CryptoCurrency

EU Regulator ESMA Urges Nations to Ensure Compliance with Stablecoin Rules Soon

The European Securities and Markets Authority has urged national authorities in the European Union (EU) to ensure that exchanges are no longer making non-compliant stablecoins available for trading within the next two months.

The regulator has requested that the 27 member states in the EU ensure crypto asset service providers (CASPs) are compliant when it comes to its stablecoin rules “no later than the end of Q1 2025,” ESMA said in a statement on Friday.

“In practice, this means that CASPs operating a trading platform for crypto-assets are expected to stop making all crypto-assets that would qualify as ARTs and EMTs but for which the issuer is not authorised in the EU (“non-MiCA compliant ARTs and EMTs” ) available for trading,” ESMA said. ARTs are asset referenced tokens and EMTs are electronic money tokens.

The move would affect stablecoins which are not compliant with EU laws like Tether’s USDT if it were offered to EU clients. Large issuers have already taken steps to try and comply with MiCA. Tether announced in November it was discontinuing its euro stablecoin, EURT. The company has not managed to obtain an e-money license to operate in the EU. Circle obtained an e-money license in July.

Exchanges like Gemini and Coinbase, who are registered in the EU, would have to delist un-authorized stablecoins, according to ESMA’s statement. Coinbase previously announced it would delist any such tokens by last December.

“Given our commitment to compliance, we restricted the provision of services to Retail, Exchange, and Prime Vault customers of Coinbase Europe Limited, Coinbase Germany GmbH, and Coinbase Custody International Limited in connection with stablecoins that do not meet the MiCA requirements beginning on December 13, 2024,“ a spokesperson from Coinbase told CoinDesk on Tuesday.

The exchange “will assess re-enabling services for stablecoins that achieve MiCA compliance on a later date,” the spokesperson said.

CoinDesk reached out to Gemini for a comment.

Read more: EU’s Restrictive Stablecoin Rules Take Effect Soon and Issuers Are Running Out of Time

CryptoCurrency

XRP Price Sets the Stage for More Gains: Bulls Hold the Momentum

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

CryptoCurrency

Ross Ulbricht Is Free: A Victory for Bitcoin and Freedom

In a landmark decision that sent waves through the Bitcoin community, President Donald Trump has granted a full and unconditional pardon to Ross Ulbricht, the creator of the Silk Road darknet marketplace. Delivered on January 21, 2025—one day later than his campaign promise—this pardon goes beyond merely commuting Ulbricht’s sentence. It’s a symbolic gesture, perhaps acknowledging the delay with goodwill. For Bitcoiners, this represents more than justice for one man—it’s a signal of potential alignment between the administration and the values Bitcoin embodies.

The pardon follows a flurry of executive orders signed on Trump’s first day back in office, underscoring the administration’s focus on a myriad of national priorities. However, this act stands out, particularly for Bitcoiners, as a commitment to keeping promises, sparking hope for pro-Bitcoin legislation and progress on issues like the Strategic Bitcoin Reserve.

Ross Ulbricht’s Silk Road wasn’t just a marketplace—it was Bitcoin’s first major use case. Launched in 2011, when Bitcoin was still in its infancy, the Silk Road demonstrated the revolutionary potential of decentralized, censorship-resistant money. While its operations drew criticism for facilitating illicit trade, it also showcased Bitcoin’s ability to enable peer-to-peer, anonymous transactions.

Ulbricht’s double life sentence became a symbol of overreach—a clash between an inflexible system and the frontier spirit of technological innovation. For many in the Bitcoin community, his case represented the broader struggle for autonomy, privacy, and the freedom to innovate. His pardon is now being celebrated as a victory for these principles.

The news of Ulbricht’s pardon has energized Bitcoiners, but it also highlights unresolved issues. The Samourai Wallet developers could still face prison time for developing Bitcoin privacy tools. Edward Snowden, another figure celebrated within the Bitcoin community, remains in exile. (Snowden’s revelations about mass surveillance have made him a key voice at Bitcoin conferences, aligning his values with the ethos of financial and personal privacy that Bitcoin embodies.)

While Ulbricht’s freedom is a win, the incomplete picture of justice for figures like the Samourai Wallet developers and Snowden reminds us of the broader challenges in protecting digital rights.

Ulbricht’s pardon is a significant moment, not just for him but for what it represents: A possible shift in how innovators and pioneers are treated when they challenge existing norms. It also signals that the current administration may be open to reevaluating policies around technology and privacy—issues that deeply resonate with Bitcoiners.

