitepaper.pdf

https://t.me/LightchainProtocol

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Crypto czar David Sacks likens Trump’s memecoin to a ‘baseball card’

President Trump’s controversial memecoin took the crypto world by storm, but not everyone thinks it’s a good idea.

CryptoCurrency

What Is UNUS SED LEO Crypto

UNUS SED LEO is a cryptocurrency token that has gained attention for its unique features within the digital asset realm. Investors exploring the world of cryptocurrencies may find it worthwhile to understand the potential advantages offered by UNUS SED LEO.

By delving into the specifics of this token, individuals can gain insights into how it may influence their investment strategies.

Exploring the intricacies of UNUS SED LEO could provide a deeper understanding of its impact on financial endeavors, offering a more nuanced perspective on its utility and potential benefits.

Key Takeaways

- UNUS SED LEO is a utility token designed for Bitfinex users, offering fee reductions and various benefits within the iFinex ecosystem.

- The token’s value and benefits are supported by mechanisms like buyback and burn, aiming to maintain token value and provide potential value appreciation.

- Investors should carefully evaluate the advantages and drawbacks of LEO, considering factors such as market fluctuations, buyback strategy effectiveness, and economic uncertainties.

- Acquiring LEO tokens involves purchasing them on platforms like Bitfinex, unlocking discounts and services within the iFinex ecosystem, but users must also prioritize secure storage and beware of potential scams.

What is UNUS SED LEO?

UNUS SED LEO is a cryptocurrency token designed by iFinex, offering Bitfinex users discounts and benefits.

How LEO operates, its advantages, and potential drawbacks are crucial points to consider.

Understanding the history, functionality, benefits, and risks of UNUS SED LEO is essential before deciding to invest.

A brief history of UNUS SED LEO

UNUS SED LEO, also known as LEO, was introduced in 2019 by iFinex, the parent company of Bitfinex and Tether. The token was launched through a private sale that raised $1 billion, indicating strong support from initial investors.

LEO tokens were primarily created to offer benefits and discounts to users of the Bitfinex platform, such as reduced fees and access to lending and borrowing services. The history of UNUS SED LEO showcases a strategic approach to improving the trading environment and building a comprehensive ecosystem for token holders.

How does LEO work

LEO was created as a strategic utility token within the iFinex ecosystem, primarily for Bitfinex users. It offers practical benefits and fee reductions to token holders. These perks include savings on Bitfinex commissions, monthly discounts based on token holdings, and fee reductions on withdrawals and deposits.

The token operates on a buyback and burn mechanism, which adds a deflationary aspect by iFinex purchasing LEO tokens monthly using a significant portion of company profits. This mechanism aims to sustain the token’s value over time.

Benefits of UNUS SED LEO

UNUS SED LEO (LEO) offers practical benefits within the iFinex ecosystem by providing fee reductions and lending services on Bitfinex. Holding LEO tokens can lead to reduced trading fees, discounts on lending fees, and potentially lower withdrawal and deposit fees. Token holders may also access tiered benefits based on their LEO holdings.

The company actively repurchases LEO tokens, which could contribute to potential value appreciation over time. These benefits could be advantageous for both active traders seeking fee savings and long-term investors looking for potential returns within the iFinex ecosystem.

Drawbacks of UNUS SED LEO

Investors should exercise caution when considering UNUS SED LEO (LEO) as an investment due to its vulnerability to market fluctuations and the possibility of diminishing utility over time. While LEO’s buyback and burn strategy aims to enhance scarcity and value, it may not always insulate the token from the effects of financial crises.

Transparency in the execution of the buyback process is crucial to maintaining investor trust, as inconsistencies could raise concerns about the long-term viability of LEO.

Economic uncertainties could also expose investors to risks associated with the reliance on LEO tokens, as fluctuations in demand and supply may impact the token’s value.

What is the LEO token?

LEO tokens are the utility tokens within the iFinex ecosystem, offering discounts on Bitfinex commissions and other benefits to its holders.

Wondering about tokenomics and how to acquire LEO tokens? Let’s explore these points further to deepen your understanding of this crypto asset.

Tokenomics

The UNUS SED LEO (LEO) token functions as a utility token within the iFinex ecosystem, offering users various benefits. iFinex conducts token burns on LEO tokens, with at least 27% of the company’s profits allocated for this purpose on a monthly basis. This strategy aims to manage the token supply effectively and potentially enhance its value over time.