The Bitcoin community’s long-standing support for Ulbricht underscores the movement’s commitment to privacy, autonomy, and resistance to overreach. Yet, as celebrations continue, there’s recognition that this is just one step in a larger journey toward protecting those who push the boundaries of innovation.

For Bitcoiners, this moment is both a celebration and a rallying cry—a signal to keep pushing for a future where technology empowers individuals and where justice and innovation can coexist.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

CryptoCurrency

Ozak AI’s $OZ Token Gains Traction as Solana and Trump Coin Struggle

Ozak AI is a revolutionary AI and blockchain platform that continues to shake the crypto market through its $OZ token. At the moment, it is priced at $0.002 within its second presale stage, and it garners a lot of attention from investors. The technological structures at Ozak AI, such as the Ozak Stream Network (OSN) and the Decentralized Physical Infrastructure Networks (DePIN), help in real-time financial data, hence improving decisions of the individuals and organizations.

The project has sold over 162 million tokens, raising $200,000, representing 81% of its funding target. Early investors are eyeing the $OZ token as a high-potential asset, with a target listing price of $0.05. This strategic positioning underscores Ozak AI’s ambition to establish itself as a leader in predictive analytics and decentralized finance (DeFi).

Solana and Trump Coin Face Market Challenges.

Solana (SOL) and Trump Coin ($TRUMP) are struggling to maintain their momentum. Solana is a scalable, low-cost blockchain platform whose market value has drastically dropped. Its price declined by 8.57% in the recent period to $236, and its market capitalization declined by 8.59% to $120,635 million. Solana proof-of-history (PoH) and proof-of-stake (PoS) consensus models offer unique advantages in facilitating decentralized applications (DApps).

Trump Coin ($TRUMP), a meme-inspired cryptocurrency, has experienced a significant downturn. Its price plummeted 44.96% in a single day to $35.83. The token’s market cap has also fallen sharply, now at $7.93 billion, as trading volumes surged to $38.35 billion within 24 hours.

Ozak AI Positioned for Growth

Hence, unlike the other projects on the blockchain, Ozak AI is centered on real-time financial data and sophisticated predictive analysis. The platform helps to solve essential tasks related to financial forecasting and risk management with the help of the Ozak Stream Network and the Prediction Agents. Specifically, the possibilities of adapting its AI models give better solutions to institutional and retail investors.

As Solana and Trump Coin experience market struggles, Ozak AI’s robust technological framework and strategic growth trajectory position it as a strong contender in the evolving cryptocurrency landscape.

For more information about Ozak AI, visit the links below:

Website: https://ozak.ai/

Twitter/X: https://x.com/OzakAGI

Telegram: https://t.me/OzakAGI

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Trump announces $500B AI infrastructure venture ‘Stargate’

The Stargate project will be led by OpenAI, SoftBank and Oracle, while Microsoft and Nvidia will be key initial technology partners.

CryptoCurrency

Coinbase would delist Tether if necessary: WSJ

CCoinbase has expressed a willingness to remove Tether’s stablecoin from its platform depending on how the U.S. regulatory landscape evolves under President Donald Trump.

According to the Wall Street Journal, Coinbase CEO Brian Armstrong said the largest U.S. crypto exchange could delist $138 billion dollar-pegged stablecoin if new U.S. laws required it. Armstrong predicted that potential stablecoin regulations would mandate holding all asset reserves in Treasury bonds and conducting regular audits to ensure customer protection.

Coinbase already delisted Tether (USDT) from its European platform, citing noncompliance with the EU’s MiCA framework.

Tether’s token is the dominant crypto stablecoin ahead of competitors like Circle’s (USDC) and Ripple’s (RLUSD), the latest market entrant.

USDT’s operator held 80% of its reserves in T-Bills, the digital payment titan publishes financial attestations issued by BDO Italia, an independent third-party accounting firm.

The quarterly updates became a norm following the 2022 market debacle. Industry players and crypto users demanded proof-of-reserves after the ecosystem discovered several firms like FTX and Three Arrows Capital were insolvent.

While these attestations have eased some concerns about USDT, critics argue they do not constitute full audits. It remains unclear if Tether would comply with new U.S. legislation if it required more rigorous financial reporting.

Notably, Tether’s business predominately exists in emerging markets outside the U.S. and Europe. The company also plans to move its global headquarters to El Salvador, the first country to legalize Bitcoin (BTC).

CryptoCurrency

What This Means For BTC

Meet Samuel Edyme, Nickname – HIM-buktu. A web3 content writer, journalist, and aspiring trader, Edyme is as versatile as they come. With a knack for words and a nose for trends, he has penned pieces for numerous industry player, including AMBCrypto, Blockchain.News, and Blockchain Reporter, among others.