LEO holders receive perks such as reduced trading fees on Bitfinex, monthly discounts based on their token holdings, and cost savings on withdrawals.

The value of the LEO token is closely linked to the performance and profitability of Bitfinex, emphasizing the importance for users to monitor both the exchange’s activities and market dynamics to optimize their advantages as LEO holders.

How to buy LEO tokens?

To acquire LEO tokens, also known as UNUS SED LEO and issued by iFinex, individuals can purchase them on platforms such as Bitfinex. These tokens are compatible with Ethereum and EOS blockchains, offering benefits such as reduced fees and access to lending/borrowing services.

To buy LEO tokens, users need to register on Bitfinex, deposit funds, locate the LEO trading pair (e.g., LEO/USD) on the trading page, and place a buy order.

Once the tokens are bought, users can take advantage of the discounts and services offered within the iFinex ecosystem, enhancing their trading activities on platforms like Bitfinex and EOSfinex.

Is LEO token a good investment?

UNUS SED LEO (LEO) token presents an interesting investment opportunity due to its role as a utility token within the iFinex ecosystem. LEO offers benefits such as fee reductions and advantages for Bitfinex users, acting as a marketplace token for transactions on Bitfinex and EOSfinex.

Its compatibility with Ethereum and EOS blockchains further enhances its utility as a bridge between these platforms. Additionally, LEO’s deflationary mechanism, achieved through token burns, aims to create scarcity and potentially increase its value over time.

Investors considering LEO should take into account its benefits like fee reductions, dual blockchain compatibility, and security features such as the buy-back option.

However, it’s essential to be aware of potential risks associated with market volatility and the evolving nature of its utility. While UNUS SED LEO demonstrates promise with its unique features and positive market trends, a cautious evaluation of its long-term sustainability is advised before making an investment in the LEO token.

Frequently Asked Questions

What Is the Price Prediction for Unus Sed Leo?

Conduct thorough research, seek advice, and analyze trends before investing. Balance potential gains with market risks. Your diligence shapes your success in navigating crypto seas.

Unus Leo Is Current price?

The current price of UNUS SED LEO is $5.71 with +3,78% in the last 24 hours.

Where Does Unus Sed Leo Come From?

Originating from iFinex, the parent company of Bitfinex and Tether, UNUS SED LEO (LEO) tokenizes with benefits for Bitfinex users. With a name meaning ‘one, but a lion,’ LEO roars with discounts, lending services, and compatibility with Ethereum and EOS blockchains.

What Does Leo Crypto Do?

Leo crypto offers fee discounts and benefits to Bitfinex users. It’s compatible with Ethereum and EOS blockchains, providing unique features like fee reductions and lending services. Consider market risks and benefits before investing.

Conclusion

UNUS SED LEO (LEO) is a cryptocurrency token that operates within the Bitfinex trading platform. LEO tokens offer users benefits such as reduced trading fees and access to lending services on Bitfinex.

Investors may find potential growth opportunities and rewards by holding LEO tokens. By utilizing LEO, users can optimize their trading experience and potentially enhance their investment strategies.

It’s important for individuals considering LEO to conduct thorough research and assess the token’s utility within the Bitfinex ecosystem before making investment decisions.

Other Cryptocurrencies to check

Byte Crypto, Metacade Crypto, Galaxy Fox Crypto, Birdies Crypto and Coreum Crypto.

Angel Marinov is the Managing Editor at Coinlabz. With extensive knowledge of crypto payments and blockchain use cases, Angel is a trusted source of accurate and timely information

CryptoCurrency

Bitcoin as a Catalyst for a New Cold War

In this article, we will analyze why Trump’s victory might be the most significant event in cryptocurrency history.

Two weeks after surviving an assassination attempt, Trump addressed a Bitcoin conference, declaring the U.S. would become the world’s cryptocurrency and Bitcoin capital. He announced that the U.S. government would never sell a single Bitcoin, that pro-crypto regulations would be implemented, and most notably, that the U.S. would establish strategic Bitcoin reserves, modeled after existing gold and oil reserves.

Pro-crypto politics significantly contributed to Trump’s victory, especially given that the crypto community is younger, tech-savvy, urban, and, by definition, has historically leaned toward Democrats. Key figures in his administration, including Elon Musk, Vivek Ramaswamy, J.D. Vance, Scott Besant (Treasury Secretary), Paul Atkins (SEC Chair), and RFK Jr., are pro-business and pro-crypto.