Edyme’s foray into the crypto universe is nothing short of cinematic. His journey began not with a triumphant investment, but with a scam. Yes, a Ponzi scheme that used crypto as payment roped him in. Rather than retreating, he emerged wiser and more determined, channeling his experience into over three years of insightful market analysis.

Before becoming the voice of reason in the crypto space, Edyme was the quintessential crypto degen. He aped into anything that promised a quick buck, anything ape-able, learning the ropes the hard way. These hands-on experience through major market events—like the Terra Luna crash, the wave of bankruptcies in crypto firms, the notorious FTX collapse, and even CZ’s arrest—has honed his keen sense of market dynamics.

When he isn’t crafting engaging crypto content, you’ll find Edyme backtesting charts, studying both forex and synthetic indices. His dedication to mastering the art of trading is as relentless as his pursuit of the next big story. Away from his screens, he can be found in the gym, airpods in, working out and listening to his favorite artist, NF. Or maybe he’s catching some Z’s or scrolling through Elon Musk’s very own X platform—(oops, another screen activity, my bad…)

Well, being an introvert, Edyme thrives in the digital realm, preferring online interaction over offline encounters—(don’t judge, that’s just how he is built). His determination is quite unwavering to be honest, and he embodies the philosophy of continuous improvement, or “kaizen,” striving to be 1% better every day. His mantras, “God knows best” and “Everything is still on track,” reflect his resilient outlook and how he lives his life.

In a nutshell, Samuel Edyme was born efficient, driven by ambition, and perhaps a touch fierce. He’s neither artistic nor unrealistic, and certainly not chauvinistic. Think of him as Bruce Willis in a train wreck—unflappable. Edyme is like trading in your car for a jet—bold. He’s the guy who’d ask his boss for a pay cut just to prove a point—(uhhh…). He is like watching your kid take his first steps. Imagine Bill Gates struggling with rent—okay, maybe that’s a stretch, but you get the idea, yeah. Unbelievable? Yes. Inconceivable? Perhaps.

Edyme sees himself as a fairly reasonable guy, albeit a bit stubborn. Normal to you is not to him. He is not the one to take the easy road, and why would he? That’s just not the way he roll. He has these favorite lyrics from NF’s “Clouds” that resonate deeply with him: “What you think’s probably unfeasible, I’ve done already a hundredfold.”

PS—Edyme is HIM. HIM-buktu. Him-mulation. Him-Kardashian. Himon and Pumba. He even had his DNA tested, and guess what? He’s 100% Him-alayan. Screw it, he ate the opp.

CryptoCurrency

Potential Strategic Crypto Reserve Spark Rally for Solana (SOL) and Ripple (XRP) – Will This New DeFi Coin Follow Next?

Just days away from Donald Trump’s inauguration, the crypto community couldn’t be more excited. The announcement of America’s first strategic reserve, albeit tentative, that prioritizes cryptocurrencies such as Solana (SOL) and Ripple (XRP), sparked an uptrend in these altcoins prices.

Which token will follow next? DTX Exchange (DTX), a new DeFi coin, is on track to explode after its scheduled listing on Tier-1 exchanges this quarter. It nears the $12 million fundraising milestone, highlighting a rapidly growing community. Given its potential transformation of the global trading scene via a blend of CEX and DEX, it is a new DeFi project to watch out for.

DTX Exchange (DTX): Projected 45X Rally Might Just Be the Start

DTX Exchange (DTX), despite flying under the radar, is quietly being accumulated by retailers and whales. Early funding has surpassed $11.9 million—achieved in record time. Alongside its rapidly growing community are its huge growth prospects, tipped to replicate or surpass the success of Solana (SOL) and Ripple (XRP).

With Tier-1 exchange listings coming soon, scheduled for Q1, experts have hailed it as the best presale to invest in. In the seventh round of the ICO, it costs just $0.14 per token, which is both undervalued and underpriced. A 45x jump in value is anticipated this year, positioning it as arguably the best new crypto to invest in.

At the same time, its DeFi-TradFi narrative sets the stage for massive adoption and growth. Its hybrid approach to trading involves combining the best elements of centralized and decentralized exchanges and bridging the gap between TradFi and DeFi. It will be the first crypto-native platform to offer stocks, ETFs and forex, set to reshape the $10 billion global trading landscape.