With such monumental promises and even greater expectations, all the ingredients for a significant bull run in the cryptocurrency market seemed to be present. But when something appears too certain, is it always the case?

However, history teaches us that when market expectations are high, the actual outcome may not always meet those expectations. Many investors have already taken long positions, effectively betting on the anticipated outcome.

While short-term considerations like historical price movements and the time elapsed since the last Bitcoin halving are relevant, this analysis will explore a different perspective: that Trump’s victory ushered in a new era where existing market paradigms no longer fully apply.

1. Bitcoin ETFs

The approval of Bitcoin ETFs in January 2024 allowed Wall Street and institutional investors to enter the Bitcoin market, previously inaccessible. Bitcoin ETFs have become the fastest-growing ETFs in history. BlackRock’s Bitcoin ETF amassed more assets in less than a year than its Gold ETF did in two decades. Ethereum ETFs followed suit, and discussions regarding Solana and XRP ETFs gained traction.

2. Bitcoin in Corporate Treasury Strategies

An increasing number of companies are incorporating Bitcoin into their treasury strategies to preserve capital. These strategies aim to: Outpace inflation, measured by the Consumer Price Index (CPI). Outperform the S&P 500, which historically averages a 10% annual return. Bitcoin’s average annual growth of 100% over the past decade has made it a standout asset for capital preservation. No other asset has exhibited such rapid growth over this period.

3. Strategic Bitcoin Reserves

A key factor hinges on creating strategic Bitcoin reserves. Even after his election, Trump reiterated his commitment to this initiative. These reserves would serve two primary purposes for the U.S. government: To profit from Bitcoin’s value appreciation, driven by its capped supply and the increasing money supply.

Historically, the value of Bitcoin tends to rise with the decline in the value of the dollar. For the maintenance of U.S. global dominance into a future where the digital economy is dominated by cryptocurrencies and CBDCs, drawing a parallel to the Bretton Woods Agreement of 1944, wherein the U.S. amassed huge stores of gold reserves before establishing the dollar as a global reserve currency, Bitcoin reserves could be the way toward a new global financial order.

If the U.S. creates Bitcoin reserves, other countries will also have to follow suit in order not to be left behind in the new digital economy. Much as countries keep gold reserves today, the reason would be as a hedge.

4. Crypto Regulation

Then there’s the promise that the U.S. government is going to roll out friendly crypto regulation, particularly about stablecoins. While the broad EU Markets in Crypto Assets Directive has been an excessive drag, it prevents promising crypto projects. This leaves the door ajar for the U.S. to become the crypto capital of the world.

Conclusion

Trump’s victory likely catalyzed the largest bull run in cryptocurrency history. This marks a whole new era for the industry. Cryptocurrencies have become part of national strategic reserves, corporate treasury strategies, and a globally accepted asset class.

But the greater danger lies in Trump’s potential inability to deliver. He might deliver in a manner that the market did not expect. Even with anticipated delays or broken promises, the longer-term direction for cryptocurrencies seems firm. This trajectory appears independent of American leadership. Other countries, such as BRICS nations, might take leading roles in the evolving financial system.

CryptoCurrency

A simplified approach to crypto mining

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

BitconeMine simplifies cryptocurrency mining with AI-driven cloud solutions, offering secure, hassle-free passive income opportunities.

Cryptocurrency mining is one of the most popular trends in 2025. BitconeMine simplifies the entire cumbersome mining process and adopts a mining package contract model to achieve mutual benefit and win-win for users. Unlike traditional mining, users do not need to invest in expensive equipment and professional technology to manage and operate mining machines in advance. They only need an electronic device to remotely control and participate in mining. BitconeMine provider provides a safe, reliable, and transparent simple platform that makes it easy for everyone to understand and focus more on returns.

Current cryptocurrency mining is usually costly and requires technology, expertise, advanced equipment, and high electricity consumption to support the operation of current mines. BitconeMine integrates ASIC mining equipment through an AI intelligent system to improve performance and efficiency, reduce hardware costs, and greatly improve output benefits. It lets each participant get more benefits from the system.

For those looking for ways to earn passive income from the cryptocurrency market and keep it stable, BitconeMine is a smart choice, with a fixed income of $700-30,000 per day

BitconeMine advantages

BitconeMine has changed the rules of the game. Participants only need to register as BitconeMine users to get $10 for free mining without any handling fees. BitconeMine has advanced algorithms and superb mining technology, which can guarantee profitability even in the volatile cryptocurrency market.