Solana (SOL): On US President’s Radar

Solana (SOL) was one of the top movers this week as it shook off bearish pressure. It retested $210, posting a 10% gain on the weekly chart. Behind this jump is the announcement of a potential strategic crypto reserve, with SOL being one of the prioritized altcoins.

The coming days promise even more intense volatility—the Trump pump—and Solana (SOL) is among the altcoins to watch. Moreover, key technical indicators like the 20-VWMA and 9-HMA suggest further upswings in the Solana price.

Cryptobits72, a top analyst on X, believes the bottom is in, suggesting a rally toward $220 and $240 in the days ahead. KryptoYakuza, equally bullish, targets $600 this cycle, positioning it as one of the best altcoins to invest in. Despite this, new altcoins like DTX Exchange have more upside potential as low-cap gems, making them more attractive.

Ripple (XRP): How High Can It Go?

Ripple (XRP) continues its outperformance by crossing $3.3 this week. Driving the uptrend is a potential US-based crypto reserve, with XRP among the prioritized coins. In the past three months, it has skyrocketed almost 500% and doesn’t seem to be slowing down anytime soon.

Bold XRP price predictions have been flying around, like Orangie’s projected rally to $50 this bull cycle. Part-Time Trader, a crypto analyst, hints at the payment-based cryptocurrency hitting $10—a more modest forecast.

Given bullish indicators like the MACD Level (12, 26) and 10-EMA, the coming days and weeks promise to be more exciting for Ripple (XRP)—a top crypto to invest in. However, considering the imminent pullback, top experts believe DTX Exchange might be a better choice, being a new altcoin with plenty of room to run.

DTX Exchange (DTX): Replicating the Success of Solana (SOL) and Ripple (XRP)

With Solana (SOL) and Ripple (XRP) this week’s top gainers and industry leaders, DTX Exchange (DTX) might be following in their footsteps. The new DeFi coin, standing at the crossroads between DeFi and TradFi, is tipped for a 45x upswing this year. Moreover, it aims to transform the global trading scene as a hybrid exchange—a trailblazer.

Find out more information about DTX Exchange (DTX) by visiting the links below:

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

Trump to converge TradFi, crypto with regulatory clarity: Franklin CEO

Franklin Templeton CEO Jenny Johnson predicts that blockchain will ultimately be used to build ETFs and mutual funds because of the technology’s efficiency.

CryptoCurrency

This altcoin could mirror Solana’s journey from $10 to $300 with over $12m raised

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

DTX Exchange emerges as a top hybrid platform, raising $12 million and poised for Solana-like gains in the crypto market cycle.

The crypto space is eager for a revolution, and we can see top altcoins emerge to deliver the right solutions in the industry. As we begin the new market cycle, a hybrid platform has become a prominent name on the lips of savvy investors today: DTX Exchange, a notable hybrid platform, is poised to disrupt the billion-dollar industry.

The DTX path is similar to that of Solana’s price trajectory. Just as SOL raised from the $10 to the $300 mark, DTX Exchange is also poised to show similar gains. The $12 million presale raise is a testament to the growth potential of DTX Exchange.

Solana price analysis: SOL crashes by 12%

The meme coin crash has caused a major slump in the Solana price as the SOL token decreased by a notable 12% within a day. The SOL token started the day at $292, but the Solana price continued to decline to reach the current trading price of $257.

The constantly dominating red candle shows that bears have taken hold of the SOL token amid the meme coin crash. The Solana price is plummeting as major meme coins have taken a massive dip, pulling the SOL token down with their decrease.

The Solana price has been in red-hot form over the past week, making a play for a new all-time high this weekend. The burst of positivity pushed SOL into an exciting Solana price setup, which could see its value skyrocket over the next few months. However, the meme coin fallout has triggered a slump in the SOL momentum.

DTX Exchange: A game-changing platform for savvy investors

We can’t deny SOL’s impressive surge over the years. However, this new player, DTX Exchange, could shake things up in the trading world. This platform rewrites the rules of engagement in the crypto market, offering something special for all kinds of traders and investors.

DTX Exchange is a notable hybrid platform that has combined the best features of centralized and decentralized exchange sites. This approach makes it possible to deliver convenience, ease of use, security, and, most importantly, liquidity in one unique hub.

In addition, users can enjoy easy access to its trading floor, where they can trade hundreds of thousands of different financial instruments. They include cryptocurrencies, forex pairs, tokenized ETFs, metals, and many more. By being the focal point of these various asset classes, DTX could be a one-stop destination for one’s trading needs.

For traders who enjoy speed, DTX Exchange delivers very well. Powered by its proprietary layer-one blockchain, VulcanX, this platform can process a staggering 100,000 transactions per second, miles ahead of giants like Solana. Even better, no KYC is required to transact your assets on the DTX Exchange site.

Furthermore, users who may prefer a passive way to earn rather than being hands-on are also covered. DTX Exchange ensures they can enjoy an income stream via staking and daily trading revenue shares. So, these traders can work on perfecting their strategies while their assets do the work for them.

Given its notable features, it’s no wonder this viral altcoin is generating buzz. This is further evident in its presale, where it acquired over $12 million within a few months. It’s currently in stage 7, where the native token, DTX, is available at $0.14. So far, early birds have enjoyed up to 600% ROI, and more gains are expected towards its final (tenth) presale stage.

Regarding post-launch predictions, experts forecast big things for DTX Exchange. Many foresee this altcoin providing 100x if listed on top-tier exchanges like Binance, Uniswap, or Bybit.

Key takeaways

As the current market cycle begins, a hybrid platform has gained popularity among astute investors. The emerging star is DeFi king DTX Exchange, which has the potential to upend the billion-dollar sector. The Solana price trajectory is comparable to that of DTX. Similar to how SOL increased from $10 to $300, DTX Exchange is also expected to see increases of this magnitude. The $12 million raised during the presale is evidence of DTX Exchange’s potential for expansion.

For more information, visit the DTX Exchange presale website and join the online community.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

Will It Smash Another ATH?

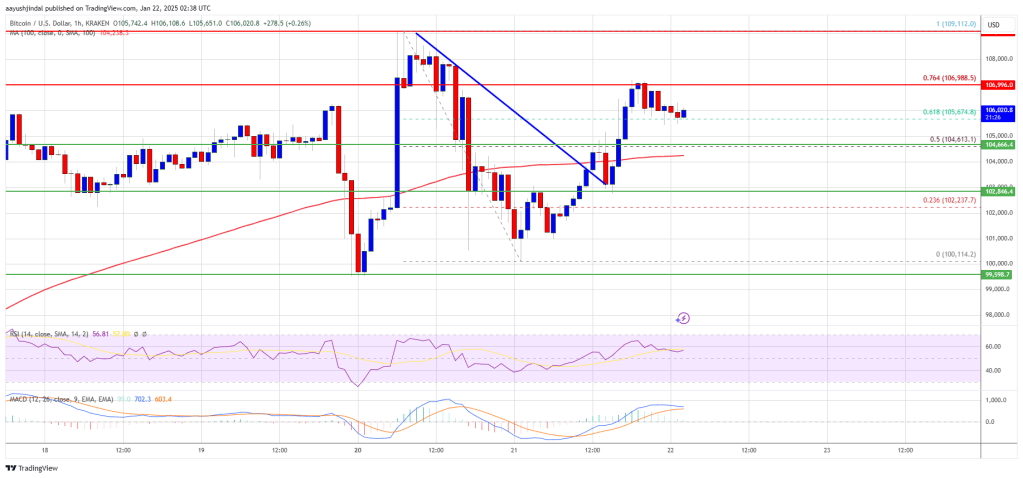

Bitcoin price started a fresh increase above the $104,000 zone. BTC is consolidating above $105,000 and might aim for a new all-time high.

- Bitcoin started a decent increase above the $102,500 resistance zone.

- The price is trading above $104,500 and the 100 hourly Simple moving average.

- There was a break above a connecting bearish trend line with resistance at $104,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $103,500 support zone.

Bitcoin Price Regains Traction

Bitcoin price started a decent upward move above the $102,500 zone. BTC was able to climb above the $103,500 and $104,000 levels.

The bulls even pushed the price above the $105,000 level. Besides, there was a break above a connecting bearish trend line with resistance at $104,000 on the hourly chart of the BTC/USD pair. The pair surpassed the 50% Fib retracement level of the downward move from the $109,112 swing high to the $100,114 low.

Bitcoin price is now trading above $104,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $107,000 level. It is close to the 76.4% Fib retracement level of the downward move from the $109,112 swing high to the $100,114 low.

The first key resistance is near the $107,500 level. A clear move above the $107,500 resistance might send the price higher. The next key resistance could be $109,000.

A close above the $109,000 resistance might send the price further higher. In the stated case, the price could rise and test the $110,000 resistance level and a new all-time high. Any more gains might send the price toward the $112,500 level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $107,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $104,500 level. The first major support is near the $103,500 level.

The next support is now near the $102,800 zone. Any more losses might send the price toward the $100,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $104,500, followed by $103,500.

Major Resistance Levels – $107,000 and $108,500.

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login