BitconeMine features

Before purchasing a mining contract, users can clearly see each contract cycle and income, such as:

Contract Price

Contract duration

Daily income

Total revenue

$100

2

$4.5

$100+$9

$500

5

$6.5

$500+$32.5

$1000

12

$14

$1000+$168

$3000

15

$45

$3000+$675

$5000

20

$77.5

$5000+$1550

BitconeMine does not charge any fees, administration fees, or operating expenses. Personal information is protected by SSL encryption, and all mining investments are covered by L&G insurance.

Why BitconeMine

BitconeMine shines thanks to its AI-driven cloud mining model, which operates in a hassle-free business manner and has attracted more than 3,000,000 active users worldwide.

“BitconeMine enables people to participate in the cryptocurrency revolution without any restrictions,” said John Smith, CTO of BitconeMine. “Our support is to enable users to maintain long-term stable returns in a simpler and more efficient way to make money.”

Transparency and security at the core

BitconeMine takes user security very seriously by employing a multi-layered identity authentication process and advanced encryption technology. The platform guarantees full transparency and precise terms of each mining contract. The real-time dashboard provides comprehensive insights into mining activities, payment schedules, and performance data, which users can easily access to increase confidence in every transaction.

In a nutshell

BitconeMine is committed to staying at the forefront of the cryptocurrency business as it continues to gain recognition as a mainstream asset class. With its low initial cost and huge profit potential, now is the best time to explore the world of cloud mining.

To start earning passive income with BitconeMine, visit the official website.

Users can also check out the 24×7 online customer service or send a mail to the company’s corporate email at [email protected].

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Top Ripple (XRP) Price Predictions: Analysts Reveal Key Targets

TL;DR

- Analysts predict XRP could rise to a new all-time high if key support levels hold, with possible pullbacks to $2.80 or $2.50 seen as buying opportunities.

- A favorable resolution in the Ripple v. SEC case and the potential approval of an XRP ETF in the U.S. could drive the asset’s price higher, with optimism fueled by the changes in the SEC leadership.

Is $10 Possible?

Ripple’s XRP has been flying high ever since Donald Trump’s victory in the US presidential elections. Prior to the vote, the asset’s price hovered around $0.50, but currently, it is worth $3.20 (per CoinGecko’s data). This represents a whopping 540% increase, with many analysts expecting further gains in the following months.

One of the people touching upon the matter is the popular X user Michael van de Poppe. He told his over 750,000 followers on the social media platform that a potential price plunge to $2.80 might serve as an optimal entry point. He also claimed that an eventual rise to $10 per coin is not out of the question.

EGRAG CRYPTO chipped in, too. The analyst envisioned a possible retest of $2.83 and a drop to $2.50, “which is normal.” In general, though, the trader remains bullish, predicting the price to reach new dimensions if it breaks above $3.40.

Recall that XRP almost hit that target on January 16. As CryptoPotato reported, it spiked to as high as $3.39, standing just 1% away from its all-time high registered at the beginning of 2018.

The Bulls Are Waiting for These Developments

One of the most important factors that could positively impact the price of XRP is the final resolution of the Ripple v. SEC lawsuit (assuming it benefits the firm). Just a few days ago, the agency’s former Chairman, Gary Gensler (considered a huge enemy of the digital asset sector), resigned and was succeeded by the pro-crypto Mark Uyeda.

This has infused enthusiasm across the XRP Army that the case might conclude with a favorable resolution for Ripple soon. The popular American lawyer John Deaton also shares that thesis.

He claimed there are three possible scenarios for the case after Gensler’s departure. The most likely includes dismissing the SEC’s appeal of the 2023 verdict set by Judge Analisa Torres. Back then, the magistrate ruled that XRP sales on public exchanges to retail investors did not constitute securities transactions.

However, Deaton thinks Ripple will have to pay the previously ordered $125 million penalty for violating certain rules. The fine shouldn’t be a problem for the company since some execs already promised to abide by the rules. It also represents just a fraction of the $2 billion the securities regulator initially requested.

The potential launch of an XRP ETF in the United States may also trigger upward pressure on the price of the underlying asset. A few weeks ago, Monica Long (Ripple’s president) said that such a product was “likely to be next in line.” According to Polymarket, there is a 64% chance that the investment vehicle will see the light of day before the end of 2025.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login